Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 05, 2024

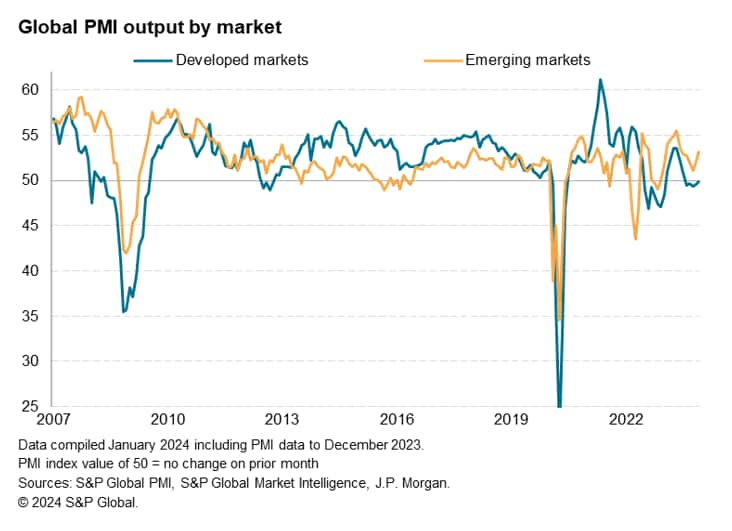

Global output growth accelerated slightly in December, according to the S&P Global PMI surveys, spurred by improved inflows of new orders. Confidence about the year ahead also lifted higher. However, all of these three gauges remain weak by historical standards, consistent with only modest global GDP growth and subdued hiring, the latter having largely stalled.

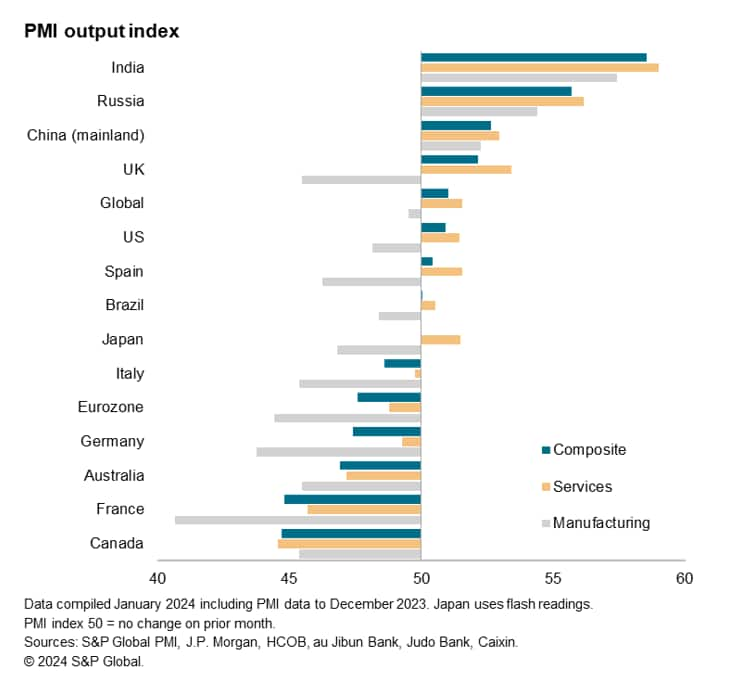

Recession risks remain most elevated in the eurozone, and business activity stagnated in Japan. But modest expansions were seen in the US and UK, and growth accelerated in mainland China, though it was India's performance which was again by far the most impressive.

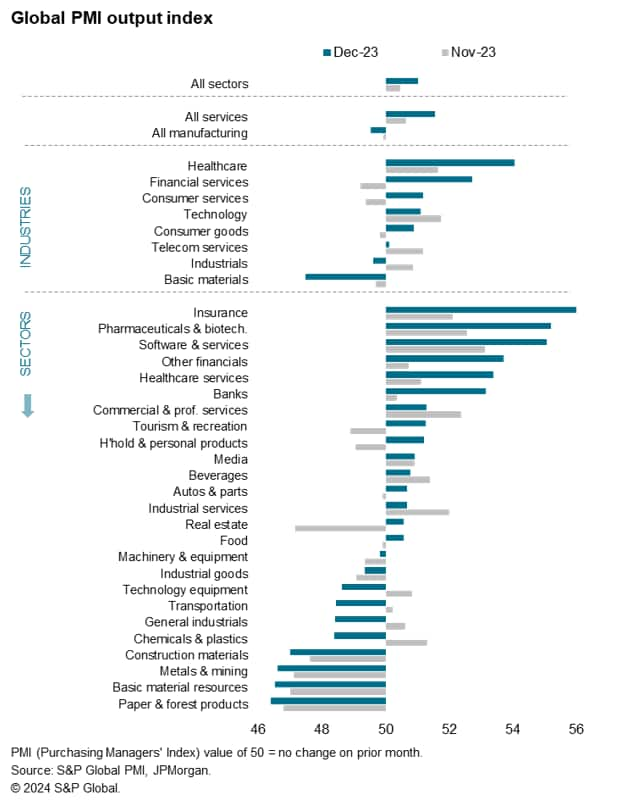

Sector variations have meanwhile widened: looser financial conditions have buoyed consumer and financial services, but the factory sector remains in decline, led by steep losses in primary manufacturing industries.

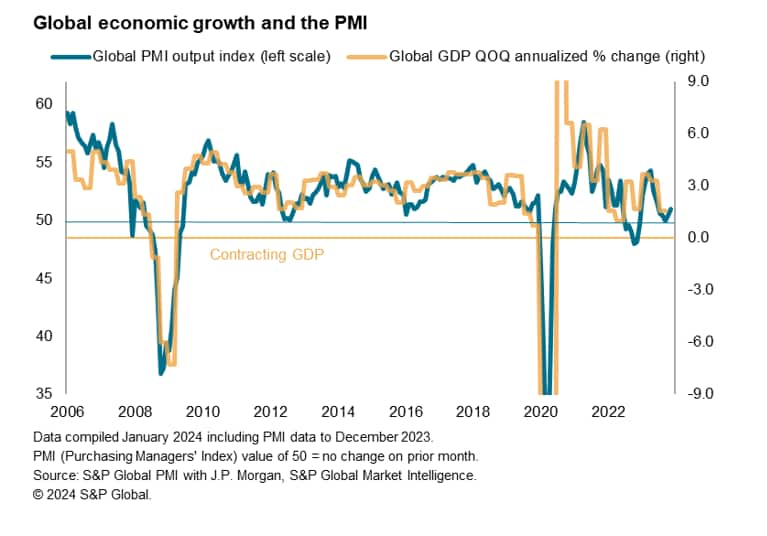

Worldwide business activity rose modestly in December, according to the Global PMI data compiled by S&P Global. The headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, edged higher for a second month, up from 50.5 in November to 51.0 in December, its highest since last July.

Despite the rise, the PMI remains well below the survey's long-run average of 53.2 and is broadly consistent with annualized quarterly global GDP growth of approximately 1.5% (half the pre-pandemic ten-year average of 3.0%). As such, the PMI signals much-reduced global growth momentum in the closing months of 2023 compared to the growth spurt seen around the second quarter of last year.

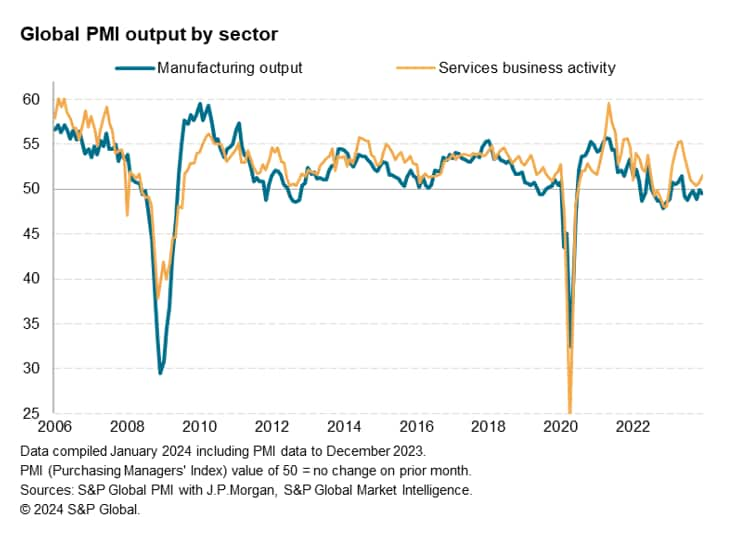

By sector, manufacturing remained a key drag on the global economy, with factory output dropping marginally in December for a seventh successive month. Of the 13 largest economies for which composite PMI data are available, only India, Russia and mainland China reported higher manufacturing production in December. Especially steep falls in factory output were seen across the eurozone nations and in Canada and Australia.

Although service sector growth accelerated globally, the rate of expansion remained far below that seen earlier in the year. Of the 13 largest economies, eight reported higher service sector output in December, led by India. The steepest falls were seen in Canada, France and Australia.

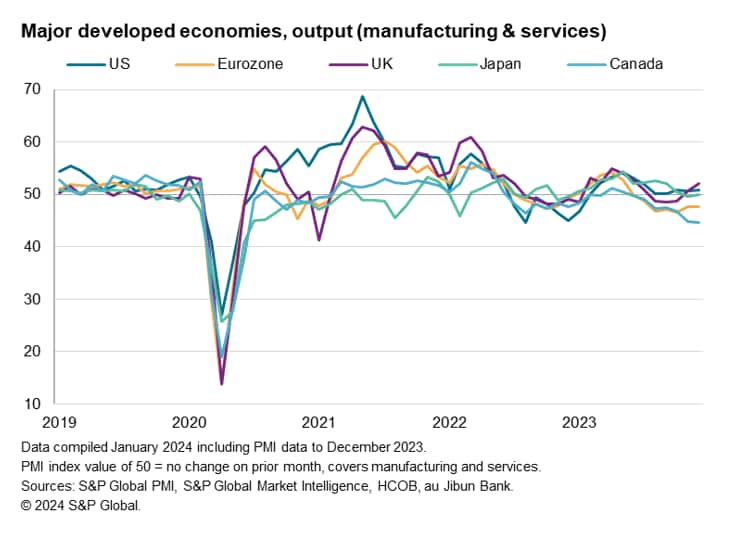

Output across the developed world fell marginally in December for a fifth successive month. The deepest gloom was seen in Canada, where output fell sharply in both manufacturing and service sectors, down for a seventh straight month.

A marked pace of contraction also continued to be recorded in the eurozone, fuelling recession worries as a steep manufacturing downturn continued to be accompanied by falling service sector activity.

In contrast, a sustained - albeit modest - expansion continued to be reported in the US, where output rose for an eleventh straight month. Faster service sector growth offset a renewed fall in manufacturing output.

An acceleration of output growth in the UK to a six-month high helped allay recession worries, albeit the pace of expansion remaining modest, dampened by sharply falling goods production.

Japan's output meanwhile stabilised after contracting slightly in November, as improved services growth countered a steepening manufacturing decline, rounding off a broadly flat fourth quarter.

The sustained developed market decline contrasted with emerging market growth, accelerating to a six-month high.

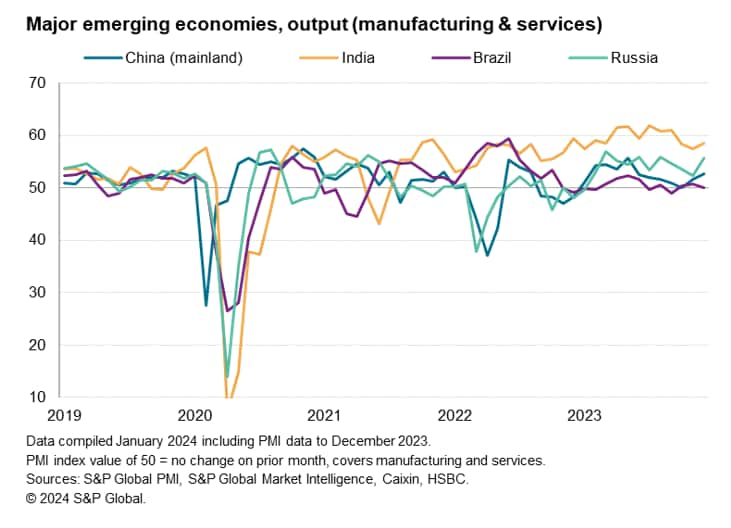

India remained the fastest-expanding economy, a re-acceleration of growth helping to sustain its best spell for 15 years. Although factory output grew at the slowest rate for 14 months, the pace of expansion remained impressive, accompanied by an improved service sector expansion.

Russia's expansion also regained momentum, with faster manufacturing and services growth resulting in one of the strongest upturns seen since the pandemic.

China's mainland expansion likewise picked up further pace after having stalled in October, with growth reviving in both manufacturing and services.

Brazil bucked the improving trend, with output unchanged in December. Manufacturing output contracted for the thirteenth time in the past 14 months and growth in the service sector cooled to near-stagnation.

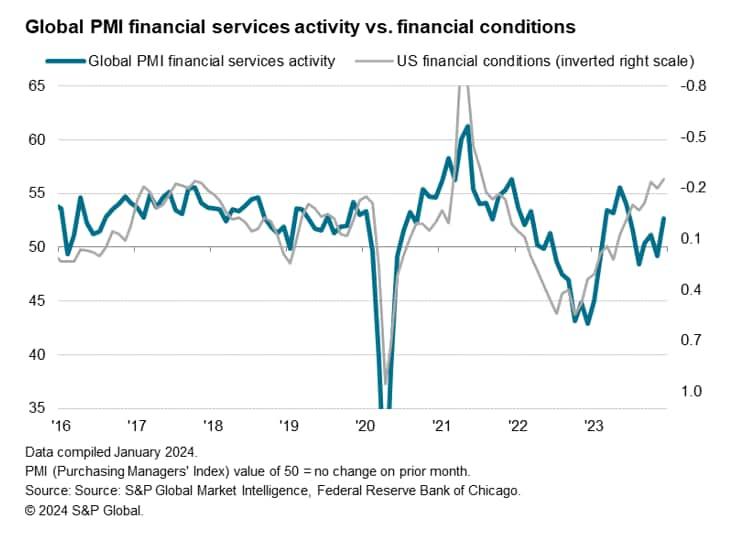

Looking across broad global industries, output rose most sharply for healthcare in December, though one of the most important developments was a marked revival of growth in financial services activity. The latter in part reflected looser financial conditions in many countries, notably the United States, as markets reassessed the outlook for interest rates in 2024.

Encouragingly, some signs of renewed consumer demand were also evident, reviving output growth for both consumer goods and services compared to November. Rates of increase nevertheless remained subdued.

The steepest decline was meanwhile recorded for basic materials, reflecting ongoing inventory reduction policies amid falling global trade flows and weak manufacturing demand. Industrials, which includes goods producers and B2B services, also reported a renewed fall in output.

Drilling down into more detailed sub-sectors, the top eight fastest growing sectors were all services-related, led by insurance, pharma & biotech, and software.

Three of the top six fastest growing sectors were from the broader financial services industry, and even real estate activity returned to growth, underscoring the revival of financial-related activities amid hopes of lower interest rates.

The bottom six slots of the rankings were meanwhile all held by manufacturing-focused sector, and in particular input producers, such as paper & forest products, basic materials, metals & mining, construction materials and chemicals & plastics.

The relative poor performance of these primary manufacturing sectors again largely reflected ongoing aggressive inventory reduction policies, with reduced buying activity causing global stocks of inputs to fall at one of the fastest rates seen over the past decade if the initial pandemic period is excluded.

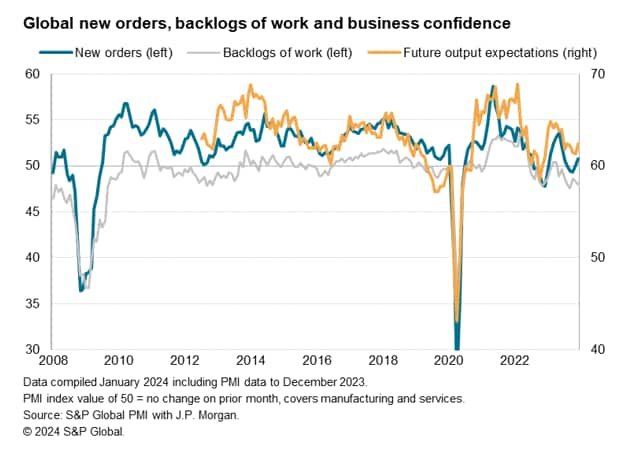

Some encouragement regarding the near-term global growth trend can be derived from the slight acceleration in growth during December, having been driven by an increased in new order inflows, which showed the largest rise since last June. Similarly, business expectations about the year ahead lifted higher in December, also striking the most optimistic tone since last June.

However, both of these forward-looking gauges remain weak by historical standards, hinting at sustained sub-par growth. Furthermore, the recent rise in new work was insufficient to prevent backlogs of work falling at an increased rate - and one of the fastest rates seen since the global financial crisis.

The steep decline in backlogs of work hints that companies' order books are becoming increasingly depleted, meaning - unless demand picks up to a more substantial degree - firms will be prone to focus on capacity reduction.

More insights will be available with the flash January PMI data, published on 24th January, in which we will be especially eager to assess the order book trend. However, from an inflation perspective, we will also be keen to evaluate any impact from recent supply chain stress, notably from global shipping.

Access the Global Composite PMI press release here.

Access the Global Sector PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location