Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 07, 2023

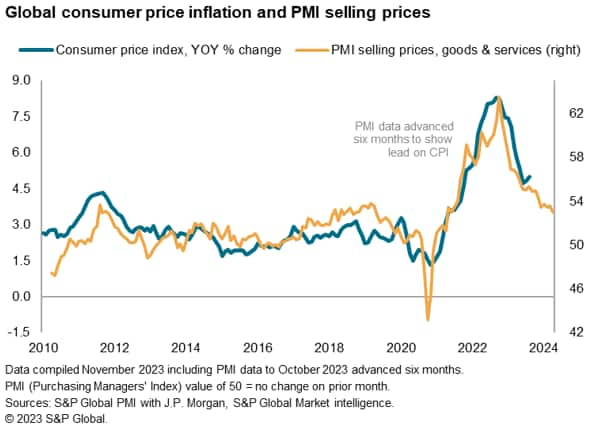

Global inflationary pressures moderated in October to their lowest since late-2020, according to PMI® data compiled by S&P Global across over 40 economies and sponsored by JPMorgan.

Although the overall rate of inflation of selling prices for goods and services remains above its pre-pandemic average, amid some stickiness of services inflation and a modest upturn in goods prices, there is encouraging news on underlying - or core - price pressures cooling further in the coming months. In particular, wage pressures have moderated markedly in recent months and companies' pricing power has been hit by reduced demand. Demand-pull price pressures are reverting to their long-run average.

Central bank inflation targets have now consequently come into view in the US and eurozone. Some price stickiness is more evident in the UK, though even here the rate of inflation looks set to moderate sharply in the coming months.

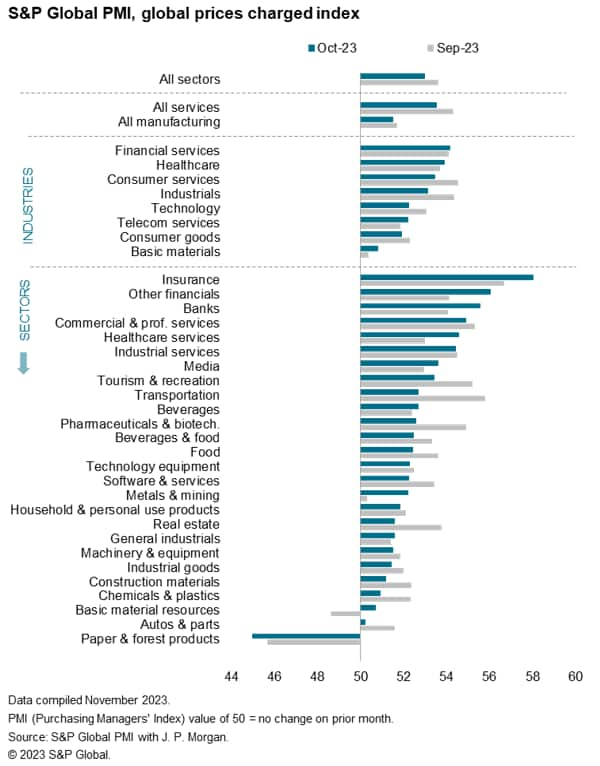

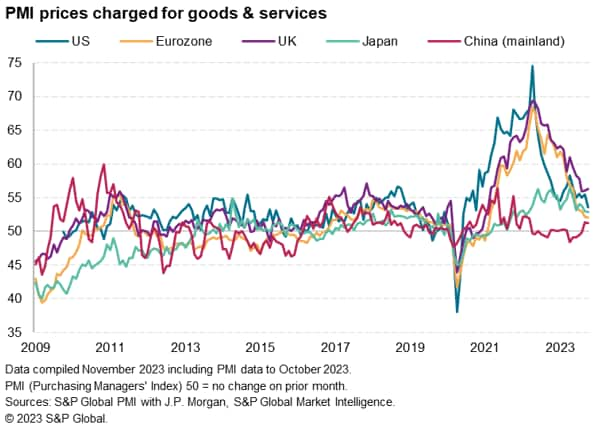

Average prices charged for goods and services rose globally at the slowest rate for nearly three years in October. The global PMI selling price index - compiled by S&P Global and covering prices charged for both goods and services in all major developed and emerging markets - fell from 53.6 in September to 53.0 in October, its lowest since December 2020.

The further decline in the selling price index from its all-time high recorded in April 2022 brings global inflationary pressures closer to the survey's long run average of 52.2 (and closer to the five-year pre-pandemic five-year average of 51.6).

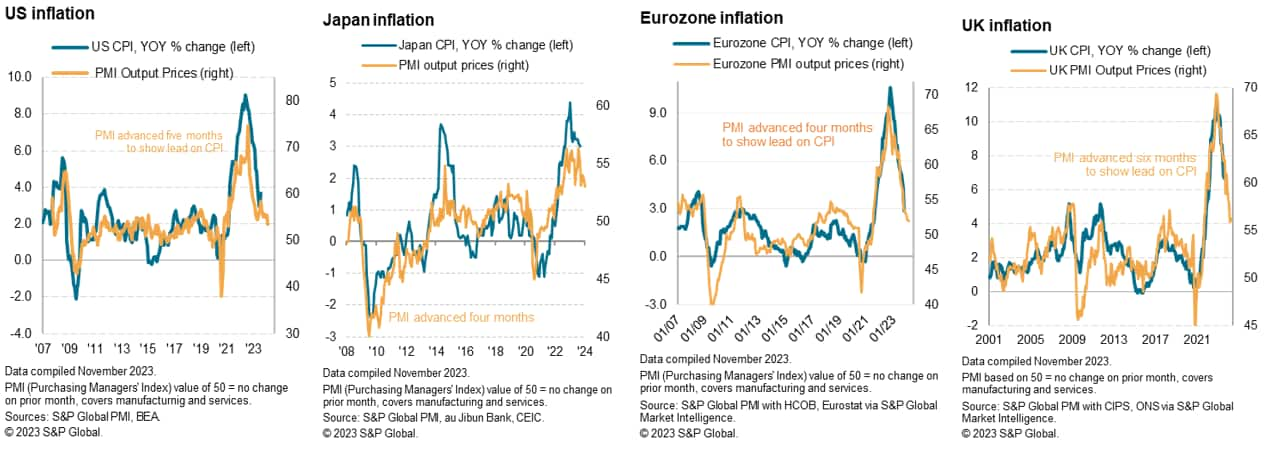

The leading-indicator properties of the PMI mean that global inflation is set to cool further from the 5.0% annual rate estimated from various national sources for July, potentially dropping to around 3.5% early in the new year.

Although a 3.5% rate remains somewhat elevated by historical standards (in the decade prior to the pandemic, global CPI inflation averaged 2.7%), there are good reasons to believe underlying price pressures will continue to moderate even further in the months ahead.

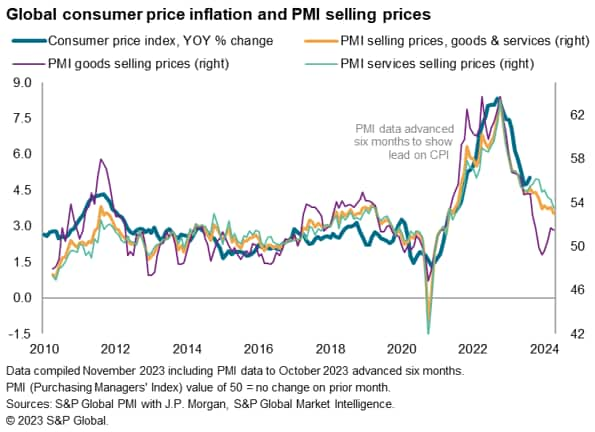

Looking at sector divergences, recent months have seen some firming of goods prices, linked in part to higher oil prices as well as a waning of the deflationary impact of healing supply chains. Encouragingly, service sector prices, which provided a major lift to global inflation earlier in the year as demand for consumer services surged, continued to show a slower rate of increase in October. The overall global rise in services prices at the start of the fourth quarter was the smallest since February 2021.

Looking in more detail, prices fell in only one of the 26 sub-sectors covered by the PMI - Forestry & Paper products - but rates of increase only gathered pace in nine sectors, and of these three were from financial services, in part reflecting higher interest rates.

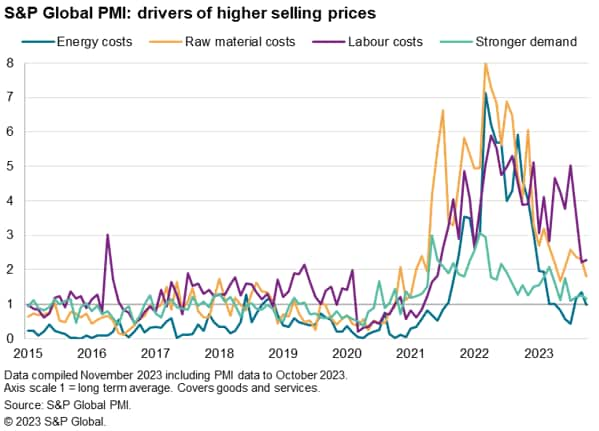

One of the big uncertainties facing the inflation outlook is the impact of changing oil prices, notably in response to the geopolitical risks. However, there seems to be some good news in this respect. Analysing the reasons for changing selling prices cited by PMI survey respondents around the world, the impact of higher energy prices remains in line with its long-run average, albeit with this representing higher pressures than seen before the recent oil price rise.

Upward pressure from broader raw material inputs has meanwhile fallen to its second-lowest since January 2021.

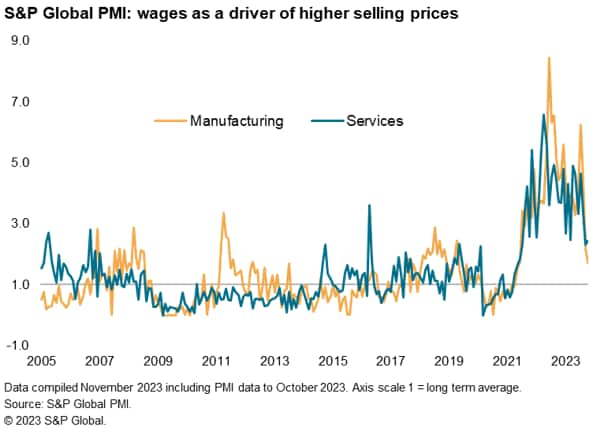

A further key development in the inflation dynamic has been a marked reduction in upward pressure from wages. The inflationary impact of wages on average prices charged for goods and services has fallen to its second-lowest since June 2021. While the easing inflationary impact of wage pressures was most marked in the manufacturing sector in October, pressures have also clearly cooled substantially in services compared to that seen over the past two years.

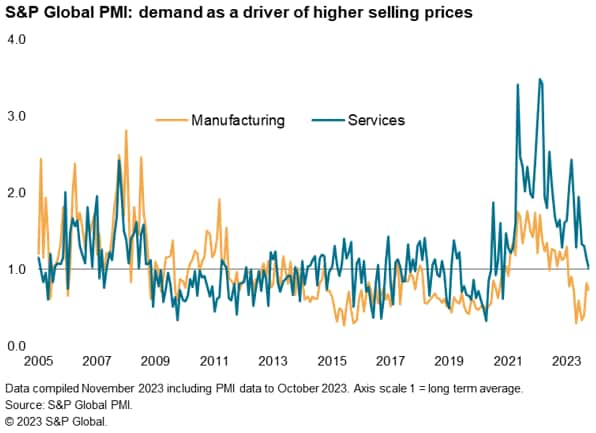

However, perhaps the most interesting development is the degree to which demand-pull inflationary forces have moderated. Lower demand has removed pricing power from manufacturers over the past nine months - as proxied by price pressures dropping below their long-run average. Additionally, upward demand pressures on prices in the service sector have now also fallen to a level in line with their long-run average amid the weakened demand environment.

The overall demand-pull effect on prices consequently evaporated at the start of the fourth quarter, boding well for a further easing of core inflationary pressures around the world.

Looking at price trend variations around the world, the steepest decline in inflationary pressures has been seen in the eurozone, where the PMI's selling price index covering goods and services has fallen to its lowest since February 2021 and is now only 1.6 index points above its pre-pandemic long run average. At this level, the PMI index is signaling CPI inflation to fall further from 2.9% in October to closer to the ECB's target of 2% at the turn of the year.

The Fed's 2% target has also come into sight after the PMI's selling price index across the US fell to its lowest since October 2020 to a level just 1.2 points above its pre-pandemic decade average.

Inflation looks stickier in the UK, however, as the PMI's selling price index rose 0.2 points in October, and remains 4.1 points above its pre-pandemic 10-year average. The latest readings are nevertheless consistent with UK annual CPI inflation moderating from its current 6.7% rate to a range closer to 4% as we move into 2024.

In Asia, the PMI hints at inflation dipping below 2% in Japan in the coming months, while in mainland China the recent ground gained by the PMI selling price index has helped allay fears of deflation.

Access the Global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location