Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 24, 2021

By Sara Johnson

Global real GDP reached a new high in the second quarter of 2021, completing a year-long recovery from the COVID-19 recession. Western Europe rebounded from its double-dip recession, while the United States and mainland China sustained robust growth. These gains offset setbacks in India and parts of Southeast Asia and Latin America.

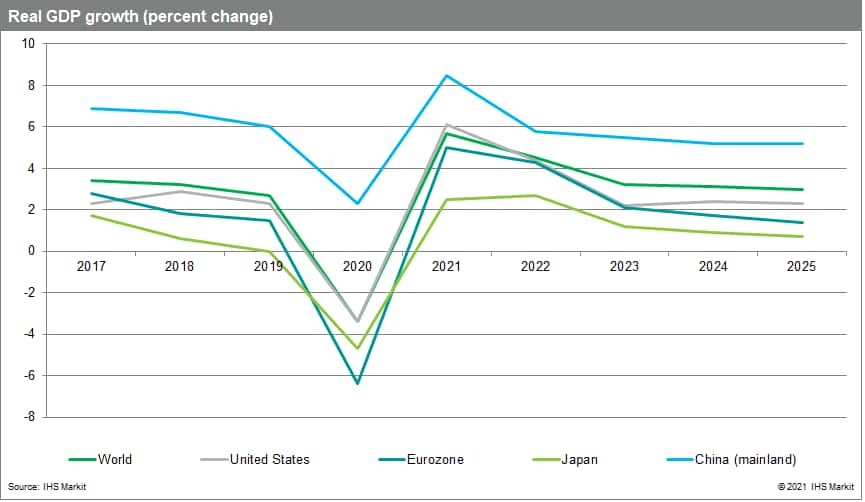

While growth momentum is slowing with the spread of the Delta variant of COVID-19, the global expansion is moving forward. After a 3.4% decline in 2020, world real GDP is projected to increase 5.7% in 2021 and 4.5% in 2022, led by strong recoveries in consumer spending and business investment. This month's forecast of global growth has been revised downward by 0.1 percentage point this year and 0.2 percentage point in 2022, mostly owing to a less robust performance in the United States. Global growth will settle to 3.2% in 2023 as pent-up demands are satisfied, and fiscal and monetary stimuli are withdrawn.

The resilience of the global economy amid a lingering pandemic suggests that the world is learning to live with the COVID-19 virus. In North America and Western Europe, which account for nearly half of world GDP, a return to strict lockdowns that directly impede economic activity is unlikely. In these regions, vaccination rates are relatively high and rising, reducing the risks of severe illness or death. People have confidence that a resumption of pre-pandemic activities—with some precautions—is relatively safe. Consumers and businesses have adapted in ways that allow them to continue to spend and produce, including online shopping, use of delivery services, work from home, and new health and safety measures. Thus, the likely response to a rise in infections is a slight reduction in travel and activities that involve social interaction. International travel restrictions may be extended, delaying recoveries in tourism-dependent areas.

Regions with low vaccination rates face greater risks from the Delta variant of COVID-19. Outbreaks in Asia Pacific have led to new containment measures, disrupting production and trade in a region that accounts for 37% of global merchandise exports. In contrast, new infections have sharply declined in South America, facilitating economic recovery and the flow of commodity exports. In Africa, the spread of the Delta variant could put the region's health facilities under pressure, but extensive activity restrictions are unlikely. The economic and social costs would be too high given the limited fiscal capacity of governments to provide income support. Risks to developing countries will diminish in 2022 as vaccine supplies increase through COVAX and the startup of local production facilities.

The US economic expansion is durable. In the second quarter, real GDP grew at an annual rate of 6.5% quarter on quarter (q/q). Strong gains in consumer spending and business fixed investment were partially offset by declines in residential investment, federal purchases, inventory investment, and net exports. In the August forecast, annual real GDP has been lowered 0.5 percentage point, to 6.1%, in 2021, and 0.6 percentage point, to 4.4%, in 2022. The revisions reflect a lower growth path through the end of 2021, owing to less inventory investment amid supply bottlenecks and more cautious consumer spending in response to the rise in COVID-19 infections.

Yet, the US expansion remains on solid footing, driven by unprecedented fiscal and monetary support, continued release of pent-up demand, and restocking of depleted inventories. Employment is surging, and job openings remain at record levels. Near-term market imbalances will push consumer price inflation up to 4.2% in 2021, before improving supply conditions will reduce it to 2.4% in 2022. The US Federal Reserve is expected to taper its asset purchases in the months ahead and start raising the federal funds rate in 2023.

Western Europe's consumer-led growth spurt will continue. The easing of COVID-19 containment measures, improving labor markets, and household savings accumulated during the pandemic have unleashed a surge in consumer spending. Eurozone real GDP increased 2.0% q/q (8.2% annualized) in the second quarter. The IHS Markit Purchasing Managers' Index (PMI™) series and the European Commission's business and consumer sentiment survey were generally upbeat in July, even as a third wave of COVID-19 cases emerged in parts of the region. The European Central Bank's new policy framework and forward guidance suggest that monetary policy will stay highly accommodative. After a 6.4% decline in 2020, eurozone real GDP is projected to increase 5.0% in 2021, 4.3% in 2022, and 2.1% in 2023.

Mainland China's economic growth is resuming a long-term slowdown. Although the scale of the COVID-19 outbreaks is relatively small, the Chinese government's zero tolerance policy has markedly curtailed economic activities. IHS Markit analysts expect subpar growth near 5% in the second half of 2021. Should the economy decelerate sharply, the Chinese government will inject fiscal and monetary policy stimulus. The country's real GDP growth is projected to slow from 8.5% in 2021 to 5.8% in 2022 and 5.5% in 2023.

Asia Pacific's manufacturing hubs are the current hotspots for COVID-19. The spread of the Delta variant in the region is aggravated by the relatively slow progress of vaccination campaigns outside mainland China. Consumer spending, tourism, industrial production, and exports have been adversely affected. The IHS Markit manufacturing PMI™ surveys for July indicated deteriorating business conditions in Indonesia, Malaysia, Myanmar, Thailand, and Vietnam, but expansions in other parts of the region. Recent COVID-19 trends vary, with infections falling in India, Taiwan, and Indonesia, but rising in Japan, South Korea, Malaysia, the Philippines, and Vietnam.

Supply chain disruptions and shipping delays persist. Pandemic-related production cuts in Southeast Asia have exacerbated input shortages and cost pressures. Semiconductor shortages have led to more global production cuts in the automotive industry in August and September. In the container shipping industry, a series of shocks—the Suez Canal closure in March, partial shutdowns of Chinese ports, the suspension by Union Pacific on rail shipments from the West Coast to Chicago in July, and the ongoing backup of ships off of Los Angeles-Long Beach—have had cumulative effects, extending delays and driving shipping rates sharply higher. The Journal of Commerce team in IHS Markit's maritime and trade group now expects that equilibrium in the container shipping system will not be fully restored until mid-2022 or later. Some commodity price pressures are relenting amid softening demand and buyer resistance; this is seen in falling prices for ferrous metals and lumber.

Bottom line: While the spread of the Delta variant of COVID-19 raises forecast risks through supply and demand channels, it is unlikely to derail the global economic expansion. The world is learning to live with the virus.