Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 22, 2022

By Sara Johnson

With inflation at a fever pitch, central banks around the world are raising interest rates with new urgency, hoping to cool inflation by slowing growth of aggregate demand and achieving a closer balance with supply. Meanwhile, Russia's war with Ukraine and recent lockdowns in mainland China have further disrupted supply chains, adding to cost pressures. With high inflation shattering consumer and investor confidence, forecast probabilities are leaning closer to recession. In Europe and North America, prospects for a "soft landing" are dimming.

Financial market turbulence is another sign of the shifting economic climate.

Global equity markets have moved into bear territory in mid-June, with the MSCI World Index and the S&P 500 Index each falling 23% year to date. In June, long-term bond yields have risen sharply in anticipation of future increases in central bank policy rates. Capital markets remain open, but financing costs are rising for businesses, consumers, home buyers, and governments. The year ahead will bring a more difficult environment for builders and capital good producers. Investor flight to safety would likely mean continued strength in the US dollar and elevated risks for emerging markets that depend on capital inflows to finance trade and fiscal deficits.

Will central banks succeed in cooling inflation?

With perseverance, monetary policy can be effective in anchoring inflation expectations and preventing an upward spiral in prices and wages from taking root. Absent new supply shocks, the outlook is sanguine. Our June forecast calls for global consumer price inflation to ease from 7.0% in 2022 to 4.0% in 2023 and 2.7% in 2024. This deceleration in prices reflects a gradual resolution of supply chain disruptions along with softening demand. Industrial and agricultural commodity prices are expected to retreat from recent peaks over the next two years, although most prices will remain significantly above 2019 pre-pandemic levels. As consumer demand shifts from goods to services, a moderation in goods price inflation will be partially offset by a pickup in services price inflation.

Energy prices will be pivotal in the inflation outlook, given the key role of energy as an input acrossgoods and services sectors of the economy.

Lean inventories, limited spare capacity, and changes in supply dependencies following Russia's invasion of Ukraine will add to price volatility, especially during seasonal peaks in demand. Our next forecast will incorporate the EU ban on about 80% of its Russian oil imports, along with continued sanctions on Iranian oil. As a result, the average price of Brent crude oil will be higher than the current forecast assumption of USD113/barrel in the second half of 2022 and USD100/barrel in 2023.

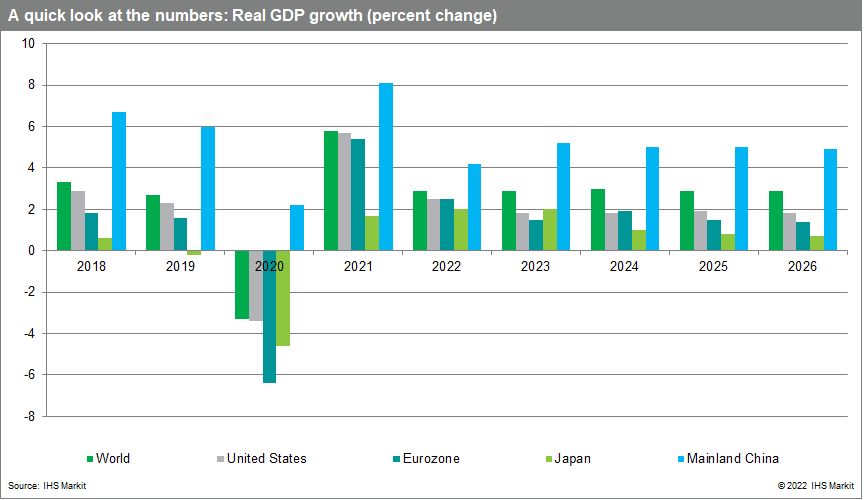

Our June forecast calls for global real GDP growth to slow from 5.8% in 2021 to 2.9% in 2022 and 2023,slightly below potential.

The easing of pandemic-related restrictions and a revival in service sectors (including travel and tourism, recreation, and arts) is a key support to growth. However, the fallout from tightening financial conditions is likely to lead to a downward revision in the global growth outlook in the next forecast. The soft landing anticipated in early June will likely give way to a bumpier ride.

The United States faces a growth recession and rising unemployment.

The US Federal Reserve raised its policy rate by 75 basis points at its mid-June meeting and signaled its determination to return inflation to 2%, acknowledging it expects unemployment to increase. Forecasts by Federal Open Market Committee participants suggest that the federal funds rate will be raised another 175 basis points in 2022 and 25 basis points in 2023, resulting in a target range of 3.50-3.75%. This is 50 basis points higher than assumed in our forecast of early June. Since the forecast's release, new data on retail sales, housing starts, and inventories have prompted a downward revision in our tracking estimate of annualized real GDP growth in the second quarter from 2.4% to 0.8%. Although household finances are generally in good shape, high inflation is eroding real incomes and making households more cautious about spending. The boom in housing markets is subsiding, and businesses are likely to trim capital spending plans for the year ahead. Real GDP growth is projected to slow from 5.7% in 2021 to 2.5% in 2022 and 1.8% in 2023 and 2024, with risks weighted to the downside. With real GDP growth running below potential, the unemployment rate will rise from 3.6% in May to a high near 5.0% by 2025.

Higher energy costs could push Western Europe into recession.

Our June forecast already incorporates mild second-quarter contractions in real GDP in the UK, Italy, Spain, and the Netherlands. With inflation surprising on the upside, central banks are stepping up the pace of tightening, with the European Central Bank now expected to start raising interest rates in July. The fallout of the Russia-Ukraine war deflated consumer and business confidence. Eurozone real GDP growth is projected to slow from 5.4% in 2021 to 2.5% in 2022 and 1.5% in 2023. The prospect of further disruptions to energy supply driving up prices remains a downside risk.

Mainland China's economy begins to recover from COVID-19 lockdowns.

Mainland China's economic downturn moderated in May as industrial production and exports turned up while services and retail sales remained in contraction. The government's dynamic zero-COVID policy will remain in place through 2022, preventing a return to normalcy and limiting the effectiveness of economic stimulus. The property market remains in recession, and declining land sales are hurting local government finances. Real GDP growth is projected to slow from 8.1% in 2021 to 4.2% in 2022 before picking up to 5.2% in 2023.

The Russia-Ukraine conflict becomes a war of attrition.

Russia's invasion of Ukraine on 24 February has transformed the geopolitical landscape. Our forecast anticipates that Russia will continue to wage a war of attrition in Donbas, making slow advances. The outcome of a high-intensity but indecisive war in Donbas could be a frozen conflict with some territories in Ukraine remaining under de facto Russian occupation. Through sanctions, trade policies, and private investment decisions, Russia's international trade will be limited and its economy will undergo a restructuring to increase self-sufficiency. Russia's real GDP is projected to fall 10.6% in 2022 and 1.1% in 2023 before beginning a slow recovery. After a 44% collapse in 2022, Ukraine's real GDP is expected to rebound 28% in 2023 and 16% in 2024 as reconstruction proceeds with the support of substantial aid from Western allies.

Bottom line

The persistence of high inflation is prompting central banks to tighten policies more aggressively to cool demand amid ongoing supply disruptions. While the global economic expansion is projected to continue at a diminished pace, the risks of a recession are rising.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.