Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 15, 2022

By Laura Denman

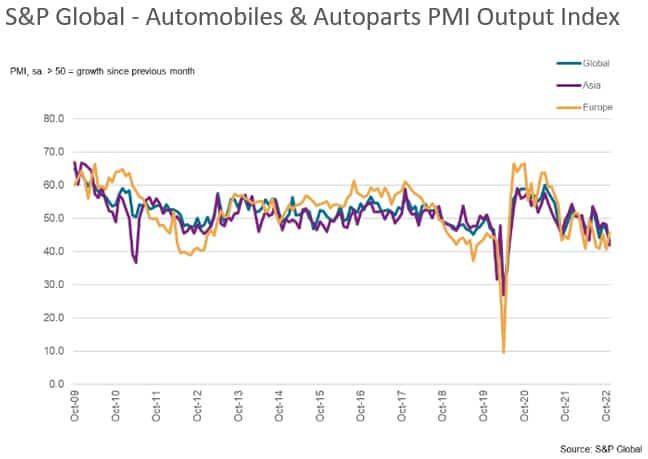

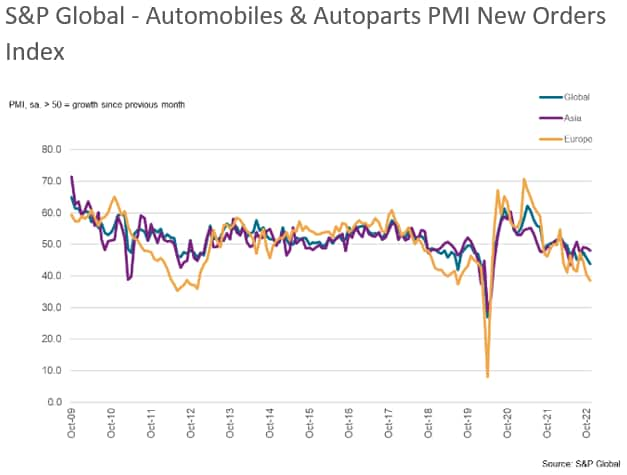

Latest global sector PMI data, compiled by S&P Global, highlighted the tough conditions being faced by Automobiles & Autoparts manufacturers at present, with the sector the second-worst performer of all those covered in November. Firms registered the most pronounced drop in production and new orders since the onset of COVID-19 in early-2020.

Meanwhile, for the first time in three months, staffing numbers declined, dropping at the quickest pace since July 2020, as producers adjusted capacity to weakened order book inflows.

More encouragingly, average cost burdens increased at a rate much faster than those recorded prior to the pandemic and manufacturers continued to raise their selling prices in November, although rates of inflation showed signs of moderating amid weaker demand conditions. This also helped to alleviate pressure on supply chains.

Central to the downturn in the global autos sector was a slump in European demand. In fact, November data saw the sharpest contraction in European order book volumes since May 2020 and one of the steepest recorded over the past decade. The current sequence of decline first began in March 2022 as selling price inflation was ramping up, eventually hitting a peak in April. With various nations experiencing a severe cost-of-living crisis, particularly within Europe, the demand for many cyclical goods, automobiles included, will be on the decline. The rate of output price inflation is still among the highest on record, and with the cost-of-living crisis becoming an increasingly prominent issue heading into the winter months, it's unlikely that we will see European autos demand recover anytime soon.

In terms of production, output across Europe's autos sector continued to fall in November, but at the softest rate since June and not to the same extent as seen in new orders. Backlogs of work fell at the fastest pace since May 2020, while stocks of finished goods accumulated at the fourth-sharpest pace in the series history. These factors helped to prevent a much sharper fall in production during the month.

Trends in Europe have seemingly fed through to Asia where manufacturers registered the fastest reduction in output volumes since May 2020. Moreover, autos firms in Asia registered the sharpest contraction in output of the 18 monitored industries. That said, relative to the drop seen in Europe, the decline in new orders was notably softer amid cooling cost pressures and easing supply chain disruptions, and Asia's data are dominated by trends in mainland China, where the ongoing fight against COVID-19 continues to cause lumpy trends in demand and output.

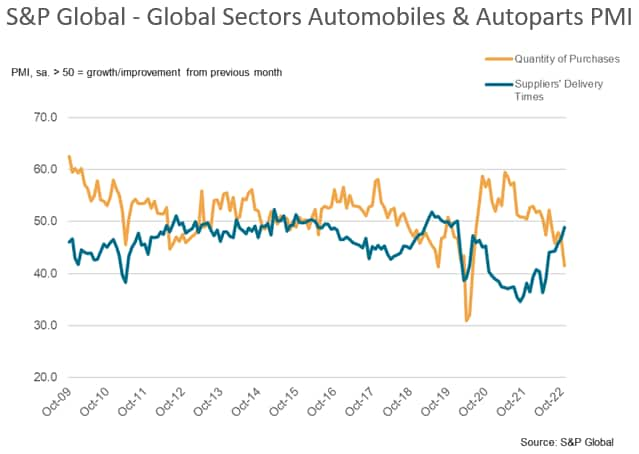

Muted input demand eases supply chain pressures

There have been tentative signs that supplier performance across the global autos sector has been improving in recent months. November data revealed the softest deterioration in vendor performance since January 2020, with lead times lengthening to a smaller degree than the pre-pandemic average. Alongside reduced pandemic disruptions, the factor perhaps playing a prominent role in an improving supply picture has been a substantial drop in demand for inputs. To mirror output trends, firms have scaled back on purchasing activity at a rate which is among the sharpest in the PMI series history, and subsequently there is much less pressure on suppliers.

While November PMI data paint a gloomy picture for the global autos sector, manufacturers maintained an overall positive outlook for output over the year-ahead. That said, sentiment varied extensively by region. Optimism was underpinned by growth expectations across Asian autos producers. Meanwhile, European manufacturers registered a third consecutive month of pessimism, albeit less so than in October.

Laura Denman, Economist, S&P Global Market Intelligence

Tel: +44 1344 327 221

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location