Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 23, 2020

By Timo Klein

How has Germany's manufacturing sector performed prior to the pandemic?

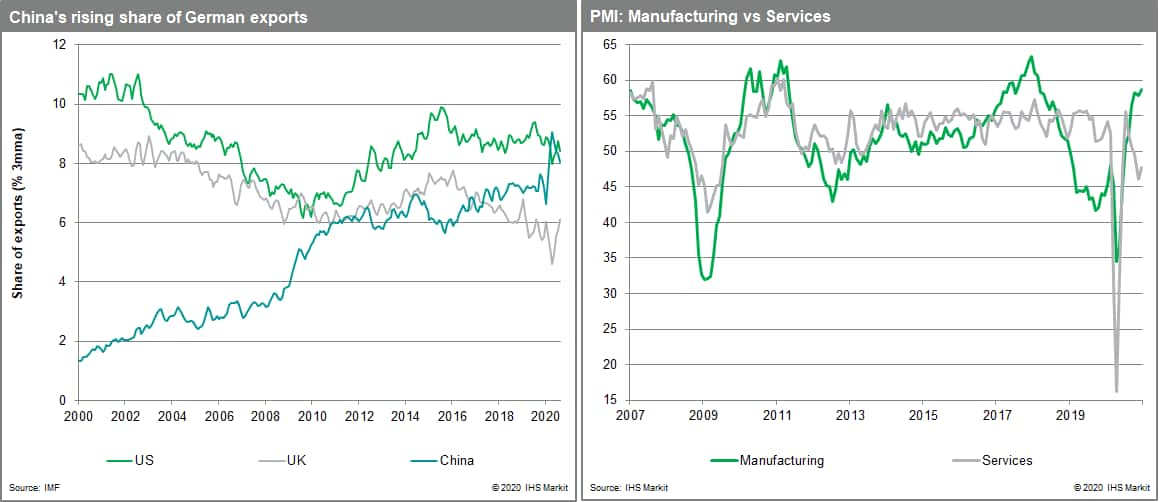

Germany's manufacturing sector contributes much more to GDP than that of most of its European peers, its output constituting roughly 24% of gross value added. As globalization gained momentum in recent decades, this has been the key factor behind Germany's export strength and the driving force for GDP growth. Since 2008, however, a series of crises has led to cyclical and, more recently, also structural setbacks - the GFC of 2008-09, the subsequent eurozone debt crisis, the various problems besetting Germany's key automotive industry since 2015 (diesel emission scandal, city ban debate linked to NO2 emissions, structural shift away from combustion engines to electric mobility), the UK's Brexit decision in 2016, increasing global trade protectionism fueled by the Trump administration in the US, and finally somewhat diminished impetus from Chinese growth due to a government shifting policy focus from investment to consumption.

Although German manufacturing firms coped quite well with the GFC and the eurozone debt crisis, helped by short-time work schemes, the cumulative effect of the above-mentioned factors triggered a downward trend in output from early 2018 onwards. At the end of 2019, German production ex-construction was about 9% lower than in December 2017.

The initial blow from COVID-19 was less severe for manufacturing than it appeared

When the COVID-19 virus began to spread in Europe from February onwards, triggering a fairly strict lockdown in Germany between mid-March and late April, it seemed at first that manufacturing was hit as hard as services due to officially enforced shutdowns of activity. However, this overlooks that government restrictions only forced firms to adapt their production processes in order to safeguard physical distancing requirements and ensure the use of protective equipment, rather than forbidding production per se (except for cases of major virus outbreaks in meat processing plants). Many firms, most notably in the automotive industry, voluntarily enacted plant shutdowns lasting several weeks in order to adapt accordingly.

Manufacturing firms shut down production voluntarily for three main reasons: First, it would have been impossible in most cases to implement above-mentioned protective measures alongside the normal production process. Second, supply chain disruptions linked to the extremely severe shutdown in China in February-March would have caused interruptions to German production in March-April anyway (given shipping times of 4-6 weeks). Third, with consumer demand at home and abroad being stifled by closed shops, manufacturing firms would not have known where to store mounting inventories.

Importantly, the manufacturing sector was also much more familiar with - and thus better placed than services to take immediate advantage of - the existing short-time work instrument, and it could utilize better the various other fiscal support measures launched during Q2 2020.

Manufacturing and services both posted sharp recoveries in Q3 - but only the former proved sustainable in late 2020

The successive loosening of administrative restrictions from May 2020 onwards, enabled by temporarily receding COVID-19 cases, allowed economic activity to rebound strongly across the board. In manufacturing, this was led by automobiles, admittedly from a very low base. The second wave that emerged in October and eventually forced the government to impose another strict lockdown between mid-December and at least mid-January 2021 (including closed shops, services, and schools) caused an almost immediate halt to most service-sector activities but will have limited impact on manufacturing.

The difference is that services, which often can only operate with human contact, are now almost back to square one as long as the lockdown lasts, whereas manufacturing firms may consider the measures they took in March-April as a one-off investment that permits them to produce close to normal now. The sharp divergence between manufacturing and service PMI indicators since August is telling (see chart). In addition, the manufacturing sector's strong export links to Asia are very helpful now that this region largely has the pandemic under control.

Outlook for 2021

Although the structural problems hurting Germany's manufacturing sector in 2018-19 have not vanished, they are overridden at present by its ability - better than in most other European countries currently - to satisfy Asian (partly pent-up) demand. Ironically, the usually cyclically much more volatile manufacturing sector is an anchor of stability in this pandemic, whereas service sector activity will fluctuate with lockdown needs and vaccination progress in the coming months.

Posted 23 December 2020 by Timo Klein, Principal Economist, Insights and Analysis, S&P Global Market Intelligence