Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 03, 2025

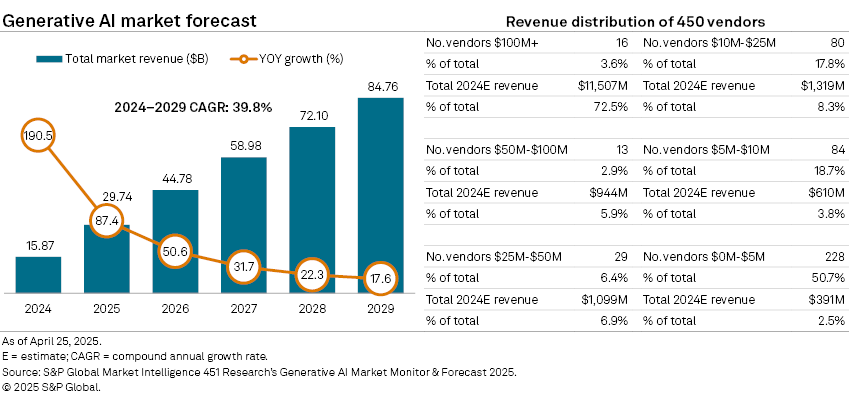

Aggregate revenue for the generative AI market is projected to reach $85 billion by 2029. Significant attention is being paid to the rapid advances in generative AI research, but the translation of those breakthroughs into commercial opportunities is less well understood. In part this reflects the gap between innovation and product, but also uncertainties regarding long-term enterprise investment appetite and market readiness.

While leading model providers often dominate discussions about the GenAI vendor landscape, the market has expanded into a vibrant ecosystem of startups and vendors offering products and services around these models, and we see a growing number of tier 2 vendors establishing substantial businesses. This doesn't mean things are easy for GenAI startups, as they face several challenges. One is the preference of many enterprises to work with established vendors and consultancies to access capabilities, rather than engaging with new startups. This is perhaps unsurprising given the security concerns associated with the emerging technology.

Focusing on one popular application area — software development — only 28% of respondents to S&P Global Market Intelligence 451 Research's Voice of the Enterprise: DevOps, Generative AI in Software Development 2024 survey expected GenAI-assisted software development tools and platforms to come from new vendors for their organization, while 48% anticipated these tools would come from existing vendors. The largest GenAI software vendors, including hyperscalers and model specialists, have broad and ever-expanding appetites. These companies are interested not only in models, but also in tooling and products, both of which are broad and sector-specific. This puts additional pressure on the startup ecosystem, with many struggling to find a niche.

Context

The Generative AI Market Monitor & Forecast is built using revenue models for vendors mapped as part of the generative AI software market — a bottom-up approach informed by 451 Research's proprietary market intelligence. For companies to be included in the Generative AI Market Monitor, they have to offer a packaged software product in which generative AI capabilities are core to that product's value proposition. The Market Monitor is built to account for general-purpose software (designed to address a range of use cases and customer segments) within the following segments: foundation models, text generators, image generators, code generators, audio generators and structured data generators. This data is collected directly from vendors where possible, and projections are framed by survey data and research interviews.

Market forecast to reach $85 billion by 2029

Aggregate revenue is projected to reach $85 billion by 2029, marking a substantial increase from the estimated $16 billion achieved in 2024. This overall forecast broadly aligns with those issued in June 2024; however, there has been a modest uplift, with higher anticipations for growth in 2026 and 2027. This increase is attributed not to changes in individual vendor projections, but to the addition of new vendors entering the market or emerging from stealth mode, resulting in an expansion of providers under coverage from 418 to 450.

Revenue acceleration led by the largest players, but growing cohort of tier 2 startups

The share of the generative AI market held by the top eight vendors has steadily increased and stands at 63% in the second quarter of 2025. Despite the significant growth of these leading players since the first edition of the Generative AI Market Monitor, the market remains competitive. According to the Herfindahl-Hirschman Index, the generative AI software market scores 857, indicating a competitive environment as it is below the 1,500 threshold for moderate concentration and well below the 2,500 mark for high concentration. Additionally, the number of vendors with revenue exceeding $10 million has risen from 78 in June 2024 to 138, with a notable increase in the $10 million-$25 million revenue category.

Code generation remains the fastest-growing segment

The code-generation sector is projected to grow at a compound annual growth rate (CAGR) of 53% from 2024–2029, surpassing other generative AI modalities. Revenue forecasts for 2025 have been revised upward for code generators, increasing from $2.6 million in the previous edition to $3.9 million. Code generators have benefited from the strong productivity and metrics-driven culture surrounding programming tasks in many organizations, making it easier to justify scaling up early pilots. The rigorous quality assurance processes in software development have also helped address some of the hallucination issues associated with generative AI, aiding code-generation products in gaining early traction within the enterprise market. Additionally, interest in "vibe coding" — where non-developers use natural language to instruct AI to write code — has helped build a consumer audience for these products. Responding to this interest, numerous specialist code-generator startups have emerged, with sector coverage expanding from 52 entities in June 2024 to 71 companies.

China in the AI race

The US remains the largest market for generative AI, with 63% of 2024 revenue attributed to AI providers based in North America. In total, 254 generative AI vendors in the Market Monitor are headquartered in the US, representing 56% of the market by count. With that said, China has seen an increase in vendor count. Despite China's high output of AI patents, research papers and models, the open-source approach taken by Chinese technology companies has slowed the commercialization of these efforts. Nevertheless, this sets a strong foundation for future growth, as reflected in the model, with a projected 53% CAGR for Asia-Pacific from 2024–2029, significantly surpassing the 34% growth forecast for North American companies.

While Hangzhou DeepSeek Artificial Intelligence Co. Ltd.'s cost-efficient R1 and V3 model releases garnered significant attention, the notion that these models represent a sudden shift in global AI leadership is misplaced. Chinese startups have already established themselves as among the leaders in areas like rich media generation, particularly for high-quality video models, with notable examples including Kuaishou Technology (Kling), Beijing Knowledge Atlas Technology Co. Ltd. (CogVideoX), Tencent Holdings Ltd. (Hunyuan), MiniMax (Hailuo) and Beijing Shengshu Technology Co. Ltd. (Vidu). Additionally, major price reductions by leading US-based model providers for high-performing models should be considered when drawing comparisons with DeepSeek. Although these price adjustments may partly have been a response to DeepSeek, it is crucial to recognize that US labs are not only releasing leading models but also enhancing their efficiency.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Networks is a regular feature from S&P Global Market Intelligence Kagan. Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan

Location

Products & Offerings

Segment