Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Nov, 2023

Highlights

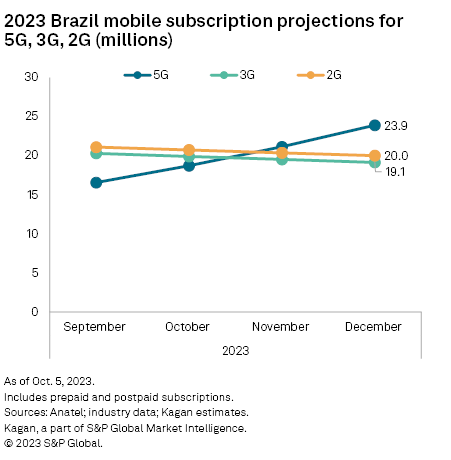

Kagan estimates that Brazil's 5G subs will be larger than both 2G and 3G subs by the end of this year with close to 24 million subscriptions.

As deployment of 5G networks remains the focus, the Brazilian market seems eager to take a step further to open the mobile market and keep the investments coming, according to speakers at Futurecom 2023, Latin America's biggest telecommunications conference, held in São Paulo on Oct. 3–5.

While Carlos Baigorri, chairman of Brazilian telecommunications regulator Anatel, considered 2021's 5G auction the first step toward making spectrum available for small internet service providers, he wants to replicate in the mobile market the asymmetrical rules of the competition goals general plan that drove those companies to dominate fixed broadband in the country.

Under the terms of the plan, heavier rules are imposed on operators with significant market power in determined areas such as coverage obligations or network sharing offers. Small companies benefit from a lighter regulation burden or a deregulated approach. In this new competition goals general plan, Baigorri mentioned new spectrum regulation, including the secondary use of vacant spectrum such as in the 700 MHz band.

Switching off legacy mobile networks will also free up more spectrum. Anatel is working on a plan to turn off 2G and 3G networks and refarm the spectrum to 4G and 5G networks. While early, the proposal is to get operators and vendors (infrastructure and handsets) to somehow subsidize the migration. The regulator is also considering a limitation on certification for new 2G and 3G equipment, including machine-to-machine and points of service, such as credit card machines, that still rely on the legacy networks.

Kagan estimates that Brazil's 5G subs will be larger than both 2G and 3G subs by the end of this year with close to 24 million subscriptions. By August, Brazil had 14.7 million 5G subs, about 6% of the 252.4 million total.

Fair share

A heated debate on the topic of "fair share" arose during one session. Fair share is a position held by telecom operators that large network traffic generators such as over-the-top platforms should contribute to infrastructure financing, or "network fees" as the OTT companies prefer to use. Tomás Paiva, representative of the Brazilian Digital Economy Chamber (Camara-e.net), an association with members such as Amazon.com Inc., Meta's Facebook and Alphabet's Google, said fair share would amount to an inappropriate government intervention in the private sector, imposing a tax on traffic generators despite the investments they are already making in infrastructure — such as submarine cables, content delivery networks and datacenters — and innovation.

Anatel's Baigorri spoke from the telecommunications industry perspective, saying fair share regulation would not be an intervention. Instead, Baigorri advocated withdrawing the net neutrality rules present in Brazil's 2014 Marco Civil da Internet law, with which he argued that the government indeed intervened. Baigorri promised that a new proposal addressing net neutrality would have yet another public hearing.

The president of the major operator syndicate Conexis Brasil Digital, Marcos Ferrari, suggested that requiring fair share payments from OTT providers would support telecoms' necessary return on investment. According to Ferrari, about 80% of Brazil's current mobile data traffic comes from a "handful" of OTT applications.

Agrobusiness

The internet of things agrobusiness was one of the most highly attended panels at the conference. ConectarAgro association President Ana Helena Andrade announced a partnership with Viçosa Federal University to elaborate the methodology for a new rural connectivity index, an economic and demographic study with more granular information about mobile users, coverage and infrastructure access in those areas. The goal is to be a resource for public policies with more consistent and precise data. Another study with the same partner should investigate the impact of broadband on small farmers and rural producers. The ConectarAgro association includes members such as TIM Brasil Serviços e Participações SA, Telefónica SA's Vivo, Nokia Oyj and Amazon.com Inc.'s AWS.

But rural areas are underserved in the country, said Aldo Clementi, the director of business development of IHS Holding Ltd.'s IHS Towers. One of the largest Brazilian tower companies, IHS Towers wants to address the connectivity gap for rural areas by using less expensive tower construction methods that would shave 30% off the construction costs.

Open networks

A new partnership with 14 companies was also announced during the Futurecom conference. Ciena do Brasil Ltda., Dell Technologies Inc., Fujitsu Ltd., International Business Machines Corp., Intel Corp. and Mavenir Systems Inc., among others, are teaming up to build a 5G private network using open networks (Open RAN) in an undisclosed public school in the city of Sorocaba in the São Paulo state.

Wireless Investor is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research