Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 02, 2019

By Arthur Dhont

In total, Ecuador is seeking USD10.2 billion to support the government's economic policies until the end of its mandate in 2021. Other contributors include the Development Bank of Latin America (CAF), the Inter-American Development Bank (IDB), the World Bank, and the Latin America Reserve Fund. Of these loans, USD3.7 billion is earmarked for investment projects; the remainder of the funds are at the disposition of the government to spend as it pleases.

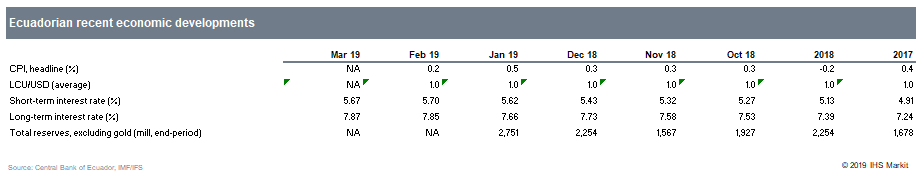

The USD10.2-billion package is likely to help support the level of Ecuador's international reserves. This will boost its liquidity position and support dollarization over the next three years, despite weaker external demand and softer oil prices in 2019-21.

Our macroeconomic outlook remains only modestly positive in 2019-21, projecting a sharp deceleration in 2019-20 in comparison with expected growth in the neighborhood of 1.0% in 2018. The context of deteriorated debt metrics, limited investor confidence, weak oil prices, and a relatively depressed economic growth outlook indicate that the government's fiscal position and its commitment to reform will be tested over the next three years.

Ecuador's government will continue to work on its fiscal adjustment strategy to meet its deficit reduction targets. We currently project a stronger fiscal position beyond 2019, as the medium-term balance of risks moderately improves. Persistent reductions in public investment could help improve fiscal balances but risk delays and cancellations to projects.

The government has pledged to reduce its public wage bill by USD1.0 billion over the next three years. It will also revise its list of social spending recipients to reduce welfare costs. It also plans to revise fuel subsidies - with the exception of socially sensitive diesel and gas - and implement further tax reform, in particular increasing value added tax (VAT) and eliminating the currency export tax (Impuesto Salida de Devisas: ISD). The government had already committed to gradual elimination of the 5% ISD before the IMF agreement was reached.

High debt repayments up to 2024 increase the pressure on the government's debt sustainability capabilities. We expect the government to work on a liability management strategy seeking to spread and extend its liabilities, and to capture concessional official funding where available.

On the downside, we assess increasing risks that could further deteriorate the current balance of risks:

On the upside, our baseline scenario assumes decreasing risks driven by the following factors: