Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 12, 2025

By John Paul O’Sullivan and Michael Johnson

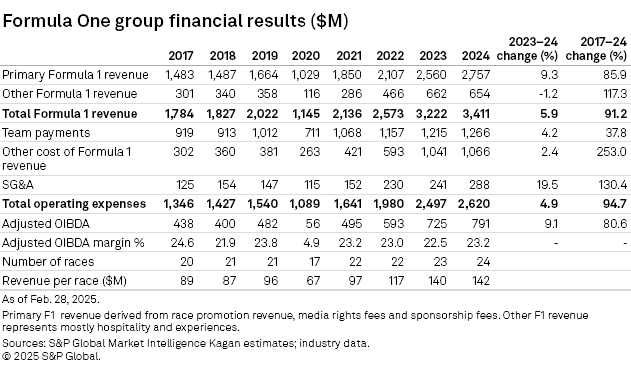

Liberty Media Corp.'s Formula One Group — holder of exclusive commercial rights to the FIA Formula One World Championship — posted revenue of $3.41 billion for 2024, up 5.9% annually. Operating income before depreciation and amortization (OIBDA) rose 9.1% to $791 million. The 2025 season, starting March 16, marks the 75th anniversary of the championship. It is also the 10th year under Liberty Media ownership, which will be pivotal for the US market in commercial terms. Formula One Group's (F1) US profile has been transformed under Liberty Media, which will try to monetize this popularity when renewing its current US media rights agreement that expires at the end of the forthcoming season.

➤ Formula One Group (F1) generated a record $3.4 billion in revenue for 2024.

➤ Liberty Media is preparing for a lucrative renewal of US media rights, maturing at the end of the 2025 season.

➤ Incumbent rights holder ESPN faces strong competition from competing media conglomerates and streamers.

➤ General Motors will enter a Cadillac F1 team in 2026, offering great national interest for US racing fans.

Commercial transformation

F1's total annual revenue grew 91.2% between 2017 and 2024. Primary revenue, which covers media rights, sponsorship and race fees, rose 85.9% during the same time frame. Other F1 revenue, which captures hospitality and race day experiences, has more than doubled with Liberty selling the event as a weekend festival of racing mixed with additional entertainment. On the expenses side, team payments and other costs have risen sharply to enhance the product and extend the season to 24 races, however, margins have remained robust throughout Liberty's ownership.

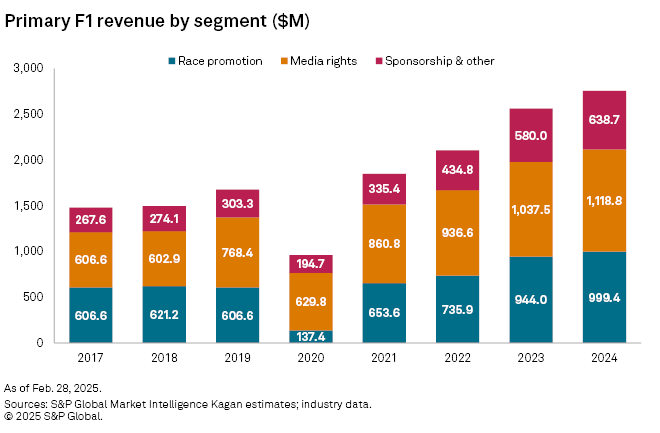

Primary F1 revenue shows that media rights fees grew from $606.6 million in 2017 to $1.18 billion in 2024. Sponsorship also grew strongly, something that Liberty Media identified as being undervalued when it acquired F1 in 2016. Race fees have grown through greater interest from hosting destinations and the rise in number of races in a season.

US media rights renewal

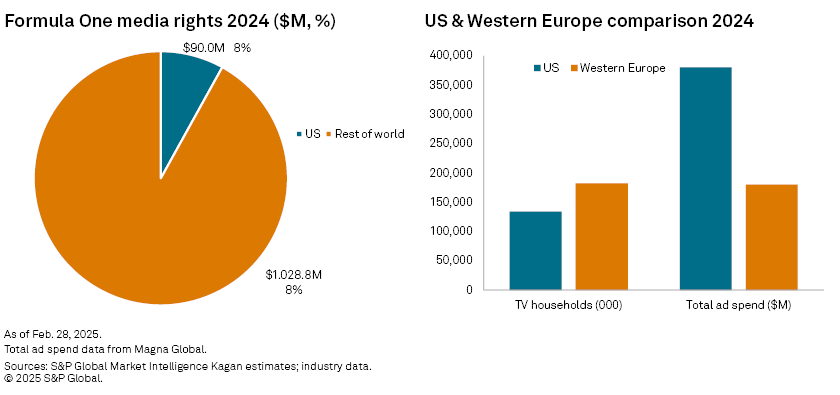

Since acquiring the media rights for F1 in 2018, valued at $90 million annually, Walt Disney Co.'s ESPN Inc. has significantly contributed to the sport's visibility in the US. With these rights set to expire at the end of 2025, however, it was initially reported that the network had chosen to withdraw from future negotiations. Comments during Liberty Media's Feb. 27 earnings call do not rule out ESPN's future involvement, but it appears that they may not be willing to bid aggressively for renewed terms.

During ESPN's partnership with F1, US viewership per race has steadily increased by about 120% over seven years. From 2018 to 2022, average viewership grew from around 500,000 to 1.2 million. In the 2024 season, F1 averaged 1.1 million viewers across ESPN, ESPN2 and ABC, matching 2023 figures but not reaching the record numbers seen in 2022.

F1's US media rights deal represents only 8% of total media income, with the majority of large deals coming from European media markets. As such, the owners may seek to double the next contract to a range of $160 million–$180 million annually, potentially reaching $200 million per year, with Comcast Corp.-owned NBC (US) and Netflix Inc. emerging as the top contenders for the next deal.

Before ESPN's 2018 deal, NBC Sports was the exclusive US media rights holder to all F1 events. The likelihood of a return to the series increased as media rights for Indy Racing League LLC (IndyCar), valued at $20 million annually, expired following the 2024 season. Over the past decade, IndyCar averaged nearly 1.2 million viewers on NBC platforms, peaking at 1.3 million in 2023 before dropping just below 1.2 million in 2024. This decline may have signaled lost momentum and a fresh agreement with F1 could help drive Peacock's future subscription growth. Additionally, CNBC, part of the NBCUniversal network, has broadened its sports coverage and featured the F1 documentary "Inside Track: The Business of Formula 1," which premiered before the inaugural Las Vegas Grand Prix and explored the series' finances, revenue and expansion.

Netflix has experienced remarkable growth in sports coverage and has played a pivotal role in the increasing popularity of F1 through its successful documentary series "Formula 1: Drive to Survive," which highlights the competitors and the dramatic aspects of F1. Netflix and F1 have executed a strong partnership with the series, which debuted in 2019, and a seventh season expected to be released prior to the Australian Grand Prix. Netflix is emerging as a key player sports rights, with recent deals with World Wrestling Entertainment LLC (WWE) and the National Football League Inc. (NFL), as well as showcasing significant sports entertainment events. The streamer is also rumored to be a competitive bidder for the UFC's highly anticipated 2025 media rights.

Apple Inc. could also enter the mix with a substantial bid for F1's US media rights with a focus on exclusive global rights in the future. The tech giant has ties to sport through the recent production of "F1," a film expected to be released in June 2025. Apple is in the midst of a 10-year sports media rights agreement with the Major League Soccer LLC (MLS), valued at $250 million annually.

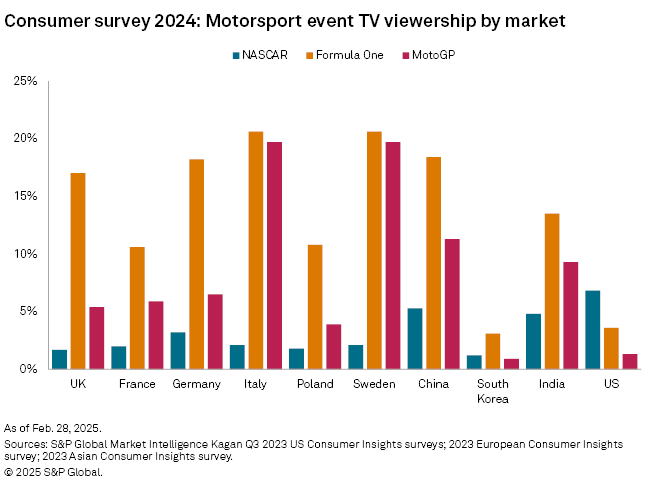

Comparing F1's popularity to other motorsports events, NASCAR remains the most popular among US TV viewers. Nevertheless, the emergence of a Cadillac F1 team in 2026 may attract further support from US racing fans wishing to back a national constructor. From a media perspective, the emergence of competitive local driving talent would benefit the sports appeal.

The Grand Prix schedule in 2025 once again includes three US races in Austin, Las Vegas and Miami. The start time of the Las Vegas Grand Prix has been allocated a prime-time 8 p.m. slot, two hours earlier than last season. The move can be seen as an attempt to support local TV viewing metrics, which has seen stagnation during an uncompetitive 2024 season. In 2025, Max Verstappen will work to maintain his dominance after 53 wins and 70 podiums in 90 total races over the last four seasons, however, Lando Norris has been tipped as the marginal favorite according to bookmakers, which should enhance viewer intrigue in the US and other global markets.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Networks is a regular feature from S&P Global Market Intelligence Kagan.