Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 24, 2022

The October S&P Global flash PMI surveys present a picture of the economy at increased risk of contracting in the fourth quarter at the same time that inflationary pressures remain stubbornly high. Forward-looking indicators have also deteriorated. However, there are clearly signs that weakening demand is helping to moderate the overall rate of inflation, which should continue to fall in the coming months, especially if interest rates continue to rise.

The US economic downturn gathered significant momentum in October, according to the S&P Global PMI data, led by a downward lurch in services activity and a near-stalled manufacturing sector.

The headline Flash US PMI Composite Output Index registered 47.3 in October, down from 49.5 in September. With the exception of the initial pandemic period, the rate of decrease was the second-fastest on record (behind August) and indicative of GDP falling at an annualised rate approaching 2%.

The service sector has seen a markedly worse performance than manufacturing in the past three months, and has also seen optimism for the year ahead slump sharply amid pressures from the rising cost of living and tightening financial conditions. Barring the initial pandemic lockdowns, the average rate of service sector contraction over the past 3 months represents the worst performance for the sector since S&P Global survey data collection commenced in the US in 2009.

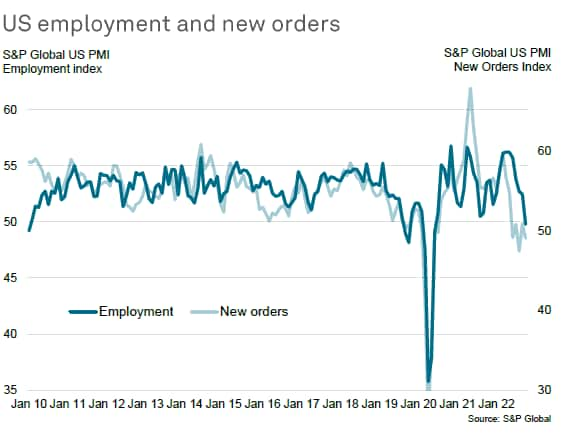

The service sector is now consequently also starting to cut payroll numbers in response to the deteriorating economic situation. The decrease in employment was the first since June 2020.

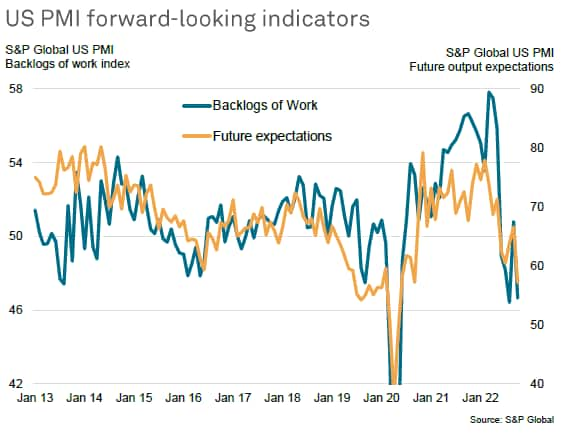

While output and staffing levels in manufacturing remain more stable for now, October saw a steep drop in demand for goods, meaning current activity levels are only being maintained by firms eating into backlogs of previously placed orders. Clearly this is unstainable absent a revival of demand, and it was therefore not surprising to see manufacturers reporting greater caution in relation to payroll numbers in October, and to also be cutting back sharply on their input buying.

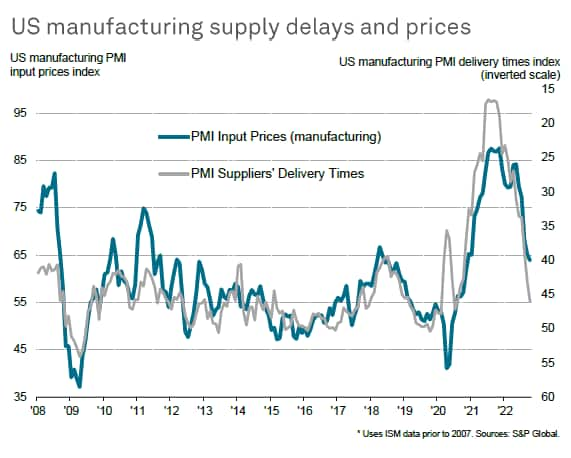

One upside of this drop in input buying has been a further alleviation of supply constraints, with the incidence of delays now at the lowest since July 2020. These easing supply issues, alongside the stronger dollar, have helped cool price pressures in the manufacturing sector.

Although price pressures picked up slightly in the service sector due to high food, energy and staff costs, as well as rising borrowing costs, increased competitive forces meant average prices charged for services increased at a slightly reduced rate. Combined with the easing of price pressures in the goods-producing sector, this adds to evidence that consumer price inflation should cool in coming months, albeit remaining stubbornly elevated into the new year and well above the Fed's target.

A key area to watch will be the labour market, as the recent slump in demand signalled by the PMI new orders index is clearly already feeding through to slower jobs gains. Overall employment was broadly stagnant as a consequence in October, with the respective seasonally adjusted index registering just below the neutral mark of 50.0.

As for the near-term outlook, a plunge in future output expectations bodes ill for business activity over the rest of the year. Likewise, backlogs of work - the accumulation of which has helped drive much of the expansion in 2022 - are now starting to fall at a worryingly steep rate. These metrics will not only feed through to lower output in coming months, but also likely drive a pull-back in the labour market. This should in turn filter through to weaker price pressures.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.