Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 16, 2022

The UK economy contracted for a fifth month in December, according to provisional PMI survey data, with companies cutting staff for the first time since the lockdowns of early-2021 amid signs of excess operating capacity developing relative to order book growth. Supplier delivery delays further moderated to the lowest since the start of the pandemic in a sign that the imbalance of supply and demand seen during the height of the COVID-19 crisis is now reversing, with a commensurate shift in pricing power from sellers to buyers becoming evident. Inflationary pressures consequently eased to the lowest for sixteen months.

There was some encouraging news in terms of business activity and new orders falling at reduced rates, with business confidence in the outlook also reviving further. However, these gauges continue to run at very low levels by historical standards of the survey, and it remains to be seen if the recent upticks merely reflect some noise in the data in the aftermath of September's mini budget. While signs of lower inflation may be helping to restore some business confidence, further interest rate hikes by the Bank of England represent a gathering headwind to the near-term economic outlook.

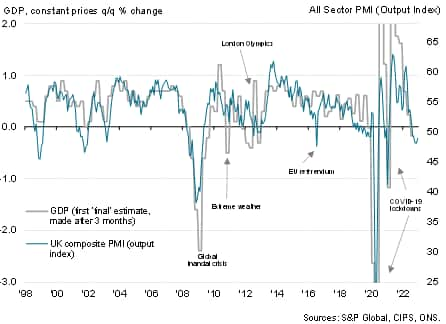

Business activity fell for a fifth straight month in December, according to the flash PMI survey data compiled by S&P Global and sponsored by CIPS. There was some good news, however, as the composite PMI rose from 48.2 in the prior two months to 49.0 to indicate only a modest rate of contraction and an easing in the rate of deterioration. Nonetheless, if pandemic lockdown months and the initial EU referendum shock are excluded, the PMI is still signalling the steepest economic contraction since the height of the global financial crisis in early 2009.

Comparisons with GDP indicate that December's PMI reading is broadly consistent with the economy contracting at a modest quarterly rate of 0.2%, putting fourth quarter growth as a whole at approximately -0.3%. After the 0.2% contraction of GDP in the third quarter, such a decline in the fourth quarter would indicate that the UK is in a technical recession of two consecutive quarterly GDP declines.

UK flash PMI vs. GDP

While the rate of decline remains relatively modest at present, the forward-looking indicators provide a mixed picture as to near-term growth prospects.

There was positive news on firms' expectations of output in the year ahead, with future sentiment recovering further from the 13-year low seen in October in the aftermath of the "mini Budget". However, while the overall degree of optimism has picked up, it remains extremely low by historical standards and at a level which in the past has tended to signal economic stress. Firms often anticipated that weaker economic conditions, intense cost pressures and higher interest rates would translate into further falls in spending and dampen output over the coming year.

Similarly, inflows of new business fell at a slower rate than the 22-month high seen in November, though remain indicative of sharply falling demand and further output losses in the coming months.

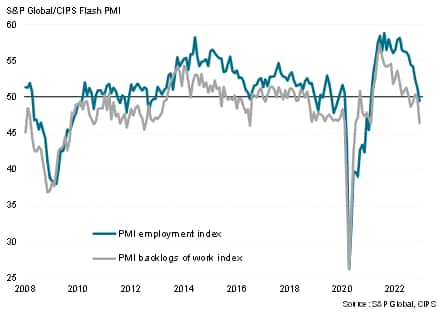

UK flash PMI forward-looking indicators

In contrast, two other PMI indicators painted a downbeat picture. First, backlogs of work - which measures the amount of orders that companies have yet to work through and as such provides a reliable indicator of future operating capacity needs - fell sharply in December, registering the steepest decline since 2012 barring only the early-2020 pandemic lockdowns and the Brexit vote in 2016.

Whereas sharply rising backlogs during the pandemic had encouraged firms to take on extra staff at historically elevated rates, the situation is now reversing whereby falling backlogs of work are causing companies to start reducing payroll numbers, with December seeing the first - albeit marginal - decline in employment recorded since the lockdowns of early-2021.

UK flash PMI backlogs of orders and employment

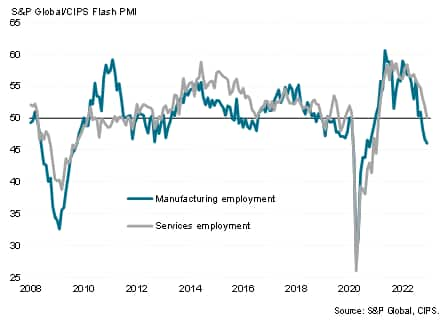

UK flash PMI employment

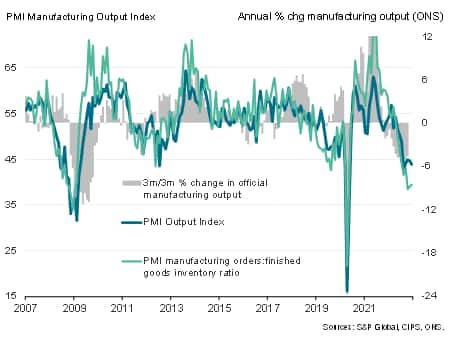

The downturn continued to be led by manufacturing, where the rate of decline accelerated to the fastest seen since the global financial crisis with just four monthly exceptions. Both new orders and export orders fell especially sharply, though the export downturn showed some signs of moderating. Factories nevertheless shed workers at an increased rate.

Looking in more detail by sector, only the food and drink producing sector reported any increase in demand in December, while the steepest downturns are being seen in basic materials, chemicals & plastics and timber industries, often reflecting destocking by customers. Note that both input buying and inventories of inputs fell in December at marked and increased rates, despite supplier delivery delays easing during the month. Supplier delays were the least widespread since January 2020, just prior to the onset of the pandemic in the UK.

UK manufacturing output

Business activity in the service sector meanwhile steadied after two months of decline. However, new orders for services fell for a fourth consecutive month in the sector, leading to a steep drop in backlogs of work at service providers and a stalling of job creation for the first time in the pandemic recovery.

UK output by sector

UK flash PMI employment by sector

Trends were uneven within the service sector, with a notably revival of business growth evident in the hotels & restaurants sector. But new order inflows fell in all other major areas of the services economy, with transport seeing the steepest decline followed by financial services. The latter at least saw its decline of business activity continue to moderate from the slump seen in October in the aftermath of the botched mini budget to play a key role in helping the broader service sector stabilise in December.

UK flash PMI new orders

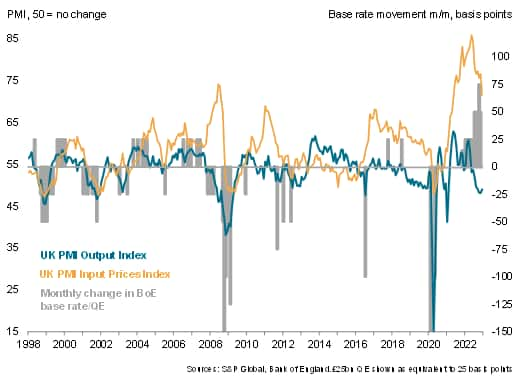

Although average input costs paid by manufacturers and service providers continued to rise at an elevated rate in December, the rate of increase fell to the lowest since May 2021. The easing in cost pressures adds further evidence of a sharp moderation in upward cost increases from a peak back in May. Growth rates cooled markedly in both manufacturing and services.

Slower cost inflation allowed for some pull-back in selling price inflation. Average prices charged for goods and services also continued to rise steeply, but the rate of increase was the lowest for 16 months.

While the sustained elevated levels of the PMI price indices hint at inflation remaining well above the Bank of England's 2% target as we head into the new year, the survey data add to evidence that consumer price inflation has peaked (the rate fell from 11.1% to 10.7% in November) and is likely to moderate significantly in the coming months.

UK flash PMI vs. inflation

The December data add to the likelihood that the UK is in recession, and that the contraction looks set to continue into the early months of 2023. For now, the downturn looks to be relatively mild, and the easing in the rate of decline in December is encouraging news, as is the further marked cooling of inflationary pressures.

However, the fact that the survey's key leading indicators have lifted compared to the turmoil created in the immediate aftermath of the botched "mini budget" is no real cause for cheer, and it is worrying to see business confidence and demand remain so low by historical standards. Hence businesses are battening down the hatches, most notably by reducing headcounts, in a sign that the downturn not only has further to run but could yet accelerate again, especially given the further 50 basis point hike to interest rates announced by the Bank of England at its December meeting.

UK PMI and Bank of England monetary policy decisions

Read the accompanying press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.