Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 24, 2023

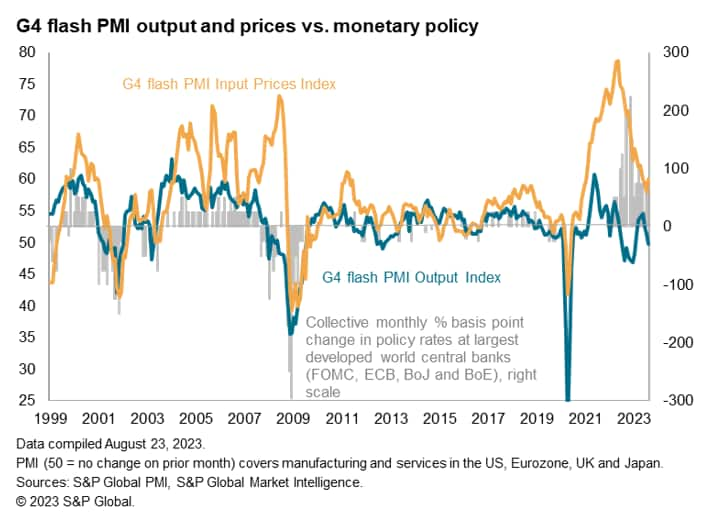

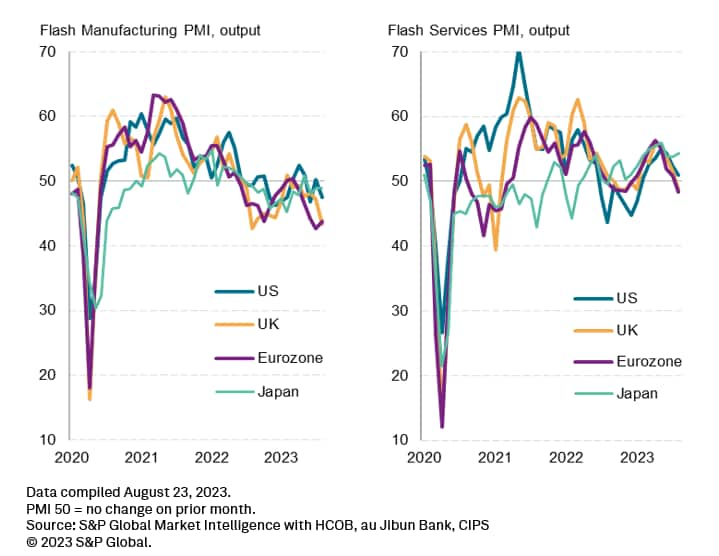

Early PMI survey data for August from S&P Global showed the major developed economies collectively slipping into contraction for the first time since January. Falling business activity in the Eurozone and UK, and a near-stalling of growth in the US, contrasted with robust growth in Japan and underscored how tighter monetary policy in the west is dampening demand.

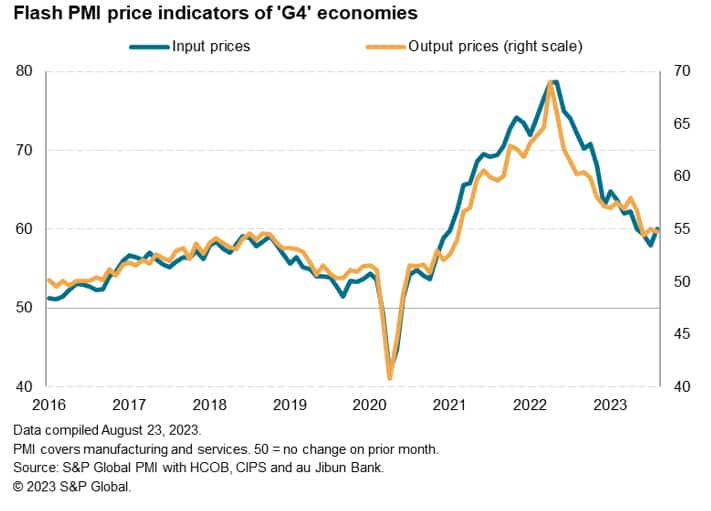

Price pressures meanwhile showed signs of stickiness, especially in the service sector, adding to concerns that the battle to get inflation down to 2% remains far from won.

However, while employment continued to grow, a further deterioration in order books and the demand environment led to a near-stalling of employment across the G4, which should help bring wage-related inflation pressures down in the months ahead.

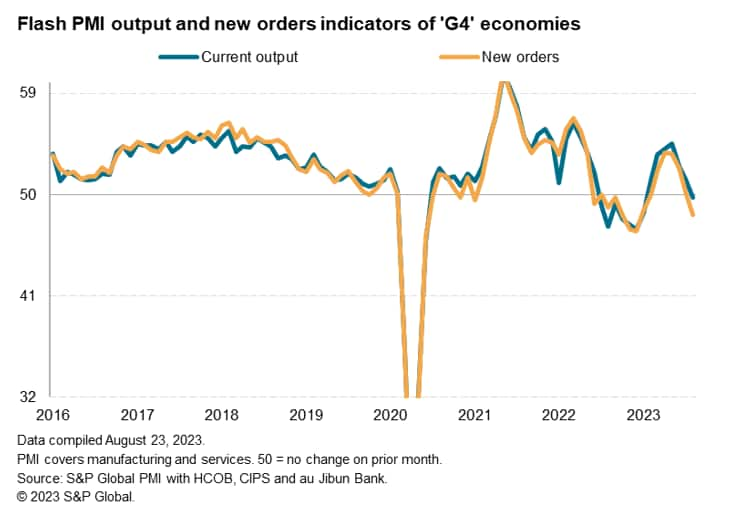

Business activity across the four largest developed world economies (the "G4") fell into decline in August after six months of continual output growth, according to the provisional 'flash' PMI data compiled by S&P Global Market Intelligence.

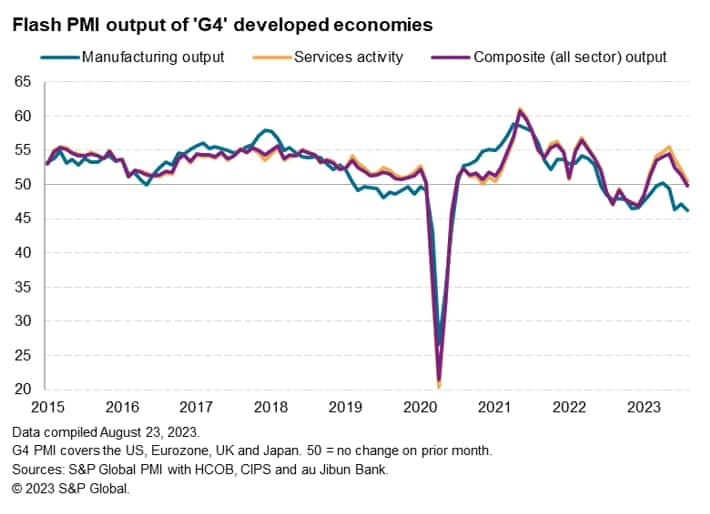

Although only marginal, the decline in output represents a major change from the robust expansion which peaked in May. Worse also looks set to come, after new orders fell across the four economies in August at a relatively steeper rate than output.

The rate of service sector expansion slowed in the G4 for a third successive month to its weakest since the sector's current upturn began in February. The resultant near-stalling of service sector growth represents a faltering of a recent key area of support to the global economy, and hints at a growing impact of higher interest rates on demand notably from consumers, hitting demand for activities such as recreation, travel and tourism especially hard. These sectors had seen the strongest expansion earlier in the year, according to S&P Global's detailed sector PMI data, buoyed by the full removal of worldwide COVID-19 containment measures in 2023 compared to prior years. New orders for services fell in August for the first time since January.

Manufacturing output in the G4 economies meanwhile contracted for a fourth successive month, and for the fourteenth time in the past 15 months. The rate of factory output decline accelerated to one of the sharpest rates seen since the global financial crisis. New orders for goods likewise fell sharply, notably continuing to deteriorate at a considerably steeper rate than output to hint at further downward production adjustments in the coming months as producers scaled back capacity. Companies reported lower final demand from customers as well as an ongoing trend towards inventory reduction, which further stymied orders.

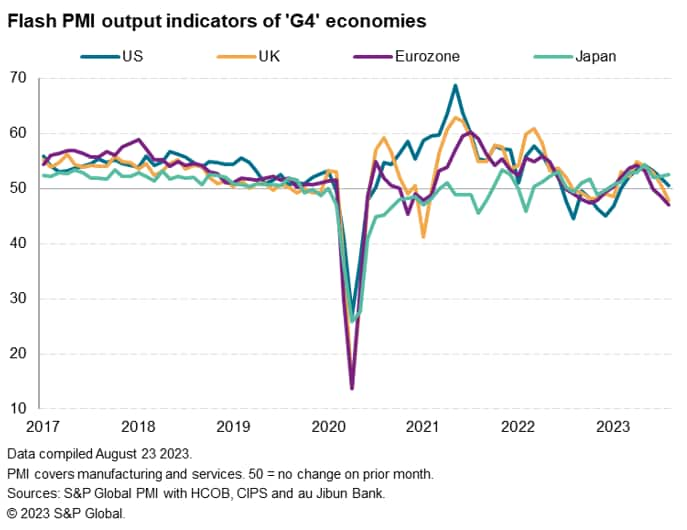

Both the Eurozone and the UK reported falling output in August and growth slowed to near-stagnation in the US, leaving Japan as the only major developed economy to report expansion.

All four economies reporting falling manufacturing output, with the Eurozone and UK seeing especially sharp declines, but growth was more mixed in the service sector. Increasingly robust growth of services activity in Japan contrasted with falling activity in the Eurozone and the UK and a much-weakened expansion in the US.

These service sector growth variations can be partly explained by monetary policy differences, with interest rates having been hiked aggressively in the US, Eurozone and UK but remaining unchanged in Japan. The service sector is typically the most interest rate sensitive part of the economy.

The Eurozone consequently led the overall G4 downturn, registering a fall in the combined output of manufacturing and services for a third straight month with the rate of decline accelerating to the fastest since lowest since November 2020. If pandemic months are excluded, the latest reading signaled the steepest downturn since April 2013, commensurate with GDP falling by approximately 0.3% on a quarter-on-quarter basis.

Overall business output meanwhile fell in the United Kingdom at the fastest rate since January 2021 and, if the lockdown months are excluded, at one of the fastest rates since the global financial crisis. The UK flash PMI data signal a similar rate of GDP decline to that seen at the Eurozone, at around 0.3%.

While growth continued to be recorded in the United States, the overall expansion was only marginal and the weakest since February, indicative of a near-stalled economy midway through the third quarter.

Japan's overall expansion meanwhile accelerated thanks to the ongoing resurgence of service sector activity, albeit continuing to run below May's recent peak. The latest composite output reading, covering both sectors, is broadly consistent with Japan's GDP growing at a solid annual rate of around 2%.

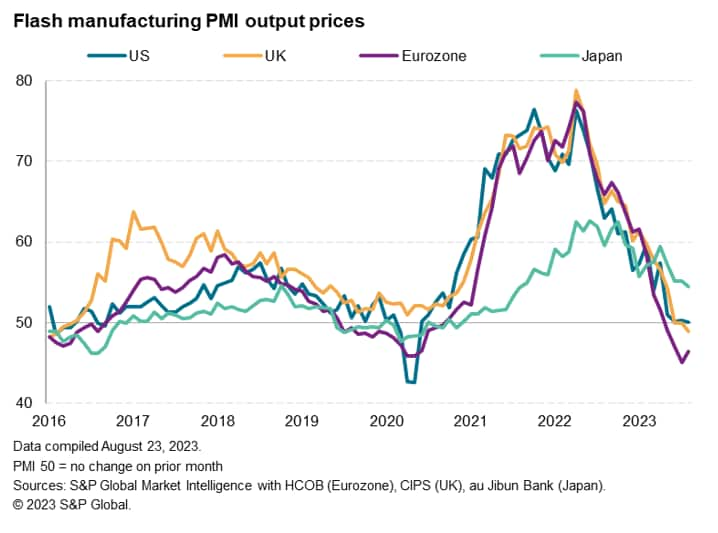

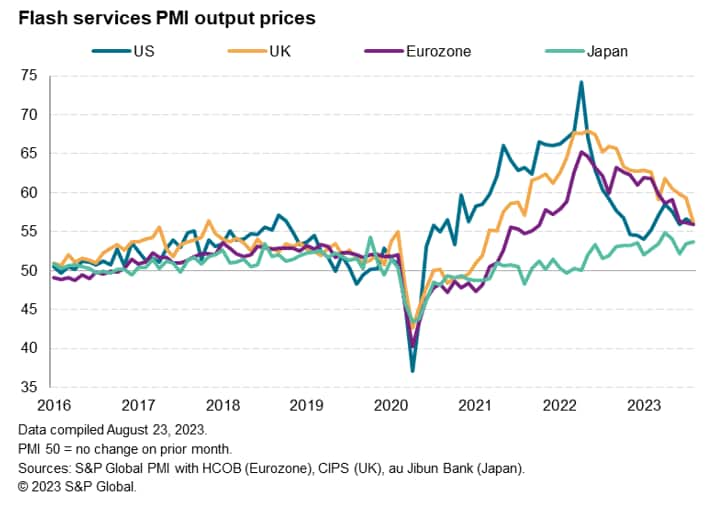

On the inflation front, the surveys collectively pointed to some stickiness of both input costs and average selling price inflation, albeit with rates of increase well down on the strong rates seen over the two years prior to mid-2023. Input cost inflation even ticked slightly higher across the G4 on average, commonly linked to higher wage costs and increased energy prices.

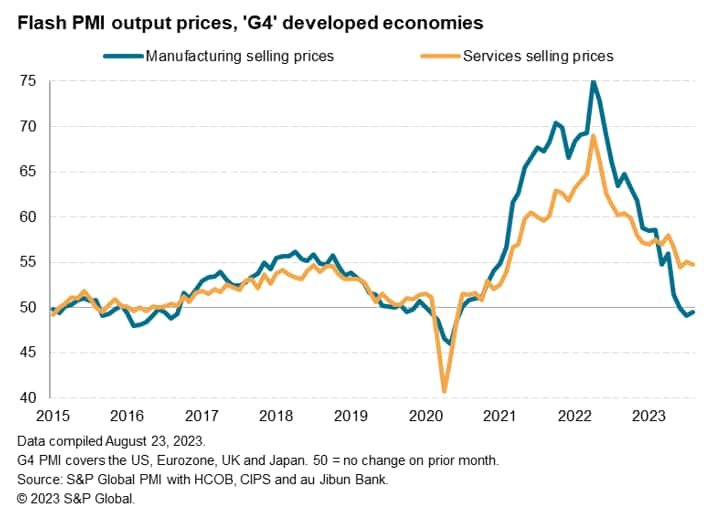

Looking at selling prices across the G4, average prices charged for goods by factories fell slightly for a second successive month, albeit with the rate of decline moderating compared to July. Service sector charges meanwhile continued to rise at an historically elevated pace, though even here the rate of increase has cooled in recent months to some of the weakest seen since early 2021. Some upward pressure on costs from energy prices was reported, as well as higher wages.

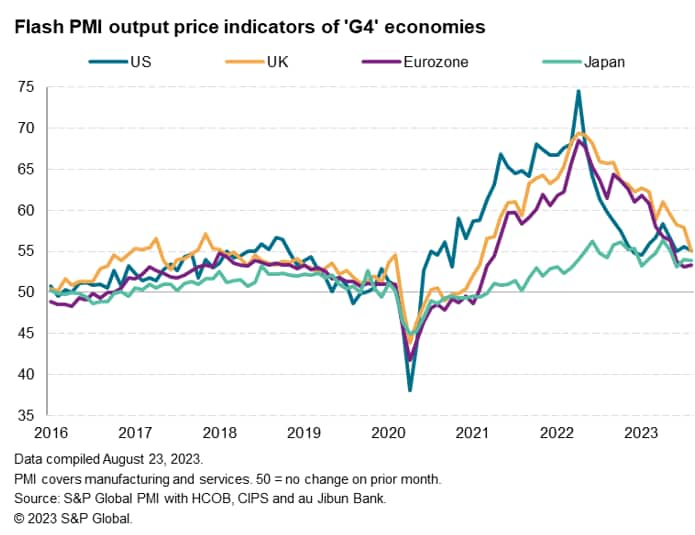

The UK was notable is seeing overall selling price inflation moderate substantially in August, though the slowing merely brought the rate of inflation more in line with the rate seen in the US and still above that of the Eurozone and Japan. Largely unchanged readings in the US and Eurozone, as well as the continued elevated reading in Japan, point to some stickiness of consumer price inflation in the months ahead, all largely driven by the service sector.

In the US and Eurozone, annual CPI rates of around 3% are indicated and in the UK the rate looks set to dip below 4% in the coming months. In Japan, inflation is signalled to remain around the 2% mark.

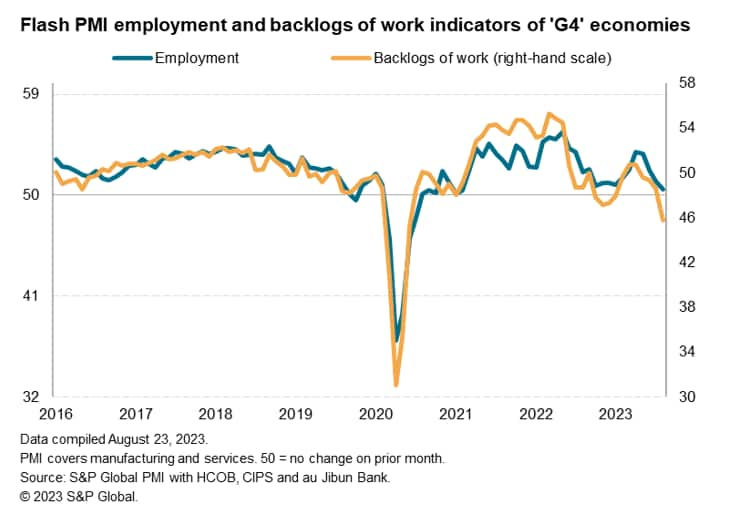

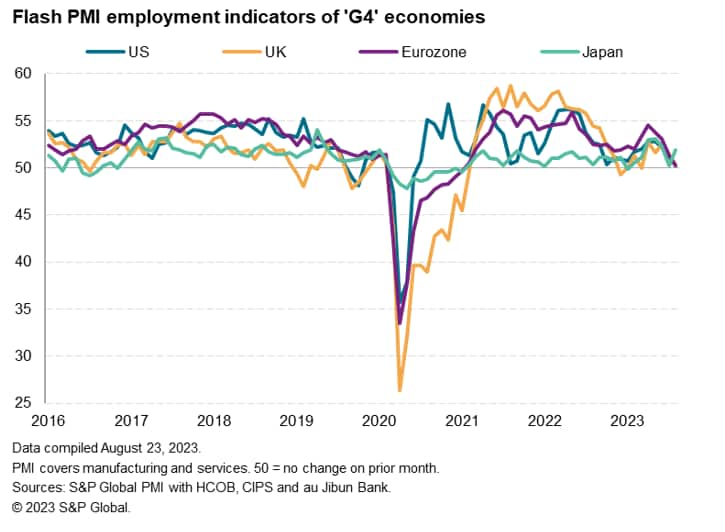

With the stickiness of inflation in the service sector largely linked to wages, policymakers will be encouraged to see signs of further cooling jobs markets. Across the G4 economies as a whole, employment barely rose in August, registering the smallest increase for almost three years and contrasting markedly with the robust jobs gains seen earlier in the year. Jobs growth has almost stalled in the US, Eurozone and the UK.

Broadly speaking, companies are reassessing their hiring needs and adjusting their recruitment lower in the face of dwindling demand. Backlogs of work across the G4, for example, are now falling at the sharpest rate since May 2020, and at one of the steepest rates yet recorded by the surveys, in a sign that excess capacity is developing to an extent that companies will start to reduce headcounts in the coming months. Such a labour market cooling should in theory feed through to lower pay pressures.

The August survey data, and in particular the divergences between the weakness appearing in the US and European economies relative to Japan, therefore suggest strongly that higher interest rates from the Federal Open Market Committee (FOMC), European Central Bank (ECB) and Bank of England (BOE) are exerting an increasing toll on demand. Third quarter contractions of GDP are now being signaled for the Eurozone and UK and a near stalling of growth in the US is evident.

However, price pressures have meanwhile shown signs of settling at levels indicative of inflation running ahead of targets in the US and Europe. A further softening of the inflation picture is only likely to occur with a downturn in labour markets. In that respect, some encouragement comes from the fact that hiring has now all but stalled in the US and Europe, and forward-looking data suggest that net job losses could soon be indicated by the PMI survey panels.

How the central banks will assess these trends remains uncertain, but the August data certainly raise the bar for further rate hikes in the US and Europe as it is becoming increasingly clear that demand is being squeezed to an extent that should cool inflation in the months ahead.

Access the Flash Eurozone PMI, UK PMI, US PMI and Japan PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.