Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 22, 2024

By Jingyi Pan

Japan's private sector activity broadly stagnated in February according to flash PMI data, attributed to a combination of slowing services activity growth and an acceleration in manufacturing output contraction. A sharper decline in goods new orders, underpinned by sluggish demand conditions, also largely offset improved demand for services.

Concurrently, price pressures eased with both input costs and output prices rising at slower rates across Japan's private sector. The slowing of growth and further cooling of inflationary pressures midway into the first quarter therefore place less pressure on the Bank of Japan to exit their current ultra-loose monetary policy as we await their next move.

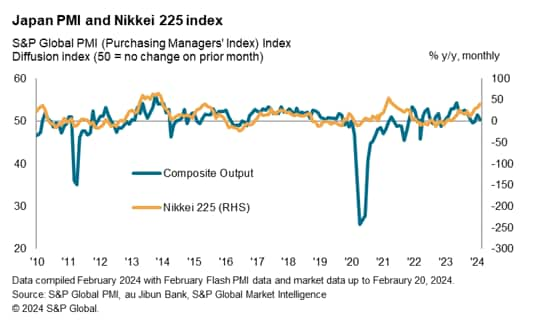

While the latest flash PMI declined, equity indices have continued to soar in Japan and the deviation between the two is worth watching for how eventual convergence may unfold, given the prior strong correlation.

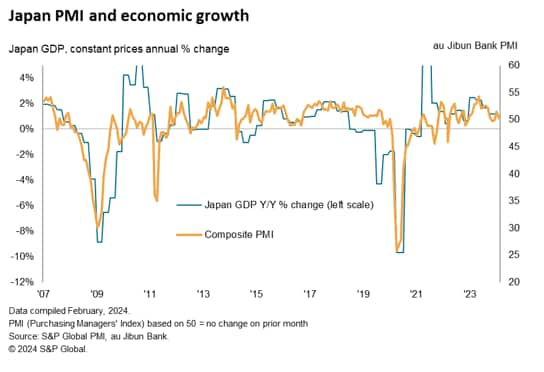

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, fell from a final reading of 51.5 in January to 50.3 in February. The flash reading, based on approximately 85%-90% of total PMI survey responses each month, therefore suggests that Japan's private sector conditions broadly stagnated in the latest survey period. The latest composite output reading - covering both manufacturing and services - further points to GDP growing at an annual rate around 1% midway into the first quarter.

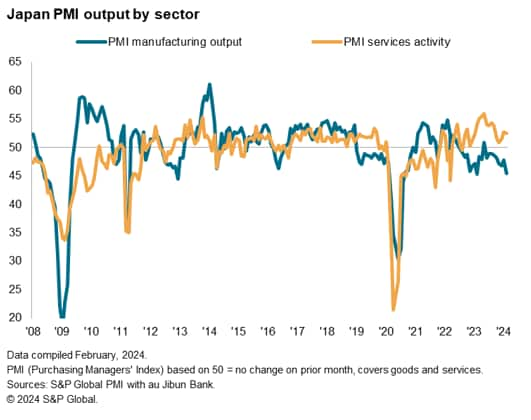

Japan's key manufacturing sector remained in contraction, with output dropping for a ninth successive month in February, falling at an even faster rate when compared to the 12-month average in the latest survey period. This was as goods orders declined at the sharpest pace in a year due to sluggish demand conditions and inventory management policies at clients, according to anecdotal evidence from survey respondents. Foreign demand likewise remained weak by historical standards. In turn, Japanese manufacturers reduced their purchases of inputs and shed staff at a faster rate in February.

On the other hand, services activity remained in growth territory in February, extending the period of expansion to one-and-a-half years. The rate of expansion eased from January, however, contributing to the stagnating of overall conditions in February. That said, it is worth highlighting that the latest slowdown in services activity growth is partly due to capacity constraints amid reports of labour shortages by panellists. The level of backlogged work rose at the sharpest pace since last June despite Japanese service providers increasing headcounts at the most pronounced rate in nine months to cope with ongoing workloads. This signalled that conditions remained robust in the service sector to sustain activity growth in the coming months.

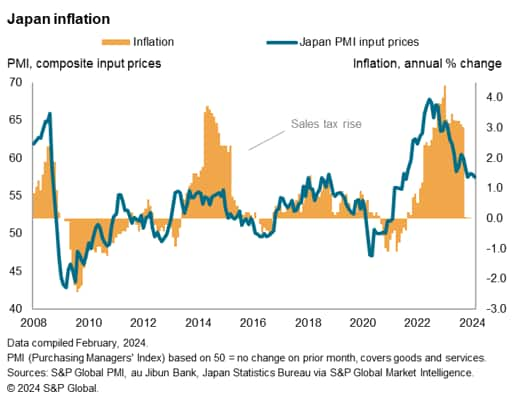

Price pressures meanwhile eased in tandem with the broad stagnation of operating conditions in February. Average input prices increased at the slowest pace since August 2021, with both manufacturing and service sectors recording softer cost inflation rates. Firms were thereby able to raise selling prices at a slower rate, with anecdotal evidence further suggesting that some manufacturers kept prices unchanged or even lowered output prices with the intention to boost sales.

The latest PMI price indications are consistent with the headline CPI falling further past the 2.0% level in the coming months. Easing inflationary pressures, alongside stagnating growth conditions, therefore provide little reason and urgency for the Bank of Japan to shift policy quickly despite expectations for the central bank to exit its current ultra-loose monetary policy stance in early Q2.

Ongoing market optimism has meanwhile continued to support the Japanese equity market, with the Nikkei 225 having surged higher of late. This has caused the equity index to deviate further from the composite PMI index, with which it typically exhibits a strong correlation. With the consensus bullish view for the Japanese stock market built on the longer-term growth potential, it will be of interest to observe how the PMI and the Nikkei 225 will eventually converge. As far as the PMI future output index is concerned, optimism among businesses remains elevated, above the series average level, despite easing from the start of the year.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location