Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 24, 2023

The UK economy continued to skirt with recession in October, as the increased cost of living, higher interest rates and falling exports were widely blamed on a third month of lower output.

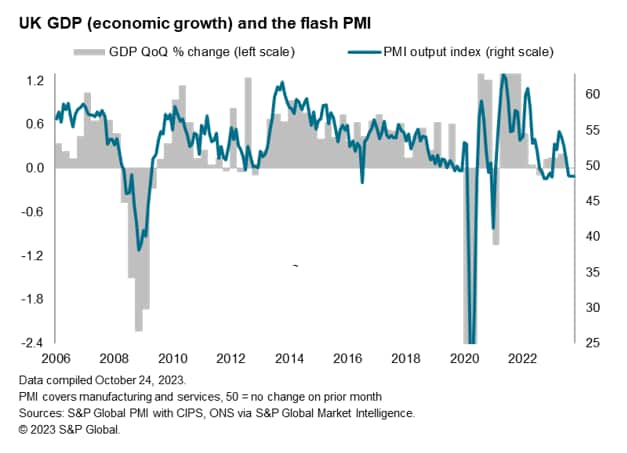

The overall pace of decline remains only modest, signalling a mere 0.1% quarter rate of GDP decline, but gloom about the outlook has intensified in the uncertain economic climate, boding ill for output in the coming months. A recession, albeit only mild at present, cannot be ruled out.

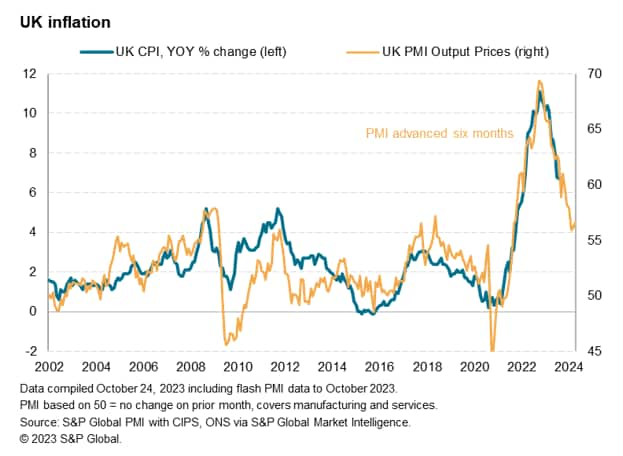

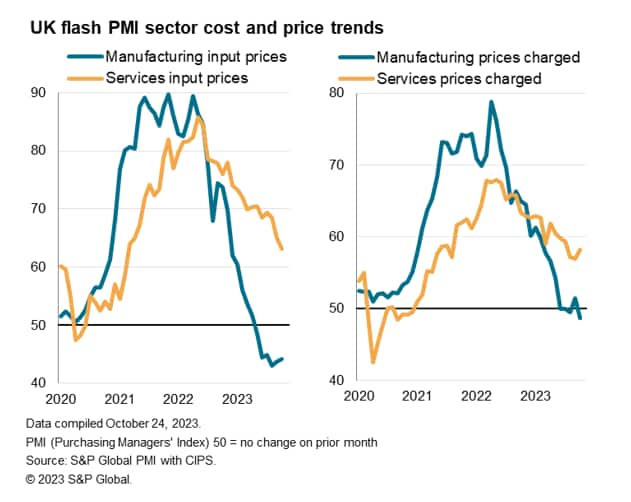

Encouragingly, cost pressures have continued to moderate, in part helped by reports of lower wage inflation and further falls in prices charged by manufacturers. However, selling price inflation for services remains somewhat elevated, and even ticked higher in October, pointing to some stickiness of headline inflation around the 4% mark into the early months of next year.

In this context, any upward inflation pressures due to higher oil prices will be a major concern, meaning it would be unlikely for policymakers to rule out the possibility of rates rising again later in the year.

UK business activity declined for a third month running in October, suggesting the economic malaise seen at the end of the third quarter has spilled over into the fourth quarter.

At 48.6, up marginally from 48.5, the headline seasonally adjusted S&P Global / CIPS Flash UK Composite Output Index signaled an overall reduction in the combined output of manufacturing and services at only a slightly milder rate compared to that seen in September. At its current level, the PMI is broadly indicative of GDP falling at a quarterly rate of just over 0.1%, having pointed to a 0.1% quarter-on-quarter GDP contraction in the third quarter.

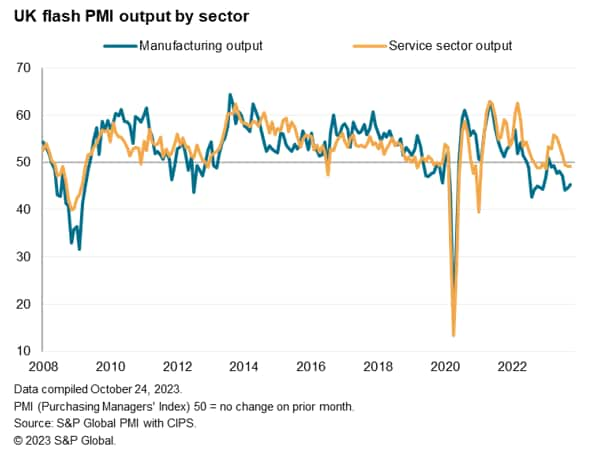

Both manufacturing and services remained in contraction during October, the latter continuing to report the steeper decline.

Service sector output fell for a third successive month. Although again only modest, the sustained downturn represents a major change to the buoyancy seen in this part of the economy earlier in the year. The decline was the steepest since January. Worse may be to come, as new business inflows into the sector fell at a quicker pace in October. The overall drop in demand signalled by the service sector's new business index was the sharpest since last November and contributed to a step-down in expectations about future activity levels. Future prospects among service providers slipped in October to the lowest since last December.

Within the service sector, consumer-facing services remained under especially steep pressure, with transport also again slumping sharply during the month. Demand for financial services likewise continued to slide which, combined with a sustained contraction of demand for business services, led to a broad-based downturn across the services economy. Only the tech/IT sector reported higher output.

Manufacturing output meanwhile continued to fall sharply in October, dropping for an eighth successive month with the rate of contraction easing only slightly compared to the sharp declines seen in August and September. Some encouragement can be gleaned from a cooling in the rate of loss of new orders in the factory sector to the lowest since June, though the rate of decline remained worryingly severe by historical standards, in part reflecting steep export losses. Also of concern was a drop in future output expectations to the lowest since last December.

Measured across both sectors, future output expectations have now fallen to their lowest in 2023 to date which, alongside a further marked fall in backlogs of work, hints at the downturn persisting in the near term.

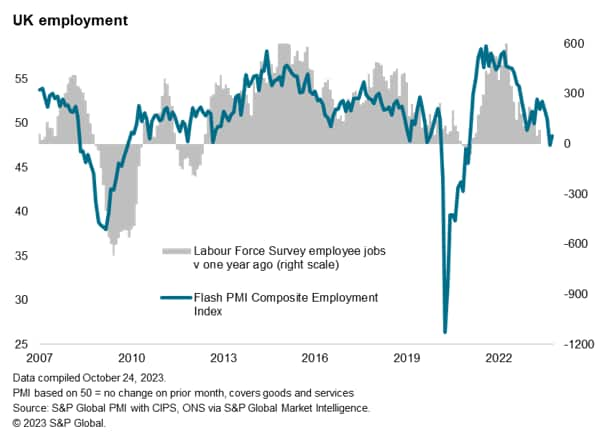

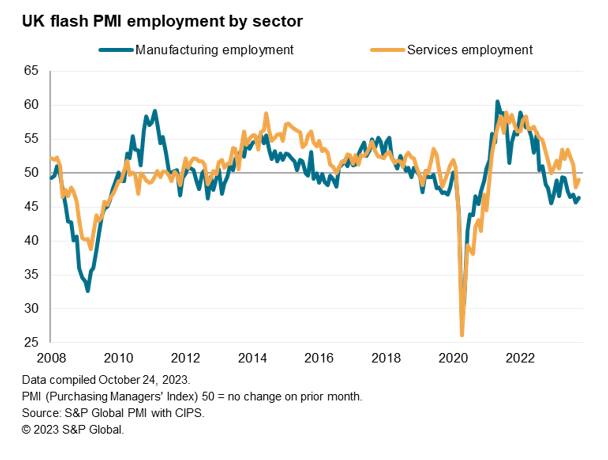

The gloomier outlook led to a second month of falling employment. Manufacturing headcounts fell especially sharply, down for a thirteenth straight month, while service sector payrolls were trimmed for a second successive month, albeit both to lesser extents than in September.

It's worth noting that the PMI's employment index remains historically consistent with a broad stabilisation in official labour force jobs, rather than a decline, but this nevertheless presents a much-weakened picture of the labour market compared to earlier in the year.

The survey meanwhile brought mixed news on inflationary pressures.

Average prices charged for goods and services rose at an increased rate for a second successive month, the rate of inflation edging up to its highest since July. A fall in manufacturing prices, the largest such fall since early-2016, was offset by an increased rate of service sector selling price inflation.

Although down sharply from the start of the year, the overall rate of increase consequently remained elevated by historical standards. The current index reading of 56.6 compares, for example, with an average of 53.4 in the four years prior to the pandemic and a survey long-run pre-pandemic average of just 52.2.

At this level the PMI's selling price index points to some stickiness of CPI inflation around the 4% mark, albeit signalling a further substantial cooling from the current 6.7% rate in the near-term.

There was better news on the inflation front from firms' costs, which across both sectors rose in October at the slowest rate since January 2021. Manufacturing input costs fell for a sixth straight month, albeit the rate of decline moderating slightly on the back of higher oil prices, while service sector input cost inflation slipped to its lowest since February 2021.

With changes in costs tending to lead price movements, the further moderation in cost growth in October bodes well for selling price inflation to resume its easing path in the months ahead, albeit with uncertainty over oil prices in particular clouding the outlook.

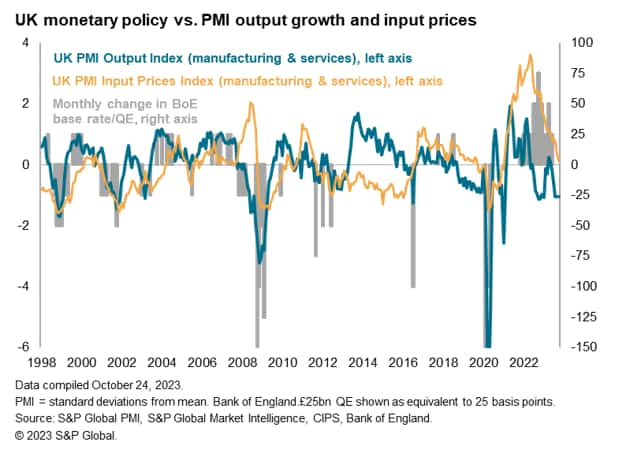

The further economic contraction signalled in October alongside the sustained cooling of cost growth supports the Bank of England's decision to unexpectedly hold interest rates unchanged at 5.25% at its September Monetary Policy Committee meeting, ending a run of 14 consecutive rate hikes. The signs of a weakening labour market will also help allay concerns over second-round inflation pressures from rising wage rates.

However, higher oil prices pose a threat to inflation in the months ahead, and the feed through of upward energy costs to prices will be an important aspect of the inflation process to monitor, especially given the slight uptick in selling price inflation signaled by the October surveys. In this environment, it would be unlikely for policymakers to rule out the possibility of rates rising again later in the year.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location