Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 23, 2023

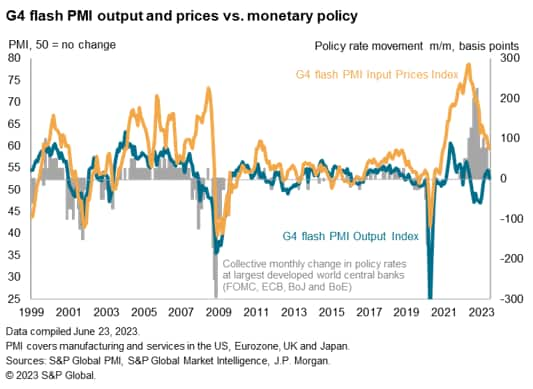

June's flash PMI surveys rounded off a solid second quarter, with all four largest developed world economies having continued to grow in June. However, the recent growth surge seen in the spring has lost momentum, and almost petered out in the eurozone, as a deepening manufacturing downturn has been accompanied by slower growth in service sector activity. The latter had been buoyed by resurgent post-pandemic spending in the spring, but this impact now appears to be waning as the reality of higher interest rates and the rising cost of living dominates.

Encouragingly, inflation pressures have continued to abate, disappearing almost entirely in manufacturing and cooling in services - the latter having been a major source of concern in recent months as higher prices were linked to rising labour costs. Consumer price inflation should therefore continue to moderate - potentially markedly in the US, Eurozone - though some stubbornness remains especially evident in the UK.

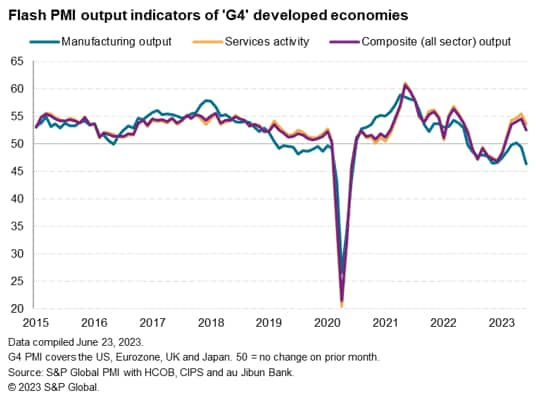

Business activity across the four largest developed world economies (the "G4") rose for a fifth month running in June, according to provisional 'flash' PMI data compiled by S&P Global. However, the rate of growth slowed from May's 13-month high to register the weakest expansion of output since February.

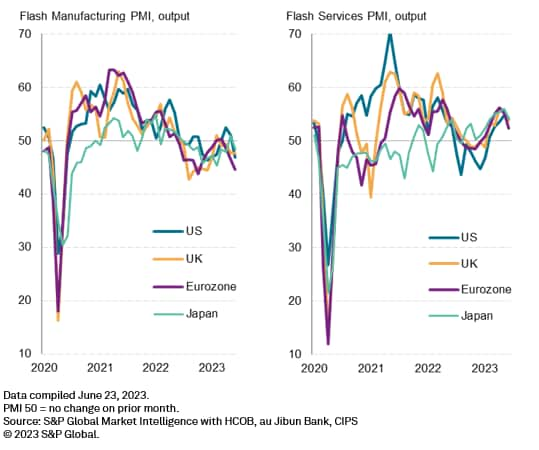

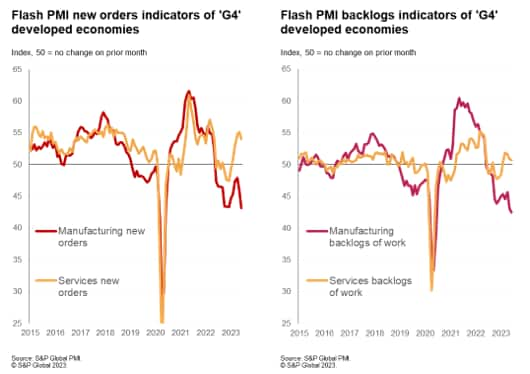

The slowdown was led by manufacturing, where output fell for the twelfth time in the past 13 months with the rate of decline accelerating to the fastest since last November. More notably, the decline was the joint-fastest since May 2009 if pandemic lockdown months are excluded. New orders for goods fell at an even steeper rate than output, dropping at the sharpest pace since May 2009 barring only the decline seen in the four months to June 2020.

The service sector meanwhile continued to expand, with activity up for a fifth straight month, though the rate of growth here was the weakest since February. This slowing suggests that the strong growth spurt seen in the three months to May has lost some momentum, linked in turn to a cooling of order book growth during the month.

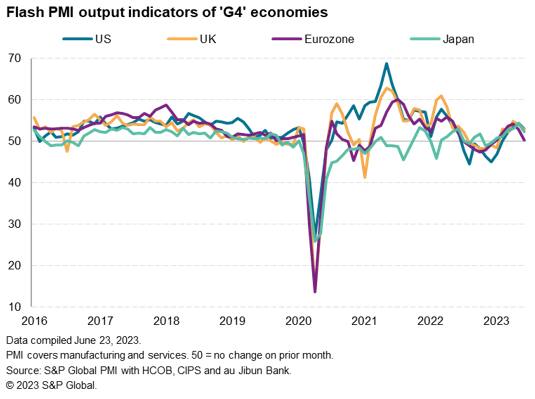

The sharpest slowdown was seen in the eurozone, which was in turn led by a renewed drop in output in France. Output growth across manufacturing and services almost ground to a halt across the eurozone after four months of robust growth. A drop in new orders hints strongly at the single currency area falling into decline in June. The eurozone's manufacturing sector is already in a steep contraction, which gathered further pace in June, but the region's service sector also saw growth weaken materially in June, down to its lowest in five months. Both sectors consequently sat at the bottom of the G4 rankings.

The United States meanwhile continued to lead the pack, albeit by a small margin as even here the rate of growth cooled to a three-month low. The US manufacturing sector slipped into a marked decline, with output falling for the first time in four months, while the service sector reported a weakening in the rate of output growth, albeit only modestly from May's 13-month high.

Growth also slowed to a three-month low in the United Kingdom, as a fourth successive monthly decline in manufacturing output coincided with a cooling of service sector growth.

Japan likewise reported a slowdown, with growth down to a four-month low. A renewed decline in manufacturing output was accompanied by the weakest service sector growth for four months.

We are seeing two key trends develop in June, which have driven the weakening growth picture.

First, prior months had seen manufacturing buoyed in many countries by improving supply conditions. This supply boost had allowed factories to fulfil orders placed in prior months, many having been accumulated during supply-constrained pandemic months. However, with new orders falling at an historically marked rate, these backlogs of orders are not being replaced, meaning factories are adjusting output lower in the light of the deteriorating order book situation.

An exacerbating factor has been an increasing trend towards inventory reduction amid excess stock holdings, which means purchases of inputs - many of which are manufactured items such as electronic components - are falling sharply.

Note that with manufacturing backlogs falling at a steeper rate in June, we would expect G4 factory production to decline at an accelerating rate in July.

Second, the resurgent growth in recent months had been largely propelled by a revival of spending by consumers on services, as well as an uplift in financial services activity. The consumer spending uplift in particular appears to have shown signs of losing steam in June, something which is not surprising given the consumer sector's exposure to higher interest rates.

Growth in prior months had been fueled by a surge in spending on travel, tourism and recreation activities such as hotels and restaurants, as the spring months coincided with the first truly opened global economy in terms of COVID-19 containment since 2019. However, there are signs that the rising cost of living and higher interest rates are now overriding this renewed propensity to spend. This dampening is more evident in Europe than the US and Japan. National variations in financial conditions also appear to be playing a role.

We will know more about these trends with the release of detailed sector data on 7th July ( the May data can be viewed here). However, with interest rates having risen again in the Eurozone and UK in June, and the lagged impact of prior rates set to fully feed through to the economy in the US as well as Europe, there are clearly downside risks to growth in the coming months.

The prospect of further rate hikes will naturally be steered by inflation developments, for which the flash PMI surveys brought encouraging news.

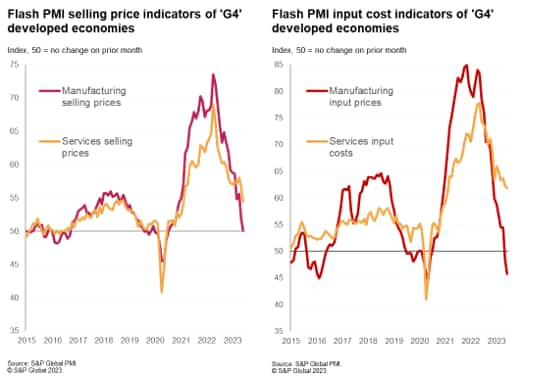

In prior months the surveys had shown stubbornly elevated input cost and selling price inflation in the service sectors of all G4 economies, driven primarily by higher labour costs ( see our recent inflation note here). However, the June flash PMI data showed a welcome and marked cooling of service sector selling price inflation across the G4 economies, taking the rate of increase down to its lowest since the lockdowns of early-2021. Manufacturing selling price meanwhile barely rose, registering the smallest increase since July 2020.

These weaker rates of selling price inflation were linked to reduced input cost price pressures. In fact, manufacturers' input costs fell at the steepest rate since May 2020, dropping for a second successive month, and service sector costs rose across the G4 at the slowest rate since February 2021. Although the latter is still showing unwelcome signs of stickiness, remaining elevated by historical standards and even rising in the US, some of the elevated nature of this cost index reflects higher interest rates.

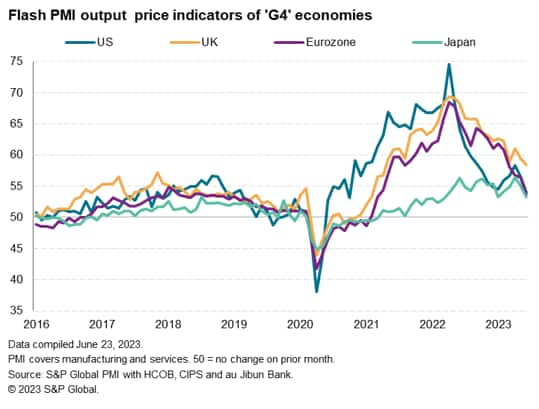

Looking across the G4 economies, selling price inflation rates for goods and services consequently slowed across the board in June. The rate of increase sank to the lowest for three years in the US, and hitting 27- and 26-month lows in the Eurozone and UK respectively. In Japan, the rate of inflation was the joint-lowest for 15 months.

Goods selling prices fell in the UK and Eurozone and broadly stagnated in the US, rising to any significant degree only in Japan.

Service sector selling price inflation cooled across the board, most notably in the US and Eurozone, but notably remaining stubbornly high in the UK to leave the UK as something of an outlier.

The June flash PMI data therefore point to downside risks to growth in the near term as manufacturing in the major developed economies continues to report an increasingly severe downturn in demand and the service sector's post-pandemic spending surge shows signs of being overwhelmed by the rising cost of living and higher interest rates. The Eurozone and, to a lesser extent, the UK are looking especially vulnerable to possible recessions according to the PMI data, though further Fed rate hikes would add to US growth risks in the second half of the year.

Meanwhile the survey data suggest that the fight against inflation is being won, with particularly welcome news on slower service sector price inflation, which tends to correlate closely with core inflation. An outlier is the UK, where services price trends appear stubbornly elevated, though even here the direction of travel is encouraging.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location