Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jul, 2016 | 14:00

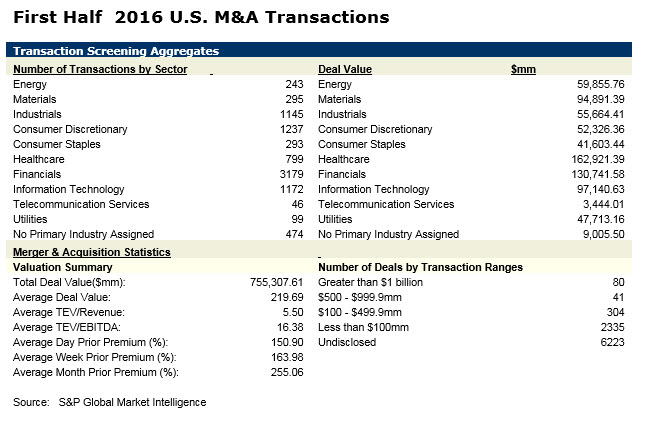

Health care and financials ranked as the top two sectors for announced U.S. merger and acquisition activity in the first six months of 2016 according to data from S&P Global Market Intelligence. In sum, those two sectors accounted for over $293 billion, or nearly 39%, of the $755.3 billion in announced first half 2016 U.S. M&A deal value. The biggest announced U.S. M&A deal in the first half of 2016 was Germany’s Bayer AG (DB:BAYN) making an unsolicited, non-binding proposal to acquire Monsanto Company (NYSE:MON) for $62.3 billion in cash on May 18, 2016. That was followed by Shire plc (LSE:SHP) entering into an agreement to acquire Baxalta Incorporated (NYSE:BXLT) from Baxter International Inc. (NYSE:BAX) and others for $36.2 billion on January 11, 2016. The next biggest announced deal was Abbott Laboratories (NYSE:ABT) entering into a definitive agreement to acquire St. Jude Medical Inc. (NYSE:STJ) for $30.2 billion on April 28, 2016.

In the aftermath of late June’s BREXIT vote, it appears that the pace of merger and acquisitions have seen little in the way of retrenchment. According to S&P global Market Intelligence data, since June 24th over $179 billion in announced worldwide M&A deals have taken place lead by Mondelez International, Inc.’s (NasdaqGS:MDLZ) bid to acquire The Hershey Company (NYSE:HSY) for $25.5 billion on June 30, 2016 and National Bank of Abu Dhabi PJSC (ADX:NBAD) agreeing to acquire First Gulf Bank PJSC (ADX:FGB) from Al Nahda Investments, Direct Access Investments LLC, The Cooperation Council for the Arab States of the Gulf and other shareholders for $14.8 billion in stock in a merger of equals on July 2, 2016. The latter transaction ranks as the largest ever financial M&A deal from the Middle East region. Also of note is French food company Danone (ENXTPA:BN) agreeing to acquire The WhiteWave Foods Company (NYSE:WWAV) for $12.5 billion on July 6, 2016.