Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 30, 2025

By

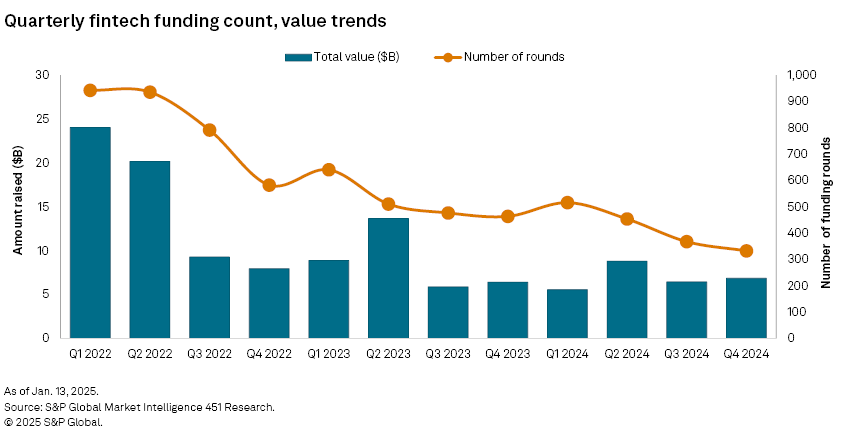

The global fintech funding landscape in 2024 continued its downward trajectory, reflecting the persistent caution among venture capital investors. Total funding dropped sharply, from $35 billion in 2023 to $28 billion — a decline of 20%. Deal activity mirrored this contraction, with transaction counts also falling 20% to 1,671.

However, there was a bright spot in the fourth quarter of 2024, when funding rose 17% year over year to $6.86 billion, even as the number of transactions fell 28% to 333. This dichotomy underscores a shift toward fewer but larger deals as the year drew to a close. This report explores the nuanced dynamics shaping fintech funding, dissecting trends across regions, sectors and funding stages to uncover where the industry stands, and where it might be headed.

The shadow of the fintech boom years looms large, casting today's funding activity as subdued by comparison. Yet, it is worth noting that investors are still deploying an average of $7 billion per quarter, even in the midst of a two-and-a-half-year downturn. For now, fintech venture capital firms are consolidating around fewer, larger deals, indicating a strategic shift toward backing vendors with proven potential for scaling in turbulent conditions. Amid this challenging environment, artificial intelligence gained prominence, signaling a recalibration in fintech priorities.

Context

Our 2024 forecast for a mild recovery in the second half did not fully materialize, with deal counts continuing their downward trend despite an uptick in values toward the closing. However, as we look ahead to 2025, the macroeconomic outlook, such as expectations of lower rates and the momentum in funding data, all suggest a potential recovery. A growing pipeline of significant fintech IPOs could not only inject the liquidity needed but also spark another positive cycle in fintech funding.

As we have seen in previous cycles, venture capital investors often shift their focus across fintech segments and regions, gravitating toward less saturated areas as they reassess their portfolios. As a result, some of the fintech sectors and geographies that struggled in 2024 may experience a rebound. North America, particularly the US, could see a notable resurgence. Within verticals, payments may once again emerge as a prominent investment theme. In addition, as we noted in our 2025 preview, we continue to be optimistic about startups that are innovating payment flows, enhancing money movement infrastructure and providing value-added services.

Mega rounds attracting private equity firms, banks

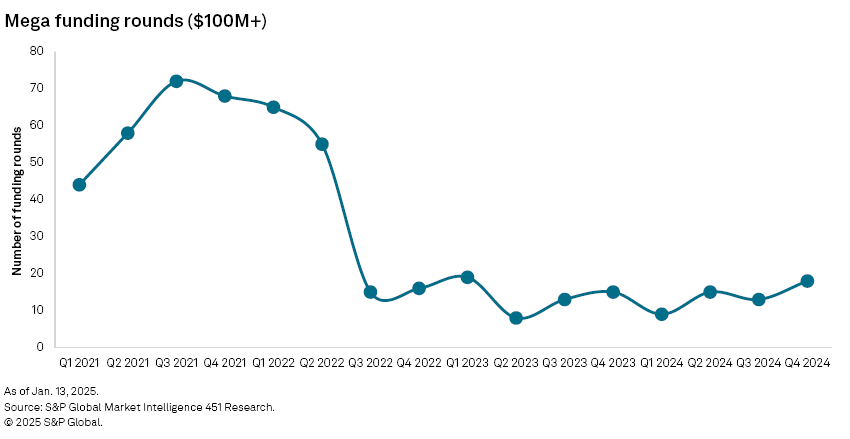

The era of mega funding rounds in fintech has faded dramatically from the heights of 2021 and 2022. Back then, deals exceeding $100 million numbered 242 in 2021 and 151 in 2022. By 2023, this figure plunged to 55 and stagnated at that level through 2024 — a sobering indicator of diminished investor exuberance.

Quarterly data from 2024 reveals a cautious but somewhat steady investment trend. The first quarter of 2024 recorded just nine mega rounds, down from 19 in the same quarter of 2023. A modest rebound came in the second quarter, matching second-quarter 2023's 15 rounds. Activity picked up slightly in the latter half of the year, with 13 deals in the third quarter and 18 in the fourth quarter, suggesting tentative signs of stabilization.

Interestingly, many of the largest funding rounds are directed toward capital-intensive business models in lending and other financial services. These sectors increasingly attract private equity firms, hedge funds and traditional financial institutions with expertise in credit and banking, rather than venture capitalists from Silicon Valley.

For example, SeQura, a Spanish BNPL platform, raised $435 million in a round led by Citi and supported by M&G and Chenavari, with a convertible loan from Svea Bank. Similarly, Splitero, a US-based fintech that enables homeowners to access their home equity without new debt or monthly payments, secured $300 million, adding private equity firm Antarctica Capital to its cap table.

As noted in our previous reports, digital banks in Southeast Asia continue to seek investor backing to fuel regional growth. In the latest quarter, Tyme Group raised $250 million in series D funding to expand in Southeast Asia. The South African fintech recently launched a digital bank in the Philippines and chose Singapore as its headquarters, signaling plans for broader regional growth. Leading the round is Brazil-based Nu Holdings Ltd., whose Nubank has become one of the world's most valuable digital banks.

Meanwhile, Silicon Valley venture capital firms, which typically prefer to invest in asset-light segments such as payments, have scaled back big-ticket investments. Notable exceptions include Accel, which led Zepz (formerly WorldRemit)'s $267 million funding round and participated in Melio's $150 million series E. The latter round, led by Fiserv Inc., follows the previous year's partnership between the two companies to combine Melio's accounts payable and receivable workflows with Fiserv's payment capabilities and network.

AI a popular funding theme

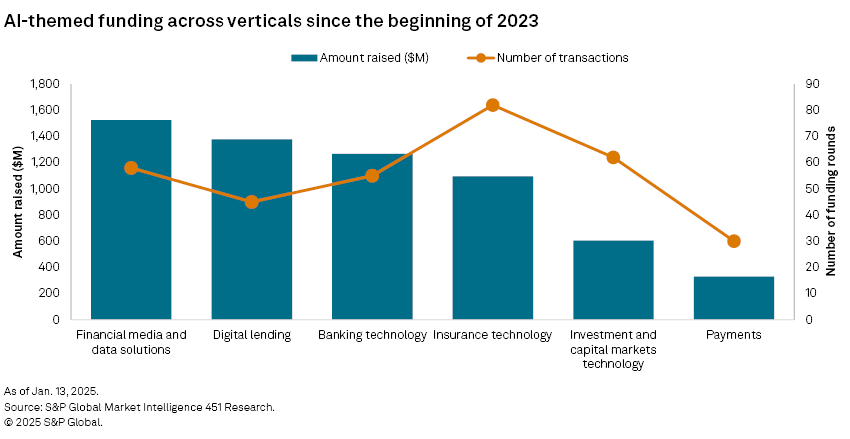

AI emerged as a popular theme in fintech funding, with the share of funding rounds involving AI-enabled startups jumping from 6% in 2021 and 2022 to 15% in 2024. This underscores the sector's growing reliance on AI to drive innovation amid broader funding challenges.

Since the beginning of 2023, the leading fintech verticals attracting AI-themed funding rounds have been financial media and data solutions, which raised $1.52 billion across 58 transactions, and digital lending, with $1.38 billion from 45 transactions. Banking technology follows closely, securing $1.27 billion through 55 transactions. Insurance technology also stands out, raising $1.10 billion with the highest number of transactions at 82.

Regional analysis: EMEA, Latin America bounce back

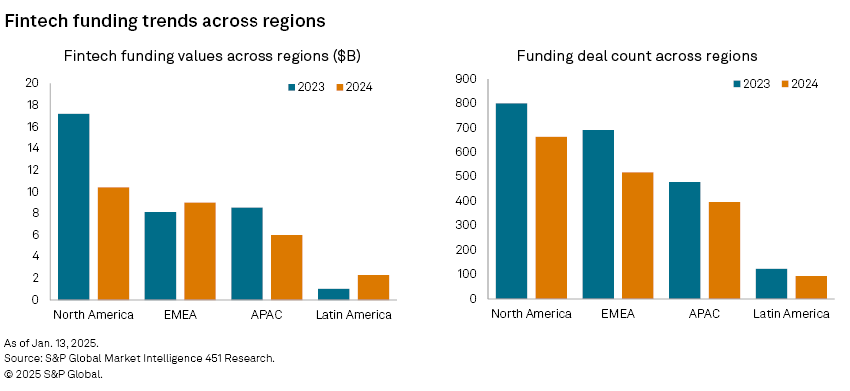

The fintech funding landscape in 2024 revealed stark regional disparities:

– North America experienced a steep 39% decline in funding, dropping from $17.18 billion to $10.40 billion. Deal counts fell 17% to 663.

– Europe, the Middle East and Africa bucked the trend with an 11% increase in funding to $9 billion, even as deals dropped 25% to 518.

– Asia-Pacific faced a 30% funding contraction to $6 billion, with deal counts down 17% to 396.

– Latin America was a standout, with funding soaring 122% to $2.30 billion despite a 24% drop in transactions to 93.

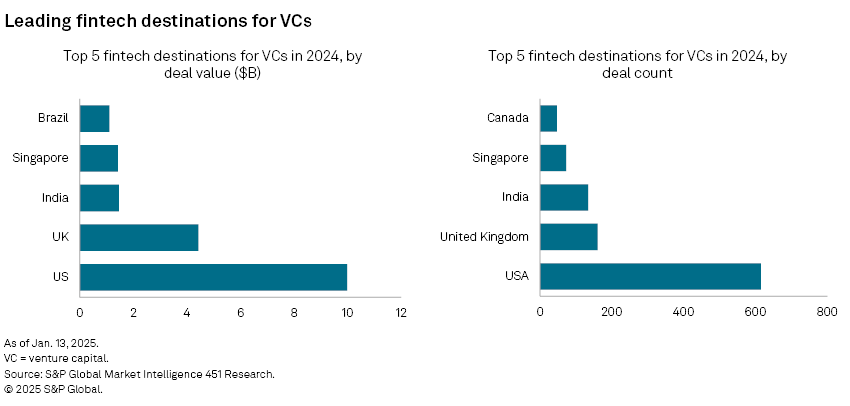

Major country hubs for fintech investors

Historically, four countries have had outsized impact on the funding landscape. Trends in these popular fintech hubs are as follows:

– US: Funding fell 40% from $17 billion in 2023 to $10 billion, with deal counts down 17% to 615.

– UK: Funding surged 46% to $4 billion, while deals dropped 19% to 160 — a sign of larger, more strategic investments.

– India: Funding halved to $1 billion, with transactions down 8% to 134, reflecting tighter investor scrutiny.

– Singapore: Funding held steady at $1 billion, although deals fell 16% to 72, pointing to a phase of consolidation.

Canada, France and Brazil are among other popular destinations for venture money. Of these, only Brazil managed to surpass the $1 billion mark. The Latin American country is likely to emerge as another growth spot for fintechs and could well see a growing share in the global venture funding.

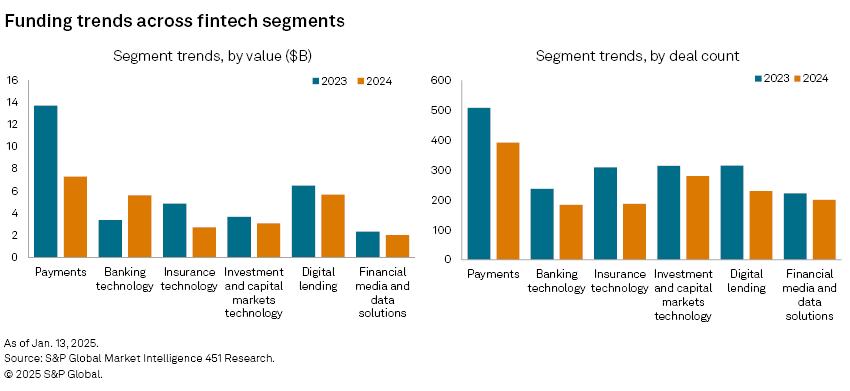

Sector analysis: Banking tech, digital lending bright spots

The fintech landscape in 2024 reflects a complex interplay of growth and decline across various verticals, with some sectors thriving while others struggle to maintain their previous momentum:

– Payments saw a dramatic 50% funding decline to $7 billion, with deals down 23% to 392.

– Banking technology doubled its funding to $6 billion, despite a 22% drop in transactions to 184.

– Insurance technology faced a 40% drop in funding to $3 billion, with deal counts falling 39% to 187.

– Digital lending maintained $6 billion in funding but saw a 27% drop in transactions to 230.

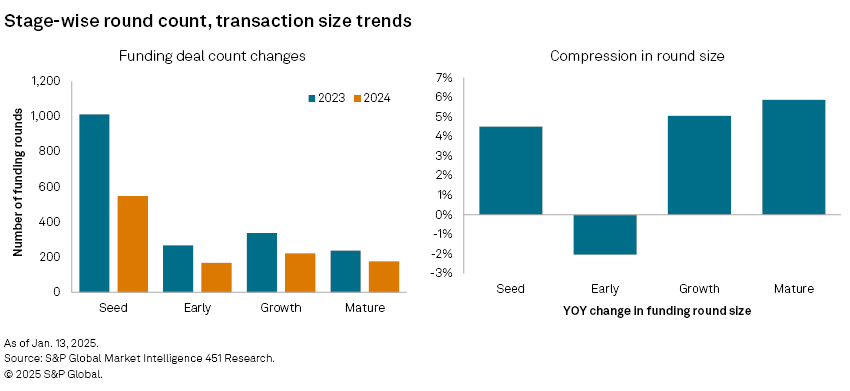

Stage-wise analysis: Round sizes remain largely resilient

In analyzing the funding trends from 2023 to 2024, a noticeable decline in the number of transactions across all stages of funding is evident. Seed-stage funding bore the brunt of the downturn, with deal counts plummeting 46% from 1,012 in 2023 to 547 in 2024. Early-stage funding fell 37%, while growth and mature stages dropped 34% and 26%, respectively.

However, average ticket sizes provided a silver lining. Seed-stage investments edged up 4%, while growth and mature stages saw increases of 5% and 6%, respectively. These figures suggest a pivot toward high-value investments, even as overall activity waned.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Location

Products & Offerings

Segment