Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Feb, 2017 | 13:15

By Tim Zawacki

Highlights

In the wake of uncharacteristically high combined ratios for Travelers' personal auto business in Q4 of 2016, the company has resorted to corrective actions in the form of rate increases.

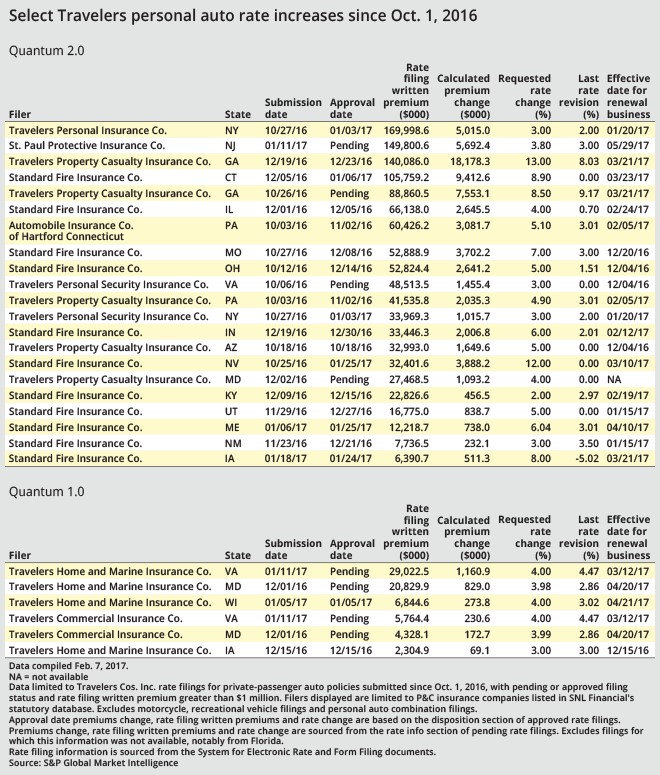

S&P Global Market Intelligence obtained a collection of rate filings that offers data points regarding certain of the corrective actions Travelers Cos. Inc. is employing to address adverse environmental trends in its private-passenger auto business.

Travelers subsidiaries submitted numerous private auto rate filings in the last three months of 2016 and the opening weeks of 2017 for both its legacy private auto programs and its newer Quantum Auto 2.0 platform in a reflection of what company officials described as their primary response to rising loss severities in the business line.

The combined ratios in Travelers' agency automobile business for the 2016 fourth quarter and full-year soared to 116.7% and 104%, respectively, from 98.1% and 94.7% in the respective periods in 2015. The company attributed 8.8 percentage points of the quarter's combined ratio and 3.5 percentage points of the full-year combined ratio to elevated bodily injury losses. Traffic fatalities increased in consecutive years during 2015 and 2016 for the first time in "decades," company officials said, a development they attributed to factors such as distracted driving, accidents occurring at higher speeds, and more accidents occurring on highways and at intersections.

"We will have made rate filings in the majority of the states where we have the auto product by the end of the first quarter," Travelers President of Personal Insurance Michael Klein said during a January 24 conference call. "We also have additional rate actions planned for later in the year."

Among the noteworthy submissions was a request for an overall rate increase of 13% on a Georgia book of Quantum Auto 2.0 business with more than $140 million of annualized written premium. That request was filed in October 2016 by Travelers Property Casualty Insurance Co., effective for renewing policies on or after March 21. The request represents an example where the company is obtaining rate on rate, having previously implemented an 8% overall hike on the same book, effective in May 2016.

In another case, however, Travelers unit Standard Fire Insurance Co. is seeking an overall rate increase of 8% on an Iowa book of Quantum Auto 2.0 business with nearly $6.4 million in associated written premium, one year after it lowered that book's rates by 5% overall. The hike took effect on January 24.

Two other Travelers companies that write business in Iowa using the Quantum Auto 1.0 platform, Travelers Home & Marine Insurance Co. and Travelers Commercial Insurance Co., filed for overall rate increases in the state of 3% and 2.9%, respectively, in December 2016. Those companies had obtained rate increases of a similar magnitude on the applicable books of business in each of the previous three years.

In Maine, Standard Fire filed Jan. 6 for an overall rate increase of more than 6% on a book of Quantum Auto 2.0 business with associated written premium of $12.2 million, effective for renewal business on Feb. 24. It previously raised rates on that book by 3% in both February and August of 2016. S&P Global Market Intelligence last obtained filings for Travelers Home & Marine and Travelers Commercial Insurance rate increases on Quantum Auto 1.0 business in Maine in June 2016.

The situation is similar in Connecticut where Standard Fire filed in December 2016 for an overall rate increase of 8.9% on its $105.8 million Quantum Auto 2.0 book. Travelers Home & Marine and Travelers Personal Security Insurance Co., each of which write Quantum Auto 1.0 business in the state, filed for rate increases of just less than 3% apiece in June 2016.

Based on the respective sizes of the Quantum Auto 1.0 and 2.0 programs in all four states, the newer product has obtained a growing share of the group's overall private auto business mix since the time of its introduction several years ago. Standard Fire noted in several of the filings that the Quantum Auto 2.0 product "has little data to date," such that the "result of a traditional indication calculation would not be credible or meaningful."

But Travelers CEO Alan Schnitzer said during the call, "Our claim data, the public chatter we hear from others in the marketplace, and other third-party data all cause us to continue to believe that our experience is principally environmental, as opposed to specific to us or a Quantum Auto product." Executives later said they have seen the "same fundamental trends" emerging in Quantum Auto 1.0 business as in Quantum Auto 2.0 policies.

Limitations associated with the timing and nature of filing collection in individual states mean it may take additional time for a more complete picture of Travelers' efforts to emerge. With several of the hikes not due to take effect for renewing business until the second quarter, some patience will be required before they meaningfully impact results. The company said it could take up to 24 months for the rate increases to fully earn into the book.