Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 15, 2023

The dynamic changes that are taking place, particularly in Western societies are reflected in the approach to life. Contemporary societies are changing their view on food, vegetarian and vegan movements dominate in these communities, and it is even fashionable not to eat meat. The following analysis is an attempt to answer whether this trend is also visible in the global trade of these products, or whether it occurs only in Western societies. This analysis of the dynamics will also answer not only if COVID-19 has disrupted global meat trade and whether the growing price dynamics affects exports, but also to what extent has the geopolitical situation (Russian-Ukrainian war) impacted this trade. According to Food and Agricultural Organization (FAO) forecasts, by 2029 the average meat consumption will increase to 35 kg per capita.

The beef market seems not to be hit significantly by COVID-19 and the Russian invasion of Ukraine. In 2022, according to S&P Global Market Intelligence Global Trade Analytics Suite (GTAS), major exporters of frozen beef were Brazil, India, Australia, and Argentina, which together accounted for 56.6% of global frozen beef exports. At the same time, all other countries from the list of top 10 world exporters together reach 19.7%. GTAS latest predictions show that by 2026, Brazil and India will remain in place, whereas Australia's exports share will decrease to 10.3% and the country will lose its third position to Argentina, whose share in global frozen beef exports will increase to around 10.5% in 2026. This is of course subject to change, depending on the time and course of the ongoing market uncertainty (Russia-Ukrainian war, supply chain disruptions, high inflation, potential recession, and potential escalation in the Taiwan Strait).

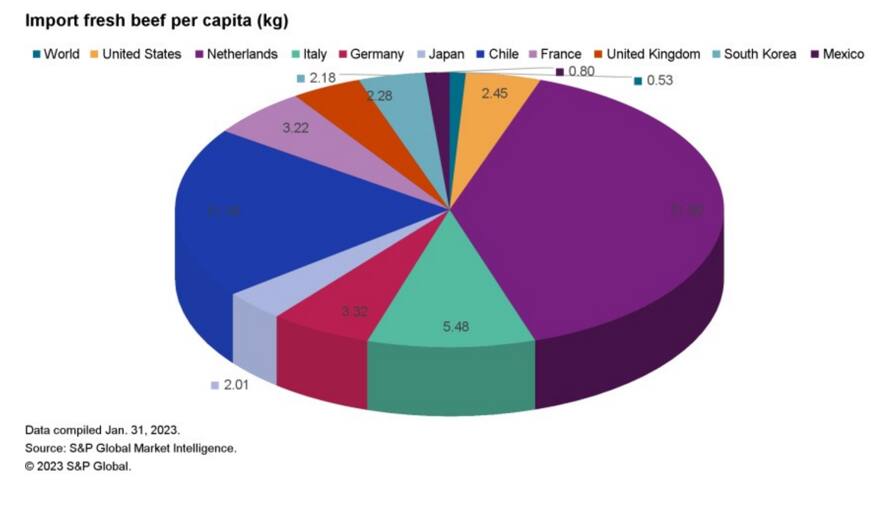

What is very noticeable is the fact that the top exporters dominating the frozen beef exports are not the same as those exporting beef, fresh or chilled. Therefore, two main exporters of fresh beef are Canada and the United States, which together accounted for 21.9% of global exports in 2022. It should also be noted that the top 10 major exporters (listed in the table above) accounted for nearly 70% of global fresh beef exports in 2022. What is also worth emphasizing is that the United States, which was the leader in fresh beef exports in 2021 but lost its position to Canada in 2022, will return to the first place by 2026 and its share in global exports will reach 11.8%.

According to GTAS statistics, the main importer of frozen beef is mainland China and the forecast shows the country's share of global imports increased up to 36.5% between 2022 and 2026. The second-largest importer is the United States with stable share in global import between 8.6% and 9.1% during the analyzed forecast period (until 2026). Looking at the list of main beef importers, there are only two countries among the 10 that are not from Asia. This fact could be easily explained, Southeast Asia has become richer and the population of the countries in this region is above 8.5% of world population with median age of approximately 31 years. Furthermore, Asian countries cannot produce enough beef to meet the consumption of their citizens. In contrary, one of the countries that we can distinguish among the top 10 major importers is Egypt. It is the most populated country in North Africa, with a population of more than 100 million. Apart from that, most Egyptians do not eat hog owing to religious reasons and if we take into account that Egypt is net food importer as a result of climate conditions, it becomes obvious why it is one of the main importers.

The last country in our analysis is the United States. When we take a deeper look at its situation in the beef market, we see that the United States is not only a major exporter of fresh beef but also a major importer of fresh beef and one of the largest importers of frozen beef. According to 'new trade theory,' the reason for 'intra-industry' trade between countries could be explained by economies of scale with a combination of consumer preferences ('difference of variety'). Recon with above theory, US exports lower-value beef products to countries such as Mexico and imports more sophisticated beef types for steaks as the internal production cannot match fully preferences of domestic consumers. This export/import product mix enables producers to adjust to consumer needs.

Netherlands is a similar case; exporting and importing fresh beef at the same time, but unlike the United States, Netherlands is a net exporter, which means the country exports more than it imports. If we take into account Netherlands's population of only 17 million, this could indicate the Rotterdam effect (also known as the Rotterdam-Antwerp effect), which refers to how trade flows are miscalculated when passing through major word ports. In this example, meat is exported and imported through Antwerp and Rotterdam ports to other countries in the European Union, but in the trade statistics it is reported as if Netherlands and Belgium were the meat exporters/importers, while, in fact they were only intermediates in these trade flows.

World meat consumption (all types) has more than doubled in the last 20 years. The world market for beef, mutton, and goat meat is doing very well. In terms of quantity as well as value, increases in exports/imports of this meat are forecast. A large part of importers to whom this meat is supplied to has positive forecasts regarding the growth of the population and thus the growth of potential consumers. We can see an increase in the consumption of this meat in Asian markets and also in the Middle East. This is mainly due to the increase in the wealth of these societies and the parallel increase in population.

As for these types of meat in the European market, they are considered very expensive, and the average family is not able to afford this type of meat. It is rather associated with the upper class and not everyone can afford a seven-bone roast or chateaubriand steak. However, there is a change in the diet and attitudes toward the consumption of meat of the young generation in the European Union (up to 29 years of age).

The most noticeable trend in this age group in relation to meat is the reduction of its consumption. In addition, strong movements are observed in the European Union, exerting pressures on the introduction of an excise duty or a special tax on meat, giving as a pretext high consumption of electricity and water in their production.

The full version of this article is available on the Connect platform for S&P Global Market Intelligence clients with a subscription to GTA/GTA Forecasting or GTAS Suite

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?