Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jan, 2017 | 13:45

Highlights

With the mining industry’s exploration budgets down yet again in 2016, no global region was spared cutbacks for the fourth consecutive year.

In an increasingly integrated global economy, political, economic and social uncertainties transcend the boundaries of region and country; with the mining industry’s total exploration budget down yet again in 2016, no region was spared cutbacks for a fourth consecutive year.

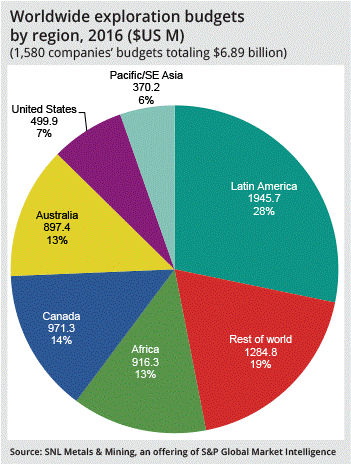

S&P Global Market Intelligence's "Corporate Exploration Strategies", or CES, study for 2016 calculates that the exploration budgets of 1,580 companies totaled $6.89 billion in 2016, down 21% year-over-year. In four straight years of declining budgets, the exploration industry has slashed its aggregate budget by almost one-third since the record-setting high of more than $20.5 billion in 2012.

According to our analysis, Latin America remained the most popular exploration destination, a position it has held since 1994. The 22% decline in the total budgets for 22 Latin American countries was slightly above the 21% worldwide average decrease and left the region’s share of the global budget at 28%, its largest share since 2001. Rest of World — China and Russia together accounted for 56% of the region’s budget — remained in second place for the third year in a row. Planned expenditures of about $1.28 billion were down 24% from 2015 — greater than the global average decrease, but maintaining the region’s 19% share of the global budget.

Canada took third place in 2016, bumping Africa from its former position. Its $971 million budget represented an 18% drop in allocations, which is less than the 22% overall decrease. With total budgets of $916 million, Africa dropped into fourth place; with a 24% decrease, its global share slipped from 14% to 13%. Out of the region’s 34 countries, only the Democratic Republic of the Congo had allocations totaling more than $100 million in 2016. Australia has been in fifth place since 2004; its 2016 budget of $897 million was 16% below 2015’s budget and increased the region’s share of the global total to 13% from 12%. The United States remained in sixth place with $500 million, representing 7% of the global budget. Pacific/Southeast Asia continued in last place with allocations totaling $370 million, representing about 6% of the total; the traditional big three — the Philippines, Papua New Guinea and Indonesia — attracted three-quarters of the region’s total.

As the global economy deals with unexpected U.S. election results and political and economic uncertainties in the Eurozone, volatile commodity prices will cause many explorers to continue favoring near-mine reserves replacement and less risky locations for their greenfields programs.