Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

COMMENTARY — Dec 09, 2022

By Sian Jones

Recent PMI data for the US compiled by S&P Global have shown inflationary pressures easing sharply as demand for goods, services and inputs cools rapidly following aggressive Fed policy rate hikes. November data once again signalled slower rates of input price and output charge inflation as consumer spending was curtailed by strains on disposable incomes and company cashflow. Expectations of a 0.5% increase in the federal funds rate at the 14 December FOMC meeting point to policymakers already starting to take a less aggressive stance to policy tightening compared to the prior four 75 basis point hikes.

Hot on the heels of the December FOMC meeting will be the S&P Global Flash US PMI (16 December), which will provide fresh insights into growth and inflation paths, and will help steer expectations of future policy decisions.

US private sector firms registered the slowest rise in cost burdens since December 2020 midway through the fourth quarter, according to latest PMI data from S&P Global. Firms noted reductions in prices for a wide variety of key inputs including plastic, lumber and steel, often driven by supplier discounts. Concessions made by vendors in an effort to remain competitive and drive sales are a relatively new development as the sharp impact of policy intervention on the wider economy and strong stockbuilding by firms earlier in the year drove the first improvement in delivery times for over three years.

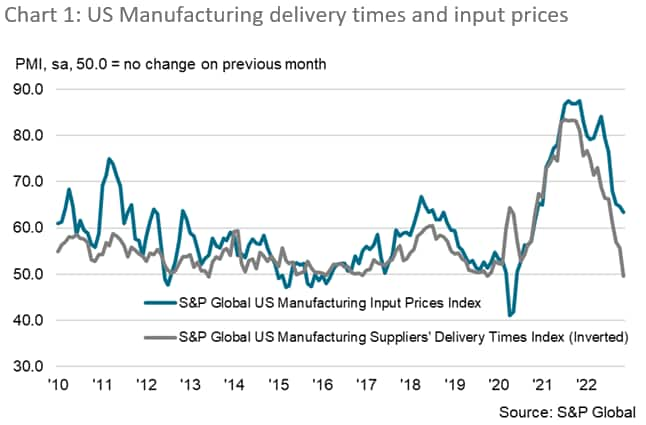

With the exception of the initial pandemic lockdown period, when cost burdens tumbled but logistics blockades lengthened delivery times, there has been a close relationship between the PMI Input Prices and Suppliers' Delivery Times Indexes, whereby delivery delays are associated with rising prices (a sellers' market) and vice versa (a buyers' market).

At 50.5 in November, the seasonally adjusted Suppliers' Delivery Times Index (manufacturing only) indicated shorter lead times for materials for the first time since the early pandemic months. Delivery times reportedly improved amidst strong signals that capacity strain at suppliers, and their ability to keep some material prices elevated, has dissipated swiftly as demand has dwindled. As such, the PMI delivery times data point to further instances of downward pressure on input prices over the coming months.

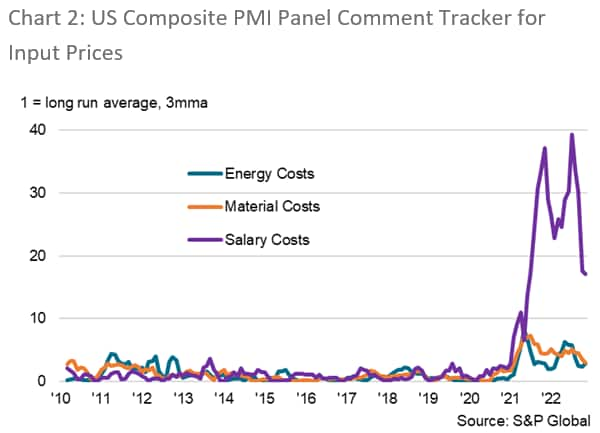

Cost pressures in the service sector followed a similar trajectory, as firms recorded a softer uptick in input prices. Nonetheless, input prices remain historically elevated across the private sector, and well above the long-run series average. A shift in driving forces away from material and delivery costs towards the retention of staff and wage pressure over last two years had in part altered the narrative. In recent months, and as demand conditions have deteriorated, the volume of comments relating to hikes in wage bills has waned, however.

As has been seen throughout the supply chain, concessions and discounts made by vendors are now being used more frequently across the private sector to encourage sales and purchases. This change in tack by suppliers signals a marked shift away from panellist reports earlier in the year, when sellers were maintaining inflated prices due to strong demand for inputs and materials.

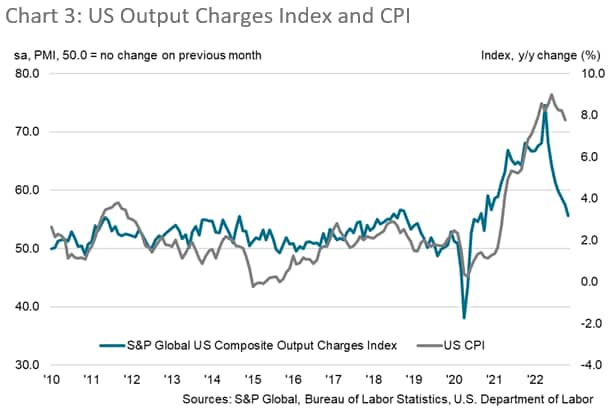

That said, companies have not necessarily seen a reprieve following such a move in supply chain stability, as weak demand conditions meant discounts were offered by some to clients in an effort to drive sales. Selling prices at private sector firms rose in November at the softest pace since October 2020, and at a rate only slightly faster than the series trend. In fact, in sectors which have been hardest hit by the recent slowdown, output charges have been adjusted notably. As an example, the financial sector, which once again registered the sharpest decline in activity during November, saw selling prices fall for the first time since May 2020 (despite higher borrowing costs).

In line with PMI data, latest official data signalled a slowdown in the pace of Consumer Price Inflation (CPI) during October to 7.7%. Core prices also rose at a slower pace than September's 40-year high (core CPI at 6.3%). Ahead of the release of CPI data for November, US PMI data suggest hikes in costs paid by consumers will ease further.

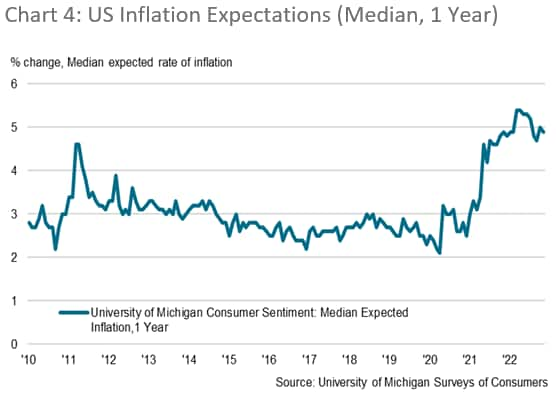

Although the swift tightening in monetary policy is beginning to impart the desired effect on price pressures, rates of inflation remain far above the target set out by the Fed. As such, projections for the upcoming meeting (14 December 2022) signal a further hike in the policy rate of 0.5% is expected. Based on futures prices monitored by the CME Group FedWatch Tool, there is currently around a 75% probability of a 0.5% hike (at time of writing), meaning the target federal funds rate would sit at 4.25%-4.5%.

The December meeting also sees the release of the Fed's latest round of economic projections. In times of broad economic uncertainty, information as to the central bank's stance and outlook will be gleaned for details of any changes to the anticipated future rate path. Although views on inflation will be crucial to any further movements in monetary policy, the impact of increases in interest rates on the wider economy will also be assessed.

The release of December Flash PMI data for the US just two days after the upcoming FOMC meeting will give a timely insight into how the wider economy has fared in the final month of the year.

sian.jones@ihsmarkit.com

sian.jones@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location