Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 24, 2024

Business activity in the euro area fell at the slowest rate for six months in January, according to provisional PMI® survey data, albeit with downturns persisting in both manufacturing and service sectors amid further falls in new business. The overall contraction of new orders was nevertheless the smallest recorded since last June, helping stabilise employment levels and lift business optimism about the year ahead to an eight-month high.

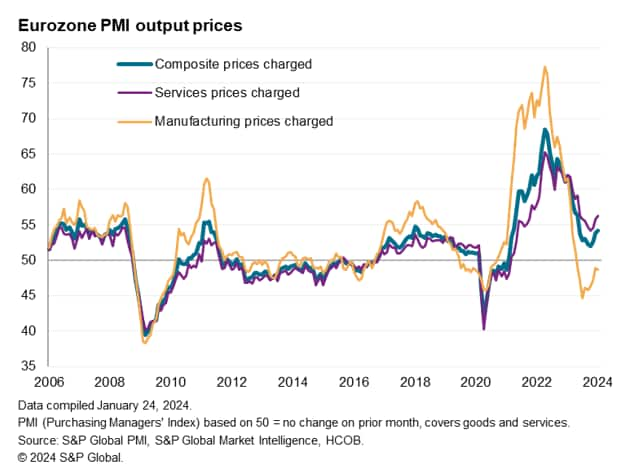

Although disruptions to shipping in the Red Sea caused supply chains to lengthen for the first time in a year, manufacturing input costs continued to fall on average. However, service sector cost growth accelerated during the month, contributing to the steepest overall rise in prices charged for goods and services since last May, the rate of inflation having now accelerated for three months from October's 32-month low.

The survey data, and in particular the price trends, are likely to encourage policymakers at the ECB to not rush into cutting interest rates, leaving us to consider the prospects of the first cuts appearing only towards the middle or second half of the year.

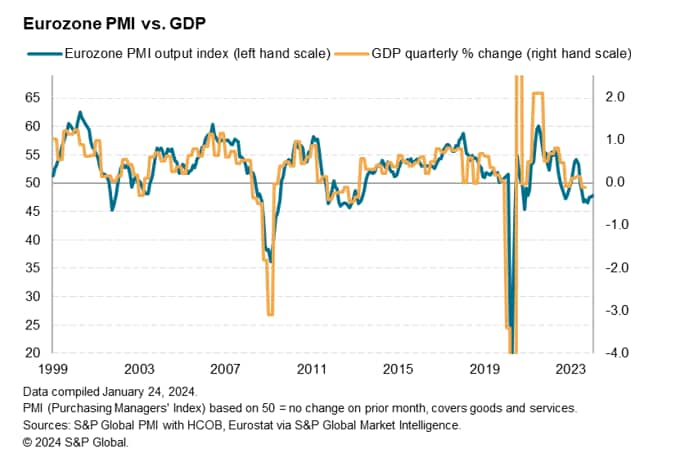

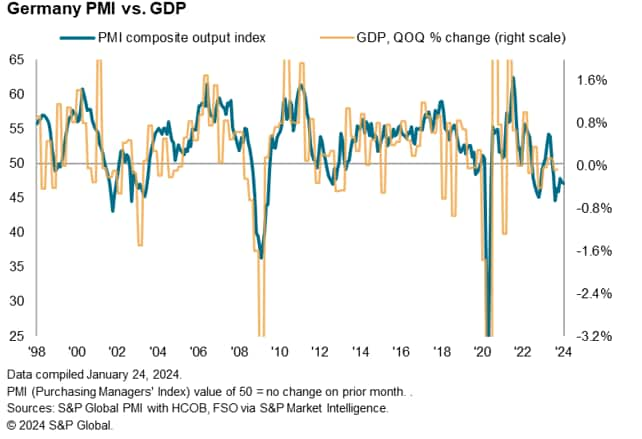

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, rose from 47.6 in December to 47.9 in January. Although signaling an eighth successive month of falling output, January's decline was the smallest registered since last July.

Historical comparisons indicate that the January PMI reading is consistent with eurozone GDP contracting at a quarterly rate of 0.20%, similar to the 0.25% decline signaled for the fourth quarter of last year.

With the latest available GDP data having estimated a 0.10% contraction in the third quarter of 2023, the PMI points to a prolonging of this downturn into the new year. The PMI in fact suggests that the eurozone's is enduring its deepest contraction since 2013 (if early pandemic months are excluded), albeit with recent months hinting at a bottoming out of the downturn.

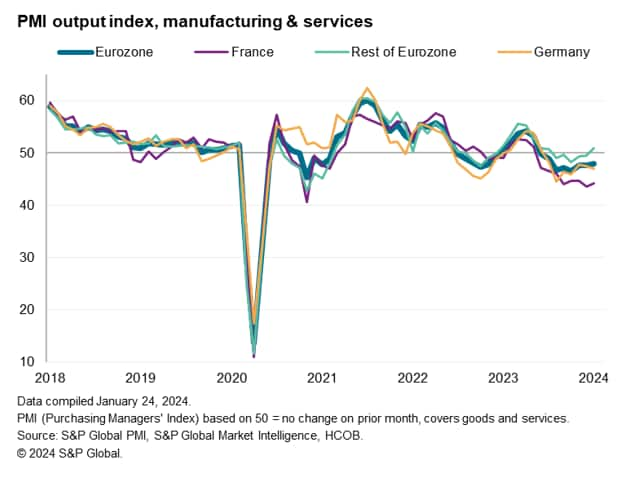

Although goods producers continued to lead the downturn, with manufacturing output falling for a tenth consecutive month in January, the fall in factory production was the smallest witnessed since last April. New orders for goods likewise showed the smallest decline for nine months.

Although services activity fell for a sixth straight month, the pace of decline gathering momentum slightly to register the steepest fall since last October, new business placed at service providers fell at the slowest rate since last July, providing a further hint of a cooling in the demand downturn.

January also saw the region's export decline easing, with overall new export orders dropping at the slowest rate for nine months thanks to reduced losses for both goods and services.

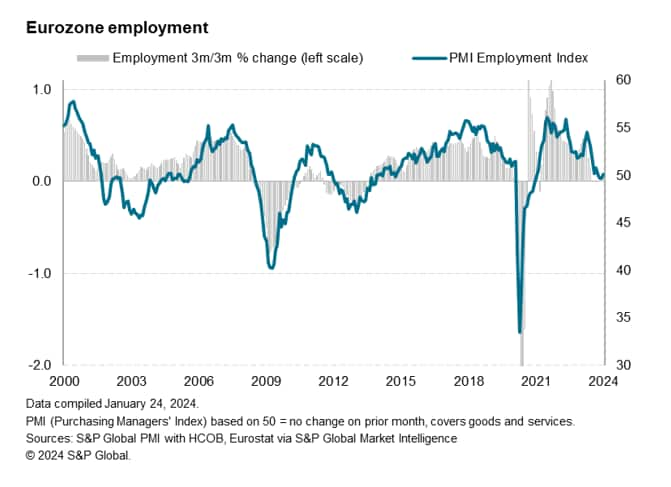

Employment increased fractionally in January as a slight upturn in net hiring in the service sector offset an eighth successive monthly fall in manufacturing payroll numbers. Although the marginal overall rise in employment signalled by the flash PMI represented a modest improvement on the minor declines seen in the closing two months of 2023, the largely unchanged picture continues to reflect a reluctance to add to headcounts amid a weak demand environment.

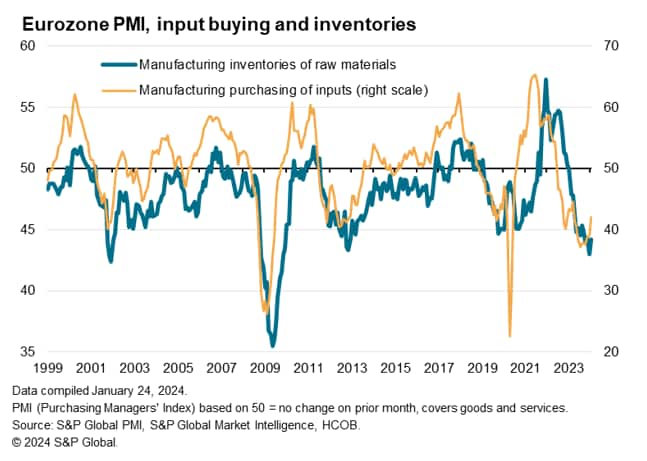

As well as reducing employment, manufacturers cut their purchasing activity for a nineteenth successive month in response to lower production needs in the months ahead, resulting in a twelfth consecutive monthly fall in inventories of inputs.

However, inventories were also impacted by delays in the supply of inputs. Supplier delivery times lengthened on average for the first time in a year in January, widely linked to shipping delays caused by disruptions in the Red Sea. The extent to which supplier lead times lengthened on average nevertheless remained far less severe than recorded throughout much of the 2020-2022 pandemic period.

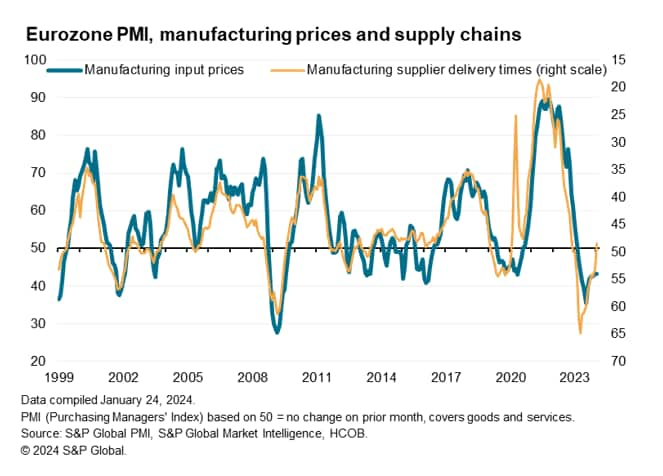

Despite additional costs associated with shipping delays, manufacturers' average input costs fell sharply in January for an eleventh successive month, albeit with the rate of decline easing slightly to register the smallest fall since last April. Eurozone service providers meanwhile reported an increased rate of cost growth, to the highest in eight months, causing overall cost growth across goods and services to accelerate to the fastest recorded since last May.

Faster input cost inflation was matched by an upturn in selling price inflation in January. Average prices charged for goods and services also rose at the steepest rate since last May. Having fallen to a 32-month low last October, the rate of selling price inflation has now ticked higher for three successive months to therefore remain elevated by the historical standards of the survey. Although goods prices fell at a slightly increased rate, down for a ninth straight month, charges for services rose in January at a rate not seen since last June.

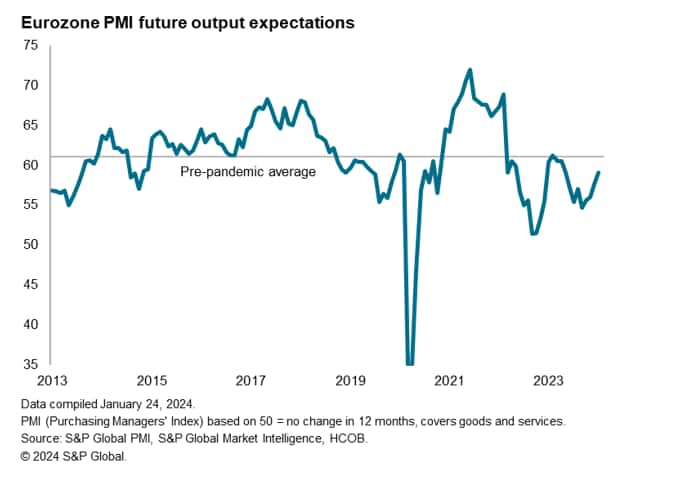

Looking ahead, business optimism about the coming 12 months improved for a fourth successive month in January, rising to the highest since last May. Confidence struck a nine-month high in manufacturing and an eight-month high in services, albeit the latter remaining the more upbeat of the two sectors.

Improved growth prospects were commonly a reflection of hopes of reduced cost of living pressures and lower interest rates in the year ahead, helping boost broader economic growth and demand both in domestic and international markets. Year-ahead optimism nevertheless continued to run below pre-pandemic averages.

Business conditions varied across the region. The downturn continued to be led by France, where output fell for an eighth successive month and at the sharpest rate since last September thanks to steepening contractions in both manufacturing and services.

Output also fell at a steep and accelerating rate in Germany, albeit a moderating downturn in manufacturing helping offset a worsening service sector situation.

In contrast, the rest of the eurozone as a whole returned to growth after five months of decline, recording the largest - yet still modest - expansion since last June. Service sector growth outside of France and Germany accelerated to a six-month high and the manufacturing decline moderated to register the smallest reduction for ten months.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location