Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 16, 2023

By Jingyi Pan

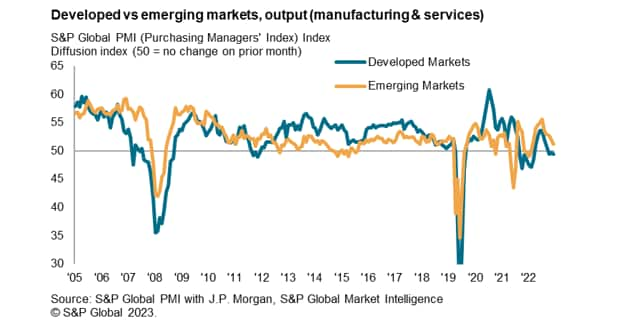

Global growth stalled at the start of the fourth quarter as the contraction of developed market deepened while emerging market growth further decelerated to the slowest in the year-to-date, according to the latest PMI indications. The expansions of both manufacturing and service sectors softened in the emerging market, though staying relatively resilient when compared to developed economies where conditions across both sectors deteriorated in October.

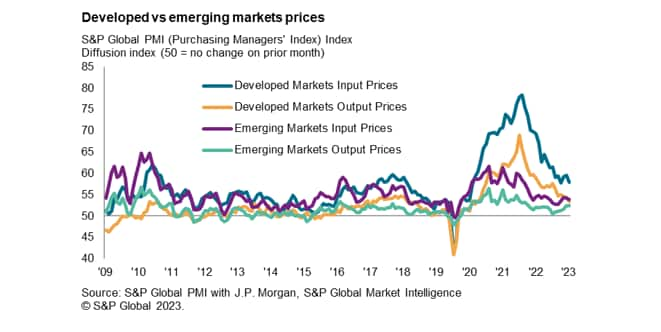

That said, price pressures showed signs of stickiness in the emerging market space with selling price inflation staying unchanged from September. In contrast, the easing of demand and output conditions in the developed world helped lower selling price inflation for a third straight month in October, even though it remained relatively elevated when compared with the emerging market print.

Forward looking indicators meanwhile point to still-expanding new business for emerging markets, but it was their developed counterparts that held a more positive view with regards to output in the 12 months ahead.

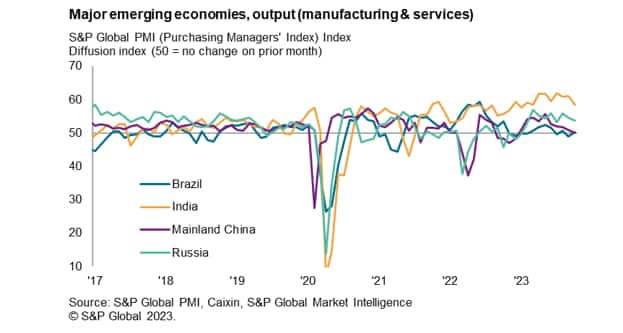

October's PMI data revealed a tenth consecutive month of emerging market growth, measured across both manufacturing and services, albeit at the slowest pace in the current sequence. This contrasted with developed markets which saw a third straight month of contraction and at a sharper pace compared to September.

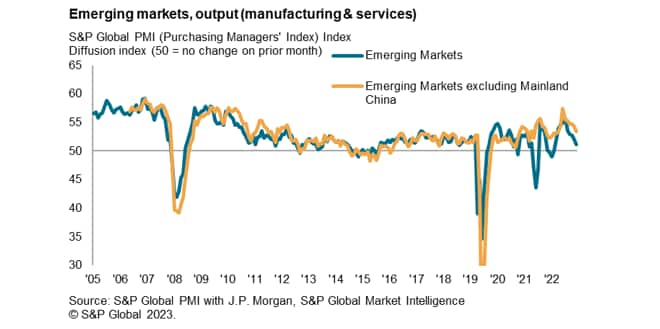

Excluding mainland China, growth have likewise slowed to the joint-weakest since January. That said, the rate of expansion remained well above the series average to signal still-solid improvements in economic conditions in emerging market ex-China economies. This was as the expansion in mainland China stalled after nine consecutive months of expansion, outlining the dissipation of the post-pandemic boon.

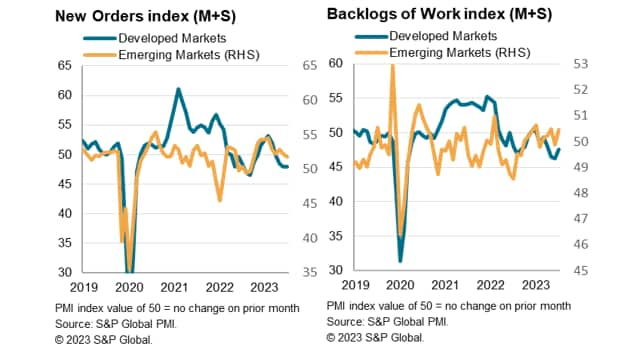

Underpinning the easing of growth performance in the emerging market had been the softening of new business growth in October. Incoming new orders rose at the slowest rate since January and was only mild. Both manufacturing new work intakes and services new business continued to grow, but at slower rates among emerging market firms, thus signalling the softening of demand conditions.

Although developed economies saw incoming new orders fall for a fourth straight month, which should not come as a surprise given the tighter financial condition settings among developed world central banks, the rate of decline was unchanged from September's nine-month low. A slower contraction of goods new orders helped to offset a sharper downturn in services new business, keeping overall new work intake in moderate contraction.

That said, the average level of backlogged work marginally increased in emerging markets but had continued to deplete for a sixth straight month among developed market firms. The renewed rise in backlogs, alongside sustained growth in new work intakes for emerging markets, highlight the expectation for growth to sustain in the coming months. The same may not be said for developed markets as both incoming and existing orders contracted in October, pointing to still-pressured output conditions ahead.

Drilling slightly deeper into the causes of softening demand conditions, deterioration of trade conditions had been a common theme across both the emerging and developed world. It had, however, been heartening to see conditions broadly stabilise in the emerging market space, indicating that the downturn recorded in the previous quarter has been phased out. The uptick was helped by a faster services export business growth and an easing of the goods trade downturn.

Despite softening demand conditions in emerging markets, price pressures have remained somewhat sticky. Selling price inflation across emerging markets remained unchanged from September's 14-month high. In comparison, it was developed economies that led the softening of price pressures globally with the lowest selling price inflation print since December 2020. This was despite both regions showing easing cost pressures at the start of the fourth quarter.

To some extent, easing inflationary pressures supported resilience in business confidence among developed markets with the Future Output Index, the only sentiment-based PMI sub-index, staying unchanged for developed markets in October but pared to a 19-month low in the emerging market space.

Finally, examining the output conditions across the four major emerging economies, India continued to outperform the remaining three for the sixteenth consecutive month in October. This was backed by solid expansions of both manufacturing output and services activity in India. The pace of expansion pared in the latest month to the slowest since January, however, and was accompanied by waning confidence surround private sector output according to the latest S&P Global India Business Outlook. Concerns have risen around output, profitability and capital expenditure plans, though more positively, inflation expectations have improved with firms seeing a more stable price environment ahead.

Russia followed with solid growth recorded at the start of the fourth quarter, though likewise softening to the slowest in three months. Further increase in new work and backlogs highlight the expectations for the expansion to sustain.

Brazil exhibited resilience in October, returning to growth in October, though only marginally. Better service sector performance helped to offset a sharper downturn in the goods producing sector. Furthermore, falling interest rates and forecasts of a stable inflation environment were found to have boosted optimism among Brazilian companies according to insights from business outlook surveys.

The expansion in mainland China meanwhile stalled in October after nine straight months of growth post the easing of pandemic restrictions. Faster services activity expansion contrasted with a renewed fall in manufacturing output, albeit only fractionally in both cases. The business mood across mainland China have also softened in the latest S&P Global Business Outlook survey, accompanied by concerns over rising costs.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location