Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 03, 2021

By Jingyi Pan

Emerging markets slipped into contraction in August for the first time in fourteen months, reflecting the pressure stemming from the latest COVID-19 wave. In contrast developed markets sustained strong expansion, though also experienced more severe supply chain constraints and higher price pressures than emerging markets. The continued divergence could put a further strain on emerging markets with many developed market central banks seen unwavering in their considerations of pulling the plug on various extraordinary support measures.

The latest JPMorgan Global Manufacturing PMI, compiled by IHS Markit, registered a mild decline in the headline index to 54.1 in August from 55.4 in July. While still appearing solid overall, the sub-indices provided a more illuminating picture of supply constraints doubling down on output alongside weaker demand growth.

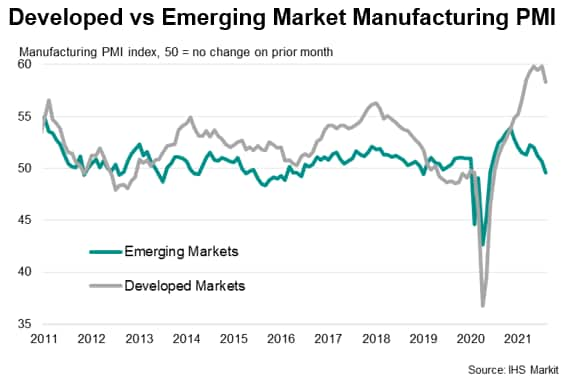

Dissecting the latest global reading by developed and emerging markets, one would also find that regionally, the divergences had worsened, with emerging markets manufacturing PMI dipping into contraction - albeit marginally - for the first time since June 2020.

The spread of the COVID-19 Delta variant amongst emerging markets, which also have relatively lower vaccination rates, continued to disrupt manufacturing sectors. Weakness in demand, as growth momentum in developed markets eased, meanwhile manifested through declining foreign and overall export orders in August. In turn, emerging market manufacturing firms continued to take a cautious stance with their inventory levels and reduced their workforce numbers for the first time in six months.

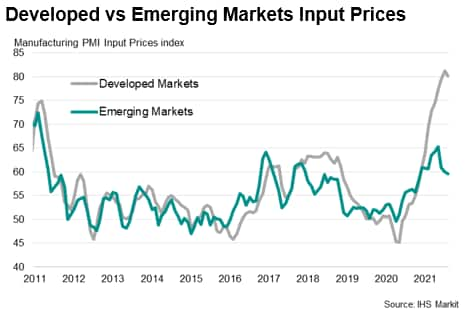

On the flipside, however, developed markets experienced a more severe state of supply chain delays and price pressures as the manufacturing PMIs diverged. With many emerging markets, particularly emerging Asia markets, affected by the spread of the highly infectious COVID-19 Delta variant, the lack of production caused the build-up of bottlenecks for the developed world.

Consequently, the urgency to meet the relatively stronger and more insulated demand in the developed world led to the build-up of price pressures. As shown by the chart below comparing developed and emerging market input price indices, although both readings eased from July, developed markets continued to find much more severely elevated price pressures when compared to the emerging markets.

We had already highlighted in an earlier piece in July on how the vaccine dividends has contributed to the widening of global economic growth divergences, and the latest PMI numbers illustrate how the divergence in growth and inflation conditions between the developed and emerging markets had persisted in August. The wedge clearly remains even as emerging markets nations attempt to play catch-up with their vaccination rates.

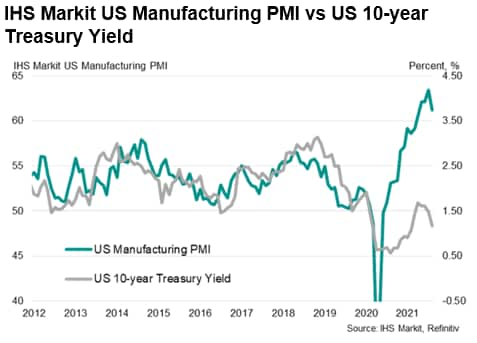

That said, sitting at the crossroads where developed markets central banks such as the Federal Reserve and European Central Bank (ECB) are mulling the tweaking of extraordinary measures amid better economic conditions, the need to manage potential risks should also continue to be considered by market watchers. In particular, an unusual divergence in economic conditions and the bond market can be observed.

The IHS Markit US Manufacturing PMI has shown a strong recovery in 2021 so far, yet yields have remained largely suppressed due to the Fed's interventions and reassurances. Over time, convergence is due. There is a clear likelihood of the US Manufacturing PMI easing from the elevated growth rate seen in the first half of 2021 as the rebound fades. Though one suspects that yields could likewise rise, albeit to a much smaller extent, to meet somewhere in the middle. The question with respect to the timing of the gap closing awaits further data, hence we will be watching the PMI releases.

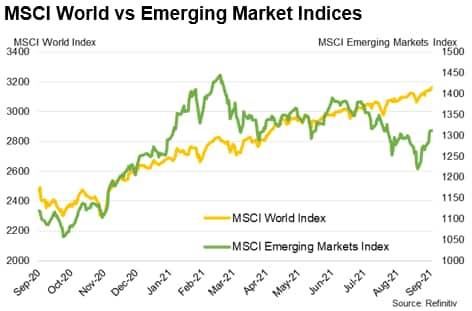

Given the very gradual retraction of accommodative monetary policy by developed markets central banks expected amid the oscillating COVID-19 conditions, emerging markets may also better weather rising US yields this time compared to 2013. In the short-term, however, slower output conditions continue to do a disfavour for emerging markets as the trend for equity prices likewise diverge.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.