Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 May, 2017 | 10:00

With more than a quarter of 2017 in the books, foreign companies are once again making their mark on the U.S. M&A market.

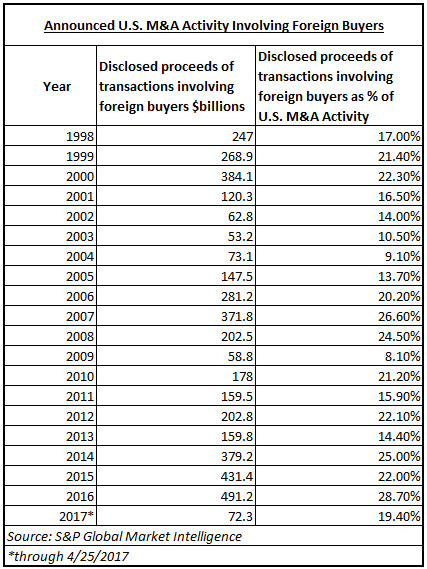

Foreign companies are the acquirers in some of the largest deals involving U.S.-based targets thus far in 2017, including the largest deals in the consumer staples and restaurant sectors. They are on pace to once again account for a significant chunk of overall U.S. M&A activity after being responsible for about a quarter of U.S. deal proceeds in each of the last three years. In fact, 2016 saw the highest percentage of foreign acquisitions of U.S. targets in about two decades, as nearly 29% of the year's $1.71 trillion in announced U.S. deals involved foreign buyers.

Those results largely stemmed from foreign companies serving as the acquirers in some of 2016's largest transactions, such as the proposal by Germany’s Bayer to purchase Monsanto Company for $64.1 billion, and British American Tobacco p.l.c. acquiring a 58% stake in Reynolds American Inc. for $63 billion.

The dollar amount of foreign acquisitions in the U.S. set a record in 2016 with $491 billion in deals announced, exceeding the previous record of $431 billion set in 2015, according to data from S&P Global Market Intelligence.

This year’s second-largest announced U.S. M&A transaction to date is British consumer staples company Reckitt Benckiser Group's agreement to acquire Illinois-headquartered Mead Johnson Nutrition Company for $17.9 billion, or 17.7x the target’s last twelve months EBITDA. Announced U.S. consumer staples M&A transactions involving domestic buyers have an average multiple of 6.7x EBITDA year-to-date.

Additionally, the largest ever announced U.S. M&A transaction in the restaurant industry occurred this month as Germany’s JAB Holdings B.V. agreed to buy Panera Bread Company in a deal valued at nearly $7.5 billion, or 18.5x Panera’s last twelve months EBITDA. Year-to-date, the largest restaurant M&A deal involving both a domestic target and acquirer was Darden Restaurants Inc.’s $780 million purchase of Cheddar’s Inc. at 10.4x EBITDA. Domestic buyers in announced U.S. restaurant industry deals paid an average of 10.4x a target’s EBITDA, according to disclosed figures.

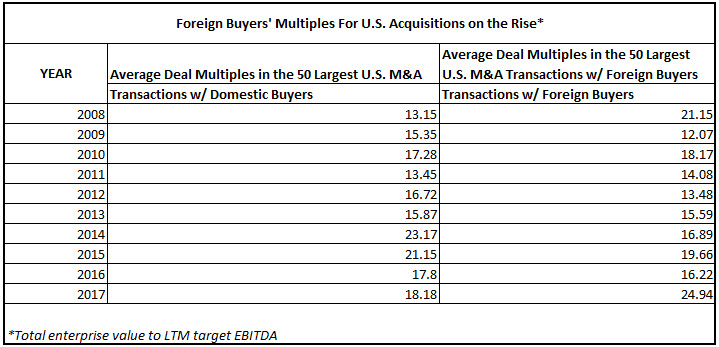

Until recently, it appears that domestic buyers tended to offer higher multiples on large deals in the U.S. M&A marketplace than their foreign counterparts. S&P Global Market Intelligence compared average transaction multiples for the 50 largest transactions involving domestic buyers to a similar subset of deals with non-U.S. acquirers in each year going back to 2008. The analysis examined the ratio of total enterprise value to a target’s last-twelve-months EBITDA. This result is not surprising to some extent, as the deals in this analysis involving domestic buyers were generally larger. For example, of the top 50 domestic acquisitions in the U.S. M&A market announced in 2016, 12 were valued at over $10 billion, compared to 8 in that size range for U.S. deals involving foreign buyers. The average deal size of the top 50 U.S. transactions with domestic buyers announced in 2016 was $11.7 billion, compared to $7.8 billion for deals with foreign acquirers.

For the most part since 2008, both domestic and foreign buyers have on average increased the multiples paid in large U.S. M&A transactions, although average domestic buyer premiums have been higher. The last year in which the top 50 announced acquisitions of U.S. targets by foreign buyers commanded a higher average multiple was 2011.

That dynamic appears to be poised for a change in 2017. Year-to-date, foreign buyers are, on average, paying higher multiples in the largest U.S. M&A transactions than their domestic counterparts. It could be that foreign buyers are simply more willing to offer a higher valuation to fend off possible bids by domestic suitors. Also, foreign buyers might believe that a higher premium now may be offset later in the foreign exchange markets. Finally, foreign buyers may simply assume that higher premiums are justified to retain executive and managerial talent.