Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Jul, 2022

By Nathan Sovall

Introduction

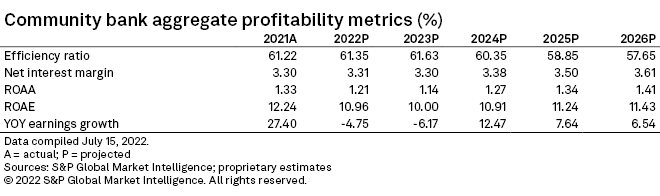

Higher interest rates will allow community bank margins to recover but the quicker pace of rate increases by the Federal Reserve will cause deposit costs to rise faster than previously expected.

The Fed's efforts to tame inflation by tightening monetary policy at the quickest pace in nearly 30 years will drive community bank margins higher over the long term, but the speed of rate increases will cause deposits to reprice more quickly than loans, preventing margins from expanding in 2023. Community banks will also feel some earnings pressure in 2022 and 2023 as institutions record higher credit costs and weaker noninterest income in the periods.

Deposit betas in focus

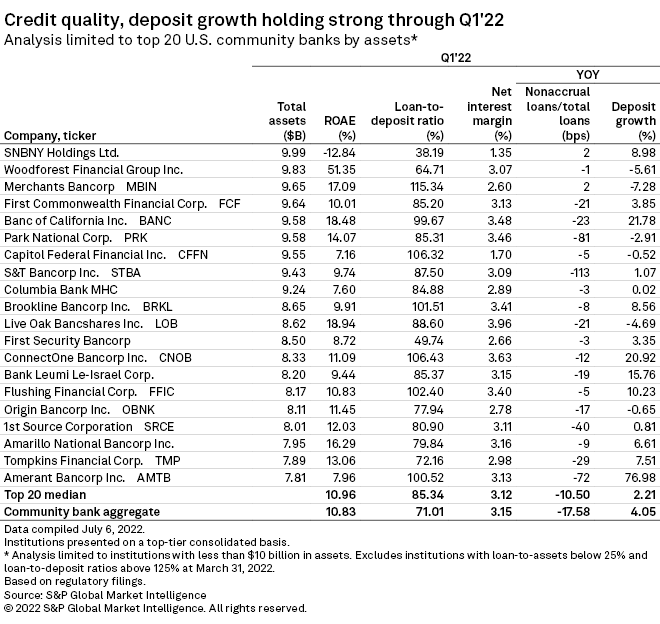

The Fed has raised short-term rates by 150 basis points through mid-July and is expected to continue tightening monetary policy through at least 100 more basis points of rate hikes and the shrinkage of its balance sheet during the remainder of 2022. Those actions will bolster community bank margins and allow the key profitability metric to reach 3.31% in 2022, up notably from 3.15% in the first quarter of 2022.

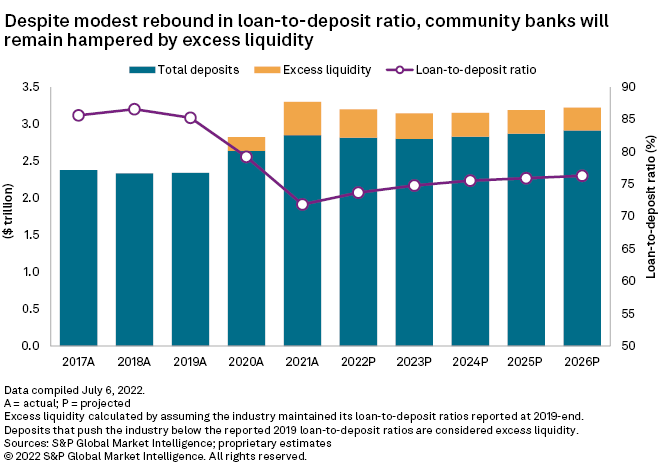

We expect the Fed's balance sheet reduction and utilization of some of the nearly $2.6 trillion in excess savings that consumers have accumulated through the pandemic to pressure community bank deposit balances, allowing loan-to-deposit ratios to recover from depressed levels.

Community bank deposits dipped slightly in the first quarter from year-end 2021 levels, while loans shrunk 1.3% in the period. Deposits are projected to decrease 1.25% from year-ago levels in 2022 and dip 0.50% in 2023. Stronger loan growth is expected during the remainder of 2022, leaving loans 1.25% higher than 2021 levels. Community bank loans are projected to climb another 1% in 2023.

Early reporters in second-quarter earnings season continued to show signs of stronger loan growth in 2022. In the second quarter, total loans grew 6.1% year over year at JPMorgan Chase & Co., 11.9% at Bank of America Corp., 8.6% at Wells Fargo & Co., 11.1% at U.S. Bancorp and 5.1% at The PNC Financial Services Group Inc. Bank management teams said their commercial lending segments drove loan growth, while a number of institutions reported weakness in mortgage origination activity due to sharp increases in interest rates.

Loan growth and pressure on deposits will allow community banks to shrink some of the estimated $477 billion in excess liquidity held at the end of the first quarter. We expect excess liquidity will decline in 2022, 2023 and 2024 but remain above $300 billion through 2024.

While excess liquidity will remain a headwind to earnings, the glut of cash will help community banks' deposit costs lag short-term rate increases, at least in the near term. However, the pressure on deposit costs will grow in 2023 as customers react to the swifter pace of rate increases by the Fed.

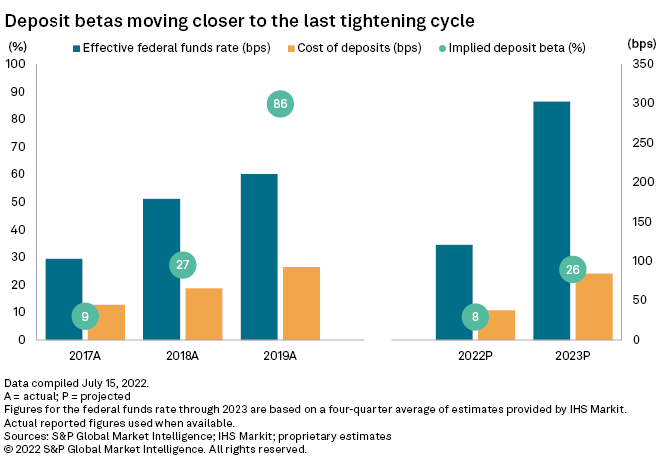

Some banks like PNC Financial said during their respective second-quarter earnings calls that deposit betas, or the percentage of changes in the federal funds rate that banks pass through to depositors, have lagged early in the current rate hike cycle. However, PNC expects betas to accelerate during the second half of 2022 given the speed of rate increases.

We now expect community banks' deposit betas to be higher than previously expected but believe the metrics will remain relatively close to the levels seen during the last rate hike cycle given that institutions continue to operate with historically low loan-to-deposit ratios.

We expect the community banks in aggregate to record a deposit beta of 8% in 2022 and 26% in 2023, leading to a cumulative beta of 19% by the end of 2023. That experience would be slightly lower than in the last tightening cycle. Between the fourth quarter of 2015 and the fourth quarter of 2018, community banks recorded a cumulative beta of 21.65%.

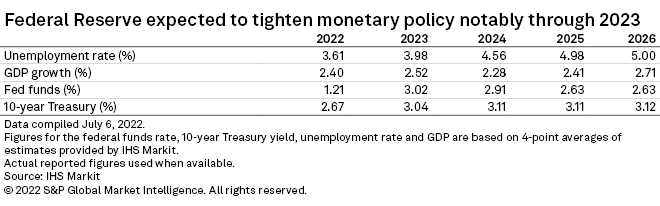

Earning-asset yields will also reprice higher but fail to expand at the same rate as funding costs in 2023, causing margin expansion to stall for community banks. The IHS Markit forecast for fed funds, which is incorporated in our projections, assumes the Fed will have to ease rates in mid-2024, reducing pressure on deposit costs. Meanwhile, community banks' earning-asset yields will continue to reprice higher due to the prevalence of higher-yielding loans and securities available in the market.

Earnings headwinds from credit costs, weaker fee income

Higher rates will benefit community banks' net interest income in 2022, but the group will still face earnings pressure due to higher credit costs and weaker noninterest income. We expect earnings to fall 4.8% in 2022 and decline another 6.2% in 2023.

Regulatory pressure and emerging competition from neobanks should contribute to weaker noninterest income as many large institutions have eliminated overdraft fees and a number of smaller banks have followed suit. Fee income should feel even greater pressure as higher rates have caused mortgage refinancing activity to plunge, leading to weaker mortgage banking income. Noninterest income is projected to drop 7.4% from year-ago levels in 2022 and then fall 1.5% year over year in 2023.

Credit costs remain historically low for community banks, and even the early reporters during second-quarter earnings season have reported few, if any, signs of stress in their borrowing base. Still, higher rates and elevated inflation, which has tracked at 2x or more the central bank's 2% target rate since June 2021, will lead to normalization of credit trends.

We expect credit costs to rise in 2023, albeit to manageable levels as strength in consumer balance sheets, the lack of loan growth in recent years and stronger risk management by banks will help mitigate credit deterioration.

Net charge-offs are expected to rise nearly 60% in 2022, up to just 0.14% of average loans, from relatively low levels recorded in 2021. Net charge-offs are expected to rise further in 2023 but are projected to only reach 0.22% of average loans.

We expect reserves to increase modestly in 2022 to 1.34% from 1.33% in 2021 before increasing more in 2023 as loan balances grow, credit quality normalizes and smaller institutions adopt the current expected credit loss model at the beginning of that year.

Scope and methodology

S&P Global Market Intelligence analyzed nearly 10,000 banking subsidiaries, covering the core U.S. banking industry from 2004 through the first quarter of 2022. The analysis includes all commercial and savings banks and savings and loan associations, including historical institutions, as long as they were still considered current at the end of a given year. It excludes several hundred institutions that hold bank charters but do not principally engage in banking activities, among them industrial banks, nondepository trusts and cooperative banks.

The analysis divided the industry into five asset groups to see which institutions have changed the most, using historically significant regulatory thresholds. The examination looked at banks with assets of $250 billion or more, $50 billion to $250 billion, $10 billion to $50 billion, $1 billion to $10 billion, and $1 billion and below.

The analysis looked back more than a decade to help inform projected results for the banking industry by examining long-term performance over periods outside the peak of the asset bubble from 2006 to 2007. Market Intelligence has created a model that projects the balance sheet and income statement of the entire industry and allows for different growth assumptions from one year to the next.

The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

IHS Markit is now part of S&P Global.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.