Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 12, 2021

By Jingyi Pan

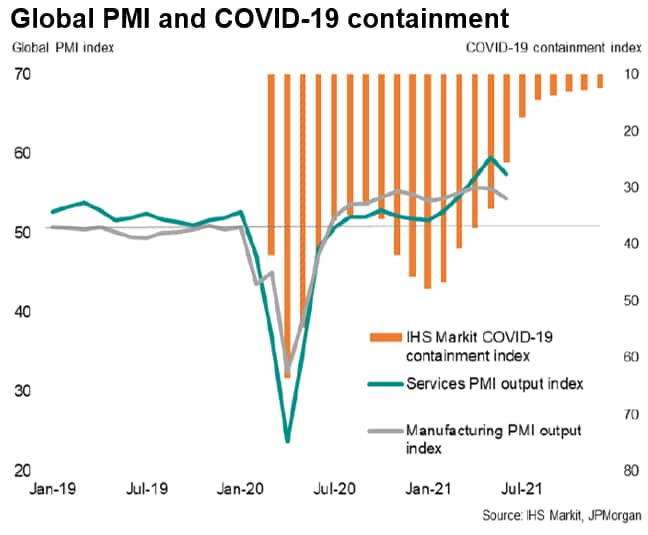

The JPMorgan Global PMI, compiled by IHS Markit from its proprietary business surveys, showed global growth tapping the brakes in June as the JPMorgan Global PMI Composite Output Index eased to 56.6, a three-month low from the 15-year high in May.

While both manufacturing and service sectors contributed to the decline of the composite figure in June, services can nevertheless be seen retaining the apparent lead in terms of growth momentum. This is congruent with easing COVID-19 restrictions globally on average to the lowest since the pandemic began.

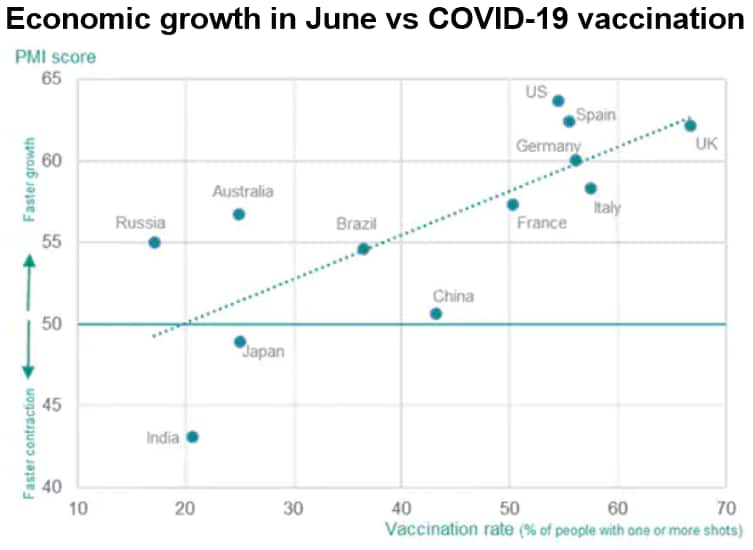

That said, regional variations in COVID-19 restrictions have been marked, and economic trends have to a large extent been driven by vaccine dividend differentials amid the spread of the Delta variant across many parts of the world, particularly emerging markets.

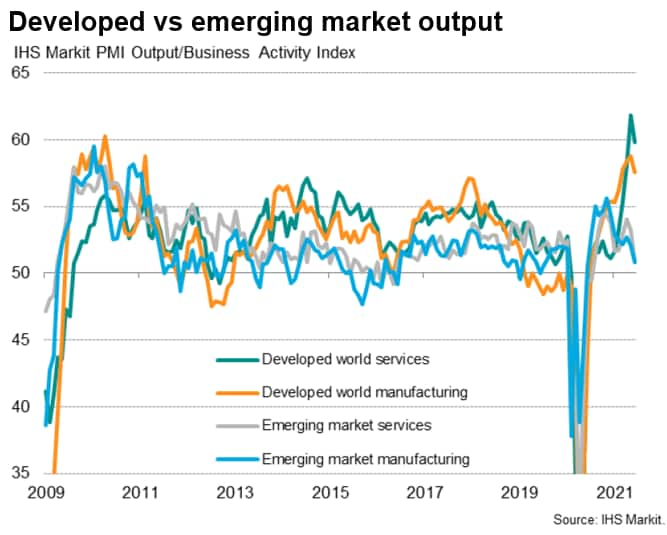

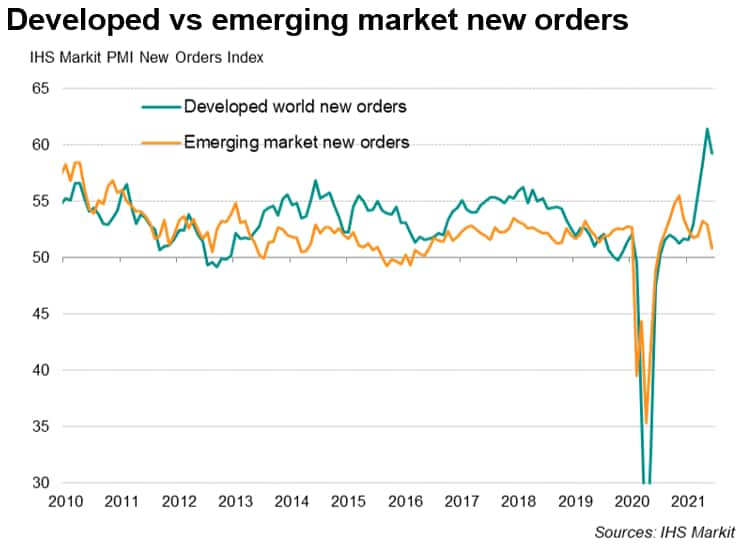

As shown, developed world manufacturing and services growth slowed in June, but notably from very elevated levels. In comparison, emerging market saw sharp dips for both manufacturing and services towards near-stagnation levels, according to PMI figures. While developed world economies continued to enjoy the reopening boost for economic recovery, particularly services, emerging market manufacturing and services both reeled from the Delta wave's setback towards economy recovery.

Divergence deepening as an issue for global growth

Hints of global growth peaking, according to PMI data, can be seen during a period in which growth stocks reclaimed the lead against their value counterparts. As displayed by the US S&P 500 index growth and value ETFs, value stocks which are sensitive towards economic recovery saw the uptrend stalling in June while growth names picked up pace to lead the broader market to fresh heights.

Although positive earnings expectations for tech stocks, which are most synonymous with growth stocks, ahead of the earnings release seaon had a part to play, the amalgamation of easing inflation concerns and burgeoning growth worries had been a major driving force for the rotation from value to growth.

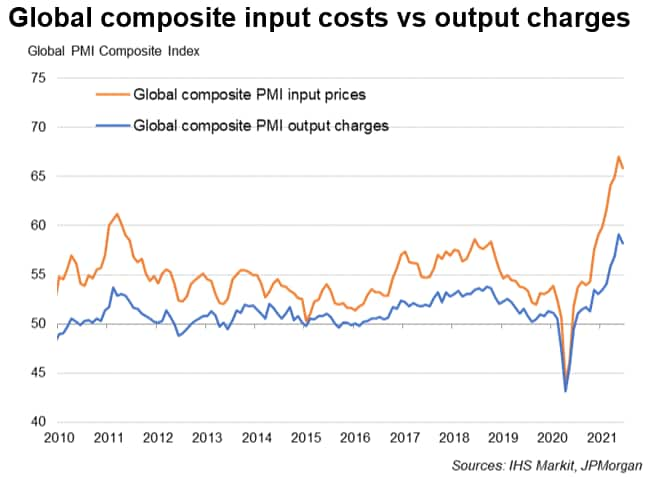

To expand on the easing inflation pressures trend, the latest JPMorgan Global Composite PMI prices sub-indices had also ascertained this. Input cost and output charge inflation both eased marginally in June. While this is not to say that we are anywhere near a point to look past supply constraints woes, the trend at least suggests that price pressures softened. Yet, output slipped with the surge in COVID-19 breakouts, brought about by the Delta variant, which appear to be playing a more pertinent role weighing on global output.

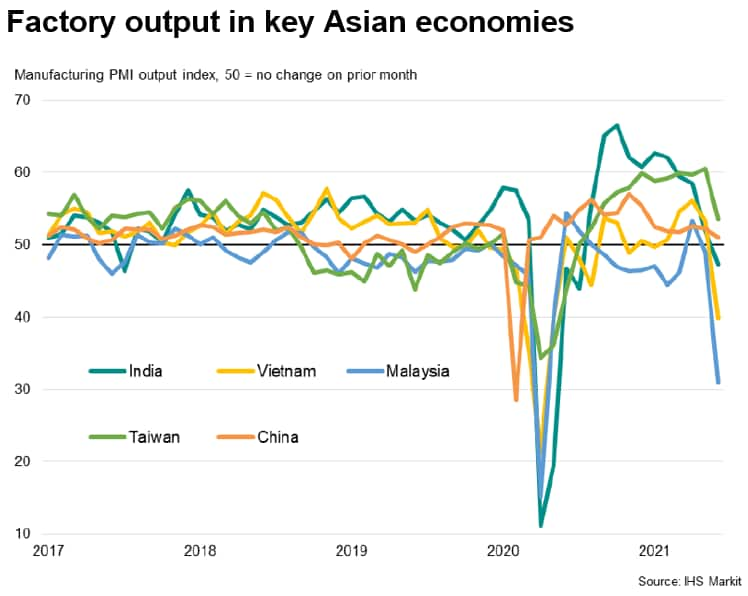

Drilling into the specific regions where the Delta variant played a part in weighing on output in June, one can see this is most apparent in various emerging Asian economies, plunging some areas' factory output into contraction in June.

Risks of Delta variant driven divergence for the global economy

The effect of diverging regional growth conditions are multi-fold. On a regional level, areas coping with the Delta variant, which also renders vaccines less effective on average, have been subjected to lower demand conditions. This does not bode well for recovery and furthers the risk of the APAC region and other emerging markets being left behind.

As it is, spooked by the latest Delta wave, both emerging market currencies and equities lost their shine against their developed market counterparts into June. The situation had notably been aggravated by developed markets' central banks, including the US Federal Reserve that adopted a more hawkish tone amid relatively better economic conditions, driving the outflows from emerging markets.

Rounding back, it is also worth scrutinising the effect on global economic recovery should the emerging Asia bloc fall behind. Over and above dampened output, the Delta wave's impact on supply chains cannot be ignored as the disruption engulfs emerging Asia and risk prolonging ongoing inflation woes.

All said, a key reason for the divergence in global growth conditions had been the COVID-19 vaccination progress. June's economic health check had spelt out loud and clear the urgency for areas lagging in the vaccination drive to speed up their inoculation efforts. A catch-up here, which may also qualify these regions for further easing of restrictions, could alleviate the current problem of diverging conditions. The uncertainty, however, lies with how fast the vaccination rates can rise, an area to be closely watched with the next iteration of July global PMIs.

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.