Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 20, 2024

By Russell Ernst

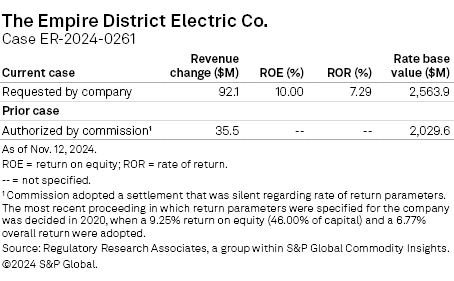

Algonquin Power & Utilities Corp. subsidiary The Empire District Electric Co. is seeking $92.1 million of additional revenue in Missouri.

Empire serves roughly 184,000 retail electric customers, about 164,000 of which are in Missouri. The company also provides service in Arkansas, Kansas and Oklahoma.

➤ Empire, a direct subsidiary of Liberty Utilities Co., proposes a $92.1 million base rate increase for its vertically integrated electric utility operations in Missouri. The requested increase reflects a 10.00% return on equity (ROE). A final Missouri Public Service Commission decision is expected by September 2025.

➤ The company has cited infrastructure investments made since its last base rate case as being the primary driver for the rate change request.

➤ Empire seeks to utilize deferral accounting to address certain environmental costs and investment in two new gas-fired generation units. If the proposal is approved by the PSC, these costs would be considered in a future proceeding for rate recovery.

➤ Regulatory Research Associates accords Missouri energy utility regulation an Average/3 ranking and considers the jurisdiction to be somewhat more restrictive than average from an investor perspective.

In Case ER-2024-0261, Empire proposes a $92.1 million (15.99%) base rate increase premised upon a 10.00% return on equity (53.10% of capital) and a 7.29% return on a year-end rate base valued at $2.564 billion for a test year ended Sept. 30, 2023, adjusted for known and measurable changes.

The company has cited infrastructure investments — including substation upgrades and new transmission lines — as the primary driver for the requested increase. It has also replaced its information technology systems and increased cybersecurity protection of its assets and is looking to include these investments in its rates.

Empire seeks permission to eliminate the existing 95/5 allocation between ratepayers and shareholders included in its fuel adjustment clause such that all fuel and transmission costs can be recovered through the rider. The company said "market dynamics [i.e., the implementation of a centrally dispatched wholesale electric market] have changed substantially and warrant the reconsideration of such a sharing provision."

In prior proceedings for other Missouri electric utilities, the PSC has determined the transmission costs eligible for companies to include in their fuel adjustment clauses. The first category is for costs incurred to transmit power to serve companies' native load that is sourced from generation plants owned by others ("true purchased power"). The second is to transmit excess power the companies sell to third parties in locations outside of the Southwest Power Pool regional transmission organization, i.e., off-system sales. Hence, it is unclear whether the commission will be receptive to Empire's stance on this matter.

Empire said, "As the markets and resource mix [have] evolved, the company has become a full participant in an organized market. All of the power it produces is sold to that market, and all of the power it requires is purchased from that market. There is no difference in the transmission expense incurred to deliver power purchased under traditional [power purchase agreements] and to deliver power purchased under RTO transactions."

Empire had submitted a notice of intent to file a rate case in March but delayed the case filing until November to "provide additional time for our employees to learn how to navigate the new [customer information] systems and work out any challenges from the transition."

Deferral proposals

Empire seeks to establish an environmental cost tracker pertaining to its Neosho Ridge, North Fork Ridge and Kings Point wind farms. The costs that would be reflected in the tracker would be those attributable to compliance with environmental monitoring requirements pursuant to the Endangered Species Act and the Bald and Golden Eagle Protection Act. Amounts included in the tracker would be addressed for possible recovery in a future rate proceeding.

The company envisions operating under the terms of an accounting authority order that would allow it to defer, for potential future recovery, the costs associated with new gas generation projects, specifically investment in the Riverton CT units 13 and 14, for which the company was authorized a certificate of convenience and necessity June 5 in Case EA-2023-0131 to replace the existing gas-fired Riverton units 10 and 11. Empire said "increasingly severe weather conditions [in the SPP footprint] and the penalty for [generation] non-performance has created a unique and extraordinary situation" that warrants approval of an accounting authority order.

Empire concluded, "Given the timing of this rate proceeding and the June 5, 2024, [certificate of convenience and necessity] approval for Riverton 13 and 14, it is unlikely that [the company] will be able to engage in a regulatory proceeding for recovery of those investments without experiencing significant regulatory lag that would jeopardize the company's opportunity to earn a fair return."

State law allows utilities to be subject to the terms of a plant-in-service accounting framework. The law permits electric utilities, upon receiving PSC approval, to defer for future recovery 85% of all depreciation expense and return associated with "qualifying electric plant" investments made after the bill is enacted. The resulting regulatory asset balances, which are to accrue carrying charges at the utility's weighted average cost of capital and which would be amortized over a 20-year period once included in rates, are to be adjusted to reflect any prudence disallowances ordered by the PSC. New gas-fired plant investments are not eligible for plant-in-service accounting treatment under the law.

Previous proceeding

Empire's previous Missouri-jurisdictional base rate proceeding, Case ER-2021-0312, was decided in 2022, when the PSC adopted partial settlements that gave rise to a $35.5 million rate hike. Rate-of-return parameters were not specified in the agreements, although a $2.03 billion rate base figure was included.

Empire was permitted to pursue unrecovered costs associated with the Asbury plant and costs related to a February 2021 weather event for recovery, in Cases EO-2022-0193 and EO-2022-0040, respectively, through the securitization process. The securitization bonds were issued in January 2024.

The most recent proceeding in which return parameters were specified for Empire was Case ER-2019-0374. That proceeding was decided in 2020, when the PSC adopted a 9.25% return on equity (46.00% of capital) and a 6.77% overall return.

RRA perspective on Mo. regulation

Missouri regulation is somewhat more restrictive than average from an investor perspective. In recent years, most rate proceedings in the state have been resolved through settlements that did not specify ROEs. However, when equity returns were approved, they approximated prevailing industry averages at the time established. All large electric utilities have fuel adjustment clauses in place that allocate a portion of fuel and purchased-power-related cost variations to shareholders.

The state's gas utilities are permitted to adjust rates to reflect changes in gas commodity costs on a timely basis, and the commission has approved the use of surcharges for recovery of infrastructure improvement costs between base rate cases.

State law allows utilities to use a deferral arrangement for certain investments that would otherwise not be immediately captured in rates, which is intended to reduce the impact of regulatory lag. In addition, state law permits electric utilities to securitize energy transition costs and qualified extraordinary costs following the issuance of a financing order by the PSC.

The other large utilities subject to the PSC's jurisdiction are Evergy Inc. subsidiaries Evergy Metro Inc. and Evergy Missouri West Inc.; Ameren Corp. subsidiary Union Electric Co.; Empire affiliates Liberty Utilities (Midstates Natural Gas) Corp. and Empire District Gas Co.; Spire Inc. subsidiary Spire Missouri Inc.; and Summit Natural Gas of Missouri Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Theme

Location