Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Mar, 2024

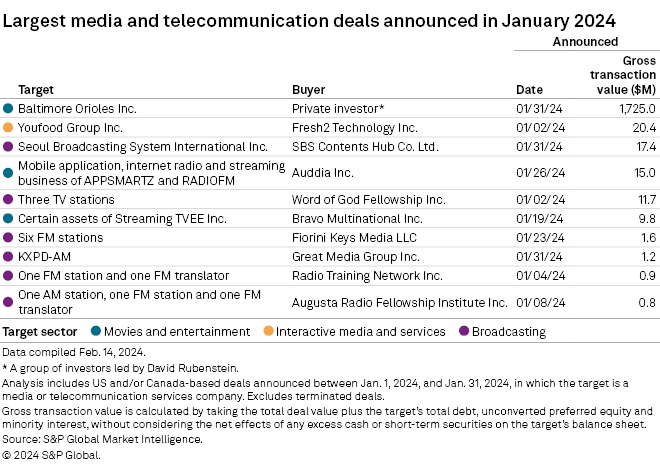

America's pastime was a major driver of North American media and telecommunications M&A activity in the first month of 2024.

In January, Carlyle Group Inc. co-founder David Rubenstein led a group of investors in agreeing to acquire a Major League Baseball team, the Baltimore Orioles, in a transaction worth $1.73 billion.

The deal was not only the sector's largest transaction in January by far, but it also ranked among the largest deals since the start of 2023.

The Rubenstein-led investor group purchased the Orioles from the Angelos family, which had owned the team since Peter Angelos bought it for $173 million in 1993. Chairman and CEO John Angelos, who has been running the club since his father's health began to decline, will be a senior adviser to Rubenstein. A Baltimore native, Rubenstein will become the Orioles' "control person," with the Angelos family remaining a major investor.

The deal came after the Orioles won 101 games in 2023, their best mark since 1980, and clinched the American League East title for the first time since 2014. With a core of talented young players, the team is expected to contend for American League supremacy for years to come.

In December 2023, a new long-term lease agreement was approved that will keep the Orioles at the historic Camden Yards ballpark. The deal, which was set to expire at the end of 2023, extends the lease for 30 years. There is an opt-out after 15 years if the Orioles do not receive approval from state officials for development plans next to the venue.

"The impact of the Orioles extends far beyond the baseball diamond," Rubenstein said in a news release. "The opportunity for the team to catalyze development around Camden Yards and in downtown Baltimore will provide generations of fans with lifelong memories and create additional economic opportunities for our community."

The investor group also includes Ares Management Corp. co-founder and CEO Michael Arougheti; Ares Credit Group co-heads Mitchell Goldstein and Michael Smith; retired Orioles player Cal Ripken; former Baltimore mayor Kurt Schmoke; retired NBA player Grant Hill; entrepreneur and philanthropist Mike Bloomberg; and business leader Michele Kang.

The Orioles team purchase remains subject to review and approval by the MLB's ownership committee and a full vote of the MLB ownership. Goldman Sachs & Co. LLC, which ended 2023 as the third-ranked media M&A financial adviser by deal credit, is the Orioles' financial adviser on the transaction.

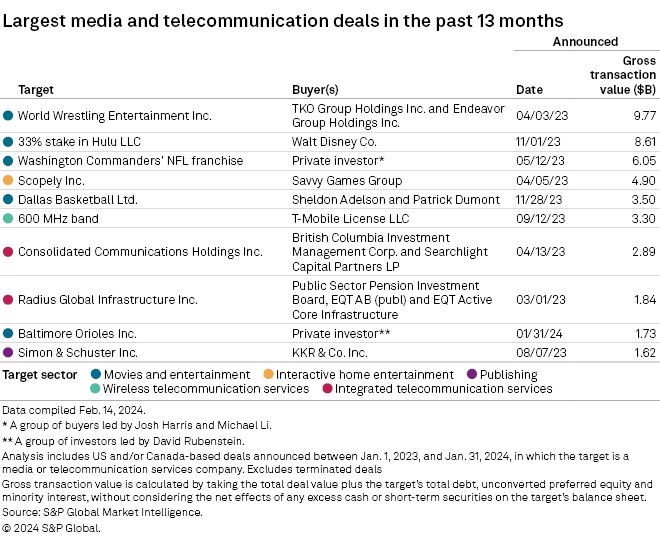

The Orioles sale emerged as the ninth-biggest transaction in terms of gross value over the past 13 months. Three other deals had sports teams or companies as targets.

World Wrestling Entertainment LLC's $9.77 billion sale to Endeavor Group Holdings Inc.-owned Zuffa LLC remained on top of the M&A rankings for the period. Goldman Sachs and four other firms served as financial advisers on the transaction, which spawned a new publicly listed entity, TKO Group Holdings Inc.

An investor group's $6.05 billion acquisition of the franchise of a National Football League Inc. team, the Washington Commanders, emerged as the third-largest deal.

The $3.50 billion sale of an unknown majority stake in Dallas Basketball Ltd., the operator of NBA team the Dallas Mavericks, to the families of deceased Las Vegas Sands Corp. CEO Sheldon Adelson and president and COO Patrick Dumont, ranked fifth overall in the top deals list.

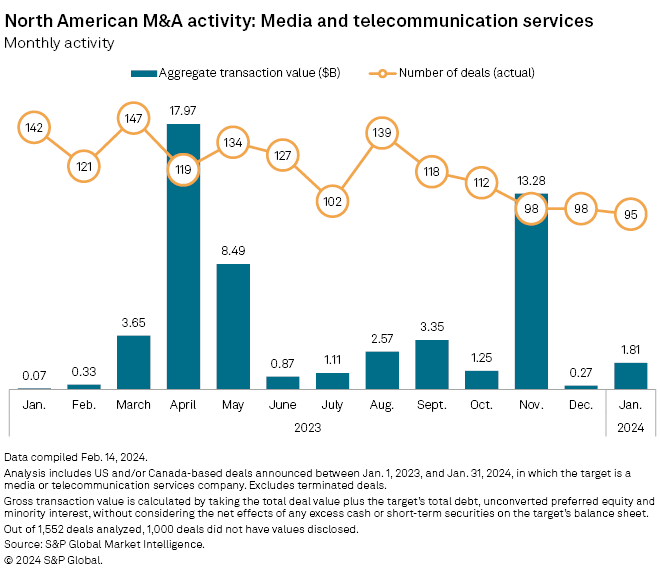

Overall for January 2024, there were 95 North American media and telecommunications transactions worth an aggregate value of $1.81 billion, according to S&P Global Market Intelligence data.

The aggregate deal value for January represents a significant increase from the December 2023 total of $268.5 million from 98 transactions, as well as the January 2023 total of $65.7 million across 142 deals.

Mike Reynolds contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.