Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 1 Apr, 2022

By Haikal Razak and Roy Shao

The Russia-Ukraine conflict has added further complexity at a time when many economies are grappling with soaring inflation while still recovering from the Covid fallout. Other than the announced sanctions from the US, UK and EU on various Russian banks, companies and individuals, there will be other entities that could see their business operations and supply chains directly or indirectly impacted by the sanctions and conflict.

Given the fluid nature of the ongoing Russia-Ukraine conflict and the likelihood that more and wider sanctions may be imposed on Russian-related businesses and individuals going forward, it has become increasingly tricky for businesses and investors to keep tabs on how these sanctions could have a direct and indirect impact on their supply chain and portfolio holdings.

The Key Developments data set could be used to aid in highlighting the impact from recent and potentially future sanctions imposed on Russia, particularly on companies receiving less/little coverage in mainstream media.

Ideation for such screening is most easily done on the S&P Capital IQ or Capital IQ Pro platforms before a confirmed, more permanent workflow can be passed onto the data feed side. There are many keywords that a client could use to screen for affected companies and individuals to suit the purpose of their analysis. Some of these keywords may include “lawsuit”, “fraud” and others. For the purposes of this data story, we have opted to use sanctions on Russian entities as an example.

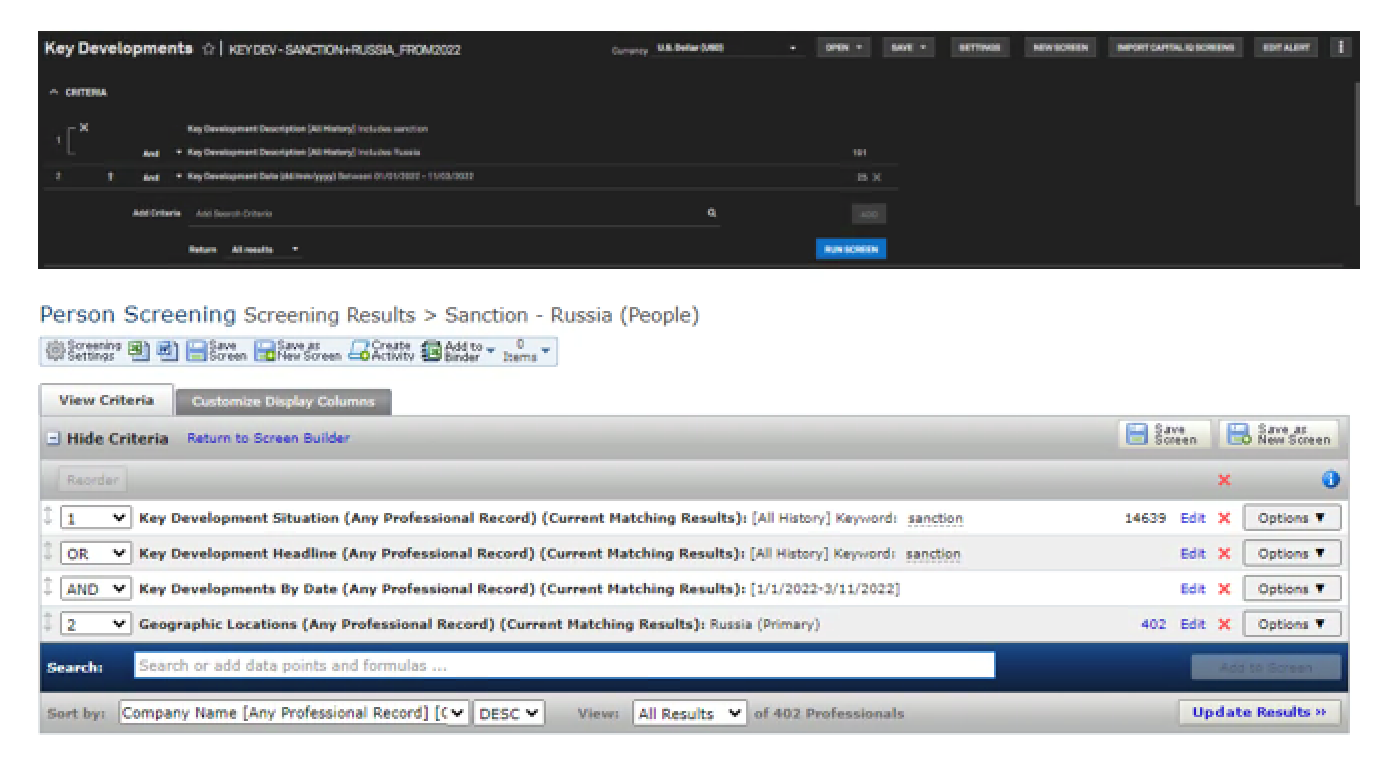

We used the following criteria on the Key Developments and People Screening Tools on S&P Capital IQ Pro:

Key Developments and People Screening Tools on S&P Capital IQ Pro & Capital IQ:

The results have surfaced a number of entities that are affected in some way, directly or indirectly by the announcement of sanctions on Russia. Highlighting such entities can make it easier to assess the likely impact on client holdings or interests, particularly for those entities that clients are less familiar with. Depending on the nature of its business and how crucial a particular country or region is to its operations, sanctions would affect these entities differently.

Among the most straightforward impact of such sanctions are those entities with varying levels of business presence in Russia.

Energy company Equinor ASA (OB: EQNR), which has had business interests in Russia for more than 30 years with about USD1.2bn in non-currents assets in the country, decided to begin exiting its joint ventures in the country. Given the difficulties expected in doing so, the decision taken by its board members is expected to impact the value of its Russian assets, potentially leading to impairments. Nonetheless the impact is expected to be relatively light. Its Russian assets represent just 1.7% of Equinor’s total assets amounting to USD71.2bn as of FY2021, while no revenue was recognized to be from Russia based on the S&P Capital IQ Fundamentals data set. Equinor is 67%-owned by Norway’s Ministry of Petroleum and Energy.

Even sectors not directly subjected to sanctions could see a significant enough indirect impact that could weigh on business operations.

AAK AB (OM: AAK), a global supplier of vegetable oils and fats, decided to suspend its sales and deliveries operations in Russia temporarily due to challenges faced on matters such as sanctions-compliance and trade flows. The impact from this is expected to be minor however, as Russia accounts for 3% of its volumes by metric tons. AAK’s Ukrainian volumes are even smaller, accounting for less than 1% of its volumes.

Results have also surfaced the difficulties certain firms may face in attempting to reduce or suspend their business operations in Russia.

IPG Phototonics Corporation (NasdaqGS: IPGP) is unable to halt or suspend its Russian operations despite Russia accounting for just a nominal amount of the company’s sales (ca. USD30m in 2021). The company has major production and R&D operations in Russia which supply component parts to operations in other countries for the manufacturing of products such as high-performance fiber laser, fiber amplifiers and diode lasers among other. That said, IPG does expect to begin reducing its reliance on Russia over the coming months. Further capital investments into Russia have been suspended except for those required for maintenance and other non-material items.

Some companies may have to divest some of their overseas holdings (be it in firms or assets) due to the impact of these sanctions (e.g. Russian firms having to divest assets in US/Europe etc.). This could potentially present attractive buying opportunities for clients/investors.

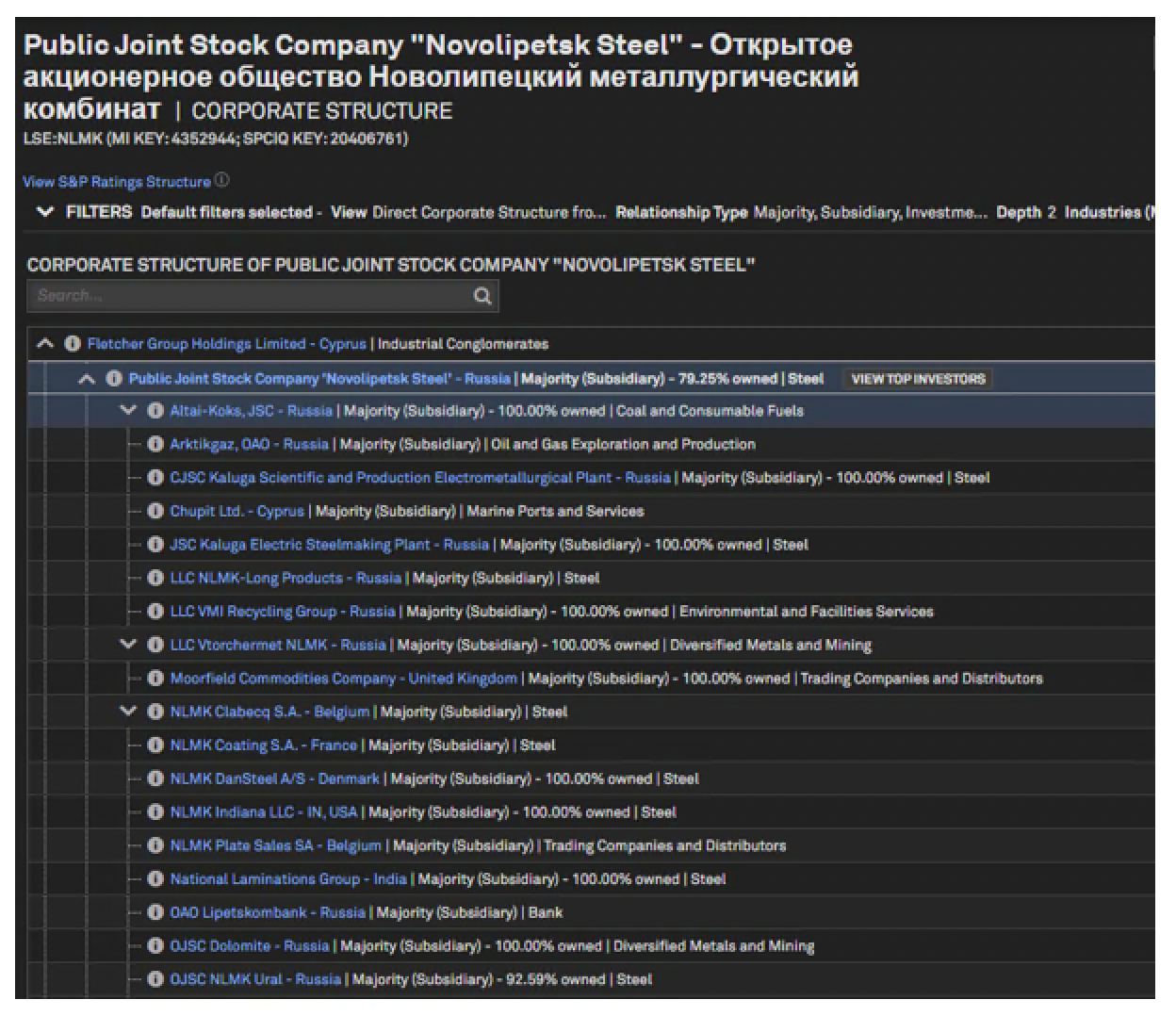

Novolipetsk Steel (LSE: NLMK), which engages in the manufacturing and sale of steel products, announced it is contemplating options with regards to its US assets. This could include any potential M&A opportunities or an exit from the market as part of its broader strategic discussions.

From Novolipetsk Steel’s Corporate Structure screen (see screenshot below), we can see a number of US-registered subsidiaries which may be focal points of the afore-mentioned strategic discussions. NLMK Indiana LLC and NLMK Pennsylvania Corp are US operating subsidiaries that produce low carbon, high carbon, high strength low alloy and other carbon/alloy specialty steels. Duferco US Investment Corporation, an investment company owned by a Luxembourg-based subsidiary of Novolipetsk Steel, is the 100% owner of US-based Sharon Coating LLC which produces galvanized and galvannealed steel coils. Top Gun Investment Corp is another US-based investment company with links to Novolipetsk Steel albeit there is little information with regards to its investments or operations. US-based subsidiaries aside, Novolipetsk Steel has plenty of European-based subsidiaries that may be similarly impacted by strategic decisions going forward.

Snapshot of Novolipetsk Steel’s corporate structure:

Some companies may have parent entities which may also be affected by sanctions. This may potentially impact other assets/holdings held by these parent entities.

Building on our above example, Cyprus-based Fletcher Group Holdings Ltd owns 79.25% of Novolipetsk Steel. That aside, it is also the majority owner of Dutch-based railway and river-sea transportation service provider Universal Cargo Logistics Holdings BV. This operating subsidiary is also the majority owner of a number of Russian and other European-based subsidiaries such as the Russia-based Stevedoring Timber Company and Dutch-based holding company UCL Port BV.

From a due diligence perspective, this can help bring to attention other possible linked entities that could be indirectly impacted by the sanctions. Clients may be impacted if it has them in its portfolio or if its portfolio companies have them. Otherwise, they may present potential buying opportunities if the parent companies have to offload their holdings in these other entities.

Key Development data set – A more permanent workflow using data feeds

Similar results can be found via the data feed option. Data feeds are useful once the logic, rationale and criteria with regards to a particular analysis are confirmed. This would allow one to broaden the analysis further, either by extending the analysis to a longer timeframe or by bringing in other data sets (for this example, having a look at Ownership data of the affected entities as demonstrated later in this Data Story).

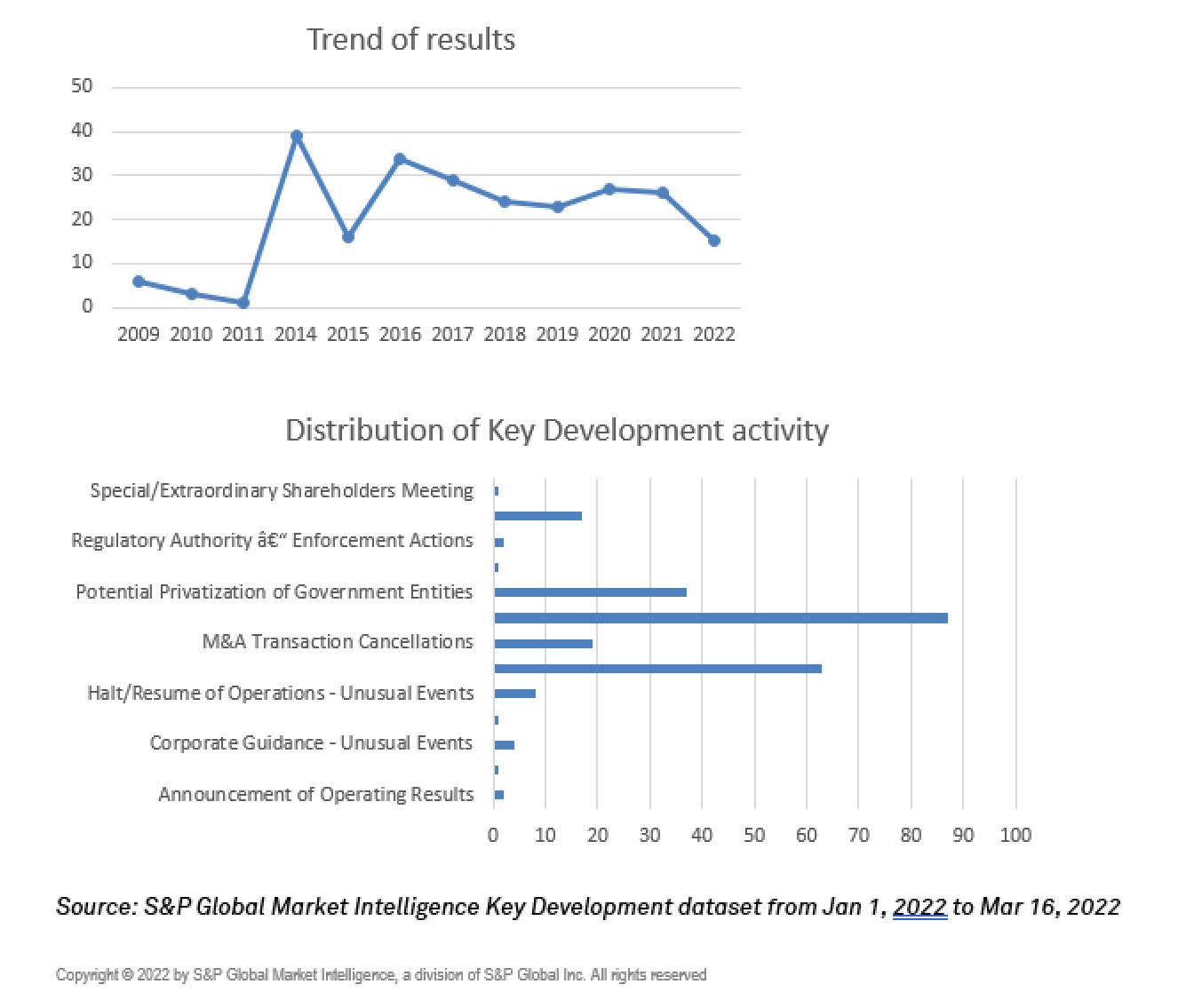

Using data feeds and extending our analysis to an all-history time horizon surfaced results going back as early as 2009. Sanctions on Russia are not exactly a new occurrence; one would recall the sanctions imposed onto Russia when it annexed Crimea back in 2014, which is in-line with the sharp spike in results as per the charts below. Merger and acquisition activities, the potential privatization of government entities and firms seeking to sell/divest are among the more common activities that arose when we extended our analysis to an all-history time horizon.

An illustration of Key Development results via data feed:

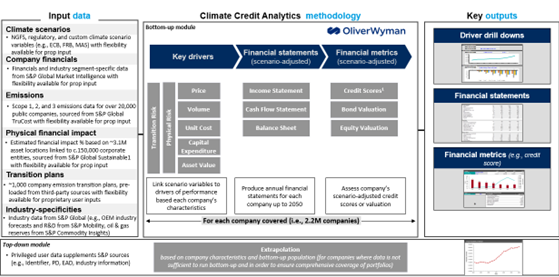

Using Data Management Solutions (DMS) to Aid with Data Research Work

Besides the S&P Capital IQ or Capital IQ Pro platform, if the users are familiar & comfortable with the Data Management Solutions including direct data analytics tools and platform, we are also able to provide different tools and solutions such as Snowflake and Workbench for future pure-data-based studies. Let’s use Workbench as an example in this case study.

S&P Global Marketplace Workbench is a cutting-edge technology that enables users to test, explore, and experiment with data sets from S&P Global and curated third-party providers in a scalable and secure cloud-based environment with no installation required. Using the web-based notebook environment, users can create and share documents that contain live codes, equations, visualizations, and explanatory text.

Here are some data research cases which we could easily run using the notebooks in the Workbench:

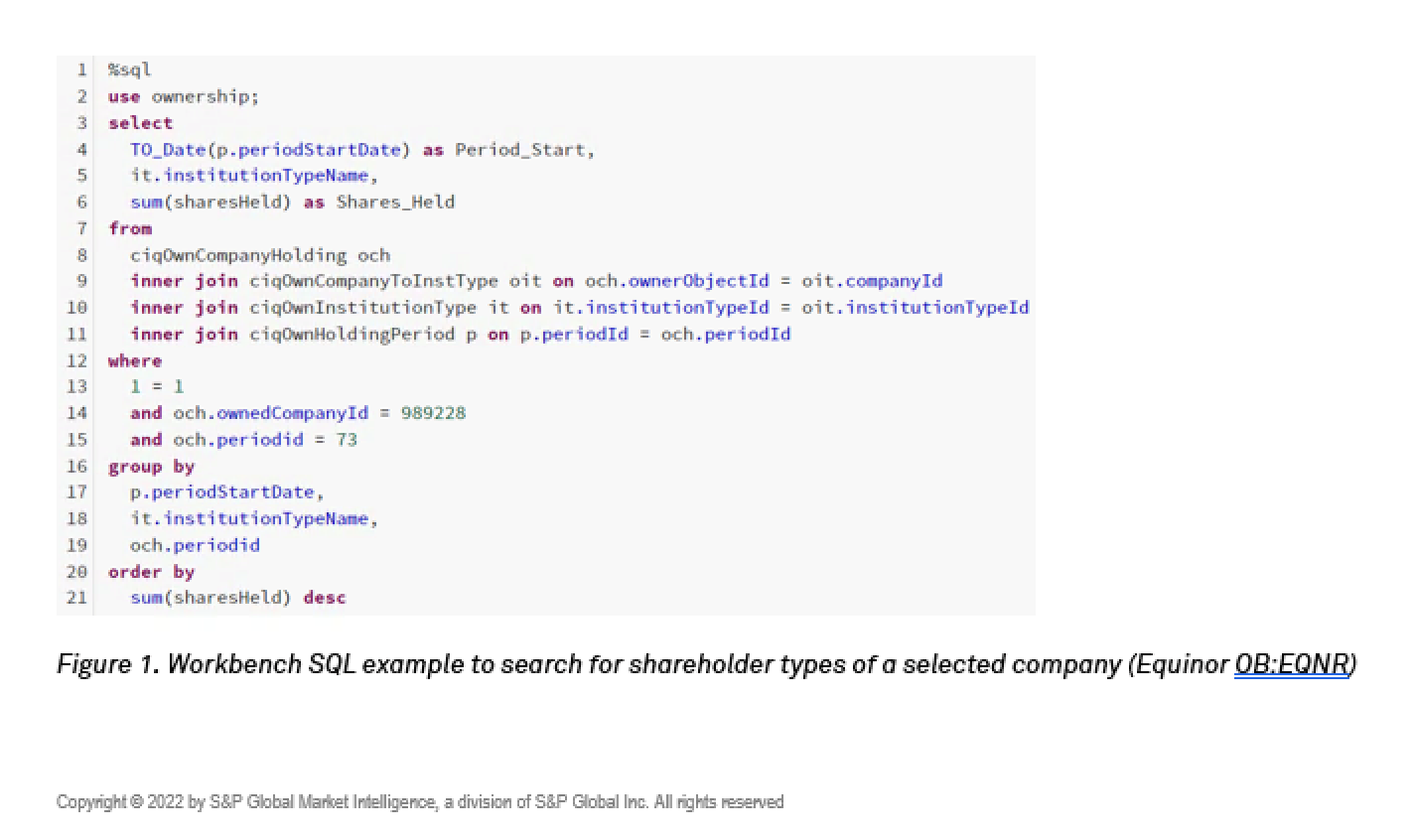

Ownership Data Research

1.1 Shareholder Types

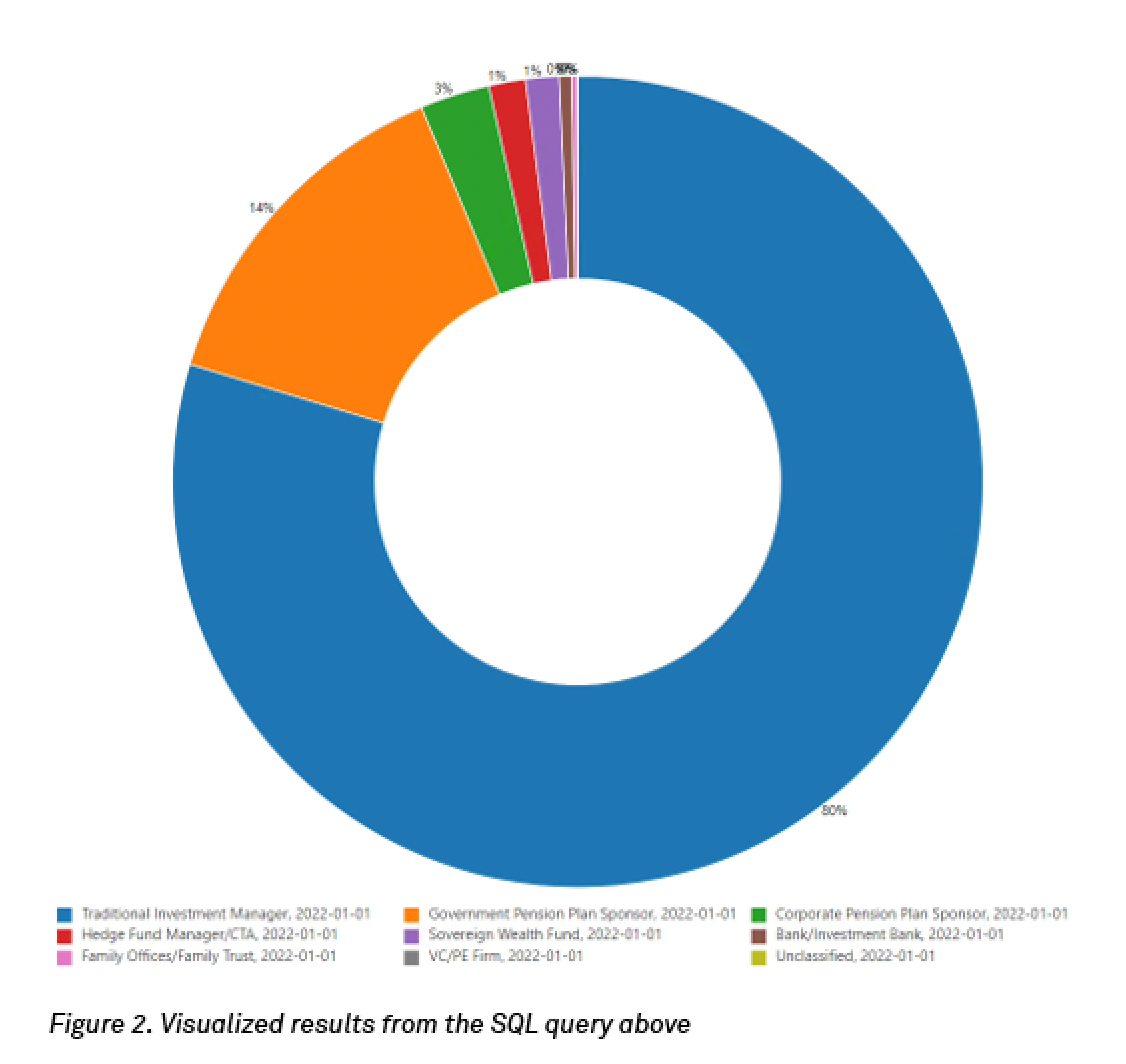

Let’s use Equinor ASA (Ticker: OB:EQNR; MI KEY: 4204408; SPCIQ KEY: 989228) as an example. With a very simple SQL query in the online notebook, we are able to pull out all the shareholders by their types:

We can see that the majority shareholders (80%) are Traditional Investment Managers, followed by Government Pension Plan Sponsors (14%) and then Corporate Pension Plan Sponsors (3%). The rest including Hedge Fund Manager/CTA, Sovereign Wealth Funds and Bank Investment, etc. are all holding no more than 1% of the total shareholdings.

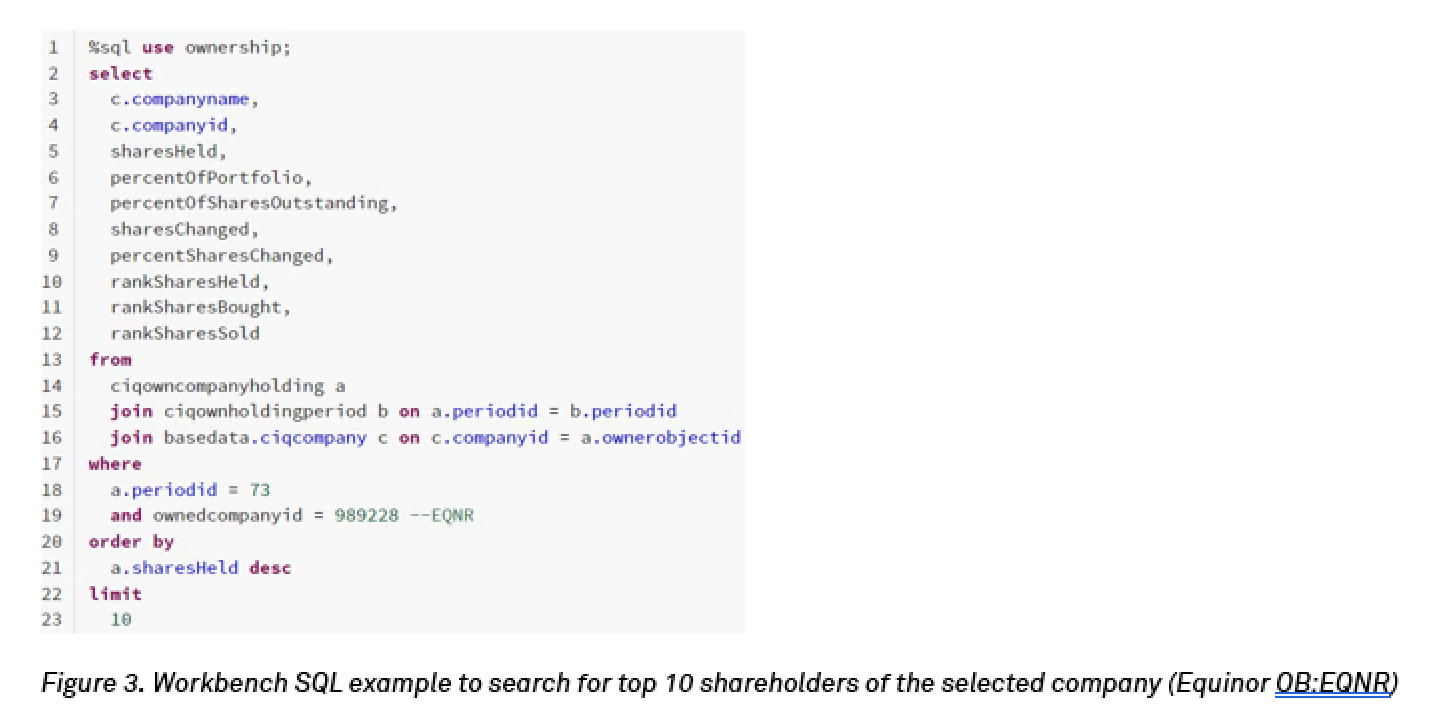

1.2 Top Holders

Similarly, we could use another SQL query to find the Top 10 holders of Equinor ASA with their detailed shareholding position and changes.

We can see that the Ministry of Petroleum and Energy Norway (Olje- og energidepartementet) is the top shareholder by number of shares while other major asset managers such as BlackRock, Inc. and Vanguard Group are also in the top 10 holder list. Based on this query, we can also see that BlackRock had reduced their shareholding by 910.7K (recorded at the latest time-period by end of Dec 2021) comparing with their previous shareholding position (by end of Sept 2021).

Key Development Data Research

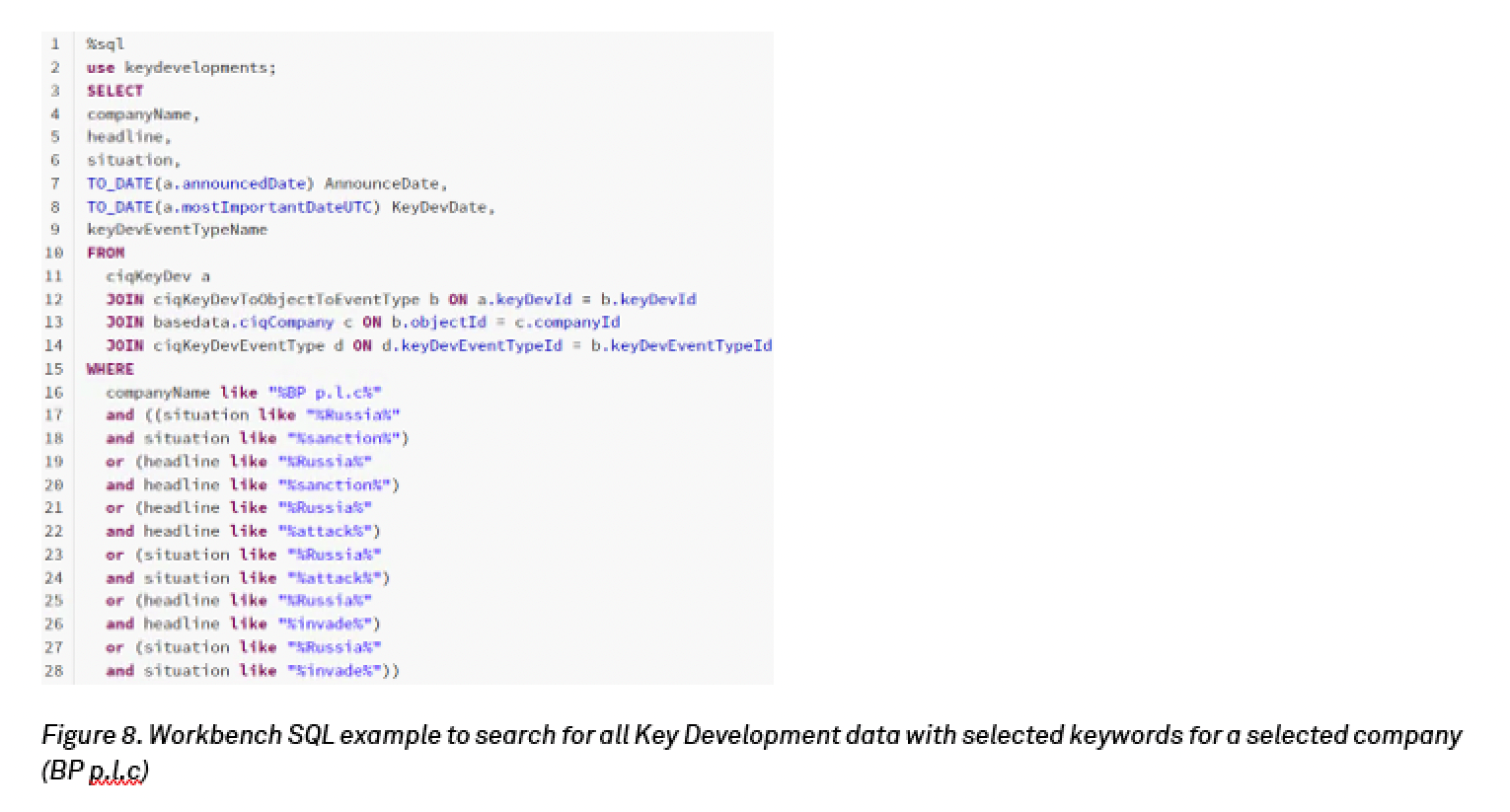

As we discussed earlier, Key Development might be a great source of data to find interesting topics using some keywords. The ideation process could be done in S&P Capital IQ or Capital IQ Pro using the appropriate screening functions. By using Workbench, searching for keywords within Key Development would be easier and faster.

Let’s run a simple example to search for keywords: “Russia” + “sanction” / “attack” / “invade” (i.e., “Russia” and “sanction”, or “Russia” and “attack” or “Russia” and “invade”)

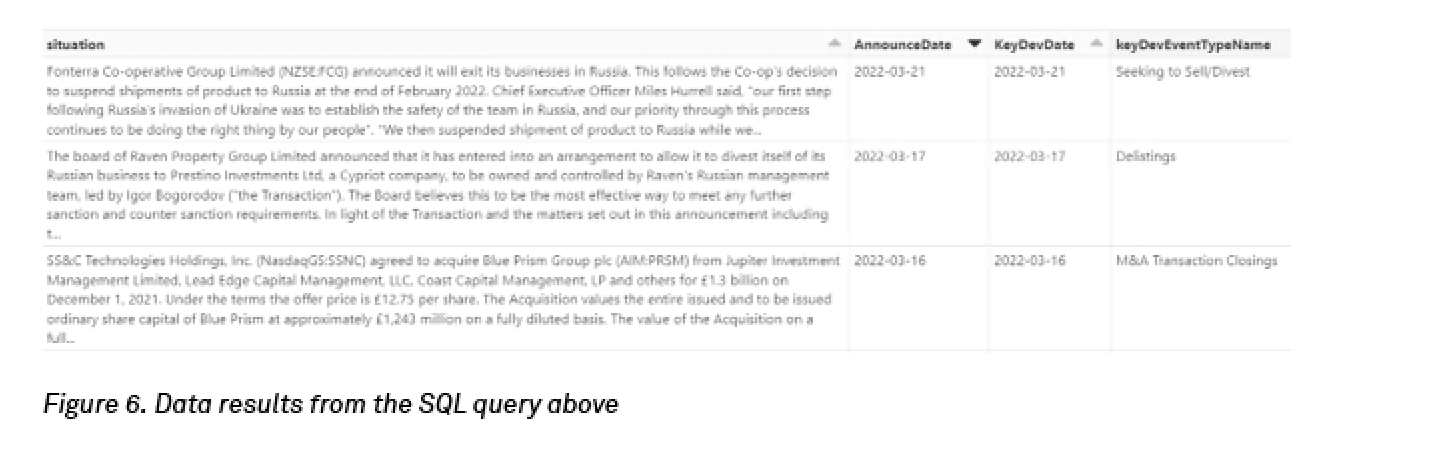

After searching the entire Key Development database in seconds, we get a full list of search results with the relevant keywords found in either Headline or Situation (information details).

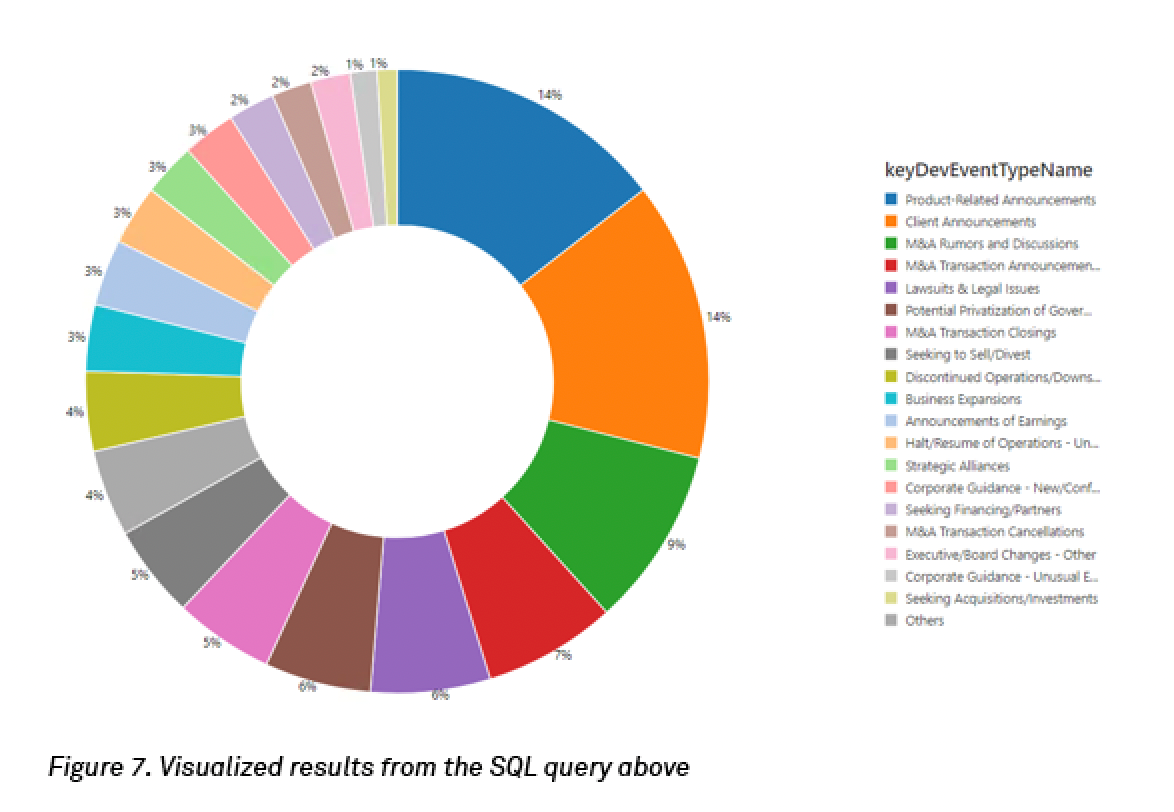

Based on the Key Development types, we could find the potential actions once these kinds of key developments happened.

To summarize, it seems that when events happened with the keywords “Russia” + “sanction” / “attack” / “invade”, the market’s reactions as categorized by the Key Development types are:

Most of these activities are M&A-related or announcements-related, followed by potential privatization and seeking to sell/divest of assets, when events associated with “Russia” + “sanction” / “attack” / “invade” happened. This suggests that in the aftermath of such key developments, investors and affected entities tend to engage in activities geared towards consolidation and risk mitigation, depending on how their businesses have been impacted.

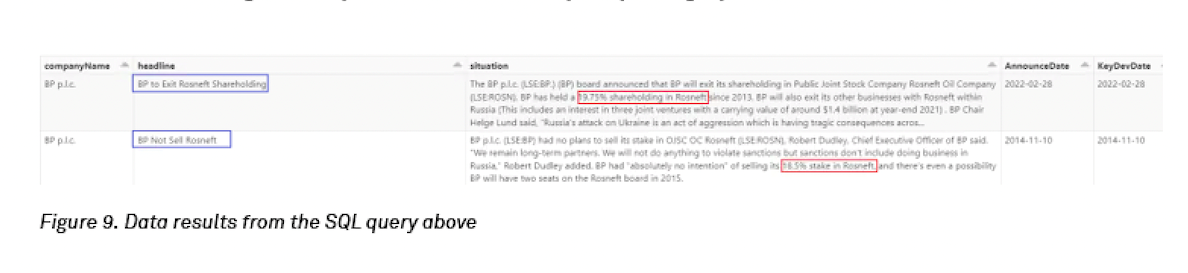

We might be able to spot some interesting case studies on some specific companies. For example, there are a few Key Developments of BP Plc that looks very interesting. Let’s run a similar SQL query but using BP as our case study example.

In the second headline (in the second blue box), we can see that BP did not sell Rosneft after the Annexation of Crimea by Russia in 2014 (see S&P Global Market Intelligence news article). BP was holding a 18.5% stake in Rosneft (see the second red box above) then.

However, in the latest Key Development announced in February 2022 after the declaration of war by Russia against Ukraine (see S&P Global Market Intelligence news article), BP decided to Exit Rosneft shareholding (please see the first headline in the first blue box). BP actually held 19.75% stakes in Rosneft (highlighted in the first red box), an increase of 1.25 percentage points compared to its holdings in 2014 after the Annexation of Crimea by Russia.

Leveraging the Key Development dataset can therefore aid in capturing and understanding the various strategic decisions taken by companies be it a decision driven internally or externally, in this case the sanctions imposed on Russia.

Transactions Data Research

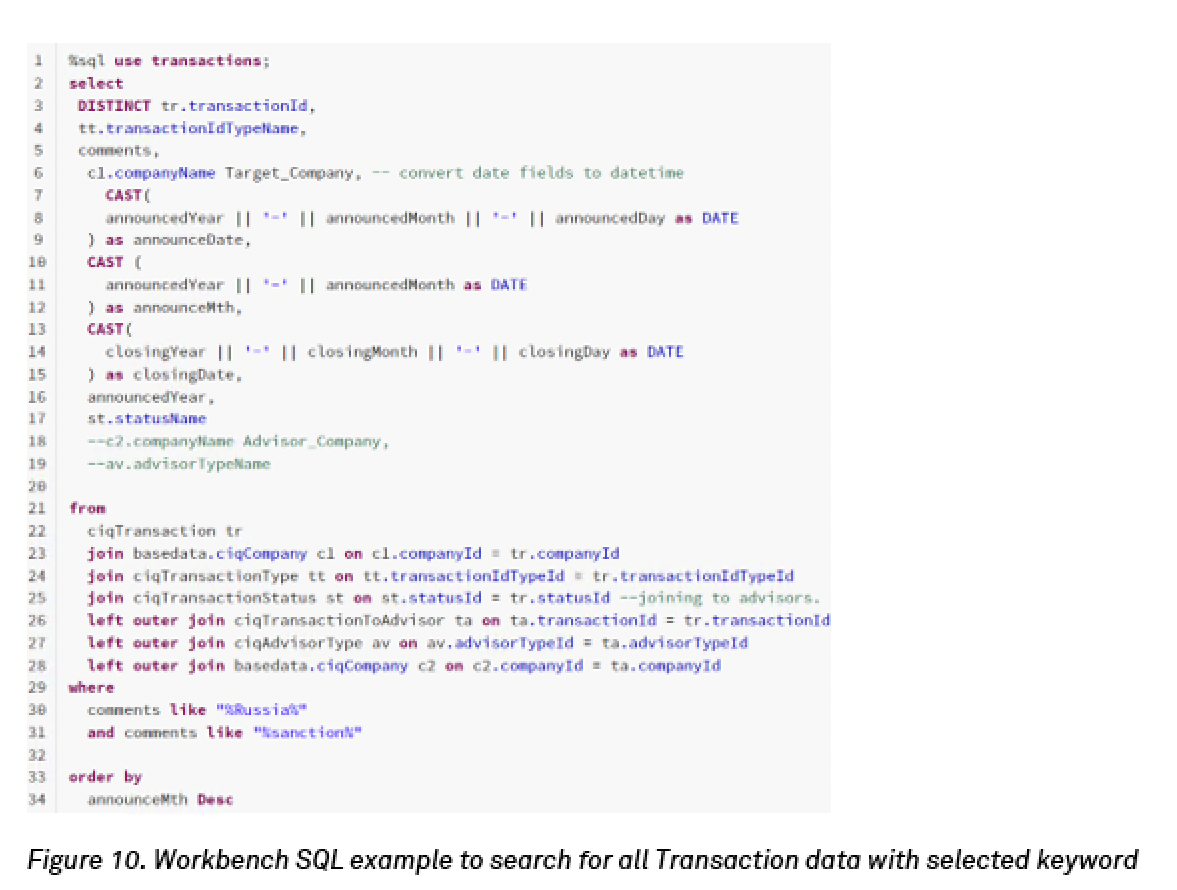

It is also possible to search within the entire Transaction database by selected keywords to find relevant transactions. Let’s run a SQL query to search for keywords “Russia” and “sanction” within the comments of all Transactions.

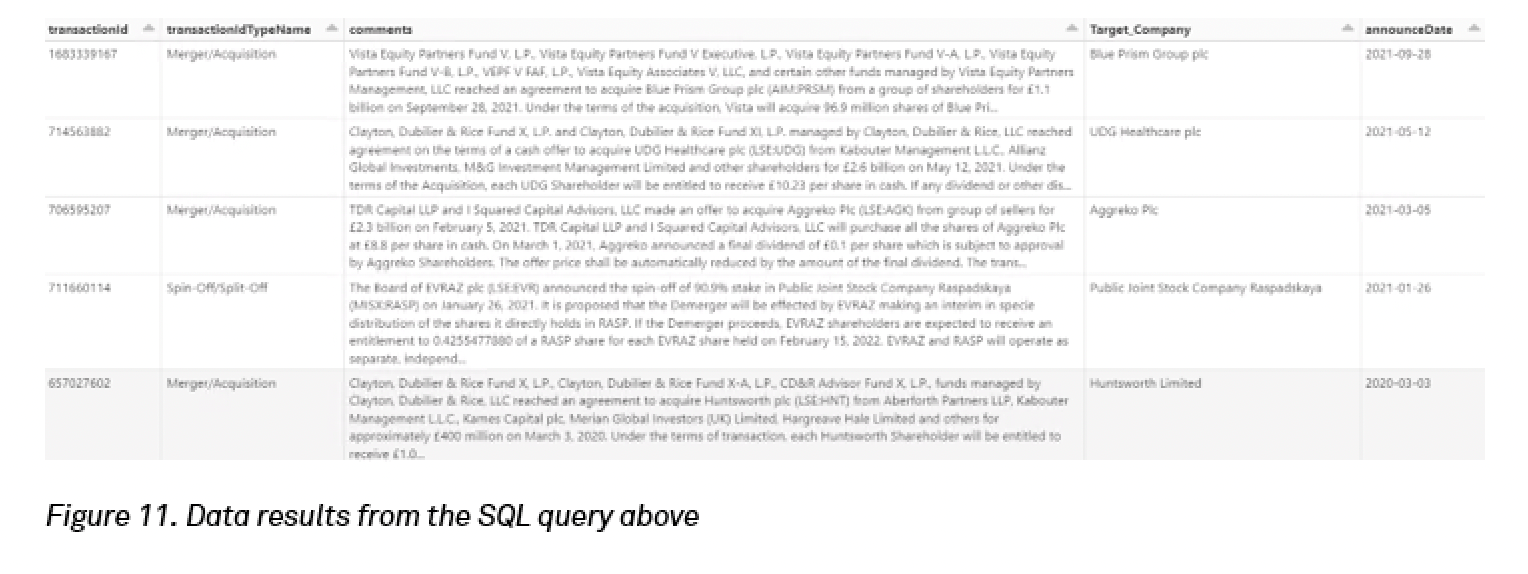

We can generate the full list of transactions associated with these keywords found in the comments.

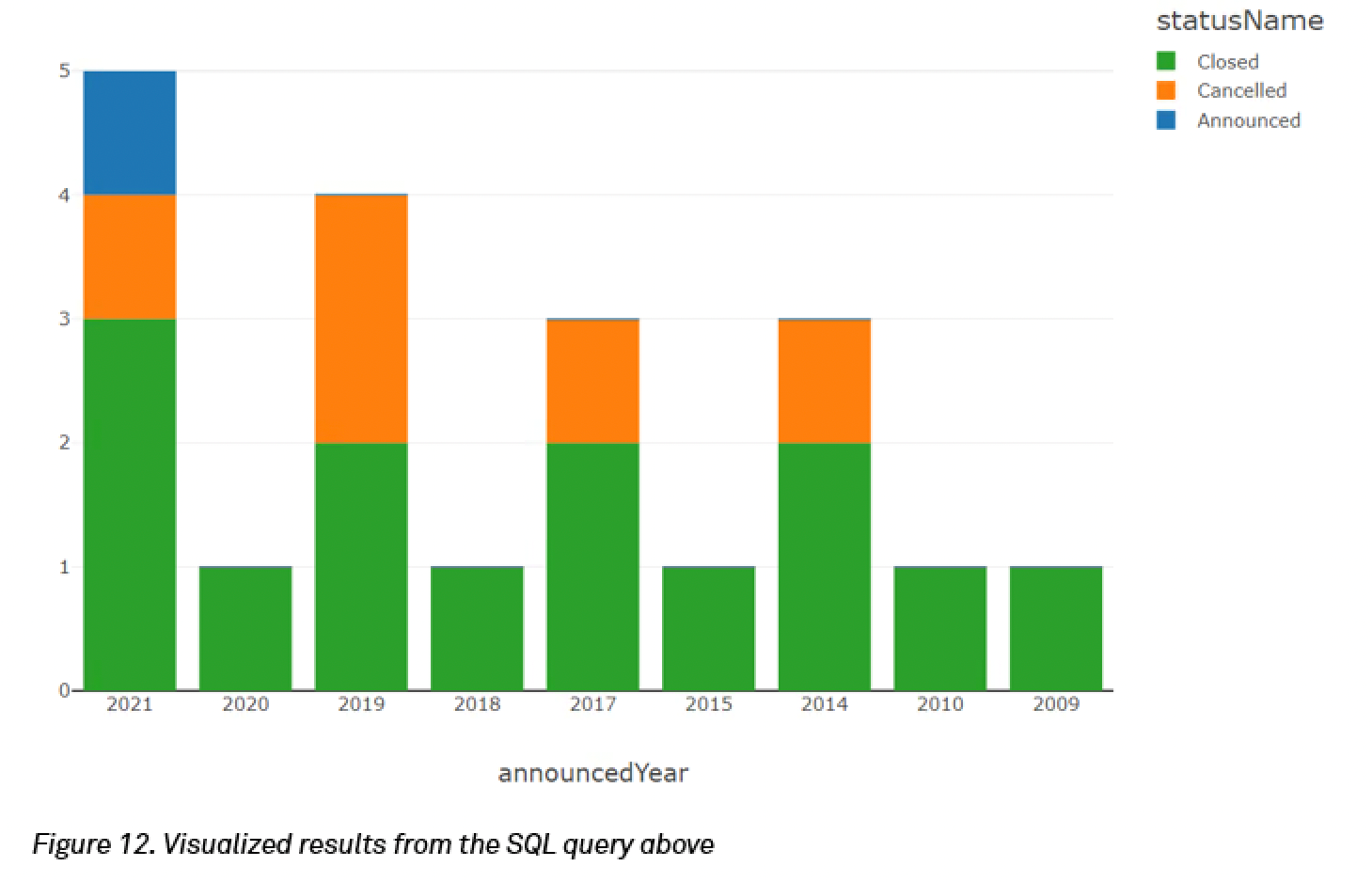

We can also run a visualization of the transaction summary (those with keywords “Russia” and “sanction” in their transaction comments) by the number of transactions, grouped by Transaction Status and spread over different years when the transactions were announced.

We can see that there are about 1 to 2 closed transactions from year 2014 to 2020 (except year 2016 has 0 transactions). There was a notable increase in transactions activity (3 closed, 1 cancelled and 1 announced but not closed) in 2021 compared to the previous years.

Key Developments for a multitude of use cases

For this data story, we aim to demonstrate how the Key Developments data set may be useful in aiding users to surface and consolidate companies that could be impacted by ongoing sanctions on Russia due to the ongoing conflict. This can be widened to other uses cases and workflows including, but not limited to searching for businesses impacted by investor activism, firms involved in frauds or lawsuits, aiding in due diligence work, bankruptcies and other potential red flags, among others.

In summary, we suggest that the ideation process is best done on S&P Capital IQ Pro or Capital IQ to firm up the logic and rationale of one’s analysis or due diligence. Once this has been firmed up, more permanent workflows could be set up with the aid of data management solutions, which will be useful in terms of tying in other data sets easily and in a timely fashion.

Theme