All major European equity indices closed higher, APAC was mixed, and the US was lower. US government bonds closed higher, while most benchmark European bonds were lower. European iTraxx and CDX-NA closed almost unchanged on the day across IG and high yield. The US dollar, natural gas, and copper were lower, and oil, gold, and silver were higher on the day.

Americas

- US equity indices closed modestly lower; Nasdaq/S&P 500 -0.1% and Russell 2000/DJIA -0.3%.

- 10yr US govt bonds close -4bps/1.66% yield and 30yr bonds -3bps/2.32% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY -1bp/294bps.

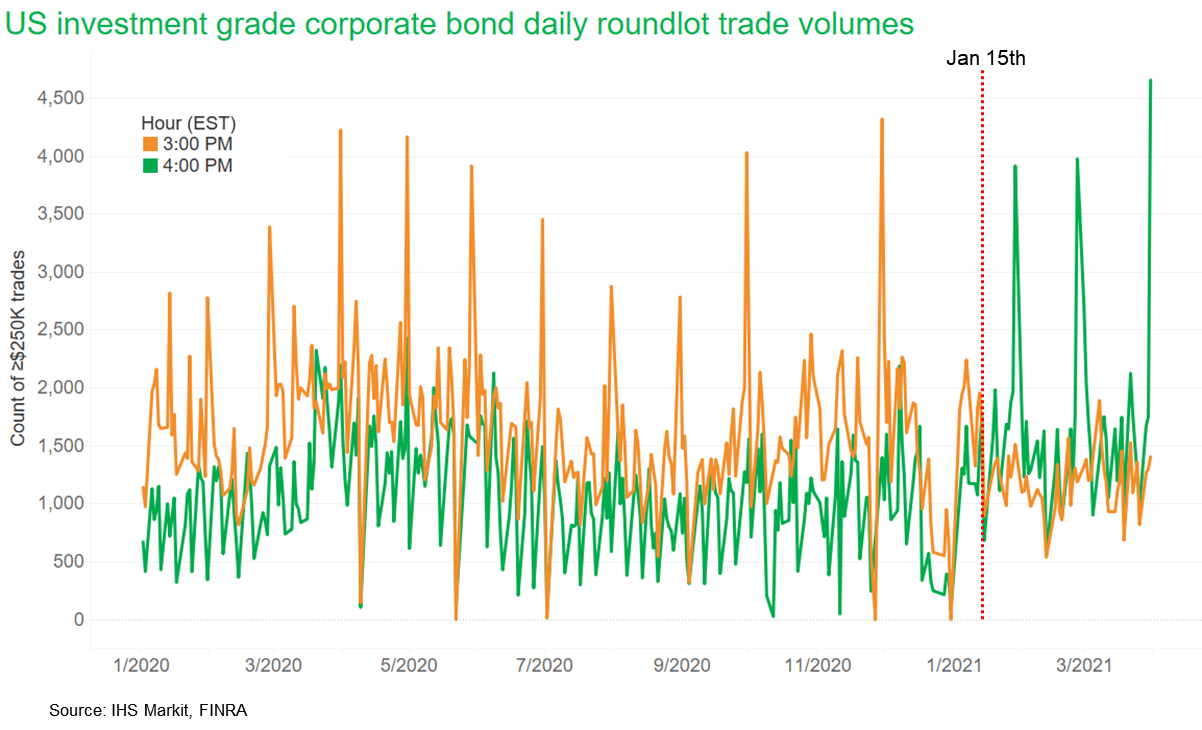

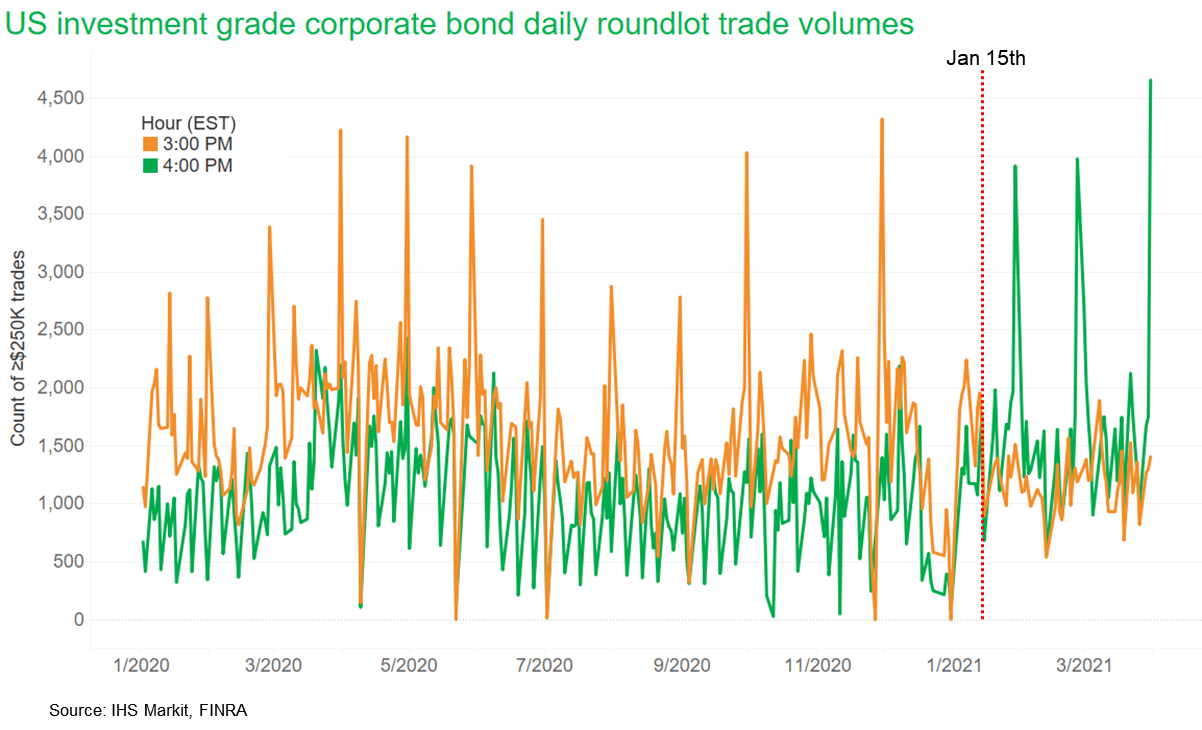

- The impact of changing the closing time for the major US dollar denominated fixed income indices from 3:00pm to 4:00pm this year is becoming apparent in the shift of the timing of trading activity of US corporate bonds. The below chart shows the daily counts of investment grade US corporate bond roundlot (≥$250K trade sizes) trades from January 2020 to March 2021 at 3:00pm (3:00-3:59pm) and 4:00pm (4:00-4:59pm). The monthly surges in trading volumes coincide with heightened activity on the last trading day of each month, with 3:00pm activity being higher than 4:00pm for almost every day in 2020 and up until 15 January this year, which is the day after the Bloomberg Barclays USD bond indices changed to a 4:00pm close. IHS Markit iBoxx USD indices changed to a 4:00pm close on 26 February, which appears to have further increased the shift of trades to 4:00pm.

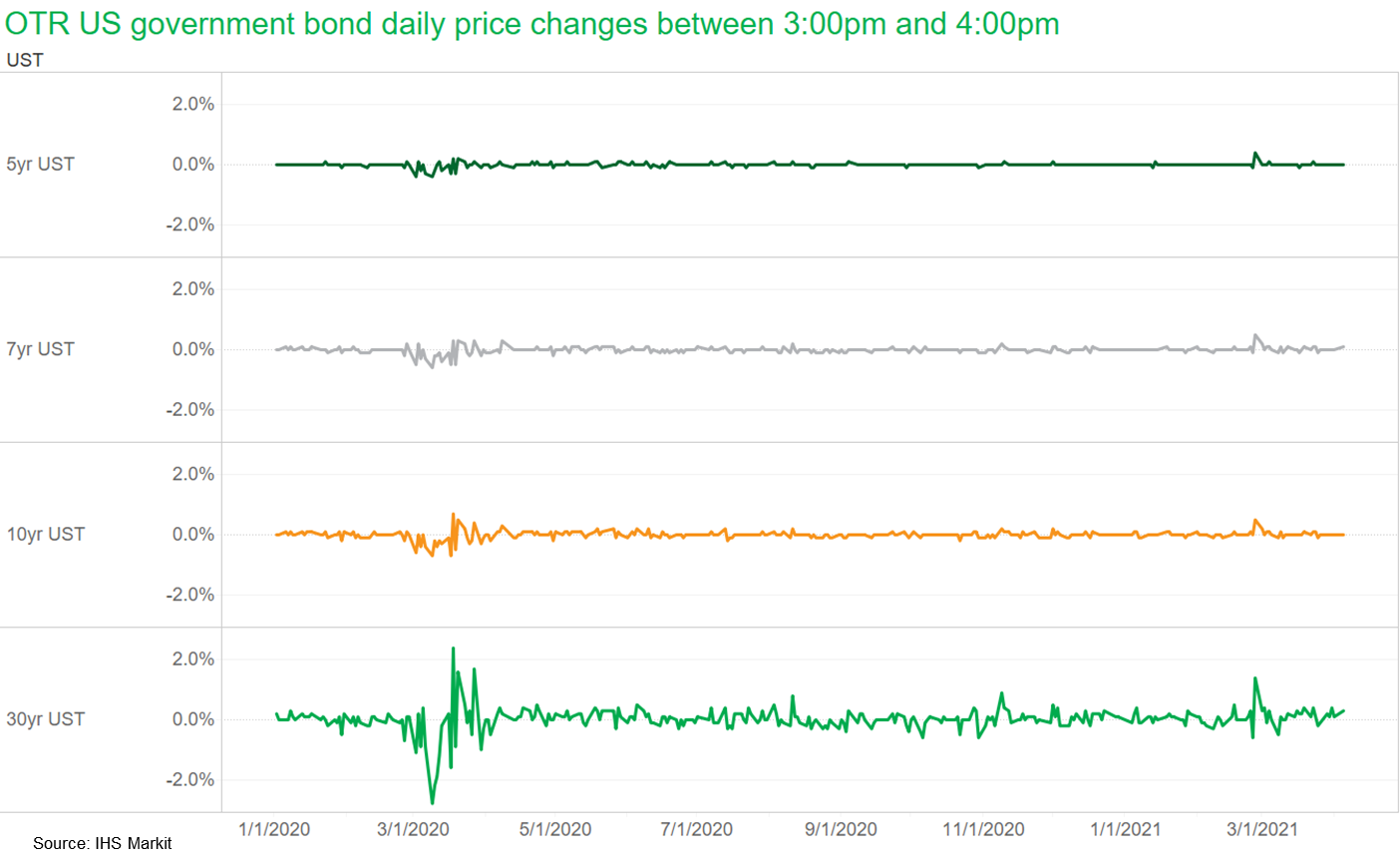

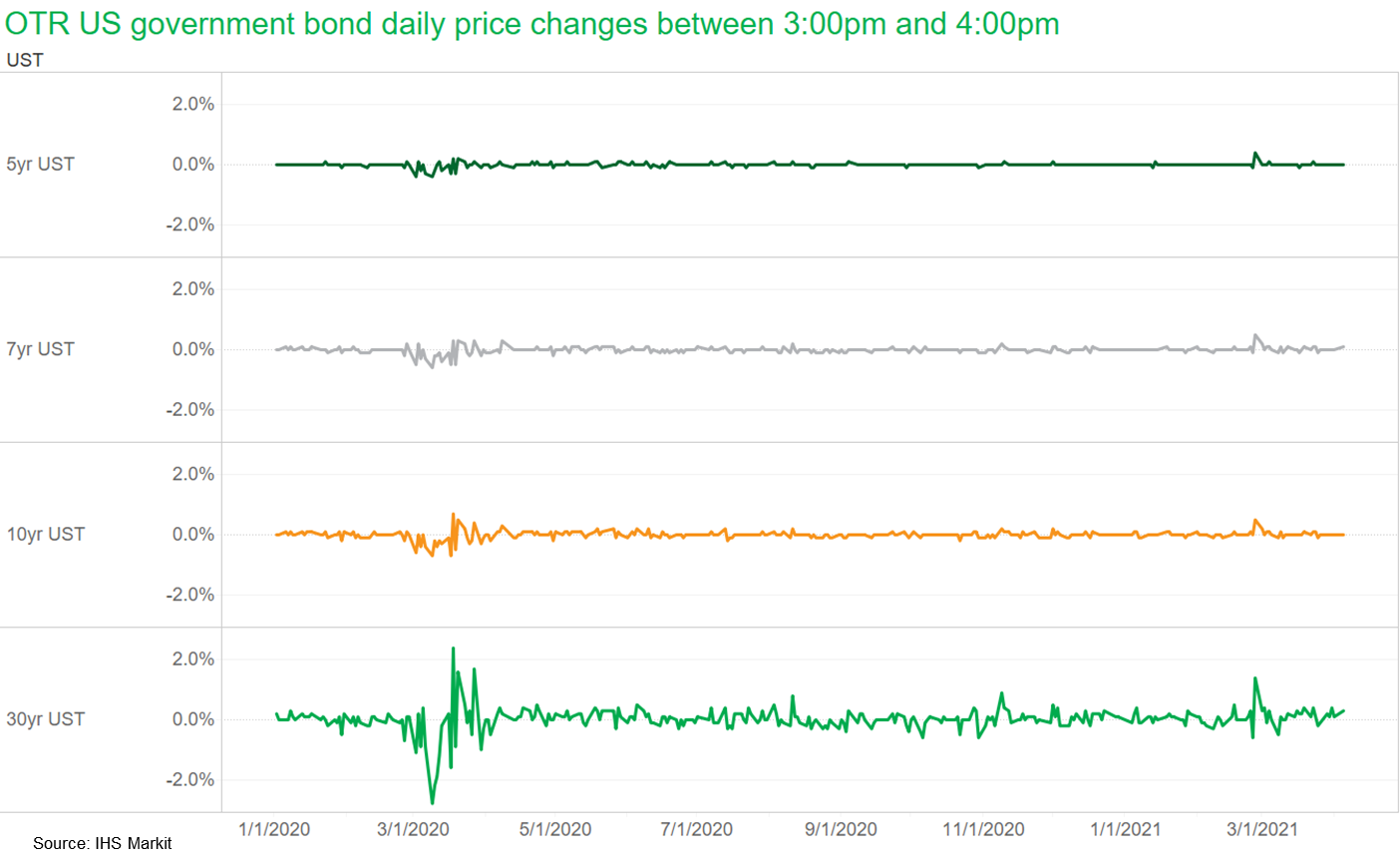

- The below chart shows the difference in on-the-run benchmark US government bond prices between 3:00pm and 4:00pm EST since January 2020. Price changes between those snaps never breached ±1.0% for the shorter duration 5-, 7-, and 10-year bonds, but 30-years bond prices changed by over 2.0% twice during the heightened volatility of March 2020.

- DXY US dollar index closed -0.3%/92.34.

- Gold closed +0.8%/$1,743 per troy oz, silver +1.8%/$25.23 per troy oz, and copper -0.5%/$4.12 per pound.

- Crude oil closed +1.2%/$59.33 per barrel and natural gas closed -2.2%/$2.46 per mmbtu.

- More than 80% of all power generation capacity installed in 2020 was renewable, with solar and wind accounting for 91% of new renewables, according to International Renewable Energy Agency (IRENA) data released 5 April. A year earlier, renewables accounted for 72% of generation additions. More than 260 GW of renewable energy capacity came online in 2020, exceeding newbuild figures for 2019 by close to 50%, and the highest total on record, the trade association said in its Renewable Capacity Statistics 2021 report. Total fossil fuel additions fell to 60 GW in 2020 from 64 GW a year earlier, highlighting a continued downward trend of fossil fuel expansion, it added. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

- The latest US JOLTS report points to a strong February for the labor market as businesses benefitted from the loosening of COVID-19 restrictions in February. (IHS Markit Economist Akshat Goel)

- Job openings rose to 7.4 million in February, the highest since January 2019. The number of hires rose to 5.8 million.

- Job separations rose to 5.5 million in February with layoffs and discharges edging up to 1.8 million.

- The quits rate, a valuable indicator of the general health of the labor market, was unchanged at 2.3% and remains at its pre-pandemic average.

- Over the 12 months ending in February, there was a net employment loss of 8.6 million.

- There were 1.4 workers competing for every job opening in February. In the two years prior to the pandemic, the number of job openings exceeded the number of unemployed in every report.

- In the fourth quarter of 2020, state personal income fell by a quarter-on-quarter (q/q) annualized rate of 6.8%. (IHS Markit Economist Alexander Minelli)

- This is a marked improvement on the 11.3% q/q annualized decline in the third quarter.

- The increases in net earnings and dividends, interest, and rent were unable to offset the decline in transfer payments during the fourth quarter, as several Coronavirus Aid, Relief, and Economic Security (CARES) Act programs expired, including the enhanced $600-per-week state unemployment insurance compensation.

- Transfer payments fell by $573.6 million, while net earnings and dividends, interest, and rents grew by $178.2 million and $40.5 million, respectively.

- Personal income fell in 37 states, most after disproportionate decreases in transfer payments.

- The largest declines were in Pennsylvania and Rhode Island, which both saw incomes fall by 16.1% q/q. While South Dakota saw income expand at the fastest rate, 16.7% q/q, growth was more modest in many of the other states that expanded.

- Tesla has announced initial global production and delivery figures for the first quarter of 2021, with 184,800 vehicles delivered and 180,338 vehicles produced. These figures are slightly ahead of the fourth quarter of 2020, and bode well for a strong 2021. The first quarter of 2021 included having production of both Model 3 and Model Y in China, with Tesla noting it is "quickly progressing" to full production capacity in China. Production of the Model S and Model X was non-existent in the first quarter, however, as Tesla is in process of installing and testing equipment for a model change; deliveries of those two products reached only 2,020 units as a result. Tesla delivered 182,780 Model 3 and Model Y vehicles in the first quarter of 2021, and produced 180,338 units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ford and Volkswagen's (VW) autonomous operation partner, Argo AI, is reported to be considering a bid to go public to boost funding, according to a report from Bloomberg. The report cites an internal Argo AI source as saying that Argo co-founder Bryan Salesky told employees in an all-hands meeting on 1 April that the move is under consideration, and possibly in 2021. The report says that Salesky is looking to boost funding as Argo comes closer to commercialization of its technology. Blooomberg cites sources who say the timing could be right as it is in advanced stages of technology development, including tests in six cities, a new LiDAR guidance system, and a path to commercialization through the Ford and VW partnerships. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Private investment fund 40 North Management has increased its bid for W.R. Grace to $70/share, the firm said in a 1 April letter to Grace management. The bid reflects "our belief that Grace's full potential for all stakeholders can best be achieved outside of the public markets with proactive, hands-on management," 40 North says. "In this regard, we are prepared to submit our best and final offer of $70 per share in cash." The latest bid implies a purchase price of about $4.63 billion in cash. It represents a multiple of 11.9 times (x) the analyst consensus for W.R. Grace's EBITDA, according to 40 North. (IHS Markit Chemical Advisory)

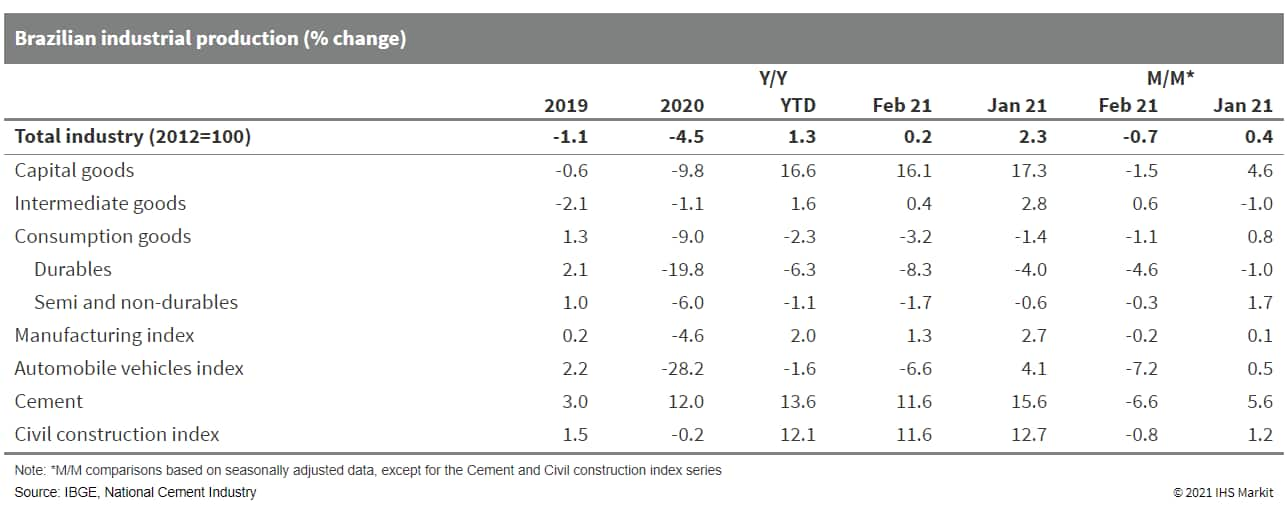

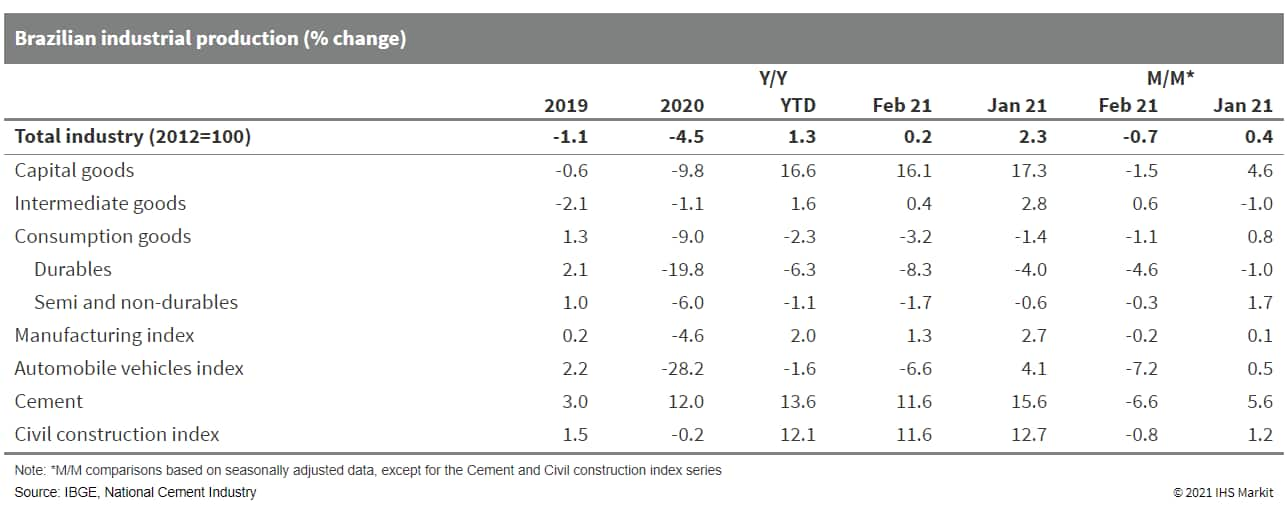

- The Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística: IBGE) has reported that industrial production contracted by 0.7% in February compared with January based on seasonally adjusted data. The drop was driven by sizeable declines in the production of capital goods and durable goods. (IHS Markit Economist Rafael Amiel)

- Global shortage of semiconductors have impaired production in many sectors within the industry, particularly in automotive.

- The second wave of the COVID-19-virus health crisis takes center stage: social discontent is building up because of the record daily death tolls, hospitals working at full capacity, and shortages of medical supplies (particularly oxygen tanks).

Europe/Middle East/Africa

- All major European equity indices closed higher; UK +1.3%, Germany/Spain +0.7%, France +0.5%, and Italy +0.2%.

- 10yr European govt bonds closed mixed; Italy +7bps, Spain +4bps, France +2bps, Germany +1bp, and UK flat.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover flat/246bps.

- UK passenger car registrations recorded some improvement during March, which is typically one of the peak selling months due to the number plate change. According to the Society of Motor Manufacturers and Traders (SMMT), registrations grew by 11.5% year on year (y/y) to 283,964 units last month as COVID-19 virus-related lockdown measures that closed showrooms remained in force. Despite the further changes made to the Plug-in Car Grant (PiCG) during the month, demand for alternative powertrain types remains strong. (IHS Markit AutoIntelligence's Ian Fletcher)

- Registrations of battery electric vehicles (BEVs) expanded by 88.2% y/y to 22,003 units, while plug-in hybrid electric vehicle (PHEV) sales leapt by 152.2% y/y to 17,330 units.

- Sales of hybrid electric vehicles (HEVs) were up by 42% y/y to 21,599 units.

- Of the traditional internal combustion engine (ICE) powertrain types, diesel has struggled with most with a drop of 31.4% y/y to 30,730 units, although its performanmild-hybrid diesels which recorded a surge of 127.5% y/y to 23,273 units.

- Traditional ICE gasoline passenger cars slipped by 10% y/y to 137,557 units, while mild-hybrid gasoline passenger cars jumped by 140.9% y/y to 31,472 units.

- The European Food Safety Authority (EFSA) has proposed a framework for conducting the environmental risk assessment (ERA) for naturally occurring metals, such as copper, when used as agrochemicals. Its final statement follows a draft version issued for public consultation last year. It aims to overcome shortcomings in current guidance, which was developed for synthetic organic chemicals and does not allow for the distinct chemical behavior of metals in the environment. (IHS Markit Crop Science's Jackie Bird)

- Siemens Gamesa has received a firm order for 100 of its latest and largest SG14-222 DD offshore wind turbines for the Sofia Project. The contract, awarded by RWE, also includes a two year service and maintenance agreement. Installation of the turbines is slated for 2025 and will last until the end of 2026. The direct drive turbines are capable of producing up to 15 MW with the proprietary Power Boost function. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- French infrastructure group Vinci has agreed to buy Cobra Instalaciones y Servicios SA from Spain's Actividades de Construccion y Servicios SA for a consideration of USD5.8 billion. The deal, which has been in negotiations for the last six months, marks Vinci's entry into the renewable energy market. Traditionally a major construction firm for airports and highways, Vinci will now acquire a pipeline of 15 GW of new renewable power assets comprising mostly solar and onshore wind, and possibly considering 8 GW of offshore wind projects. The company will also add 45,000 employees and 6 billion euros in annual sales. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Ørsted has awarded MDE Consultants and Taylor Hopkinson each a four-year framework agreement for the provision of personnel for Ørsted's offshore wind farms in Germany. The wind farms include Gode Wind 3 and Borkum Riffgrund 3, both located in the German sector of the North Sea. Under the agreement, which started on 1 March and will run until 2025, MDE Consultants will be providing qualified personnel for the entire lifecycle of the developer's offshore wind projects. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- The Norwegian Pharmacy Association (Apotekforeningen) predicts that pharmacy spending on seasonal allergic rhinitis medications will increase steadily in 2021 amid general healthcare advice and recent public behaviour trends suggesting that allergy sufferers treat early to avoid confusion with sometimes similar COVID-19 symptoms. Pharmacy spending on seasonal allergic rhinitis medications during 2020 was estimated to have increased by more than 7% annually compared with pre-pandemic 2019 sales statistics. A further increase is likely in 2021, with the generic antihistamine Zyrtec (cetirizine hydrochloride) predicted to be among the chief beneficiaries. (IHS Markit Life Sciences' Eóin Ryan)

- LiDAR supplier Innoviz Technologies announced it has closed its business combination with special purpose acquisition company (SPAC) Collective Growth Corporation, paving the way for going public. The new company will be traded on the NASDAQ stock exchange with ordinary shares traded under the ticker symbol INVZ and warrants traded under INVZW. The transaction has provided Innoviz with approximately USD371 million in gross proceeds, including Collective Growth's USD141 million in cash held in trust following public stockholder redemptions and USD230 million from an ordinary share PIPE (private investment in public equity). (IHS Markit AutoIntelligence's Stephanie Brinley)

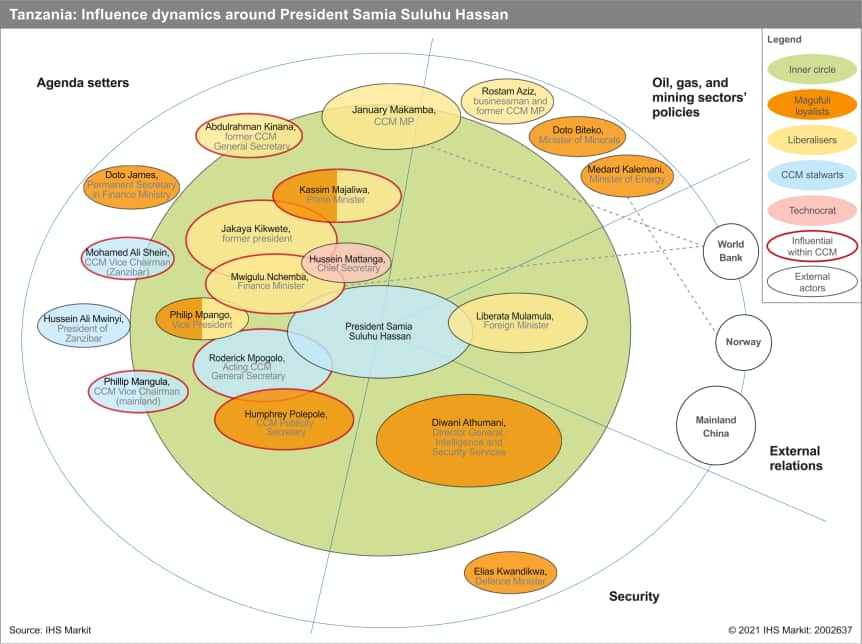

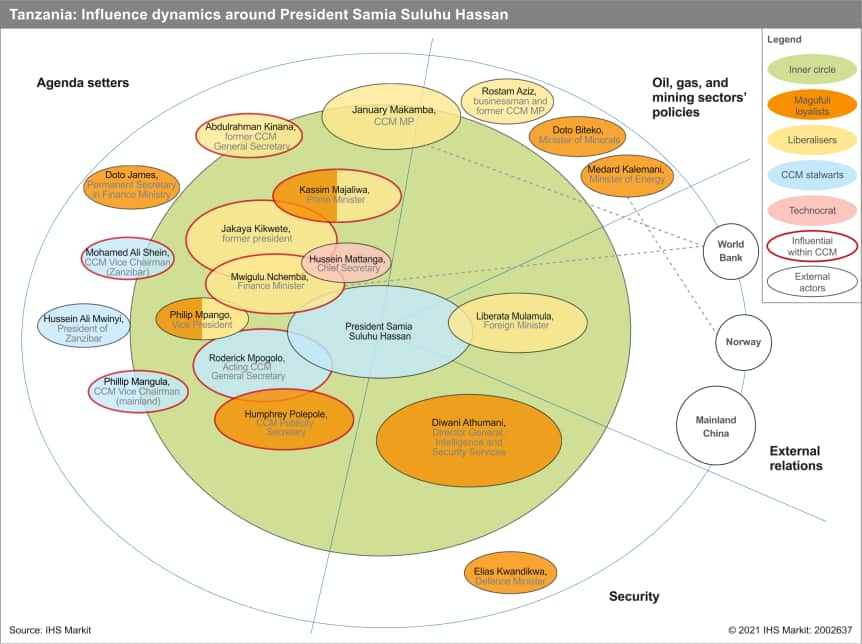

- Tanzanian President Samia Suluhu on 31 March announced a series of changes to her cabinet, appointing two prominent figures under former president Jakaya Kikwete (in office 2005-15), Mwigulu Nchemba and Liberata Mulamula, to the posts of finance minister and foreign minister respectively. (IHS Markit Country Risk's William Farmer and Eva Renon)

- Nchemba's appointment as finance minister increases the likelihood of policies favoring private investors. Such measures are likely to include making tax appeals easier to file.

- Mpango's appointment also increases the likelihood that short-term budgetary commitments to be announced in the June 2021 budget will be upheld, including funding of Magufuli's priority projects. Before his nomination was approved by parliament, Mpango, echoing Suluhu's earlier public statements at Magufuli's funeral, told MPs that he would continue his efforts supporting the completion of the construction of major infrastructure projects championed by late president Magufuli. These include the Julius Nyerere Hydropower Project and the standard gauge railway.

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.8%, South Korea +0.2%, India +0.1%, Mainland China flat, and Japan -1.3%.

- Dongfeng Motor Corporation Passenger Vehicle Company, a passenger vehicle subsidiary of Dongfeng Motor Corporation, plans to roll out its first battery-swappable model this year. Production of the Dongfeng Fengshen E70, an electric model featuring a swappable battery, is due to begin in June. The E70 is to be put into operation first in Wuhan and Nanjing for ride-hailing services and later to be launched in more cities, according to a gasgoo.com report. Dongfeng has entered into a partnership with Chinese battery-swapping technology provider Aulton on the launch of the E70. Aulton is to build 10 to 15 battery-swapping station this year in Wuhan to support the launch of the Fengshen E70. (IHS Markit AutoIntelligence's Abby Chun Tu)

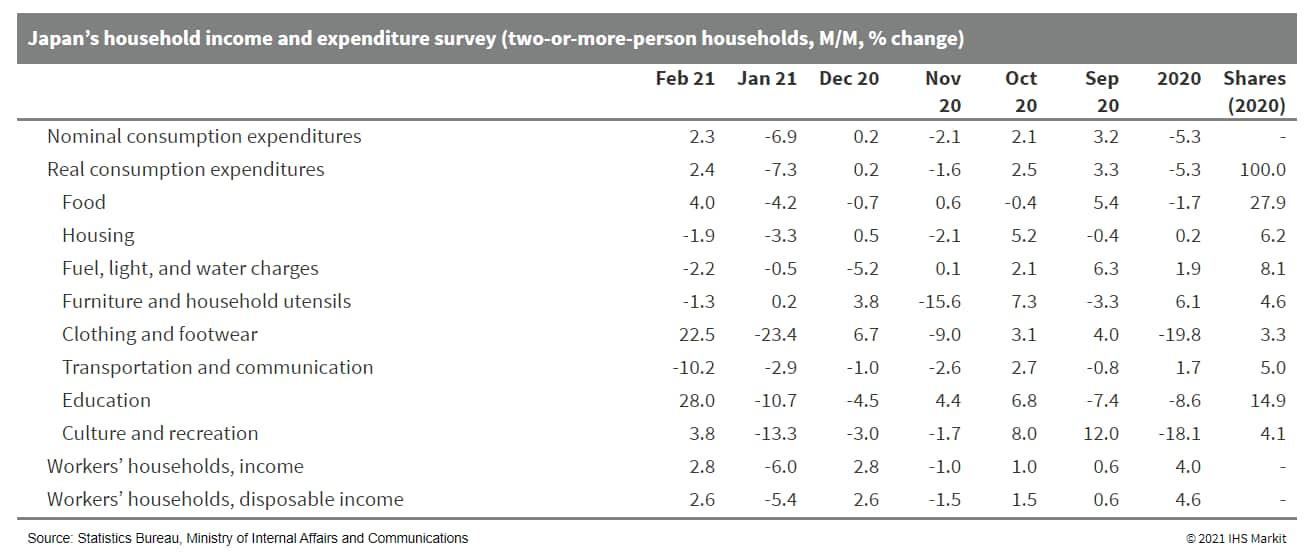

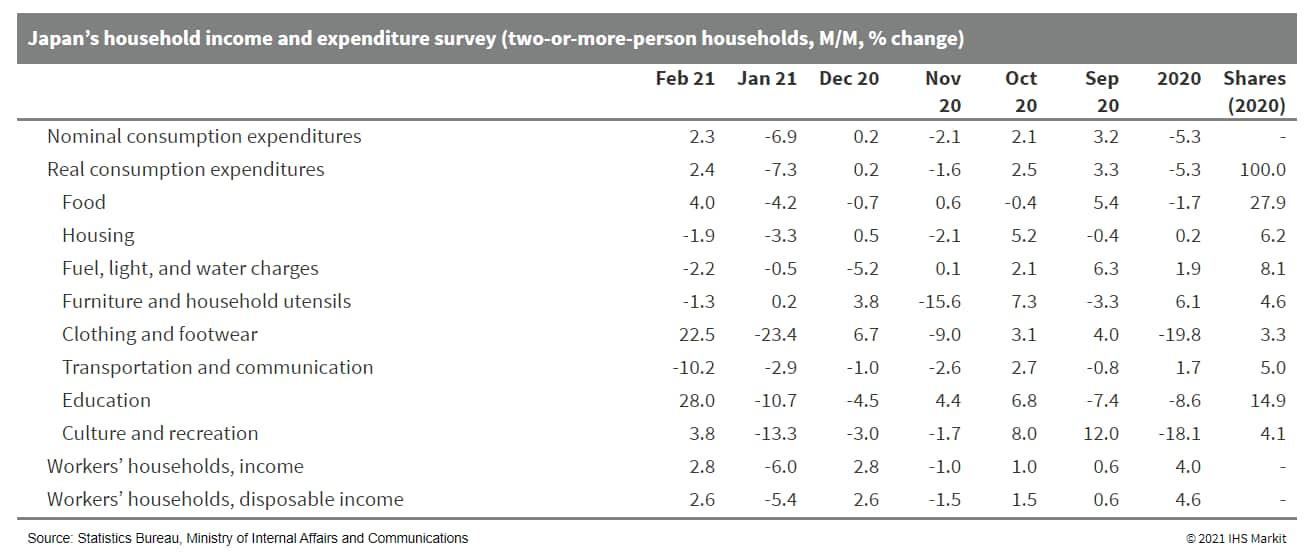

- Japan's real household expenditure rose by 2.4% month on month (m/m) in February following a 7.3% m/m drop in January. However, the year-on-year (y/y) contraction widened to 6.6% in February from a 6.1% decrease in January partially because of leap-year effects (one fewer day than February 2020), but largely because of the negative effects of the state of emergency on 11 prefectures. (IHS Markit Economist Harumi Taguchi)

- The m/m improvement largely reflected rebounds in spending for education, clothing and footwear, and culture and recreation, offsetting continued declines in spending in transportation and communication; fuel, light, and water charges; and housing.

- Monthly average nominal cash earnings continued to slip, but the decline softened to 0.2% y/y in February 2021. Real cash earnings turned positive for the first time since February 2020 with a 0.2% y/y increase.

- Daiichi Sankyo (Japan) has announced a new five-year plan, under which the company plans to invest JPY1.5 trillion (USD13.6 billion) in the development of new oncology treatments, the company's president and CEO Sunao Manabe told an online news conference. Under the plan, Daiichi Sankyo plans to increase its revenue from cancer-related businesses to JPY600 billion by March 2026, and increase total company revenue by 63% to JPY1.6 trillion, compared with year-end March 2020. In particular, Daiichi Sankyo plans to use part of the planned investment amount to expand the approved indications for its antibody drug conjugate (ADC) Enhertu (trastuzumab deruxtecan), as part of its partnership agreement with AstraZeneca (UK). (IHS Markit Life Sciences' Sophie Cairns)

- The Japan Automobile Importers Association (JAIA) has reported that imported vehicle sales in the country increased by 18.6% year on year (y/y) to 45,040 units in March. This figure includes sales of foreign brands' imported vehicles, which increased 2.7% y/y to 32,742 units last month, and domestic brands' imported vehicles, which increased by 101.6% y/y to 12,298 units. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- By brand, Nissan led the imported market with a 13.7% share during March, with its sales coming in at 6,159 units compared with 858 units in March 2020.

- Mercedes-Benz followed in the rankings with sales of 6,369 units, down 8.0% y/y, and a market share of 14.1%.

- BMW ranked third with a market share of 10.6% and remained flat with sales of 4,780 units, 13.6% y/y.

- BMW was followed by Toyota and Volkswagen (VW) with sales of 3,394 units (up 14.6% y/y) and 3,578 units (down 32.6% y/y), respectively, equating to market shares of 7.5% and 7.9%. In the year to date (YTD), sales were up 21.6% y/y to 101,364 units in March.

- The significant growth in sales last month was due to a low base of comparison.

- US hydrogen equipment manufacturer Chart Industries and India's Reliance Industries announced on 6 April they will team up to create the India H2 Alliance to commercialize hydrogen technology and develop a supply chain in collaboration with other private-sector partners and the Indian government. The India H2 Alliance was Chart's second hydrogen announcement in the last week, as it said it has become a "cornerstone investor" in the FiveT Hydrogen Fund, along with hydrogen fuel cell maker Plug Power and oilfield services firm Baker Hughes. "Dedicated to delivering clean hydrogen projects at scale," the companies will invest €260 million ($307 million) in the fund, and they are seeking other investors to raise a total of €1 billion ($1.18 billion). (IHS Markit Climate and Sustainability News' Abdul Latheef)

Posted 06 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.