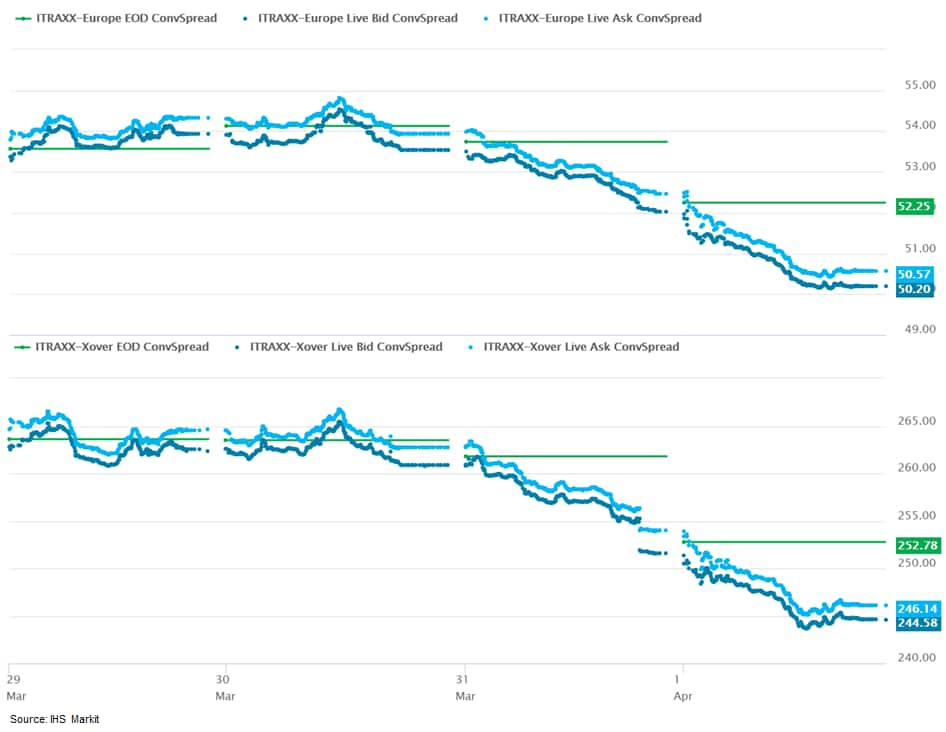

Almost every major equity index across APAC, Europe, and the US began the new quarter higher on the day. US and benchmark European government bonds also closed higher. European iTraxx and CDX-NA closed tighter across IG and high yield, concluding a relatively strong week for credit. The US dollar and copper closed lower, while oil, natural gas, gold, and silver were higher on the day.

Americas

- US equity indices closed higher; Nasdaq +1.8%, Russell 2000 +1.5%, S&P 500 +1.2%, and DJIA +0.5%.

- 10yr US govt bonds closed -7bps/1.68% yield and 30yr bonds -8bps/2.33%.

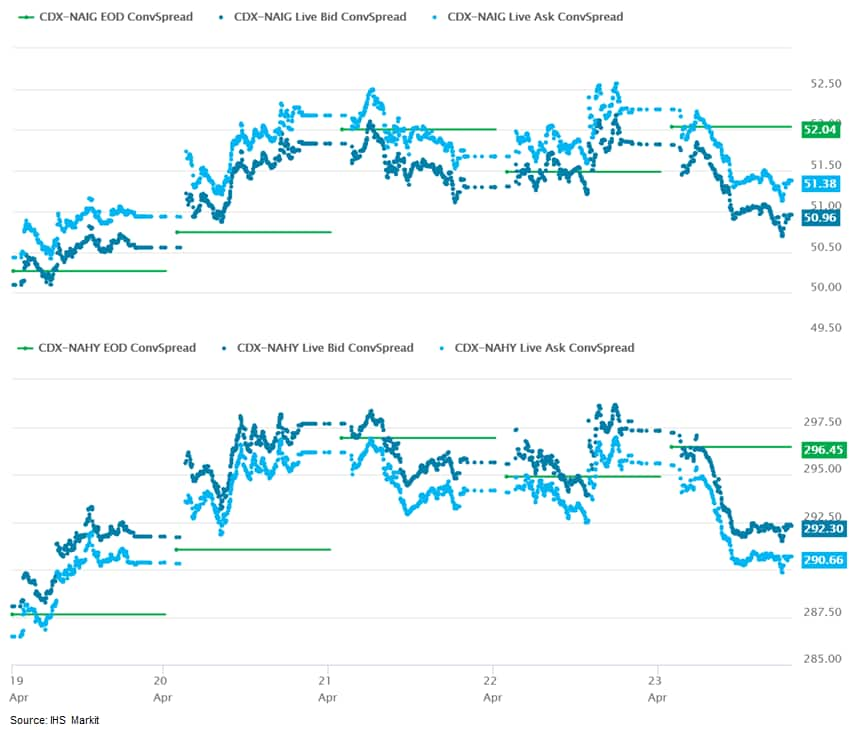

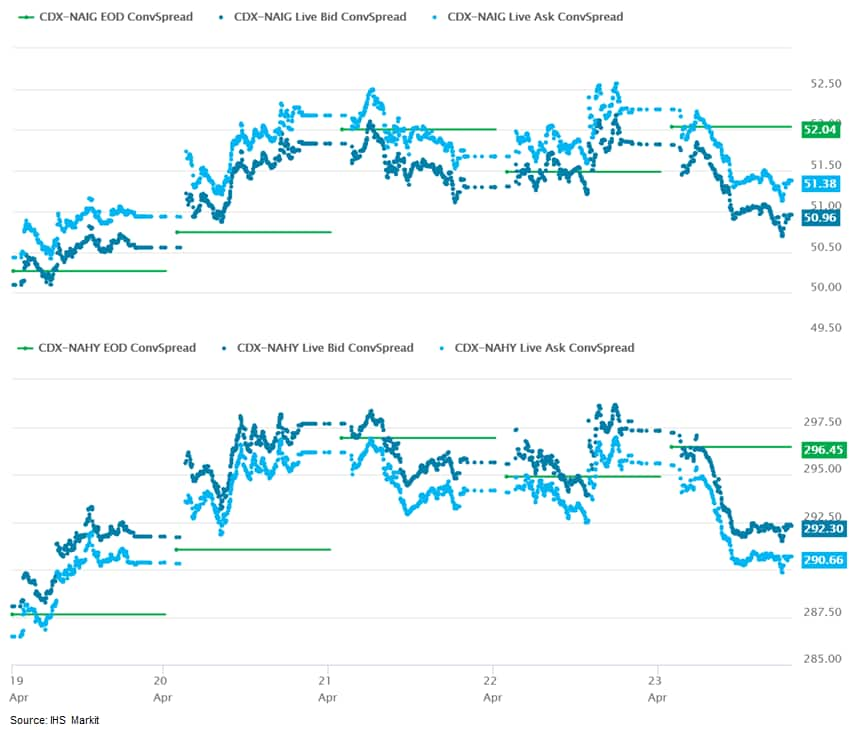

- CDX-NAIG closed -3bps/51bps and CDX-NAHY -9bps/299bps, which is -5bps week-over-week for the former (CDX-NAHY rolled on Monday, so a week-over-week comparison is not possible).

- DXY US dollar index closed -0.3%/92.93.

- Gold closed +0.7%/$1,728 per troy oz, silver +1.7%/$24.95 per troy oz, and copper -0.1%/$3.99 per pound.

- Crude oil closed +3.9%/$61.45 per barrel and natural gas closed +1.2%/$2.64 per mmbtu.

- Nuveen Real Estate, an investment manager that is part of the $1.1 trillion Teachers Insurance and Annuity Association of America (TIAA) financial services behemoth, in March announced it would reach net-zero emission operations across its $133 billion property portfolio by 2040. It follows an announcement by The British Land Company, the developer behind London's Leadenhall Building skyscraper, that it would target net-zero for its £14.8 billion ($20.38 billion) portfolio by 2030. Nuveen's emissions and offsets targets for real estate vary across its array of debt and equity investments, whether they are new developments, corporate buildings, standing assets, or borrower assets. The investment manager says its net-zero targets will bring Nuveen into Paris Agreement alignment a decade ahead of the accord's 2050 net-zero target. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- March PMI data from IHS Markit indicated the second strongest improvement in the health of the U.S. manufacturing sector since data collection began in May 2007. The seasonally adjusted IHS Markit U.S. Manufacturing Purchasing Managers' Index (PMI) posted 59.1 in March, up from 58.6 in February but broadly in line with the earlier released 'flash' estimate of 59.0. (IHS Markit Economist Chris Williamson)

-

- The overall expansion was supported by the steepest rise in new orders since June 2014, although production was reportedly held back by supply shortages.

- Supplier lead times lengthened to the greatest extent on record. At the same time, inflationary pressures intensified, with cost burdens rising at the quickest rate for a decade.

- Firms partially passed on higher input costs to clients through the sharpest increase in charges in the survey's history.

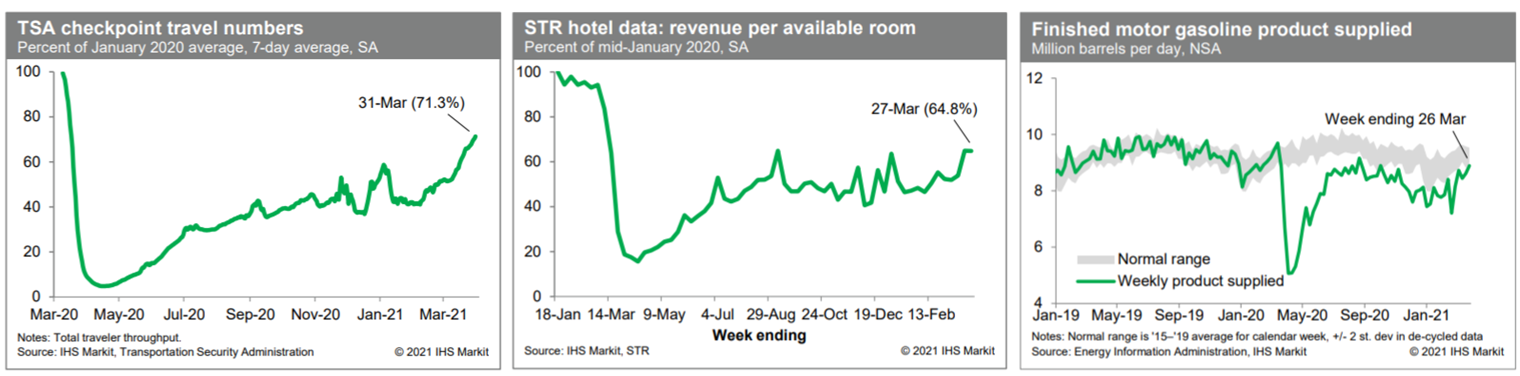

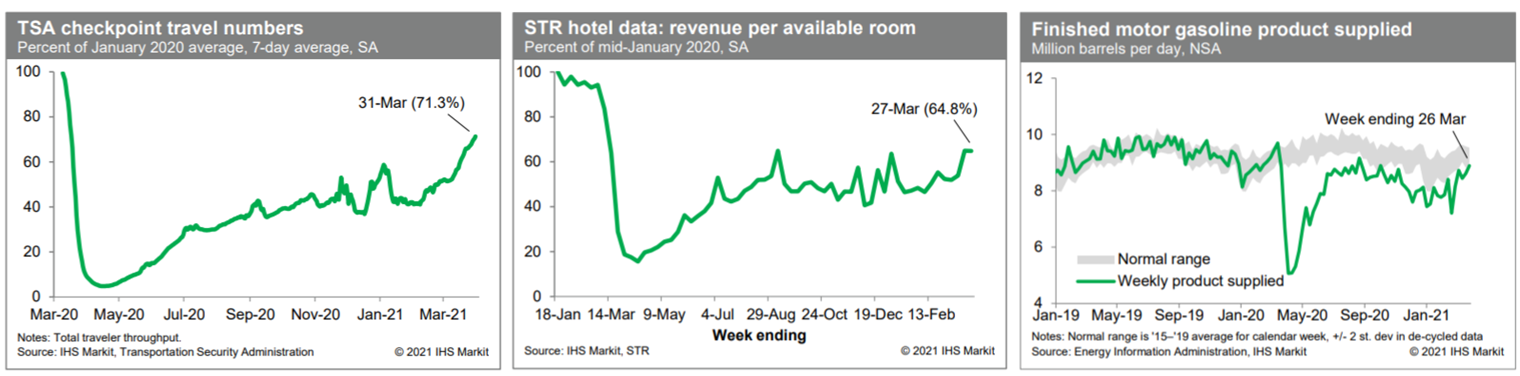

- Passenger throughput at US airports has continued to strengthen in recent days. Averaged over the last week, and adjusting for seasonal variation, airport passenger traffic was 71.3% of the January 2020 level, a vast improvement from early this year, when passenger traffic was roughly 40% of the January 2020 level. In addition, revenue per available room at US hotels was about 64.8% of the mid-January 2020 level last week, up materially from earlier this year, as hotel activity is firming along with air travel. Meanwhile, consumption of gasoline turned up last week, according to the Energy Information Administration, but has generally remained at or below the lower end of a normal range during the recovery. This indicates ongoing reduced internal mobility. (IHS Markit Economists Ben Herzon and Joel Prakken)

- US seasonally adjusted (SA) initial claims for unemployment insurance rose by 61,000 to 719,000 in the week ended 27 March. The previous week's level was revised down by 26,000 from 684,000 to 658,000. The 4-week moving average fell to 719,000, its lowest level since 14 March 2020, when it was 225,500. (IHS Markit Economist Akshat Goel)

-

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 46,000 to 3,794,000 in the week ended 20 March. The insured unemployment rate was unchanged at 2.7%.

- In the week ended 13 March, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 705,137 to 5,515,355.

- There were 237,025 unadjusted initial claims for PUA in the week ended 27 March. In the week ended 13 March, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 495,204 to 7,349,663.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 13 March, the unadjusted total fell by 1,517,926 to 18,213,575.

- US employers announced 30,603 planned layoffs in March, according to Challenger, Gray & Christmas—down 11% from February's 34,531. March's total was the lowest monthly reading since July 2018 and was 86% lower than the number of cuts announced in March 2020, the first month affected by the COVID-19 pandemic. (IHS Markit Economist Juan Turcios)

-

- Job-cut announcements specifically tied to COVID-19 totaled 1,076 in March; other reasons cited included market conditions (12,356), closing (5347), acquisition/merger (5,266), and demand downturn (1,987).

- The five sectors that have announced the most job cuts through the first quarter of 2021 are aerospace/defense (31,073), telecommunications (24,157), retail (11,932), entertainment/leisure (9,866), and services (9,811).

- US total construction spending declined 0.8% in February, in line with the consensus expectation. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

-

- Core construction spending fell 0.9% following upward revisions to the levels of spending for December and January. The decline in February was larger than we had expected. We responded by lowering our estimate of first-quarter GDP growth 0.1 percentage point to 5.2%.

- February was unseasonably cold and snowy. We believe this was an important factor in February construction activity.

- The harsh winter weather interrupted what had been a robust recovery in total construction spending to well beyond the pre-pandemic peak. We look for a rebound in construction spending in March, as activity returns to a pace consistent with normal weather.

- Much of the recent strength in construction spending has been in the residential sector, as low mortgage rates and a migration from urban to suburban areas has fueled a boom in activity.

- There is a limit to this source of strength, though, and we think we are approaching it. Single-family housing permits declined sharply in February, the first decline since last April. While partially related to weather, we think this also is the leading edge of a cooling trend in residential housing starts.

- Vineyard Wind has selected DEME Group subsidiary DEME Offshore US as its contractor for the offshore transport and installation of wind turbine generators at the 800 MW Vineyard Wind 1 project located 24 km (15 mi) offshore Massachusetts. While demand for offshore wind power is set to increase over the next 10 years in North America, with a new proposed target of 30 GW capacity by 2030, the strict US maritime laws laid out in the Jones Act currently prohibit foreign-flagged vessels from transporting goods between two US points, such as a port and offshore wind turbine foundation. There are currently no active wind turbine installation jackups that meet Jones Act requirements, and just one Jones Act compliant newbuild is under construction for 2023 delivery, at a cost of approximately USD500 million—a price understood to be very high compared with similar units built in the Asia-Pacific region. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Autonomous truck startup Embark has launched a universal autonomous hardware and software stack, called the "Embark Universal Interface" (EUI), according to a company statement. This interface can be integrated into trucks from multiple manufacturers, including Freightliner, Peterbilt, International, and Volvo Trucks. The EUI consists of two elements. The first is a standardized components package, which includes all of the necessary hardware and the second element includes the physical, electrical, and software interfaces that allow the standardized components to connect with any OEM platform's steering, braking, throttle, telematics, power, chassis, and HVAC systems. At the centre of the interface is the Embark Gateway, an electronic control unit developed by Embark to enable communication between Embark's technology and any OEM truck platform. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous truck startup Plus has raised USD220 million in a funding round led by FountainVest Partners and ClearVue Partners, according to a company statement. New investors including Quanta Computer, Phi Zoyi Capital, and Millennium Technology Value Partners and existing investors including Sequoia, SAIC Capital, and Full Truck Alliance also participated in this round, which is an extension of the USD200-million round announced last month. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to the Chilean National Statistics Institute (Instituto Nacional de Estadísticas: INE), unadjusted industrial production growth fell by 3.4% year on year (y/y) during February, with contractions in all three output components. (IHS Markit Economist Claudia Wehbe)

-

- After surprising change to the downside in January, manufacturing continued to fall although at a slower rate, led by a drop in the production of food components because of lower demand for feeding fish.

- Mining production continued to decline for the third consecutive month. During February, the contraction was stronger, mainly pulled downwards by lower mineral law in metallic mining and reduced copper production.

- Utilities - electricity, natural gas, and water - have remained on a downward trend since January 2020, mainly because of lower consumption in the commercial and manufacturing sectors.

- Argentina's economic activity index decreased by 2.0% year on year (y/y) in January 2021, while the seasonally adjusted data showed a 1.9% m/m increase during the month. Nearly half of the categories in the composite index show an annual rise in January. (IHS Markit Economist Paula Diosquez-Rice)

-

- There were steep declines in the hospitality sector, which was down by 39% y/y; the transport and communication, mining, and education sectors; and the government services sector, which fell by 5.6% y/y.

- Argentine real retail sales decreased by 3.8% y/y in supermarkets and plunged by almost 32% y/y in shopping centers in January as these were still being affected by the activity restrictions imposed by local governments. In terms of supermarket sales, less than 3.6% were online purchases; the main drivers of sales were electronic items and appliances, fresh produce, meats, and pantry dry goods.

Europe/Middle East/Africa

- Most European equity markets closed higher; Germany +0.7%, France +0.6%, UK +0.4%, Italy +0.3%, and Spain flat.

- 10yr European govt bonds closed higher; UK +5bps, Germany +4bps, Italy/France +3bps, and Spain -2bps.

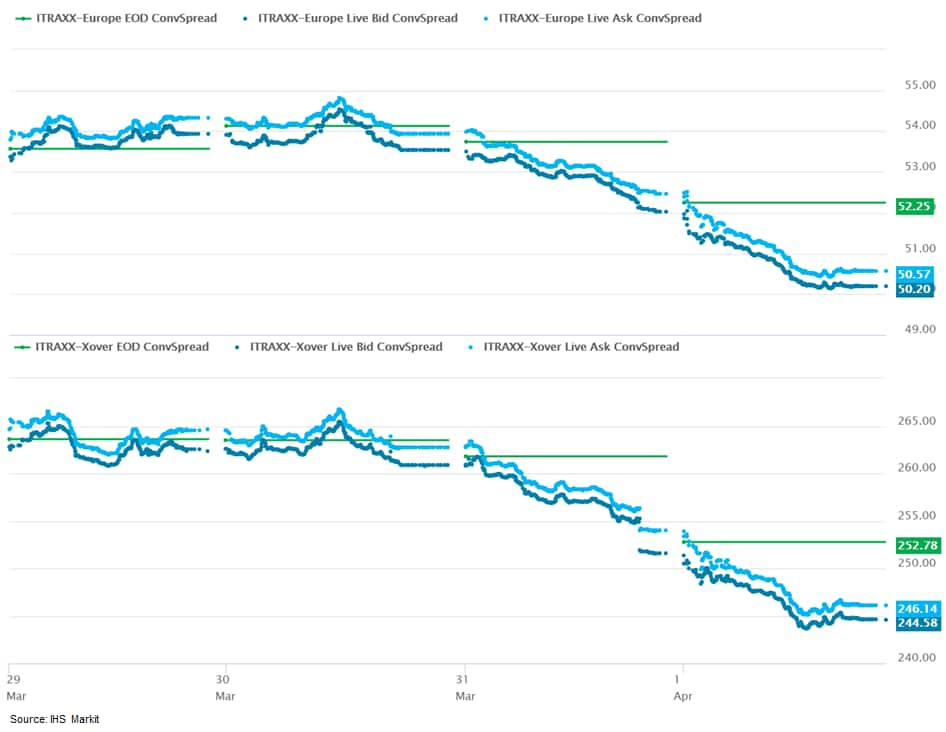

- iTraxx-Europe closed -2bps/50bps and iTraxx-Xover -7bps/245bps, which is -3bps and -18bps week-over-week, respectively.

- The European Banking Authority (EBA) published its latest risk dashboard, for the fourth quarter of 2020, on 31 March. The main adverse development was that loans showing a "significant increase in credit risk", defined as stage 2 loans, rose "across the board". (IHS Markit Economist Brian Lawson)

-

- This was despite a decline in the non-performing loans ratio, which fell 20 basis points to 2.6%. The share of "stage 2" loans reached 9.1%, from 8% in the prior quarter.

- More positively, loans under EBA-eligible moratoriums declined to EUR320 billion from EUR590 billion in the third quarter of 2020. EBA's text notes, "The share of stage 2 loans still under moratoria was 26.4%%", versus 20.1% on loans under expired moratoria and 9.1% of total loans.

- Elsewhere capital ratios continued to strengthen: the CET1 ratio reached 15.5% on a fully loaded basis, up 40 basis points versus the prior quarter.

- Liquidity metrics also improved with the liquidity coverage ratio improving to 173.1% from 171.2% in the prior quarter.

- However, the sector's profitability remained poor, with RoE declining from 2.5% in the third quarter to 2%, with the average cost/income ratio also rising.

- Lastly, the EBA highlighted that cyberattacks are becoming more commonplace while remote customer onboarding risks increasing AML/CFT challenges.

- Germany's retail sales rose by 1.2% month on month (m/m) in February, the first gain in three months, although the increase fell short of the market consensus expectation (of 2.0% m/m, according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- Bayer is preparing to kick off the sale of its environmental science professional business this summer with a potential price tag topping €2.0 billion ($2.4 billion), according to people close to the matter, Reuters reports. (IHS Markit Chemical Advisory)

-

- The company, looking to reduce debt in the wake of its $63.0-billion purchase of Monsanto in 2016, is working with Bank of America on the sale, the people said, speaking anonymously as the information is not public.

- Bayer announced in February this year it intended to divest the environmental science unit, which generated sales of approximately €600.0 million in 2019, to accelerate the implementation of its strategy for its crop science division and focus on its core agricultural business.

- Bayer is planning to market the unit to peers such as Scotts Miracle-Gro and ICL, as well as private equity groups, the sources said. The environmental science professional business unit is expected to post EBITDA earnings of about €200 million this year and could be valued at 10-12 times that figure, the sources said.

- Stellantis and Engie EPS have formed a new e-mobility joint venture (JV), called 'Free2Move eSolutions', according to a company statement. The JV aims to support the transition to electric mobility by offering a range of services including installation of charging infrastructures, public and home charging subscriptions with monthly fee, battery lifecycle management, and advanced energy services. The formation of the JV is expected to be completed in the second quarter of this year, and Roberto Di Stefano has been appointed as CEO. Di Stefano is an automotive and tech industry veteran with more than 30 years of experience. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In 2020, Croatia suffered its first current-account deficit since 2013. The gap was small, however, equivalent to only 0.6% of GDP. Moreover, after a sharp, year-on-year (y/y) deterioration of the current-account balance in the third quarter, the fourth-quarter deficit of USD446 million was actually down by USD230 million y/y. In 2020 as a whole, a 40.8% plunge of service exports undermined the current-account balance. Tourism service exports have historically paid for perpetual, large merchandise trade deficits. With the COVID-19-induced collapse of global tourism, this source of financing evaporated, dropping Croatia's headline figure into deficit. (IHS Markit Economist Andrew Birch)

- Polestar has joined a consortium of companies to launch a project to accelerate the development of vehicle-to-everything (V2X) technology in Sweden, according to a company statement. The project is supported by the Swedish Energy Agency with members including Chalmers University of Technology, energy grid supplier Göteborg Energi, charging solution provider CTEK, and energy solution provider Ferroamp. V2X technology will allow transfer of energy between an electric vehicle (EV) and a house (V2H), and the electricity grid (V2G). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- After dipping in January, Turkey's merchandise imports surged ahead year on year (y/y) again in February 2021, reigniting the widening of the merchandise-trade gap. Overall merchandise imports rose by 9.4% y/y. Import growth would have been even more substantial if not for a sharp drop-off of gold imports (by 22.6% y/y in February) and a fall of energy purchases (by 12.2% y/y in February). (IHS Markit Economist Andrew Birch)

-

- The resulting merchandise-trade deficit of USD3.299 billion in February 2021, pushing the gap for the first two months of 2021 as a whole to USD6.350 billion. That two-month trade deficit was nearly USD1.2 billion smaller than it had been in the same period of 2020. However, in February alone, the trade deficit was nearly 9% larger than it had been in February 2020.

- Export gains were strong in February, building on the general recovery that began in September 2020. The European production cycle - in which Turkey has slowly engaged - has proven resilient to the second and third waves of COVID-19 infections that have swept the region. These export gains have similarly kept Turkish industrial production strong in recent months.

- The Quarterly Employment Survey (QES) produced by the South Africa Statistical Service (StatsSA) shows that average monthly earnings paid to employees in the formal non-agricultural sector (including over time and bonusses) of the South Africa economy improved from ZAR22,588 (USD1,527) in August 2020 to ZAR23,133 in November 2020, up 2.4% quarter on quarter (q/q) and 3.1% y/y. (IHS Markit Economist Thea Fourie)

-

- Total gross salaries paid by employers in the South African economy increased by 3,0% q/q during the fourth quarter of 2020, but were down by 3.4% y/y. Industries recording a q/q improvement in remuneration included community services, business services, trade, manufacturing, construction, transport, mining and electricity.

- The recovery in overtime and bonus remunerations were more pronounced, showing an 85.4% q/q improvement but remaining 12.7% down from a year ago. The q/q recovery in overtime and bonus payments were the strongest in the business services, trade, manufacturing, community services, transport, construction, and electricity sector of the economy during the fourth quarter of 2020.

- StatsSA reported that overall employment fell by 5.8% y/y during the fourth quarter of 2020, with the annual slowdown the most pronounced in the manufacturing and construction sectors of the economy. The mining sector was the only sector maintaining its job numbers over the period.

Asia-Pacific

- APAC equity markets closed higher; Hong Kong +2.0%, India +1.1%, South Korea +0.9%, Japan +0.7%, Mainland China +0.7%, and Australia +0.6%.

- The government-owned Assets Supervision and Administration Commission (SASAC; Beijing, China) has approved the merger of Sinochem Group and China National Chemical Corp. (ChemChina). China's State Council and the two state-owned companies will carry out a restructuring, under which Sinochem and ChemChina will become subsidiaries of a new holding company that will be established and wholly owned by SASAC on behalf of the State Council. The new holding company has not been named and a timetable for the restructuring has not been given. (IHS Markit Chemical Advisory)

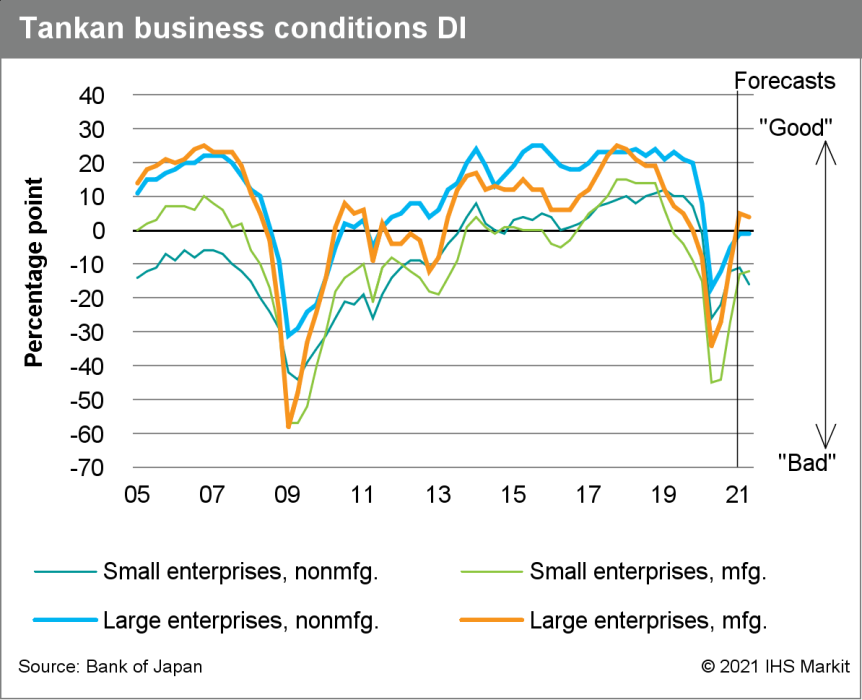

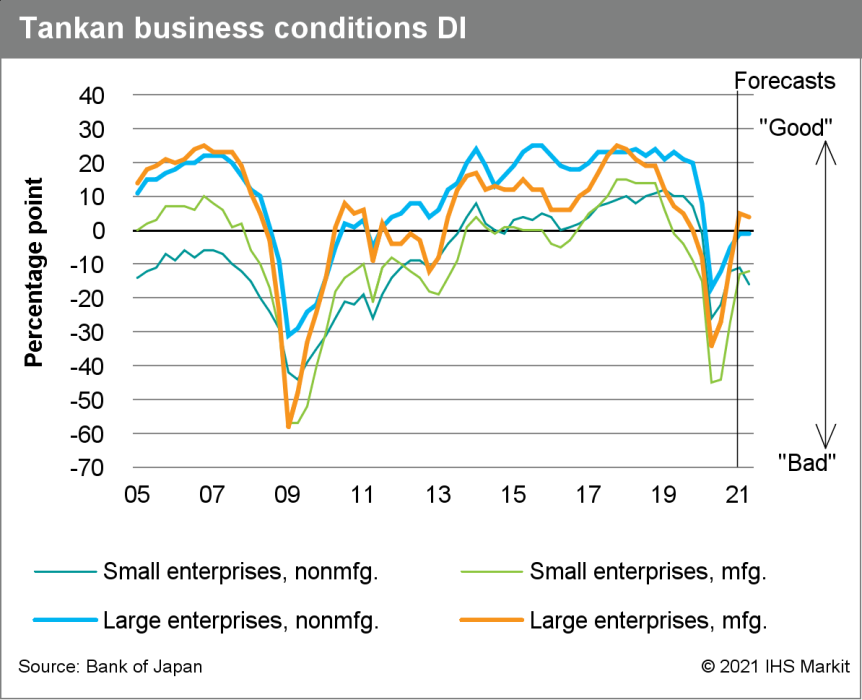

- The diffusion index (DI) of current business conditions for large manufacturing groupings in BoJ's March Tankan survey moved up 15 points to 5, returning to positive territory for the first time in six quarters and matching the level of the third quarter of 2019. The improvement reflected the resumption of business activity in Japan and Japan's trade partners and was driven by improvements in the DIs for a broad range of industry groupings, particularly for petroleum and coal products, production machinery, iron and steel, non-ferrous metals, and motor vehicles. The DI for small manufacturing enterprises also improved by 14 points to -13, although it remained below the pre-pandemic level. (IHS Markit Economist Harumi Taguchi)

- The South Korean government has launched a committee on carbon neutrality, with automotive firms in line with the efforts to reduce carbon emissions to zero by 2050, reports the Yonhap News Agency. The committee will pave the way for the government to expand co-operation with local carmakers, including Hyundai Motor Group, in rolling out policies related to carbon neutrality, according to the South Korean Ministry of Trade, Industry, and Energy. (IHS Markit AutoIntelligence's Jamal Amir)

- Singapore-based food tech company Sophie's Bionutrients has unveiled the world's first plant-based burger patty made from microalgae. The company claims its alternative meat patty contains up to two times more protein than beef or most commercially available fish. Scaling up the protein source from single-cell microalgae, Sophie's Bionutrients produces an unadulterated protein-rich plant-based flour. To achieve a chewy meat-like consistency, the flour is extruded into textured protein crumbles. These crumbles are then formed and shaped into patties. Each production batch, which makes around 20 to 100, can be done within a week. Prioritizing food safety, Sophie's Bionutrients uses various strains of microalgae, including chlorella, which is commonly found in health supplements. These microalgae strains have been approved by the Singapore Food Agency and European Food Safety Authority for being safe for consumption. (IHS Markit Food and Agricultural Commodities' Max Green)

- The Indonesian government aims to produce 600,000 units of electric cars and 2.45 million units of electric motorcycles in 2030, reports Tempo.Co. The production target of battery-powered electric vehicles (EVs) will hopefully be able to reduce CO2 emissions from cars by 2.7 million tons and from motorcycles by 1.1 million tons, according to Indonesian Industry Minister Agus Gumiwang Kartasasmita. To boost production of such vehicles, the government is providing fiscal and non-fiscal incentives to consumers and manufacturers. The incentives for consumers include zero percent luxury sales tax (PPnBM), a 10% cap on regional tax, zero percent down payment, low interest, and an electricity connection discount, among others. The incentives for manufacturers cover tax holiday, tax allowance, an import duty exemption, government-borne import duty, and a super tax deduction for research, development and demonstration (RD&D), according to the minister. (IHS Markit AutoIntelligence's Jamal Amir)

- Australia's first offshore wind project - Star of the South - has confirmed a transmission route, which would connect wind turbines off the south coast of the state of Victoria to the grid in the Latrobe Valley. This follows a rigorous 12-month assessment of three potential transmission routes, said Erin Coldham, chief development officer for Star of the South. Star of the South has the potential to provide up to 2.2 GW of power, which could supply up to 18% of Victoria's electricity needs and power 1.2 million homes, Coldham said in a statement, adding that the project has the potential to provide thousands of jobs in construction and hundreds more in the rural Gippsland region of Victoria when operating. (IHS Markit Climate and Sustainability News' Bernadette Lee)

Posted 01 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.