All major US equity indices closed lower, while APAC and European markets were mixed. US and benchmark European government bonds closed higher. CDX-NA and iTraxx Europe closed wider across IG and high yield. Oil and gold closed higher, while the US dollar, natural gas, copper, and silver closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.3%, S&P 500 -0.4%, and Nasdaq/Russell 2000 -0.6%.

- 10yr US govt bonds closed -5bps/1.44% yield and 30yr bonds -7bps/1.82% yield.

- CDX-NAIG closed +1bp/50bps and CDX-NAHY +2bps/290bps.

- DXY US dollar index closed -0.1%/93.96.

- Gold closed +0.2%/$1,831 per troy oz, silver -0.9%/$24.32 per troy oz, and copper -0.6%/$4.37 per pound.

- Crude oil closed +2.7%/$84.15 per barrel and natural gas closed -7.9%/$5.07 per mmbtu.

- As the pressure to accelerate the energy transition heats up, there is increasing interest in understanding upstream greenhouse gas (GHG) competitiveness. While cost is well understood in terms of the principles that drive better and worse performance, the factors that shape GHG intensity are less well understood. (IHS Markit Energy Advisory's Raoul LeBlanc and GHG Estimation and Coordination's Kevin Birn)

- GHG emissions intensities are multifaceted - It is not necessarily a simple case of which play is better or worse. Operator behavior matters as well, and as petroleum engineers and geologists have always known, the location within a play or basin is also critical. Process, practices, and productivity all play a role with each one potentially dominating the emission intensity profile. With more and more data emerging, there are several important implications that are worth highlighting:

- Variability can be significant - To date, the public discourse around GHG emission intensity has reflected limitations in data and estimation practices that has resulted in considerable focus on play or even national-level estimates. Comprehensive analysis of entire plays and basins points toward significant differentiation within each play. Take the Permian Basin as an example: when translated to GHG intensity, rock variability means that a typical well in the least geologically productive quintile of a shale play emits two to five times as much GHG per barrel of oil equivalent as the best quintile well. When comparing the many plays of the Permian Basin—and thus including stripper wells and waterfloods—the variation is even greater.

- The "flaw of averages" applies - Aggregating the GHG intensity to the basin, region, or even in some instances company level risks concealing the essential nature of a play's emission profile—the distribution. It is not necessarily the case that the activity in region or country X will be better than region or country Y when the variable nature of GHG intensity points to significant overlap across the groups. As a result, reliance on an average of any grouping of assets rapidly becomes problematic because it does not represent any specific asset. Rather, it can mask the worst performers and detract from the best performers.

- The rich may get richer - Because geologic productivity also determines the economic returns of an oil and gas asset, profitability often aligns with GHG intensity. To put it another way, it is the more productive assets that will tend to have both lower unit costs and GHG intensity because there are more units in the denominator of each calculation. Certainly, there can be important exceptions to this rule, but economics and climate goals tend to pull in the same direction within asset-type groups. This implies that, through the energy transition, the rich may get richer and the poor may get poorer. As the cost of emissions increases—directly via taxation or indirectly through constrained access to capital—the economics of non-core, higher-GHG intensity assets have the potential to be disproportionality impacted. In the United States, private companies own a disproportionate share of these lower productivity (and thus likely more GHG-intensive) assets.

- The world is facing a $65-billion funding gap for research and development on decarbonization technologies required to reach net-zero emissions by 2050, putting the Paris Agreement's climate goal at risk, according to the International Energy Agency (IEA). (IHS Markit Net-Zero Business Daily's Max Lin)

- More than 130 countries and 630 companies have pledged midcentury net-zero targets in the hope of capping global warming at 1.5 degrees Celsius, the latest data from Net Zero Tracker shows.

- In the COP26 Sustainable Innovation Forum (SIF) 8 November, IEA Deputy Executive Director Mary Warlick said that $90 billion was needed to line up demonstration projects for low-carbon technologies by 2030 so they can be commercially adopted in time to meet the 2050 goal.

- In its net-zero scenario, the IEA estimated technologies in today's market would be almost sufficient to achieve a 40% reduction in CO2 emissions by 2030 from 2019 levels. But nearly 50% of CO2 reductions required by 2050 must come from technologies currently under development.

- The funding is needed to support low-carbon hydrogen, advanced batteries, sustainable bioenergy, small modular nuclear reactors, and carbon capture, utilization and storage (CCUS), according to the IEA.

- US producer prices for final demand increased 0.6% in October after rising 0.5% in September, and rose 8.6% from a year earlier. Food prices, up 2.0% in September, flagged by 0.1% in October. Energy prices, which climbed 2.8% in September, surged another 4.8% in October. All other producer prices rose 0.4%. (IHS Markit Economist Michael Montgomery)

- Final demand prices for services grew 0.2% once again, as in September. Retail and wholesale trade margins climbed thanks to large margin gains at motor vehicle dealers. Transportation and warehousing prices climbed 1.7% because of freight rates. The "other" services complex faltered in price thanks to a drop in brokerage charges.

- The rise in energy prices was almost across the board, but electricity prices bucked the trend by sagging 0.3% in October to partially reverse a 2.0% gain the prior month. Oil and oil product price gains ranged from double-digit percentages for propane and heating oil (and diesel) to more modest 6.7% gasoline increases. None of those should surprise buyers of those items as they happened during major distortions from Hurricane Ida that still overhang energy markets.

- Bottom line: Inflationary pressures persisted once again because of bottlenecks, supply shortages, and strong demand in addition to the usual number of special forces. The Hurricane Ida distortion continues to haunt energy markets, as does OPEC+ oil production that is leaner than announced plans.

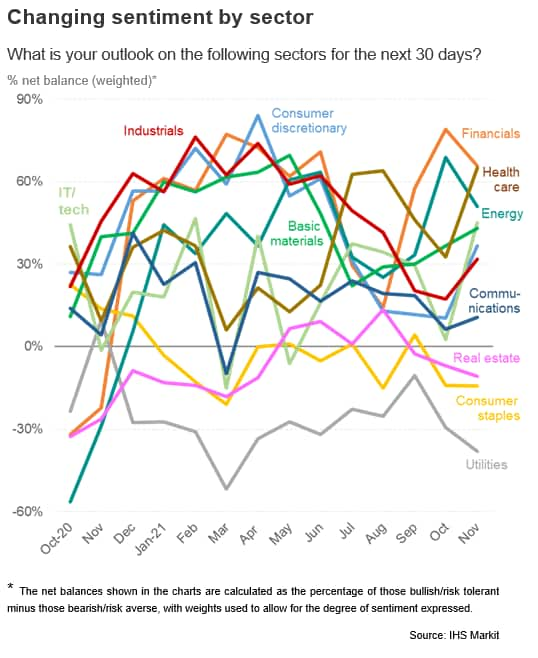

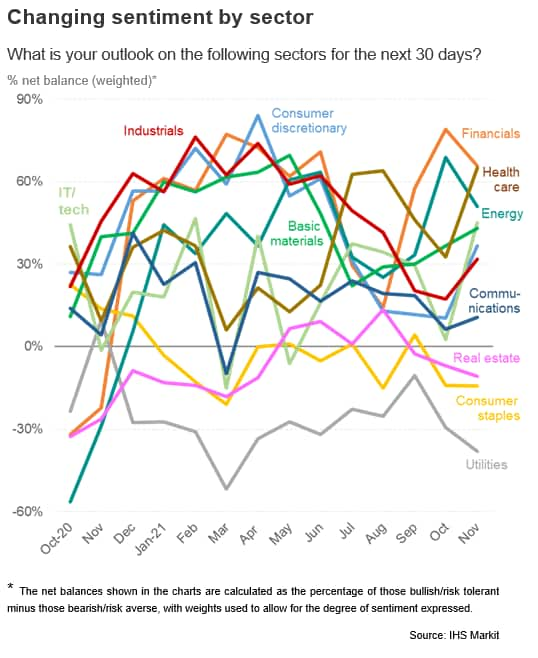

- US equity investor risk appetite improved for a second month running in November, rising to the highest since April. Expectations of near-term returns meanwhile hit a new high, fueled by improved prospects for earnings, equity fundamentals and shareholder returns, as well as brighter outlooks for macro and policy factors. (IHS Markit Economist Chris Williamson)

- The Risk Appetite Index from IHS Markit's Investment Manager Index™ (IMI™) monthly survey, which is based on data from around 100 institutional investors each month, rose from +7% in October to +36% in November, its highest since the survey peak of +54% seen back in April 2021. As such, the survey indicates a substantial improvement from the near-evaporation of risk appetite recorded back in September.

- The swelling of risk appetite was accompanied by a marked uplift in investors' expectations of market returns over the coming month to a survey high, surpassing the prior (April) peak by a wide margin and building further on the improvement seen in October.

- By comparison, the survey's Expected Returns Index had fallen to -12% in September, which preceded the brief market fall, before rising again to signal to a marked turnaround in sentiment which has gathered momentum over the past two months. The index has now risen to +38%.

- The biggest drivers of the market in the near-term are considered to be equity fundamentals and shareholder returns, the former viewed as the most supportive since August and the latter seen as more supportive than at any time over the 14-month survey history.

- Economy hopes meanwhile lifted sentiment towards consumer discretionary, industrial and basic materials, though in some cases inflation and supply line worries continued to constrain appetite. Utilities, real estate and consumer staples are seeing ongoing bearish sentiment.

- IHS Markit anticipates that the automotive market will be constrained substantially by semiconductor supply shortages not just for the next several months but for all of 2022 and into 2023 as well. The automotive industry is struggling to cope with a semiconductor shortage that is having an impact on industry volumes as severe as a deep global economic recession. IHS Markit's automotive production tracker reached a tally of 9.2 million cumulative units of lost production as of 30 October. The difference from a recession is that this particular crisis comes from the inability to supply the market with products, rather than a lack of demand. It is a stark difference. It means that virtually the entire auto market worldwide is supply-constrained, which has never happened before in peace time. At run-rates recorded in September and October, vehicle supply looks to be 15% to 20% below potential global demand (perhaps as many as one in every six cars ordered could not be delivered, even with a one-year wait). By the end of this year, global vehicle stocks will be almost 60% below normalized inventory levels. In response to the uncertainty inherent in these immense challenges, IHS Markit Automotive is redesigning several of its forecasting procedures. The first of these is to make the electrification path of the industry a core and integrated driver of our forecasts. Here, electrification of vehicles is not just a simple powertrain split but a core determinant of the future market performance of the model itself. In summary (IHS Markit AutoIntelligence's Ian Fletcher):

- This is a deep supply-side crisis with a potentially long tail to normalization.

- Inventory will be slow to rebuild.

- Competitive metrics in the short term will be determined by supply-side factors, not normal demand indicators.

- The forecasting process has been distorted and IHS Markit is adapting to that.

- Supply conditions will improve significantly in our base case from the depths of the situation in the third quarter of 2021.

- The ending of substantial supply constraints by late 2023 opens the prospect of a strong market with high industry volume lasting into early 2026, provided other supply constraints do not come to the fore.

- A White House spokeswoman confirmed on 8 November that the Biden administration is now involved in whether the Enbridge Line 5 Replacement Project should move ahead, bringing a national and international political dimension to the years-long dispute between Enbridge, the state of Michigan, and more recently Canada. (IHS Markit PointLogic's Kevin Adler)

- The US Army Corps of Engineers has been told to prepare an environmental impact statement, said Biden administration spokesperson Karine Jean-Pierre said during a press call on 8 November.

- The four-mile Line 5 Replacement Project was proposed by Enbridge several years ago to replace a part of its pipeline that lies on the lakebed of the Straits of Mackinac that separates the Upper Peninsula and Lower Peninsula of the state. It carries up to 540,000 of liquids per day.

- While all parties agree that the current pipe section (two parallel lines of 20-inch pipeline) is exposed to risk due to age and location, Enbridge and Gov. Gretchen Whitmer, a Democrat, are locked in a battle over whether the pipe segment can be safely replaced and the entire pipeline continue to operate.

- As part of the Biden administration's enhanced review of all pipeline projects, Jean-Pierre said the environmental analysis of Line 5 will "help inform any additional action or position the U.S. will be taking on the replacement of Line 5," and could identify any additional protective measures that should be taken.

- Environmental groups in Michigan have become more vociferous in the last two years in their arguments that because the US needs to reduce its use of fossil fuels, the $350-million investment to extend the life of this pipeline (built nearly 70 years ago) is a poor idea. Tribal nations have joined that fight, with all 12 of Michigan's federally recognized tribes contacting Biden on 2 November to say that the pipeline should be shut down.

- Autonomous truck developer Gatik has shared details on reaching a new milestone in its partnership with Walmart, according to a company statement. Gatik has removed the safety operator behind the wheel from its autonomous trucks on its delivery route for Walmart in Arkansas, United States. Gatik claims it to be the first company to offer driverless deliveries on a commercial delivery route. The trucks were deployed to move customer orders between a Walmart store and a neighborhood market. Tom Ward, senior vice-president of last mile at Walmart US, said, "We're thrilled to be working with Gatik to achieve this industry-first, driverless milestone in our home state of Arkansas and look forward to continuing to use this technology to serve Walmart customers with speed." Gatik focuses on autonomous middle-mile logistics by deploying its autonomous system in the Ford Transit, which can drive up to 200 miles per day. The company partnered with Walmart to launch driverless deliveries in a pilot in Arkansas, which has been running since 2019. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous truck startup Plus and special-purpose acquisition company (SPAC) Hennessy Capital Investment Corp V (HCIC V) have called off their previously announced merger agreement, according to a company statement. In May, Plus said it would go public through a merger with Hennessy, in a deal that valued the startup at USD3.3 billion. Plus is pursuing a potential restructuring of certain aspects of its business considering developments in the regulatory environment outside of the United States. Following this, the two companies may begin talks with respect to a potential new business combination. Plus said neither party will be required to pay a termination fee. (IHS Markit Automotive Mobility's Surabhi Rajpal)

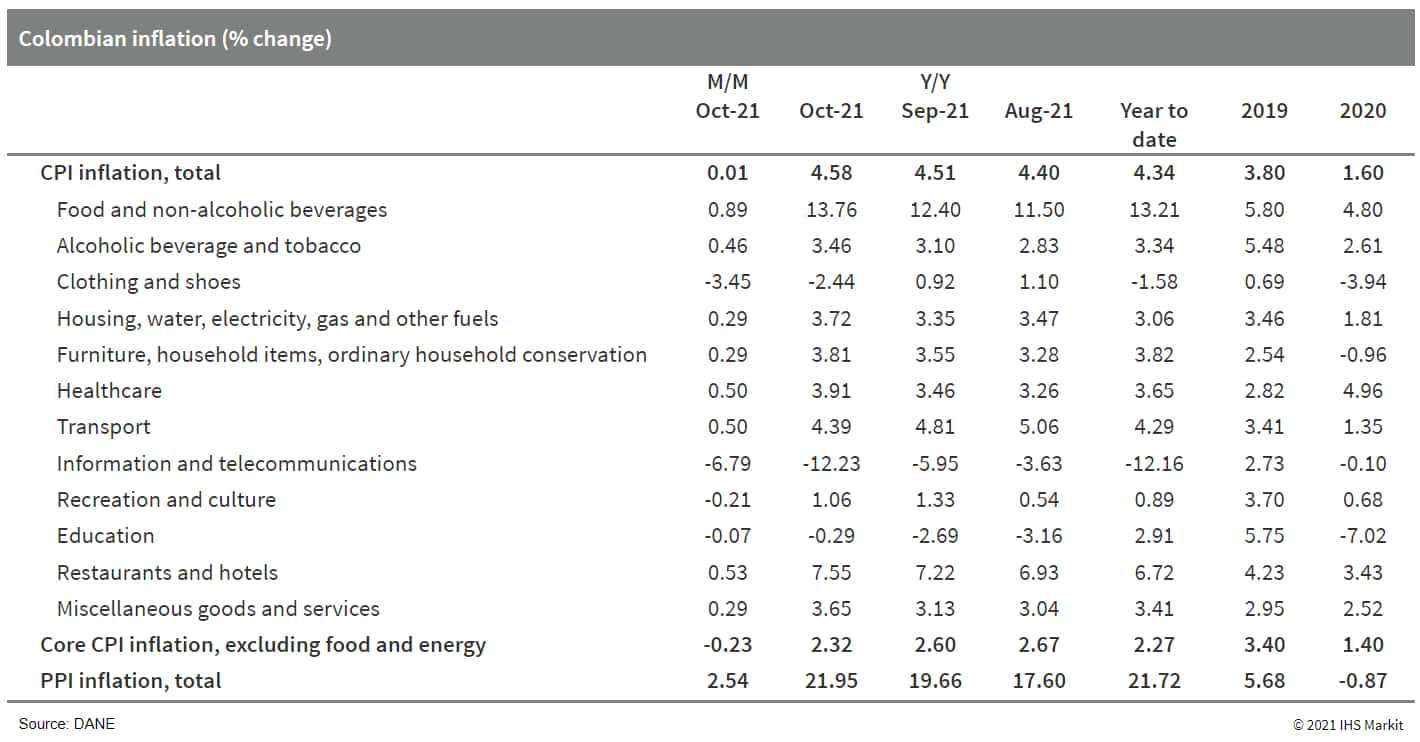

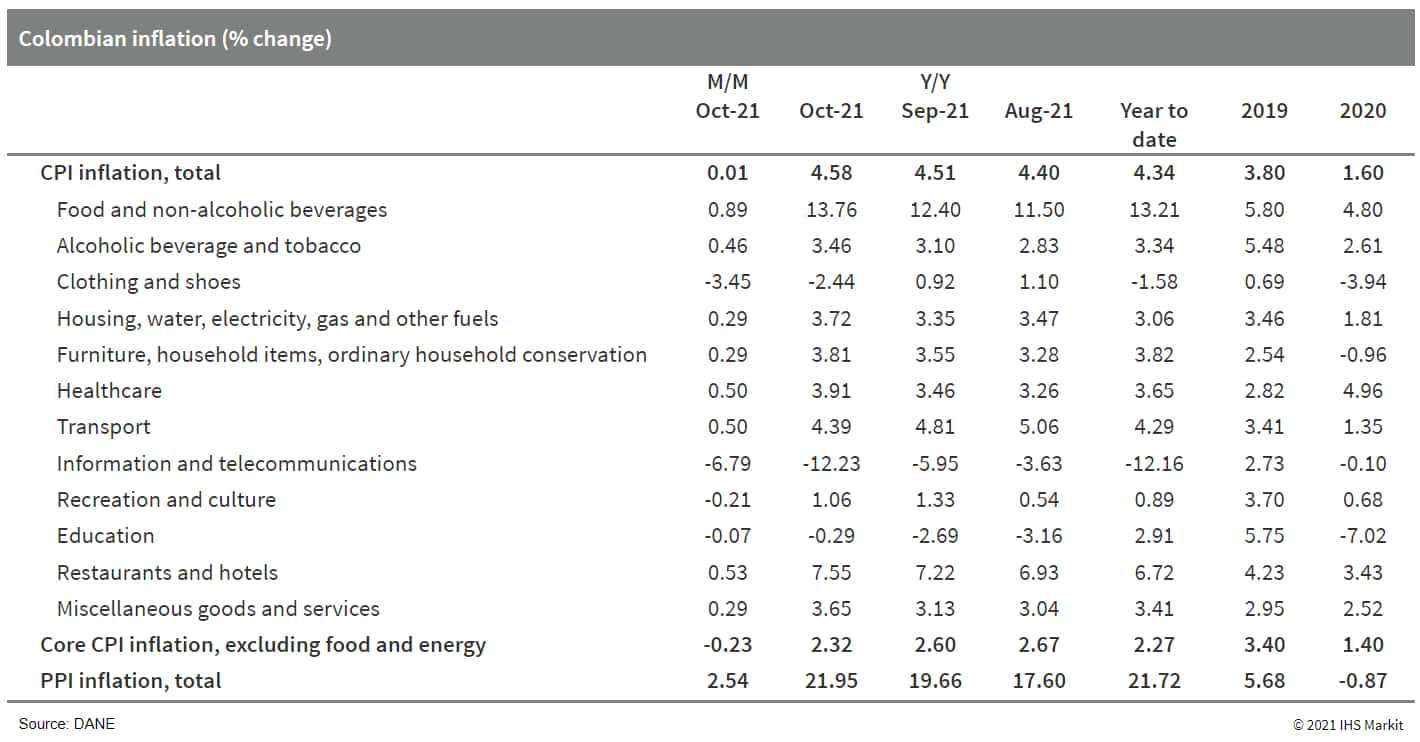

- According to the National Administrative Department of Statistics (DANE), Colombia's consumer price index (CPI) rose slightly from 4.51% year on year (y/y) in September to 4.58% y/y in October. Although the result was below IHS Markit's forecast (4.9%) and the consensus expectations (4.8%), it was still the highest rate since April 2017. In cumulative terms, inflation rose by 4.3% y/y through the first 10 months of 2021. (IHS Markit Economist Dariana Tani)

- Core inflation, as measured by the CPI that excludes food and energy prices, rose by 2.3% y/y, down from the 2.6% y/y posted in September. On a month-on-month (m/m) basis, consumer prices rose by just 0.01% m/m in October, after rising by 0.38% m/m in the previous month. This was the fourth consecutive month that the index posted a rise although it was significantly lower than our own forecast for October (0.42%).

- The breakdown of the monthly data showed that food and non-alcoholic beverages and restaurants and hotels registered the biggest price increases, followed by transport and healthcare. Meanwhile, clothing and shoes and information and telecommunications registered the largest declines. The first no-VAT day of the year on 22 October accounts for a large part of the decline in prices of the goods of the two categories; however, there was also a significant reduction in the rates of the mobile phone and internet plans, which led to a lower relative price. For now, the Colombian government has planned two more "VAT-free days" on 19 November and 3 December this year.

- Overall, we expect inflation in Colombia to rise further above target over the coming months given the surge in global food and energy prices, persisting external shocks, and pressures related to the strengthening of the domestic economy and the devaluation of the Colombian peso.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Spain +0.1%, Germany flat, France -0.1%, UK -0.4%, and Italy -1.0%.

- 10yr European govt bonds closed higher; Germany/Italy -5bps, France -4bps, and Spain/UK -3bps.

- iTraxx-Europe closed +1bp/49bps and iTraxx-Xover +5bps/245bps.

- Brent crude closed +1.6%/$84.78 per barrel.

- Siemens Gamesa (SGRE) has secured the preferred vendor agreement from Vattenfall for the 3.6 GW Norfolk offshore wind projects, Boreas and Vanguard, using its new SG14-236 DD offshore wind turbines. The deal includes a multi-year service agreement. Final award is subject to the UK government Contract for Difference Round 4 auction award in 2022 and final investment decision by Vattenfall. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The SG14-236 DD offshore wind turbines feature a 236m diameter rotor and a 43,500 sq.m swept area. The wind turbine blades will be SGRE's IntegralBlades, with the option to use SGRE's patented RecyclableBlades. The nacelle remains unchanged from the earlier SG14-222 DD offshore wind turbine. SGRE has claimed that the new SG14-236 DD allows an increase of more than 30% in annual energy production compared to the earlier SG11.0-200 DD model.

- The blades will be made in SGRE's facility in Hull, UK, which has recently seen a GBP186 million (USD252 million) investment to double its size. The facility will be capable of manufacturing next-generation offshore wind turbine blades once upgraded.

- A prototype of the model will be installed in 2022, with commercial availability targeted for 2024. The SG14-222 DD prototype is currently installed in the Danish National Test enter in Osterild, and full operation and commissioning is expected by the end of 2021. The progress will facilitate prototype installation of the SG14-236 DD next year.

- Electric vehicle (EV) charging infrastructure company Connected Kerb has announced that it plans to install 190,000 public on-street points in the United Kingdom by the end of the decade. According to a statement, the company said that the cost of the rollout is set to be around GBP1.9 billion by 2030. To support this, the company has said that it has secured new partnerships that will see 10,000 EV chargers across the country in 2021, which will have a lifespan of between 15 and 25 years. It adds that it expects to sign deals in 2022 to install a further 30,000 charging points. (IHS Markit AutoIntelligence's Ian Fletcher)

- German Federal Statistical Office (FSO) external trade data (customs methodology, seasonally and calendar-adjusted, nominal) reveal that exports declined by 0.7% month on month (m/m) in September, similar to the August dip by 0.8%. This follows a 15-month recovery that started in May 2002. Imports were little changed (0.1% m/m), their outperformance versus exports owing more to relatively stronger price increases than to differences in volume growth. (IHS Markit Economist Timo Klein)

- Based on the seasonal and calendar-adjusted series, September's year-on-year (y/y) rate for exports at 7.3% continues to be well below its counterpart for imports at 12.9%. The discrepancy is even larger - -0.3% versus 7.8% - when comparing with February 2020, the last pre-pandemic month.

- The seasonally adjusted trade surplus, which had peaked at EUR21.7 billion in January in the wake of the initial recovery from the COVID-19 outbreak, has been on a declining trajectory since. It fell further from EUR14.1 billion in August to EUR13.2 billion in September. The surplus now is smaller than the monthly average in 2020 (EUR14.8 billion), despite the major initial hit from the pandemic. The gap with the average in 2019 (EUR18.9 billion) is even larger.

- The Volkswagen (VW) Group's head of architecture and security Stephan Krause has said that the company's scale will be an advantage for developing autonomous vehicle (AV) technology, according to an Automotive News Europe (ANE) interview. As head of architecture and security, Krause oversees VW's AV technology development program through VW Group's CARIAD software subsidiary. Often VW's sheer scale is held up as a disadvantage with non-legacy OEM competitors such as Tesla. However, in the area of developing AV technology, Krause believes that it is a major advantage. He said, "One hard part of developing autonomous driving is you need a lot of data to teach and verify these systems and make sure everything is work," adding, "A fleet of a few cars may give you a few insights, but we have a fleet of millions of cars, and we can generate data a lot faster than a startup, and that's a big advantage." VW is playing catch-up in the field of developing digital platforms and architectures. It has recognized that its digital architecture development capability needed to be vastly improved in the face of competition from Tesla and other tech-company-affiliated disruptors that do not come from a traditional car making background but do have the nimble, entrepreneurial spirit that has been fostered in Silicon Valley for the past two decades. (IHS Markit AutoIntelligence's Tim Urquhart)

- Faurecia is partly financing its acquisition of Hella through sustainability-linked notes. According to a statement, the company successfully priced EUR1.2 billion-worth of 2027 sustainability-linked notes at 2.75%. It added that the net proceeds of the offering of the sustainability-linked notes will be used to "pre-finance part of the cash portion of the purchase price for the contemplated acquisition of Hella". The company also said that it has made an application to list these notes on the green segment of Euronext Dublin (global exchange market; Ireland). The settlement is expected to occur on 10 November. This is the inaugural issue of sustainability-linked notes that uses a financing framework that was first established in October. The issue is linked to meeting Faurecia's objectives to be carbon dioxide neutral in various aspects of its business by 2025 from a base year in 2019. Faurecia said that its framework for this financing has been reviewed by ISS ESG, a second-party opinion provider, which it said to have "assessed the contribution of the Faurecia's Sustainability-Linked Notes to the Sustainable Development Goals defined by the United Nations (UN SDGs) as having a "Significant Contribution" to "Affordable and Clean Energy" and "Climate action" goals". The settlement for this note offering is due to come the day before Faurecia acquires a majority stake in Hella from the Hueck family. The deal will comprise EUR3.4 billion of cash and up to 13,571,428 of newly issued Faurecia shares. (IHS Markit AutoIntelligence's Ian Fletcher)

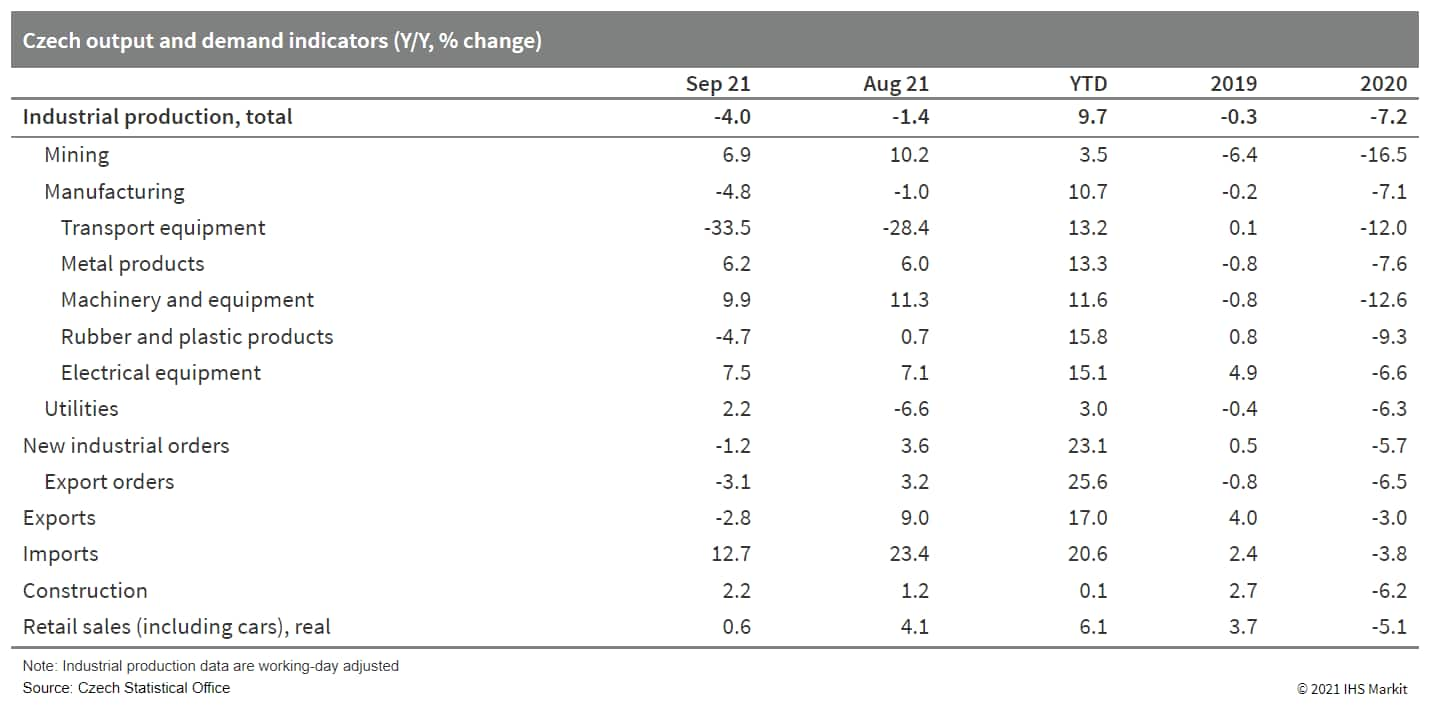

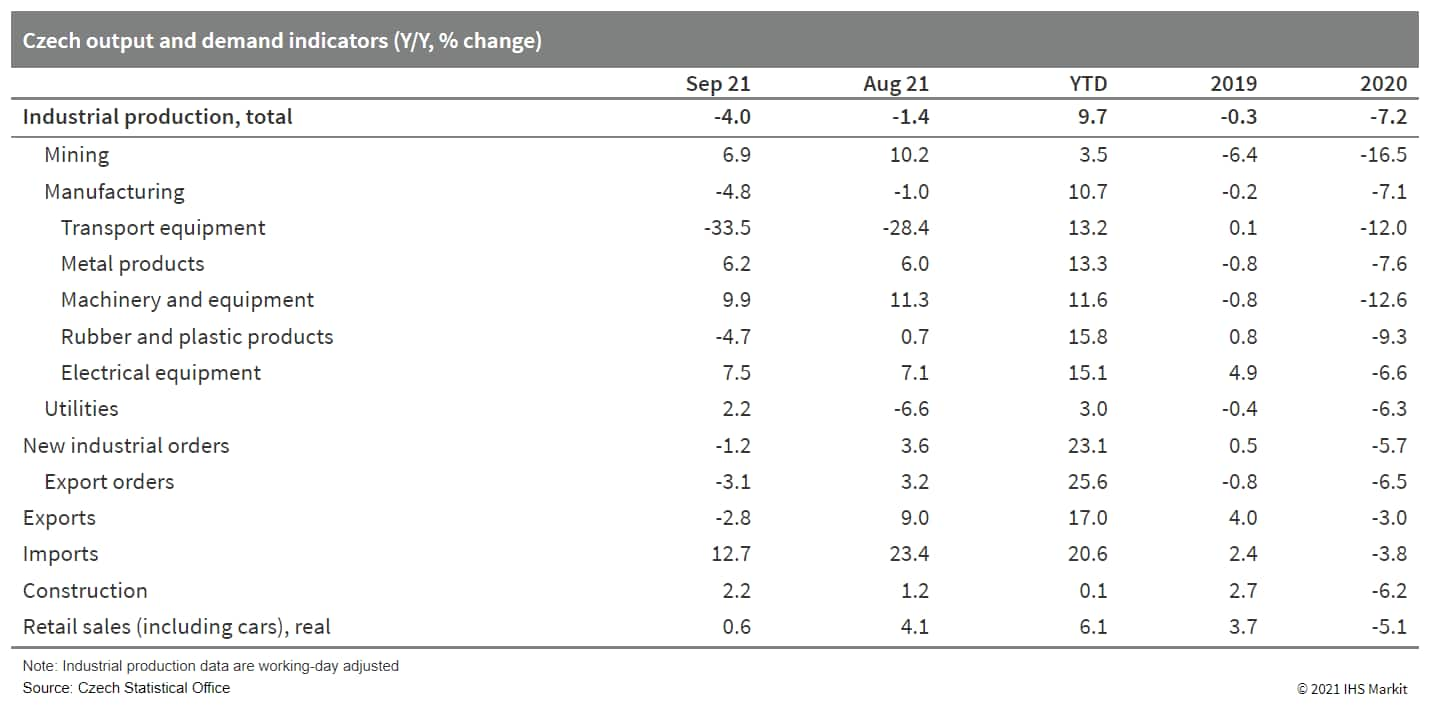

- The Czech Republic's working-day-adjusted industrial production fell by 4.0% year on year (y/y) in September, while seasonally adjusted output fell by 3.3% m/m, bringing the index to its lowest level since July 2020. The September results were affected by declining manufacturing output (down by 4.8% y/y), while mining and utilities production increased. (IHS Markit Economist Sharon Fisher)

- Within manufacturing, transport equipment continued its steep drop (down by 33.5% y/y) owing to supply-chain bottlenecks, and wood and rubber and plastic products also had a negative impact on growth (down by 21.6% y/y and 4.7% y/y, respectively). On the other hand, machinery and equipment, metal products, and electrical equipment all reported y/y gains.

- The number of industrial employees was flat in a y/y comparison in September, while the average monthly nominal wage grew by 4.2% y/y.

- The September decline in industrial production was matched by falling goods exports (down by 2.8%), while surging energy costs contributed to a rise in imports (up by 12.7% y/y). The monthly trade balance reached a deficit for the fourth straight period.

- The steep drop in automotive output corresponded with a real decline in automotive sales, falling by 2.1% m/m and 6.8% y/y in September. Excluding cars, retail sales dropped by 0.3% m/m while increasing by 3.4% y/y.

- Provisional estimates of the General Authority for Statistics (GASTAT) revealed that Saudi real GDP leaped 6.8% year on year (y/y) in the third quarter following an increase of 1.9% in the second quarter. The growth pace in the third quarter represents the highest rate since 2012, but reflects a number of factors that held back GDP in the third quarter of 2020, the basis for the comparison. (IHS Markit Economist Ralf Wiegert)

- Growth is still very strong compared with the previous quarter, though, measuring 5.8% in real terms. Strong growth has been solely due to oil production as sectoral gross value added rose 12.9% from the second quarter. Non-oil sector growth has been far slower, increasing by 1.6%, while government activities, a separate category in GASTAT's computation, rose 1.4% on the quarter.

- Oil production activities have been ramped up in the third quarter following the production restraint that Saudi Arabia had unilaterally enforced in the first half of 2021. Saudi Arabia is currently one of two or three countries with oil production spare capacities still available; the country plans to increase production at a steady pace in the next couple of months and eventually reach 10 million barrels per day (bpd) in December 2021, 1 million bpd higher compared with December 2020.

- The non-oil sector's growth rate in the third quarter has been comparably modest. However, seasonally adjusted and compared with the previous quarter, the rate of 1.6% represents the strongest growth pace since the beginning of the COVID-19 pandemic, having edged up 0.9% in the second quarter.

- The non-oil private sector is benefitting from an aggressive investment program connected with the Vision 2030. This program pushes several infrastructure projects, housing units, and also a number of large-scale mega projects in the kingdom, such as NEOM. Moreover, the private sector is also benefitting from the relocations of Middle East headquarters of multinational companies to Saudi Arabia after the government issued a directive that all companies working with the government must have their regional headquarters located in the kingdom from 2024.

Asia-Pacific

- Major APAC equity indices closed mixed; Mainland China +0.2%, Hong Kong +0.2%, South Korea +0.1%, India/Australia -0.2%, and Japan -0.8%.

- Mainland China's central bank is launching a structural carbon-reduction support tool to motivate more social capital to support the country's long-term decarbonization goals, according to a statement by the People's Bank of China (PBOC) on 8 November. (IHS Markit Economist Yating Xu)

- Financial institutions can apply for low-cost funding from the PBOC with a one-year lending rate at 1.75% to support 60% of their green loans, which refers to clean energy, energy saving and environmental protection and decarbonization in particular. The loans can be rolled over twice.

- The carbon-reduction support tool is a long-term discussed measure to promote the decarbonization goals, which are expected to boost investment in green areas. The central bank has emphasized several times of such a targeted tool since the first quarter monetary report this year.

- Targeted credit and monetary easing are likely for the carbon-reduction support tool. According to the PBOC, the balance of green loans at the end of the third quarter was CNY3.8 trillion, up CNY710 billion from the same period last year. Based on this, green loans are expected to increase CNY1 trillion in the coming year, indicating CNY600 billion of liquidity injection from the central bank.

- General interest rate cut and flood irrigation remain unlikely given the corporate deleveraging and real estate de-risking targets. The rising producer price index (PPI) and global monetary tightening trend also raise concern for the government to ease monetary policy. Targeted monetary and credit easing as well as fiscal support could be preferred choices for cross-cyclical adjustment policies during the 14th five-year-plan.

- Although mainland China's merchandise export growth edged down to 27.1% year on year (y/y) in October from 28.1% y/y in September in terms of US dollars, the 2020-21 average growth maintained an upward trend, recording 18.7% compared with 18.4% in the previous month. However, imports growth on 2020-21 average further slowed to 12.4%, despite an uptick in y/y growth. (IHS Markit Economist Yating Xu)

- By trade partners, robust demand from the European Union (EU) was the main contributor the headline export growth with EU exports accelerating from 28.6% y/y in September to 44.3% y/y in October and the month-on-month growth accelerating to 9%. However, exports to the United States weakened, in line with the decline of new orders sub-index of the US October PMI. Exports to ASEAN improved with the improving pandemic situation in Indonesia, Malaysia, and Vietnam. By commodities, mechanical and electronic products remain strong with exports of computers and cellphones continuing to accelerate at double-digit growth and auto exports rebounding to 155% y/y. Meanwhile, consumption goods exports remained robust due to the strong demand before western winter holidays. However, production-related goods such as general-purpose equipment and integrated circuits slowed.

- The uptick of y/y import growth was largely due to the declining baseline and import price inflation. However, the month-on-month (m/m) imports declined 9.7%, reflecting the seasonality and weakening domestic demand under the "double control" policy. Main commodities, such as iron ore and copper ore reported larger m/m decline in import volume compared with the previous month. Meanwhile, high-tech products and electronics imports slowed for two consecutive months. On the other hand, the volume of coal imports in October declined, partially reflecting the easing power shortages amid the incentives to increase domestic supply.

- Trade surplus set a new record high of USD84.5 billion in October. The cumulative surplus growth rate further picked up to 36.5% y/y from 35.0% y/y a month ago.

- The first batch of wind turbines at wpd's 640 MW Yunlin offshore wind farm (OWF) in Taiwan are expected to be operational by the end of 2021. The first wind turbine has connected to the grid and feed-in commenced on 5 November. The Yunlin OWF comprises of 80 units of SGRE 8.0-167 DD 8 MW wind turbines installed on monopile foundations. Sapura Offshore is responsible for installing the offshore wind turbine foundations, while Fred. Olsen Windcarrier is undertaking the wind turbine installation scope under a contract from Siemens Gamesa Renewable Energy. The transition piece (TP) and tower of the wind turbine were manufactured by Taiwan-based CTCI Machinery Corporation (CTCI MAC) and Formosa Heavy Industries (FHI) respectively. CTCI MAC and Smulders each delivered 40 TPs for Yunlin OWF. Steelwind Nordenham delivered 40 complete monopiles and supplied 120 monopile segments for the 40 monopiles constructed by FHI. Jumbo is contracted to transport 40 TPs from the Netherlands to Taiwan and install 80 TPs for the offshore wind project under a contract from wpd's subsidiary Yunneng Windpower. (IHS Markit Upstream Costs and Technology's Lopamudra De)

- According to Japan's Economic Watchers Survey (EWS) for October, the diffusion index (DI) of current economic conditions rose by 13.4 points from September to 55.5, the highest level since January 2014. While all component indices rose, the major contributor to the solid rise was household-related activity, particularly the DIs for department store, drinking and eating places, and amusement and leisure, reflecting easing containment measures. (IHS Markit Economist Harumi Taguchi)

- The DI of future economic conditions continued to increase, moving up by 0.9 points to 57.5, which is also the highest level since November 2013. However, the improvement was partially offset by declines in the DIs for drinking and eating, household services, and manufacturing firm operators, reflecting concerns about continued negative impacts stemming from uncertainties related to the pandemic and rising costs.

- According to the monthly labor survey for September, the year-on-year (y/y) growth for nominal cash earnings softened to 0.2% from 0.6% in the previous month. Real cash earnings fell by 0.6% y/y following two consecutive months of increases. The softer growth reflected a weaker increase in non-scheduled cash earnings and a 2.3% y/y decrease in special earnings (mainly seasonal bonuses). A faster increase in the number of part-timers compared with full-time workers was thanks largely to a recovery in eating and drinking services, in line with the easing containment measures. However, this was part of the reason behind weaker monthly average cash earnings because of shorter work hours and weaker wage rates.

- SK Innovation's battery business 'SK On' has signed a memorandum of understanding (MOU) with the Korea Electrotechnology Research Institute (KERI) to create a lithium-ion (Li-ion) battery safety-maximizing technology and other related standards, according to a company press release. The MOU outlines the two organizations' collaboration in creating technologies to produce considerably more advanced batteries by conducting rigorous tests and research in the areas of battery performance, reliability, and safety, among others. KERI is a government-funded research institute under South Korea's Ministry of Science and ICT that conducts power machinery testing and certification. The institute also engages in a variety of electricity-related technologies research and development (R&D). SK On claims that not a single fire accident has happened in its 150 million battery cell deliveries to date. Attributing its safety track record behind rising demand for its batteries, SK On said that it has secured 1,600 GWh order backlogs. (IHS Markit AutoIntelligence's Jamal Amir)

- Tata Motors has signed a retail finance memorandum of understanding (MOU) with the Bank of India (BOI) to offer financing solutions to passenger vehicle (PV) customers, reports Live Mint. As part of the MOU, the BOI will provide loans to Tata PV customer at an interest rate starting at 6.85% per year. The bank will also offer 90% of financing on the total cost of the vehicle (which includes the Ex-showroom price, insurance, and registration). The BOI will also offer an equated monthly installment (EMI) option starting from INR1,502 (USD20.2) per INR100,000 on a seven-year repayment period. According to the source, the offers will be applicable on Tata's Forever range of internal combustion engine (ICE) cars and sport utility vehicles (SUVs) and electric vehicles (EVs) for personal-segment buyers across the country. The BOI will charge zero processing charges until 31 March 2022 for Tata customers. (IHS Markit AutoIntelligence's Tarun Thakur)

- Indian car-rental firm Zoomcar has raised USD92 million in a Series E funding round led by New York-based SternAegis Ventures, reports TechCrunch. The company plans to use the infused capital to expand its operations in over 20 countries in the next 18 months. Greg Moran, co-founder and chief executive of Zoomcar, said, "We are the largest emerging market-focused marketplace for car sharing in the world. Think of us as Airbnb for cars, but for emerging markets. Globally, there are about 35 countries that are emerging markets. All of these have less than 10% of car ownerships. In fact, most of them have car ownership of less than 5%. So you have a huge middle class that simply doesn't have access to private cars. But they need to use these cars a couple of times a month." Zoomcar introduced car-sharing services in India in 2013 and currently has over 10,000 cars in its fleet, with around 4.8 million users. Headquartered in Bangalore, it operates in more than 45 cities across India. (IHS Markit Automotive Mobility's Surabhi Rajpal)

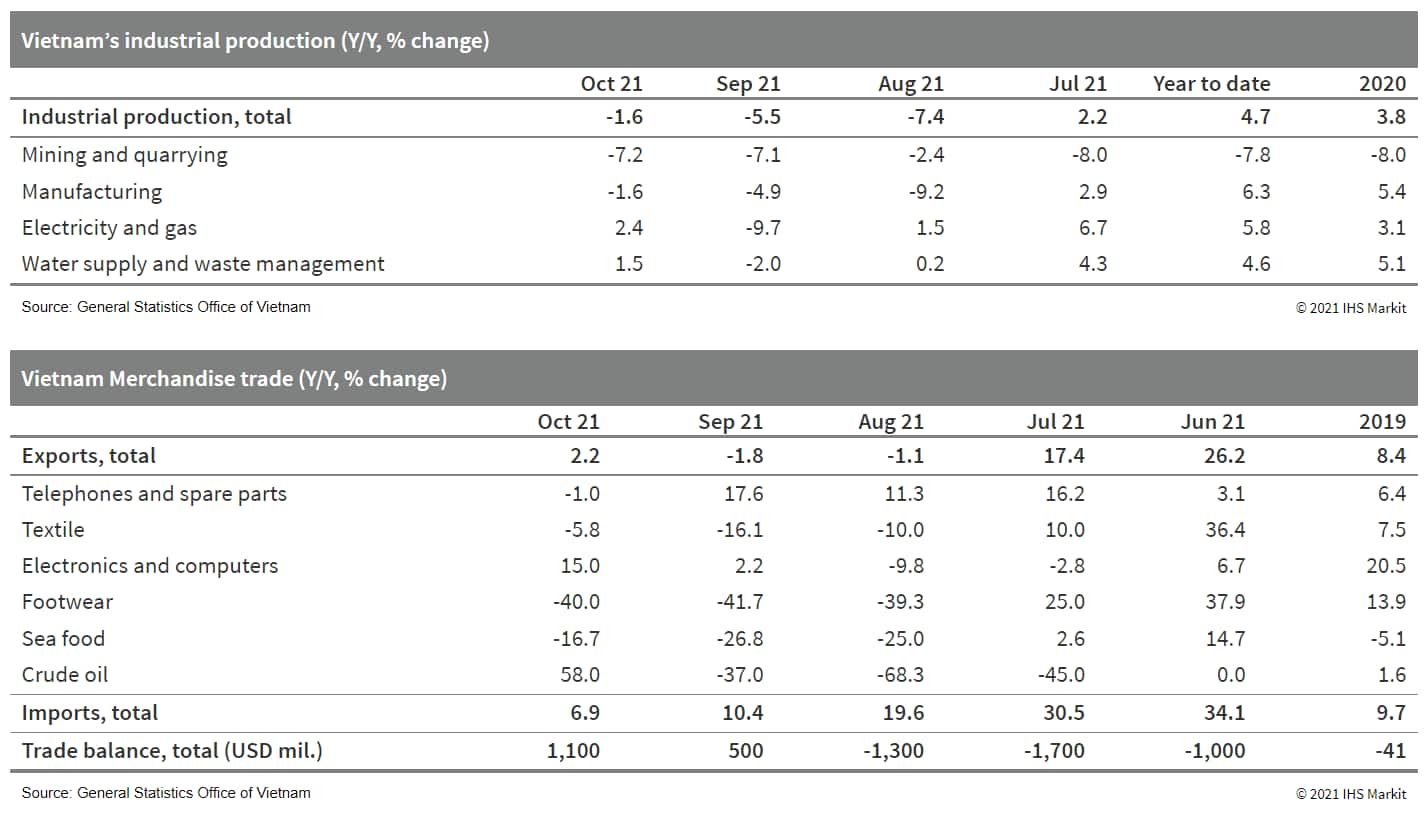

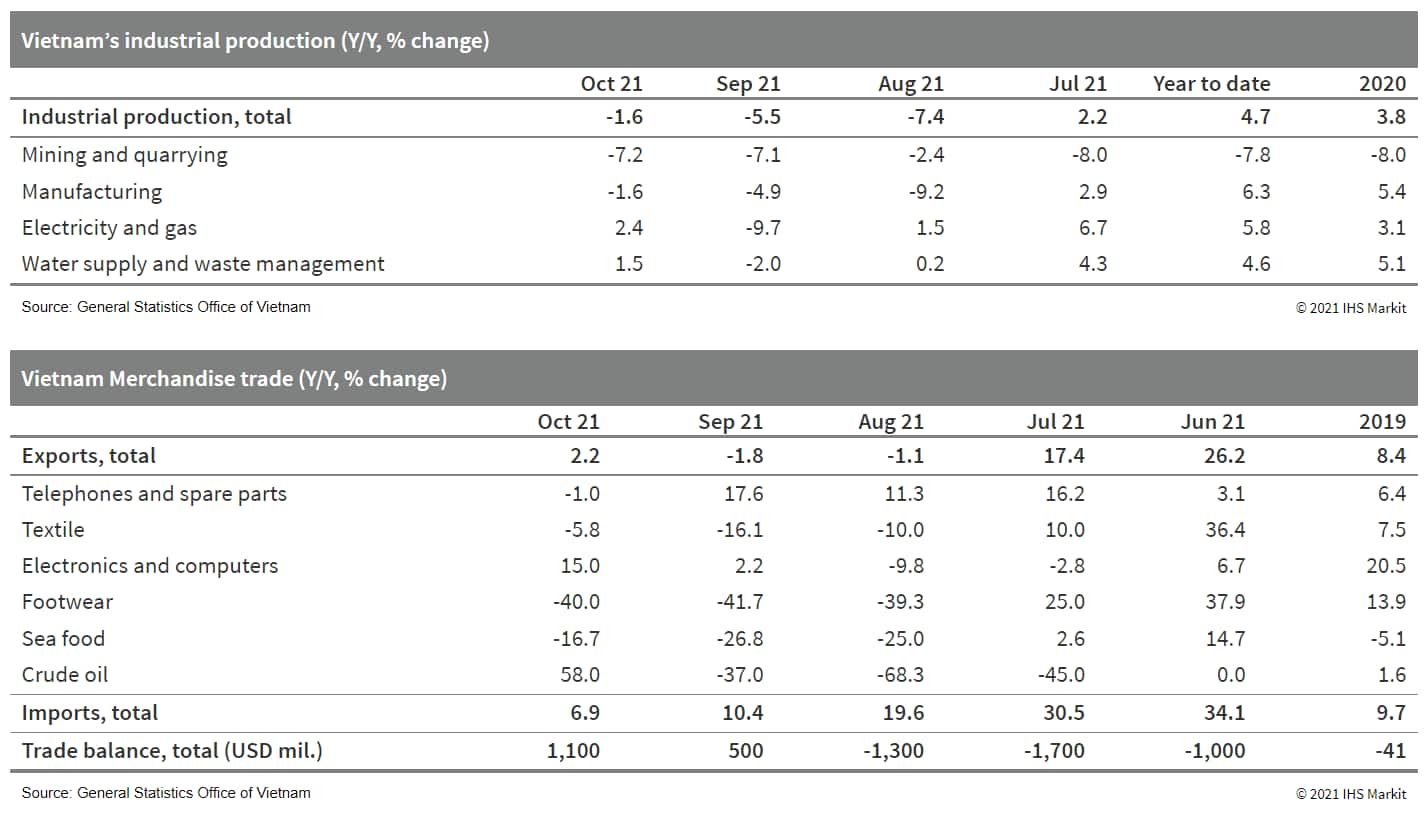

- Vietnam's merchandise exports rebounded in October, up by 2.2% year on year (y/y), marking the first growth recorded in the last three months. In terms of categories, electronics and crude oil recorded the largest year-on-year increases, up by 15% and 58%, respectively. Other categories of goods continued to post negative year-on-year growth. (IHS Markit Economist Jola Pasku)

- Merchandise imports grew by 6.9% y/y in October, moderating from a 10.4% y/y growth recorded in the previous month, enabling a larger trade surplus of USD1.1 billion for the period.

- Industrial production activities continued to contract, down by 1.6% y/y, albeit at a smaller magnitude compared with September. Key industrial sectors such as manufacturing and construction continue to operate at a reduced capacity because of damaged port and logistics infrastructure.

Posted 09 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.