Major US and European equity indices closed higher, while APAC was mixed. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. Gold and silver closed higher, while the US dollar, oil, and copper were lower on the day.

Americas

- US equity markets closed higher; Nasdaq +3.7%, Russell 2000 +1.9%, S&P 500 +1.4%, and DJIA +0.1%.

- CDX-NAIG closed -1bp/55bps and CDX-NAHY -5bps/309bps.

- 10yr US govt bonds closed -7bps/1.53% yield and 30yr bonds closed -6bps/2.24% yield.

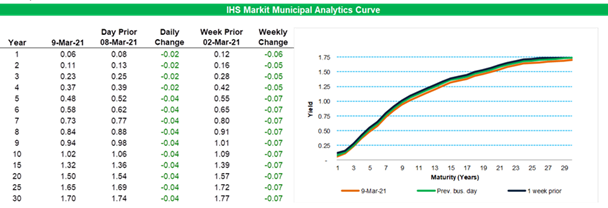

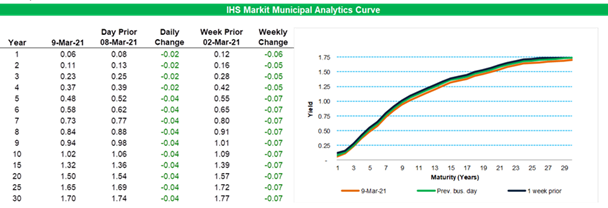

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) yields rallied across the curve today, closing -4bps for 5yr and longer paper and is -7bps week-over-week for ≥5yr paper.

- DXY US dollar index closed -0.4%/91.96.

- Gold closed +2.3%/$1,717 per ounce, silver +3.6%/$26.18 per ounce, and copper -2.0%/$4.01 per pound.

- Crude oil closed -1.6%/$64.01 per barrel.

- The below chart was created in preparation for last Thursday's CERAWeek Energy Investment Forum and it shows the average prices (y-axis) and yields (marker color and number labels) of CCC rated US E&P debt from the IHS Markit iBoxx USD High Yield Index each year (denoted by marker shape) as compared to WTI prices. It is important to note that a CCC rating typically denotes an expected default in approximately 12 months. The chart shows that (1) prices/yields reacted similarly in 2016 and 2020 when WTI dropped below $40 per barrel; (2) CCC debt was trading to high single-to-low double digit yields when WTI went above $75 per barrel; (3) 2019 (solid diamonds) bond prices/yields were at the lowest tier for a $50-$65 WTI price range; and (4) 2021 (inverted triangles) prices/yields are at the top tier for the current WTI price range.

- Two further studies may allay some of the concerns over protection of the Pfizer (US) vaccine against new COVID-19 variants. Both studies indicated protective activity against three current variants of concern, although the company is also developing a variant-specific booster for use if needed. In addition, the development of next-generation vaccines and therapeutics engineered to target conserved sequences and suppress emerging spike protein-mutated escape mutants has continued apace, including ImmunityBio's (US) second-generation injectable/sublingual/oral vaccine - which also has the potential to induce long-term immunity and suppress viral transmission - and Swiss biotech Molecular Partners' innovative and easily scalable DARPin product ensovibep, in development with compatriot firm Novartis. (IHS Markit Life Sciences' Janet Beal and Eóin Ryan)

- General Motors (GM) has said that it plans to reveal the GMC Hummer electric vehicle (EV) sport utility vehicle (SUV) on 3 April during the NCAA Final Four basketball tournament in the United States. The model, the SUV version of the Hummer EV pick-up, will be available for reservations on the same date, according to a company statement. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Waymo has published a white paper in which it offers a glimpse of how its autonomous system, Waymo Driver, could have mitigated fatal crashes in a virtually recreated environment. The simulations were based on 72 fatal accidents that occurred between 2008 and 2017 in Chandler (Arizona, US) where Waymo currently operates a small-scale autonomous ride-hail service. To conduct the study, Waymo reconstructed the crashes through a third party, and simulated them in a computer environment to determine how its autonomous system would respond in similar situations. These 72 fatal crashes yielded 91 simulations, and Waymo's system avoided collisions in 84 of the scenarios studied. Waymo's system also reduced the severity of crashes in four of the remaining incidents. Waymo vehicles did not avoid or mitigate crashes where they were hit from behind, reports Automotive News. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous truck startup Plus is in advanced talks with a few special purpose acquisition companies (SPACs) for a merger, reports Automotive News. The startup is expected to announce the merger deal soon as it has received several letters of intent from US-based listed SPACs. According to the report, Plus is also planning to lay down its valuation range later this month. The SPACs range in size between USD300 million and USD500 million, and after the SPAC is finalized, Plus will begin a roadshow in collaboration with Goldman Sachs for additional financing via a private investment in public equity. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Santiago-based beverage group CCU, one of Chile's largest soft drinks producers, saw its sales revenue increase to CLP1.86 trillion (USD2.65 billion) in 2020, up 1.9% y-o-y. CCU's EBITDA dropped 11.7% to CLP296.4 billion, which the group attributed to a 48% EBITDA contraction at its international arm and an 8.2% EBITDA drop in its Chilean operations. The Chile operating segment reported a 12.1% growth in cost of sales per hectoliter, driven by higher USD-linked costs, because of the devaluation of the Chilean peso, partially offset by lower raw material costs, especially aluminum and PET. CCU also benefited from a 47.1% devaluation of the Argentine peso in relation to the Chilean peso in 2020. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

Europe/Middle East/Africa

- European equity markets closed modestly higher; Italy/Spain +0.6%, France/Germany +0.4%, and UK +0.2%.

- 10yr European govt bonds closed higher; Italy -6bps, Spain -4bps, Germany/UK -3bps, and France -2bps.

- iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -2bps/253bps.

- Brent crude closed -1.1%/$67.52 per barrel.

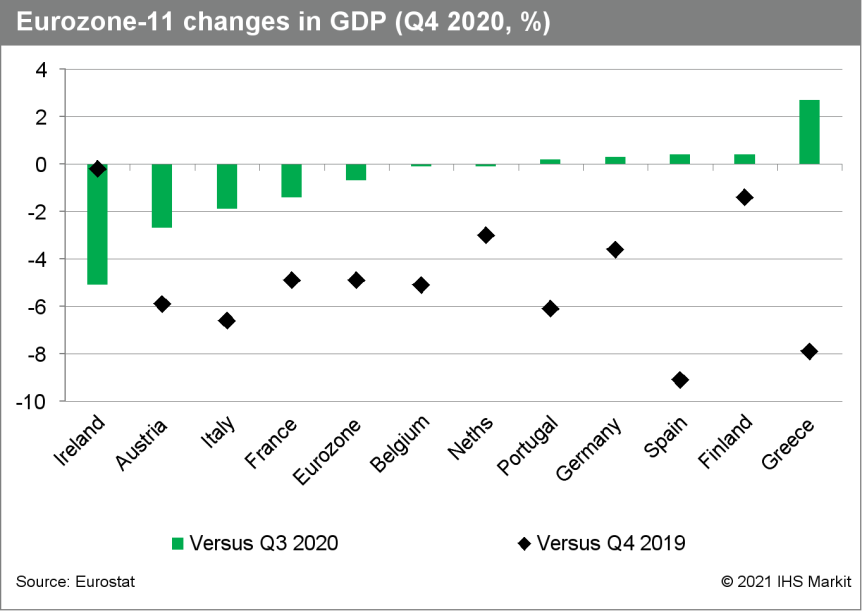

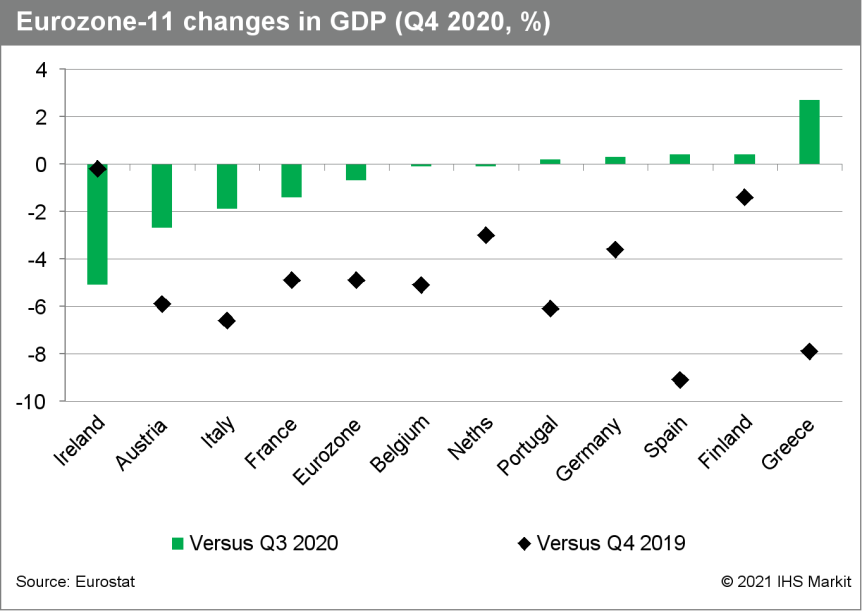

- According to Eurostat's third estimate, eurozone GDP contracted by 0.7% q/q in the fourth quarter of 2020, marginally weaker than the second estimate (-0.6%). (IHS Markit Economist Ken Wattret)

- Eurozone GDP fell by 4.9% in the fourth quarter of 2020 relative to its pre-pandemic level in the fourth quarter of 2019, a marginal upward revision compared with the second estimate (-5.0%).

- In 2020 overall, eurozone GDP fell by 6.6%, a somewhat smaller decline than the prior estimate (-6.8%) but a record annual contraction by some distance nonetheless. In comparison, GDP contracted by 4.5% in 2009 after the global financial crisis (GFC).

- Inventories contributed 0.6 percentage point to the q/q growth rate in the fourth quarter last year, although this only partly unwound the prior quarter's 1.4 percentage point drag.

- Of the larger member states, Italy (-1.9% q/q) and France (-1.4% q/q) underperformed in the fourth quarter of 2020, although Ireland recorded the biggest decline in GDP (-5.1% q/q).

- In contrast, looking at the changes in GDP relative to the fourth quarter of 2019, Ireland was the star performer, with GDP edging down by only 0.2% q/q. The biggest declines, in contrast, were in Spain (-9.1%) and Greece (-7.9%).

- In line with widespread COVID-19-related restrictions, reflected in IHS Markit's COVID-19 containment indices, we continue to forecast a somewhat larger q/q contraction in eurozone GDP in the first quarter of 2021 (of around -1%).

- Consumer spending will again be the key area of expenditure driving the decline, and based on the latest "hard" data available, the risks look tilted to the downside.

- Germany's Federal Statistical Office (FSO) external trade data for January (customs methodology, seasonally adjusted, nominal) reveal steadily increasing exports and a setback in imports. Following exports' increase by 1.4% month on month (m/m; seasonally and calendar adjusted), they were only 2% below year-ago levels. In contrast, imports' -4.7% m/m set them back to more than 6% below year-ago levels. (IHS Markit Economist Timo Klein)

- In 2020 as a whole, exports declined by 10% and imports by 7.7% year on year (y/y).

- January's regional breakdown unusually shows an outperformance of trade with other EU countries compared with the non-EU world. This is in contrast with the data in recent months and is linked to another drastic decline at the start of 2021 of trade with the United Kingdom, which belongs to the "rest of the world" now. Exports to the UK were down by 29.0% y/y and imports from the UK by 56.2% y/y in January. This reflects the additional disruptions to EU-UK trade after the transition period ended at the turn of the year 2020/21.

- Among countries outside the EU, trade with China still stood out positively, although calendar effects dampened January's annual growth compared with recent double-digit rates (exports up by 3.1% y/y and imports up by 1.1% y/y). Trade with the United States suffered a setback (exports -6.2% y/y and imports -22.8% y/y).

- Bosch has announced that it has begun test production at a new automotive wafer fab facility in Dresden (Germany). In a statement, the company said that the facility is "Bosch's response to the surging number of areas of application for semiconductors, as well as a renewed demonstration of its commitment to Germany as a high-tech location". The company added that investment in the project stood at around EUR1 billion, with funding provided by the German government's Federal Ministry of Economic Affairs and Energy. Bosch added that the facility will open officially in June and production operations are due to begin in late 2021. A Reuters report states that the site will focus on the manufacture of application-specific integrated circuit (ASIC) microchips. (IHS Markit AutoIntelligence's Ian Fletcher)

- Rimac Automobili has announced that Porsche has increased its stake in the business. According to a statement, the German automaker has spent EUR70 million to take its shareholding in Rimac to 24%. This confirms earlier reports that Porsche was planning to increase its investment in Rimac, which had started off as an electric hypercar manufacturer, but has now broadened its remit to making advancements in the area of electrified powertrains, batteries, infotainment and other components related to vehicle electrification. Porsche initially took a 10% stake in the business during 2018, and raised it to 15.5% in 2019. The latest acquisition now gives it almost one-quarter interest in Rimac. (IHS Markit AutoIntelligence's Ian Fletcher)

- Greece's GDP rose by 2.7% quarter on quarter (q/q) during the fourth quarter of 2020, according to seasonally adjusted figures. Its GDP is now estimated to have risen by 3.2% q/q during the third quarter (revised up from 2.3% q/q) and declined by 13.4% during the second quarter (revised from -14.1% q/q). (IHS Markit Economist Diego Iscaro)

- Despite the second successive q/q increase in activity, GDP was still down by 7.9% year on year (y/y) during the fourth quarter of 2020. Over 2020, Greek GDP declined by 8.0%, one of the largest contractions in the eurozone.

- Exports of goods and services were still 13.4% below their level during the last quarter of 2019. In 2020, they fell by 21.7%. Rising exports of goods (+4.3%) could not offset a 43.9% fall in exports of services resulting from collapsing tourism activity.

- Although the provisional fourth-quarter-2020 figures were better than expected, they should be treated with caution. The collapse in tourism activity may be having an impact on the seasonal adjustment of exports, while the relatively large contribution from inventories, which is calculated as a residual, during the fourth quarter suggests that the figures may be revised substantially in subsequent releases.

- Einride, a Swedish transportation company focusing on autonomous electric trucks, is seeking USD75 million in a new financing round. Simultaneously, Einride is exploring the potential for a public listing through a merger deal with a special purpose acquisition company (SPAC), reports TechCrunch. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Nigeria's AFEX Commodities Exchange Limited has announced the listing of cashew on its platform, in a bid to diversify available investment options and create more wealth. AFEX Commodities Exchange in the recent disclosure rationalized the need to list cashew on its platform. It hinged this on the lucrative nature of the commodity, noting that it has a lot of untapped potentials. According to the disclosure, cashew exports in Nigeria are highly profitable, with a yearly export volume of over USD167 million, and untapped yearly potential of over USD115.8 million. Therefore, listing the commodity on the AFEX Exchange provides opportunities for investors to gain exposure to the commodity and maximize their returns on investment. (IHS Markit Food and Agricultural Commodities' Julian Gale)

Asia-Pacific

- APAC equity markets closed mixed; India +1.2%, Japan +1.0%, Hong Kong +0.8%, Australia +0.5%, South Korea -0.7%, and Mainland China -1.8%.

- Chinese Premier Li Keqiang delivered the 2021 government work report at the start of a week-long National People's Congress (NPC) on 5 March. The 2021 GDP growth target has been set at above 6%, with other major economic targets returning to pre-COVID-19 pandemic levels. Consumption, urbanization, leverage control, and emissions reduction were highlighted in 2021 government work report. (IHS Markit Economist Yating Xu)

- In line with the 2021 GDP goal, other major economic targets have returned to pre-pandemic levels. The target for the surveyed urban unemployment rate has been set at 5.5% for 2021, down from the 6.0% target set in 2020 and equivalent to the pre-pandemic target level. However, there was no mention of a target for registered urban unemployment rate in the report.

- China aims to create more than 11 million new urban jobs in 2021, equivalent to the 2019 level and 2 million higher than the 2020 target. Meanwhile, the consumer inflation target has been cut to 3.0% from 3.5% in 2020, returning to the 2015-19 level.

- Government budget spending growth will moderate. According to China's financial minister, fiscal revenue is expected to reach CNY19.8 trillion in 2021, up 8.1% from a year ago, compared with a 3.9% year-on-year (y/y) decline in 2020. Fiscal spending is expected to be above CNY25 trillion, with growth down to 1.8% y/y from 2.8% y/y in 2020.

- While most Chinese households continue to prepare their meals from scratch and source ingredients from local wet markets, online sales of frozen food are soaring amid the pandemic. China's total retail sales of frozen food reached CNY175 billion (USD27 billion) in 2020, and are projected to be USD51 bln by 2025, according a report from Zhongshang Industries Research Institute, a local market research firm. Sales through e-commerce performed particularly well during the pandemic. Tmall's frozen food sales were CNY12.1 billion in 2020, up 73% year-on-year while Taobao up 44%. Tmall, Taobao and JD are major e-commerce platforms in China. Urban Chinese are living an increasingly busy lifestyle and are looking for quick and convenient meal solutions. Food technology improvements mean that manufacturers are able to provide a wide range of frozen food with close to authentic regional special flavor and tastes. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Chinese electric vehicle (EV) startup Xpeng Motors will launch a navigation-assisted autonomous expedition in China. This will be a seven-day driving expedition from 19 to 26 March, covering a total distance of 3,675 km across six provinces in the country. The distance will include about 3,140 km of highways, and the expedition will be supported by Xpeng's highway-driving feature Navigation Guided Pilot (NGP). The NGP feature, part of the automaker's autonomous vehicle (AV) package XPILOT 3.0, is offered on the premium version of the P7 sedan. The P7 will be driven by members of the media and third parties during the driving expedition to test the NGP's functionalities, including "automatic highway ramp entering and exiting, automatic switching of highways and optimization of lane choices, automatic lane changing, overtaking and speed limit adjustment". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Baidu launches a testing site for autonomous vehicles (AVs), known as Apollo Park, in Guangzhou. Apollo Park is located in the city's Huangpu district, covering an area of 30,000 square metres, to test AVs and their applications in various scenarios. The testing site supports functions such as cloud-based remote control of big data and operations center, reports Caixin Global. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's real GDP for the fourth quarter of 2020 was revised down to 2.8% quarter on quarter (q/q; or 11.7% q/q annualized) from 3.0% q/q (or 12.7% q/q annualized). The annual figure remained a contraction of 4.8% for 2020. The downward revision reflected weaker private capital expenditure (capex) and steeper destocking. (IHS Markit Economist Harumi Taguchi)

- Although capex was revised down from 4.5% q/q to 4.3% q/q, the solid rise was thanks largely to a 13.5% q/q increase in investment in other machinery and equipment, which is the first rise in five quarters, and a continued increase in investment in transport equipment (up 12.0% q/q).

- While the revision for capex was limited, as IHS Markit expected, the larger-than-expected downward revision to GDP stems from a larger decline in inventory. The Cabinet Office explained that the sluggishness mainly reflected weak figures for inventories of raw materials and supplies as well as work in progress (according to financial statistics of corporations).

- Real household expenditures fell by 7.3% month on month (m/m) or 6.1% y/y in January.

- The revisions to the fourth-quarter 2020 figures were slightly larger than expected, but IHS Markit maintains its view that the resumption of economic activity and solid external demand will drive a recovery following a contraction in the first quarter of 2021. IHS Markit expects Japan's real GDP growth to rise to 2.7% in 2021 before softening to 1.8% in 2022.

- Supply chain disruptions caused by semiconductor shortages and the 13 February 2021 earthquake could weigh on exports and household spending in autos over the short term.

- Key automakers in India, some of which have already launched electric vehicles (EVs) in the market, are adding more EVs to their line-ups to support the central government's plans. This year is set to be the busiest for new EV model launches in the Indian market, as demand slowly returns following the disruption caused by the COVID-19 virus pandemic and automakers catering to all segments prepare to debut their EVs after years of market study. EVs that are expected to make their way into the country this year include the Mahindra & Mahindra (M&M) eKUV100 and eXUV300, Tata Motors Altroz EV, Maruti Suzuki Wagon R electric, Renault Kwid electric and Hyundai 2021 Kona electric. EVs have been making a good business case, particularly in the premium vehicle segment where the volumes remain limited, but buyers do not mind paying a high price for owning an EV. Luxury models that are planned for launch this year include the Jaguar I-Pace, Audi e-Tron, Volvo XC40 Recharge and Porsche Taycan. Of these, the Jaguar I-Pace and Audi e-Tron are expected to launch soon. According to IHS Markit's alternative propulsion forecast, production of EVs in India totaled 5,965 units in 2020, compared to 2,299 units in 2019. This mainly includes models like the Tata Nexon and Tigor, MG ZS, Hyundai Kona, and M&M eVerito among others. We expect this figure to increase to 10,887 units by the end of this year, helped by the addition of new models. (IHS Markit AutoIntelligence's Isha Sharma)

Posted 09 March 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.