All major APAC, European, and US equity indices closed higher. US government bonds closed mixed with the curve was slightly flatter on the day, while all benchmark European bonds closed higher. European iTraxx and CDX-NA closed tighter across IG and high yield. The US dollar and natural gas closed lower, while oil, gold, silver, and copper were higher on the day. The market will closely be watching tomorrow's 8:30am ET US Consumer Price Index release for signs that the rate of inflation is slowing.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Nasdaq +2.1%, Russell 2000 +1.9%, S&P 500 +1.5%, and DJIA +0.9%.

- 10yr US govt bonds closed +1bp/1.95% yield and 30yr bonds -1bp/2.25% yield.

- CDX-NAIG closed -1bp/62bps and CDX-NAHY -9bps/341bps.

- DXY US dollar index closed -0.2%/95.49.

- Gold closed +0.5%/$1,837 per troy oz, silver +0.6%/$23.34 per troy oz, and copper +3.2%/$4.60 per pound.

- Crude oil closed +0.3%/$89.66 per barrel and natural gas closed -5.6%/$4.01 per mmbtu.

- The US Army on February 8 released a climate-change strategy that, among other things, outlines an ambition to install a microgrid on every installation by 2035. There are over 130 Army installations around the world that protect, support and enable the force. In the last five years alone, the Army said it has enhanced installation-wide resilience by bringing systems online such as Fort Irwin's water treatment plant upgrade, Fort Knox's 2.1-MW solar field and Fort Carson's 8.5-megawatt-hour lithium battery. There are 950 renewable energy projects supplying 480 MW of power to the Army today and 25 microgrid projects scoped and planned through 2024. The policy goals also include (IHS Markit PointLogic's Barry Cassell):

- To achieve on-site carbon pollution-free power generation for Army critical missions on all installations by 2040.

- To provide 100% carbon-pollution-free electricity for Army installations' needs by 2030.

- To implement installation-wide building control systems by 2028.

- To achieve 50% reduction in greenhouse gas (GHG) emissions from all Army buildings by 2032, from a 2005 baseline.

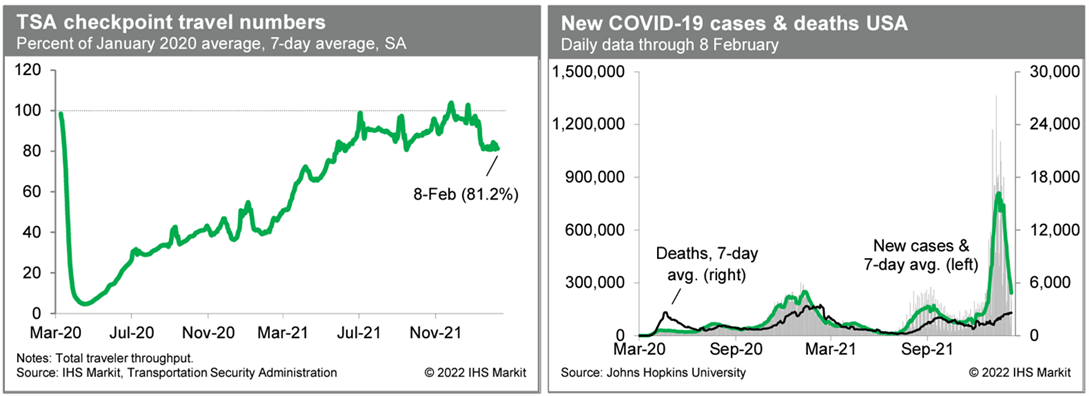

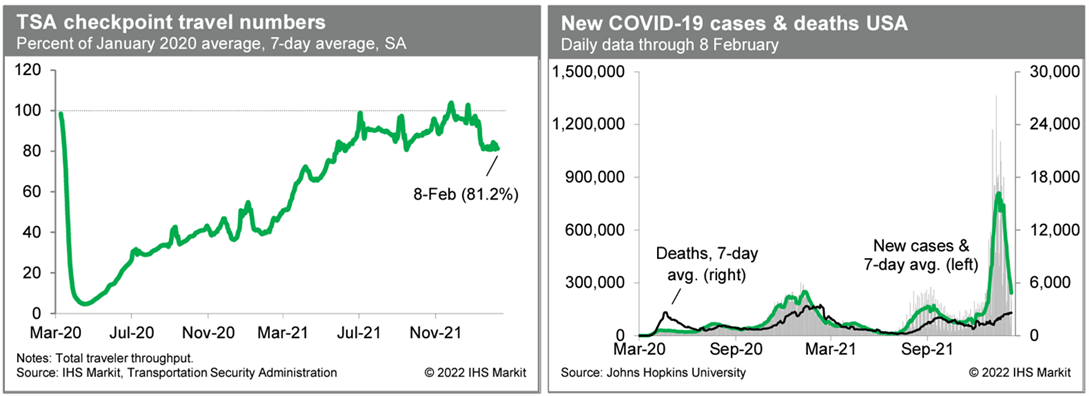

- Averaged over the last seven days, and after seasonal adjustment, passenger throughput at US airports was 81.2% of the January 2020 level. This is close to recent averages and likely was held down by disruptions across the central and eastern US stemming from Winter Storm Landon. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Ram has created a hub called RamRevolution.com to bring consumers into the process of creating the first Ram electric pick-up truck, due to be launched in 2024. According to a statement from Ram, the Ram Revolution 'insider program' of consumer consultation will "provide consumers with unique content and a closer connection with the Ram brand and its electric-vehicle (EV) philosophy". Ram is also beginning a series of year-long discussions with truck owners to better understand what they require an electric pick-up to do to meet their real-world needs. Ram has provided some images indicating what the silhouette of the new electric pick-up might look like. The brand says the images are of a concept vehicle "being developed with customer input to inspire the design of the upcoming Ram 1500 EV". In addition, Ram stated that, by 2025, it plans to introduce fully electrified products in the majority of the segments it has entries in, and a full portfolio of electrified products in all of these segments no later than 2030. In the company statement, Mike Koval Jr, Ram brand CEO - Stellantis, said, "Our new Ram Revolution campaign will allow us to engage with consumers in a close and personal way, so we can gather meaningful feedback, understand their wants and needs and address their concerns - ultimately allowing us to deliver the best electric pickup truck on the market with the Ram 1500 BEV." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Embark will supply its autonomous trucks to freight transportation company Knight-Swift in a pilot program, according to a company statement. The Truck Transfer Program will allow Knight-Swift to own an autonomous truck, maintain and deploy the truck, and place its own driver behind the wheel. This program will support both the companies to "collect driver feedback on the technology's performance, define how the system will improve driver jobs, and develop procedures and tools that enable Knight-Swift to maintain, inspect, dispatch, and remotely monitor Embark-equipped trucks". The Embark Universal Interface (EUI), the company's autonomous hardware and software stack, will be installed in a set of Knight-Swift trucks scheduled for OEM deliveries in 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Lyft has reported net loss of USD258.6 million in the fourth quarter of 2021, compared with a net loss of USD458.2 million in the same period of 2020, according to a company statement. This loss was attributable to stock-based compensation and related payroll tax expenses, as well as expenses related to changes to the liabilities for insurance required by regulatory agencies attributable to historical periods. The company reported its third consecutive quarter of adjusted EBITDA profitability, of USD74.7 million, in the fourth quarter of 2021. The company's revenue increased to USD969.9 million in the quarter, up 70.0% year on year (y/y) and 12.0% quarter on quarter (q/q). Lyft said that the growth in revenue was attributable to increased revenue per active rider, which rose by 14.1% y/y to USD51.8. The number of active riders also increased, to 18.7 million, in the period, up 49.2% y/y. Lyft chief financial officer Elaine Paul said, "We had a solid Q4 and achieved full-year revenue growth of 36 percent in 2021. Revenue per Active Rider, Contribution Margin and Adjusted EBITDA all reached new highs in the fourth quarter, driven by improving service levels and higher ride volumes in our marketplace. Despite short-term headwinds from omicron, we remain optimistic about full-year 2022." Lyft closed 2021 with its first annual profit of USD92.9 million on an adjusted EBITDA basis. Last year, Lyft announced plans to resume a shared-ride booking option, which allows multiple passengers travelling in the same direction to share a car, in Chicago, Philadelphia, and Denver, United States. With a resurgence in the number of users, Lyft and its rival Uber are struggling with driver supply and demand imbalances, leading to higher pricing and increased waiting time. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to the National Institute of Statistics and Censuses (Instituto Nacional de Estadistica y Censos: INEC), Costa Rica's Consumer Price Index (CPI) edged up to 3.5% y/y in January, almost unchanged from the previous month. This marked the highest reading since February 2015 and was slightly above of our expectations of 3.4%. (IHS Markit Economist Dariana Tani)

- However, January reading remains within the target range of between 2% and 4% established by the BCCR.

- On month-on-month (m/m) terms, the CPI rose by 0.4% m/m, with rental and housing services showing the largest monthly price increases, followed by recreational activities and food and non-alcoholic beverages.

- Moreover, separate data from INEC show that the country's unemployment rate continued to fall gradually during the last quarter of 2021, which in part reflects the ongoing recovery of the tourism sector and the ease of global travel restrictions, despite the new wave of COVID-19 cases related to the new Omicron variant.

- Nevertheless, the latest BCCR's Monetary Policy Report released on 29 January showed that in recent moving quarters, the drop in the unemployment rate was more related to people leaving the labour force, noting that this was the case, for example, in the moving quarters that ended in October and November 2021.

Europe/Middle East/Africa

- All major European equity markets closed higher; Italy +2.7%, Spain +2.0%, Germany +1.6%, France +1.5%, and UK +1.0%.

- 10yr European govt bonds closed sharply higher; Italy -7bps, Germany/UK -6bps, Spain -5bps, and France -4bps.

- iTraxx-Europe closed -2bps/62bps and iTraxx-Xover -7bps/303bps.

- Brent crude closed +0.8%/$91.55 per barrel.

- The UK government has greenlit a plan to build a large-scale battery production facility in Coventry (UK), reports the Coventry Telegraph. The newspaper reports that an outline planning application for the West Midlands Gigafactory was set to "called-in" by the Secretary of State for Housing, Communities and Local Government Michael Gove. However, a decision has now been taken not to review the application, meaning a detailed planning application will be allowed to be submitted once a backer can be found to build and run the facility. (IHS Markit AutoIntelligence's Ian Fletcher)

- German Federal Statistical Office (FSO) external trade data (customs methodology, seasonally and calendar-adjusted, nominal) reveal that exports increased by 0.9% month on month (m/m) in December 2021, extending a combined near-6% rebound already observed during October-November 2021. The latest export level exceeds that of February 2020, just before the pandemic, by about 7%. Imports even surged by 4.7% m/m, although this was partly caused by sharply increasing import prices. That said, December 2021 volume data show that stagnating exports contrast with a 4.6% m/m increase for imports. (IHS Markit Economist Timo Klein)

- Based on the seasonal- and calendar-adjusted series, year-on-year (y/y) rates for December 2021 export and import values have now reached 11.8% and 24.7%, respectively. However, corresponding y/y rates in volume terms are only 0.8% and 0.7%, highlighting the huge impact of inflation developments in 2021 for external trade data.

- The seasonally adjusted trade surplus, which had peaked at EUR21.8 billion in January 2021 following the initial recovery from the COVID-19 virus outbreak, narrowed anew from EUR10.8 billion in November 2021 to EUR6.8 billion in December 2021. This is well below monthly averages not only in 2019 (EUR18.9 billion) but also in 2020 (EUR14.8 billion), the year already hit by the outbreak of the pandemic.

- Volkswagen (VW) Passenger Cars has said that it will pay out a COVID-19 premium to its employees for the second time to thank them for their efforts during the pandemic. According to a company press release, VW will pay out a EUR500 (USD571) bonus per employee as part of the February salary round. The VW brand's chief human resources officer Gunnar Kilian said, "In recent months, the pandemic greatly tested our employees - whether they were working at our locations or remotely. The flexibility and tireless dedication they have shown is a remarkable performance that we would like to recognize. That is the reason for the new coronavirus premium." At the same time, Autocar has reported that the forthcoming ID.Buzz battery electric passenger van will be priced below EUR60,000 (USD68,600), according to company sources, a similar price to that of the current internal combustion engine (ICE) equivalent in the VW range, the VW Multivan T6.1. Perhaps surprisingly, the panel van version of the ID.Buzz will be priced below the equivalent ICE transporter, according to the report. In Germany, the price could drop below EUR50,000 after government incentives are deducted. (IHS Markit AutoIntelligence's Tim Urquhart)

- According to the Italian National Institute of Statistics (Istituto Nazionale di Statistica: ISTAT), industrial production fell 1.0% month on month (m/m) in December 2021 after a 2.1% m/m gain in November. (IHS Markit Economist Raj Badiani)

- Apart from a negative base effect after a robust performance in November, industrial output in December was weighed down by staff shortages and the Omicron-related disruption both in Italy and key export markets.

- The average level of industrial production rose by 0.5% quarter on quarter (q/q) in the fourth quarter of 2021, compared with gains of 1.0% q/q in the third quarter and 1.2% q/q in the second.

- Industrial output in December was 2.0% above its February 2020 level, the last pre-pandemic month.

- Output in December fell in consumer durables (-4.8% m/m), intermediate goods (-0.5% m/m), and investment goods (-2.2% m/m).

- Meanwhile, on a working-day-adjusted basis, total industrial output in December rose by 4.4% when compared with a year earlier.

- Therefore, industrial production rose by 11.8% in 2021 after a drop of 11.4% in 2020.

- The fall in industrial output in December was at odds with survey data signaling improving output during the month. Furthermore, the latest PMI indicators suggest that manufacturing activity lost some momentum but still performed solidly in January.

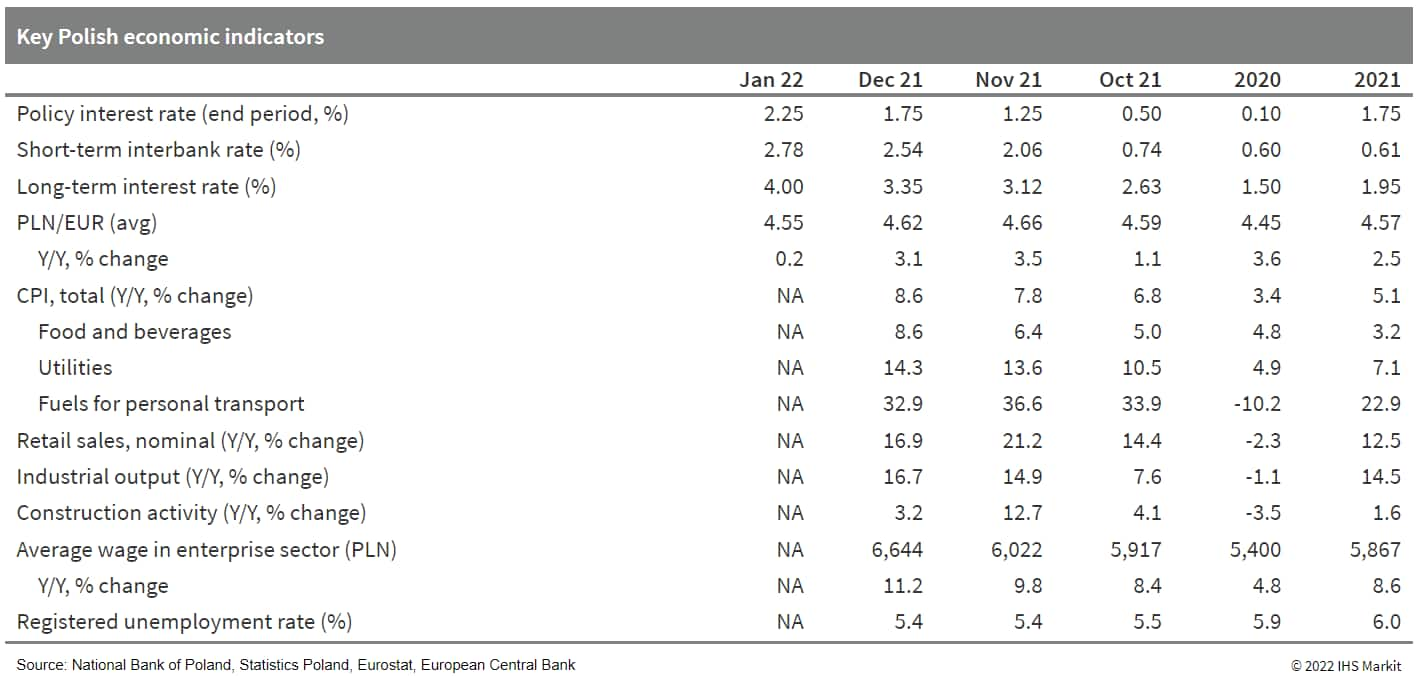

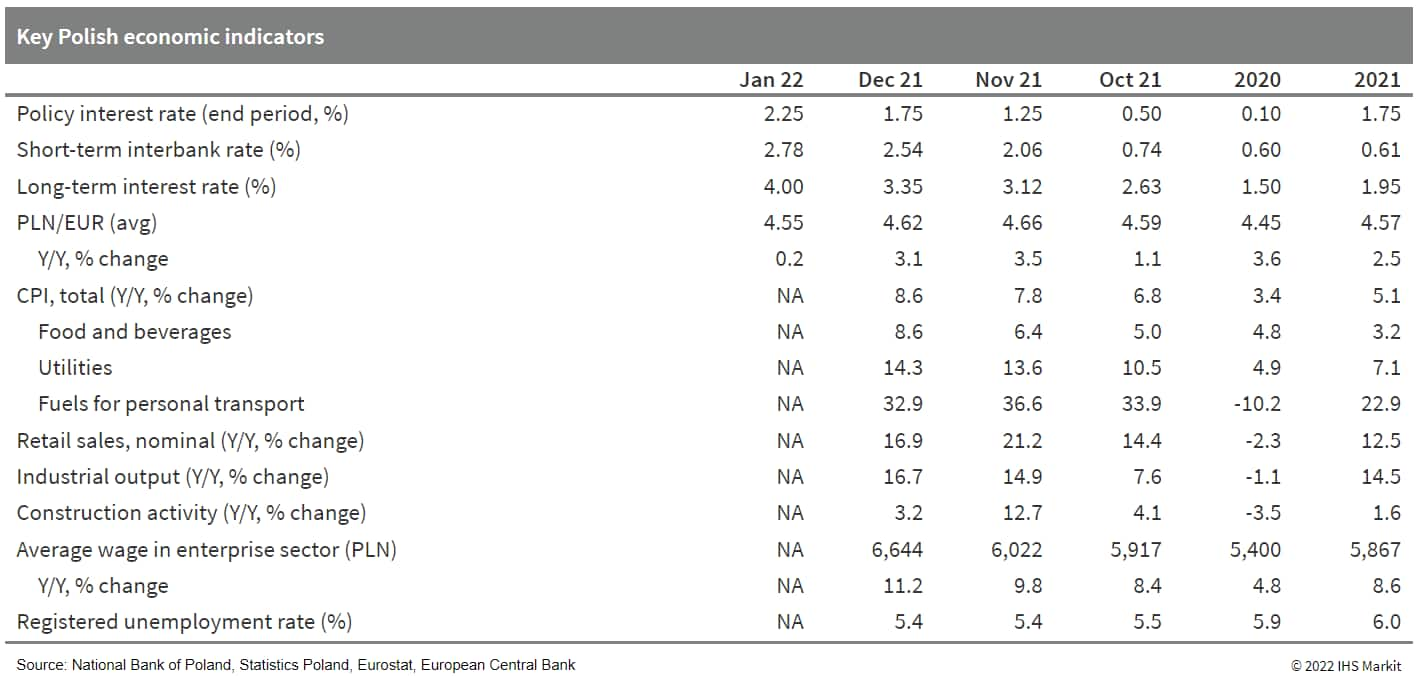

- Although consumer price inflation surged to 8.6% year on year (y/y) in December 2021, Poland's MPC increased the policy interest rate only moderately at its February session, keeping it below the comparative figures for Czechia (at 4.50%) and Hungary (at 2.90%). At the February session, the MPC also raised the required reserve ratio from 2.0% to 3.5% while bringing the Lombard rate to 3.25% and the discount and rediscount rates to 2.25% and 2.80%, respectively. (IHS Markit Economist Sharon Fisher)

- In justifying the latest decision, the MPC pointed out that global growth remains strong but is expected to decelerate in 2022. Energy prices (particularly for natural gas, oil, and coal) as well as agricultural commodities are increasing markedly, while supply chain disruptions have continued and shipping costs remain high, contributing to high global inflation.

- Despite acknowledging that the risk of inflation running above the 2.5% target over the medium term remains elevated, the National Bank of Poland (NBP) appears less concerned about domestic inflationary pressures and has been slower to react than many of its counterparts elsewhere in Emerging Europe. Indeed, the NBP has been focused not only on limiting inflation but also on supporting sustainable economic growth. According to its February statement, the NBP expects that a reduction in certain tax rates as part of the 'Anti-Inflation Shield' will limit domestic inflation in early 2022, while interest rate hikes combined with the expected fading of global shocks will also help ease pressures going forward.

- IHS Markit continues to see significant upside risks to inflation stemming from Poland's tight labor market, with enterprise wages up by nearly 10% y/y in the fourth quarter of 2021. Private consumption jumped by a preliminary 6.2% in 2021 and an estimated 8.2% y/y in the fourth quarter of 2021 alone, serving as a key driver of GDP growth.

- Volvo Cars has announced that it plans to invest around SEK10 billion (USD1.1 billion) to upgrade its Torslanda (Sweden) facility, which will support its transition to a fully battery electric vehicle (BEV) manufacturer. The investment in the site to introduce the mega-casting process will coincide with a move to shift vehicles from the current SPA architecture to the new SEA platform. IHS Markit forecasts that the first new models to use this will be the next-generation Volvo XC60 and the similar-sized Polestar 4. We forecast annual production at the site peaking at 299,900 units in 2024, before sliding back towards the end of the decade despite the introduction of new vehicles. (IHS Markit AutoIntelligence's Ian Fletcher)

- Russia exported 34 million tons of grains and oilseeds and their by-products as of February 3, down 19% y/y, according to the Federal Centre of Quality and Safety Assurance for Grain. This included 30 million tons of grains and pulses, and 28.7 million tons of grains specifically. (IHS Markit Food and Agricultural Commodities' Louisa Sabin)

- In particular, the country shipped 23.9 million tons of wheat, 2.8 million tons of barley, 1.8 million tons of corn, 1 million tons of peas, 0.6 million tons of wheat bran, 0.2 million tons of chickpeas, and 0.2 million tons of wheat flour.

- Russia also exported 0.4 million tons of soybeans, 0.7 million tons of sunflower meal, 0.5 million tons of flaxseed, and 0.2 million tons of rapeseed.

- Meanwhile, Russia sold a total of 32.9 million tons of wheat and meslin in 2021, down 14.4% compared to the previous year, according to the Federal Customs Service. Additionally, Russia sold 3.1 million tons of sunflower oil in 2021, down 15.1% y/y.

- Petrofac has been awarded an early engineering services contract by H4 Energy for a wind-to-hydrogen development project on Sakhalin Island in Russia. As part of a three-year consultancy framework agreement, Petrofac will explore options for using predominantly wind energy to produce green hydrogen and other sustainable sources of energy at the site on the south-western tip of Sakhalin Island. (IHS Markit Upstream Costs and Technology's William Cunningham)

- Initial work will evaluate hydrogen production technology, hydrogen carriers such as liquid hydrogen and ammonia, export options, turbine sizing, electrical systems, and hazards analysis. Starting at 100 MW, Petrofac will also look at options for scaling up to 3GW of total installed capacity in future phases, including cost and execution phasing. The finished facility will target the production of 17,000 metric tons of hydrogen per year.

- Petrofac will undertake the work in Woking, United Kingdom with support from a team based in Sakhalin.

- Petrofac has been present in Sakhalin since 2006, when it opened the Sakhalin Technical Training Centre, providing training to operators and contractors in oil and gas projects. It expanded its presence in 2017 through an EPC contract with Sakhalin Energy for an onshore processing facility.

- The Turkish agricultural industry closed 2021 with a sharp rise in prices. Its Producer Price of Index of Agricultural Products rose by 36 % y/y in December 2021, being listed the following product categories: citrus (+2%), rice (+20%); vegetables, melons and tubers (+25%); sheep, goats and wool (21%); nuts and bush fruits (36%); dairy cattle (+48% y/y); poultry and eggs (+49%); cereals, leguminous and oilseeds (+67%); and fiber plants (+123%). Turkey is a key cereal supplier to the Middle East and of several edible nuts and dried fruits in the global markets (hazelnuts, sultanas, dried apricots and dried figs, mainly). Fertilizer and labor costs will be at the core of farming costs in 2022, especially for labor-intensive crops such as stone fruits, hazelnuts, grapes and figs. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Fertilizers: 120% year-on-year growth in November 2021, due to the combination of rising international prices and lira devaluation. Fertilizer imports reached 4.8 million tons valued at $1.99 billion in 2021, 11% more year on year in volume and 78% more in value.

- Labor costs rose by 30% y/y. in November 2021.

- Energy (oil, gas and electricity) and lubricants: up 22% in November 2021.

- Pesticides: up 12% in November 2021.

- Seeds: up 9.5% in November 2021.

- Shared mobility company GoTo Global is going public on the Tel Aviv Stock Exchange (TASE) through a merger with Neratech Media. According to the deal, the newly formed company, to be called GoTo, will have a market value of USD163 million. GoTo Global shareholders will receive 74% of the merged company's stock and the remaining 26% will be held by Neratech shareholders. GoTo Global CEO Gil Laser said, "Transforming GoTo Global into a public company is a significant milestone in achieving our unique vision for shared mobility. People across the world are embracing shared mobility at a faster pace than ever before and city dwellers are becoming ever more multimodal. GoTo is perfectly positioned to help users embrace a true multimodal mobility experience in a simple and seamless way, all via one app. We believe in our product, our team and our dynamic way of doing things and look to continue creating added value for customers and shareholders alike." GoTo Global (also known as GoTo Mobility) is a mobility-as-a-service company that provides users with access to shared cars, dockless bicycles, and electric scooters through a single app. The firm started the service in 2008 and currently operates in Israel, Germany, Spain, and Malta. GoTo Global has 5,800 vehicles and over 450,000 subscribers, with nearly 3 million rides reported in 2021. (IHS Markit Automotive Mobility Surabhi Rajpal)

- According to data released by the Central Bank of Nigeria (CBN), credit to the private sector increased by 18.5% year on year (y/y) to NGN35.7 trillion (USD85 billion) in December 2021, compared with year-on-year private-sector credit growth of 13% in December 2020. The data also show that year-on-year credit to the government slowed to 10.7% in December 2021, compared with year-on-year growth of 30% in 2020. According to the Business Day, a local newspaper, the main beneficiaries of the loan extension was the oil and gas sector, accounting for nearly 16.2% of the total disbursed loans in September 2021, followed by manufacturing and commerce. (IHS Markit Banking Risk's Ana Souto)

- IHS Markit analysts expect a recovery of economic growth in Nigeria in 2022 because of a rebound in oil prices. The hydrocarbon sector is important to the economy given that energy receipts constitute close to 50% of Nigerian fiscal revenues and are the primary source of Nigerian export earnings.

- Nigerian banks are significantly exposed to the oil and gas sector, accounting for about one-fifth of the sector's total loans as of the end of June 2021 (when last reported). As a result, banks' credit risk profiles are vulnerable to oil-price volatility and the performance of the oil and gas sector. IHS Markit expects the global Brent oil price to average USD77 per barrel in 2022, compared with USD71 per barrel in 2021, which bodes well for the oil and gas sector.

- A portion of the increase in loan growth is also due to the inflated value of foreign-currency-denominated loans (accounting for 32.9% in September 2021) when converted to the local currency as a result of local currency devaluation pressures. Improved economic growth has supported loan growth in 2021 through the private sector's increased demand for credit and borrowers' strengthening debt-service capacity.

- The banking sector's non-performing loan ratio also reduced to 4.85% in December 2021, compared with 6.1% in the same period in 2020, because of more aggressive collection policies and forbearance measures instituted by the CBN to cushion banks from the coronavirus disease 2019 (COVID-19) pandemic, resulting in a moderated credit risk environment compared with 2020.

Asia-Pacific

- All major APAC equity markets closed higher; Hong Kong +2.1%, Australia/India/Japan +1.1%, and South Korea/Mainland China +0.8%.

- According to a joint statement issued by the People's Bank of China (PBoC) and the China Banking and Insurance Regulatory Commission (CBIRC) on 8 February, banks will no longer need to count loans to affordable rental real estate projects as part of their real estate lending target. (IHS Markit Banking Risk's Angus Lam)

- Chinese regulators normalized the real estate loan target for banks in September 2021, and banks have to meet a real estate lending target of between 12.5% and 40% of their total loans.

- The easing of loans to the real estate sector is not surprising considering that the regulators have previously asked banks to support the economy by lending more, and to also lower their short-term and medium-term loan prime rates (LPRs), which is a departure from only boosting lending to micro, small, and medium-sized enterprises and towards mortgages.

- IHS Markit has already noted that the rental market is likely to be a key area of lending in the real estate sector because of the central government's policy on establishing a rental market and supporting lower income individuals.

- Although the latest measure indicates easing of lending to real estate companies, we assess that it is not a complete opening up of lending to all types of real estate companies and will only be directed towards low-risk borrowers. This has been exemplified by the lending to state-owned real estate companies to acquire projects from weaker counterparts

- Tesla has excluded one of two electronic control units (ECUs) in the steering racks of some Chinese-made Model 3 and Model Y electric vehicles (EVs) to cope with microchip shortages, reports CNBC, citing two employees and company internal correspondence. This component reportedly is a secondary ECU in the electric power-steering system, which converts the movement of the steering wheel into turning of the wheels. Chinese media source Caijing reports that Tesla said the change poses no safety concerns as this secondary ECU is used primarily to support backup functions. Tesla did not disclose this change and it is unclear whether this is to be a temporary solution for the EV maker to cope with tight semiconductor supply or is part of an effort to lower production costs. However, CNBC reports that Tesla employees said adding "level 3" automated driving functionality, which would allow a driver to operate a Tesla vehicle hands-free without steering in normal driving scenarios, would require the dual ECU system and, therefore, require a retrofit at a service visit. Production at Tesla's Shanghai Gigafactory in China was 486,000 vehicles in 2021, accounting for more than half of Tesla's vehicle production globally. (IHS Markit AutoIntelligence's Abby Chun Tu)

- JMEV, an electric vehicle (EV) joint venture (JV) between Renault and Jiangling Motors, will soon begin to export the Mobilize Limo EV to Europe. According to Autohome, the Limo EV, a mid-size sedan, will join Renault's mobility service fleet in Europe under the Mobilize brand. The model will have a driving range of 450 km under the Worldwide Harmonized Light Vehicle Test Procedure (WLTP). JMEV has yet to disclose the number of vehicles to be shipped to Europe this year. Specifications of the European-market models are also unknown. The model, badged in China as the Yi, is available in a single-motor front-wheel-drive version or a dual-motor four-wheel-drive version. The battery option includes a 47-kWh lithium-ion (Li-ion) battery and a larger 60-kWh Li-ion battery. The dual-motor versions with a 60-kWh battery are mostly likely to be leveraged for sale in Europe owing to these models' richer technology content, competitive power performance, and a long driving range of up to 450 km. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Hyundai Transys is to showcase its innovative future mobility seat concept at Lineapelle International Leather Fair in Milan, Italy, to be held on 22-24 February, according to a company press release. Hyundai Transys CEO Steve Yeo said, "The preview event provided us an opportunity to share our expertise and insights on sustainability efforts that have been under way for a long time. Starting with Lineapelle, Hyundai Transys intends to pursue carbon neutrality in all of its product development processes." Hyundai Transys is to unveil the company's vision for future mobility driving with a color-material-finish (CMF) concept seat model made from sustainable leather and other regenerative materials from tanning waste. The company is to debut the sustainable seat concept under the theme of 'Shift to Regenerative Mobility'. According to Hyundai Transys, the company collaborated with Italian leather tanneries, manufacturers, and Korean suppliers to envision the future mobility seat concept. Lineapelle is the leading world trade fair with a focus on leather and the leather industry. The event takes place twice a year, in February for the summer and September for the winter collections, at the Milan exhibition center. The event gathers over 1,200 exhibitors from 40 countries with more than 42,000 visitors, showcasing footwear, leather goods, garments, and furniture sectors, from over 100 countries. (IHS Markit AutoIntelligence's Jamal Amir)

- Vietnamese conglomerate Vingroup, the parent company of automaker VinFast, has reported a pretax loss of VND23.9 trillion (USD1.05 billion) in the manufacturing segment during 2021, reports the Nikkei Asia. The loss may be attributable to poor sales of ICE vehicles in Vietnam and growing investments in the company's battery electric vehicle (BEV) business. Sales of VinFast's ICE vehicles last year grew by 21% year on year (y/y) to around 36,000 units. Despite this, the group's assembly plant in Hai Phong, Vietnam, which began operations in 2019, is operating far below its production capacity of 250,000 vehicles per annum. Vingroup is downsizing its manufacturing segment operations drastically, which consists mostly of auto production. In May 2021, Vingroup said it planned to stop making smartphones and televisions. The group's losses in manufacturing have expanded more than 70% from 2020, highlights the report. Regarding Vingroup's overall financial performance, the conglomerate reported a consolidated net loss of around VND7.5 trillion last year, compared with a VND4.5-trillion profit in 2020. This was the first time that the conglomerate reported a net loss. The group's property sales remain a cash cow. However, the group's woes in the manufacturing segment were added to by its slumping hotel business, which has taken a hit from the COVID-19 virus pandemic. (IHS Markit AutoIntelligence's Jamal Amir)

- Southeast Asia will become a melamine producing region in 2024 again, once Malaysia's state-owned oil and gas producer Petronas completes its new melamine plant, OPIS data indicates. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Petronas Chemicals Group plans to build a 60,000 mt/yr plant in the town of Gurun, within Peninsula Malaysia's state of Kedah.

- With targeted commercial production by 2024, this plant will make Petronas the only melamine producer in Southeast Asia once it comes on-stream, the company said in January.

- According to OPIS records, Malaysia is not the first country in the region to produce melamine. Indonesia once hosted two melamine plants, but both are no longer operational. Sri Melamin Rejeki (SMR), the oldest melamine producer in Indonesia, ceased production in November 2008, amid lawsuits over unpaid bills for feedstock, according to part-owner and urea supplier Pupuk Sriwidjaja Palembang in 2013. Based in South Sumatra's Palembang City, SMR had a capacity of 20,000 mt/yr, and was operational from 1994 to 2008.

- DSM Kaltim Melamine was a newer melamine plant that began production in 1997, but eventually ceased production in 2013. The 60,000 mt/yr plant endured prolonged shutdowns as far back as in 2008.

- Petronas sees the melamine project as a way to add value to its existing products such as urea, methanol, polyolefins, and others. The company said it will use urea produced by its subsidiary, Petronas Chemicals Fertiliser Kedah (PCFK), as feedstock to produce melamine.

- Melamine is commonly used in tableware, and in building and construction.

Posted 09 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.