All major US equity indices closed at new all-time highs, while most European markets were lower and APAC was mixed. US government bonds closed mixed and the curve continued to flatten, while benchmark European government bonds closed lower. CDX-NAIG and iTraxx-Europe closed flat, while CDX-NAHY and iTraxx-Xover were slightly wider on the day. Oil, copper, silver, and gold closed higher, while the US dollar and natural gas closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher and at new all-time high closes; DJIA +0.7%, Russell 2000 +0.2%, and S&P 500/Nasdaq +0.1%.

- 10yr US govt bonds closed +5bps/1.50% yield and 30yr bonds flat/1.89% yield.

- CDX-NAIG closed flat/49bps and CDX-NAHY +2bp/289bps.

- DXY US dollar index closed -0.3%/94.05.

- Gold closed +0.6%/$1,828 per troy oz, silver +1.6%/$24.54 per troy oz, and copper +1.3%/$4.40 per pound.

- Crude oil closed +0.8%/$81.93 per barrel and natural gas closed -2.2%/$5.51 per mmbtu.

- U.S. manufacturers said the new $1 trillion infrastructure bill will support years' worth of public works projects that will create demand for maintenance equipment and construction supplies, and potentially push prices higher. Manufacturers expect to also benefit from having refurbished and expanded ports, airports and roads in place, executives said, easing some long-running bottlenecks and helping companies move parts and products more efficiently. (WSJ)

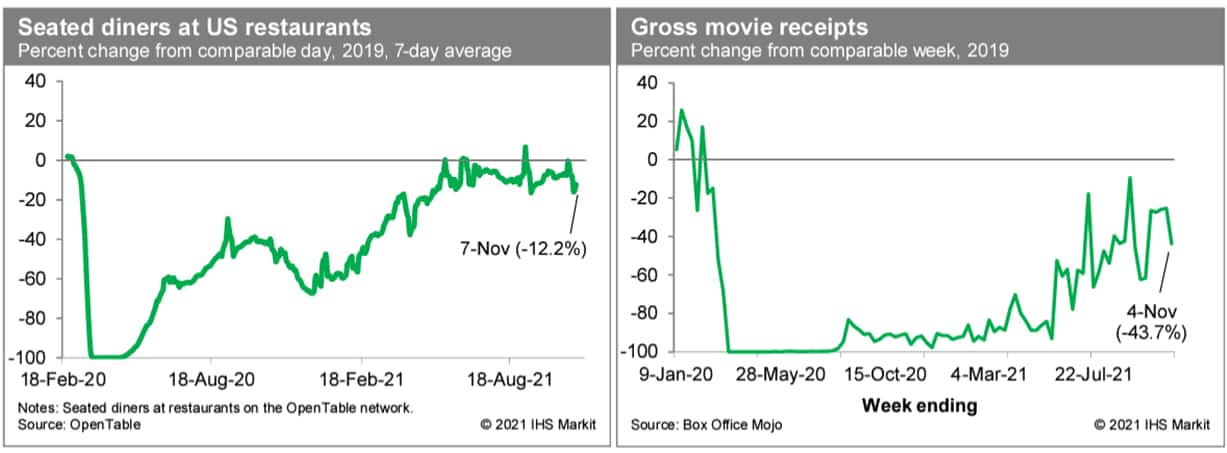

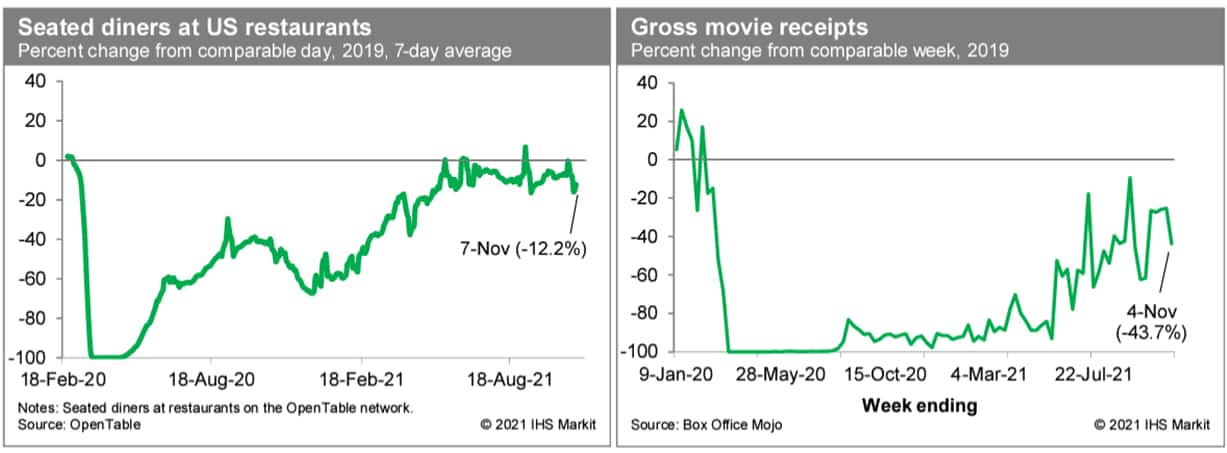

- Averaged over the last seven days, the count of US seated diners on the OpenTable platform was 12.2% below the comparable period in 2019. This was in line with what has been a broadly flat trend since early summer. At least by this measure, the recovery in restaurant activity remains stalled just short of full recovery. Meanwhile, box-office revenues last week were 43.7% below the comparable week in 2019. This was down from the prior few weeks and in line with what has been an uneven and lagging recovery. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Municipal bond buyside activity remains intact following last week's calendar which supplied $8.6 billion, offering investors an array of state and local government credits with a noteworthy supply of Texas paper housed throughout the curve. Demand for new issue paper was stable across last week after the Texas Public Finance Authority (-/AAA/AAA/-) sold $832million of general obligation refunding bonds with the 10/2031 maturity falling +40bps spread to the 10YR UST, providing investors a yield of 1.94%. The State Public Works Board of the State of California (Aa3/A+/AA-/-) also tapped into the primary arena to offer $563 million of lease revenue bond across two series spanning 11/2022-11/2041 with ESG focused investors suppressing yields given strong demand with the 11/2046 maturity landing at a 1.93 yield falling +43bps off the interpolated MAC curve. This week's holiday-shortened calendar is slated to return to double digit levels despite a market closure on Thursday for Veterans Day, with $10.4 billion spanning across 208 new issues. The District of Columbia, Washington D.C. (Aaa/AA+/AA+/-) will lead the negotiated calendar offering $655 million general obligation bonds spanning across two series with maturities ranging from 02/2024-02/2046. The Dallas Area Rapid Transit (Aa2/AA+/-/AAA) will also come to the negotiated market to sell $579 million taxable senior lien sales tax revenue refunding bonds spanning across 12/2022-12/2048 tomorrow 9 November, senior managed by RBC. This week's competitive calendar will span across 104 new issues for a total of $2.95 billion with the State of California (Aa2/AA-/AA) leading the auction schedule across three separate various purpose general obligation tranches spanning 10/2022-10/2037 for an aggregate total of $1.25 billion. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- On November 4, Desert Marble Solar LLC notified the Public Utility Commission of Nevada that it has applied with the US Bureau of Land Management (BLM) for approval of the Desert Marble Solar Project. This project would consist of a 500-MW (ac) photovoltaic solar facility, a 500-MW battery energy storage system, a two-mile, 345-kV generation-tie line and associated facilities to be located in Humboldt County, Nevada. This project would interconnect to the grid at the North Valmy Substation. The company said it will apply with the Commission for approval of a permit or permits for this project after it clears BLM's environmental review process. The project would be located on 6,980 acres of federal land, thus the need for the BLM approval. The company said it anticipates a project construction start in January 2023, with commercial operation in December 2024. (IHS Markit PointLogic's Barry Cassell)

- Lawmakers in the United States have passed a new infrastructure investment bill, including USD7.5 billion in federal funding for a national network of electric vehicle (EV) chargers. The bill is due to go to President Joe Biden for it to be signed into law. Every expectation is that the president will sign the bill. The bill includes planned US public investment in infrastructure in a number of sectors, with several of the investments particularly relevant to the auto industry. Relative to road infrastructure, the plan includes USD110 billion in additional federal funding for repairing roads and bridges, additional to the traditional funding mechanism already budgeted for this purpose. The USD110 billion is less than the USD159 billion the president had proposed, and the figure has several subcomponents. There is an element in the funding plans for public transportation, including USD39 billion of new investment to modernize public transportation, a figure also less than the amount - USD80 billion - initially proposed. According to the president's statement, "The new investments and reauthorization in the Bipartisan Infrastructure Deal provide USD89.9 billion in guaranteed funding for public transportation over the next five years." The bill maintains a similar level of funding to upgrade airports, ports, and waterways, particularly relevant during the current supply-chain issues, with USD17 billion for port infrastructure and USD25 billion for airports. Relative to EVs, the proposed USD7.5 billion to support a national network of 500,000 chargers in the US was maintained. The bill also earmarks USD65 billion to rebuild the US electric grid, significant as the nation shifts to electricity for more energy needs. For the transition to EVs in the US, the USD7.5-billion funding for a charging network is the most significant element in the bill. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors' (GM's) Cruise has reportedly filed an application with the US state of California for a permit to charge fares for its robotaxi rides. Cruise requires approval from the California Public Utility Commission (CPUC) to transport passengers in its autonomous vehicles (AVs) without a test driver and charge for the service. Cruise's application requests a permit to deploy up to 30 AVs on designated public roads within San Francisco between 10 pm and 6 am at a top speed limit of 30 miles per hour, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ball Corporation, the world's leading provider of aluminum packaging for beverages, announced that its net sales rose to $10.14 billion in the first nine months, up from $8.68 billion in the same period of 2020. The corporation's net earnings increased to $581 million in Q1-Q3 2021, up from $355 million a year ago. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Demand for aluminum beverage packaging continues to outstrip supply across North America, according to Ball's third quarter results for 2021.

- The company's new Glendale, Arizona, facility successfully started up its fourth line during the quarter, and the new Pittston, Pennsylvania, facility started up its third beverage can production line late in the third quarter, said the company.

- Ball Corporation said that its additional capacity investments in Nevada and North Carolina will serve long-term committed volume with global and regional strategic customers serving all beverage categories.

- "Demand for our products and technologies continues to outstrip supply and our new facility start-ups are all on track or better relative to our plans," said John A. Hayes, chairman and chief executive of Ball Corporation in the company's Q3 earnings call.

- In the EMEA region, a packaging mix shift to sustainable aluminum cans continues, and demand is outstripping supply. "Intermittent supply chain disruptions across the region were effectively managed during the quarter," said the company.

- Ball added it expects that growing demand for aluminum beverage cans in the remainder of 2021 and beyond will be fully addressed with line speed ups and greenfield projects in the UK, Russia and Czech Republic.

- In Brazil, underlying demand for beverage cans remains strong and customer demand inflected upward in September and is expected to be strong throughout the busy fourth quarter summer selling season.

- Volkswagen (VW) has announced its investment plans for the Latin American region, aimed at positioning the automaker for sustained profitability with a EUR1-billion infusion through 2026. VW had signaled previously that a new round of funding for the region was in the works. Although the announcement provided broad details, the automaker has not yet given specific figures associated with the actions laid out. Among the important elements of the announcement is that the company is tailoring its solutions for the region. Although shifting to a zero-emissions future is VW's overall plan, achieving this in emerging markets will take significantly more time, and the plan recognizes that. It has been difficult for most manufacturers to achieve profitability in the Brazilian and South American markets in recent years, prior to the impact of the COVID-19 pandemic. However, VW's strength in the region is an advantage and provides a basis to continue its efforts on profitability in Latin America. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- Most major European equity indices closed lower except for France +0.1%; UK -0.1%, Germany -0.1%, Italy -0.3%, and Spain -0.7%.

- 10yr European govt bonds closed lower; Italy/UK +1bp, Spain +2bps, France +3bps, and Germany +4bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -3bps/240bps.

- Brent crude closed +0.8%/$83.43 per barrel.

- Ocean Winds will create EUR300m 'gateway' for the establishment of steel fabrication industry for offshore wind in Scotland by using one of its ScotWind bids. The company is looking for a global steel fabricator to establish a quayside fabrication facility for large diameter steel turbine components at the site in Scotland. The joint venture between EDPR and ENGIE has outlined a proposal to make its bid for 1.8GW Hebridean offshore windfarm in Scotland W1 plan site a 'special case' to facilitate this investment. They plan to construct the 1.8GW site using XXL monopiles, creating a major market opportunity for large diameter steel section, both for towers and foundations. This investment offered by Ocean Winds is in addition to the previously announced bids for floating offshore projects. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Aker companies, Aker Offshore Wind and Aker Clean Hydrogen, have unveiled the massive 10 GW Northern Horizons floating offshore wind project to power floating hydrogen production platforms. The green hydrogen produced will then be sent onshore to a net-zero refinery where a range of products including ammonia, liquid hydrogen and synthetic fuels will be produced for local consumption and export. The floating wind site has been revealed to be 130 kilometers from the Shetland Islands, United Kingdom. The companies are cooperating with DNV, and in discussions with authorities and businesses to mature the project towards a future investment decision. The announcement from Aker comes shortly after Aker Offshore Wind, in partnership with Ocean Winds, submitted up to 6 GW of capacity in bids for the ScotWind leasing round. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The accelerated spread of the highly pathogenic avian flu (HPAI) in Europe has seen France raise its alert level to the highest level in hopes it can prevent damage to the country's agriculture sector. On 5 November, French Minister of Agriculture and Food Julien Denormandie placed the country at "high" risk following the "rapid progression" of the avian influenza virus across Europe. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- A first increase in the level of risk occurred on 10 September, leading to the implementation of a set of reinforced biosecurity measures in municipalities classified as at risk.

- Raising the risk level to 'high' will now see the introduction of more prevention measures throughout its territory, including the sheltering of poultry on commercial farms, in particular for free-air farms.

- The aim of these actions is to ensure a high level of protection against the risk of introducing the virus into farms. These measures will be accompanied by daily clinical surveillance on all farms while in areas at high risk, pre-movement samples will be taken and only people essential to the operation of the farms will be allowed to enter. Density reductions in areas affected by previous crises are also underway, the ministry added.

- Envision AESC is said to be scaling back the planned size of its new French battery factory, reports Bloomberg News. In a document posted on the Centre National de Documentation Pédagogique's (CNDP)'s website, the company said that the project that it is developing for Renault Group will now have an annual production capacity of 30 GWh or more by 2029 against its original proposition of 43 GWh. The head of the project for Envision, Ayumi Kurose, told journalists that the move was related to a decision to build the facility on a car park alongside the automaker's Douai (France) site rather than a woodland area that is a habitat for wildlife. He added, "It would have been complicated to build a battery factory in that zone." The documents that have appeared on the CNDP's website have also given additional details with regard to the project. Apart from confirming that production in the initial phase will begin at the end of 2024 with an initial capacity of 9 GWh reserved for Renault Group, Envision has also revealed that initial investment will stand at EUR800 million and that as many as 1,200 people will be employed at the facility, which will be 90% automated. Plans for the new battery facility were announced in June after Renault Group revealed plans for its ElectriCity project, which will take place in the Douai, Maubeuge (France) and Ruitz (France) facilities, core locations for its vehicle electrification strategy. (IHS Markit AutoIntelligence's Ian Fletcher)

- Based on State Secretariat for Economic Affairs (SECO) data, Swiss seasonally adjusted unemployment again declined sizably by 4.1% month on month (m/m) to 123,182 in October. In addition, September's level was revised down by around 600. The mid-2019 cyclical low point of around 104,000 unemployed is likely to be regained by late 2022. (IHS Markit Economist Timo Klein)

- The seasonally adjusted unemployment rate declined anew from 2.8% to 2.7%, which is already below the level of March 2020 when the pandemic started to have an impact. The unemployment rate had been very steady at a 17-year low of 2.3% throughout 2019 before rising to an interim peak of 3.5% in May 2020. Thus, two-thirds of the pandemic-related spike has now been retraced.

- Among other labor market indicators, seasonally adjusted job vacancies slipped marginally by 0.1% m/m to 55,427 in September, with the level in August being revised down by 0.3%. Although this is twice as high as its pandemic-induced nadir of 26,731 in May 2020 and about 55% higher than its pre-pandemic level in late 2019, vacancies now appear to be levelling off.

- The data regarding short-time workers (unadjusted for seasonal variations), which always lags by two months, also show a much smaller improvement than in July. In August, the number of short-time workers declined by 11.9% m/m to 60,000, roughly 6% of its peak level of 1,077,000 in April 2020 and below its peak level in May 2009 (92,000) in the wake of the global financial market crisis. However, the pre-pandemic (February 2020) level of just 5,000 remains far off.

- Aker Offshore Wind, Ocean Winds, and Statkraft have collaborated under an agreement to bid for, develop, construct, and operate a floating offshore wind farm and associated infrastructure which will cover Utsira Nord license area in Norway. Utsira Nord is a large area, closer to land and can facilitate both demonstration projects and larger projects. This area holds potential for floating wind power. All three companies under equal partnership will apply to the Norwegian authorities for the development of a commercial scale floating offshore wind farm in the Utsira Nord license area, Norwegian North Sea. Aker Offshore Wind individually has partnered with Ocean Winds for projects in California, USA, South Korea, and most recently in Scotland and also with Statkraft for the Sørlige Nordsjø II area in Norway. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- A press release on 3 November indicated that Sberbank Europe has signed a sale agreement with privately owned AIK Bank in respect of its Serbian unit. Additionally, Sberbank Europe has also signed an agreement with AIK Banka, Beograd, Gorenjska Banka, Kranj, and Agri Europe Cyprus Limited (all three entities are reportedly owned by Serbian entrepreneur Miodrag Kostić) to sell its subsidiary units in Bosnia and Herzegovina, Croatia, Hungary, and Slovenia. Russian-owned Sberbank said that it is a strategy in order to "reduce its geographic presence in CEE [Central and Eastern Europe] in order to focus on key markets and explore new business models". The closing of the transaction is subject to approvals by national and international regulators and by national competition authorities and is expected to take place in 2022. (IHS Markit Banking Risk's Natasha McSwiggan)

- Serbia's banking sector has undergone structural changes in 2021, with Austria's Raiffeisen Bank International's acquisition of Crédit Agricole's Serbian unit in August and the merger between Eurobank's Serbian banking unit and Direktna Banka. As previously assessed, this trend reflects an appetite for existing banks in the sector to expand further and for smaller banks to undergo consolidation into larger entities.

- Further consolidation is likely to be encouraged by small banks in Serbia, which are facing increased pressure from tighter lending conditions; credit growth continued to slow for the fifth consecutive quarter in the third quarter of 2021 to 6.4% year on year (y/y).

- Namibian Finance Minister Ipumbu Shiimi presented the FY 2021/22 mid-year budget policy review and the 2022/23-2024/25 Medium Term Expenditure Framework (MTEF) to parliament on 3 November. He said Namibia's FY 2021/22 national budget deficit is likely to be 8.6% of GDP - in line with original budget projections. Although the government is expected to record a state revenue overrun during FY 2021/22, higher government spending commitments are expected to absorb the tax windfall. (IHS Markit Economist Thea Fourie)

- The NAD1.5-billion (USD100-million) government revenue budget overrun assumed for FY 2021/22 stems primarily from higher personal income tax proceeds, mineral royalties, dividends from state-owned entities, and income raised through fishing quotas. Namibia's spending ceiling was raised simultaneously to USD69.7 billion, from NAD67.9 billion previously. "The proposed reallocations are primarily to address underbudgeting on personnel expenditure, utilities and other spending items across Budget Votes and to meet resource shortfalls at Health and Social Services as a result of the third wave of COVID-19," the Namibia government reported.

- Government spending commitments remain broadly unchanged at NAD68 billion over the MTEF period. Government revenue is expected to recover, in line with stronger economic recovery, but a slow recovery in Southern African Customs Union (SACU) proceeds is expected to remain a drag on Namibia's overall fiscal finances.

- The MTEF suggests that the fiscal deficit will trail down to an estimated 3.0% of GDP by FY 2024/25, from an estimated 7.4% of GDP in FY 2022/23. Public-sector debt is expected to peak at 74.2% of GDP in FY 2022/23.

Asia-Pacific

- Major APAC equity indices closed mixed; India +0.8%, Mainland China +0.2%, Australia -0.1%, South Korea -0.3%, Japan -0.4%, and Hong Kong -0.4%.

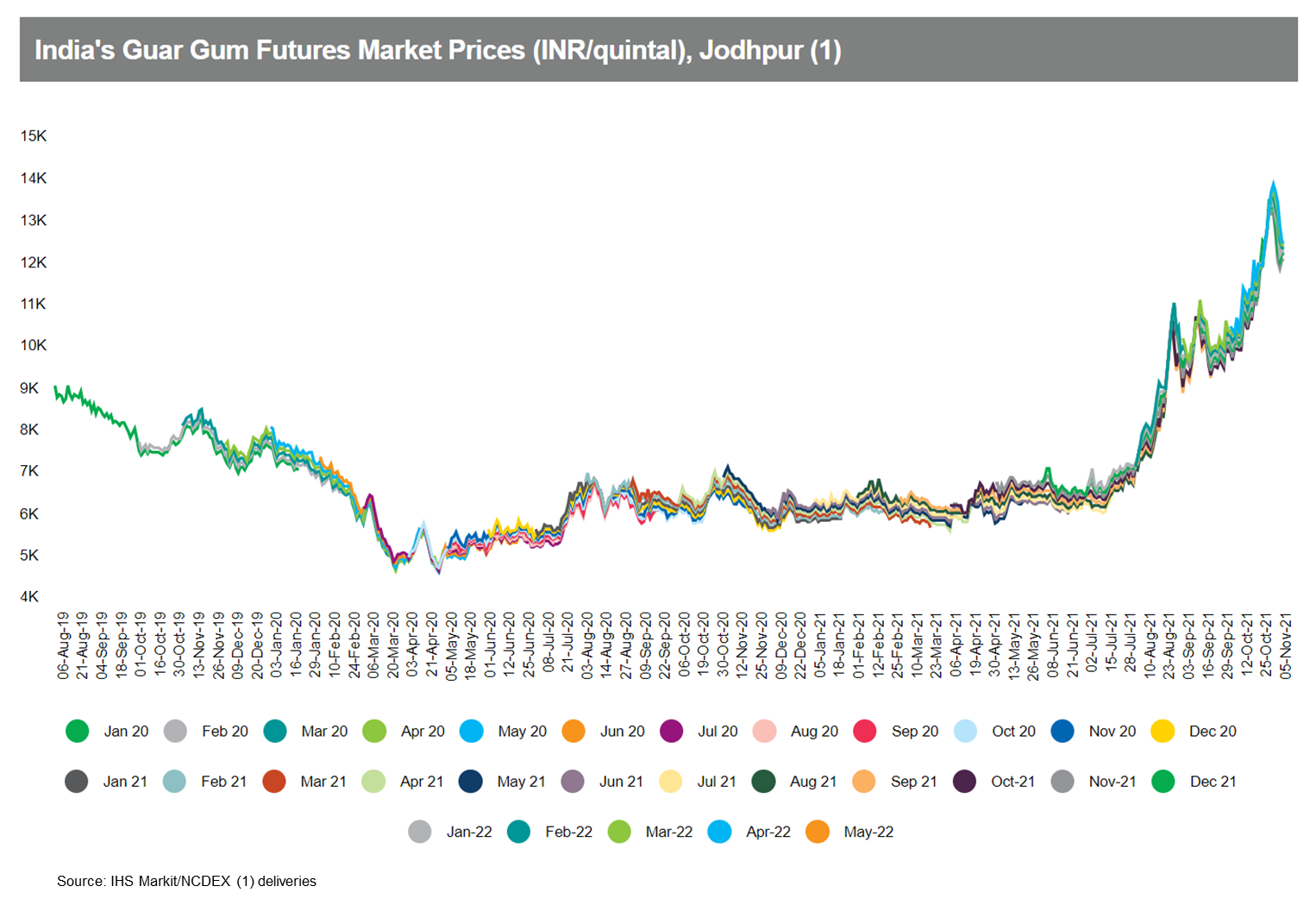

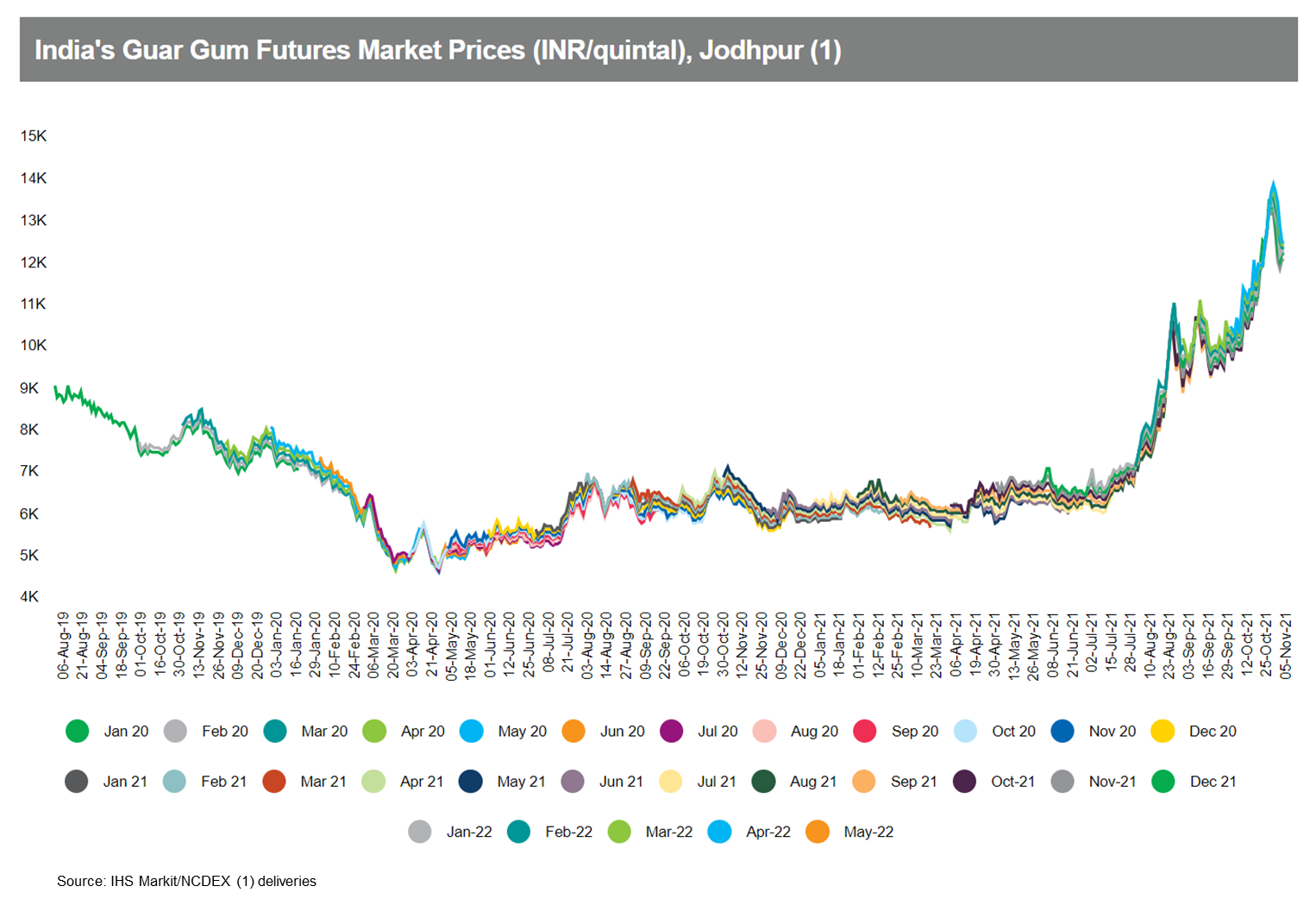

- India's guar gum spot price was INR11,900 per quintal ($160.1/quintal) at the Jodhpur wholesale market on 03 November, 20% more m/m although below the level of INR13,446/quintal reached on 29 October. Indian exports fell by 1% y/y in volume to 138,000 tons and fell by 6% in value to $178.0 million from January-August 2021. The US, Russia and Germany accounted for 29%, 15% and 13%, respectively, of the total exported volume. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- The urban air mobility division of Hyundai Motor Group has expanded its airspace management consortium with the addition of three new members, according to a company statement. Skyroads, Altitude Angel, and OneSky will join the consortium to contribute strategic insight into the auto group's concept of operations for Advanced Air Mobility (AAM) airspace management and ground mobility integration. Pamela Cohn, global chief operating officer and US general manager of the urban air mobility division of Hyundai Motor Group, said that, "Expanding digital infrastructure to accommodate new modes of aerial mobility is a challenge given all of the disparate airspace operating standards and geographies involved. It's important we convene diverse parties, such as Skyroads, Altitude Angel and OneSky, to explore safe and efficient integration of AAM and, more broadly, equitable access to airspace." The consortium was launched in June to serve as a resource for the AAM industry and policymakers as they work towards defining common operating and design standards that support industry development. Hyundai plans to create a platform dedicated to urban air mobility (UAM) and introduce passenger and cargo air vehicles in 2028. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai is considering returning to the Japanese market with electric vehicles (EVs) and fuel-cell electric vehicles (FCEVs), after it exited the market 13 years ago, reports The Korea Economic Daily Global Edition. The automaker is thoroughly reviewing the re-entry into Japan, said Hyundai president and CEO Chang Jae-hoon in an interview with Nikkei Business, adding, "we plan to decide in consideration of external circumstances such as market conditions, as well as the company's internal situations". "We are checking what competitiveness the hydrogen-powered Nexo and the EV IONIQ 5 have (compared to similar models) and reviewing their sales channels," said Jae-hoon. The automaker is also considering introducing fuel-cell buses for corporate demand. Hyundai entered the Japanese passenger vehicle market in 2001 but withdrew in 2009 on account of low demand. The automaker sold only about 15,000 passenger vehicles in the country during the period. (IHS Markit AutoIntelligence's Jamal Amir)

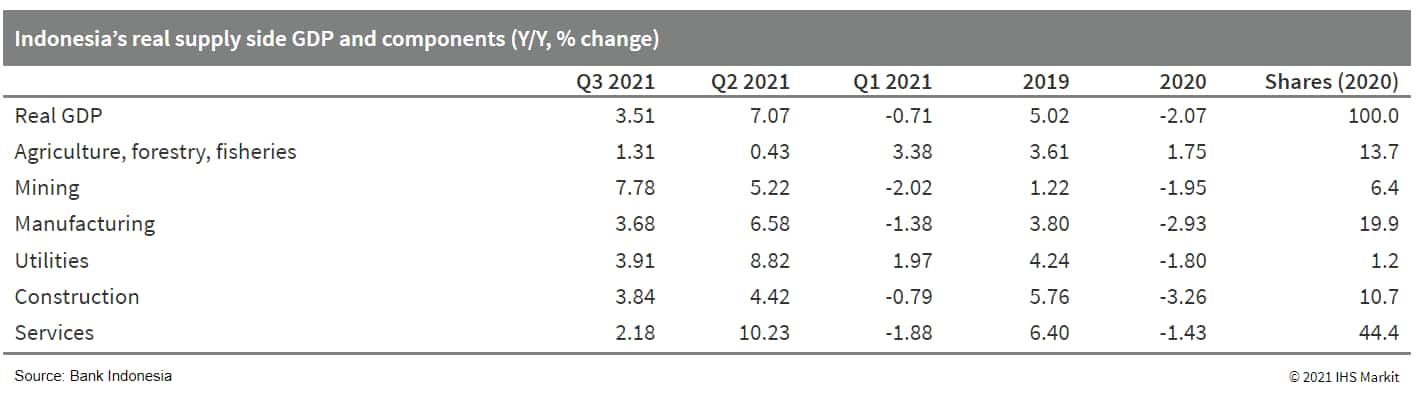

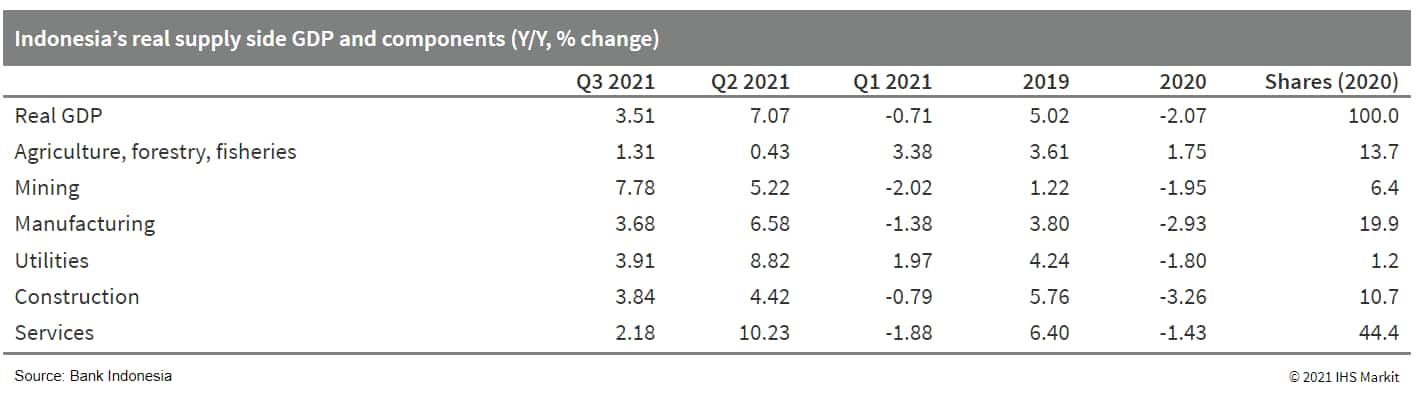

- Indonesia's real GDP growth slowed to 3.51% year on year (y/y) in the third quarter of 2021, down sharply from the 7.07% y/y expansion recorded in the third quarter of 2020 as the Delta-variant-driven wave of the COVID-19 infections triggered a significant ramping up of containment measures. With the measures easing, a strong rebound is likely in the current quarter, although weakness in the labor market is a constraint. (IHS Markit Economist Bree Neff)

- The pace of economic growth halved between the second and third quarters of 2021, because of the implementation of stricter micro-level public activity restrictions (known locally as PPKM), in response to the quick acceleration in the number of COVID-19 infections as the Delta variant took hold.

- The fact that key industrial sectors such as manufacturing and construction were able to operate during the enhanced PPKM measures, even if at a reduced capacity, was important to sustaining household incomes and spending during the quarter and limited the retrenchment. Growth in mining output was additionally critical to export growth and strong trade surpluses during the quarter.

- Fixed investment activity proved more robust than anticipated during the quarter, although the pace of growth slowed across the board, and real investment spending is still down by 6.6%, below the level recorded in the fourth quarter of 2019. Nevertheless, investment could have fared worse with building investment managing to expand by 3.4% y/y, and spending on machinery and equipment expanding by 11.5% y/y in real terms.

- The Philippine Deposit Insurance Corporation (PDIC) issued a press release on 5 November, stating that the PDIC and the Bangko Sentral ng Pilipinas (BSP), the Cooperative Development Authority, and the Philippine Competition Commission have all signed the "Memorandum of Agreement on the Procedures for Applications for Mergers, Consolidations, and Acquisition of Banks". Under the agreement, the four regulators will reduce the number of administrative requirements for banks involved in M&A. Chief among them is the reduction in the number of documents required for M&A from 58 to 30, with the aim of reducing the application processing time from 160 days to 55 days. (IHS Markit Banking Risk's Angus Lam)

- IHS Markit is not aware of any major M&A activities between Philippine and foreign banks in the last two years and, as such, it is likely that the latest memorandum is catered towards local M&A efforts.

- The last M&A announced was between the state-owned Land Bank of Philippines and the United Coconut Planters Bank; the merger was approved by President Rodrigo Duterte under an executive order in June.

- In the Philippines, banks with different sizes exhibit different financial stability indicators: the largest type, i.e. universal and commercial banks, has the best performance indications, with a non-performing loan (NPL) ratio of 4.1% in August, and their NPL coverage ratio is nearly 90%. However, smaller banks have a starkly different set of performance indicators, with an NPL ratio of 13.7% for rural banks and 17.7% for co-operative banks; their coverage ratio for bad loans stood at 59% and 57%, respectively, in June.

Posted 08 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.