All major European and most APAC equity markets closed higher, while US markets closed mixed. US government bonds sold off for the fourth consecutive day, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed almost flat across IG and high yield on the day. The US dollar and oil closed higher, while gold, silver, and copper were lower on the day. Today's December US non-farm payroll reported the first net loss of jobs since April, mirroring a trend initially reported in Wednesday's ADP private employment report.

Americas

- US equity markets closed mixed; Nasdaq +1.0%, S&P 500 +0.6%, DJIA +0.2%, and Russell 2000 -0.3%.

- 10yr US govt bonds closed +4bps/1.12% yield and 30yr bonds +2bps/1.88% yield, which is +20bps and +23bps week-over-week, respectively.

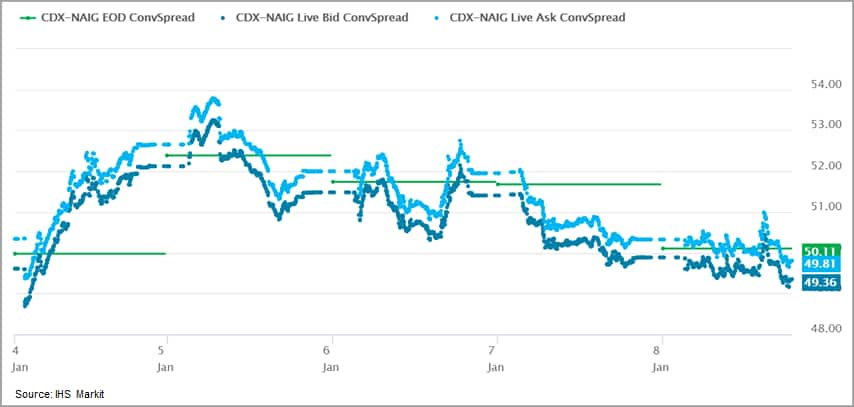

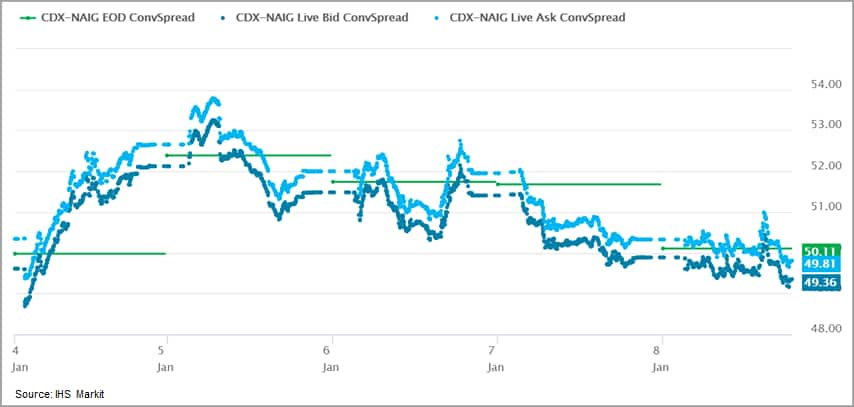

- CDX-NAIG closed flat/50bps and CDX-NAHY -2bps/292bps, which is flat and -1bp week-over-week, respectively.

- The DXY US dollar index closed +0.3%/90.10

- Gold closed -4.1%/$1,835 per ounce, silver -9.6%/$24.64 per ounce, and copper -0.8%/$3.67 per pound.

- Crude oil closed +2.8%/$52.24 per barrel, which is the highest close since 21 February and +7.7% on the week.

- US nonfarm payroll employment declined 140,000 in December, the first decline so far in the recovery. Private payrolls declined 95,000, and government payrolls declined 45,000. The unemployment rate was unchanged at 6.7%, the first flat reading so far in the recovery. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- An unexpected 51,000 decline in state and local government employment lowered our forecast of first-quarter GDP growth 0.1 percentage point to 2.3%; our estimate of fourth-quarter GDP growth remains at 2.9%.

- The decrease in employment in December was more than accounted for by a sharp 372,000 decline in employment at food services and drinking places. Surging COVID-19 cases over November and December led many local authorities to tighten restrictions on restaurants, and cooling temperatures are limiting opportunities for outdoor dining.

- Employment within amusements, gambling, and recreation services—industries where social distancing presents a challenge—also took a hit in December, as did employment in educational services.

- There were bright spots in the December report. Employment in construction and manufacturing continued their steady recoveries. Still, in December, payroll employment was 9.8 million below the February peak and even further below what had been a firming trend.

- Average hourly earnings jumped 0.8% in December, as the loss of lower-paying jobs boosted the average wage rate across those remaining.

- The December employment report is a preview of where the labor market was headed in the absence of further fiscal stimulus. In our forecast, job gains will resume in January, as the second round of fiscal stimulus begins to filter through the economy.

- President-elect Joe Biden on Friday called for trillions of dollars in immediate further fiscal support, including increased direct payments, after a surge in coronavirus cases caused U.S. payrolls to drop for the first time since April. (Bloomberg)

- Outstanding US nonmortgage consumer credit rose $15 billion to $4.18 trillion in November after a $5 billion increase in October. (IHS Markit Economist David Deull)

- The 12-month change in outstanding consumer credit rose 0.2 percentage point to 0.5%.

- Revolving (mostly credit card) consumer credit posted another negative month, falling $1 billion after a cumulative $119 billion decline during the prior eight months. The 12-month change in this category was -9.6%.

- Nonrevolving credit jumped $16 billion in November, and its 12-month growth rate edged up 0.1 percentage point to 4.0%. This category includes student and auto loans, and the growth of these types of obligations has remained steady.

- The ratio of nonmortgage consumer credit to disposable personal income rose 0.4 percentage point to 24.2% as incomes fell in November amid waning fiscal support.

- During the COVID-19 pandemic, reduced opportunities to spend, less willingness to finance spending with debt, and fiscal stimulus have combined to drive down the level of outstanding revolving consumer credit. The new round of fiscal stimulus passed on 27 December, which includes enhanced unemployment benefits through mid-March and $600 "economic impact payments" for qualified Americans, will boost incomes in January and cause a smaller repeat of this phenomenon.

- Apple could launch an autonomous vehicle within five to seven years, according to a Bloomberg report, citing "people with knowledge of the efforts". Bloomberg reports that its sources confirmed that Apple has a small team of hardware engineers developing the car's autonomous drive systems, interior, and external body design, and the company plans to ship a vehicle eventually. In the past, Apple had reportedly focused its program on creating the underlying autonomous drive system, an approach that Waymo and Argo AI are focused on. Bloomberg says that some Apple engineers on the project believe the company could release a product in five to seven years. These sources also reportedly stated that the vehicle is nowhere near ready for production, and the timeline could change. Bloomberg also reports that most of the team is either working from home or only coming into the office for short periods, and that those conditions are slowing progress on the project. Apple has declined to comment on the matter, Bloomberg reports. Apple's autonomous car project has been watched closely for several years, and Apple seems to have changed its approach several times. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The US garlic harvest concluded in the second half of November and yield is expected to be 20%-22% lower than the initial estimate as weeds have impoverished soil quality and due to labor restrictions as a consequence of Covid-19 pandemic, Olam Spices reported in its latest market update. Olam forecasts a 15% price rise in dehydrated garlic due to less available fresh product. Chinese farms have complete garlic planting. The planted area ranges from 5-5.2 million mus (333,000-346,000 ha). As a result, the 2020-21 fresh garlic crop may range from 4.8-6.2 million tons, depending on the weather. Dehydrated garlic carry-over stocks are around 335,000 tons. Olam forecast a price fall in Q2 if China's output is above 6 million tons and a rise in case the production is below 5 million tons. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Canadian net employment decreased 62,600 positions in December and the jobless rate edged up to 8.6%. Given stricter restrictions amid the rapidly rising COVID-19 cases, new employment fell for the first time since April 2020. The decrease was largely led by accommodation and food services and by information, culture, and recreation, which declined for the third consecutive month. (IHS Markit Economist Chul-Woo Hong)

- Fulltime employment climbed by 36,500 positions while part-time employment fell by 99,000 positions, which was the second consecutive decrease largely owing to re-imposed pandemic restrictions.

- The goods-producing industry added 11,300 positions while services-producing industry employment retreated 74,000.

- The labor force participation rate inched down to 64.9%, and total hours worked edged down and fell to 5.3% below February's pre-pandemic level.

- Employment growth will solidly rebound in 2021 with the unemployment rate improving to 8.0%.

- Regionally, net jobs decreased in all provinces except for British Columbia edging up in the month. The job losses were concentrated in regions where stricter restrictions were imposed before or during the Labor Force Survey period, which include Nova Scotia, Alberta, Quebec, Ontario, and Prince Edward Island. As a result, the unemployment rate solidly increased in Nova Scotia (up by 2.2 points to 8.6%), Ontario (up to 9.5%), Manitoba (up to 8.2%), and Saskatchewan (up to 7.8%).

- Mexico's annual inflation at the end of 2020 amounted to 3.15%, well within the Bank of Mexico (Banco de México: Banxico)'s target. Average consumer prices increased by 0.38% in December. Despite low inflation and a deep recession, the central bank may not cut the policy rate further; it targets inflation at 3.0% +/- 1 percentage point. (IHS Markit Economist Rafael Amiel)

- The consumer price index increased by 0.38% in December, well below the usual inflation for the last month of the year, which has averaged 0.54% in the past 10 years.

- During 2020, relatively high inflation in the food and beverages sector was partially offset by low inflation in services; lockdowns and other restrictive measures that preclude face-to-face interactions have reduced significantly demand for services. Supply-chain issues increased the cost of food and beverages, but demand was relatively inelastic, causing prices to increase more rapidly.

- Core inflation, which excludes goods with volatile prices such as agricultural products and energy-related items, amounted to 3.8% in 2020. Agricultural products' higher prices (up by 4.0%) were only partially offset by the decline in energy prices and tariffs regulated by the government (down by 0.8%).

- IHS Markit forecasts the economy to expand by 3.7% in 2021 after plunging by 9.0% in 2020. Although this implies a revival of demand, the rebound is only partial and should not impose upward pressure on prices; the output gap remains negative in our forecast.

- Moreover, the Mexican peso strengthened in the second half of 2020 after a sizeable overshooting in the earlier months. This will help consumer prices' stability.

- The Central Bank of Argentina, (Banco Central de la República Argentina: BCRA) on 6 January announced that it will keep an interest rate ceiling of 43% on refinanced credit card balances lower than ARS200,000 (USD2,350) per credit card. According to the BCRA, 95.5% of credit card balances could benefit from this measure. On larger balances, a higher limit will apply, related to the rates of personal loans and an extra 25-percentage-point ceiling. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- The announcement represents a continuation of the measures imposed in April 2020 to mitigate the effects of the coronavirus disease 2019 (COVID-19)-virus pandemic. One of the first response measures to the pandemic taken by the BCRA was to permit the refinancing of all credit card balances, allowing for a three-month grace period, followed by nine monthly instalments and a maximum interest rate of 43%. The new announcement extends the restructuring on all balances for most credit cards but increases the rate payable on larger balances.

- The measures have helped to maintain impairment at artificially low levels despite the 2020 economic deterioration, with IHS Markit estimating real GDP to have fallen by 11.4% in 2020.

- Given the relief measures in place, the credit card non-performing loan (NPL) ratio declined from 4.0% to 1.6% between September 2019 and September 2020, while the NPL ratio for the household sector fell from 4.6% to 2.7%. By contrast, corporate sector impairment rose from 5.0% to 6.2% over the same period.

- Despite the measure, as of October 2020, credit card loans were one of the few credit segments that grew in real terms, reaching 11.6% year-on-year growth, according to the BCRA, indicating that consumer demand has grown during the recession while bank standards have been lowered, increasing future asset-quality risks.

Europe/Middle East/Africa

- European equity markets closed higher; France +0.7%, Germany +0.6%, Spain +0.3%, and UK/Italy +0.2%.

- 10yr European govt bonds closed mixed; Italy -3bps, Spain -2bps, France/UK flat, and Germany +4bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -2bps/246bps, which is flat and +3bps week-over-week, respectively.

- Brent crude closed +3.0%/$55.99 per barrel, which is the highest close since 24 February and +8.1% on the week.

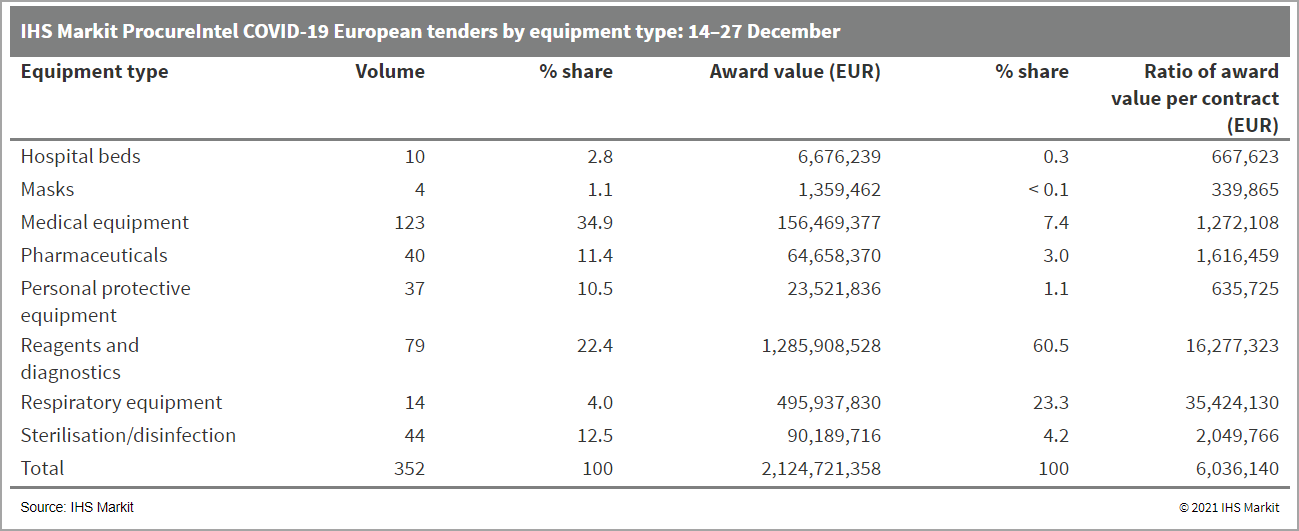

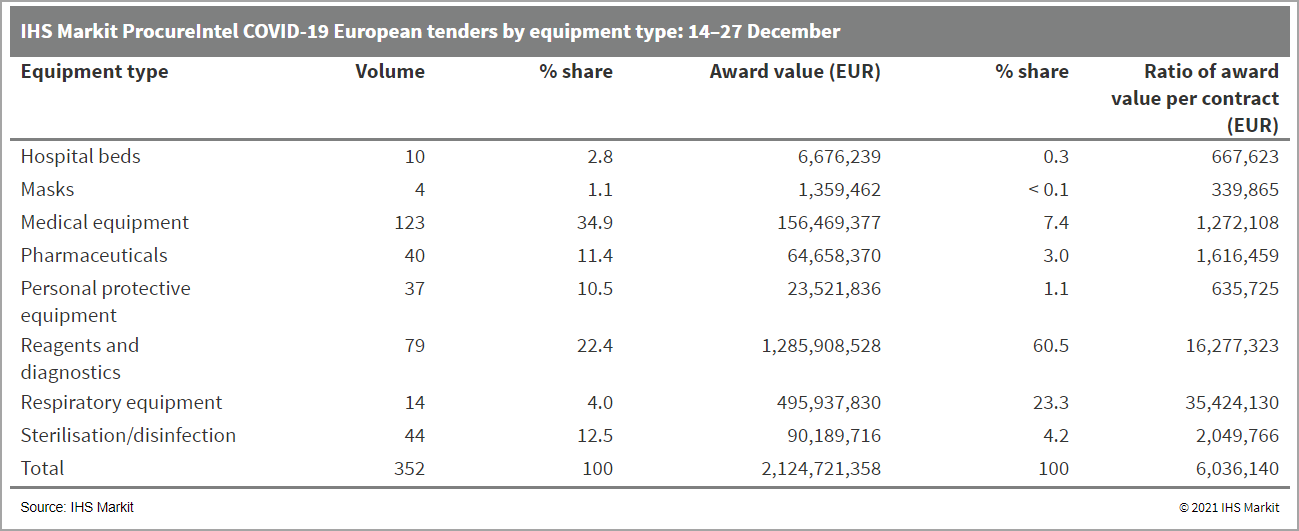

- IHS Markit analysis of European COVID-19-linked tender activity from 14 to 27 December shows that tenders were issued in 27 countries, as opposed to a typical weekly average of 22-23. The number of contract award notices stood at 160, while contract notices reached 192. One of the 352 tenders identified by IHS Markit ProcureIntel is a single open-procure, contract notice on behalf of Jamaica's social investment fund, with financial assistance provided by the EU's poverty reduction program, for reagents and testing equipment. This appears to be an example of EU funds and tendering assistance being used to facilitate the purchase of key equipment for non-European states. This is a one-off example at present, although this type of assistance by the European Union could become more frequent during 2021/22. The market from 14-27 December was strongly driven by demand for diagnostic services and reagents. The maximum potential value of contracts in this market segment reached EUR1.2 billion or the equivalent of 60% of the EUR2.1 billion in tendering activity registered by IHS Markit. Analysis shows that UK tenders in this field amounted to GBP1.0 billion (USD1.4 billion) or about 87% of all tenders for reagents and diagnostics that were published during 14-27 December. Respiratory equipment tenders (23%) were also more elevated than usual as a proportion of the value of all tenders registered and in overall potential value terms. (IHS Markit Life Sciences' Eóin Ryan)

- The European pig market has begun 2021 with prices at their lowest level since late 2009, as human and animal health issues continue to weigh on the market. Germany remains barred from key export markets in Asia because of the ongoing African Swine Fever outbreak in the east of the country. As of 7 January, a total of 461 cases have now been detected in wild boar carcasses in regions near the Polish border, and there is no sign of either the outbreak being contained, or of Germany persuading key importers to allow trade to resume from non-affected parts of the country. Latest figures for November show that German pig meat exports to China in November 2020 totaled just 13,092 tons, compared with upwards of 50,000t a month in both June and July. Spain continues to be China's biggest supplier of pig meat, and demand is currently reported to be ramping up in advance of the Chinese New Year celebrations on 12 February. However, the European market remains oversupplied and prices remain depressed. The Covid-19 outbreak is keeping many restaurants closed and is also reducing slaughtering capacity at large processing plants. With just two small exceptions, the EU benchmark price has now fallen week-on-week continuously since the start of August 2020, and starts 2021 almost 34% below where it was in January 2020. The EU average price for Class E pigs in the week ending 3 January 2021 was EUR127.97 per 100kg, down very slightly (-0.1%) on the previous week. In Germany the price has been more or less stable for the past six weeks, rising marginally over the past week to EUR124.00 per 100kg. In Denmark prices were up by 0.8% week-on-week to EUR143.70 per 100kg, but in other major producer countries prices were virtually unchanged on the week before. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- German economic activity outside services remained on a recovery path during November 2020 despite the second wave of COVID-19 virus infections that triggered a light lockdown in that month already. Orders - helped by big-ticket items - markedly exceed year-ago levels now, but data edge developments varied greatly across industrial branches. (IHS Markit Economist Timo Klein)

- Seasonally and calendar-adjusted German industrial production excluding construction increased by another 0.8% month on month (m/m) in November 2020, its seventh consecutive month of recovery. It is now only 4.5% below its February 2020 pre-pandemic level and about 3% below the average production level in the fourth quarter of 2019.

- Total production including construction increased by 0.9% m/m in November 2020, as construction output alone increased somewhat more strongly at 1.4% m/m. Indeed, November 2020 construction output exceeded the average of the fourth quarter of 2019 by 4.7%.

- As in October 2020, non-durable consumer goods production underperformed the rest at -2.9% m/m, in contrast with robust output increases of intermediate, investment, and consumer durable goods (the latter by 3.7% m/m). A different split according to industrial branches shows that November 2020 production increased across the board at an average pace of just above 2% m/m, with food/beverages/tobacco at -7.1% m/m being the only notable exception. Computers/electrical equipment, which had enjoyed a strong increase in October 2020 already (5.1% m/m), led the way at 4.0% m/m in November 2020.

- Manufacturing orders advanced by an equally encouraging 2.3% m/m in November 2020, helped to some degree by an above-average number of big-ticket items. The series excluding big-ticket items nonetheless did increase by a solid 1.6%, and in 2020 overall this series actually still marginally outperformed the headline series. Both series now reflect higher demand levels than in late 2019 or in February 2020 just before the pandemic struck.

- Orders improved the most among intermediate goods, followed by investment goods, and finally consumer goods. The latter began to be hurt by the light lockdown implemented in November 2020. Furthermore, growth in foreign orders exceeded domestic demand, but - in a reversal from October - the former was concentrated among eurozone countries (6.1% m/m) compared with a mere 0.9% m/m increase in demand from non-eurozone countries. This unwinds the September-October 2020 eurozone underperformance.

- The November 2020 orders breakdown by industrial branch shows unusually large variance. Strong increases in the computer and electrical equipment sector (6.9%), chemicals/pharmaceuticals (5.4%), and metal processing (3.1%) contrasted with corrective declines in the automobile (-3.0%) and machine-building sectors (-2.0%).

- Manufacturing PMI data currently available until December 2020 suggest that there will be a setback for both orders and production around the turn of the year 2020/21 but not a dramatic decline. Even the further tightening of restrictions since mid-December 2020 will not hurt the manufacturing and construction sectors unduly, as the measures mostly affect the service sector and retail trade.

- The German passenger car market posted a 19.1% y/y decline in 2020 as a result of the impact of the COVID-19 virus pandemic, with a final annual tally of 2,917,678 units, according to the latest data released by the Federal Motor Transport Authority (Kraftfahrt-Bundesamt: KBA). The final full-year figure was lifted by a strong rally in December, when the market rose by 9.9% y/y to 311,394 units as buyers looked to take advantage of the last month of the reduced value-added tax (VAT) rate of 16% before it was raised back to its previous level of 19%. The VAT rate was lowered in July 2020 as a balm to the economy following the initial impact of the pandemic. Like all other Western European markets, Germany found it impossible to escape a significant impact on its passenger car market in 2020 as a result of the COVID-19 virus pandemic. Government-imposed lockdowns in the first half of the year closed showrooms and temporarily halted production at plants and hit production across the domestic and global networks, affecting the availability of key vehicles, including the brand-new version of the country's best-selling model, the Mark 8 Golf. The German government reacted with a series of key measures designed to stimulate the wider economy, such as lowering the rate of VAT from 19% to 16% from 1 July while also enhancing existing environmental incentives on plug-in vehicles, with a maximum EUR6,750 (USD8,267) subsidy for plug-in hybrid electric vehicle (PHEV) purchases and a maximum EUR9,000 subsidy for battery electric vehicle (BEV) purchases. The performance of these kinds of vehicles was truly the "good news" story to come out of Germany in 2020, with alternative-drive vehicles taking a 22% share of the overall market by the end of the year, helped by these generous subsidies. (IHS Markit AutoIntelligence's Tim Urquhart)

- Clariant said today in a presentation to analysts that talks for the previously announced sale of the company's pigments business will conclude in the coming weeks and an agreement is expected to be signed in the second quarter. In addition, a reduction of the company's workforce by approximately 600, part of efficiency measures announced in February 2020, and a similar plan for its regional organizations and service units that will reduce Clariant's workforce by a further 1,000, are on schedule, the company said. Stephan Lynen, CFO at Clariant, said during the presentation that Clariant is in talks with potential buyers, including financial and industry companies, for the pigments business, and that the divestment is expected to close by the fourth quarter of 2021. Conrad Keijzer, who assumed responsibility as Clariant's new CEO on 1 January 2021, noted that restructuring the company is a priority and the workforce-reduction programs are on track and need to be completed. Lynen said that the plan to reduce the company's workforce by 600 is expected to be completed by the end of 2021. Meanwhile, the effects of the reorganization that will result in 1,000 job cuts, equivalent to about 6% of the company's total workforce—of which one third will be lost as a result of planned divestments—will be felt in 2021 and 2022, he said. (IHS Markit Chemical Advisory)

- Total employment in Italy rose by 0.3% month on month (m/m) to 22.964 million in November 2020. Therefore, cumulative job losses in March to November 2020 stood at 300,000, or 1.3% lower when compared with February 2020, the pre-pandemic level. (IHS Markit Economist Raj Badiani)

- The unemployment rate dropped to a six-month low of 8.9% in November (from 9.5% in October). The number of unemployed people decreased by 168,000 to 2.236 million in November.

- The sharp fall in the unemployment rate in November was partly because of the rising inactivity rate, with an increasing number of people neither working nor looking for work with the government continuing to tighten its COVID-19 virus containment measures during November.

- Specifically, the labor force shrank by 7.0% m/m to 2.236 million in November, with the inactivity rate increasing from 35.8% in October to 35.6%.

- The employment losses have been less severe than expected during the pandemic, with the country's short-time work or temporary lay-off schemes helping to shore up employment levels. In addition, demand for labor probably enjoyed some support from a stronger-than-expected economic rebound during the third quarter, with the national statistical office reporting that GDP increased by 15.9% quarter on quarter (q/q).

- A major support to employment has been the expansion to the Cassa Integrazione Ordinaria, or the support of salary payment by the state. An employer can suspend or reduce work activity for events related to the COVID-19 virus and enjoy social contribution exemption. Importantly, firms have to maintain their workforces to qualify for state aid.

- The European Central Bank estimates that some 8.5 million workers, or 44% of Italian employees, were on these schemes during the lockdown in Italy. In August, the government agreed to extend the short-time work scheme until the end of 2020.

- Floating wind specialist BlueFloat Energy is partnering Falck Renewables Wind to jointly apply for one or more seabed leases from Crown Estate Scotland. Italy-based Falck Renewables, the parent company of its UK subsidiary Flack Renewables Wind, is focused on renewable energy project development whilst BlueFloat is a floating wind technology specialist. BlueFloat is backed by 547 Energy, the investment platform managed by Quantum Energy Partners. The companies intend to utilize a proprietary semisubmersible floating concrete structure design, OO-Star Wind Floater, owned by Floating Wind Solutions. Crown Estate Scotland's ScotWind leasing round opened in June 2020 and will close at the end of March 2021. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The increase in Sweden's private-sector output reinforces our view of positive growth in the fourth quarter of 2020. However, the situation in the short-term period will be difficult owing to a strong resurgence of the COVID-19 virus pandemic and new restrictions in Sweden and Europe. (IHS Markit Economist Daniel Kral)

- Statistics Sweden (SCB) has reported that Sweden's private-sector production grew by 0.8% month on month (m/m) in November 2020, after growth of 1.3% m/m in October 2020. Production was down by 1.0% year on year (y/y) in November 2020, a significant improvement compared with September 2020 (-3.3% y/y).

- On a monthly basis, the main driver of growth in November 2020 was manufacturing, up by 1.5% m/m, while services were up by 1.1%. Data on construction-sector output continue to be unavailable.

- On an annual basis, in November 2020, manufacturing was up by 0.8% y/y, a remarkable turnaround from April when it was down by 17.0% y/y, while services were down by 1.1% y/y, a significant improvement from -6.1% y/y in April 2020.

- Compared with January 2020, private-sector output was down by 1.7% in November, manufacturing up by 0.1%, and services down by 3.4%.

- Leading confidence indicators suggest that the recovery in the manufacturing sector is set to continue. The strong November 2020 figure reinforces our view of Sweden avoiding a second dip in the fourth quarter of 2020, with growth remaining positive in the quarter unlike in most of Europe.

- Growth in the third quarter of 2020 was revised up, which will push up both the 2020 and 2021 full-year averages. However, the next few months will continue to be a difficult period in Sweden and Europe.

- Volvo Cars has announced that its global sales fell by 6.7% year on year (y/y) in 2020, a smaller rate of decline than other brands and OEMs in the face of the COVID-19-virus pandemic. According to data released by the automaker, volumes during the year have fallen to 661,713 units from 705,452 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- The company was once again helped by another positive performance towards the end of the year, with December volumes growing by 6% y/y to 74,239 units.

- China was one of the markets that contributed positively to Volvo Cars' performance in 2020 where, following earlier weakness due to the COVID-19 virus, its sales grew during the full year by 7.5% y/y to 166,617 units.

- In the United States its sales increased by 1.8% y/y to 110,129 units.

- There was a steep drop off in Europe after lengthy lockdowns were imposed in some markets and further measures were implemented late in the year. As a result, the automaker experienced a drop of 15.5% y/y to 287,902 units.

- Sales in its 'Other' rest of the world markets are down by 4.5% y/y to 97,065 units.

- Separately, the company has also announced that its Ghent (Belgium) facility is taking steps to triple manufacturing capacity for its plug-in electrified vehicles by 2022.

- According to the automaker, at this point it will amount to around 60% of the site's production capacity. Volvo Cars has also said that it will introduce a second battery electric vehicle (BEV) model later in 2021 to join the XC40 Recharge BEV.

- According to Trend News Agency, Azerbaijan and Turkey have signed a memorandum of understanding on the new 85km Ighdir-Nakhchivan pipeline. The Nakhchivan Autonomous Republic presently receives most of its gas from Iran. The new pipeline will supply the region with Azerbaijani gas via Turkey. The project implemented by Azerbaijan's SOCAR and Turkey's BOTAS. (IHS Markit Upstream Costs and Technology's Chris Alexander)

- Gabon's debt-to-GDP ratio has exceeded the 70% regional threshold set by the Economic and Monetary Community of Central Africa (Communauté Économique et Monétaire de l'Afrique Centrale: CEMAC). IHS Markit expects debt levels to remain elevated through the short term, driven by widening budget deficits and weaker growth. (IHS Markit Economist Archbold Macheka)

- According to a report in New Gabon of 6 January, Minister of the Economy and Recovery Nicole Roboty attributes the uptick in Gabon's debt ratio to the sharp decline in GDP output and the revision to the concept of indebtedness, which combines treaty debt and unconventional debt.

- Indeed, in his address to the nation on 31 December 2020, President Ali Bongo Ondimba noted that the country will pursue debt reduction initiatives in 2021 to bring it below the CEMAC threshold. Roboty further indicated that this will primarily be achieved by capping loans that will be contracted over the next 36 months and rescheduling or restructuring international market debt.

- Data from the Directorate General of the Economy and Fiscal Policy show Gabon's outstanding debt to be XAF5,835.1 billion (USD10.49 billion) at the end of September 2020. The International Monetary Fund (IMF) expects the country's total public debt to jump to about 74.4% of GDP in 2021, driven by the inclusion of validated past domestic arrears in the debt stock in 2019, widening budget deficits, and weaker growth.

- Gabon's borrowing increased substantially in 2020 owing to the USD1-billion Eurobond issued in February and elevated financing needs due to the COVID-19-virus pandemic with loans from institutions such as the IMF, the World Bank, and the African Development Bank. IHS Markit expects debt levels to remain elevated through the short term, driven by lower government revenues, widening budget deficits, and weaker growth as the impact of the COVID-19-virus pandemic linger on.

- We expect Gabon's external position to remain constrained through the short-to-medium term, with the outlook for net exports gloomy because of declining oil production and weak global oil prices. Slowing growth in Asia and Europe, Gabon's other wood, palm oil, rubber, and manganese consumer markets, due to the COVID-19-virus shock, suggests that normalization of the export market is likely to be very slow through the short term. A harsher external environment could compound the country's issues with transfer payment delays and foreign-exchange-reserves depletion.

Asia-Pacific

- Most APAC equity markets closed higher except Mainland China -0.2%; South Korea +4.0%, Japan +2.4%, India +1.4%, Hong Kong +1.2%, and Australia +0.7%.

- Japan's real household expenditures fell by 1.8% month on month (m/m) in November following three consecutive months of increases, and year-on-year (y/y) growth softened to 1.1%. The weakness largely reflected drops in spending on furniture and household utensils, clothing and footwear, and transportation and communication. While the softening partially reflected weaker gasoline prices as well as electric and gas charges and oil prices, warmer weather also weighed on spending on seasonal items. That said, weaker spending on transportation and communication and culture and recreation reflects concerns about the resurgence of COVID-19 cases. (IHS Markit Economist Harumi Taguchi)

- The weakness may also reflect a decline in household income as workers' household income declined by 1.5% m/m, which is in line with a decrease in nominal cash earnings, down 2.2% y/y in November from a 0.7% y/y drop in October. While a decline in scheduled hours worked dampened scheduled cash earnings of part-time employees, the major reason behind the faster decrease in nominal cash earnings was a 22.9% y/y drop in special cash earnings (mainly seasonal bonuses).

- Household expenditures are likely to decline in the coming months as the government suspended a program of travel subsidies in late December 2020 and declared a state of emergency for Tokyo and three neighboring prefectures from 8 January to 7 February 2021. Although COVID-19 containment measures are milder than those implemented in April and May 2020, household spending for accommodations and drinking and eating services, travel, and some other areas will probably decline even outside of areas subject to the state of emergency, reflecting mounting concerns about increases in confirmed cases in many prefectures.

- Honda is reduce its production in Japan by about 4,000 units in January, while Ford plans to idle a US plant for one week this month, according to media reports. Both moves are reported to be over parts supply issues, including semiconductor chips. The Nikkei reports that the Honda production issues will affect mainly the Fit subcompact manufactured at the company's Suzuka plant. The Nikkei report quotes sources as saying the issue could be worse later on. The Nikkei report quotes a source as saying, "The period starting in February may be grim… [The shortage] could impact tens of thousands of vehicles during the January-March quarter on the domestic side alone." Honda has reportedly run short of semiconductors used in vehicle control systems. According to the Nikkei report, Honda will not idle the plant completely but will reduce the number of vehicles being produced. Meanwhile, a news station in Louisville, Kentucky, United States, has reported that Ford is moving a planned week of downtime at its plant in that city to 11-17 January over parts issues. A Ford spokesperson is reported as saying, "We are pulling ahead a scheduled down week at Louisville Assembly Plant due to a supplier part shortage." The president of the union local representing the plant, Todd Dunn, said that Ford's other Kentucky plant has not been affected by the supply issue so far, and that he understands the parts shortage has to do with a semiconductor that goes into the brake control module. Another union official, Herb Hibbs, is reported as saying that multiple issues are affecting the plant, including snow and the COVID-19 pandemic affecting shipping ports. He reportedly said that "material isn't getting unloaded fast enough to get it transported to us… We are, like a lot of big manufacturers, struggling but have done well making it this long without any major hiccups. Our outstanding workforce is staying safe and doing the best they can to social distance. I commend the Ford material team for doing a great job and any means necessary to keep us running and letting us get our great products to our customers." The supply of semiconductor chips has come under pressure as the auto industry has been working to recover to pre-pandemic inventory levels. At the same time, demand for consumer electronics products, which also need semiconductor chips, has been growing, including for new 5G smartphones and gaming systems. According to IHS Markit semiconductor and components analysts, the issue is expected to be problematic in the first half of 2021, but is not expected to be a long-term problem. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Japan's two largest shipbuilders, Imabari Shipbuilding and Japan Marine United (JMU), have formed a new joint venture, Nihon Shipyard. This came nine months after both shipbuilders announced their joint venture intentions to strengthen their competitiveness in the shipbuilding market. Nihon Shipyard draws on the strength of both companies and will focus on building eco-friendly commercial ships. Imabari Shipbuilding owns 51% stake of Nihon Shipyard, while JMU owns 49%. It is understood that in the bid to support its domestic shipbuilders, the Japanese government is preparing a bill offering long-term loans, tax breaks for new ventures set up, and subsidizing for technological development. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Horizon Robotics, an artificial intelligence (AI) chips provider for smart vehicles, has raised USD400 million in the second tranche of its series C funding round, reports Caixin Global. The funding round is co-led by Baillie Gifford, YF Capital, and battery-maker CATL. The company plans to use the infused capital to speed up the development and commercialization of its chips designed for Level 4 and 5 autonomous vehicles. Horizon Robotics is focusing on developing AI solutions for computer-vision purposes for automated vehicles. Horizon has inked partnerships with OEMs and tier 1 suppliers including Changan Automobile, SAIC Motor, GAC Group, FAW Group, Li Auto, Chery Auto, Great Wall Motor, Audi, Continental AG, and Faurecia. In the first half of 2021, Horizon Robotics plans to launch the Journey 5 chip, which features computing power of 96 trillion operations per second, enabling Level 3 and Level 4 autonomy. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China's live hog futures fell sharply on their debut on the Dalian Commodity Exchange despite recent increases in spot prices. The front-month September contract closed almost 12.6% lower at CNY28,290 (USD4,377) per ton on Friday (8 January) versus its CNY30,680 listing price. Local analysts attributed the fall to the contract's high listing price and expectations that hog supplies will continue to increase as the industry bounces back from losses caused by African Swine Fever (ASF). Prices for pork and pigs fell steadily in September and October as new large-scale facilities helped restore production capacity to about 85% of pre-ASF levels. Prices have since moved back upwards as demand rises ahead of China's New Year holiday season. Spot market hog prices in Jilin province currently stand at about CNY35 per kg. Looking forward however, the industry is confident that Chinese producers will be better able to meet demand as the year progresses. China, the world's largest producer and consumer of pork, has been working on the launch of live hog futures for the past decade. Large producers say the tool will reduce market volatility and help the industry standardize products. (IHS Markit Food and Agricultural Commodities' Max Green)

- Hyundai is reportedly in early talks with Apple for a potential partnership in developing electric vehicles (EVs) and batteries, reports the Yonhap News Agency. "We've been receiving requests for potential cooperation from various companies regarding development of autonomous EVs. No decisions have been made as discussions are in an early stage," Hyundai said in a statement. Apple is known to be in talks with several global automakers for the EV project. In recent years, Apple has reportedly hired engineers with expertise in EVs and autonomous driving technology. However, it will take at least five to seven years to launch an autonomous EV as the development work is still at an early stage. Furthermore, as Apple does not manufacture its own products, it is expected that the company would contract manufacturing to some other company. The possible business partnership with Apple is in line with Hyundai Motor Group's aim to transform into a smart mobility solutions provider. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 08 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.