Most major European equity indices closed higher, while US and APAC markets were mixed. US and most benchmark European government bonds closed higher. European iTraxx and CDX-NA closed almost flat on the day across IG and high yield. The US dollar, gold, and copper closed higher, while silver, natural gas, and oil closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- US equity indices closed mixed; S&P 500 +0.3%, DJIA +0.3%, Nasdaq flat, and Russell 2000 -1.0%.

- 10yr US govt bonds closed -3bps/1.32% yield and 30yr bonds -4bps/1.94% yield.

- CDX-NAIG closed flat/48bps and CDX-NAHY +2bps/275bps.

- DXY US dollar index closed +0.1%/92.64.

- Gold closed +0.4%/$1,802 per troy oz, silver -0.2%/$26.13 per troy oz, and copper +1.7%/$4.32 per pound.

- Crude oil closed -1.6%/$72.20 per barrel and natural gas closed -1.1%/$3.60 per mmbtu.

- The minutes of the meeting of the Federal Open Market Committee (FOMC) held on 15 and 16 June were released this afternoon. At that meeting, the Committee maintained the stance of monetary policy, with unanimous support among the voting members. The target for the federal funds was kept at a range of 0.00-0.25%, large-scale asset purchases were continued at the rate of approximately $120 billion per month, and the Committee repeated forward guidance for both interest-rate and balance sheet policies. As Chair Jerome Powell noted on 16 June, the Committee took the first step toward adjusting balance sheet policy, as it "talked about talking about" an eventual taper of its asset purchases. The early discussion at this meeting revealed splits in policymakers' views on tapering asset purchases: first, in terms of an earlier or later start to the taper; and, second, whether the Federal Reserve's purchases of mortgage-backed securities (MBS) should be curtailed more quickly than its purchases of Treasury securities. In "coming meetings" the FOMC will continue to assess progress toward economic goals and begin to discuss plans for the taper, setting up the possibility that this fall it will announce its plans. The actual timing of that announcement will depend importantly on the pace of recovery in labor markets. (IHS Markit Economists Ken Matheny.

- The latest US Job Openings and Labor Turnover Survey (JOLTS) report points to a strong May for the labor market. With almost 50% of the total population fully vaccinated and a low tally of new daily infections, most states have eliminated all pandemic-related restrictions, giving a boost to the labor market, which is evident in this release. (IHS Markit Economist Akshat Goel)

- Job openings remained at a series high of 9.2 million in May. The number of hires edged down to 5.9 million.

- Job separations fell to 5.3 million in May with layoffs and discharges falling to 1.4 million.

- The quits rate, a valuable indicator of the general health of the labor market, fell from a series high of 2.8% to 2.5%.

- Over the 12 months ending in May, there was a net employment gain of 8.2 million.

- There was one worker competing for every job opening in May. This is the first time since the start of the pandemic that the number of workers has not exceeded the number of job openings.

- Media reports indicate that Volkswagen (VW) Group is looking to sell its stake in electric vehicle (EV) charging network Electrify America; no comments directly from VW or Electrify America have been reported at the time of writing. Reuters cites unnamed sources as saying that VW is working with the bank Citi to find a co-investor in Electrify America that is prepared to inject about USD1 billion into the division. Reuters reports that VW is planning to present a new strategy on 13 July, and that it is looking to consolidate its charging efforts under a new Charging & Energy business area. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nestlé USA has unveiled plans to invest USD100 million to expand its frozen foods factory in Gaffney, South Carolina, by adding a new production line and expanding an existing one, local press reported. The facility prepares frozen food entrées for brands like Stouffer's and Lean Cuisine. "The frozen food category has been growing for the last few years, and the pandemic has only increased that trend. As people spend more time at home, they rediscovered the convenience, value and great taste of frozen foods," Nicole Caldwell, factory manager at Nestle's Gaffney location, said in a statement. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Making up for most of the loss since March, Canada's Ivey Purchasing Managers' Index (PMI) rose 7.2 points to 71.9 in June. Purchasing managers' spending activity in June was significantly strong as regional lockdowns have eased since the end of May and Ontario's early June reopening. (IHS Markit Economist Chul-Woo Hong)

- The employment index climbed for the second successive month, up 2.6 points, supporting the strong net job gain forecast in June.

- After decreasing for two months, the supplier deliveries index rebounded 3.1 points, still staying at a low level with ongoing supply-chain pressures.

- The inventories index edged up 0.1 points to 65.4, reflecting robust spending activities on inventories accumulation. The prices index inched up 0.8 to 79.4, mainly owing to strong commodity price inflation.

- All subindexes increased modestly in the month. Building on previous gains, the employment index hit a record high of 69.6.

- Real GDP output will solidly rebound in June, and strong growth momentum will continue in the second half of 2021.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Spain -0.1%; Germany +1.2%, UK +0.7%, France +0.3%, and Italy +0.2%.

- Most 10yr European govt bonds closed higher except for Italy flat; UK/Germany -3bps and France/Spain -2bps.

- iTraxx-Europe closed -1bp/46bps and iTraxx-Xover -1bp/231bps.

- Stellantis has announced that the future of the Ellesmere Port (UK) facility has been secured thanks to investment to manufacture battery electric vehicles (BEVs) at the site from 2022. According to a statement, Stellantis will spend GBP100 million to transition from the Opel and Vauxhall Astra to the OEM's range of compact light commercial vehicle (LCV) in electric-only guise. This will comprise the commercial Vauxhall Combo-e, Opel Combo-e, Peugeot e-Partner and Citroën e-Berlingo, alongside the passenger carrying variants, namely the Vauxhall Combo-e Life, Opel Combo-e Life, Peugeot e-Rifter and Citroën e-Berlingo. It added that these will be built for both domestic sale and export, and the investment will benefit from financial support from the UK government. (IHS Markit AutoIntelligence's Ian Fletcher)

- Seasonally and calendar-adjusted German industrial production excluding construction declined by 0.7% month on month (m/m) in May, following stagnation in April. The interim cyclical high reached in December 2020 after the initial recovery from the pandemic shock has therefore not yet been regained. (IHS Markit Economist Timo Klein)

- Total production including construction posted a slightly more friendly decline of 0.3% m/m in May due to rebounding construction (1.3% m/m). An even better result was prevented by a setback to energy output (-2.1%).

- The split by type of good reveals that investment goods output was the key depressing force, whereas intermediate goods continued their slow but steady rise and consumer goods - helped by a staggered loosening of COVID-19-related restrictions during May - increased quite sharply. This is also reflected by a breakdown by industrial branch, where motor vehicles stand out negatively (-7.2% m/m), followed by machinery and equipment (-1.7% m/m). This contrasts with strong increases for food/beverages/tobacco (3.0%) and chemicals/pharmaceuticals (4.9%), the latter thus supporting intermediate goods output.

- In the case of motor vehicles, the ongoing shortage of computer chips has led to a downward trend since January, with May's output level lower even than in June 2020 and effectively resuming the longer-term downward trend that began in mid-2018.

- Meanwhile, manufacturing orders even declined markedly in May (-3.7% m/m), erasing gains made during March-April. The same monthly decline was observed upon exclusion of big-ticket items. Unlike in March-April, however, a major drop in foreign orders (-6.7% m/m) caused May's weakness, whereas domestic orders posted a moderate recovery (+0.9%).

- May's orders breakdown by industrial branch reveals a similar pattern as its production equivalent, and even more pronounced with respect to the automotive sector given the ongoing semiconductor shortage. Demand for vehicles fell 9.6% m/m, followed by orders in the metal producing industry (-6.8%). Demand for machinery/equipment was surprisingly resilient (up 0.8% m/m), but this might be because lead times are quite long in this sector. Meanwhile, May's orders for chemicals/pharmaceuticals were broadly steady too (up 0.7% m/m), but this seeming resilience is qualified by April's plunge of 5.1% m/m.

- France's current-account deficit widened from EUR2.0 billion (USD2.4 billion) in April to EUR2.3 billion in May, according to seasonally adjusted figures released by the Bank of France. The deficit totaled EUR9.6 billion during the first five months of the year, below a shortfall of EUR18.4 billion during the same period in 2020. (IHS Markit Economist Diego Iscaro)

- The increase in the overall deficit in May resulted from a lower surplus on the services account, which more than offset a narrowing of the deficit on the goods account. The surplus on services declined from EUR2.4 billion to EUR1.6 billion, as an improving transport balance was not enough to offset a deterioration in the travel account.

- Meanwhile, the shortfall on the merchandise account eased from EUR4.2 billion to EUR3.9 billion. The deficit remains below an average of EUR4.9 billion in 2020.

- Exports of goods, which had risen by 0.3% month on month (m/m) in April, stagnated in May. Merchandise exports remain 7.4% below their level in February 2020.

- Merchandise trade data released by the Customs Office, which uses a different methodology, show exports to China, which had risen by a quarter in April, falling by 8.4% m/m in May. Meanwhile, exports to the eurozone rose by 0.4% m/m, boosted by a 3.0% m/m rise in sales to Germany.

- On the product side, exports of transport equipment, which had rebounded by 10.1% m/m in April, fell by 14.3% m/m in May. The three-month moving average shows exports of transport equipment in May still 28.5% below their level during the three months to February 2020.

- On the other hand, exports of machinery/electrical equipment and chemical products rose by 1.6% m/m and 2.8% m/m, respectively.

- Meanwhile, merchandise imports declined for the second successive month (-0.5% m/m, following a decline of 0.4% m/m in April).

- The combined deficit of the primary and secondary accounts eased from EUR300 million to EUR100 million.

- Renault Group has revealed further details of its Hyvia hydrogen commercial vehicle joint venture (JV) with US-based Plug Power. In a press statement, Renault says that Hyvia will offer hydrogen production, mobile storage stations, and, by late 2021, hydrogen refueling stations assembled in Flins (France). There will be an option to rent or purchase the hydrogen refueling stations. The JV will provide three fuel-cell-powered light commercial vehicles (LCVs) by the end of this year, including a Master large van for transportation of goods with a range of 500 km and cargo volume of 12 cubic meters; a master chassis cab with 19 cubic meters of cargo-carrying capacity and a range of 250 km; and a Master Citybus with a range of 300 km and the capacity to carry 15 passengers. These vehicles are based on Dual Power architecture and are powered by a 33-kWh battery, a 30-kW fuel cell, and tanks containing between 3 kg and 7 kg of hydrogen, depending on the version. The maximum range of 500 km in the Master large van includes 100 km from electrical power, with the rest from hydrogen. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- On 6 July, the Hungarian National Bank (Magyar Nemzeti Bank: MNB) announced the Green Monetary Policy Toolkit Strategy. As part of the strategy, the MNB will launch two new schemes, the Green Mortgage Bond Purchase Programme and the Green Home Programme. The Green Mortgage Bond Purchase Programme, with an initial target of HUF200 billion, is set "to contribute to the development of the domestic green mortgage bond market through targeted purchases". Under the Green Home Programme, the central bank will provide 0% interest loans to banks, which will be lent to residential borrowers at a maximum rate of 2.5%. The program, part of the Funding for Growth Scheme (FGS, a market-based lending scheme), will be launched in October 2021 with a total limit of HUF200 billion. (IHS Markit Banking Risk's Greta Butaviciute)

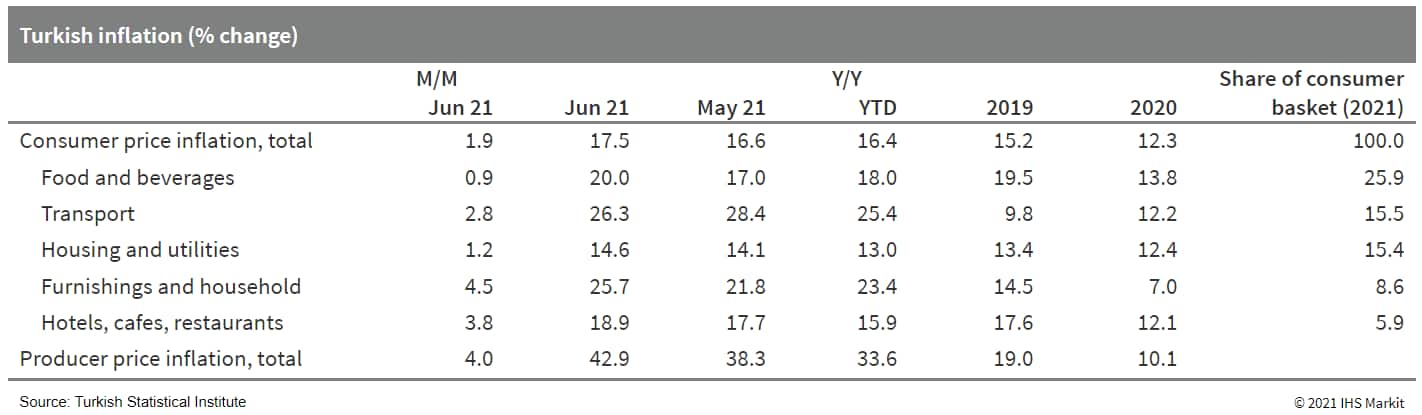

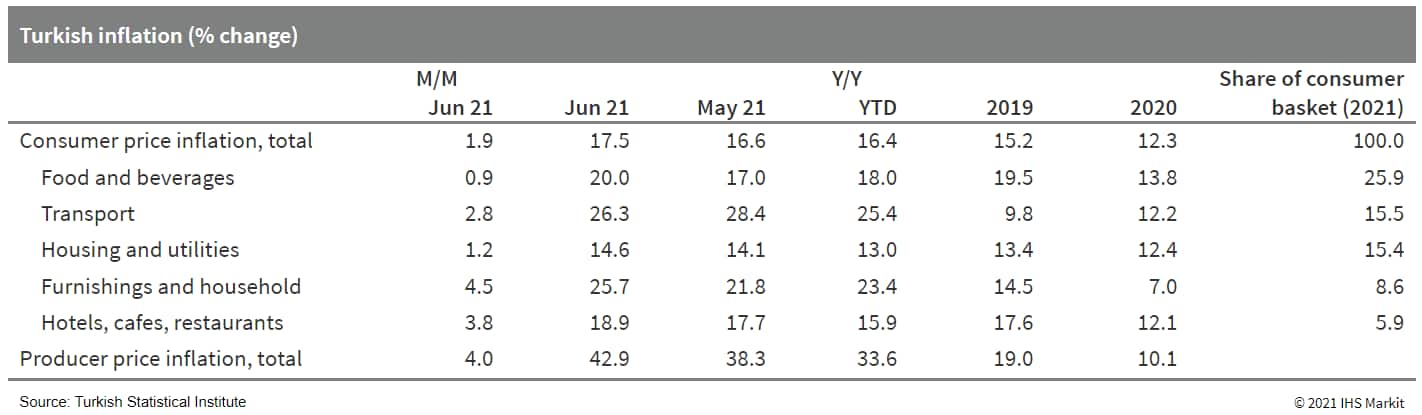

- Turkey's annual consumer prices marched upwards in June 2021, raising pressure for the central bank to increase the main policy rate at their next meeting on 14 July. However, signals from central bank leadership suggest that interest rates will be kept on hold. Further acceleration of inflation in late 2021 is increasingly likely due to surging producer price inflation and drought conditions. The central bank may need to act more aggressively at that time. (IHS Markit Economist Andrew Birch)

- Annual consumer price inflation rose to 17.5% as of June 2021 according to the latest data from the Turkish Statistical Institute (TurkStat). A weak lira, high global commodity prices, and rising domestic demand as anti-pandemic restrictions fall have fuelled an acceleration of inflation since October 2020.

- Primary among the causes for higher inflation was a 20.0% annual increase in the prices on food and non-alcoholic beverages. Global agricultural prices have contributed to the rise of domestic prices.

- Rising global energy prices also fed the rise of both transportation and utility prices as well, with annual price inflation on these categories reaching 26.3% and 25.7%, respectively, in June 2021.

- The Bank of Central African States (Banque des États de l'Afrique Centrale: BEAC) kept its key policy rate at 3.25% during its latest monetary policy committee (MPC) meeting on 28 June. Central bank authorities also expect the economic recovery to be weak, reflecting uncertainties related to the coronavirus disease 2019 (COVID-19) virus pandemic and slow vaccine rollout efforts. (IHS Markit Economist Archbold Macheka)

- The BEAC also held the marginal lending rate at 5.0% and the marginal deposit rate at 0.0%, while it maintained the reserve requirement ratio at 7.0% and 4.5% on demand and forward liabilities, respectively.

- However, some measures implemented since March 2020 to support the economy in the wake of the pandemic have been suspended, while new ones have been implemented. The suspended measure relates to the adjustments to conditions for the eligibility of guarantees for the refinancing operations of the BEAC. The new measure concerns the reactivation of liquidity recoveries via long maturity operations (one month) targeting credit institutions in excess of liquidity and wishing to make investments at the BEAC.

- Annual inflation in the Economic and Monetary Community of Central Africa (Communauté Économique et Monétaire de l'Afrique Centrale: CEMAC) region is expected to accelerate to an average of 2.7% in 2021, from an average of 2.4% in 2020, as both food and non-food prices are forecast to tick up. The MPC members further downgraded regional GDP growth projection for 2021 to 1.3% from an earlier forecast of 1.9%. The downward revision was driven by significant uncertainties related to the COVID-19 virus pandemic and slow vaccine rollout efforts.

- The CEMAC region's current account (including official grants) is forecast to register a deficit of 4.8% of GDP in 2021, thanks to recovering external demand and global oil prices. The budget deficit (commitment basis including grants) is expected to narrow to 2.9% of GDP in 2021, from a revised deficit of 3.1% of GDP in 2020.

- Foreign-exchange reserves are projected to remain above the three-month threshold for imports of goods and services, while the rate of external coverage of the regional currency is expected to marginally improve to 66.8% in 2021, from 63.6% in 2020.

- The slide in Chinese apple juice concentrate (AJC) exports to the US, partly due to China's reduced production this season and partly due to the present freight crisis, is demonstrated by the latest export data. For years, the US has been China's biggest customer for its AJC, but in May this year the US imported just 5,100 tons of product, compared with over 9,000 tons in May 2020. South Africa leapfrogged the US to take nearly 7,700 tons of AJC, up from just 1,610 tons last year. This follows another leap in South African purchases of Chinese juice in April: 6,600 tons, compared with 2,100 tons in April 2020. Generally, South Africa buys between 2,000-3,000 tons per month from China; occasionally between 4,000-5,000 tons. However, the season-to-date data, from July through May, shows that South African uptake has remained virtually unchanged at 41,615 tons this season and 41,400 tons last. The 2017/18 season shows 40,370 tons and that leaves an unexplained dip in 2018/19 to 22,700 tons. (IHS Markit Food and Agricultural Commodities' Neil Murray)

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.9%, Mainland China +0.7%, India +0.4%, Hong Kong -0.4%, South Korea -0.6%, and Japan -1.0%.

- MINIEYE, a perception solution provider for autonomous vehicles (AVs), has completed a Series D1 funding round for an undisclosed amount from lead investors CICC Alpha and Dongfeng Asset Management. Existing investors including Harvest Fund and Vision Plus Capital also participated in the financing round, reports Gasgoo. The company plans to use the capital to strengthen its capabilities of technology development, volume production and cost control. MINIEYE, which was founded in 2014, has developed its Level 1 to Level 2+ autonomous solutions. The company uses artificial intelligence (AI)-based sensing solutions in developing ADAS (advanced driver assistance system) for serving customers including Dongfeng, Geely, SAIC, and BYD. MINIEYE claims that it has delivered around 230,000 units of ADAS in the first half of 2021, up 245% y/y. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- AutoX has launched its fifth-generation fully driverless system, AutoX Gen5, for robotaxis. It features 50 sensors and a vehicle control unit of 2200 TOPS (trillion operations per second) computing power. The AutoX Gen5 system has 28 cameras, six high-resolution LiDARs, and 4D RADAR with 0.9-degree resolution that provides 360-degree coverage around the vehicle. The AutoX LiDAR stack generates 15 million points every second. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Korea reported 1,275 Covid-19 cases, a record daily tally surpassing infections during the peak of country's last major surge in December. The latest rise comes as Korea eased social distancing measures including wearing masks outdoors for those fully vaccinated and extending business hours. The measures were initially eased as the Asian nation stepped up vaccinations with about 30% of the population having had at least one shot. (Bloomberg)

- The South Korean Ministry of Industry, Trade and Energy has launched an electric vehicle (EV) standardization forum to establish ground rules for five industries based on future technology, including wireless charging and liquid-cooled rapid chargers, reports the Korea Herald. The industry-academia-research co-operation platform, formed by the Korean Agency for Technology and Standards under the Industry Ministry, will also lead standardization efforts in vehicle-to-grid (V2G) technology, electric motorcycles, and solid-state batteries. (IHS Markit AutoIntelligence's Jamal Amir)

- The Korea Advanced Institute of Science and Technology will lead the standardization of wireless charging technology, which can charge a vehicle while driving. South Korea has already proposed standards to the International Electrotechnical Commission for three core technologies for wireless charging, with the aim of achieving the international standardization of next-generation charging technology by 2024.

- The Korea Smart Grid Association will meanwhile spearhead the development of new technology and safety standards for liquid-cooled rapid chargers. For future ultra-fast chargers with power ranges of 400 kilowatts or higher, liquid-cooling systems are more suitable than the existing air-cooling systems, highlights the report. The Korea Smart Grid Association will also be responsible for developing standards for V2G technology.

- The Korea Smart E-Mobility Association will be responsible for the standardization of electric motorcycles. It will lead the development of standards for the shape and voltage of electric motorcycle batteries, which are detachable.

- The Korea Battery Industry Association will draw up standards for the safety and performance of solid-state batteries, which will replace lithium-ion batteries, and will take the initiative in international standardization efforts.

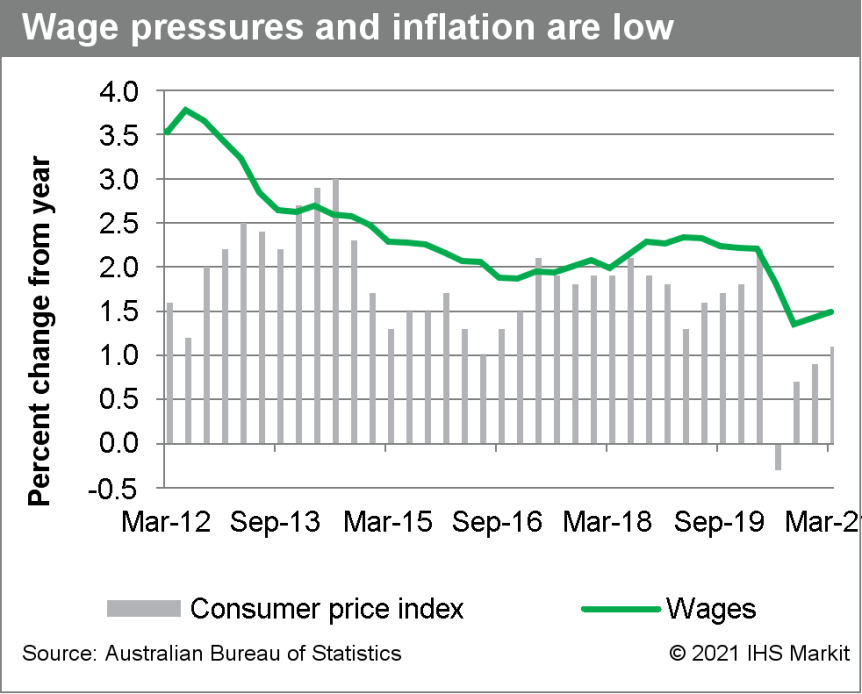

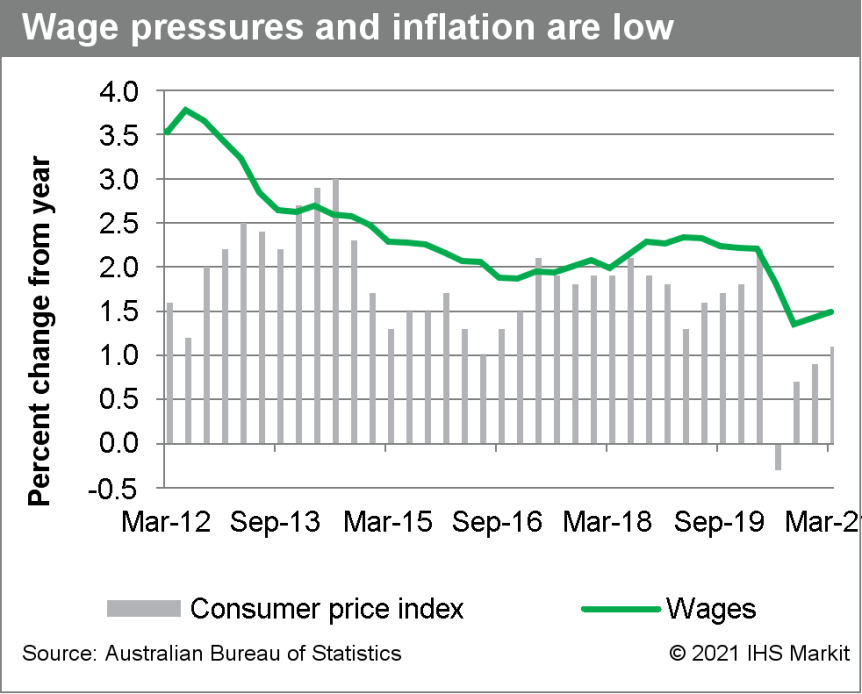

- After signaling over the past two months that July's meeting of the monetary policy board would include decisions on the bank's next steps for monetary policy, the Reserve Bank of Australia (RBA) board delivered incremental adjustments, as expected. The official cash rate target will remain unchanged at 0.10%. RBA governor Philip Lowe indicates that the policy rate will not move until headline inflation is sustainably within the 2-3% target range, which the bank's baseline scenario predicts will not arise before 2024. (IHS Markit Economist Bree Neff)

- The most significant change to the RBA's policy settings is that the bond buying program will slow to AUD4 billion (USD3.01 billion) per week starting in September, down from the current AUD5 billion. The split between Australian Government Securities (AGS) and state and territorial securities will remain 80-20. These settings will hold through mid-November, when the RBA has pledged to review its policy settings again, and make further adjustments based on economic conditions.

- For the other major decision this month, the RBA decided to not extend the yield-targeting program to the next maturity - the November 2024 bond - because it now believes that the need to maintain low interest rates that far into the future is less critical. That said, the RBA decided to maintain the yield target at 0.10% to keep bank funding costs low and interest rates low at the short-end of the yield curve. As a reminder, the RBA halted new drawdowns from the Term Funding Facility on 30 June 2021, but the facility will continue to offer low-cost fixed rate funding for three years for the funds drawn from the facility.

- On the inflation front, the RBA's baseline scenario calls for underlying (core) inflation to come in at 1.5% for 2021 and reach 2% y/y by mid-2023. Lowe highlighted that upcoming headline inflation data will have some policy-related spikes, but without the support from wage growth, headline inflation is unlikely to stay above the lower band of the inflation target sustainably and consistently.

- Lowe acknowledged that the unemployment rate fell further to a seasonally adjusted 5.1% in May, with the labor force participation rate hovering near record highs and firms reporting labor shortages in sectors that rely on workers migrating from abroad. But the RBA's view remains that the unemployment rate will need to come down closer to the low-4% range before it generates the necessary wage inflation.

Posted 07 July 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.