All major US equity and European equity indices closed lower, while APAC was mixed. US and most benchmark European government bonds closed modestly lower. CDX-NA and European iTraxx closed wider across IG and high yield. Natural gas, oil, gold, silver, and copper all closed higher, while the US dollar was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.9%, Russell 2000 -1.1%, S&P 500 -1.3%, and Nasdaq -2.1%.

- 10yr US govt bonds closed +2bp/1.48% yield and 30yr bonds +2bps/2.05% yield.

- CDX-NAIG closed +2bps/54bps and CDX-NAHY +6bps/304bps.

- DXY US dollar index closed -0.3%/93.78.

- Gold closed +0.5%/$1,768 per troy oz, silver +0.5%/$22.64 per troy oz, and copper +1.2%/$4.24 per pound.

- Crude oil closed +2.3%/$77.62 per barrel to close at the highest level since November 2014 and natural gas closed +2.6%/$5.77 per mmbtu.

- US manufacturers' orders rose 1.2% in August, while shipments rose 0.1% and inventories rose 0.6%. The increase in orders was in line with the consensus estimate. Orders and shipments of core capital goods (nondefense capital goods excluding aircraft) were little revised from the advance estimates, and inventories rose through August about as we had expected. As a result, we left our estimate of third-quarter GDP growth unrevised at 2.2%. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Surging prices in the manufacturing sector continue to boost nominal measures of orders and shipments.

- Year-to-date (through August), the Producer Price Index (PPI) for the net output of the manufacturing sector rose 12.0%, reflecting elevated demand for goods and limitations on supply (from various supply-chain constraints).

- Over the same period, nominal orders rose 10.1% and nominal shipments rose 6.9%. That is, after adjusting for price change, both real orders and shipments are down on the year—this after both had mounted a full recovery by last fall.

- It is unclear how long supply-chain restrictions will slow activity. As demand for goods ebbs, and as the spread of COVID-19 slows, we expect restrictions on supply to ease, price gains in manufacturing to slow, and activity to pick up.

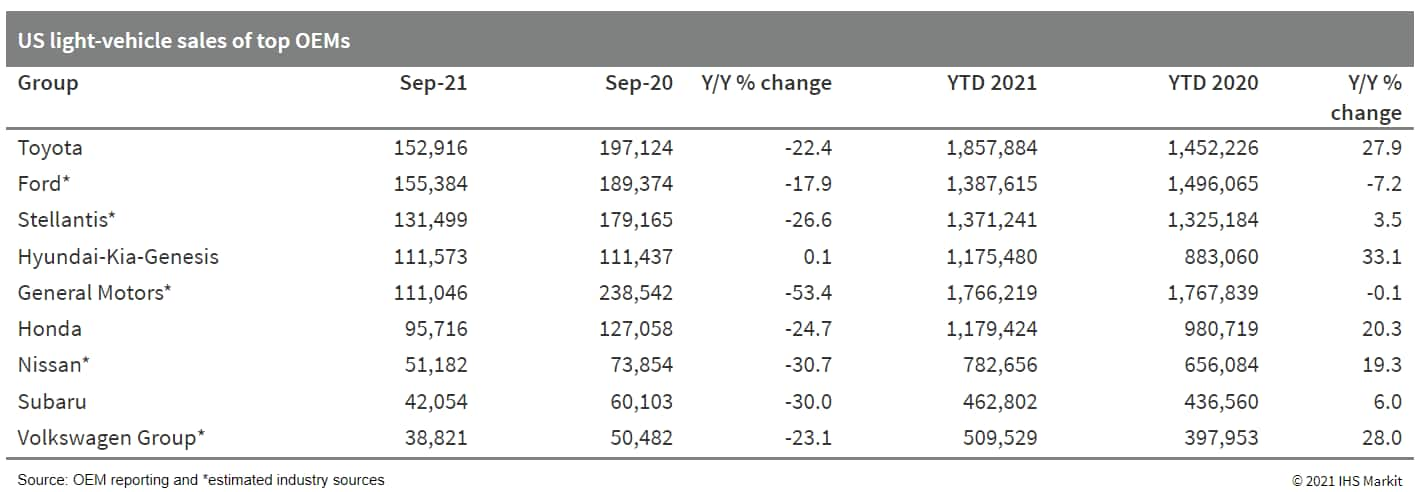

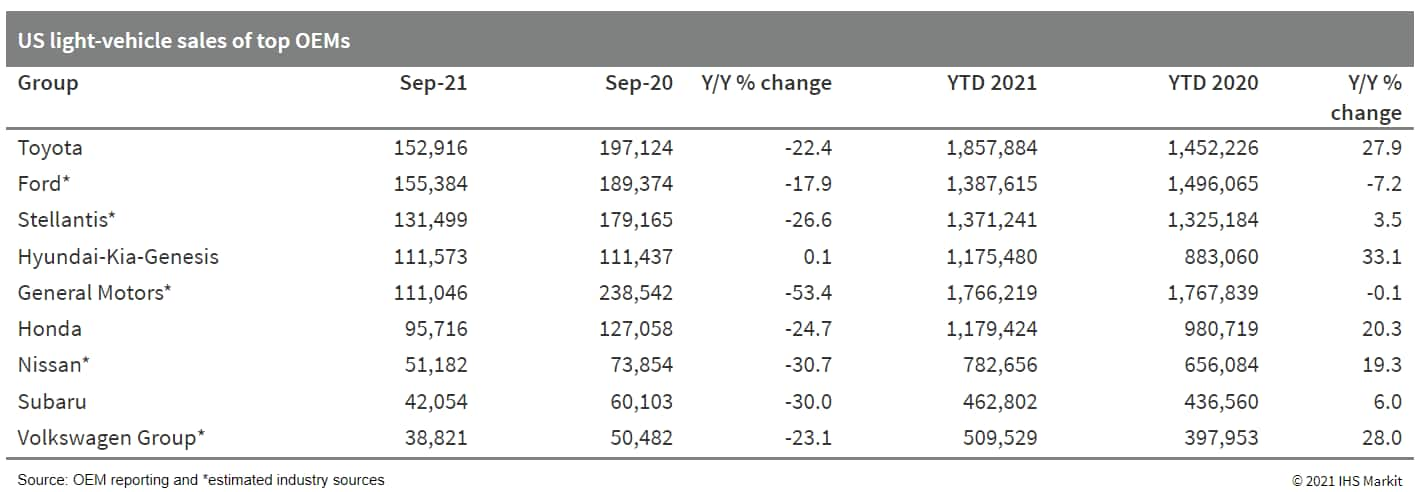

- US light-vehicle sales were impacted more sharply by low inventory levels in September than in August and y/y sales dropped 26.1%. In the year to date, the sales improvement has been constrained at 13.2%. Light vehicle sales in September were at the lowest monthly level since April 2020, during the depths of the COVID-19 lockdown period of last year. The lack of inventory is holding down the sales volume despite favorable consumer interest and buying conditions. This situation is expected to continue through 2021 and into 2022. IHS Markit has decreased its forecast for US light-vehicle sales in 2021 to 15.55 million units. This figure is up from 14.59 million units in 2020, but less than the over 16 million units in prior forecasts. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) manufacturer Tesla has announced its initial global production and delivery figures for the third quarter, reporting 241,300 vehicle deliveries and production of 237,823 vehicles. These figures are more than the figures for the second quarter and bode well for strong results from Tesla in full-year 2021 in spite of industry supply-chain issues slowing production for automakers globally. In the company's statement on the third-quarter figures, Tesla said, "We would like to thank our customers for their patience as we work through global supply chain and logistics challenges." Tesla now carries out production of both the Model 3 and the Model Y in China. In addition, Tesla is now producing the Model S and Model X after carrying out no production of the two models in the first quarter as the company was in the process of installing and testing equipment for a model change. Production and deliveries of the Model S and Model X reached only 8,941 and 9,275 units, respectively, as a result. Tesla delivered 232,025 Model 3 and Model Y vehicles in the third quarter of 2021 and produced 228,882 units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Foxconn and Lordstown Motors have announced an "agreement in principle" for the two to "work jointly" on Lordstown electric vehicle (EV) programs at the EV truck startup's Ohio (US) manufacturing facility. In addition, Foxconn has agreed to buy USD50 million of Lordstown stock, according to press statements from both companies. The two companies say the "goal of the partnership is to present both Lordstown Motors and Foxconn with increased market opportunities in scalable electric vehicle production in North America." There are four key elements of the tentative agreement. First, the two will use "commercially reasonable best efforts" to negotiate the sale of Lordstown's Ohio plant to Foxconn for USD230 million. That would, however, exclude Lordstown Motors' hub motor assembly line, battery module and packing line assets, as well as other undefined intellectual property rights and other excluded assets. Second, the two will negotiate a contract manufacturing agreement under which Foxconn would manufacture the Lordstown Motors Endurance; this would be a condition of closing any sale of the plant. Under this condition, Lordstown would also agree to provide Foxconn with certain rights to future Lordstown vehicle programs. Third, Lordstown Motors would issue warrants to Foxconn for 1.7 million shares of common stock at an exercise price of USD10.50 per share; this would be exercisable until the third anniversary of the deal's close. Fourth, the two have agreed to explore licensing arrangements for additional pick-up truck programs. Fifth, following closing, Lordstown would enter into a long-term lease for a portion of the facility for its current Ohio-based employees, and Foxconn would offer employment to agreed-upon Lordstown operational and manufacturing employees. Although the deal does have potential for both companies, as Lordstown has a larger plant than it needs now and the facility could speed up Foxconn's automotive production aspirations, these are early negotiations, and it is unclear when or if the talks will ultimately bear fruit. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Rivian has filed initial documents as it prepares to offer publicly traded stock, as per requirements of US regulators, the Securities and Exchange Commission (SEC), which detail pre-orders for the Rivian retail vehicles as well as information on the Amazon delivery van deal. Rivian plans to use the stock ticker RIVN, and trade on the US NASDAQ exchange. The company notes that as of 30 September, it had approximately 43,89 R1T and R1S pre-orders, each with a fully refundable USD1,000 deposit. In comparison, Ford has noted more than 150,000 reservations for the F-150 Lightning, although at USD100 each and for a truck that can serve broader use cases than the R1T. Regarding the Amazon agreement, which it calls the EDV agreement, further detail has been provided. The agreement provides that Rivian will be reimbursed for certain development costs but does not ultimately impose purchase requirements on Amazon. It gives Amazon exclusive access to Rivian's electric delivery vans for the first four years of production and gives Amazon first right of refusal for two years after that. Once Rivian executes the IPO, it expects to use the funding for working capital, to fund growth, and for other general corporate purposes. Without providing a full roadmap, the company also noted that the growth plan includes using both the R1 and RCV (truck and commercial vehicle) platforms and to develop new platforms that "underpin our diverse portfolio of vehicles". (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Bank of Mexico (Banco de México: Banxico) at its meeting on 30 September increased the policy rate from 4.50% to 4.75%. It was the third 25 basis-point raise in as many meetings. The decision was split as four of the members voted for the rate hike and one to keep the rate unchanged. At its previous meeting, the decision to increase the rate was also divided, with three in favor and two against a higher rate. (IHS Markit Economist Rafael Amiel)

- As of mid-September, Mexican headline inflation and core inflation, which excludes items with volatile prices in the agriculture and energy categories, amounted to 5.9% and 4.9%, respectively. The bank targets headline inflation at 3.0% +/- 1 percentage point.

- Banxico assesses that the shocks that have driven high inflation are temporary. However, it highlights that given the variety, magnitude, and the extended period in which they have affected consumer prices, the shocks pose a risk for price formation and inflationary expectations. This means that there may be second-round effects or contagion from higher prices of some items into others; economic agents may believe that high inflation is here to stay, which usually becomes a self-fulfilled prophecy.

- The Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) on 2 October announced that it will be launching a new credit line to micro, small, and medium-sized enterprises (MSMEs). The measure forces banks to disburse at least 7.5% their private-sector deposits' stock into working capital or into machinery of MSMEs focused on agriculture or services. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- The BCRA's measure is likely to continue the slowness of sector's profitability, which has fallen significantly through 2020 and 2021, reaching a return on average assets (ROAA) of 0.8% in July, when last reported - significantly below the 3.7% averaged in the three years prior to March 2020.

- Over the last year and a half, banks have been obliged to pay minimum interest rates on deposits, increasing their costs. Moreover, one of their main sources of income, the liquidity notes (leliqs), has also been contained, reducing significantly banks' overall income.

- Therefore, a measure that limits 7.5% of their stock of deposits (roughly 12% of credit outstanding) to a maximum interest rate of 30% or 35% - well below the BCRA's reference interest rate of 38% - will decrease the sector's income and stall the sector's profitability.

Europe/Middle East/Africa

- All major European equity indices closed lower; Spain -0.1%, UK -0.2%, Italy -0.6%, France -0.6%, and Germany -0.8%.

- Most 10yr European govt bonds closed lower except for France flat; Germany/Italy/Spain/UK +1bp.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +5bps/259bps.

- Brent crude closed +2.5%/$81.26 per barrel.

- Brent prices zoomed past $80/bbl this morning as OPEC+ announced an agreement to continue increasing production in November by 400,000 b/d, in line with recent monthly increases. Continued production increases were largely a foregone conclusion given recent price action and shortage fears spreading through energy markets like wildfire. Despite some rumors over the weekend of a potential pro-active acceleration of the unwinding to alleviate market anxiety, the group issued a remarkably swift decision to stick to schedule, maintaining the reactive and lead-from-behind posture championed by Saudi Energy Minister Abdulaziz bin Salman and adopted by the group through much of this year. While the move will keep the OPEC+ production cursor pointed higher over the next few months and likely into the winter, it may fall short of disproving spare capacity naysayers or responding to what is likely an increasingly loud chorus of consuming countries. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, and Sean Karst)

- Communication is key: With prices above $80/bbl, OPEC+ is now walking a delicate line between what could be described as pragmatic reactive management and either intentional or unintentional under-supplying of tightening markets amid a global energy crisis. Where markets interpret OPEC+ actions along this spectrum can have dramatically different price implications. Whereas pragmatic reactive management implies an ability to respond to market needs if the stability of physical markets is threatened, undersupplying markets implies either willingly or, more bullish still, unwillingly, squeezing markets at a time when oil demand is liable to benefit from the unexpected switching boon from gas.

- A full increase of 400,000 b/d would put more oil into the system than our current base case, which calls for flatter OPEC+ output as some gulf members step back to make way for more Russian and Kazakh increases, with other members beginning to reach production ceilings. In November we forecast a global deficit of 800,000 b/d (with a monthly OPEC+ uplift of 200,000 b/d), which could be closer to 1 MMb/d as switching from natural gas to fuel oil and diesel begins to bite in the northern hemisphere. This risk extends through the winter, with any surprise stock declines starting to have a bigger impact on price now that the huge inventory buffer from 2020 is gone in most markets outside of China.

- A group of environmental lawyers has taken the European Commission to the EU Court to challenge the secrecy surrounding the pesticide approvals process in the Standing Committee on Plants, Animals, Food and Feed (SCoPAFF). (IHS Markit Food and Agricultural Policy's Sara Lewis)

- ClientEarth is challenging the Commission's refusal to disclose the positions that national governments take in PAFF discussions and votes in the EU's General Court, specifically when it comes to cypermethrin.

- In a September 30 statement on the case, ClientEarth environmental lawyers explained that member states are collectively responsible for approving or rejecting the proposals of the European Commission to allow certain chemicals to be used as pesticides in the EU, pointing as example to the renewal of the authorization to use glyphosate until December 2022.

- ClientEarth's lawyers have "condemned the secrecy" of the SCoPAFF where the 27 agricultural ministries "decide whether to approve dangerous pesticides behind closed doors," the statement says.

- ClientEarth is therefore challenging the Commission's refusal to disclose the positions that member states are defending when it comes to renewing the authorization of cypermethrin in front of the General Court.

- Siemens Gamesa has received a firm order from Ørsted and Eversource to supply wind turbines for two wind farms offshore the USA with a combined capacity of 847 MW. This contract includes the supply, delivery, and installation of 77 SG 11.0- 200 DD wind turbines for the Revolution Wind project off Rhode Island and the South Fork wind farm off Long Island, New York. Of the total 77 offshore wind turbines, 65 will be installed at the 715 MW Revolution Wind, and the remaining 12 at the 132 MW South Fork. Revolution Wind and South Fork are scheduled to be completed in 2024 and 2023, respectively. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Renault Group is set to receive a dividend of around EUR931 million from its RCI Bank and Services consumer financing arm, reports Bloomberg News. According to the news service, this is due to the European Central Bank (ECB) lifting restrictions on dividend payments that were imposed on financial institutions early in the COVID-19 virus pandemic. The ECB decided in July not to extend these restrictions beyond September. RCI Bank and Services capital ratios will return to pre-pandemic levels, helping to bolster the automaker's financial performance in 2021. (IHS Markit AutoIntelligence's Ian Fletcher)

- Paris-based investment firm Ardian joined forces with Zurich-based FiveT Hydrogen on 1 October to create a €1.5-billion ($1.7 billion) fund known as Hy24 that will be dedicated to accelerating large-scale clean hydrogen projects and infrastructure. (IHS Markit Net-Zero Business Daily's Amena Saiyid and Mark Thomas)

- Hydrogen, especially the "green" variety produced from renewable power sources, is increasingly being viewed as an alternative to carbon-intensive fossil fuels because in liquid form it can be transported in existing pipelines, in solid form it can be used in fuel cells for automobiles, and it can be used to produce steel and cement, two traditionally carbon-intensive industrial processes.

- Expected to secure its first closing before the end of 2021, Hy24 plans to reach its funding goal by drawing on global chemical, energy, engineering, and construction companies as well as institutional investors that are already vested in finding clean hydrogen solutions. The partners say they will be creating "the industry's largest clean hydrogen infrastructure manager."

- Hy24 already has commitments from two sets of investors: Air Liquide, TotalEnergies, and construction group Vinci being one, while New York-based Plug Power, original equipment manufacturer (OEM) Chart Industries, and Baker Hughes form the other.

- The fund has already secured initial commitments of €800 million ($927.5 million), the backers say. Air Liquide, TotalEnergies, and Vinci said 1 October they each will invest €100 million ($115 million). Lotte Chemical and financial services group Axa also have indicated a commitment to participate as anchor investors, according to Hy24.

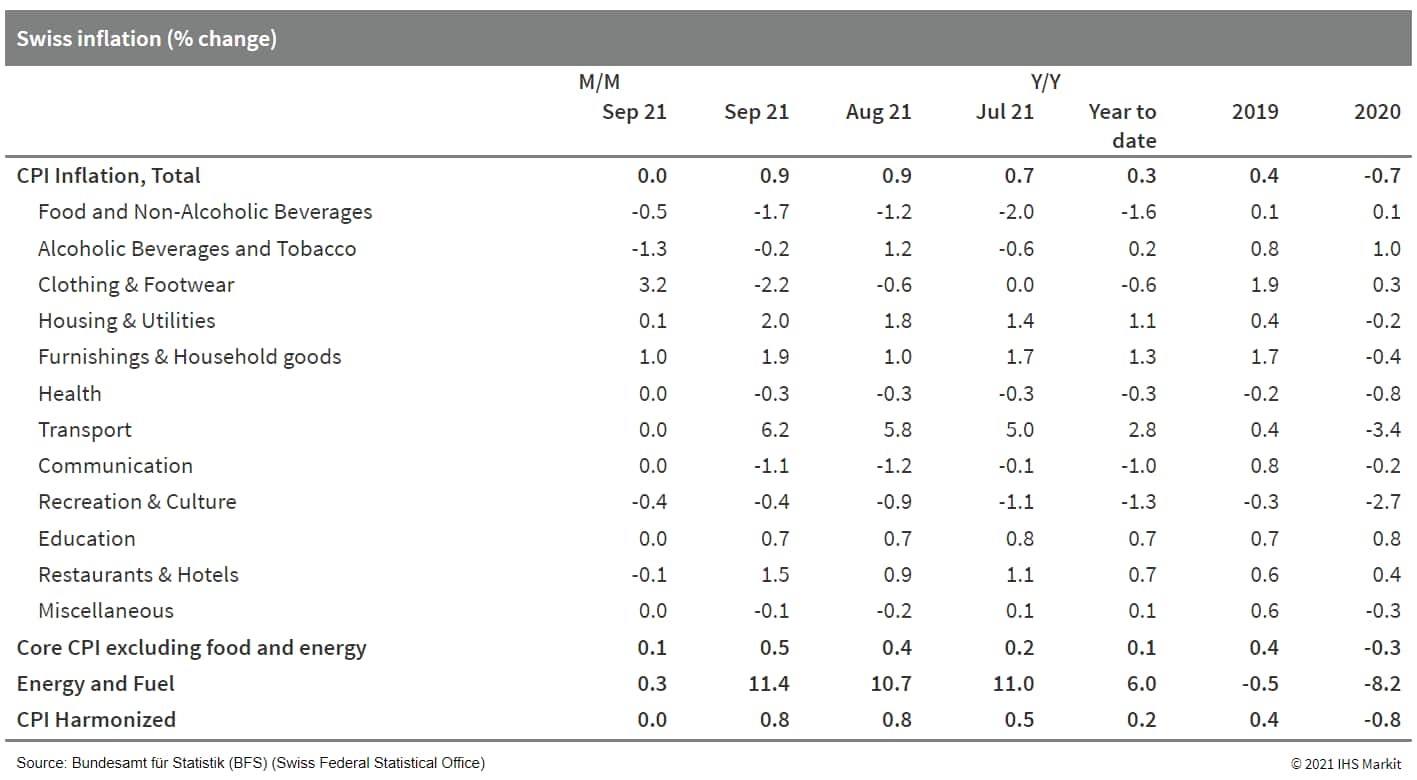

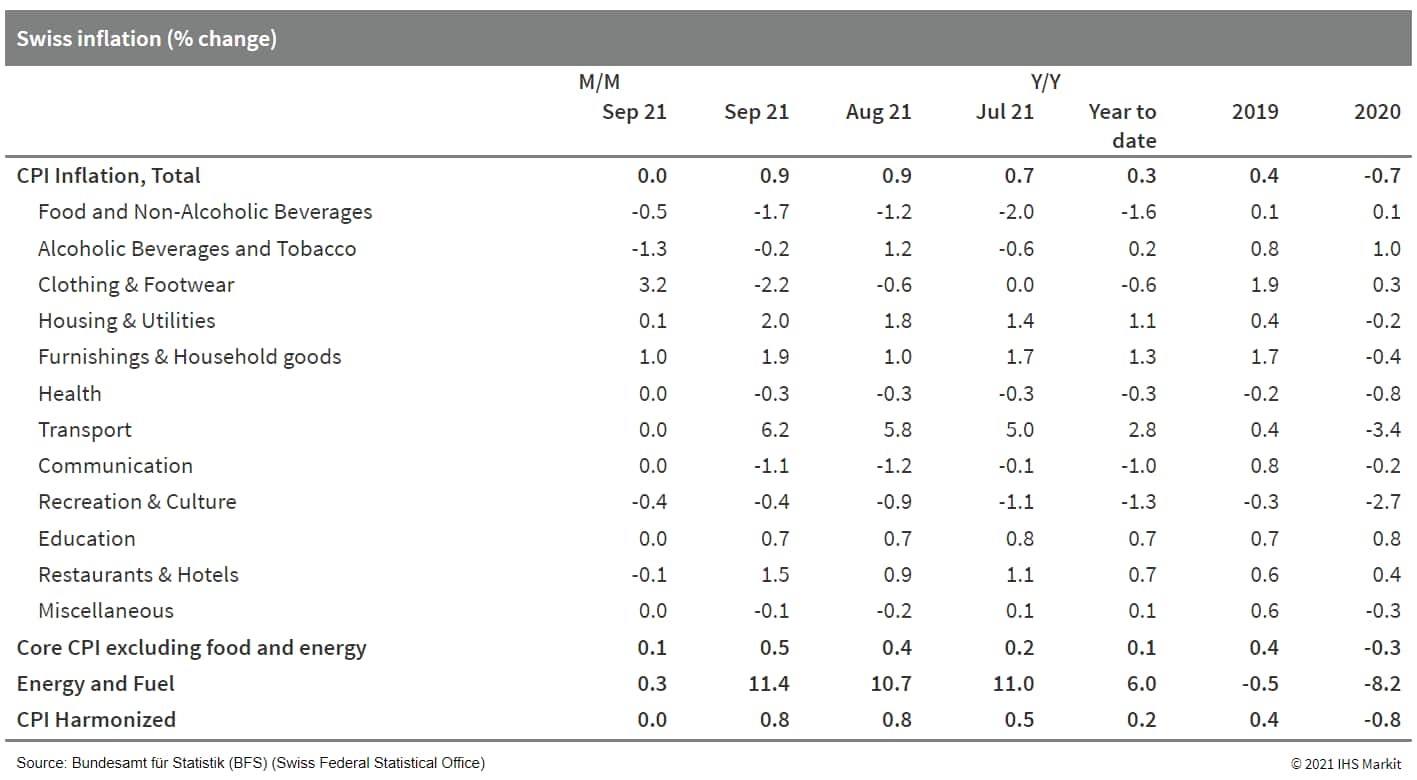

- According to the Swiss Federal Statistical Office (SFSO), Swiss consumer prices stagnated in month-on-month (m/m) terms in September, broadly in line with the September average of recent years. Thus, the annual inflation rate remained steady at 0.9%, which nonetheless is the highest level since November 2018. (IHS Markit Economist Timo Klein)

- Remarkably, only three of the 12 main (COICOP) categories of goods and services posted a decline in their annual rate, while seven showed an increase and two held steady (for details, see table below). These three, with a combined weight of 18%, were food, alcohol/tobacco, and clothing and footwear. They largely compensated for increases in the housing and utilities, transport, recreation and culture, and hotels and restaurant categories. Energy prices, which had declined in August, have rebounded modestly in September (0.3% m/m). The previous month's dip in year-on-year (y/y) terms therefore was unwound (up from 10.7% to 11.4%).

- The dampening influence from food and clothing restrained prices of goods generally, dampening their y/y rate from 1.4% to 1.2%. In contrast, inflation in the service sector increased anew from 0.5% to 0.8%, reflecting a sub-average seasonal monthly decline of -0.1% m/m.

- State-owned Uzbekneftegaz (Tashkent, Uzbekistan) has signed agreements with European banks worth €1.10 billion ($1.28 billion) for the financing of a previously announced expansion of its Shurtan gas chemical complex. (IHS Markit Chemical Advisory)

- The agreements were signed with Deutsche Bank, Landesbank Baden-Wuerttemberg, and Landesbank Hessen-Thüringen Girozentrale, it says. The agreement with Deutsche Bank is for up to €500 million, while the agreements with the other two banks are each for up to €300 million, it says.

- The total cost of the Shurtan expansion project is put at about $1.80 billion, with $600 million to be funded directly by Uzbekneftegaz, it says.

- The expansion of the Shurtan facilities will include the addition of 280,000 metric tons/year of bimodal polyethylene (PE) capacity, 100,000 metric tons/year of polypropylene (PP) capacity, and 50,000 metric tons/year of pyrolysis distillate, it says. Uzbekneftegaz will use naphtha as feedstock for the additional production.

- The Shurtan complex currently produces ethylene and more than 134,000 metric tons/year of PE, as well as 116,000 metric tons/year of liquefied petroleum gas (LPG), 103,000 metric tons/year of gas condensate, and 4.1 billion cu meters/year of raw gas. In October last year Lummus Technology was awarded a contract by Enter Engineering (Tashkent) to design and supply four steam-cracking furnaces to more than double ethylene production at the facility located in the Kashkadarya region of southwestern Uzbekistan.

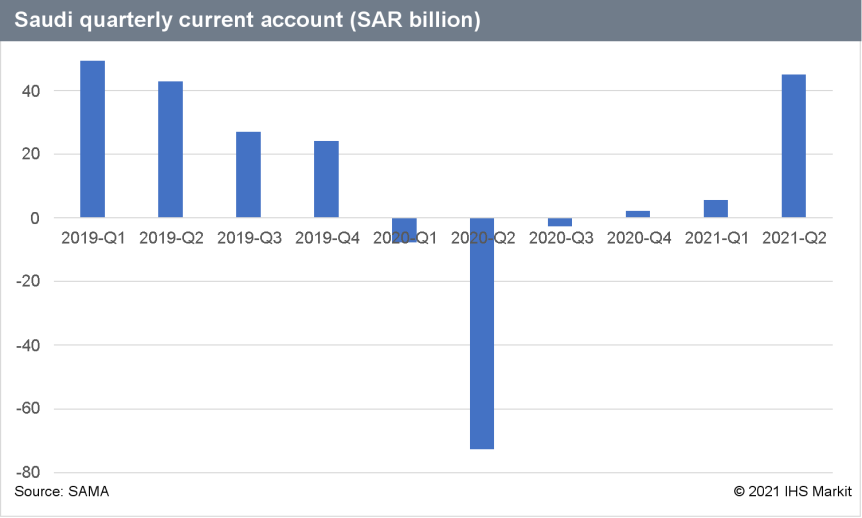

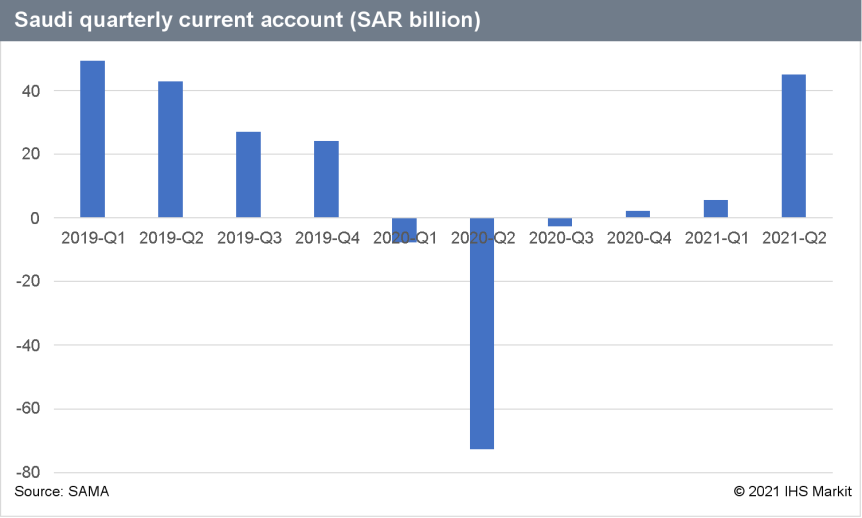

- The Saudi current account surplus reached SAR45 billion (USD12 billion) in the second quarter, according to the Saudi Monetary Authority (SAMA), the central bank. The surplus compares with an average of SAR5.5 billion in the first quarter and a deficit of SAR73 billion in the second quarter of 2020. (IHS Markit Economist Ralf Wiegert)

- The deficit in the second quarter 2020 had suffered from the low oil price and Saudi Arabia's production restraint at that time; the rebound of the oil price since then, during the first half 2021, meant that a sizable surplus was expected. However, the surplus in the second quarter 2021 was still higher than expected, equaling 6.1% of GDP.

- The oil share of goods exports has trended down compared to the pre-crisis period. At 73%, the oil share was some four percentage points below the value for 2019 (77%). It should be kept in mind that oil production was still restricted in the second quarter; with a higher production rate, oil exports will catch up in the second half of 2021.

- Foreign direct investment inflows reported a record inflow of SAR51.9 billion, the highest inflow ever and more than seven times the size of the previous quarter (SAR6.8 billion). However, the bulk share of the inflow was connected with the sale of a 49% stake in Saudi Aramco's pipeline network, which accounted for SAR46.5 billion (USD12.4 billion) alone.

- African Export-Import Bank (Afreximbank) and the AfCFTA Secretariat announced on 28 September the "operational roll-out" of the Cairo-based Pan-African Payment and Settlement System ("PAPSS"). (IHS Markit Economist Brian Lawson)

- PAPSS was initially launched in July 2019 to facilitate implementation of the African Continental Free Trade Agreement (AfCFTA).

- The announcement follows a pilot phase in the West Africa Monetary Zone (WAMZ), with Afreximbank having approved USD500 million to "support… clearing and settlement" in WAMZ countries including Nigeria and Ghana.

- The statement states that another USD3 billion will now be made available "to support the system's continent-wide implementation".

- It notes that Afreximbank provides settlement guarantees and overdraft facilities for system users.

- It is now holding "advanced discussions" with other national and regional bodies to extend the system. PAPSS Chair and Afreximbank President Benedict Oramah highlighted that PAPSS is not seeking to replace existing systems, but instead seeks their integration into a common payment network.

Asia-Pacific

- APAC equity markets closed mixed; Australia +1.3%, India +0.9%, Japan -1.1%, and Hong Kong -2.2%.

- The People's Bank of China and the China Banking and Insurance Commission at the end of September held a working seminar with several local government bodies and 24 major banks. The meeting reiterated the importance of several things: stable real estate financing to encourage wider financial stability, "stable land price, stable house price and stable expectations", and the notion of property for living, not for flipping. In addition, the meeting also noted the need to protect homeowners' rights and the need to speed up financing for homes for rent. (IHS Markit Banking Risk's Angus Lam)

- Real estate financing has come into focus since the house price slowdown in China and the issues with Evergrande Group (see China: 27 September 2021: Isolated debt issue at China Evergrande unlikely to materially affect banking sector, confidence remains at large banks). The current focus is not surprising since about 29% of loans issued by Chinese banks are used towards the real estate sector.

- Chinese authorities have already stepped up their safety net around Evergrande Group through taking control of the pre-sale revenues of housing projects to ensure that the funds are used to develop the projects, therefore allowing their completion. IHS Markit expects that this will affect Evergrande's ability to repay its liabilities to debt holders but will reduce the contagion risk and homebuyers' confidence in terms of property projects that are yet to be completed. It is currently uncertain whether the move will become a permanent feature for all property projects from all developers in China.

- FAW Group's premium vehicle brand, FAW Hongqi, has announced that it is to commence exports of China-made electric sport utility vehicles (SUVs) to Norway, reports Reuters. The brand states that it has received 500 orders for its SUVs in Norway. The automaker has not revealed details of the models ordered. (IHS Markit AutoIntelligence's Isha Sharma)

- Chinese electric vehicle (EV) maker NIO has officially opened its dealership NIO House in Oslo (Norway). The automaker will offer the ES8 sport utility vehicle (SUV) in 75-kWh and 100-kWh battery pack variants. The starting price of the NIO ES8 with a standard battery pack is NOK609,000 (USD69,151), while that of the NIO ES8 with a long-life battery pack starts at NOK679,000 (USD77,099). Customers can buy the ES8 without the battery and use NIO's Battery as a Service (BaaS) sales model, in which there is a monthly subscription for use of the battery and additional services. The first integrated NIO station, with both battery swapping and charging stalls, will be launched by the end of next month in Norway. The EV maker intends to install 20 battery swap stations covering Norway's five biggest cities and major highways by the end of 2022, reports Pandaily. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- LG Uplus, a mobile carrier in South Korea, will provide 5G connectivity services for a local car-sharing platform HUMAX Mobility, reports Aju Business Daily. The 5G communication technology will be used to connect cars, services, and facilities such as smart car parks and a control tower. LG Uplus will offer 5G-connected smart city technologies, while HUMAX will provide real-time information about vehicles, charging stations, and parking facilities. This development will enable LG Uplus to make a foray into the 5G-connected mobility service market. LG Uplus aims to deploy 5G infrastructure in major South Korean cities. The mobile carrier has established 5G mobile communication infrastructure for South Korea's autonomous vehicle (AV) test-bed, K-City. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SK Innovation plans to double the number of researchers to develop electric vehicle (EV) batteries from the current level by 2023, reports the Yonhap News Agency. The announcement was made by SK Innovation CEO and president Kim Jun during a global forum in San Francisco (US). The forum was meant to recruit battery researchers and expand SK Innovation's network with US universities and research institutes. The company did not provide any information about the current status of its researchers. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korean automakers posted a 20.7% year-on-year (y/y) plunge in their combined global vehicle sales to 539,236 units in September, according to data released by five major domestic manufacturers, as reported by the Yonhap News Agency and compiled by IHS Markit. The five automakers reported a 33.7% y/y decline in their combined domestic sales last month to 91,790 units, while their combined overseas sales went down by 17.3% y/y to 447,446 units. The plunge in South Korean OEMs' combined global sales during September was mainly due to the global semiconductor shortage and the prolonged COVID-19 virus pandemic, which continued to weigh down on vehicle production and sales. South Korea relies heavily on overseas sources for automotive chips. The current shortage has disrupted automakers' production in the country and the issue is expected to continue to have an impact as manufacturers ramp up production of next-generation EVs. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 04 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.