All major European and most APAC equity markets closed higher, while most US indices were lower. US and benchmark European government bonds closed mixed for a second consecutive day. European iTraxx was unchanged across IG and high yield, CDX-NAIG was also flat, and CDX-NAHY was slightly wider on the day. The US dollar and natural gas closed higher, gold was unchanged, and silver, copper, and oil were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower except Nasdaq +0.1%; S&P 500 -0.5%, DJIA -0.9%, and Russell 2000 -1.2%.

- 10yr US govt bonds closed flat/1.18% yield and 30yr bonds -1bp/1.84% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY +3bps/296bps.

- DXY US dollar index closed +0.2%/92.27.

- Gold closed flat/$1,815 per troy oz, silver -0.5%/$25.46 per troy oz, and copper -1.2%/$4.33 per pound.

- Crude oil closed -3.4%/$68.15 per barrel and natural gas closed +3.3%/$4.16 per mmbtu.

- In a press release, Callon Petroleum Company announced the signing of an agreement to acquire Primexx Energy Partners and its affiliates in a cash and stock transaction valued at $788.4 million. The transaction is expected to close early in the fourth quarter of 2021. Under the deal, Callon will pay $440 million in cash and will issue 9.19 million Callon shares valued at $348.4 million based on its closing price on 3 August 2021. The transaction includes a contiguous footprint of 35,000 net acres in the Delaware Basin in Reeves County. Net production averaged 18,000 boe/d (61% oil) during the second quarter of 2021, Callon said. Callon said the acquisition represents a significant step forward in its strategy to deliver long-term value to shareholders through the application of its scaled, life-of-field development model while strengthening its financial position. Primexx Energy Partners is a privately held E&P company operating in the Southern Delaware Basin of West Texas. The company is based in Dallas, Texas. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Job creation at private companies tumbled in July as fears mounted over the spreading Covid-19 delta variant, payroll processing firm ADP reported Wednesday. Employers added 330,000 positions for the month, a sharp deceleration from the downwardly revised 680,000 in June. It's also well below the 653,000 Dow Jones estimate. June's final total fell from the initial estimate of 692,000. (CNBC)

- The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 59.9 at the start of the third quarter, down from 64.6 in June. (IHS Markit Economist Chris Williamson)

- The latest upturn in business activity was marked overall, despite easing to a five-month low. Greater output was linked to strong demand conditions and a sustained increase in new orders. Some companies stated that capacity constraints hampered activity growth.

- The IHS Markit U.S. Composite PMI Output Index* posted 59.9 in July, down from 63.7 in June and falling further from May's recent high. The rate of expansion was the softest since March amid a slower upturn in service sector activity, but was quicker than the series average. Inflationary pressures remained substantial at the start of the third quarter. Input costs rose markedly, and at one of the fastest rates on record amid significant supplier delays and material shortages.

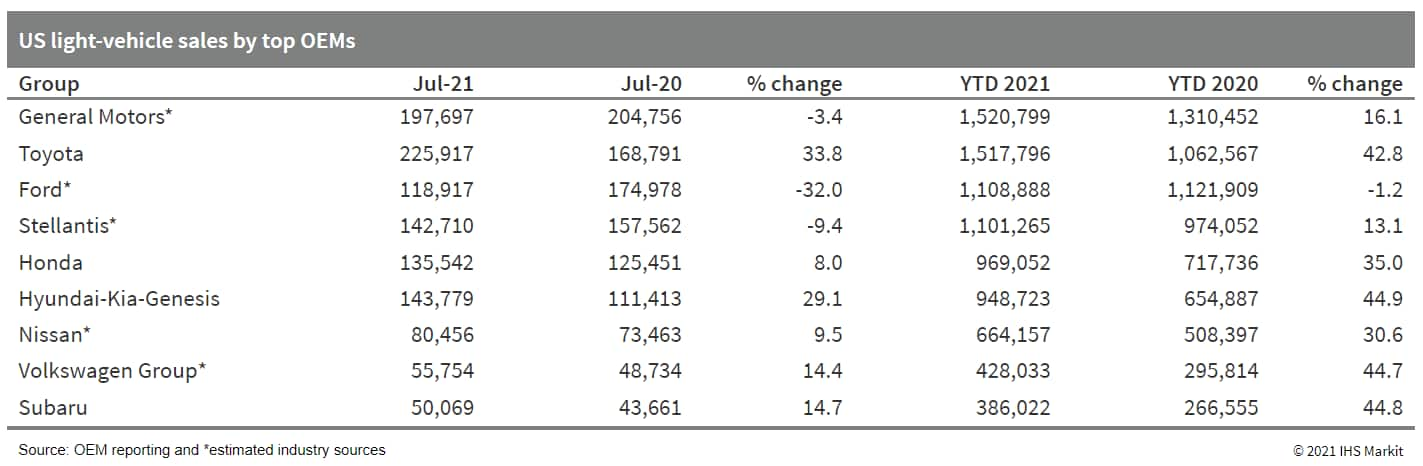

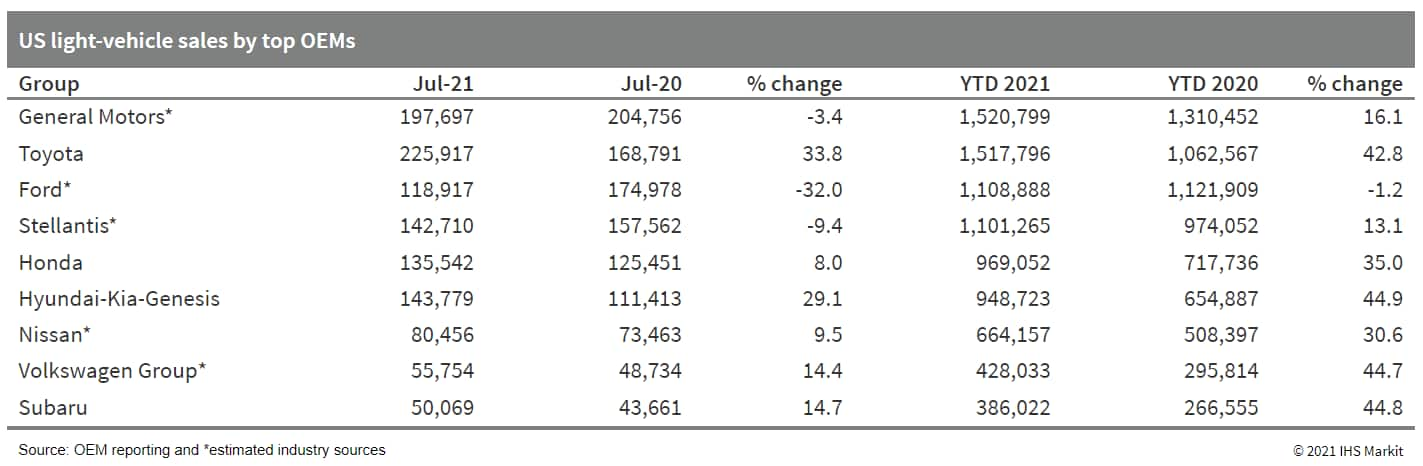

- July's sales were affected by supply issues, and the frenetic pace in March, April, and May was slowed by inventory issues. On a volume basis, US light-vehicle sales improved by 4.7% y/y in July. Owing to the progressively thinning inventory levels and a possible pull-ahead effect from the torrid pace of auto demand realized in March, April, and May, auto sales demand dropped again in July, reflecting our assumption that monthly sales levels would moderate. Although we expect improvements from the inventory side of the equation as the industry progresses through the second half of the year, there is not much relief likely to be realized in August. IHS Markit forecasts full-year sales to reach 16.8 million units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) startup Nikola has reported its financial results for the second quarter, although it has not yet started delivering vehicles. The company continues to post an operating loss, with a greater loss in the second quarter (USD138.4 million) than in the second quarter of 2020 (USD86.6 million). With partner Iveco in Ulm (Germany), Nikola has completed the second batch of nine Tre battery electric vehicles (BEVs) and in June started trial production on an assembly line at the facility, with two pre-builds currently "on the line being assembled". Nikola said that three of the nine trucks are at various stages of validation at its headquarters in Arizona (United States), and the remaining six are undergoing commissioning in Arizona. The company has completed Phase 0.5 at its Coolidge, Arizona, manufacturing facility and is in the process of building seven trucks there; two of them are Tre BEV pre-builds and five are Tre fuel-cell electric vehicle (FCEV) Alphas, the company noted. This is in alignment with the expectations that Nikola laid out in its first-quarter earnings. With first-quarter earnings, the company had announced an agreement with RIG360, a network of heavy-duty truck service and maintenance centers in the US, to provide both servicing and a sales network and distribution channel for Nikola trucks. With second-quarter results, it announced a further expansion of the network by 51 locations in Texas, Arizona, California, Colorado, New Mexico, Florida, Delaware, Virginia, and Maryland. The total has increased to 116, the company said. Reuters reported that Nikola also revised its expectations for deliveries in 2021 to between 25 and 50 vehicles, down from an earlier estimate of 50 to 100 vehicles. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lyft has reported a narrowed net loss of USD251.9 million for the second quarter of 2021, compared with USD437.1 million in the same period of 2020, according to a company statement. This loss is attributable to stock-based compensation and related payroll tax expenses as well as previously disclosed agreement to reinsure certain legacy auto insurance liabilities. It reported its first quarterly adjusted EBITDA profit of USD23.8 million three months ahead of its target. The company's revenue increased to USD765.0 million in the quarter, up 125.0% year on year (y/y) and 26.0% quarter on quarter (q/q). Lyft said that the growth in revenue was attributable to increase in the number of active riders, which reached 17.1 million in the period, up 97.3% y/y. In addition, revenue per active rider increased 14.3% y/y, to USD44.6. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- ArcelorMittal announced that it will collaborate with the Government of Canada to accelerate decarbonization efforts at ArcelorMittal Dofasco in Hamilton, Ontario. The two entities will jointly invest USD1.4 billion (CAD1.8 billion) to reduce annual CO2 emissions at the plant by approximately 3 million tons within the next seven years. According to ArcelorMittal, it will transition towards the Direct Reduced Iron (DRI) - Electric Arc Furnace (EAF) production route, which carries a significantly lower carbon footprint, to produce steel. This method will replace the polluting blast furnace-basic oxygen furnace steelmaking production route. The new DRI facility will have a capacity of 2 million metric tons and will be accompanied by an EAF facility capable of producing 2.4 million metric tons of high-quality steel through its existing secondary metallurgy and secondary casting facilities. The company revealed that investment is contingent on support from the governments of Canada and Ontario. The Government of Canada has committed USD320 million (CAD400 million) for this project. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- The Canadian Pest Management Regulatory Agency (PMRA) has proposed continued registration of the systemic fungicide, tebuconazole, and products based on the active ingredient. In its proposed re-evaluation decision on tebuconazole, the Agency notes that risks posed by the ai to human health and the environment were found to be "acceptable" when used in accordance with proposed conditions of registration, including new risk mitigation measures. Tebuconazole is registered in the country for the control of foliar, seed-borne and soil-borne diseases on large field crops, asparagus and turf, besides other non-crop uses. The PMRA backs its proposed re-evaluation decision citing an assessment of available scientific information, although it mandates that risk mitigation measures be put in place for human health and the environment. To protect humans from dietary exposure including through drinking water, the Agency notes that the maximum cumulative rate for turf uses must be reduced from 3.10 kg/ai/ha per year to 1.44 kg/ai/ha. It also proposes a rotational plant back interval of 120 days for food and feed crops to ensure consistency among product labels. The Agency says that labels must be updated to reflect the requirement of personal protective equipment (PPE) for workers using agricultural and turf end-use products, while those harvesting short-rotation intensive culture crops such as poplar and willow must adhere to a restricted-entry interval (REI) of one day. (IHS Markit Crop Science's Akashpratim Mukhopadhyay)

- The Board of the International Monetary Fund (IMF) approved on 2 August a USD650-billion allocation of Special Drawing Rights (SDRs) to be distributed among its members to help them face the economic effects of the coronavirus disease (COVID-19) virus pandemic; Argentina is scheduled to receive USD4.35 billion on 23 August. The Argentinian government is still restructuring the USD44-billion loan that the IMF extended to then-president Mauricio Macri in 2018, and, on 2 August 2021, made a USD345-million interest payment to the organization using foreign reserves. Argentina is also restructuring its debt with the Paris Club; on 23 June, Minister of Finance Martín Guzmán announced partial payments to that entity in 2021, while extending to 31 March 2022 the deadline to renegotiate the remainder of the debt with the club. Argentina will use the newly provided SDRs to service its debt with the IMF during the rest of 2021. This, together with the larger-than-expected dollar revenue as a result of rising prices for soybeans, Argentina's main export, reduces the risk of default on its debt with multilateral organizations by allowing the country to service repayments due in September and December. (IHS Markit Country Risk's Carla Selman)

Europe/Middle East/Africa

- All major European equity indices closed higher; Germany +0.9%, Italy +0.5%, France +0.3%, UK +0.3%, and Spain +0.2%.

- 10yr European govt bonds closed mixed; Germany -2bps, Italy/France -1bp, UK flat, and Spain +1bp.

- iTraxx-Europe flat/47bps and iTraxx-Xover flat/293bps.

- Brent crude closed -2.8%/$70.38 per barrel.

- Electric vehicle (EV) startup Arrival has completed a live demonstration of its automated system at a parcel depot in the UK, according to a company statement. During the demonstration, the Arrival van maneuvered around the facility without a human driver and completed all the operations of a commercial fleet driver autonomously. It developed this technology as part of a project called Robopilot, which is partly funded by Innovate UK and the Centre for Connected Autonomous Vehicles (CCAV), and aims to improve market knowledge, functionality and public perception of autonomous systems. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Eurozone retail sales volumes rose by 1.5% month on month (m/m) in June, the fourth increase in the past five months. Although slightly below the market consensus expectation (of 1.7%, according to Reuters' survey), June's rise means that sales volumes are 4.8% above their February 2020 level prior to the first wave of the COVID-19 virus pandemic. (IHS Markit Economist Ken Wattret)

- Retail sales in the second quarter as a whole rose by 3.4% quarter on quarter (q/q), following successive q/q contractions in the prior two quarters.

- Back-to-back increases in May and June also mean that "carry over" effects should be very positive for retail sales growth in the third quarter. No change in the level of retail sales from July to September would still yield a 2%-plus q/q increase.

- The breakdown of June's data again highlights the contrast between post-pandemic trends in expenditure, with mail-order and internet sales still over 40% above their pre-pandemic level despite June's near-3% m/m decline.

- Non-food sales overall were almost 9% above their pre-pandemic level in June, despite weakness in key areas such as sales of textiles, clothing, and footwear.

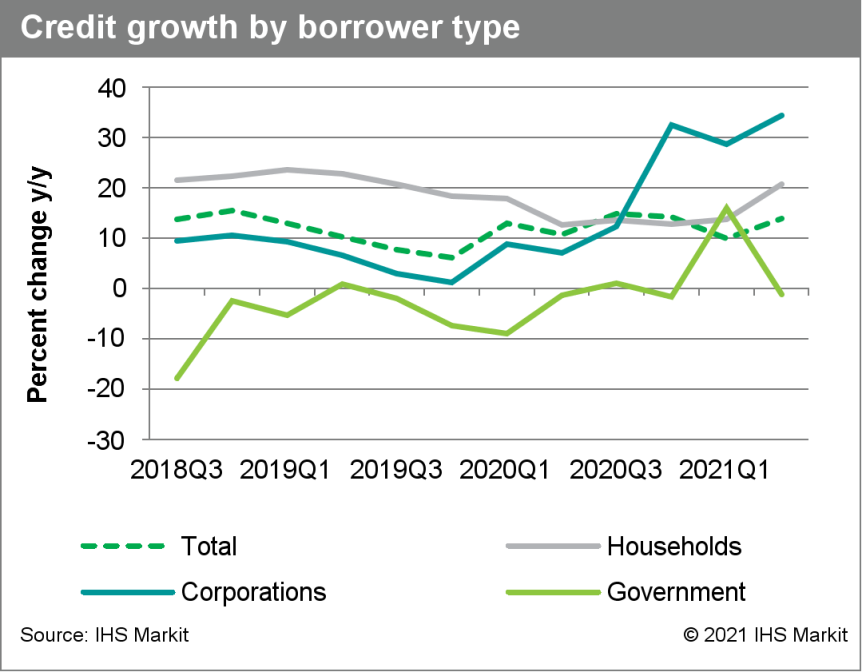

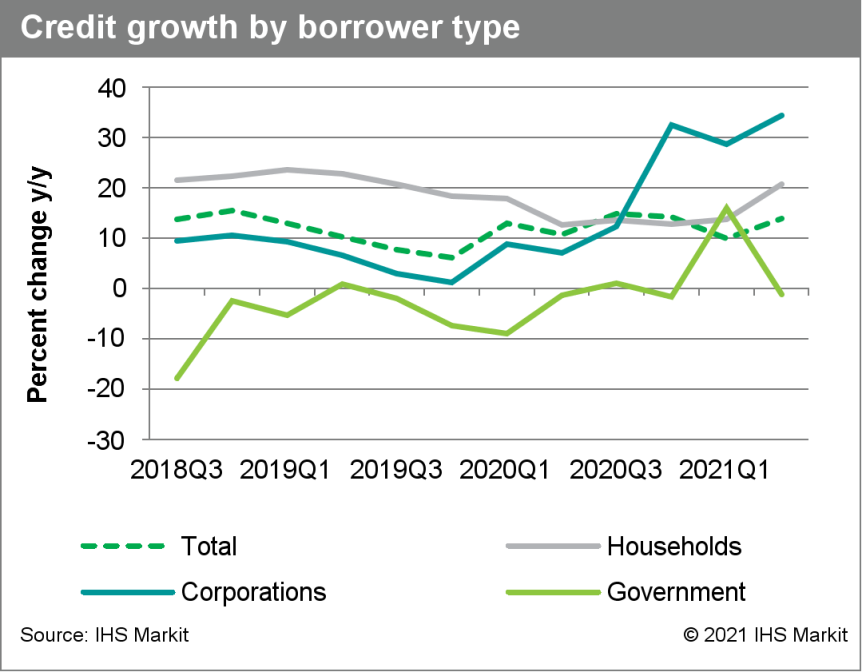

- According to the latest data from the Central Bank of Russian Federation (CBR), credit growth accelerated to 14% year on year (y/y) in the second quarter of 2021, up from 9.9% y/y in the first quarter. Household credit rose by 20.7% y/y, driven by a surge in mortgages and unsecured loans, while corporate credit increased by 34.4% y/y. (IHS Markit Banking Risk's Greta Butaviciute)

- The faster economic recovery in the second quarter supported the sharp increase in lending. The CBR highlighted that the highest rise in lending, amounting to over 30% y/y, occurred in "large universal banks actively ramping up consumer lending to diversify their business", while mortgage lending accelerated in June as households rushed to take out loans before the end of the concessional lending program on 1 July.

- IHS Markit expects lending to slow in the second half of the year as the central bank tightens macroprudential requirements. At the end of July, the regulator increased risk weight add-ons for unsecured consumer loans issued from 1 October "to discourage banks to increase high-risk lending and to hinder the growth of households' debt burden".

- In May, the CBR raised risk weight add-ons for mortgages granted from 1 August to "help reduce the incentives for banks to expand lending by issuing loans with a low down payment to borrowers." These efforts by the central bank are likely to result in credit growth slowdown in the second half of the year. As such, IHS Markit projects that the annual credit growth will reach 10.6% in 2021 before slowing to 9.2% in 2022.

- Russia's first electric vehicle (EV), the Zetta, will go into mass production at the end of this year, according to Electrive. The three-door EV will be manufactured at the Togliatti plant in the Samara region. The vehicle can reach a top speed of 120 km/h and will be priced at RUB550,000 (USD7,551). Production of the Zetta EV was originally supposed to begin last year, but this timeline was not met. According to media reports, Russia wants EVs to account for 10% of the country's total vehicle production by 2030. However, there is no real market for battery electric vehicles (BEVs) in Russia at this time, with a significant number of the 687 new BEVs sold in the country last year being high-cost models such as Teslas, which are sold almost exclusively in metropolitan areas. The overall BEV parc in Russia is currently just 10,000 units, according to Russian analytical agency Autostat. (IHS Markit AutoIntelligence's Nitin Budhiraja)

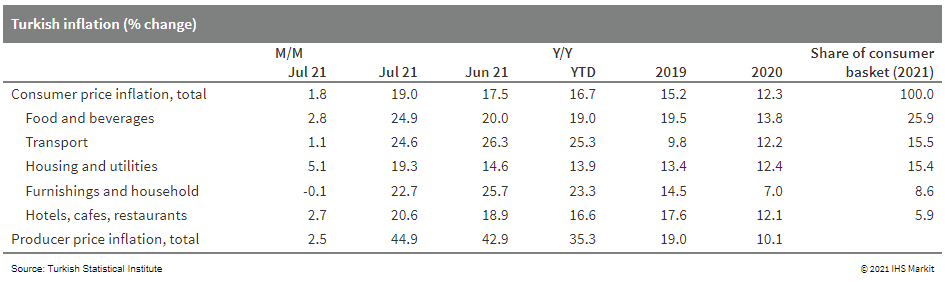

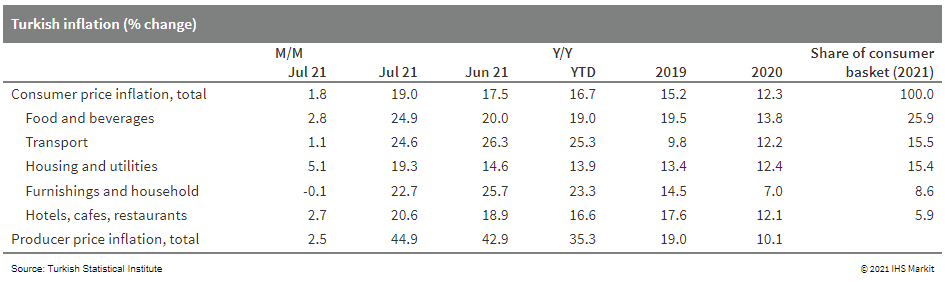

- Turkish annual inflation shot up to 18.95% in July 2021, now only slightly below the central bank main policy rate of 19%. With input and producer prices soaring, consumer price inflation is likely to accelerate. The surge of price growth will elevate the importance of the rate policy meeting on 12 August. The current central bank governor recently dropped his pledge to keep the policy rate above inflation, but he continues to promise to maintain "restrictive" monetary policy. (IHS Markit Economist Andrew Birch)

- As of July 2021, Turkish annual consumer price inflation pushed to 18.95% according to data from the Turkish Statistical Institute (TurkStat). Annual consumer price growth reached its highest level since April 2019.

- Amid a local drought, food prices rose by 2.8% in July and prices in hotels, cafés, and restaurants increased by 2.7% - both contributing to an overall 1.8% rise of inflation that month.

- TurkStat also reported that producer price inflation surged to 44.9% in July 2021, soaring from 8.3% a year earlier. Domestic producer price inflation jumped by 2.5% over the course of July alone, with a 9.3% surge in crude petroleum and gas prices driving up overall costs.

Asia-Pacific

- Most major APAC equity markets closed higher except Japan -0.2%; South Korea +1.3%, India +1.0%, Hong Kong +0.9%, Mainland China +0.9%, and Australia +0.4%.

- China's State Administration for Market Regulation has said that it is investigating auto chip dealers that are suspected of illegal practices like hoarding, price gouging and collusion resulting in driving up the prices of semiconductor chips during the global shortage, according to Dow Jones Newswire. According to reports, Chinese authorities have vowed to establish semiconductor supply chains that rely less on imports and have said they are engaging with auto manufacturers and chip makers to match supply and demand. According to IHS Markit's forecast, the total production loss in mainland China during the first two quarters the year due to the semiconductor shortage issue stands at 364,000 units and 420,000 units lost, respectively and the latest shows 87,000 units at risk in the third quarter. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Autonomous truck startup Inceptio Technology has completed a Series B funding round worth USD270 million, which was jointly led by JD Logistics, Meituan, and PAG. New investors Deppon Express, IDG Capital, CMB International, SDIC, Mirae Asset, Eight Roads, and Broad Vision Funds as well as existing investors GLP Hidden Hill Capital, CATL, NIO Capital, and Eastern Bell Capital also participated in the financing round. The company plans to use the infused capital to further develop its full-stack autonomous system, named Xuanyuan, as well as accelerate deployment of fully electric trucks on its logistics network, reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Mitsubishi Chemical Holdings reports ninefold growth in net profit for the company's fiscal first quarter ended 30 June, to ¥49.9 billion ($457.4 million), from ¥5.1 billion in the year-earlier quarter. Operating income rose threefold to ¥87.0 billion versus ¥23.7 billion in the year-earlier quarter. Group revenue rose 28.4% year on year (YOY) to ¥928.2 billion. (IHS Markit Chemical Advisory)

- Operating income more than doubled at Mitsubishi's performance products business, to ¥26.6 billion, compared with ¥11.3 billion a year earlier, on sales of ¥283.0 billion, up 26.7%. In the polymers and compounds businesses, revenue increased reflecting a rise in volumes for products used in the automotive industry and an upturn in market prices for some polymers.

- In films and molding materials, revenue increased reflecting a rise in sales of molding materials for use in cars and other applications, and due to growth in sales of films used for optical applications for displays. In advanced solutions, revenue grew because of recovering demand.

- The chemicals business, Mitsubishi's largest, swung to an operating profit of ¥34.7 billion from a loss of ¥17.5 billion in the year-earlier period, on sales of ¥291.8 billion, a rise of 57.0%. In methyl methacrylate (MMA), revenue grew because of a rise in the market price of MMA driven by strong demand. In petrochemicals, sales expanded.

- Toray Industries says its net profit for the fiscal first quarter ended 30 June increased threefold to ¥29.7 billion ($272.4 million), compared with ¥9.4 billion in the year-earlier quarter. Revenue grew 9.2% year on year (YOY) to ¥1.9 trillion. First-quarter operating income also rose threefold to ¥35.8 billion, compared with ¥9.4 billion in the year-earlier period. (IHS Markit Chemical Advisory)

- Toray's fibers and textiles business posted revenue higher by 27.0% YOY, to ¥184.2 billion. Increased demand was seen in Japan and abroad. In the apparel sector, some applications remained affected by COVID-19 and sports and outdoor applications performed strongly. In the industrial sector, automotive applications recovered with increased sales volume. Quarterly operating income in the business was 63.4% higher YOY, at ¥11.8 billion.

- Revenue of the company's performance chemicals business increased 43.0% YOY, to ¥222.6 billion. Operating income more than doubled to ¥27.9 billion. Demand in the resins business was strong given the rebound from the COVID-19 pandemic, resumption of operations by car manufacturers, and the recovery of the Chinese economy. The chemicals business saw a recovery in the basic chemicals market.

- In the films business, battery-separator films for lithium-ion secondary batteries recovered for automotive applications, and polyester films for optical applications and electronic components performed strongly. In the electronic and information materials business, organic-light emitting diode (OLED)-related demand increased.

- Toray's carbon fiber composite materials business posted an increase in revenue of 6.9% YOY, to ¥48.45 billion, and an operating loss of ¥2.1 billion. Sales for wind turbine blade applications remained strong in industrial applications, but the aerospace application segment was hurt by declining production of commercial aircraft. Higher raw material prices weakened the performance of this sector.

- The environment and engineering business recorded a 17.6% YOY increase in revenue, to ¥43.7 billion, with operating income rising fourfold to ¥3.4 billion. In the water-treatment segment of the business, demand for reverse-osmosis membranes and other products grew strongly, but shipments to certain regions were restricted by COVID-19.

- MG Motor India has reportedly partnered with Indian telecommunications company Reliance Jio to equip its upcoming gasoline (petrol) derivative of the MG ZV electric vehicle (EV) with Internet of Things (IoT) solutions, reports the Economic Times. As per the terms of the partnership, the telco company's 4G network will provide high-speed in-car connectivity to customers of the automaker's upcoming sport utility vehicle (SUV), which is likely to be rebadged as the Astor, in cities, towns, and rural areas. Reliance Jio's embedded SIM (eSIM) and IoT solutions will help customers access infotainment features and real-time vehicle telematics. (IHS Markit AutoIntelligence's Tarun Thakur)

- Jadestone Energy has finalized the acquisition of SapuraOMV's entire interests in producing assets offshore Peninsular Malaysia. The assets include AAKBNLP, PM318, PM323 and PM329 production sharing contracts (PSCs). Jadestone Energy will hold a 70% operated interest in PM329 PSC, which contains East Piatu field, and a 60% operated interest in PM323 PSC, containing East Belumut, West Belumut and Chermingat fields. All fields are in production and have been developed by fixed wellhead and central processing platforms, which deliver oil to onshore Terengganu Crude Oil Terminal. Other assets include a 50% non-operated working interest in PM318 and AAKBNLP PSCs, which are operated by Petronas Carigali. (IHS Markit Upstream Costs and Technology's Lopamudra De)

Posted 04 August 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.