All major European and US equity indices closed lower, while APAC markets were mixed. US and benchmark European government bonds closed higher. CDX-NA and European iTraxx closed wider across IG and high yield. The US dollar, oil, natural gas, gold, silver, and copper all closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Nearly all the stocks in the S&P 500 fell as investors pulled away from riskier assets and sought haven in government bonds. The financial, communications, industrials, consumer staples and material sectors all declined more than 2%, and all 11 sectors in the index slid at least 1%. Stocks dropped after the opening bell Tuesday, and the declines accelerated after Federal Reserve Chairman Jerome Powell said the central bank would consider speeding up the wind-down of its easy-money policies in an effort to curtail inflation. In response, investors sold shares deemed most apt to be affected by inflation, such as banks and rapidly growing companies, as well as those that have been hit by supply-chain issues, like manufacturers and miners. (WSJ)

- All major US equity indices closed lower; Nasdaq -1.6%, DJIA -1.9%, S&P 500 -1.9%, and Russell 2000 -1.9%.

- 10yr US govt bonds closed -6bps/1.44% yield and 30yr bonds -6bps/1.79% yield. The 2s10s basis closed at +92bps, which is the flattest point since 26 January.

- CDX-NAIG closed +3bps/58bps and CDX-NAHY +11bps/329bps.

- DXY US dollar index closed -0.4%/95.99, with the index surging 1% on Chairman Powell's hawkish remarks during today's congressional testimony.

- Gold closed -0.5%/$1,777 per troy oz, silver -0.2%/$22.82 per troy oz, and copper -1.4%/$4.28 per pound.

- Crude oil closed -5.4%/$66.18 per barrel and natural gas closed -5.9%/$4.57 per mmbtu.

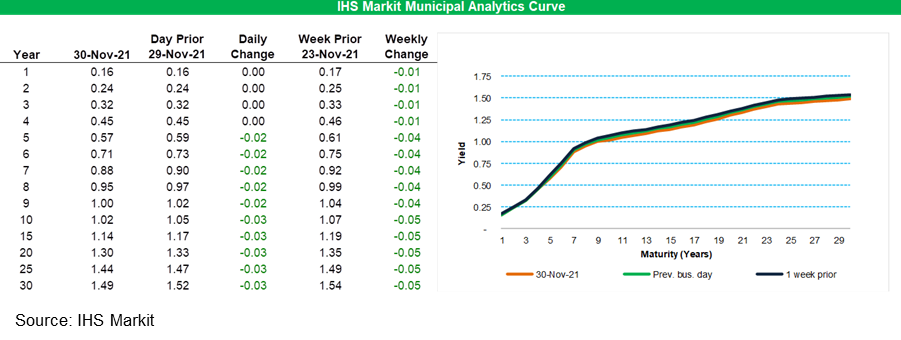

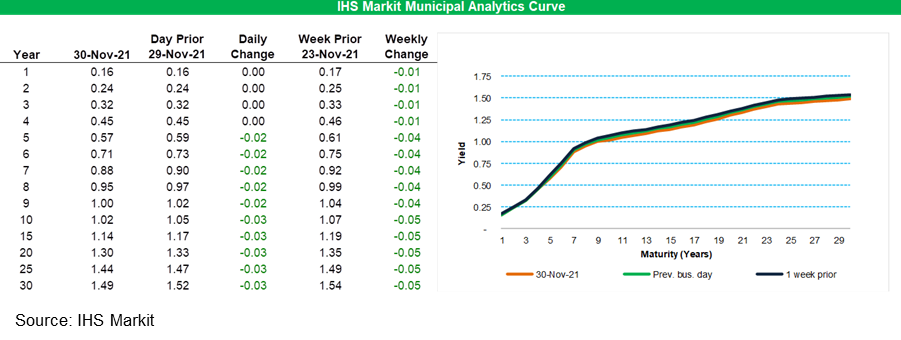

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) rallied 2-3bps for 5-year and longer paper, with that same part of the curve 4-5bps better week-over-week.

- Municipal bond buyside accounts will welcome greater par size following the volume-reduced Thanksgiving Holiday week which supplied $1.4 billion, after several issuers stepped up to the plate and priced throughout a period of quiet new issue activity. The Desert Community College District, CA (Aa2/AA/-) led last week's negotiated calendar, offering buyers $205mm of general obligation bonds spanning across two series with maturities ranging from 08/2022-08/2037, with investor demand suppressing yields by 2-5bps with the largest bumps noted in the front-end maturities. The Schertz-Cibolo-Universal City Independent School District of Texas (Aaa/-/-) also came to market with $68 million of unlimited tax refunding bonds with a PSFG enhancement across 02/2023-02/2039 with noteworthy bumps of 5-20bps across the scale, providing longer date focused investors a yield of 2.75% in the 2039 maturity, falling +109bps off the 10YR UST. This week's uninterrupted calendar will provide $8.8 billion spanning across 247 new issues with The Illinois State Toll Highway Authority (Aa3/AA-/AA-) offering $600 million of highway senior revenue bonds spanning across 01/2039-01/2046, selling on Thursday 12/02 and senior managed by Loop. The New York State Housing Finance Agency (A2/-/-) will also tap into the negotiated arena to price $454 million affordable housing revenue bonds across four sustainability/climate bond series with maturities ranging from 05/2024-05/2066, senior managed by Citi. This week's competitive calendar will span across 131 new issues for a total of $2.4 billion with the State of Illinois (Baa2/BBB/BBB-) leading the auction schedule to sell $200 million of general obligation bonds on Wednesday December 1st. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- The US Conference Board Consumer Confidence Index fell 2.1 points to 109.5 (1985=100) in November. The index is down 15% from a June peak. (IHS Markit Economists James Bohnaker and William Magee)

- "Concerns about rising prices—and, to a lesser degree, the Delta variant—were the primary drivers of the slight decline in confidence", according to the Conference Board.

- The index of views on the present situation lost 3.0 points to 142.5. The expectations index dropped 1.4 points to 87.6.

- The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) increased 1.5 percentage points to 46.9%, its strongest reading on record (dating back to 2000).

- Fewer respondents planned to buy homes, automobiles, or major appliances over the next six months.

- Consumers were less optimistic about income growth. The net percentage of respondents expecting higher incomes in the next six months lost 1.3 points to 5.9%.

- Consumers also viewed business conditions less favorably: 17.0% of consumers saw business conditions as "good," down 1.3%; 29.0% viewed business conditions as "bad," up 3.3%.

- Bottom line: Consumer confidence has been slipping since June. Rising prices and the Delta variant (not the Omicron variant) are to blame.

- The US Federal Housing Finance Agency (FHFA) House Price Index (purchase-only) increased a record 17.4% from a year earlier in the third quarter; quarterly growth slowed from a record rate of 5.1% in the second quarter to 4.2% in the third. (IHS Markit Economist Patrick Newport)

- Home prices grew in all 50 states from a year earlier. They rose fastest in Idaho (35.8%), Utah (30.3%), and Arizona (27.7%) and slowest in North Dakota (10.5%) and Louisiana (10.9%)—yes, all 50 states saw double-digit growth. Home prices grew by more than 20% from a year earlier in 16 states.

- Home prices were also up from last year in all of the 100 largest metropolitan areas, with Boise City, Idaho (prices up 37.3%) leading the pack and Philadelphia, Pennsylvania (home prices up 9.9%) in last place. Ninety-nine metro areas had double-digit growth; home prices soared by more than 20% in the top 20 metropolitan areas.

- The monthly purchase-only index slowed to 0.9%, after rising by 1% or more 15 straight times; year-on-year growth slowed to 17.7%, down from July's 19.3% peak, with the Mountain division witnessing the fastest growth (23.6%) and the West North Central states the slowest (13.9%).

- Housing prices over the long term are linked to construction costs, which have risen less than house prices. This indicates a correction in home prices is likely—particularly in places where geography and zoning restrictions make it easy to build.

- Low mortgage rates, tight inventories, and the "Great Reshuffling"—workers able to work from home moving to more favorable locations—are behind this unprecedented surge in house price growth.

- US-based Clean Energy Fuels Corp. and French oil major TotalEnergies said their partnership, announced in March 2021, has started construction on a biomethane production unit, in Friona, Texas. Located on the Del Rio Dairy farm, the facility will utilize livestock manure to produce more than 40 GWh of biomethane per year. The biomethane will be distributed in the United States by Clean Energy through its network of fueling stations, enabling the supply of RNG to between 200 and 300 trucks per year. (IHS Markit PointLogic's Kevin Adler)

- The project will avoid about 45,000 metric tons of CO2-equivalent emissions per year, they said.

- Through the acquisition of an interest in Clean Energy in May 2018, TotalEnergies became the largest shareholder, with a stake of 19%.

- TotalEnergies is the largest biomethane producer in France, with close to 500 GWh of production capacity, and said it "aims to become a major player in biomethane internationally by partnering with market leaders in other geographies, such as Clean Energy in the United States and Adani in India."

- The company is active across the entire biomethane value chain, from project development to marketing of biomethane and its byproducts such as biofertilizers. It aims to produce 2 TWh of biomethane per year by 2025, equivalent to the average annual consumption of 670,000 U.S. consumers, and a reduction in CO2 emissions of 400,000 mt.

- Clean Energy says it is the largest provider of RNG in North America.

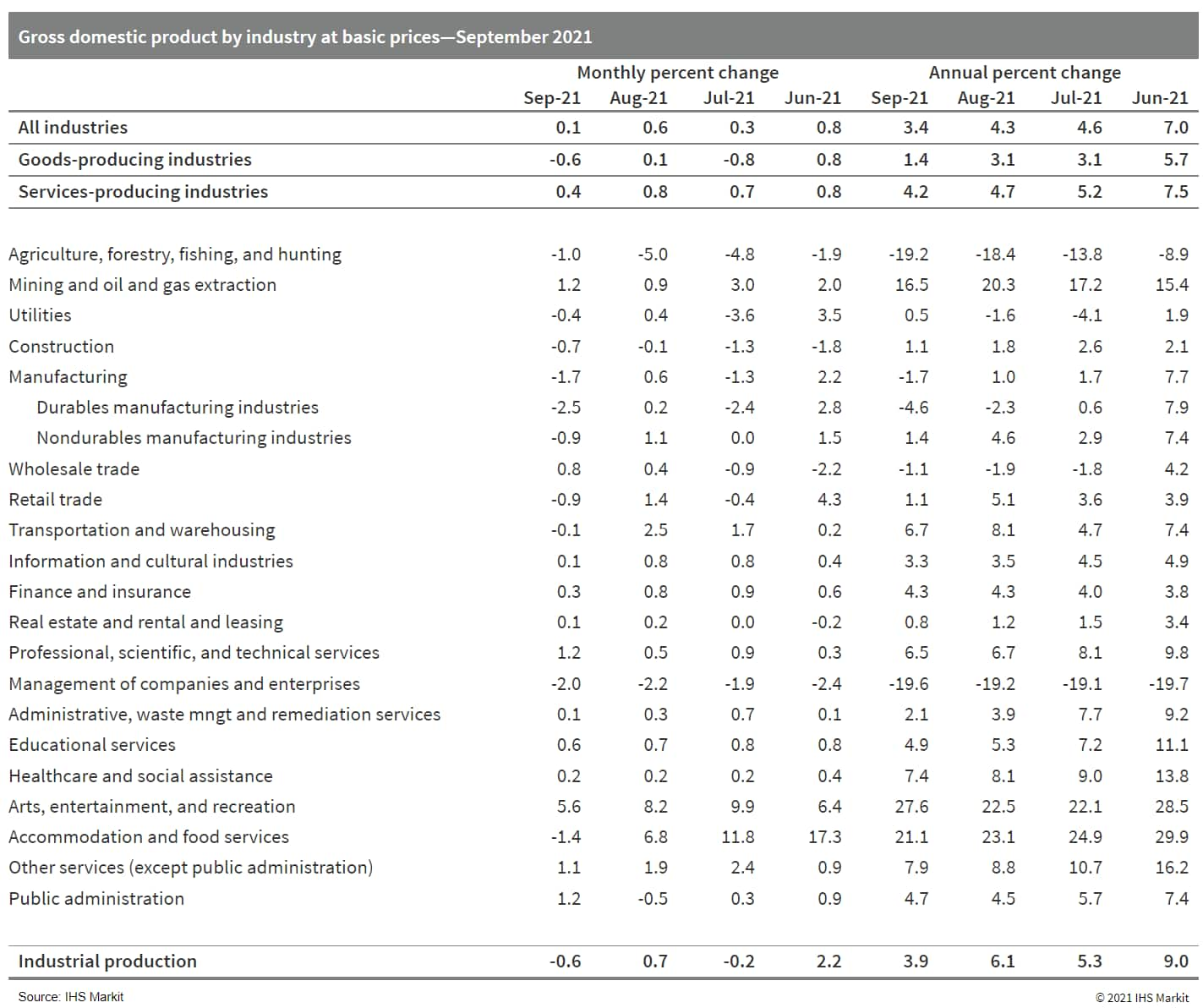

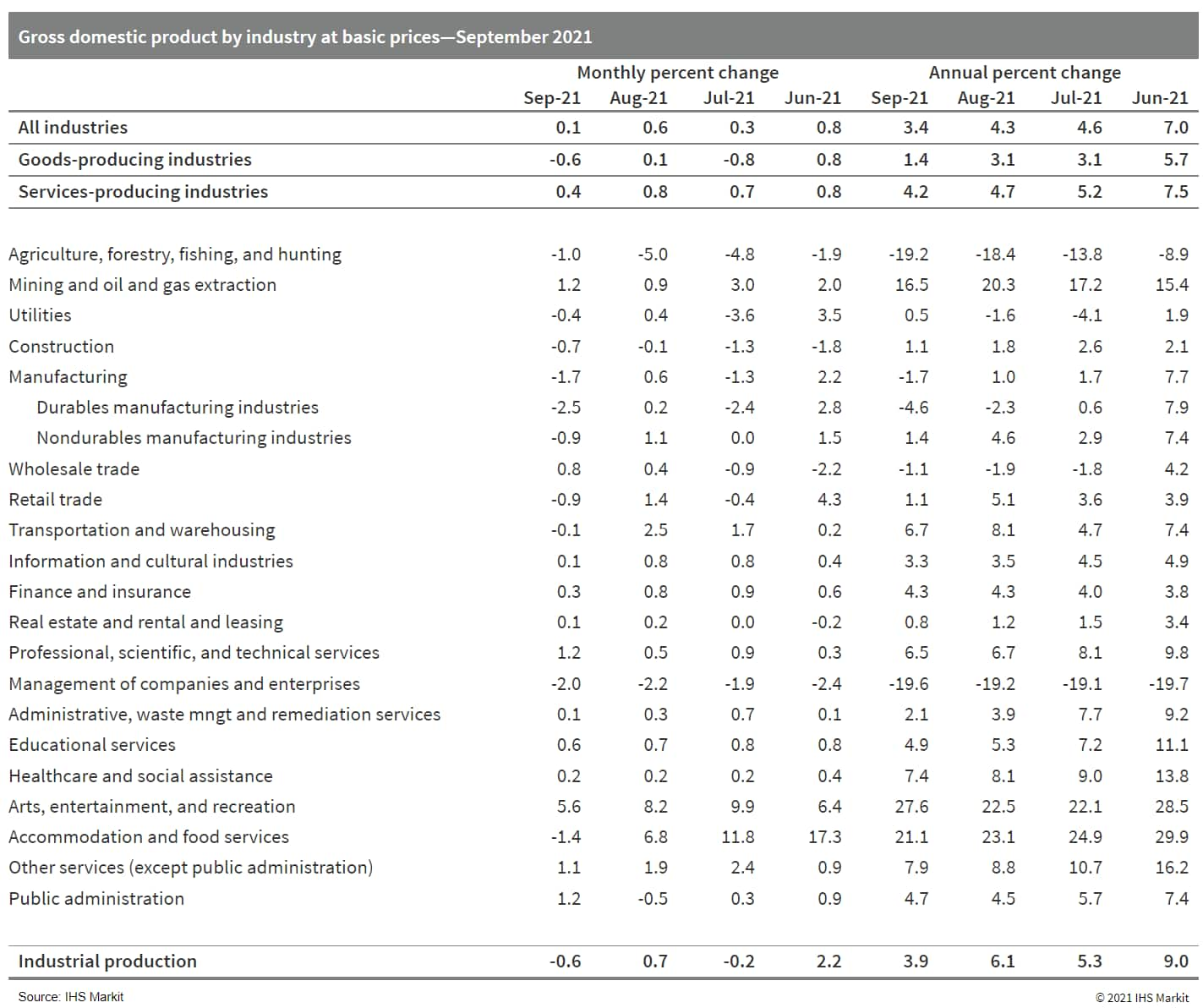

- Coming in slightly above the advance estimate of no change, Canada's September real GDP by industry edged up 0.1% month on month (m/m). Growth in August was revised up 0.2 percentage point to 0.6% m/m and July was revised up 0.4 percentage point to 0.3% m/m. (IHS Markit Economist Evan Andrade)

- The sharp 17.4% m/m decline in motor vehicle and parts manufacturing was a major reason for the 0.6% m/m decline in industrial production.

- The welcoming of fully vaccinated international travelers in September aided accommodation services jumping 4.1% m/m, but this was offset by substantially lower output in the food services and drinking places subsector. Overall tourism-related industries did not perform well in the month.

- The fourth quarter got off to a strong start, as Statistics Canada's advance estimate for October is a gain of 0.8% m/m.

- Performance across industries was mixed, as expected, with 12 of the 20 main industries recording increases in output. The sole bright spot within goods-producing industries was oil and gas extraction, which advanced 2.4% m/m and posted its fifth consecutive monthly increase.

- While forestry and logging output recorded a modest rebound, the broader agriculture, forestry, and fishing sector continued to slide. Although the contraction was not quite as bad as in the summer months, crop and animal production has now declined in every month over the past year. Summer drought conditions have also caused third-quarter average output to decline 11.9% quarter on quarter (q/q).

- Performance within manufacturing subsectors was split evenly but skewed to the downside. Severely constrained automotive production also reduced the output from plastic and rubber manufacturing—which fell 7.2% m/m.

- Construction has continued to contract since April, in line with the slowing residential building construction subsector.

- The Bank of Mexico (Banco de México: Banxico) reports that the current-account balance of the balance of payments posted a USD4-billion deficit in the third quarter of 2021 as imports outpaced exports and led to a sizeable trade deficit of USD10.2 billion following a surplus in second-quarter 2021 as well as in the full year of 2020. (IHS Markit Economist Rafael Amiel)

- The trade deficit is not all bad news as almost 80% of total imports are intermediate goods and a fraction of them are used in the maquiladora industry (assembly for re-export). However, the bad news is that imports of capital goods are decreasing, relative to levels recorded before the COVID-19 pandemic, while imports of consumption goods are increasing in the same comparison or versus 2019 values.

- Similar to many other emerging economies, Mexico's financial account benefited from the allocation of the International Monetary Fund (IMF)'s special drawing rights (SDRs), equivalent to USD12.2 billion; the IMF's board in August approved a general allocation of SDRs to boost global liquidity.

- Mexico posted a current-account surplus of over USD26 billion in 2020 - the first surplus in more than 30 years, caused by the pandemic-induced recession. As the economy is recovering, Mexico is returning to its normal deficits, which have been fully financed by foreign direct investment in the past 20 years.

- Higher oil prices have benefited fiscal accounts but not external accounts since 2015 when Mexico became a net oil importer; the outlook for relatively high oil prices implies a weaker trade balance.

- Mexico's President Andrés Manuel López Obrador (AMLO) issued on 22 November an "executive accord" that designates all of his government's infrastructure projects in "strategic sectors" such as energy, telecommunications, transportation, mining, customs, and ports as matters of national security and public interest. (IHS Markit Country Risk's Jose Enrique Sevilla-Macip)

- The directive indicates increasing centralization of political power in the hands of the president under AMLO. The decree mandates all federal ministries and agencies to grant contractors working on priority projects a "preliminary authorization" in less than five working days, after which construction works would be allowed to begin. This preliminary authorization would be valid for a 12-month period, after which a definitive authorization should be awarded. It is unlikely that any 'definitive authorization' would be denied once a project is under way.

- Enforcement of environmental regulation and permitting procedures are likely to be affected most significantly by the decree, raising protest risks. The decree reduces to five days (down from three to six months) the time provided for feasibility studies. Although the Ministry of Environment and Natural Resources (Secretaría del Medio Ambiente y Recursos Naturales: SEMARNAT) would technically be able to revoke the "preliminary authorization" after 12 months, the advance in the works by then would have potentially already resulted in environmental impact.

- Weakening enforcement of transparency and competition provisions as a result of the decree is likely to result in less transparent awarding of contracts. The national security designation allows government institutions to classify information related to government-sponsored projects as sensitive and thus refuse to disclose it.

- Judicial action to suspend the decree's enforcement would be likely result in AMLO further favoring military control of government infrastructure projects. As of 24 November, Mexico's National Institute for Transparency, Access to Information and Personal Data Protection (Instituto Nacional de Transparencia y Acceso a la Información Pública: INAI) and the opposition coalition in the Chamber of Deputies have said that they would file separate challenges to the decree's constitutionality to the Supreme Court. Both legal actions will be based on the grounds of alleged weakening of transparency.

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -0.7%, France -0.8%, Italy -0.9%, Germany -1.2%, and Spain -1.8%.

- 10yr European govt bonds closed higher; UK -5bps, Germany/Spain -3bps, France -2bps, and Italy -1bp.

- iTraxx-Europe closed +2bps/58bps and iTraxx-Xover +7bps/287bps.

- Brent crude closed -5.4%/$69.23 per barrel.

- An autonomous passenger shuttle has started operating on UK roads as part of a trial funded by the UK Space Agency and the European Space Agency (ESA). Darwin will trial an autonomous shuttle at the Harwell Science and Innovation Campus in Oxfordshire and has mapped the area, giving the vehicle all the information it needs to navigate. Telematics data will be transmitted from the shuttle using O2's 4G and 5G networks and Hispasat satellite communication channels, allowing for real-time monitoring. The shuttle, which is manufactured by Navya, is controlled by 5G and satellite connectivity and has Level-4 autonomy. These features allow the shuttle to pick passengers up, transport them around the campus, and drop them off at their destination. The shuttle is insured by Aviva, which will use the resulting data from these trials to better understand the evolving mobility market. The trials will allow Aviva to build its first comprehensive insurance model for the autonomous shuttle, which will evolve as the trial progresses. The trial builds on a launch by mobile network operator O2 and Darwin Innovation Group of a commercial lab, called Darwin SatCom Lab, to help companies test connected and autonomous vehicles (CAVs). (IHS Markit Automotive Mobility's Surabhi Rajpal)

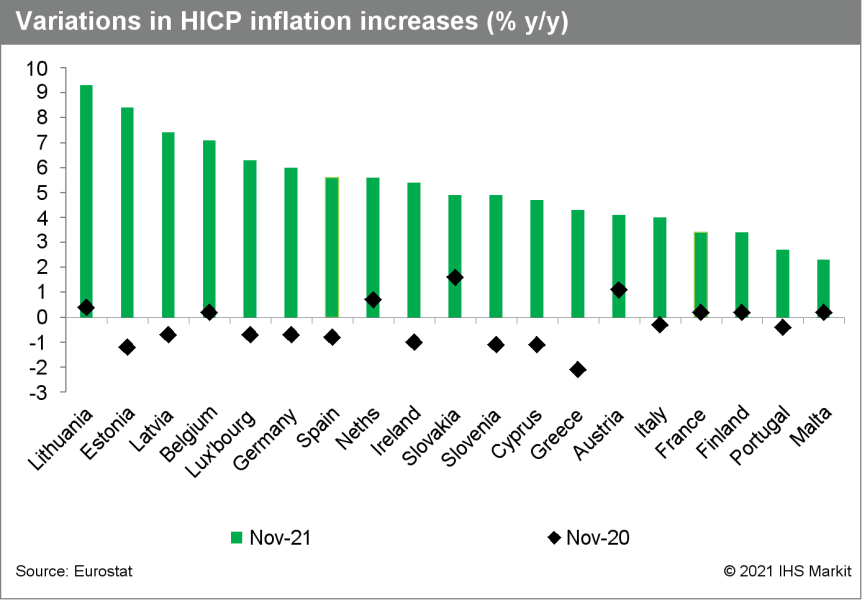

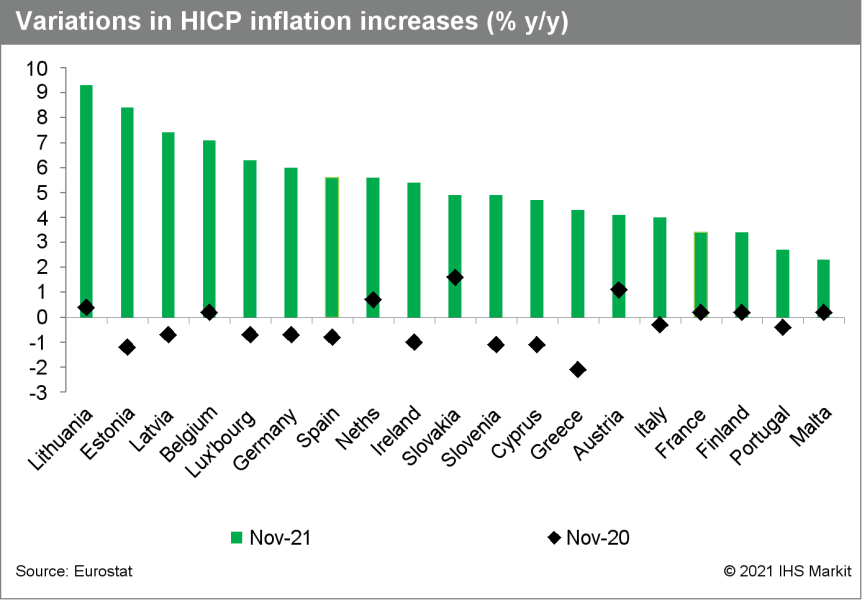

- November recorded yet another stronger-than-expected increase in eurozone Harmonised Index of Consumer Prices (HICP) inflation. Based on Eurostat's "flash" estimate, it increased from 4.1% to 4.9%, well above the initial market consensus expectation of 4.4%, according to Reuters's survey. The latest figure is the highest headline inflation rate since the eurozone's inception in 1999 by some distance; the prior peak in 2008 was 4.1%, with the cumulative increase during 2021 to date now in excess of five percentage points. (IHS Markit Economist Ken Wattret)

- Energy inflation was again a key driver, with the year-on-year rate of increase rising by almost four percentage points to reach another record high of 27.4%. With a weight of just over 9% in the HICP, energy inflation is contributing more than half of November's overall inflation rate (2.6 percentage points).

- Core HICP inflation rates, while less elevated, also rose markedly in November. The rate excluding food, energy, alcohol, and tobacco prices jumped from 2.1% to 2.6%, again well above the market consensus expectation of 2.3%. This is also a record high for the series.

- The two constituent parts of the core rate above both showed strong increases in November. Services inflation rose from 2.1% to 2.7%, well above the 1.6% recorded in February 2020 before the COVID-19 pandemic, and the highest rate since 2008. The most COVID-19-sensitive areas of services inflation, such as restaurants and hotels, fell markedly in 2020 and are rebounding as economies have reopened, although the momentum is likely to fade given the recent pandemic trends.

- Non-energy industrial goods (NEIG) inflation increased from 2.0% to 2.4%. The rate has been rather volatile in recent months because of COVID-19-pandemic-related influences on the timing of seasonal price discounts. Nevertheless, the trend has been strongly upwards and the upward pressure has further to go (discussed below). NEIG inflation has risen by almost three percentage points since December 2020 and is almost two percentage points above its pre-pandemic rate of 0.5%.

- While higher inflation rates this year have been broad-based across the eurozone's member states, there are some variations. Among the larger economies, inflation is particularly high in Germany (6.0%) but much less pronounced in France (3.4%).

- Seasonally adjusted German unemployment declined by 34,000 month on month (m/m) in November, broadly matching the monthly average of 33,000 during the first 10 months of 2021. A total of 76% of the initial, pandemic-related unemployment surge in second-quarter 2020 has been unwound by now. (IHS Markit Economist Timo Klein)

- Germany's Labor Agency calculates a cumulative COVID-19 net boosting effect of 139,000 on unemployment by November 2021, down from 174,000 until October and its peak of 638,000 in June 2020. This represents a comparison with a hypothetical continuation of the pre-pandemic trend if the pandemic had never occurred.

- Germany's (national) unemployment rate has declined anew from 5.4% to 5.3% in November. This compares with a peak of 6.4% after the end of the first pandemic wave in mid-2020 and a pre-pandemic, 40-year low of 5.0% in March 2020.

- Employment, data for which regularly lag by one month, increased by 34,000 to 45.041 million in October. The shortfall versus the pre-pandemic high recorded in February 2020 has narrowed to 0.85%. The sub-category of "regular" jobs - for which employers pay social security contributions, i.e., excluding the self-employed, mini-jobs, or other forms of precarious employment - exceeded its level of a year earlier by 1.5% in September (latest data available). This outperforms the 0.6% annual increase for total employment, confirming previous evidence that the recovery of precarious forms of employment still lags considerably. Meanwhile, among regular jobs, September's part-time employment continues to outperform full-time employment at 2.1% versus 1.3% year on year (y/y), but the gap is narrowing gradually.

- Data about cyclically induced short-time work, an important indicator for imminent changes in labor market trends, is currently available until September. The seasonally adjusted level, which had jumped from just 0.1 million in February 2020 to a record 6.0 million two months later, has now declined to 0.75 million, down from 0.81 million in August and an interim high of 3.35 million in February (then linked to the COVID-19 second strict lockdown).

- Stellantis has announced that it has signed an agreement to source lithium hydroxide from Vulcan Energy Resources to manufacture batteries for its electrified vehicles. According to a statement, shipments will begin in 2026 and the agreement is binding, for five years. The material will be sourced from Vulcan's Zero Carbon Lithium Project located in Germany's Upper Rhine Valley, with the plan that Stellantis will receive a minimum of 81,000 tons and a maximum of 99,000 metric tons over the term. However, the statement added that the supply agreement is "subject to the successful start of commercial operation at the Vulcan facility and full product qualification". (IHS Markit AutoIntelligence's Ian Fletcher)

- Dana has announced that its Dana TM4 joint venture (JV) is to build a new electric motor facility in Åmål (Sweden). According to a statement, around USD50 million is being spent on what is expected to a "fully sustainable operation" and will become its largest electrodynamic facility in Europe. Of this, USD10.7 million has come from the "Swedish business development community". The site will produce a range of Dana TM4 Motive high-speed electric motors for vehicles that will begin production during the first half of 2023, after the site opens in late 2022. The company said it expects to create over 80 new jobs in the rollout of the "highly automated manufacturing and final assembly lines".

- The lira depreciation has contributed to the narrowing of Turkey's merchandise-trade deficit. Exports are more competitive and imports more expensive, diminishing demand. After narrowing in 2021, the trade gap will widen once again in 2022 due to high commodity prices and interrupted exports. However, further lira losses will mitigate this widening. (IHS Markit Economist Andrew Birch)

- The lira's depreciation continued to buoy Turkish exports while discouraging imports in October 2021 according to data from the Turkish Statistical Institute (TurkStat). That month, the merchandise-trade deficit was USD1.44 billion, nearly USD1 billion smaller than it had been in the same month of 2020. Cumulatively, the trade deficit fell by over USD6.4 billion year on year (y/y), to USD33.86 billion in January-October 2021.

- Turkish exports of raw and minimally processed commodities have grown particularly rapidly in 2021, helping to limit the trade deficit. Through the first 10 months of 2021, iron and steel, gold, energy, aluminum, and plastics were all among the fastest growing commodities. Meanwhile, the export growth rates of high- and medium-high technological products lagged overall expansion rates.

- Meanwhile, high international commodity prices sent energy and iron and steel import growth rates soaring in January-October 2021. However, high prices are dissuading import volume increases, subsequently keeping import growth rates lower than those of exports.

- The sharp depreciation of the lira is exacerbating both export competitiveness and import costs, further fueling the narrowing of the trade deficit. As of end-October, the lira had depreciated by over 28% against the US dollar - the worst performing currency among the major developed economies.

Asia-Pacific

- Major APAC equity indices closed mixed; Australia +0.2%, Mainland China flat, India -0.3%, Hong Kong/Japan -1.6%, and South Korea -2.4%.

- China's 2022 Winter Olympic preparations, which include pollution control measures expected to shutter heavy industries, will unlikely impact either the polyester or the solvents sectors, industry sources said Tuesday. (IHS Markit Chemical Advisory's Chuan Ong)

- China will host the Winter Olympic Games in Beijing and neighboring Hebei Province from Feb. 4 to 22 next year. Industry sources said that authorities will curb steel production in Hebei's Tangshan City in January, while coal production will be reduced in efforts to host a carbon-neutral event.

- Polyester sector participants polled were unconcerned about the Winter Olympic restrictions. Sources said that polyester production is concentrated in eastern China, which is far away from northern China where the event will be held.

- Controls measures will mainly affect coal-based plants in the north, according to the source.

- In the solvents sector, participants also expect limited impact due to primary production sited in eastern China.

- "Gasoline blending, solvents demand aren't expected to be affected by the Winter Olympics. Demand has been weak, and the main worry is still the Covid virus," according to a market player.

- China has outlined new rules to safeguard the rights of drivers in its ride-hailing industry, Reuters reports. The country now requires operators of the ride-hailing services to provide drivers with social insurance and report their earnings publicly. The transport ministry said ride-hailing companies should enhance income distribution mechanisms and anti-monopoly measures will be stepped up against these companies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Baidu-backed smart electric vehicle (EV) company JiDU has said that its first production vehicle will feature an intelligent digital cockpit system, reports Global Times. The system is based on the fourth generation of Qualcomm's Snapdragon automotive cockpit platform, together with the next-generation intelligent cockpit system and software solutions developed by JiDU and Baidu. JiDU's production vehicles featuring the new digital cockpit will be available in 2023. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Audi's joint venture (JV) with FAW Group (FAW) is behind schedule due to a delay in approval by the relevant authorities, reports Reuters citing an Audi spokesperson. The automaker said it would start the construction of relevant facilities as soon as the approval has been granted, although no timeline has been given. German auto publication Automobilwoche reported on Monday (29 November) that thanks to intervention from Germany's economic ministry, Chinese authorities will grant the JV a license to begin plant construction in December. The FAW-Audi JV is expected to launch production of Audi-branded electric vehicles(EVs) in China in 2024. New models coming from the JV will be based on the Premium Platform Electric (PPE) platform, a dedicated platform jointly developed by Audi and Porsche for premium EVs. (IHS Markit AutoIntelligence's Abby Chun Tu)

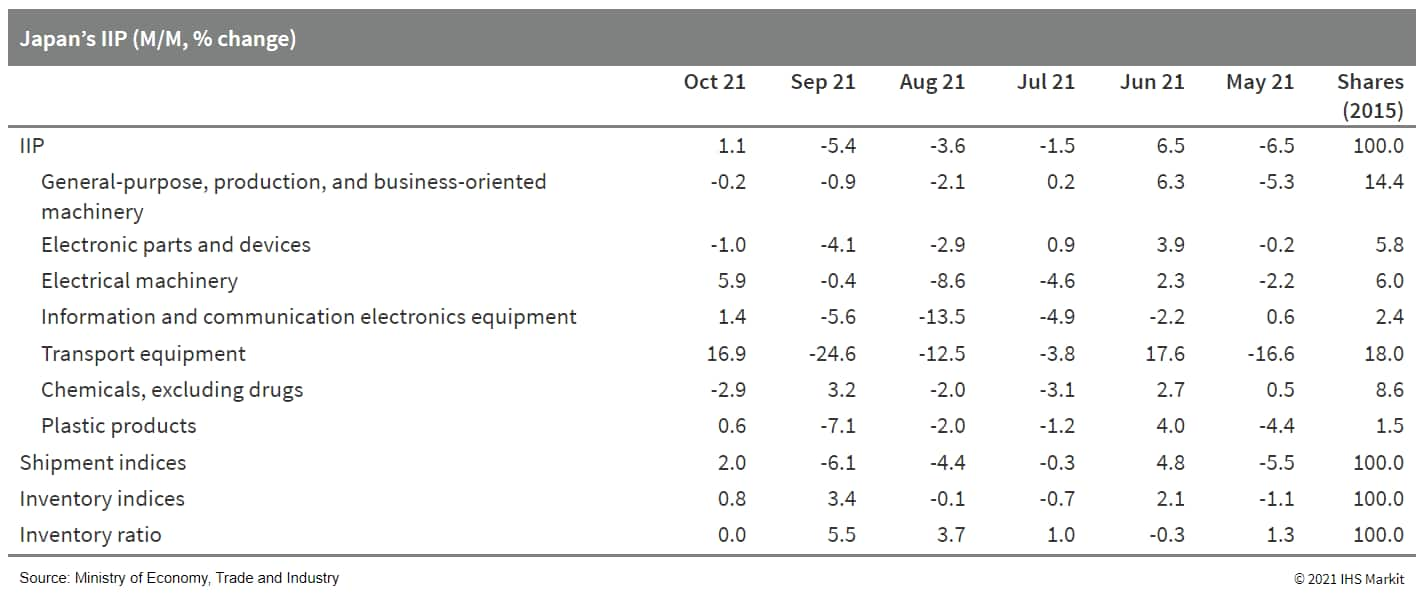

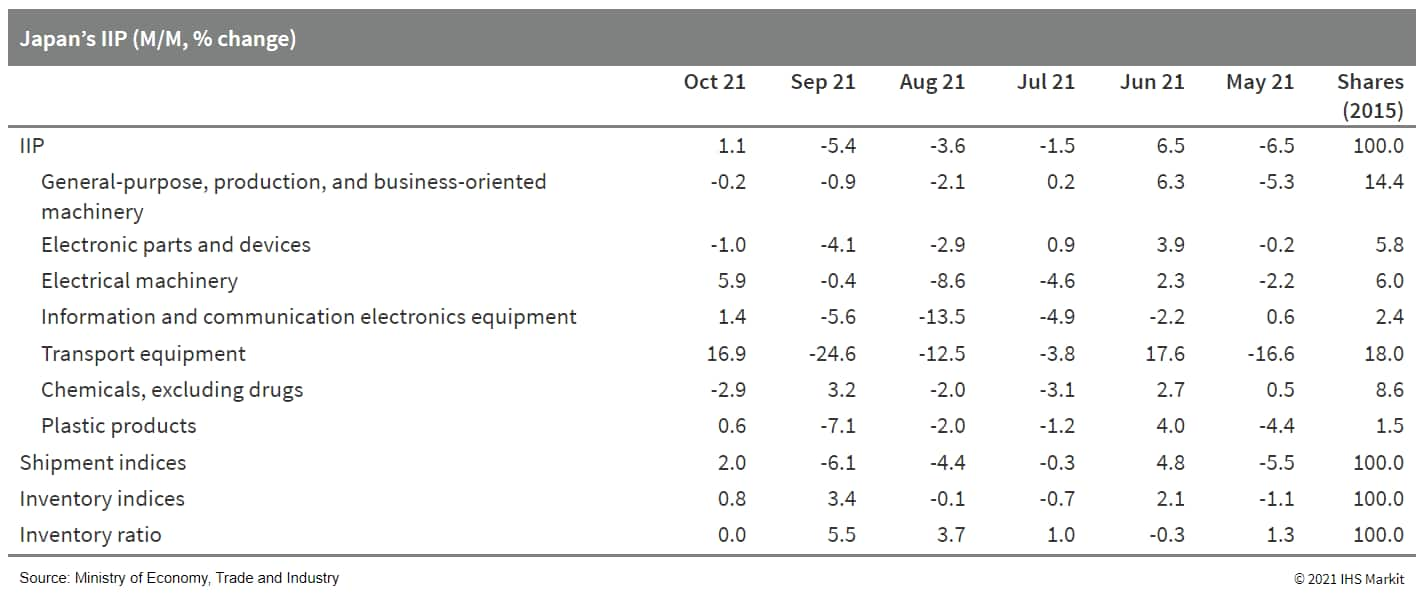

- Japan's Index of Industrial Production (IIP) rose by 1.1% month on month (m/m) in October following three consecutive months of declines. Manufacturers' shipments rose by 2.0% m/m, and inventories continued to increase by 0.8% m/m while the index of inventory ratio remained at the September level. (IHS Markit Economist Harumi Taguchi)

- The major factor driving the increase in production was a 16.9% m/m rebound in the production of transport equipment thanks to improvements in the supply of auto components from Asia. The improvement also reflects rebounds in the production of production machinery (up 4.2% m/m), general-purpose machinery (up 8.5% m/m), and electrical machinery (up 5.9% m/m). The increase in manufacturers' shipments was also driven by an 18.3% rise in shipments of autos and electrical machinery (up 9.0% m/m) and information and communication electronics equipment (up 7.3% m/m).

- Although solid rises in shipments led to declines in inventory for autos, electrical machinery, communication electronics equipment, and some other industries, inventory rose for a broad range of industries partially because of disruption in distribution or intentional stockpiling to counter supply chain disruption and prepare for regular maintenance and repairs of facilities.

- Nitin Gadkari, India's Minister for Road Transport and Highways said, "I am going to sign a file in the next 2-3 days, in which carmakers will be asked to make engines that can run on 100 per cent bio-ethanol," reports Asian News International. He cited India's current imports of gasoline (petrol), diesel and petroleum products being INR8 trillion (USD106.5 billion) every year, and said, "If the country continues its consumption like this, then its import bill will rise to INR25 trillion in the next 5 years." Gadkari intends to make India self-reliant with the introduction of flex-fuel engines in vehicles. He added, "MDs of Toyota Motor Corporation, Suzuki and Hyundai Motor India have assured me that like Brazil, America and Canada, the vehicles in our country will run on 100 per cent bio-ethanol, which produced by our farmers, instead of 100 per cent petrol." Flex fuel is an alternative fuel made with a combination of gasoline, methanol, or ethanol. India is currently using E10 (10% ethanol blended with gasoline). At the beginning of November, Gadkari has advocated the use of ethanol in vehicles as a cost-effective and pollution-free substitute for other fuels and announced that flex-fuel engines will be made mandatory in the coming days. (IHS Markit AutoIntelligence's Tarun Thakur)

- Indian ride-hailing firm Ola is considering raising over USD500 million in debt from US investors through a Term Loan B (TLB) deal, reports Livemint. According to the report, international ratings agency Moody's Investors Service has assigned a B3 rating to Ola's proposed senior secured term loan. Ola's wholly owned subsidiaries, Ola Netherlands B.V. and Ola USA Inc., are the borrowers. The capital infused from the loan will be used for general corporate purposes. Ola reportedly plans to conduct a USD1-billion initial public offering in the next few months. The company, which operates in over 100 cities in India, has expanded to several international markets, including Australia, New Zealand, and the United Kingdom, in a bid to improve its valuation. It has also expanded into offering cars on lease and into the electric vehicle space. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 30 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.