All major APAC, European, and US equity indices closed lower on Friday. US government bonds closed higher, while benchmark European bonds were mixed. CDX-NA and European iTraxx closed wider across IG and high yield. The US dollar and oil closed higher, while natural gas, gold, silver, and copper closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.4%, S&P 500 -0.5%, Russell 2000 -0.6%, and Nasdaq -0.7%.

- 10yr US govt bonds closed -4bp/1.23% yield and -3bps/1.90% yield.

- CDX-NAIG +1bp/50bps and CDX-NAHY +7bps/293bps, which is +1bp and +12bps week-over-week, respectively.

- DXY US dollar index closed +0.3%/92.17.

- Gold closed -1.0%/$1,817 per troy oz, silver -0.9%/$25.55 per troy oz, and copper -0.9%/$4.48 per pound.

- Crude oil closed +0.4%/$73.95 per barrel and natural gas closed -3.6%/$3.91 per mmbtu.

- US personal income edged up by 0.1% in June and real disposable personal income (DPI) decreased by 0.5%. A strong 0.8% increase in wage and salary income was roughly offset by fewer economic impact payments (stimulus checks) and declining payments from the Pandemic Unemployment Compensation program, the latter of which partially reflects the early termination of the enhanced benefits in several states beginning in June. (IHS Markit Economists James Bohnaker and David Deull)

- Real personal consumption expenditures (PCE) increased 0.5% in June, but the monthly profile suggests a lower-than-expected jumping off point for the third quarter. We revised down our estimate for third-quarter growth in real PCE 0.7 percentage point to 2.1%. Real PCE for durable goods declined 2.5%, primarily due to a 7.7% plunge in spending on motor vehicles and parts as supply constraints and high prices likely discouraged purchases. Real PCE for services increased 0.8% to get within 3.0% of the pre-pandemic level; sectors such as childcare services, recreation and entertainment, public transportation, and accommodations remain depressed amid ongoing health concerns.

- The core PCE price index increased 0.4% in June, a deceleration from the prior two months. We expect recent price pressures, particularly for certain goods where supply-chain disruptions have resulted in higher consumer prices, will ease over the next several quarters.

- The levels of personal income and outlays were revised down in each of the last five years. In 2020, the level of DPI was revised down 0.5% and the level of outlays was revised down 0.7%, resulting in a higher personal saving rate than previously estimated. The saving rate averaged 16.6% in 2020.

- The Employment Cost Index (ECI) increased 0.7% in the three-month period ending in June 2021 (the sample is from monthly payroll records that include 12 June). (IHS Markit Economist Patrick Newport)

- Year-over-year (y/y) growth moved up from 2.6% in March to 2.9% in June; year-over-year real growth was -2.4% (the Bureau of Labor Statistics [BLS] calculates real ECI growth using the consumer price index for all urban consumers).

- Wages and salaries (about 70% of compensation costs) rose 0.9% for the three-month period and 3.2% y/y; benefits (about 30% of compensation) increased 0.4% for the three-month period and 2.2% y/y.

- Private industry compensation grew 3.1% y/y, wages and salaries (about 70% of compensation costs) rose 3.5%, and benefits (about 30% of compensation) climbed 2.0%.

- State and local government compensation increased 2.0% y/y; for this sector, wages and salaries (about 62% of compensation costs) rose 1.6% and benefits (about 38% of compensation) grew 2.6%.

- The University of Michigan Consumer Sentiment Index fell 4.3 points (5.0%) from its June level to 81.2 in the final July reading. This was a marginal 0.4 point above the preliminary reading for the month and left the July level at a five-month low. (IHS Markit Economists James Bohnaker and David Deull)

- The decrease was split between expectations, the index for which fell 4.5 points to 79.0, and views on the present situation, which fell 4.1 points to 84.5. Relative to the preliminary July reading, the entirety of the uptick over the latter half of the month was driven by consumer expectations.

- The decline in sentiment was mainly expressed by upper-income households. The index of sentiment for households earning more than $100,000 a year fell 7.4 points to 84.3, while sentiment for households earning less than $100,000 a year fell only 0.9 point to 79.4.

- The expected one-year inflation rate in the University of Michigan survey rose 0.5 percentage point to 4.7%, the highest monthly reading since the summer of 2008, but 0.1 point lower than recorded earlier in July. Consumers continue to regard inflation as principally a short-term phenomenon; the expected 5-to-10-year inflation rate remained unchanged in July at 2.8%.

- Views on buying conditions for big-ticket items moved deeper into negative territory in July, although the decline moderated in the second half of the month. The index of buying conditions for large household durable goods fell 10 points to 102, while that for vehicles fell 6 points to 81, the lowest since 1981. The index of buying conditions for homes fell 8 points to 66, the lowest since 1982.

- Respondents were increasingly bullish on their own prospects. The mean expected probability of an increase in personal income rose 1.5 percentage points to 54.3%, matching the highest pandemic-era reading.

- The new sodium reduction requirements that are set to go into effect for US schools in 2022 have stirred deep concerns for dairy makers, who fear the requirements will lead to a sharp decline in school offerings of dairy products such as cheese and milk. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- The dairy industry is particularly concerned about the requirements' impact on cheese - a school lunch staple that is a kids' favorite but presents tremendous challenges for sodium reduction.

- With stricter sodium reduction limits, cheese will be either severely restricted or fully removed as a school meal offering in both breakfast and lunch - a development that could have wide-reaching implications for industry, warned speakers at the International Dairy Foods Association (IDFA's) Regulatory RoundUp on Wednesday (July 28).

- The changes could affect a variety of stakeholders in the food industry, as a significant reduction of cheese offerings at US schools would raise costs, while also increasing the time for product development in the dairy sector and presenting a slew of technological and food safety challenges, said Cheryl Isberner, K-12 program team leader at Land O'Lakes Inc.

- Most importantly, there is no technology currently available to allow cheese-makers to reduce sodium in cheese to Target 3 sodium levels without either increasing food safety risks, or adding undesirable and potentially harmful ingredients that the industry has been working to keep out of cheese, Isberner warned participants at the meeting.

- Eli Lilly's (US) Loxo Oncology unit and privately owned Kumquat Biosciences have announced that they have entered into an exclusive collaboration focused on the discovery, development, and commercialization of potential novel small molecules that stimulate tumor-specific immune responses. Under the deal, Kumquat will use its small-molecule immuno-oncology (IO) platform to discover novel clinical candidates, while Lilly will have the option to select an (unspecified) number of drug candidates for further development and commercialization worldwide, excluding mainland China, Hong Kong SAR, Macao SAR, and Taiwan, where Kumquat will retain rights but Lilly will have an option to co-commercialize. Kumquat also has the option to co-develop and co-commercialize an (unspecified) number of the drug candidates selected by Lilly in the United States. (IHS Markit Life Sciences' Milena Izmirlieva)

- TuSimple will work with Ryder Truck on TuSimple's autonomous freight network (AFN), according to a joint statement. Select Ryder fleet maintenance facilities will serve as terminals on TuSimple's AFN. The facilities will serve as secure start and end facilities for autonomous driving missions. The companies will collaboratively determine which Ryder facilities will serve as terminals. These are already facilities that can have multiple heavy-duty trucks and trailers come and go 24 hours a day, 365 days a year, TuSimple said. With more terminals in the AFN, shippers and fleets have greater access to autonomous freight operations, TuSimple notes. In addition, by leveraging Ryder's existing freight trucking facilities, TuSimple will be able to quickly scale across the country. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Optimus Ride has been selected by the US Department of Energy (DOE) to deploy autonomous shuttle fleets at Clemson University in South Carolina. Optimus Ride will receive up to USD4.3 million from the DOE to carry out the deployment. Optimus Ride will collaborate with Clemson University, the University of California, Berkeley, and Argonne National Laboratory to study rider behavior and adoption, as well as the potential impact that electric autonomous shuttles can have on the environment when deployed at scale. Optimus Ride will also examine its routes, vehicle performance, sustainability benchmarks, and other information to enhance its mobility service and autonomous technology. (IHS Markit Automotive Mobility's Surabhi Rajpal)

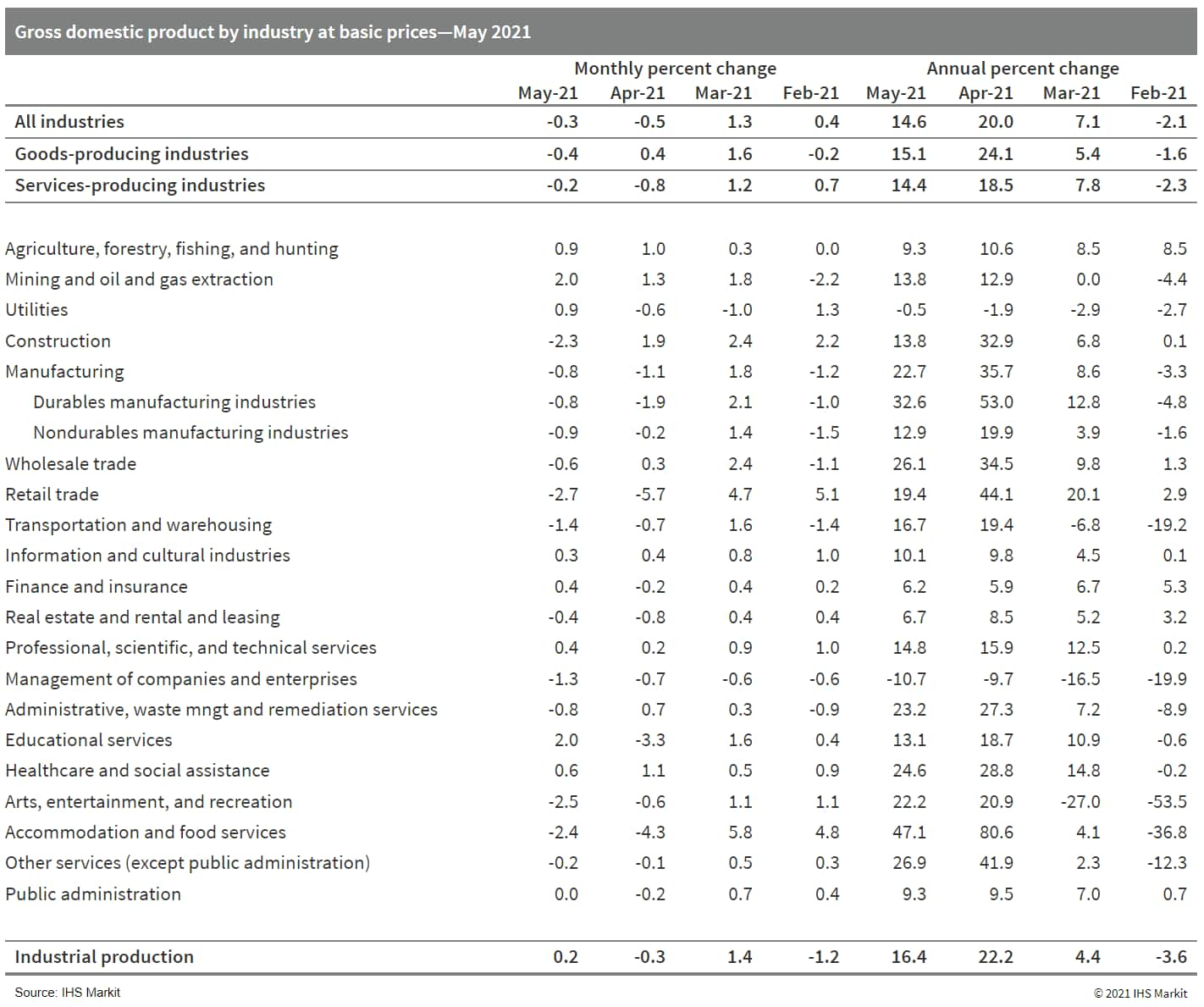

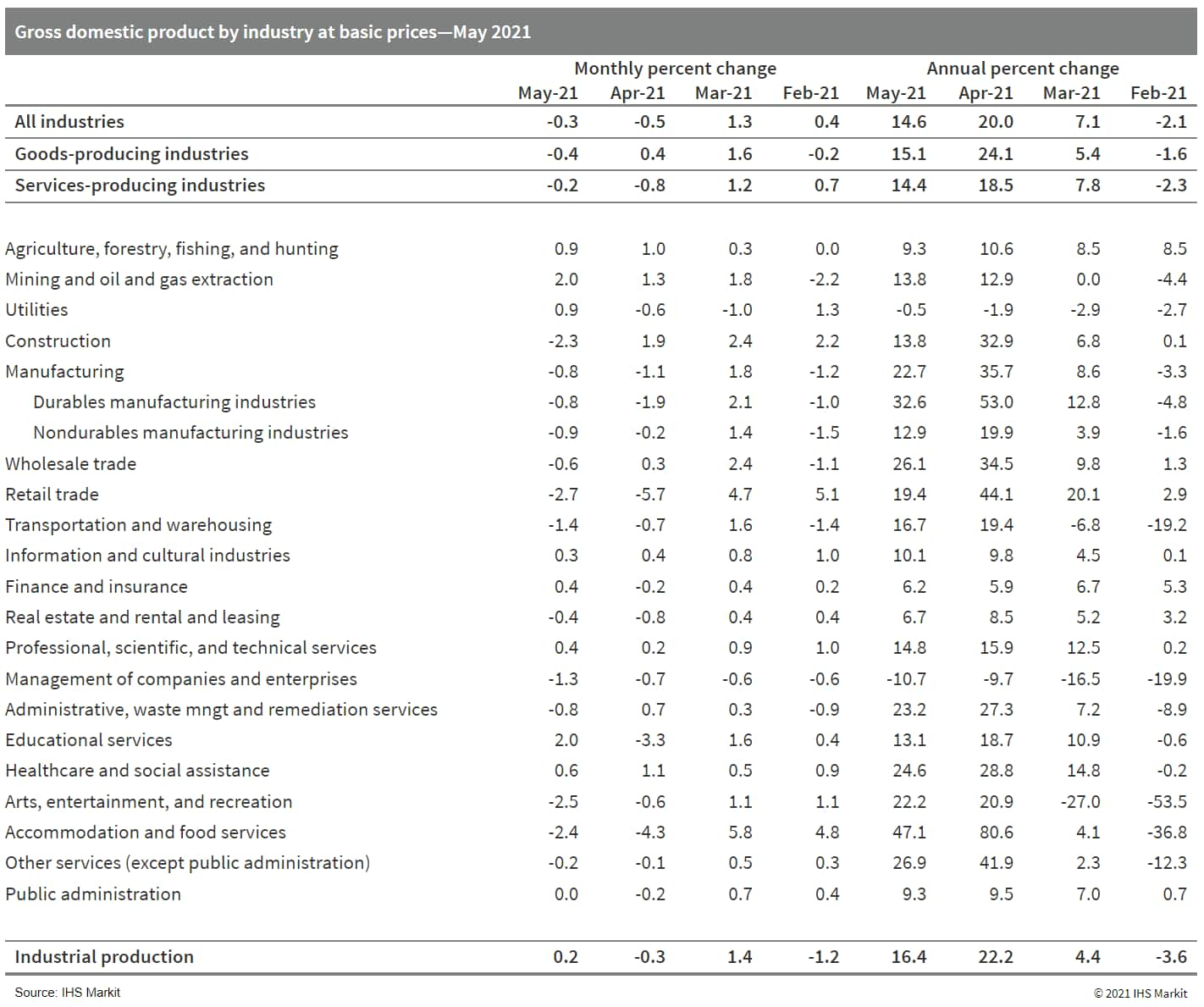

- Matching initial expectations, Canada's real GDP by industry output declined 0.3% month on month (m/m) in May, following a revised-down 0.5% m/m decrease in April. (IHS Markit Economist Arlene Kish)

- The negative impact from the pandemic's third wave and supply-chain shortages hit output in the goods-producing industries (down 0.4% m/m) as well as the services-producing industries (down 0.2% m/m). Industrial production advanced 0.2% m/m as manufacturing was the only industry that suffered a setback.

- Statistics Canada estimates June's real GDP by industry output will rebound 0.7% m/m, which is aligned with July's forecast.

- May marks Canada's probable industry-output low of the year as most of the pandemic's metrics remain low for now.

- Data from Mexico's National Statistics Office (INEGI) show that consumer prices increased by 0.37% during the first half of July compared with the second half of June; annual inflation remains at 5.8%. (IHS Markit Economist Rafael Amiel)

- Food and energy prices remain the major drivers of inflation, but services related to hospitality and tourism are also showing increases in prices as the sector progressively reopens. Average prices in restaurants and hotels went up by 0.48%, while in the recreation and culture category, they increased by 0.53% (comparing the first half of July with the second half of June)

- Food prices have increased by 7.0 % while energy and related products have jumped by 14.5% to date in 2021. International oil prices explain, in part, the higher energy prices. A severe drought affected Mexico in the second quarter of 2021, but the situation seems to be improving. The Bank of Mexico (Banco de México: Banxico) nevertheless still cites it as an upward risk for inflation as the northern states are still grappling with a severe lack of rain.

- At its June 24 policy meeting, Banxico increased the policy rate from 4.00% to 4.25%. The bank targets inflation at 3.0% +/- 1 percentage point but it is clearly above the upper bound of the targeted band.

Europe/Middle East/Africa

- All major European equity indices closed lower; France -0.3%, Italy/Germany -0.6%, UK -0.7%, and Spain -1.3%.

- 10yr European govt bonds closed mixed; Germany/Spain/UK -1bp, France flat, and Italy +1bp.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +3bps/236bps, which is +1bp and +5bps week-over-week, respectively.

- Brent crude closed +0.4%/$75.41 per barrel.

- Plans for a new electric vehicle (EV) battery plant to supply Nissan's Sunderland (UK) facility have been submitted by Envision AESC, reports Sunderland Echo. According to the documents, the facility will be built at the International Advanced Manufacturing Park (IAMP) in the city. It added that if approved, construction is due to begin in 2022, with the aim of starting battery production in 2024. It was announced earlier this month that Sunderland is to benefit from GBP1-billion-worth of investment related to Nissan over the next few years. (IHS Markit AutoIntelligence's Ian Fletcher)

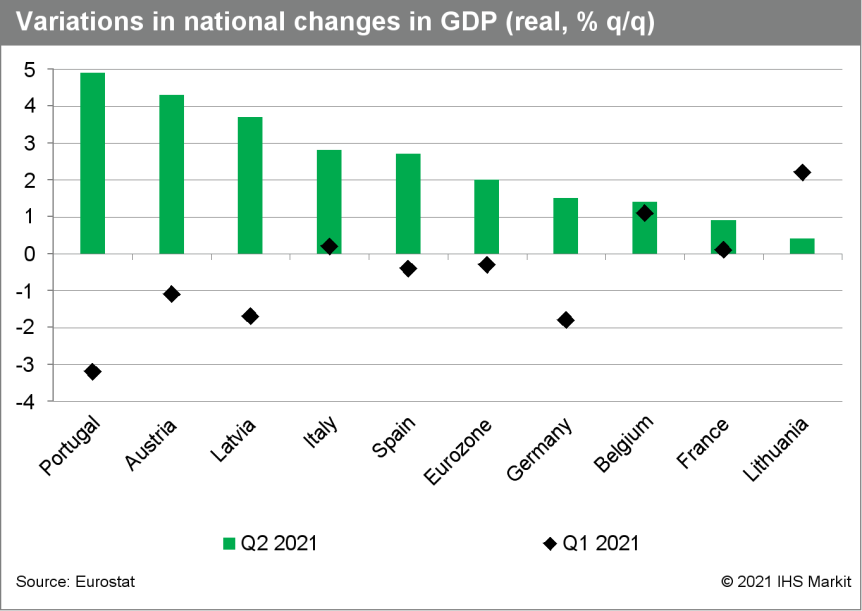

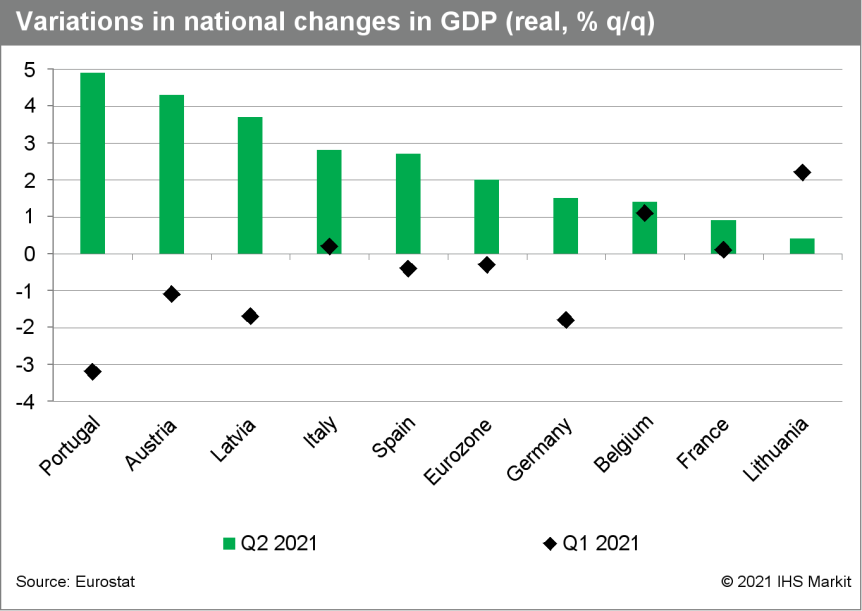

- According to Eurostat's initial preliminary 'flash' estimate, eurozone GDP rose by 2.0% quarter on quarter (q/q) in the second quarter, above the market consensus expectation of 1.5% q/q (according to Reuters's survey). IHS Markit's forecast was a slightly stronger 1.7% q/q. (IHS Markit Economist Ken Wattret)

- On a year-on-year (y/y) basis, eurozone GDP surged by almost 14%, although with y/y rates of change distorted by huge base effects related to the early 2020 extreme COVID-19-driven declines, levels of GDP are a better reference point.

- Despite the second quarter's upward surprise, eurozone GDP remained 3% below its pre-pandemic level in the fourth quarter of 2019.

- Across the member states that have published the data for the second quarter to date, there were marked variations in performance.

- Portugal and Austria experienced the largest q/q increases (4.9% and 4.3%, respectively), with the lowest q/q increases in Lithuania and France (0.4% and 0.9%, respectively).

- Eurozone Harmonised Index of Consumer Prices (HICP) inflation rose from 1.9% in June to 2.2% in July, according to Eurostat's "flash" estimate, a little above the market consensus expectation (of 2.0%, based on Reuters' survey). (IHS Markit Economist Ken Wattret)

- Headline inflation is running at the highest rate since October 2018, with energy inflation primarily responsible for July's acceleration.

- After a short-lived moderation in June, the year-on-year (y/y) rate of change in energy prices has risen to a new high in July of 14.1%.

- Unlike in prior months, the acceleration reflects a strong month-on-month (m/m) rise (of 1.8%, due to higher crude oil prices) rather than base effects.

- Food inflation has jumped from 0.5% to 1.6%, its highest increase since November 2020.

- July's core HICP inflation rates remain low and broadly stable (again, see table below). The rate excluding food, energy, alcohol, and tobacco prices has actually ticked down from 0.9% in June to 0.7%, a tad below the market consensus expectation.

- Splitting this rate into its two key elements, non-energy industrial goods inflation has reversed June's acceleration, slipping from 1.2% back down to 0.7%. However, July's rate remains well above its level at the end of 2020 (-0.5%), with further upward pressure to come.

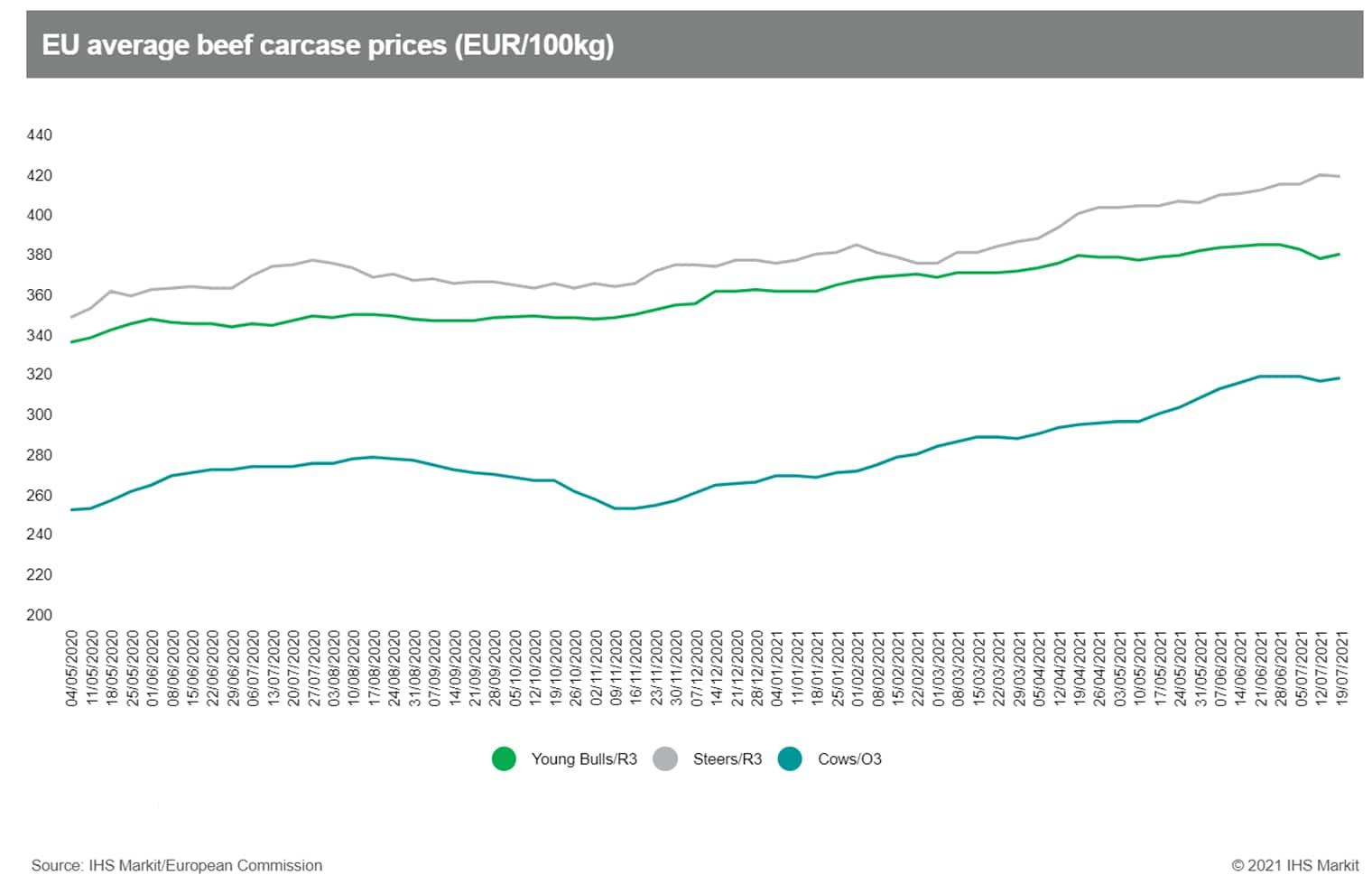

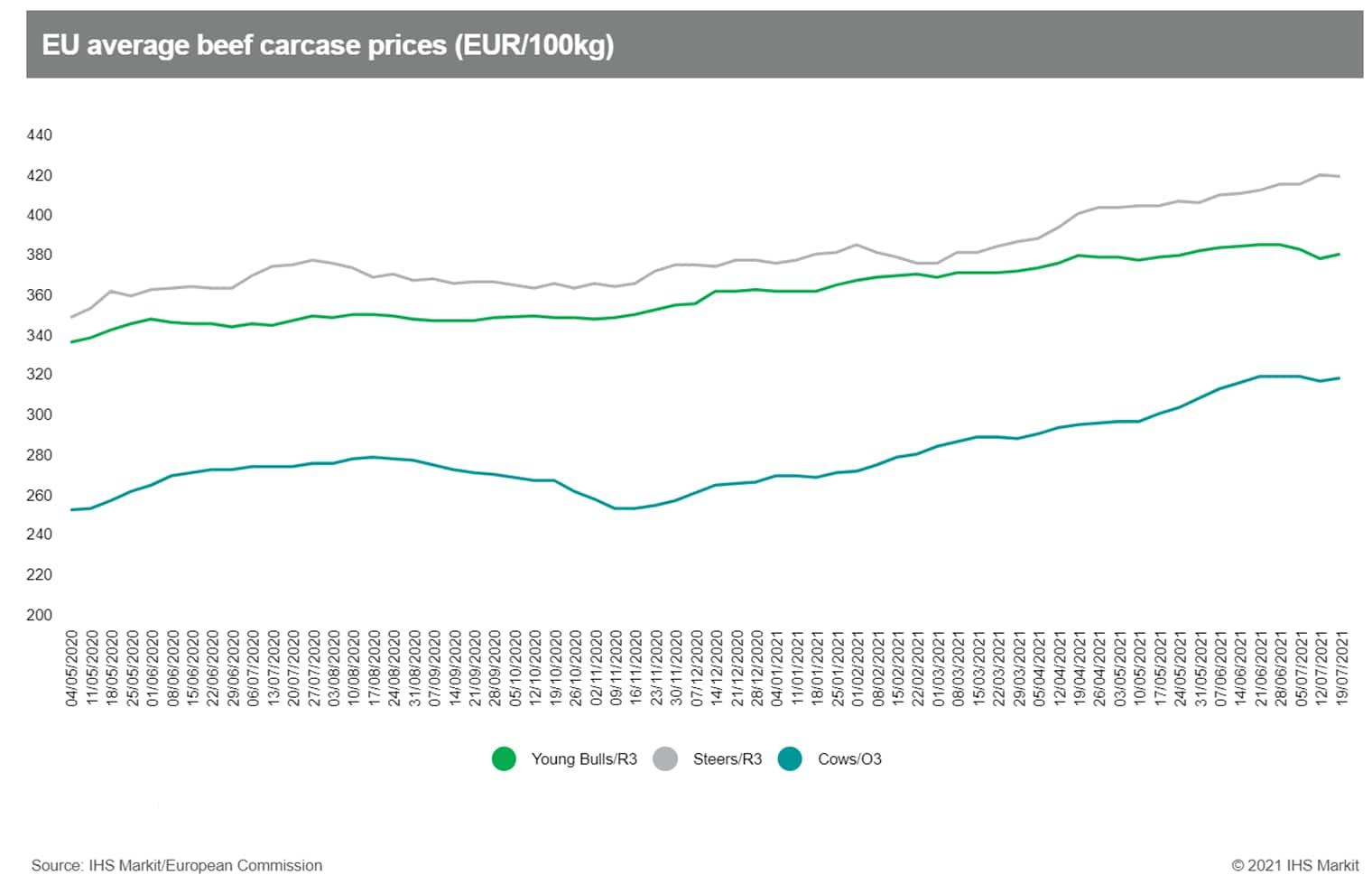

- Prices for European cattle have nudged upwards again over the past week, as the market's focus shifts back to low levels of supply. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- Following a dip in the previous week - the first week-on-week fall for more than two months - prices have now regained their upward trajectory.

- This trend has been led in particular by Germany and Italy, where supplies of slaughter-ready cattle, and especially young bulls, remain low enough to prompt some nervousness on the part of buyers. Average prices in both countries have risen by more than 1% over the past week.

- However, levels of consumption are generally low, despite the ongoing reopening of the restaurant and foodservice sectors in many member states. and this is likely to prevent prices rising too much higher.

- 'Flash' data released by the Federal Statistical Office (FSO) show that German real GDP rebounded by 1.5% quarter on quarter (q/q) in the second quarter, which recoups only part of its first-quarter decline by 2.1% q/q (revised down from -1.8%). Growth in the second half of 2020 was moderately revised upwards, however, ensuring that the GDP level in the second quarter is very close to our prediction. Thus, we are not changing our forecast of 3.8% for average growth in 2021. As of the second quarter, German GDP was still about 3% below pre-pandemic (end-2019) levels. (IHS Markit Economist Timo Klein)

- Information gleaned from recent monthly frequency indicators has signaled that the staggered loosening of lockdown restrictions since mid-May has clearly helped retail sales and the labor market, accompanied by improving consumer confidence.

- The manufacturing sector, which had suffered far less than services from administrative restrictions during December-May, has increasingly been burdened by supply-chain bottlenecks (notably affecting semiconductors and shipping capacity), thus hurting especially the automotive industry in recent months. Industrial production excluding construction remained broadly flat in the second quarter, and manufacturing orders in May (latest month available) suffered a setback of -3.7% month on month (m/m).

- President Cyril Ramaphosa announced on 25 July a series of measures to assist people and businesses affected by several days of looting, damage to property, and arson following the imprisonment of former president Jacob Zuma on 7 July. Violent protests began with the blocking of the two key N2 and N3 national roads on 9 July, and later resulted in the looting of large retail stores in the Durban and Johannesburg inner city areas and surrounding neighborhoods. The protests largely have stopped following the deployment of 25,000 soldiers by Ramaphosa on 14 July. Zuma was arrested after the Constitutional Court on 29 June ordered his imprisonment for reportedly refusing to appear before the Commission of Inquiry into Allegations of State Capture. Zuma has denied all allegations of wrongdoing. (IHS Markit Country Risk's Thea Fourie and Langelihle Malimela)

- Military deployment is likely to be scaled down only after the Constitutional Court rules on Zuma's appeal against his 15-month jail sentence. On 12 July, the Constitutional Court heard an application by Zuma seeking rescission of his 15-month jail sentence and is very likely to announce its ruling during August. If Zuma's application is rejected, which is very likely, a resumption of protests is likely in his home province of KwaZulu-Natal, especially in low-income neighborhoods surrounding Durban and Pietermaritzburg.

- New social measures to reduce future unrest will increase fiscal spending during fiscal year (FY) 2021/22. The reintroduction of the Social Relief of Distress Grant, providing a monthly payment of ZAR350/month (USD24/month) to unemployed South Africans until March 2022, will cost approximately ZAR27 billion, while a further ZAR9 billion will be disbursed via several mechanisms aimed at alleviating the effect of the unrest on small businesses, including those that are uninsured.

- High global commodity prices should permit a significant government revenue overrun during FY 2021/22. Despite the higher outlays, a tax windfall from the mining industry during the first quarter of FY 2021/22 suggests that a significant government revenue overrun of ZAR80 billion could be achieved for the whole FY.

- Debt sustainability risk remains elevated beyond FY 2021/22. The 2021 increase in fiscal capture from the mining sector and resulting revenue overrun are unlikely to be repeated and may well be reversed once recovery from the COVID-19 pandemic runs its course and pent-up global commodity demand is satisfied. Even with the mining windfall, the country's fiscal deficit is unsustainably high and could rise even further if global commodity prices move sideways or decline and South Africa's GDP returns to its potential longer-term projected growth path of 1.5-2.0%.

- The International Monetary Fund (IMF) has approved a USD689.5-million loan under the Extended Credit Facility (ECF) and the Extended Fund Facility (EFF) for Cameroon, according to a press release on 29 July. (IHS Markit Economist Archbold Macheka)

- The USD689.5-million three-year arrangement, which accounts for about 175% of Cameroon's IMF Special Drawing Rights (SDR) quota, is intended to support the country's economic and financial reform program. Approval of the ECF/EFF enables immediate disbursement of about USD177.2 million, which can be used for budget support if the government so chooses.

- The IMF noted that the COVID-19 pandemic has worsened Cameroon's development challenges and has elevated concerns about the country's growth prospects and external and fiscal positions. In addition, "security risks in parts of the country persist. The pandemic could reverse improvements in poverty reduction and development outcomes and jeopardize the implementation of reforms".

Asia-Pacific

- All major APAC equity indices closed lower; India -0.1%, Australia -0.3%, Mainland China -0.4%, South Korea -1.2%, Hong Kong -1.4%, and Japan -1.8%.

- Ride-hailing company Didi Chuxing (DiDi) has denied a media report that it was considering going private to appease Chinese regulators and repay investors for losses suffered since its initial public offering (IPO) in the United States, reports Reuters. According to the media reports, DiDi has been considering delisting plans as China tightens its scrutiny levels on technology firms, gaining support from cybersecurity officials. (IHS Markit Automotive Mobility's Surabhi Rajpal)

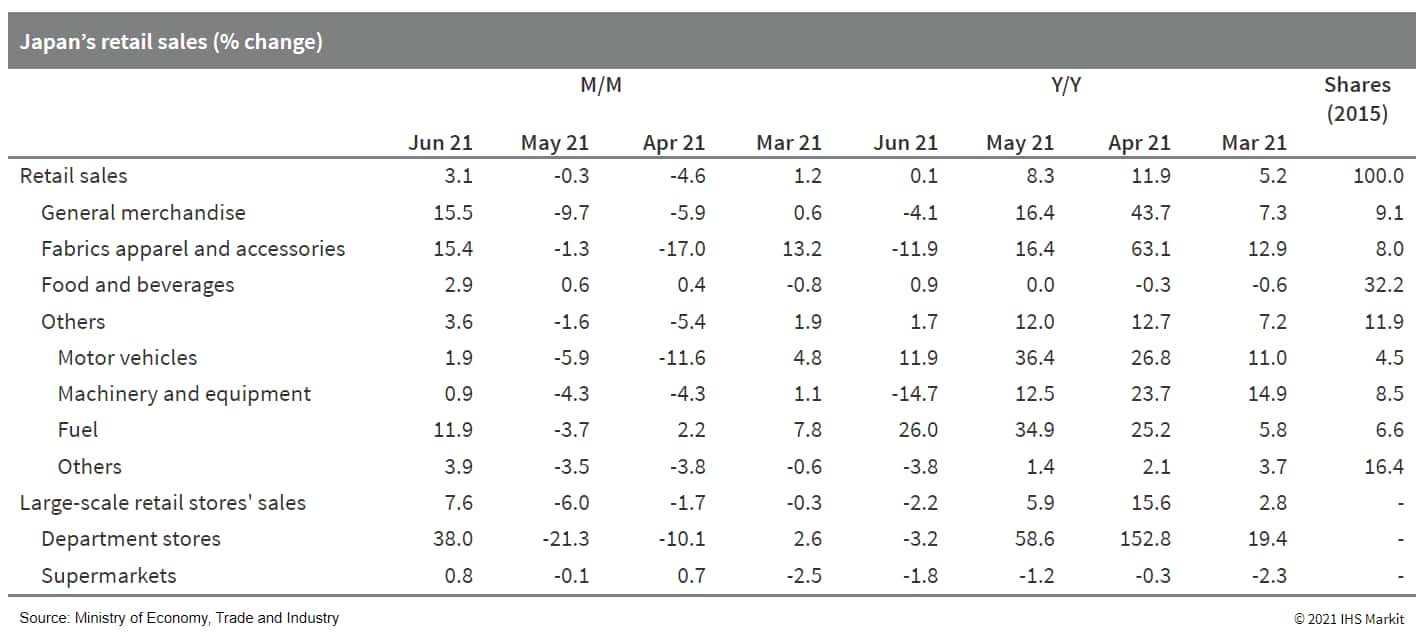

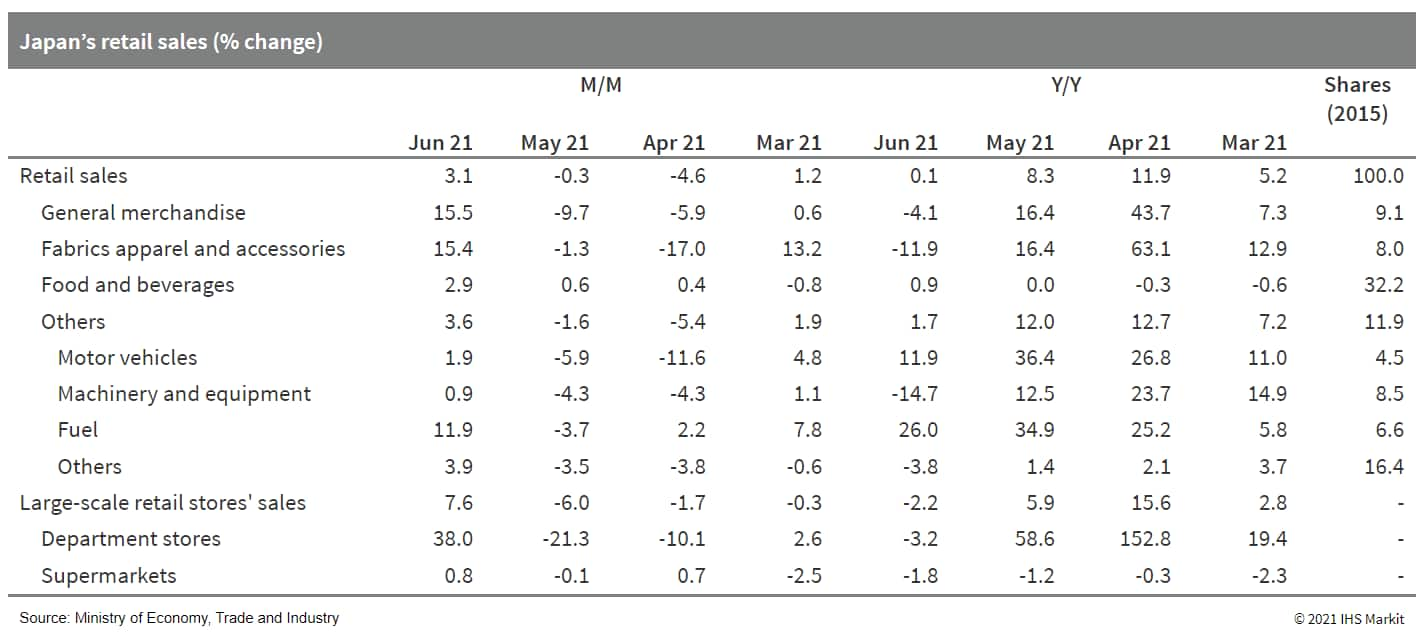

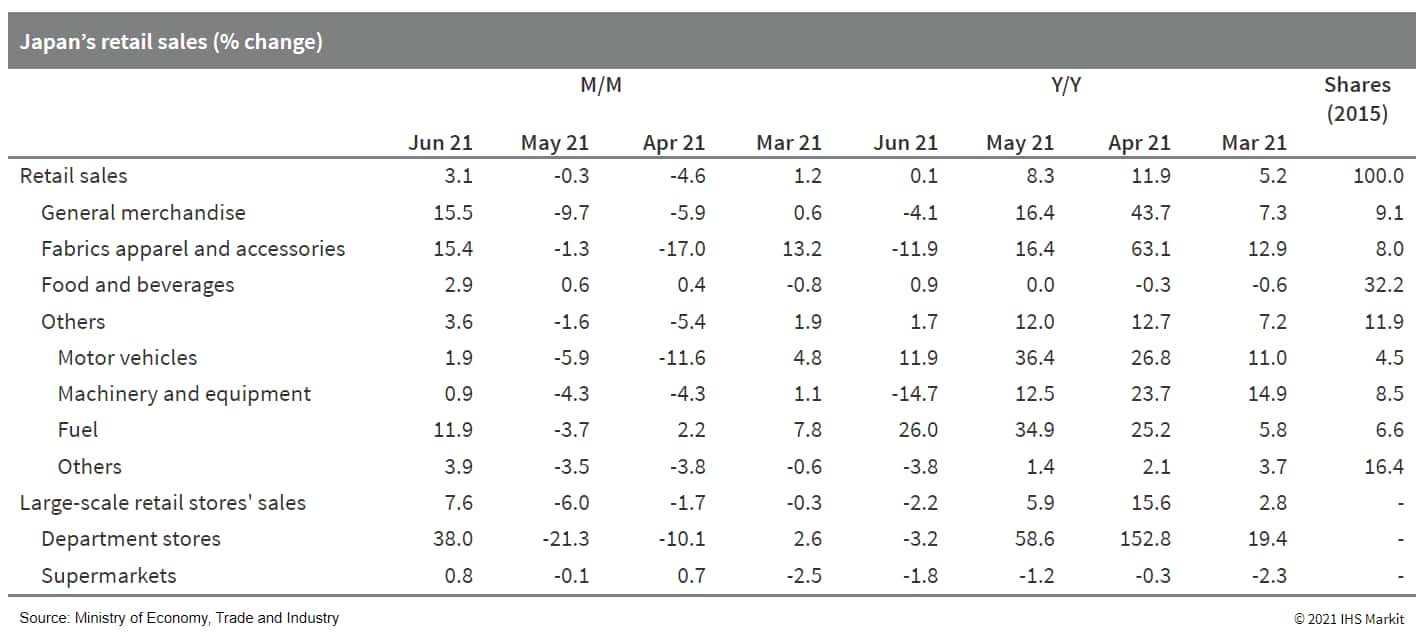

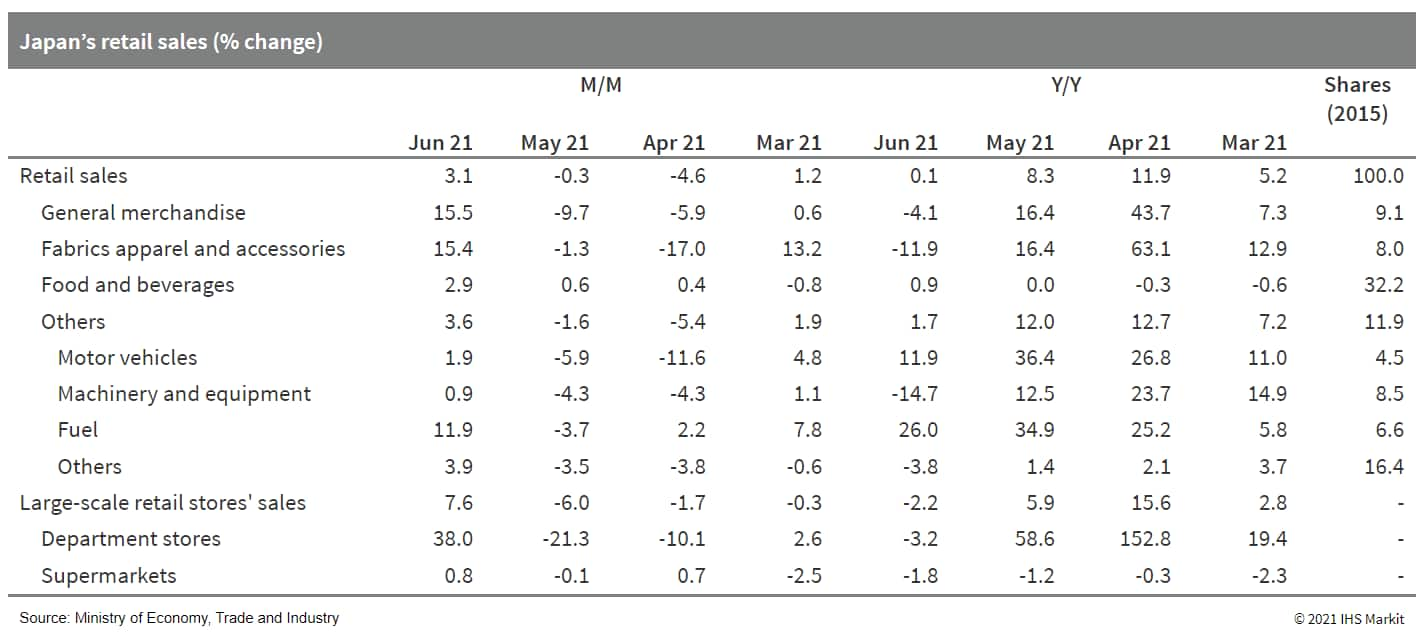

- Japan's retail sales rose by 3.1% month on month (m/m) in June following two consecutive months of declines. A decline in new daily infections during the month and progress in vaccine rollouts helped lift a broad range of retail sales, particularly for general merchandise and fabrics apparel and accessories. That said, retail sales for the second quarter of 2021 declined by 2.1% from the previous quarter for the first drop in five quarters. (IHS Markit Economist Harumi Taguchi)

- Improved business prospects also helped labor demand. The unemployment rate notched down to 2.9% thanks to an increase the number of employees (largely regular employees) while the job participation rate rose.

- Accordingly, the ratio of active job openings to active job applications rose to 1.13 in June from 1.09 in May, reflecting a decline in active job applications.

- Japan's index of industrial production (IIP) rose by 6.2% month on month (m/m) in June following a 6.5% m/m drop in the previous month. A softer rise in manufacturers' shipments than production (even solid at 5.5%) led to an increase in inventories (up 2.3%) for the first time in three months, but the index of inventory ratio declined slightly by 0.3% m/m. (IHS Markit Economist Harumi Taguchi)

- The solid rise in the IIP was due largely to a 22.6% m/m increase in production of autos and an 8.9% rise in production of production machinery (driven by semiconductor and flat panel display production equipment), while production in 11 out of 15 industries increased from a month ago.

- Although semiconductor shortages led to temporary shutdowns of production lines at several auto manufacturers, increases in inventories were largely driven by growth in inventories of autos and electric parts and devices (such as liquid crystal panels). Inventory growth partially reflected efforts to counter supply-chain disruptions and demand to lock in stock before further rises for material costs while external demand remained strong.

- Toyota Kirloskar Motor (TKM) has announced battery-warranty extensions for its Self-charging Hybrid Electric Vehicles (SHEVs), including the Camry and Vellfire, in India, according to company sources. The warranty is being extended from the existing three years or 100,000 kilometers to eight years or 160,000 kilometers for vehicles sold from 1 August onwards. For customers who purchased SHEVs January 2019 onwards, the automaker is offering similar warranty benefits at a special offer price. (IHS Markit AutoIntelligence's Tarun Thakur)

- LG Electronics and Magna International have signed a transaction agreement that establishes a joint venture (JV) between the two companies. According to a press release issued by Magna, the new company, to be called LG Magna e-Powertrain, is headquartered in Incheon (South Korea). The JV will manufacture e-motors, inverters, and onboard chargers and, for certain automakers, related e-drive systems. Leading the new firm will be CEO Cheong Won-suk, who was most recently the VP and head of LG Vehicle component Solutions company's green business. The new company will develop powertrain components that offer automakers a scalable portfolio, from complete solutions enabling electrification and functionality to integrating intelligent operating software and controls in new e-drive systems. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korean tower supplier CS Wind is buying a 60 percent stake in Portuguese tower and foundation manufacturer ASM Industries. ASM Industries, established in 2007, is part of the A. Silva Matos Group. The company builds both onshore and offshore wind turbine towers and has production facilities in the Port of Aveiro and Sever do Vouga, both in Portugal. Besides towers, the company is also able to build floating and fixed foundations, having participated in the early designs of the WindFloat project. CS Wind, with the purchase of ASM Industries, hopes to establish a core production base to serve the Europe market. The company has plans to expand tower production volume and increase its market share within the next two to three years. In June this year, CS Wind acquired Vestas' US tower plant, and expanded its production in Turkey. The company currently has presence in Europe through CS Wind UK, which was established in 2016, through CS Wind's purchase of the former Wind Towers Scotland. CS Wind UK however has been struggling to secure projects over the last couple of years and has had to lay off the majority of its workforce. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The Bank of Mongolia (BOM), the country's central bank, announced on 29 July that it has granted the Transport and Development Bank (TransBank) and Credit Bank permission to merge. The merger reportedly follows the suspension of operations at Credit Bank and the transfer of "rights, duties and responsibilities" to TransBank. The BOM has highlighted that the merger aims to ensure further financial stability, and that the "governance, joint control system, capital risk tolerance and the ability to serve the interests of customers and depositors will improve". (IHS Markit Banking Risk's Natasha McSwiggan)

- Aiming to enhance stability, an amended Banking Law was adopted in early 2021 to reduce the risk of sector concentration and to support banking supervision independence. The amendments apply restrictions to the size of shareholdings, clarify liquidation procedures, and identify "influential" banks, highlighting the BOM's vision for enhanced financial supervision to facilitate improved stability in the sector.

- The newly combined entity will hold 1.7% of total sector assets based on 2020 asset value data for the sector, in which TransBank and Credit Bank were the seventh- and ninth-largest banks, respectively.

Posted 30 July 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.