The last trading day of April concluded with almost all major equity indices closing lower on the day across Europe, the US and APAC. US government bonds closed higher and benchmark European bonds were mixed. Most major European and North American credit indices closed flat, except for CDX-NAHY being slightly wider on the day. The US dollar and natural gas closed higher, gold flat, and copper, silver, and oil were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.5%, S&P 500 -0.7%, Nasdaq -0.9%, and Russell 2000 -1.3%.

- 10yr US govt bonds closed -2bps/1.63% yield and 30yr bonds -1bp/2.29% yield.

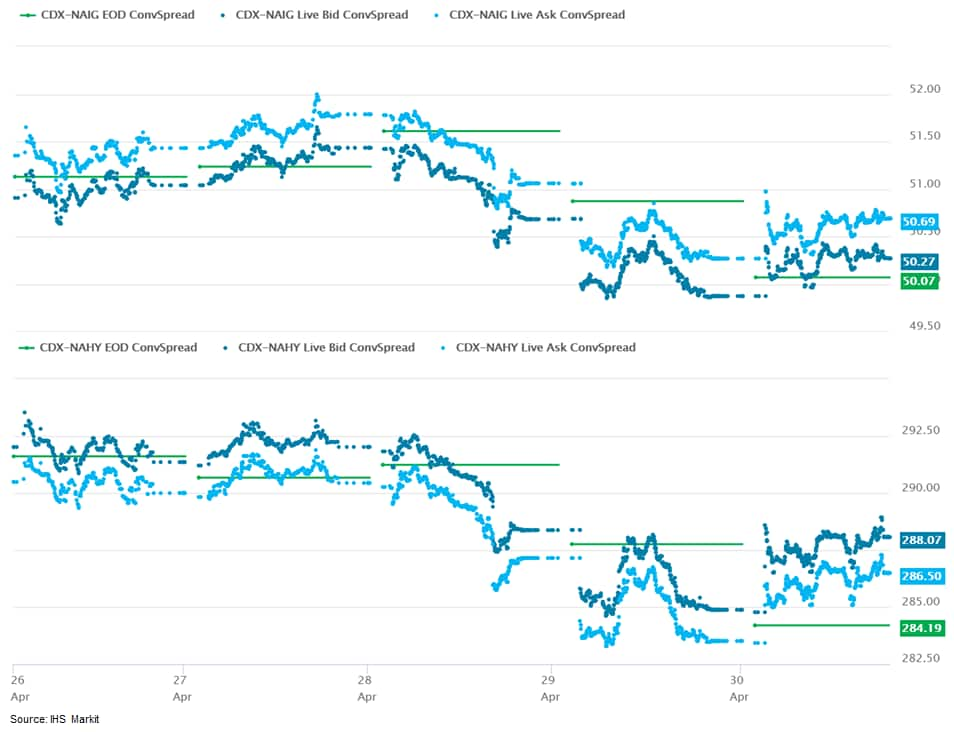

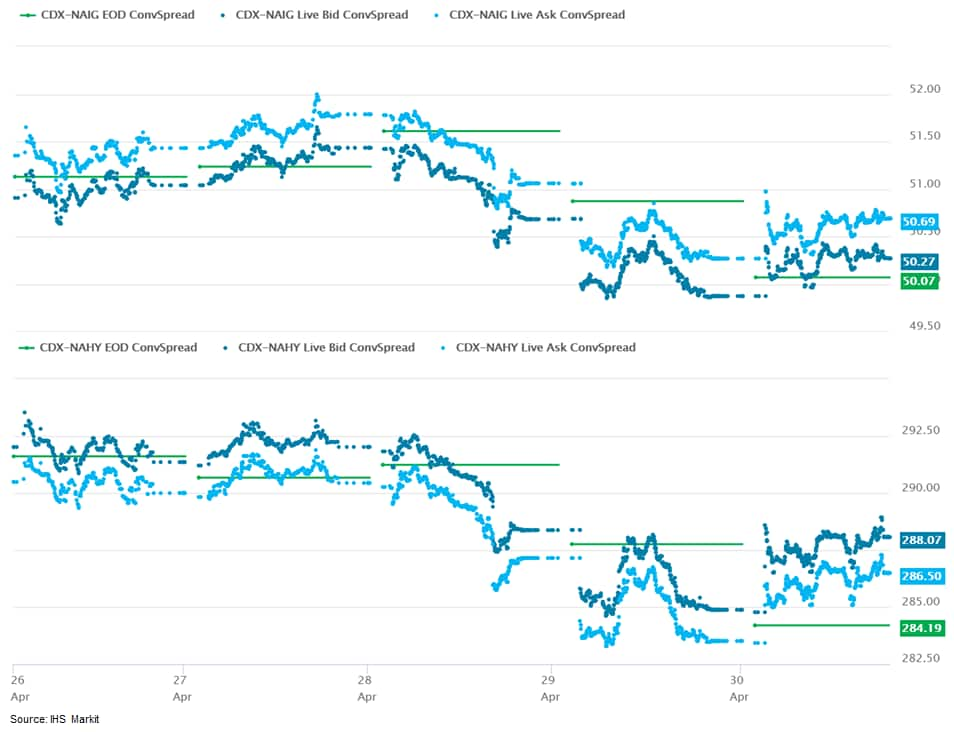

- CDX-NAIG closed flat/50bps and CDX-NAHY +3bps/284bps, which is -1bp and -5bps week-over-week, respectively.

- DXY US dollar index closed +0.7%/91.28.

- Gold closed flat/$1,768 per troy oz, silver -0.8%/$25.87 per troy oz, and copper -0.4%/$4.47 per pound.

- Crude oil closed -2.2%/$63.58 per barrel and natural gas closed +0.7%/$2.93 per mmbtu.

- Big oil companies returned to profitability during the first quarter as they recovered from the unprecedented destruction of oil and gas demand wrought by the coronavirus pandemic. Exxon Mobil Corp. reported $2.7 billion in net income Friday, its first quarterly profit since the pandemic erupted last spring, while Chevron Corp. reported $1.4 billion in first-quarter profit. The results were boosted by rising oil prices during the first months of 2021, as countries around the world soften coronavirus quarantines. The largest European oil companies, BP, Royal Dutch Shell and Total SE, all reported profits earlier in the week after enduring huge losses last year. (WSJ)

- Work on development of COVID-19 therapeutics to complement vaccination programs has at last begun to show some success, with Eli Lilly (US) submitting a filing for accelerated approval in Europe for its repurposed anti-inflammatory Olumiant (baricitinib), for the treatment of hospitalized patients requiring oxygen. In addition, Atea (US) and Roche (Switzerland) have started dosing in a pivotal Phase III trial of oral antiviral AT-537, one of a growing number of promising oral RNA replicase inhibitors now advancing towards late-stage development for home use to reduce viral load, severity of infection, and transmission in the community. (IHS Markit Life Sciences' Janet Beal and Ewa Oliveira da Silva)

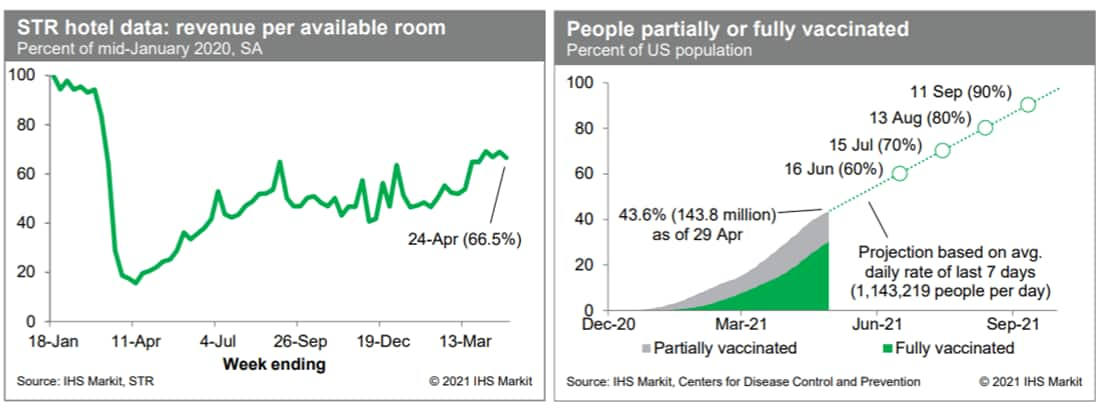

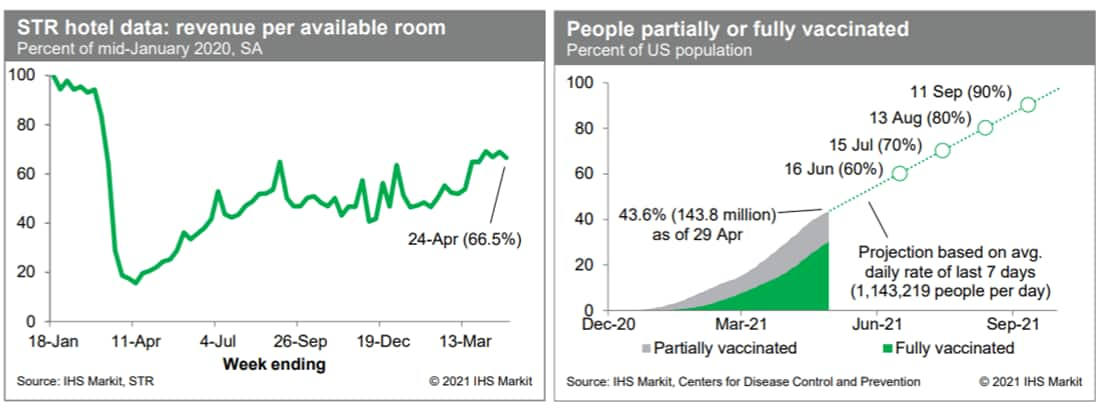

- Revenue per available room at US hotels last week, after seasonal adjustment, was 66.5% of the mid-January 2020 level (our estimate based on weekly data from STR). This is close to readings of the prior five weeks, indicating that the recovery in travel may have plateaued, at least for the time being. Meanwhile, averaged over the last week, about 1.1 million US residents per day received a first dose of a COVID-19 vaccine, bringing the total number of residents either partially of fully vaccinated as of yesterday to about 144 million, or 44% of the US population. The average daily rate of new vaccinations was down roughly 0.3 million per day from the prior week's rate of 1.4 million per day and even further below 2.0 million per day from two weeks prior. The pause in the use of the Johnson & Johnson vaccine was lifted on 23 April, so the slowing in the pace of new vaccinations likely does not reflect supply limitations; it is more likely a slowing in demand. Still, at this week's pace, widespread vaccination (70-80% of the US population) would be achieved by this summer. (IHS Markit Economists Ben Herzon and Joel Prakken)

- US personal income vaulted 21.1% in March and real disposable personal income (DPI) soared 23.0% as the bulk of the stimulus payments authorized in the American Rescue Plan (ARP) Act were disbursed. The month-on-month change in real DPI was the greatest on record. (IHS Markit Economists James Bohnaker and David Deull)

- Economic impact payments amounted to $337 billion in March, about 82% of the total authorized in ARP. These payments contributed to a near-doubling (up 95%) in personal transfer income in March.

- Other categories of income also rose in March, including wage and salary income, whose increase of 1.1% was the strongest in seven months. The saving rate vaulted 13.7 percentage points to 27.6%.

- The core personal consumption expenditures (PCE) price index rose 0.4% in March, the most since the pandemic began, and its 12-month change increased to 1.8%.

- Real PCE rose 3.6% in March, somewhat more than we expected, implying more PCE and imports in the second quarter but less inventory investment. In response, we raised our estimate of second-quarter PCE growth by 1.3 percentage points to 9.1%.

- Real PCE on durable goods led the pack, jumping 10.3% and continuing the pattern in place during the pandemic. Real PCE for nondurable goods rose 5.6%. Real spending on services rose a more modest 1.7%, but this was still a nine-month high as weather warmed and some state and local containment measures eased. Spending on services remained 5.1% beneath its pre-pandemic (February 2020) level.

- The US Employment Cost Index (ECI) increased 0.9% for the three-month period ended in March 2021 (the reference day is the pay period that includes the 12th day of March). (IHS Markit Economist Patrick Newport)

- Year-over-year (y/y) growth was 2.6%, up from 2.5% in December.

- Year-over-year real growth was 0.8%, up from the 0.7% y/y reading of March 2020 (the Bureau of Labor Statistics calculates real growth using the consumer price index as the price deflator).

- Wages and salaries (about 70% of compensation costs) rose 1.0% for the three-month period ended March 2021 and 2.7% y/y; benefits (about 30% of compensation) increased 0.6% for the three-month period and 2.3% y/y.

- Private industry compensation grew 2.8% y/y, wages and salaries (about 70% of compensation costs) rose 3.0%, and benefits (about 30% of compensation) grew 2.5%.

- The University of Michigan Consumer Sentiment Index rose 3.4 points (4.0%) from its March level to 88.3 in the final April reading. This was 1.8 points higher than the mid-April reading, indicating a steady rise in consumer sentiment over the course of the month. (IHS Markit Economists James Bohnaker and David Deull)

- The April gain in consumer sentiment was broadly based. The expectations index rose 3.0 points to 82.7, while the index of current conditions rose 4.2 points to 97.2. The entirety of the improvement from the preliminary April reading, however, took place in the expectations index.

- With the domestic vaccination campaign proceeding quickly, the reported proportion of respondents expecting a drop in the unemployment rate in the next year reached an all-time high (data begin in 1978). The measure of the expected probability of increases in personal income reached a pandemic-era high.

- Consumer sentiment rose mainly among high-income households in April. Sentiment reported for households earning more than $75,000 a year rose 6.6 points to 94.3, while sentiment for lower earners rose 0.9 point to 82.2.

- Views on buying conditions were mixed in April. The index of buying conditions for large household durable goods slipped 2 points to 126 but remained elevated, while that for vehicles rose 4 points to 118.

- The index for homes, however, fell 13 points to 114 amid growing concerns about home affordability. This was the lowest since a pandemic-induced swoon in April 2020 and the second lowest since the end of 1984.

- Bechtel has been selected by Advanced Power to complete the EPC of the Cutlass Solar Project in Fort Bend, Texas. The solar PV project will add 140 MW to the Electric Reliability Council of Texas' Houston Zone. The solar farm is scheduled to begin commercial operations in 2022. According to Bechtel, Cutlass Solar is the fourth project and first renewable energy facility that Bechtel will deliver for Advanced Power. (IHS Markit Upstream Costs and Technology's Dag Kristiansen)

- Wendy's is the latest US fast-food chain to announce elimination of PFAS from consumer-facing packaging, pledging to ban it by the end of this year. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- In its 2020 Corporate Responsibility Report, Wendy's announced the latest progress in meeting eco-friendly benchmarks including the goal to sustainably source 100% of customer-facing packaging by 2026.

- "To accomplish this goal, over the next five years, Wendy's will optimize customer-facing packaging and transition to sustainable options including items that: have higher recycled content; use fewer raw materials; adhere to an established restricted substances list; are recyclable, compostable or reusable; and are sourced from areas that do not contribute to deforestation," the seventh-largest fast-food chain said.

- In the report released April 20, the fast-food company said it is meeting incremental goals by establishing a restricted substances list, exploring strawless lids and using a company-operated restaurant to test innovative packaging ideas. Canada restaurants are moving from plastic salad bags to paper and from plastic stir sticks to birch wood stir sticks.

- The report also pledged to enact a "full elimination of per- and polyfluoroalkyl substances, commonly called PFAS, from consumer-facing packaging in the U.S. and Canada by the end of 2021."

- LyondellBasell says tight markets and strong demand helped push first-quarter net income to $1.1 billion, up 643% year-over-year (YOY), and up 25% from $855 million during the fourth-quarter of 2020. Diluted earnings per share came to $3.18, well above the consensus estimate of $2.65 as compiled by Zacks Investment Research. Sales totaled $9.1 billion, up 21% YOY. EBITDA was $1.6 billion, up 145% YOY. (IHS Markit Chemical Advisory)

- Sales in the olefins & polyolefins - Americas segment totaled $2.9 billion, up 60% YOY from $1.8 billion. EBITDA came to $867 million, up 137% YOY from $366 million in the prior-year quarter, which included an LCM inventory charge of $111 million. Olefins results increased about $330 million as higher ethylene and propylene pricing outpaced increases in feedstock costs.

- Sales in the olefins & polyolefins - Europe, Asia, international segment totaled $3.0 billion, up 37% from $2.2 billion. EBITDA totaled $412 million, up 118% YOY from $189 million in the prior-year quarter, which included a $36 million LCM inventory charge. Olefins results decreased approximately $95 million on lower margins driven by higher feedstock costs.

- Sales in the intermediates & derivatives segment totaled $1.8 billion, flat versus the prior-year quarter, which included an LCM inventory charge of $78 million. EBITDA totaled $182 million, down 10% YOY from $203 million. Propylene oxide & derivatives results decreased about $25 million as weather and planned maintenance cut into volumes, while tight market supply boosted margins.

- Sales in the advanced polymer solutions segment $1.3 billion, up 16% YOY from $1.1 billion. EBITDA totaled $135 million, up 19% YOY from $113 million. Compounding & solutions results increased more than $10 million, with higher demand in Asia and Europe driving increases in volumes and margins.

- Sales in the refining segment totaled $1.1 billion, down 22% YOY. EBITDA came to a $110 million loss, versus a loss of $272 million in the year-ago quarter, which included an LCM inventory charge of $192 million.

- Alphabet Inc.'s autonomous vehicle (AV) subsidiary, Waymo, is looking to raise additional external investment and make acquisitions of its own, the company's new CEOs Dmitri Dolgov and Tekedra Mawakana said, reports Bloomberg. They also said, "Going forward, we are open to having those same sort of conversations with parties beyond Alphabet." Waymo is at the forefront of automated transportation development and has conducted 20 million miles of AV testing on public roads in 25 cities and more than 10 billion miles of simulation. Last year, it raised USD2.25 billion in an external funding round, which later expanded to USD3 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's real GDP by industry output increased 0.4% month on month (m/m) in February, exactly as anticipated and a bit below Statistics Canada's initial estimate. (IHS Markit Economist Arlene Kish)

- Output in the goods-producing industries was down 0.2% m/m with losses in mining and oil and gas extraction and manufacturing. This led to the sharp 1.2% m/m drop in industrial production.

- The services industries gained momentum as output was down in only 4 of 15 industries with the overall gain spearheaded by the supercharged 4.5% liftoff in retail trade volumes.

- Statistics Canada estimates March's real GDP by industry output will advance 0.9% m/m. First-quarter real GDP growth should advance about 6.7% from the previous quarter on an annualized basis.

- General Motors (GM) Mexico has announced the Ramos Arizpe Manufacturing complex will be the next North American site to be adapted for electric vehicle (EV) production, with an investment of more than USD1 billion. The investment also includes a new paint plant to come online in June 2021, as well as for expansion and preparation to become the fifth North American plant prepared for EV production. GM's statement indicates that production of the new EVs will begin in 2023, with production of electrical components for the Ultium drive units to begin in the second half of 2021. Along with vehicle assembly, Ramos Arizpe will produce batteries and electrical components. The investment will also update infrastructure, including dining rooms, medical services and recreational spaces. The statement says that the complex will continue to produce the Chevrolet Equinox and Blazer, and internal combustion engines and transmissions along with the EV products, although details on the EV products and start of production for those will be announced later. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- Most major European equity indices closed lower except UK +0.1%; Spain -0.1%, Germany -0.1%, France -0.5%, and Italy -0.6%.

- 10yr European govt bonds closed mixed; Germany -1bp, France/UK flat, Spain +1bp, and Italy +3bps.

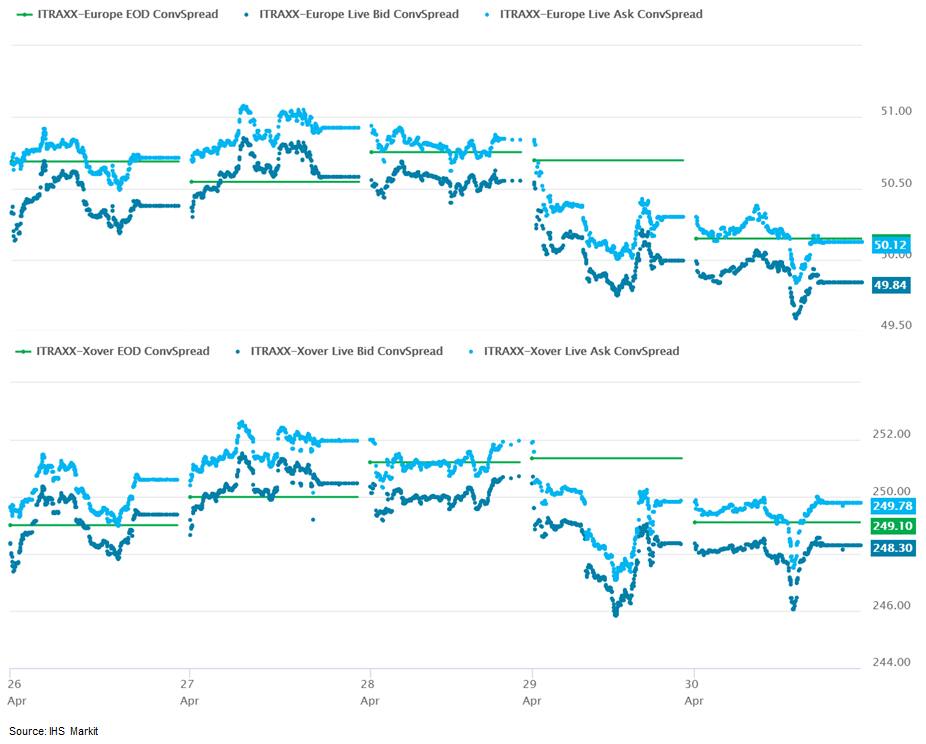

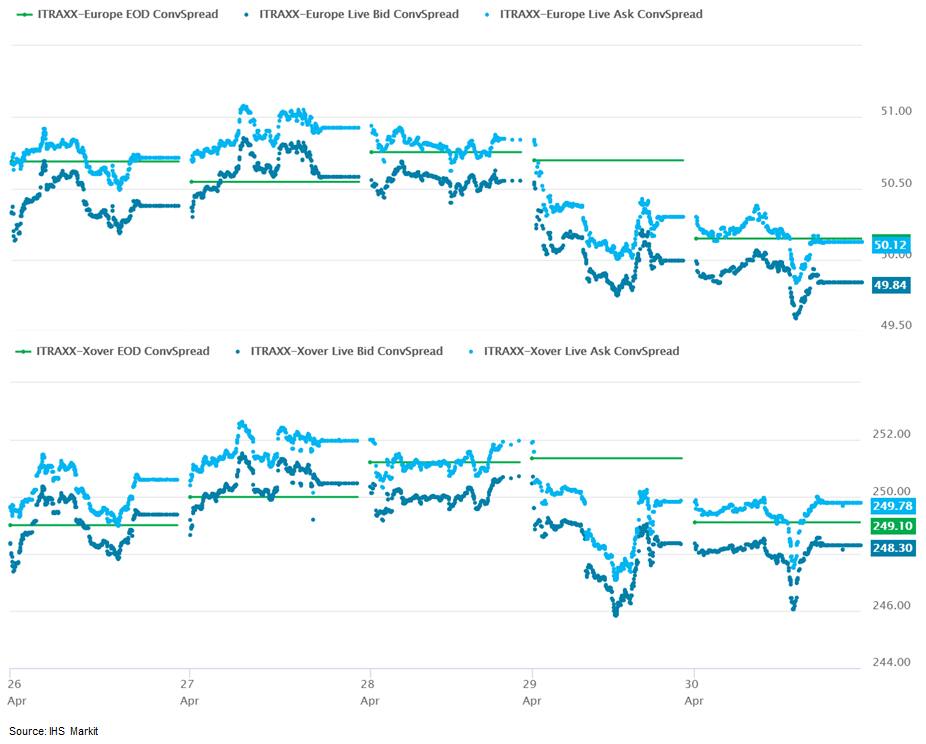

- iTraxx-Europe closed flat/50bps and iTraxx-Xover flat/249bps, which is -1bp and flat week-over-week, respectively.

- Brent crude closed -1.9%/$66.76 per barrel.

- The European Commission has said genome editing could help the EU achieve a more sustainable agri-food sector and recommends the bloc update its laws to reflect this. On 29 April, the EU executive published a study on new genomic techniques (NGTs) and found EU legislation needs to be adapted to allow more of these innovations reach the market. Commissioner for Health and Food Safety, Stella Kyriakides, said: "The study we publish today concludes that new genomic techniques can promote the sustainability of agricultural production… now is the moment to have an open dialogue with citizens, member states and the European Parliament to jointly decide the way forward for the use of these biotechnologies in the EU." NGTs alter the genome of an organism using techniques like CRISPR-Cas9, but they are severely limited in the EU because of a 2018 ruling by the European Court of Justice that found they should be treated as genetically modified organisms (GMOs). This means they are subject to the GMO directive (2001/18/EC), which stipulates that NGTs can only be authorized after an environmental risk assessment and therefore face strict traceability, labelling and monitoring obligations. (IHS Markit Food and Agricultural Policy's Steve Gillman)

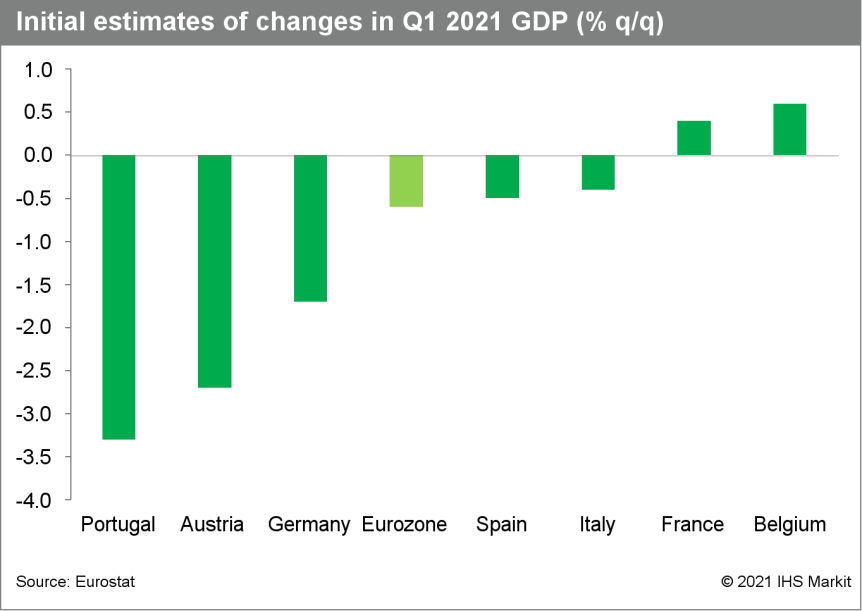

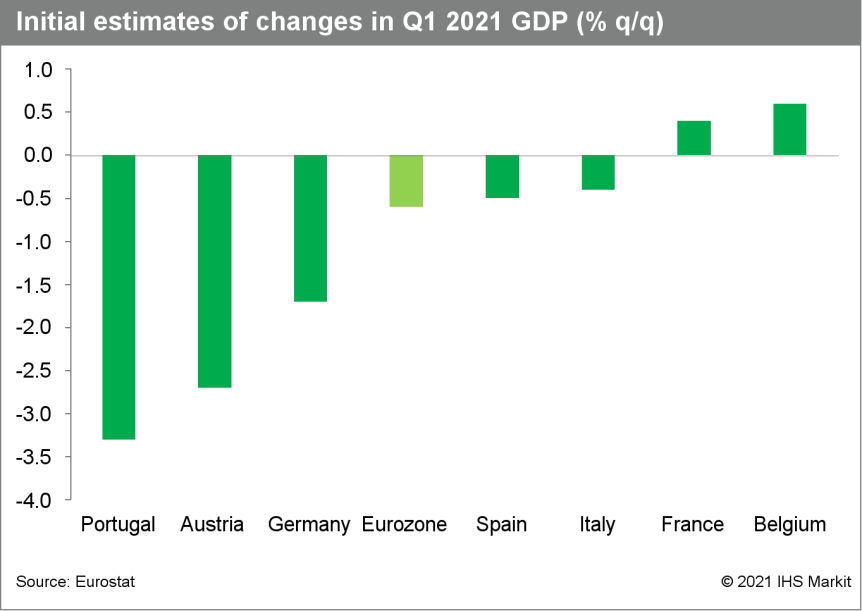

- According to the initial "preliminary flash" estimate, eurozone GDP declined by 0.6% quarter on quarter (q/q) in the first quarter of 2021, the fourth contraction in the past five quarters. (IHS Markit Economist Ken Wattret)

- The decline was marginally smaller than expected, with the market consensus expectation (according to Reuters' survey), and IHS Markit's forecast, at -0.8% q/q.

- This follows a 0.7% q/q decline in the fourth quarter of 2020, confirming another "technical" recession in the eurozone, and leaves eurozone GDP 5.5% below its pre-pandemic level in the fourth quarter of 2019.

- Eurozone Harmonised Index of Consumer Prices (HICP) inflation has risen from 1.3% in March to 1.6% in April, according to Eurostat's "flash" estimate, its highest level in two years, although in line with the market consensus expectation. (IHS Markit Economist Ken Wattret)

- The cumulative acceleration since December 2020 now stands at 1.9 percentage points, with energy responsible for more than four-fifths of the increase.

- The year-on-year (y/y) rate of change in energy prices has jumped by around six percentage points in April alone, to 10.4%, near its historic highs.

- "Flash" data released by the Federal Statistical Office (FSO) show that German real GDP declined by 1.7% quarter on quarter (q/q) in the first quarter, partially correcting the initial rebound in the second half of 2020. Given upward revisions of 0.4% in total to the data for the two preceding quarters, the first-quarter GDP level is very close to our prediction and does not require an adjustment to our forecast for average growth in the full year 2021 (3.5%). First-quarter GDP was still about 5% below the level seen prior to the pandemic in late 2019. As usual, only the flash data relating to total GDP (real and nominal) have been released today; detailed component data will be released on 25 May. (IHS Markit Economist Timo Klein)

- The Volkswagen (VW) Passenger Cars brand has outlined its road map towards becoming a net climate-neutral company by 2050 in a press statement. Although the goal is laudable and lofty, there had been little flesh on the bones of the plan until this point but VW has now shared some of the details about how this aim will be achieved. The main building block is a plan for a targeted 40% reduction in carbon dioxide (CO2) emissions per vehicle in Europe by 2030. This is in comparison to the original baseline of a 30% reduction. This would mean that on average every VW vehicle would emit around 17 tons less CO2, while at the same time production, the supply chain, and battery electric vehicle (BEV) charging will also be made net carbon neutral. The company is also already well advanced in developing a large-scale battery recycling program. BEVs are only as green as the energy source from which they are charged and VW is accelerating its involvement in ensuring zero-carbon charging sources for its BEVs. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Daimler-Volvo Cellcentric joint venture (JV) plans fuel-cell series production in 2025, according to a joint statement loosely outlining a road map. The Cellcentric name for the JV was announced earlier this year. According to the statement, Cellcentric aims to become a leading global manufacturer of fuel-cell systems and targets one of Europe's largest planned series production in 2025. Cellcentric aims to develop its systems for both long-haul trucking and other applications. The partners believe that pure battery electric trucks and hydrogen fuel-cell electric trucks will complement each other depending on individual customer use case; the statement notes that the two expect battery power to be preferred for lower cargo weights and shorter distances, while fuel-cell solutions would be favored for heavier loads and longer distances. The two companies have also called for a "harmonizing EU framework" to support the technology. Cellcentric partners are calling for the development of about 300 high-performance hydrogen refueling stations suitable for heavy-duty vehicles by 2025 and about 1,000 by 2030. (IHS Markit AutoIntelligence's Stephanie Brinley)

- BASF has reported a robust first-quarter performance and raised its full-year guidance. The company's net profit almost doubled year on year (YOY) in the first quarter to €1.7 billion ($2.1 billion) on sales up 16%, to €19.4 billion. EBIT before special items grew 42% YOY to €2.32 billion, beating analysts' consensus estimate of €2.25 billion provided by Vara Research (Frankfurt, Germany). EBITDA increased 31% YOY to €3.2 billion. (IHS Markit Chemical Advisory)

- Sales of BASF's chemicals segment rose 16% YOY in the first quarter to €2.7 billion. The segment's two divisions posted higher sales, primarily due to significantly higher price levels, and volumes increased significantly, the company says. EBIT before special items amounted to €558 million with a particularly strong increase in the petrochemical division. A recovery in demand drove margins higher, as did lower fixed costs, BASF says.

- In the materials segment, first-quarter sales rose 20% YOY to €3.4 billion, primarily due to "significantly higher" prices and volumes. EBIT before special items jumped to €672 million, mainly driven by a significantly higher earnings contribution from the monomers division on improved isocyanate margins supported by higher prices.

- Sales of €2.1 billion in the industrial solutions segment were flat compared with the prior-year quarter. Slightly higher sales in the dispersions and pigments division were offset by a slight decrease in the performance chemicals division.

- Sales in the surface technologies segment rose 37% YOY to €5.9 billion, largely attributable to higher price levels in the catalysts division as a result of higher precious metal prices.

- Sales in the nutrition and care segment declined 3% YOY mainly on negative currency effects. EBIT before special items decreased considerably compared with the prior-year quarter. The decline in earnings primarily reflected weaker margins caused by lower sales.

- Sales in the agricultural solutions segment increased 1% YOY to €2.8 billion. Volumes were above the prior-year quarter in all regions, BASF says. Higher price levels also contributed to sales growth.

- South Africa's Department of Mineral Resources and Energy is set to merge PetroSA, the national oil company (NOC) that holds the state's interests in exploration and production (E&P) licenses (upstream); iGas, the government agency in charge of the development of gas and gas infrastructure in the country (midstream); and the Strategic Fuel Fund, the state-owned enterprise (SOE) that manages South Africa's crude oil stockpile and refined product storage facilities (downstream). The resulting company will be called the South African National Petroleum Company (SANPC). The government had hoped to effectuate the merger in April, although the timeline may have slipped. The merger has been planned since last year and is part of a broader SOE reform campaign launched by President Cyril Ramaphosa's administration. The primary benefit will be to streamline the state's involvement across the oil and gas value chain. Closer integration could help to improve the management of the government's petroleum interests through better strategic and operational planning and coordination and greater efficiency, potentially making the NOC a better partner for upstream firms. (IHS Markit E&P Terms and Above-Ground Risk's Josh Holland)

Asia-Pacific

- All major APAC equity markets closed lower; Australia/Mainland China/South Korea/Japan -0.8%, Hong Kong -2.0%, and India -2.0%.

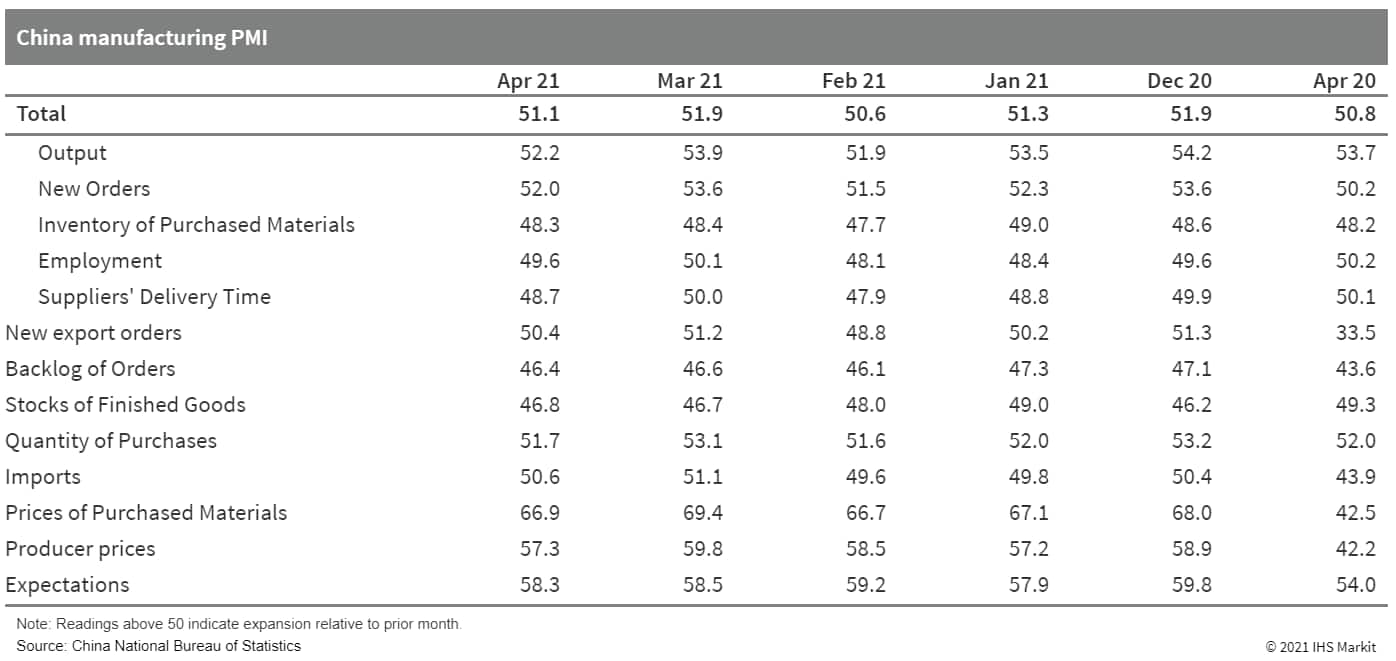

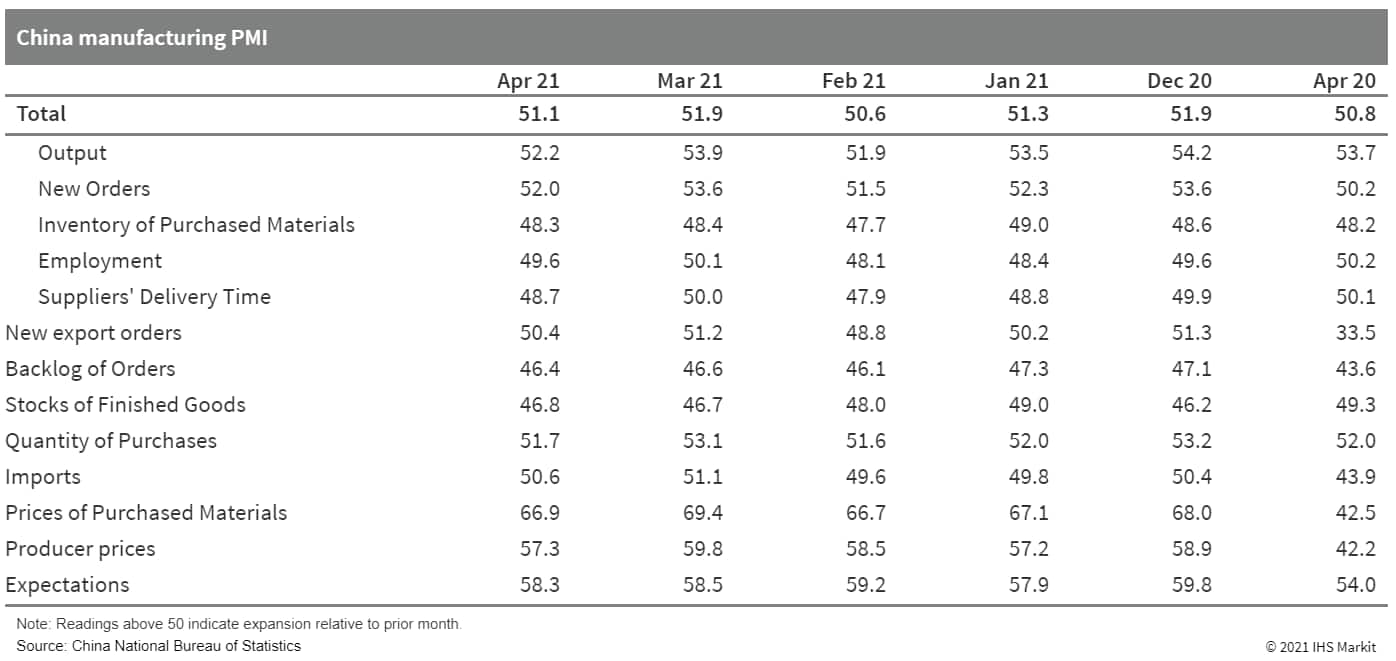

- China's official manufacturing Purchasing Managers' Index (PMI) fell by 1.5 points to 53.8 in April, but remained in expansionary territory and above the 2020 and 2019 April readings. (IHS Markit Economist Yating Xu)

- By firm scale, the PMI reading for small firms continued to rise, with production and new orders sub-index having increased for the second straight month, while large and medium-sized firms registered slower expansion from March.

- China's non-manufacturing Business Activity Index declined by 1.4 point to 54.9 in April, but it remains the fastest April growth rate in the past five years.

- Both construction and services growth moderated from March, with the construction Business Activity Index reading falling to below 2019 and 2020 levels.

- The services Business Activity Index edged down by 0.8 point, with 19 out of the 21 surveyed sectors reporting expansion from the preceding month; the financial services sector reported a decline, in line with the moderation in total social financing (TSF) growth.

- The PMIs for the catering, accommodation, culture, and entertainment segments rose by at least 1.8 points from March, reflecting increasing willingness to spend as the domestic pandemic situation further improves.

- NIO's significant growth in revenues and vehicles sales during Q1 can be attributed to a low base of comparison. Despite the stronger sales, the company witnessed a net loss attributable to equity holders of the company of CNY4.875 billion in the first quarter, which can be attributed to the purchase of 3.305% equity interests in NIO China from minority strategic investors. According to IHS Markit's light-vehicle sales data, NIO's light-vehicle sales are expected to increase by 44.7% to around 64,400 units in 2021. (IHS Markit AutoIntelligence's Nitin Budhiraja)

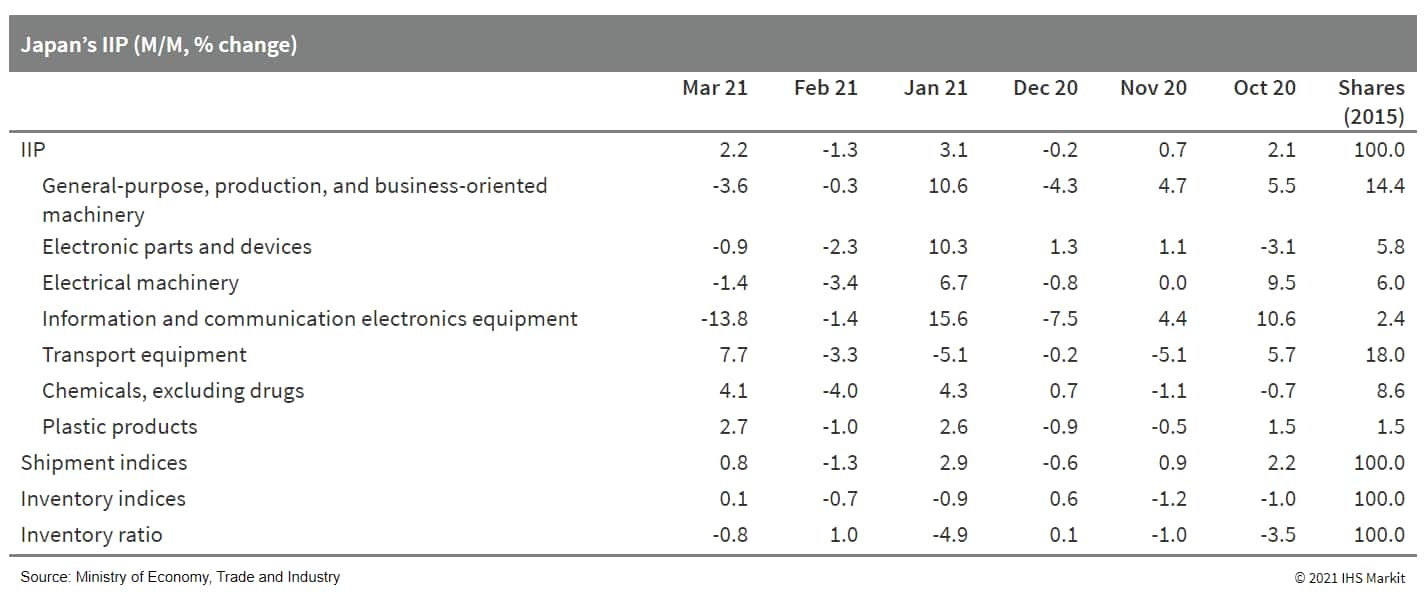

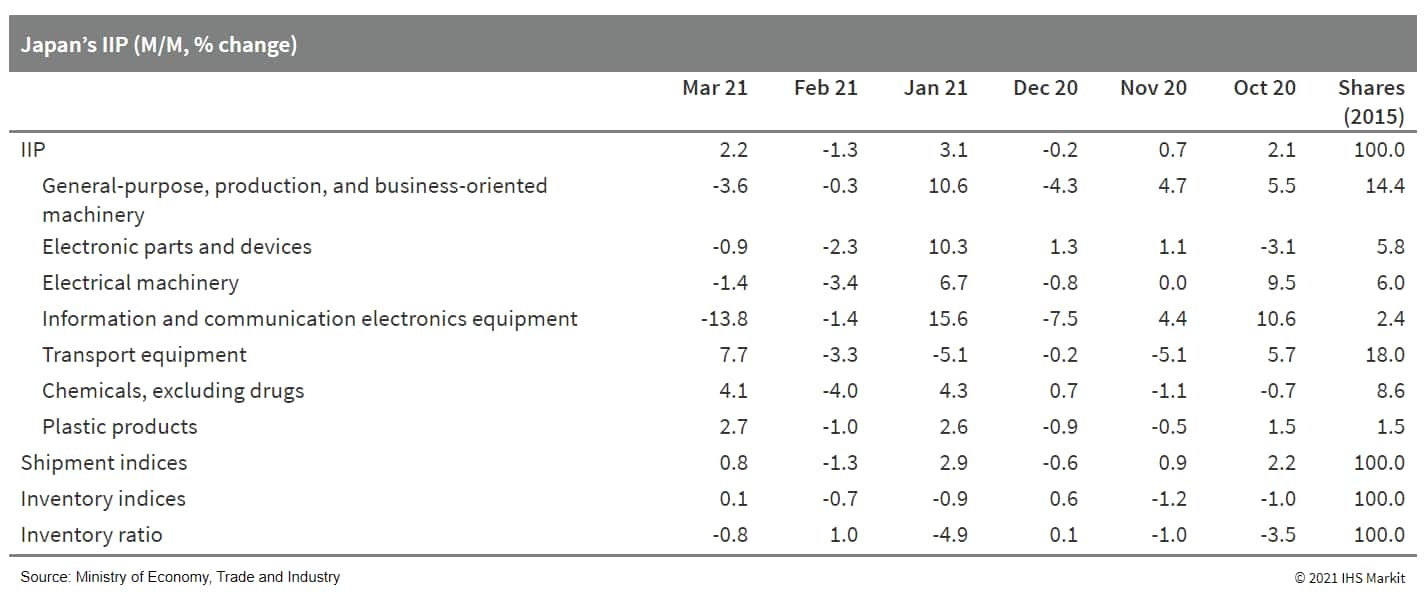

- Japan's index of industrial production (IIP) rose by 2.2% month on month (m/m) in March following a 1.3% m/m drop in February. Manufacturers' shipments also increased by 0.8% m/m, while inventories notched up by 0.1% m/m. A rise in shipments outpacing inventory led the index of inventory ratio to fall by 0.8% m/m. (IHS Markit Economist Harumi Taguchi)

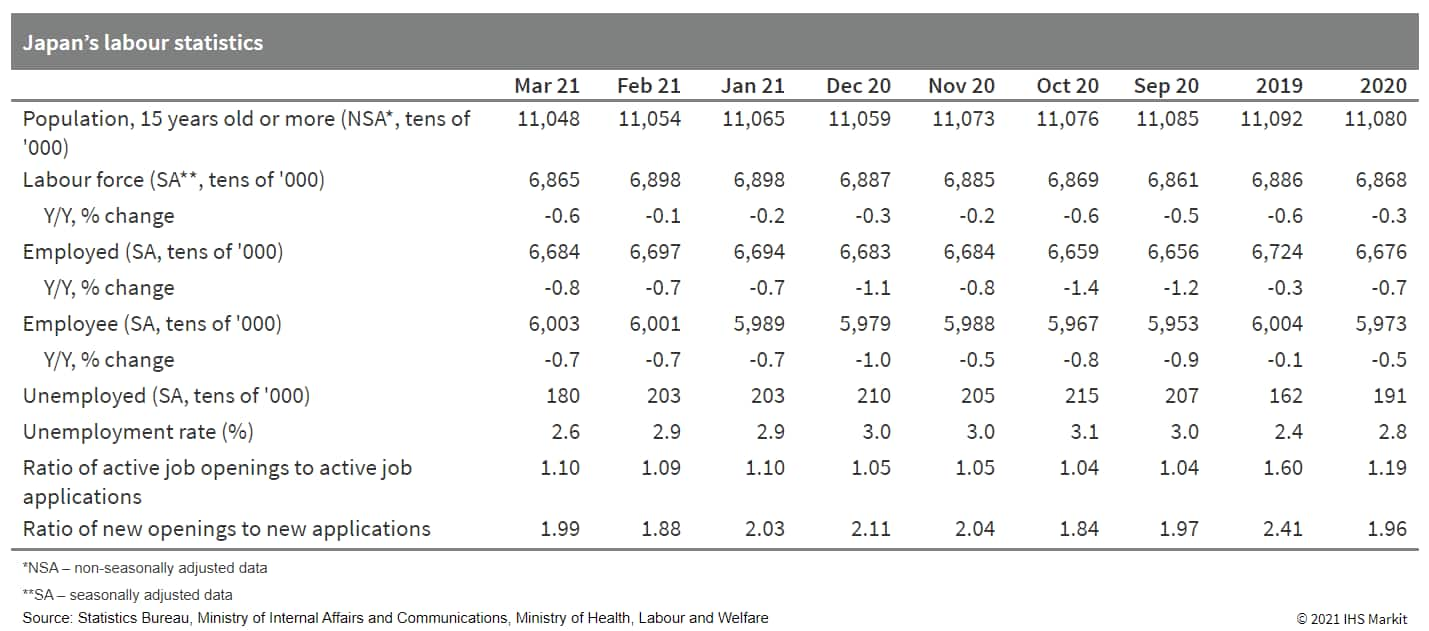

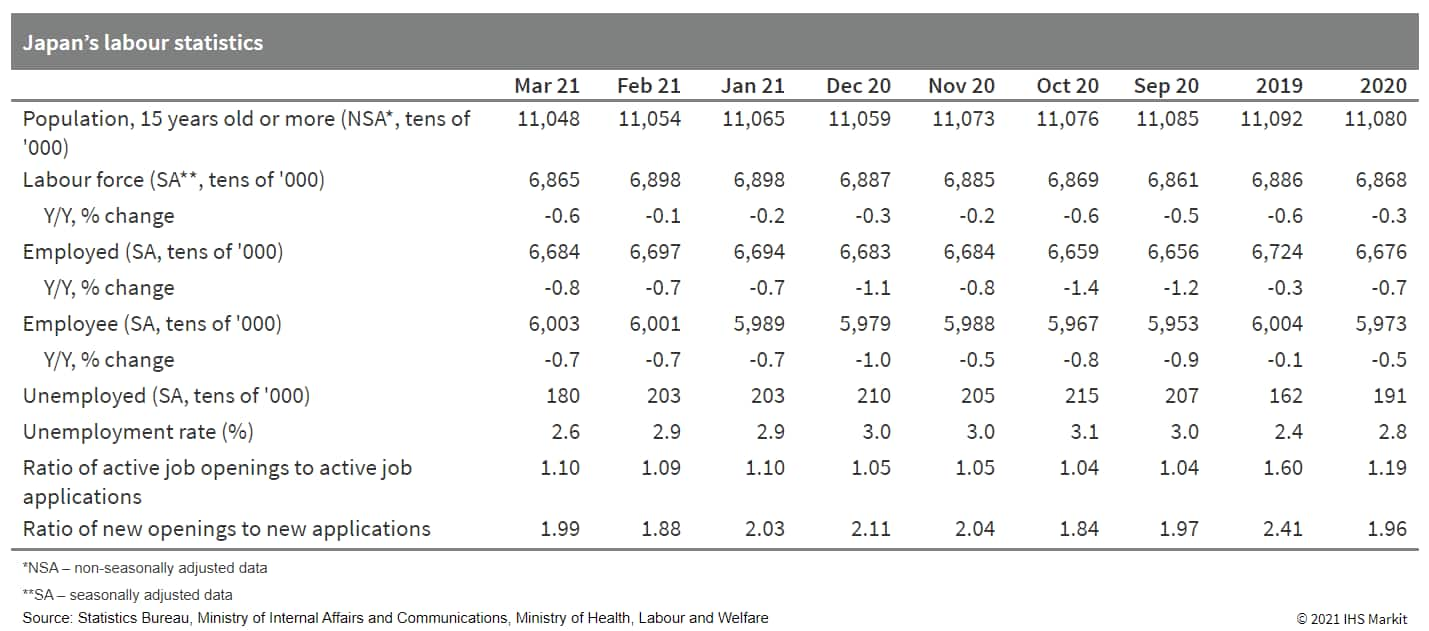

- Japan's unemployment rate fell by 0.3 percentage point to 2.6% in March 2021, the lowest level since April 2020. However, the improvement was due largely to a decline in the job participation rate, while the number of employed fell by 130,000 from the previous month because of a decrease in male workers - and more than half of whom were self-employed. An increase in the number of regular employees was offset by a decline in the number of non-regular employees, reflecting continued negative effects of containment measures. (IHS Markit Economist Harumi Taguchi)

- The ratio of active job openings to active job applications notched up to 1.10 in March thanks to an increase in job openings, although the number of new job openings remained well below the pre-pandemic level.

- The number of new job openings turned positive from a year earlier in manufacturing and continued to rise in construction and some other industry groupings, which was offset by sluggishness in accommodation, eating/drinking and life-related industries, and some other industry groupings.

- Toyota has joined Maruti Suzuki in idling Indian manufacturing to redirect oxygen for medical use, according to media reports. Honda will idle motorcycle production and Toyota Kirloskar Motor will also temporarily close, according to Nikkei Asia. The report says that Toyota Kirloskar Motor's two plants in Bidadi in Karnataka state will remain idled through to 14 May; production was suspended on 26 April to carry out annual maintenance. Honda is halting production at its four motorcycle plants in the country through to 15 May. (IHS Markit AutoIntelligence's Stephanie Brinley)

- According to figures released by the Japan Automobile Manufacturers Association (JAMA), Japanese vehicle production decreased by 8.3% year on year (y/y) to 704,800 units during February. The figure includes passenger vehicles, trucks, and buses. Output in the passenger car category reached 596,379 units during the month, down by 10.6% y/y. Within the passenger car category, production of standard cars with an engine displacement of more than 2.0 liters was down by 11.3% y/y to 365,292 units, while output of small vehicles declined by 21.5% y/y to 107,916 units. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korea's largest airport, Incheon International Airport (which serves the Seoul area) attracted over USD1.5 billion for the sale of USD300 million of five-year Green Bonds. (IHS Markit Economist Brian Lawson)

- The deal priced at 1.361%, 52.5 basis points over US Treasuries.

- A recent S&P Global Ratings (S&P) report cites "renewable energy, energy efficiency, pollution prevention and control, terrestrial and aquatic biodiversity conservation, clean transportation, and green buildings" as eligible Green projects.

- Chemical, refining, fertilizer, and steel companies in India are ramping up medical-grade oxygen production as shortages in the country exacerbate a deadly second wave of COVID-19 infections. (IHS Markit Chemical Advisory)

- Indian Oil said on 19 April that it had begun the supply of 150 metric tons of oxygen, at no cost, to hospitals in the states of Delhi, Haryana, and Punjab. The company says that in the wake of a massive surge in demand for medical oxygen during the second wave of COVID-19, it has diverted high-purity oxygen normally used at the ethylene glycol (EG) unit at its Panipat refinery and petrochemical complex to produce medical-grade liquid oxygen.

- Indian Oil is in the process of converting 29 unused "liquefied natural gas [LNG] tankers from its fleet into medical-grade oxygen carriers within the next week to address gaps between production and distribution of oxygen and also ensure smooth supplies," the ministry adds. The company is also procuring ISO cryogenic containers to transport LMO.

- Meanwhile, Bharat Petroleum Corp. Ltd. (BPCL) says it will use its refinery at Bina, Madhya Pradesh State, to supply 10 metric tons/day of gaseous oxygen of 90% purity at a 1,000-bed temporary COVID-19 hospital being built by the state government near the refinery.

- Separately, Reliance Industries says it has been supplying oxygen to Gujarat, Maharashtra, and Madhya Pradesh States and to the union territories of Diu, Daman, and Silvassa. According to press reports, the company's Jamnagar refinery is currently producing 700 metric tons/day of oxygen.

- Agricultural chemicals company UPL (Mumbai) has decided to convert four of its nitrogen plants in Madhya Pradesh and Gujarat States to produce oxygen.

- Thailand's economy is now grappling with the largest resurgence of COVID-19 since the beginning of the pandemic, which has quickly spread across most provinces throughout the country. (IHS Markit Economist Jola Pasku)

- The number of new COVID-19 cases surged from 559 in early April to more than 2,000 on 23 April. The government has so far refrained from imposing a strict national lockdown and has reverted to localized virus containment measures instead. The timing of the latest outbreak coincided with an increase in domestic travelling during the Songkran national holiday, which may complicate the timeline for containment measures.

- The country's ability to return to the pre-crisis trends will primarily depend on how quickly the government can contain the current outbreak and inoculate its population and when tourism can be fully restored. Thailand's vaccine rollout program is progressing at a slow pace, with 1.5% of the population inoculated as of 30 April. The target is to reach 45% of the population by the end of 2021, which may be challenging to achieve. The latest resurgence may also derail the government's plan to reopen tourism to vaccinated international tourists.

Posted 30 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.