All major European and US equity indices closed lower, while APAC was mixed. US and benchmark European government bonds closed higher. CDX-NA and European iTraxx closed slightly wider across IG and high yield. Natural gas, gold, silver, and Brent closed higher, the US dollar was flat, and WTI and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.2%, S&P 500 -0.8%, Nasdaq -1.9%, and Russell 2000 -2.1%.

- 10yr US govt bonds closed -9bps/1.36% yield and 30yr bonds -9bps/1.68% yield.

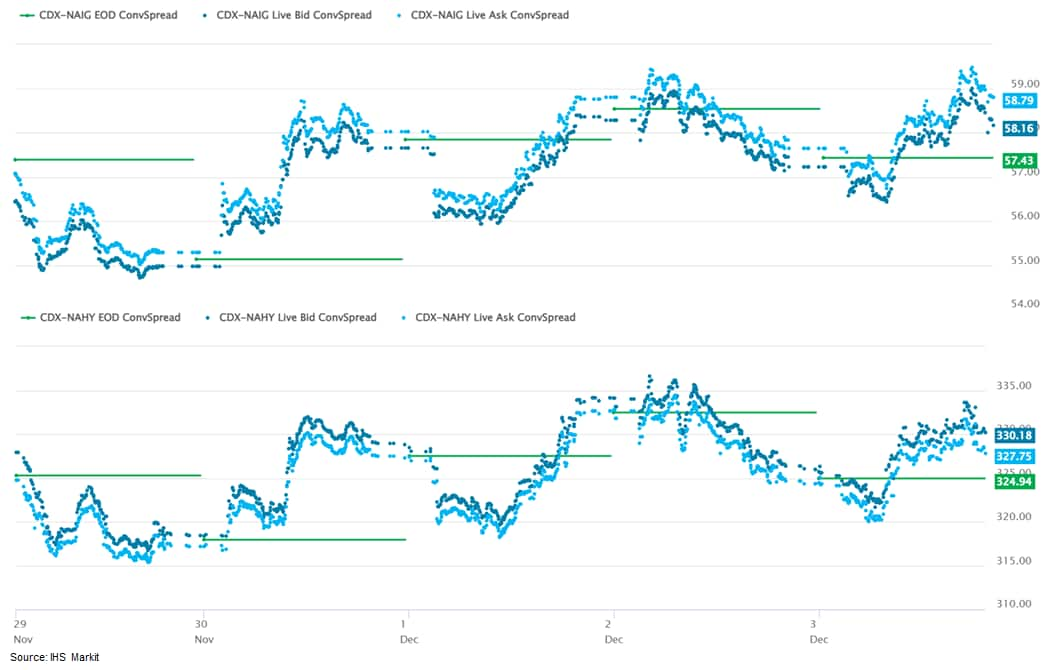

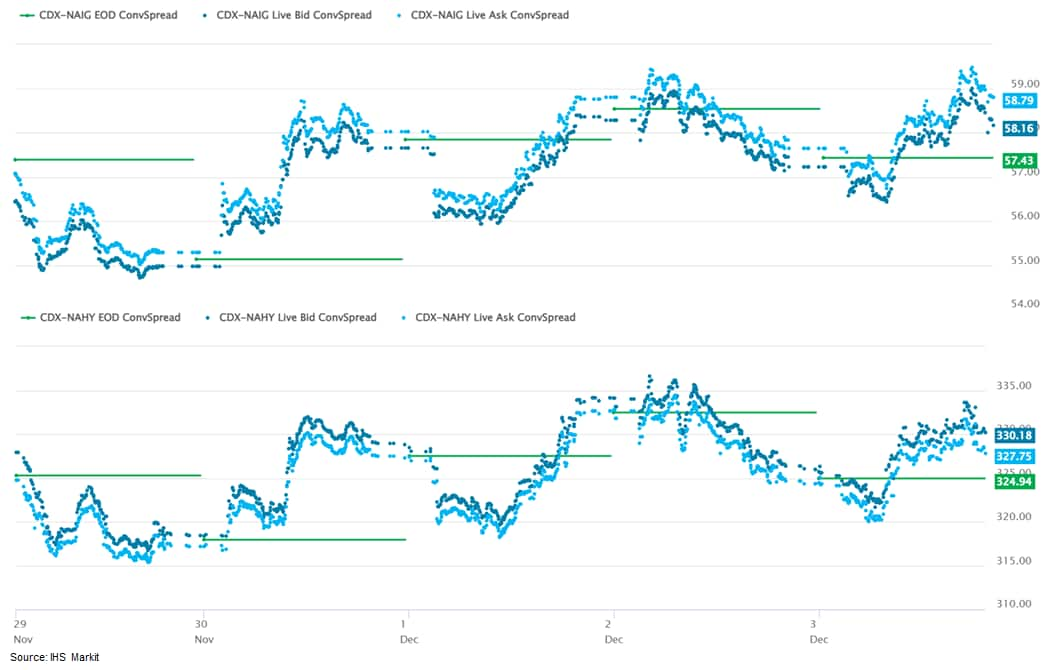

- CDX-NAIG closed +1bp/59bps and CDX-NAHY +4bps/329bps, which is +1bp and +4bps week-over-week, respectively.

- DXY US dollar index closed flat/96.12.

- Gold closed +1.2%/$1,784 per troy oz, silver +0.7%/$22.48 per troy oz, and copper -0.7%/$4.27 per pound.

- Crude oil closed -0.4%/$66.26 per barrel and natural gas closed +1.9%/$4.13 per mmbtu.

- IHS Markit forecasts 2022 exploration & production company (E&P) operating cash flow surpluses to be large, and E&P shares still trade at modest price to 2022 cash flow multiples (3.4 times at $75/bbl WTI versus 2.4 times in early September), which continues to create huge potential for share buybacks and other forms of returns of capital. (IHS Markit Energy Advisory's Raoul LeBlanc and Companies and Transactions' Sven del Pozzo)

- At $75/bbl WTI, oil-weighted E&Ps can still deliver similar yields on current share price as prior to the E&P share price run-up that began in early September at $65/bbl WTI.

- Pioneer Natural Resources, EOG Resources, Diamondback, Coterra, and Devon Energy lead the group by our forecast 2022 dividend yields of 6.5‒10.0% at $75/bbl oil, $3.50/Mcf gas, and $28/bbl NGLs.

- If all 2022 surplus operating cash flow after our forecast debt reduction were to buy back shares, the drop in share count would be huge, ranging from 10% to 27%.

- Continental Resources' recent acquisition from Pioneer allows the former to initiate a larger, more repeatable return of capital program and the latter to add a buyback program.

- Unhedged, Occidental Petroleum shows up as having the most potential to return capital via share repurchases after debt reduction because credit risk compresses its cash flow multiple, but first it needs to raise dividends.

- Callon Petroleum is also heavily indebted, but upside in its 2022 EBITDA is limited by commodity derivatives.

- Among Bakken E&Ps, Oasis Petroleum now trades among the sector's most highly regarded, while Whiting Petroleum lags despite having very similar assets and no debt.

- Global installations of new renewable power will set a record in 2021 of about 290 GW, compared with the 2020's record of about 280 GW, but the pace of deployments won't be enough to meet a global net-zero carbon goal by 2050, according to the latest report from the International Energy Agency (IEA). (IHS Markit Net-Zero Business Daily's Kevin Adler)

- The Renewables Market Report said growth will accelerate to average 305 GW per year for 2021 through 2026. By the end of 2026, global renewables capacity will reach 4,800 GW, or 60% greater than at end-2020. Renewables will represent about 95% of the new power capacity installed worldwide from now through 2026.

- At that point, renewable generation worldwide of just over 5,000 GW will be equivalent to the current total power capacity of fossil fuels and nuclear energy combined, IEA said.

- The sobering news, however, is that IEA calculates that installations would have to be about 550 GW annually, or 80% higher than its projections to keep the world on track for 2030 interim goals and the 2050 Net-Zero Scenario it laid out earlier this year.

- It also noted an uneven commitment to renewables, with 10 nations accounting for almost 80% of the projected growth in renewables.

- A US Congressional committee has sent letters to major oil and gas operators in the Permian, asking them for detailed information on their methane leaks reduction strategies. (IHS Markit PointLogic's Kevin Adler)

- Admiral Permian Resources Operating, LLC; Ameredev II, LLC; Chevron; ConocoPhillips; Coterra Energy; Devon Energy; ExxonMobil; Mewbourne Oil; Occidental Petroleum; and Pioneer Natural Resources received letters dated 2 December from House Committee on Science, Space, and Technology Chair Eddie Bernice Johnson (D-TX). She is seeking responses on 21 January.

- "The United States cannot achieve its targeted reduction in methane emissions under the Global Methane Pledge without a swift and large-scale decline in oil and gas sector methane leaks," the letter began. "The existence of these leaks, as well as continued uncertainty regarding their size, duration, and frequency, threatens America's ability to avoid the worst impacts of climate change."

- The letter references leak detection and repair (LDAR) programs, which industry says are effective at quickly identifying "super-emitter" leaks that, though few in number, contribute one-third to one-half of annual methane leaks, according to some scientific estimates. Johnson wrote that her committee "is investigating whether existing LDAR programs possess the capabilities to achieve wide-ranging, quantifiable emission reductions from oil and gas sector methane leaks, and whether additional policies and research may be required …"

- Despite the clear need to reduce methane emissions quickly and significantly, Johnson wrote, "... the release of methane due to malfunctions and abnormal operating conditions—remain widespread throughout U.S. oil and gas infrastructure. Their persistence raises concerns about whether existing LDAR practices in the United States are adequate to identify them."

- She also references studies that found that the US EPA underestimates oil and gas sector methane leaks by up to 60%, "due to its inaccurate understanding of the size and intermittency of methane leaks, particularly so-called 'super-emitters.'"

- US nonfarm payroll employment rose 210,000 in November, shy of expectations. That's where the "bad news" ends. The balance of this report was encouraging. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- Civilian employment surged by 1.1 million, outpacing a healthy (594,000) increase in the labor force, driving the unemployment rate down 0.4 percentage point to 4.2%.

- The gain in the labor force was perhaps the most encouraging development in this report. The labor-force participation rate rose 0.2 percentage point to 61.8%. This was the highest level so far in the recovery.

- Continued gains in labor-force participation, were they to occur, would go a long way toward easing supply constraints.

- Turning back to the Establishment Survey, private payrolls expanded by 235,000 in November (below expectations) but prior months' gains were revised higher. The private workweek, moreover, rose 0.1 hour to 34.8 hours.

- Average hourly earnings rose 0.3% in November and are up 4.8% over the last 12 months.

- Taken together, data on private employment, hours, and hourly earnings point to a solid increase in private wages and salaries in November, which we estimate are now on track to rise at a 10.5% annual rate in the fourth quarter.

- The recovery in payroll employment has come a long way, but payrolls still remain 3.9 million below the February 2020 level, with employment in leisure and hospitality accounting for about one-third of the shortfall.

- US manufacturers' orders rose 1.0% in October, while shipments rose 2.0% and inventories rose 0.8%. The gain in orders outpaced the consensus expectation. Orders and shipments of core capital goods (nondefense capital goods excluding aircraft) were revised slightly higher through October, as were total inventories. After rounding, though, we left our forecast of fourth-quarter GDP growth unrevised at 7.5%. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Supply constraints continue to restrain real expansion in manufacturing, even as demand remains elevated. The result has been surging prices.

- Year to date (through October), the producer price index (PPI) for the net output of the manufacturing sector rose 14.5%. Rapid price gains are widespread throughout manufacturing. An extreme example is in primary metals manufacturing, where the year-to-date increase through October was 63.6%.

- These prices gains have more than accounted for the year-to-date gains in orders and shipments. In real terms, both peaked in January and have backtracked since.

- Supply constraints, broadly, are expected to continue into next year.

- A normalization of demand back toward services (and away from goods) would go a long way to easing supply constraints; the emergence of the Omicron variant of the COVID-19 virus threatens to delay this.

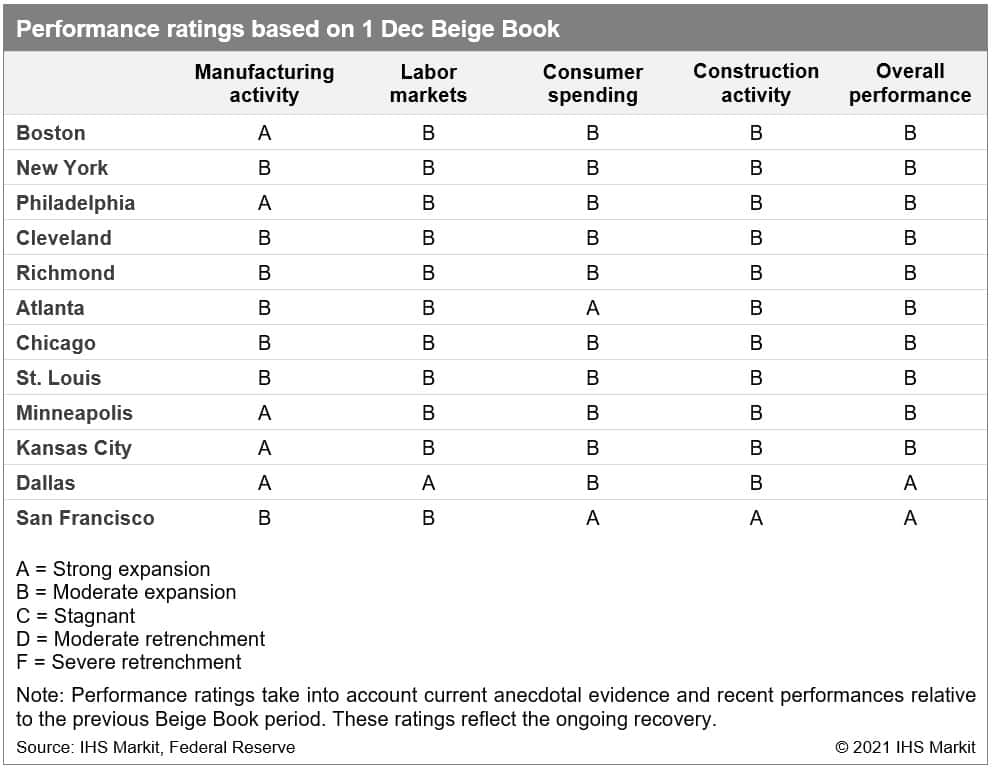

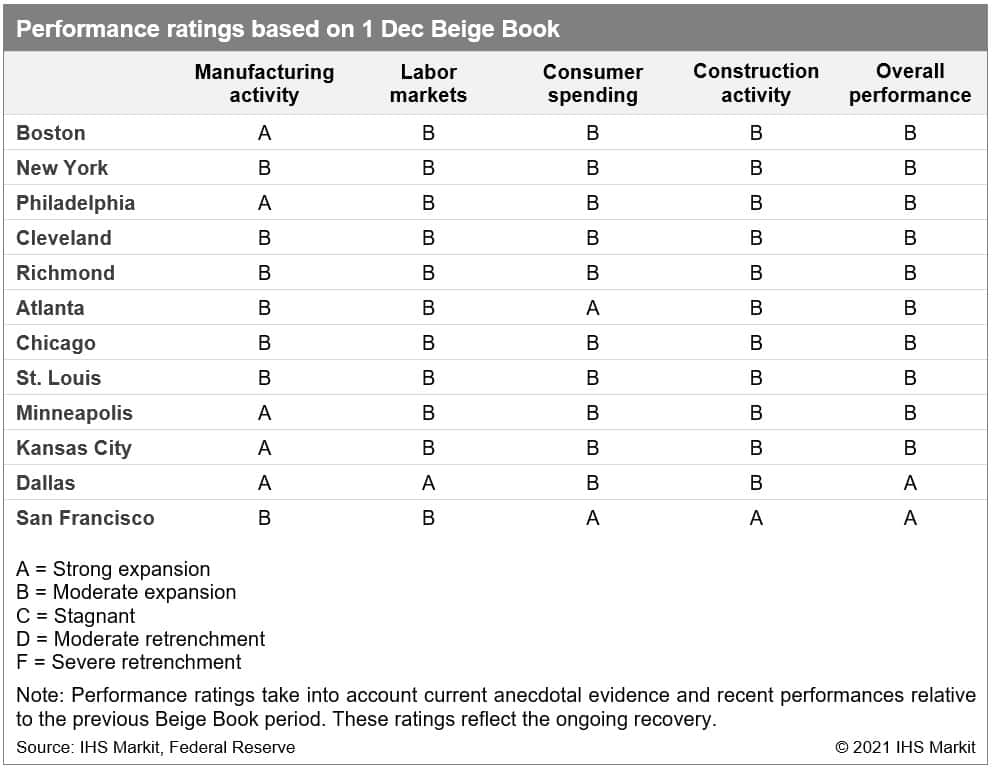

- Supply chain disruptions and ongoing labor shortages in many sectors led to a modest pace of economic growth in most parts of the country in October and early November according to the US Federal Reserve's latest Beige Book report, containing anecdotal information from regional business contacts. Despite difficulties hiring enough workers and widespread supply delays, the ebbing of the Delta variant surge in the West, Northeast, and South propelled leisure and hospitality activity as consumers returned to restaurants, movie theaters, hotels, and attractions. Labor markets remained tight across the country as many businesses in the Midwest and Southeast limited their operating hours and services due to lack of staff. The ongoing microchip shortage restrained auto production in the Great Lakes and South while supply chain disruptions in other manufacturing sectors held back business growth. Homebuilding stayed at high levels in the South and West but higher building costs, delayed building materials, and shortages of construction labor lengthened delivery timelines for new homes. (IHS Markit Economist James Kelly)

- Consumer spending was supported by solid retail sales in much of the country. Demand for clothing, home goods, and furniture remained at high levels with the robust activity giving retailers cause for optimism as the holiday shopping season approaches. Auto sales continued to be lackluster in the face of the ongoing chip shortage.

- Labor markets remained very tight in every region as firms found it difficult to hire across most sectors. Restaurants, hotels, and retail stores in the Midwest and Southeast limited their services and operating hours due to lack of adequate staffing. Manufacturers in the Northeast and around the Great Lakes could not hire enough workers to keep up with increased demand for their products.

- Manufacturing activity expanded at strong paces in most areas of the country. Limited auto production growth among manufacturers in the Great Lakes region, Kentucky, and Tennessee led to only modest overall gains. The ongoing microchip shortage continues to restrain production of cars and trucks. Supply chain disruptions in other industries remain a headwind and, along with shortages of workers, have restrained business growth.

- Construction activity experienced lengthening delays as shortages of labor and building materials persisted. The pace of homebuilding in the Midwest and South remained at high levels, but homes began to take longer to be completed. Delays in appliance installation, contractor scheduling, and disruptions in other parts of the supply chain resulted in longer delivery times for new single-family homes.

- Maine lobster interests are urging the US Supreme Court to overturn fishing restrictions in nearly 1,000 square miles in the Gulf of Maine, warning that the regulations are onerous and threaten the future of the $1 billion industry. (IHS Markit Food and Agricultural Policy's JR Pegg)

- The controversy rests on a rule imposed by the National Marine Fisheries Service (NMFS) that bans use of vertical buoy ropes in 967 square miles of federal waters some 30 miles off the coast of Maine, a move that effectively prohibits lobster fishing in the affected area.

- NMFS finalized the rule in August as part of an effort to protect the endangered North Atlantic right whale. Less than 360 North Atlantic right whales are believed to exist and the marine mammals have been known to become entangled in fishing nets and collide with fishing boats.

- The Maine Lobstering Union and others filed suit and in October were granted a preliminary injunction to halt the closure after US District Judge Lance Walker concluded NMFS failed to show the endangered whales were typically present in the affected area.

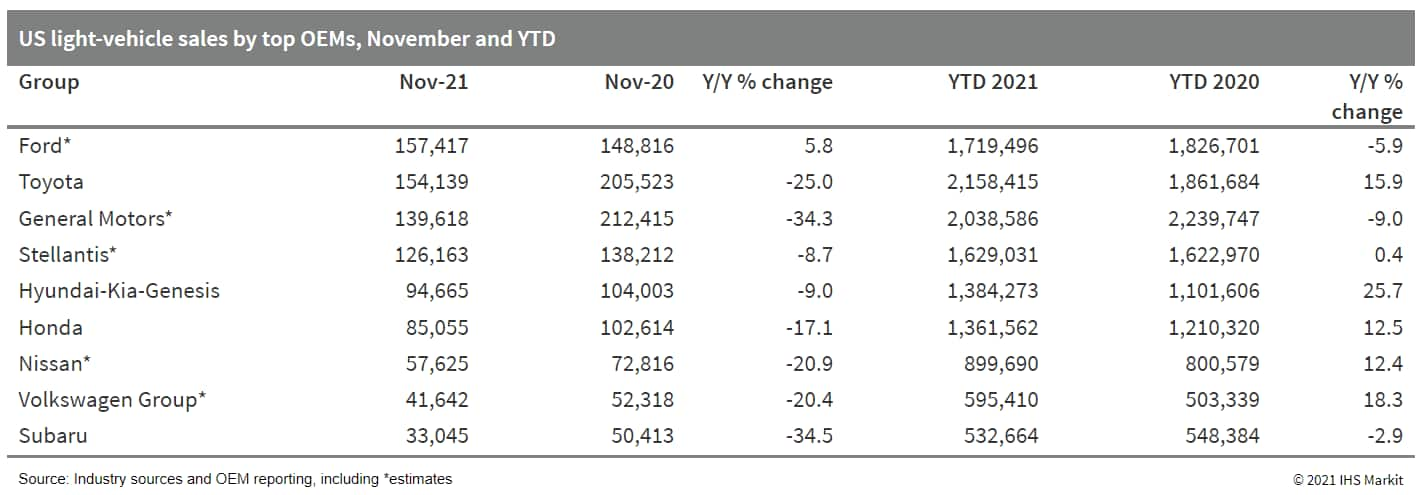

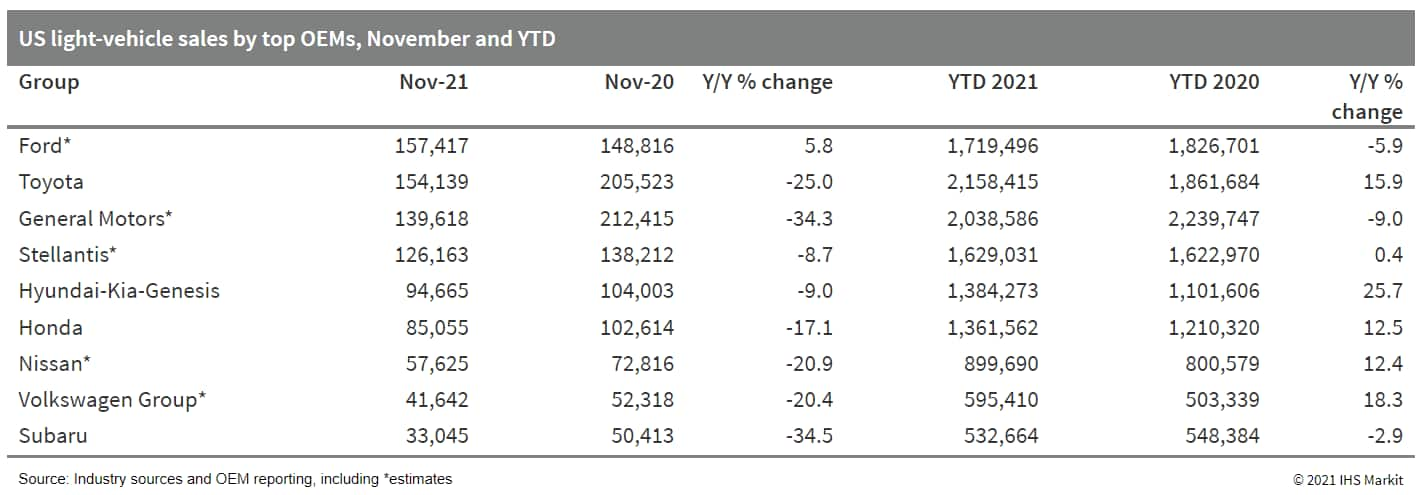

- The lack of inventory pushed US light-vehicle sales down by 15.9% y/y in November 2021; YTD sales are up 6.9%. Although the SAAR of light-vehicle sales is projected to have increased moderately for the second consecutive month in November, auto demand levels in the US continue to be subdued by new-vehicle inventory constraints. With a light-vehicle sales SAAR of 12.9 million units in November, the pace of auto sales continues to improve from the low SAAR reading in September of 12.2 million units, but also reflects limited upside potential for demand growth given current inventory conditions. US light-vehicle sales levels continue to reflect constraints on consumer demand caused by automakers' supply chain shortages and consequent slowdowns in vehicle production that have led to the limited new-vehicle inventory levels. We expect the monthly light-vehicle sales SAAR not to improve significantly above a range of 13-15 million units until the second half of 2022. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Bollinger Motors has announced a strategic partnership with commercial fleet company EVAX to bring to the market new vehicles on Bollinger's new commercial truck platform for vehicles in classes 3 to 6. According to a joint statement, the two companies' collaboration will see EVAX commercial work-truck bodies integrated on to Bollinger's newly announced electric vehicle (EV) commercial truck platform. Bollinger is developing an EV platform for chassis cab and other applications in the Class 3 to 6 categories. The company says the platform will offer adaptable battery solutions to accommodate large payloads, sufficient range, and long-life durability. EVAX partners with advanced electric and alternative power-chassis producers to design, manufacture, distribute, and service large commercial fleets and markets. The companies have left several details of the partnership to be disclosed later, including the timing of when the vehicles may go into production or be sold, specific details of the range and payloads the Bollinger chassis will support, and financial arrangements between the two. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Toyota Mobility Foundation (TMF), in partnership with Energy Systems Network (ESN) and the Indiana Economic Development Corporation (IEDC), has selected May Mobility to launch a free autonomous shuttle service for the public in Central Indiana (US). May Mobility will deploy a fleet of five hybrid Lexus RX 450h vehicles and one wheelchair-accessible Polaris GEM shuttle, available to the public beginning from 20 December. The autonomous shuttles will operate along a three-mile fixed-route loop with nine designated stops to serve the area surrounding the Nickel Plate Cultural District in Fishers, Indiana. The service will be available on weekdays from 8am-8pm, with shuttles arriving every 10-15 minutes on a rotating loop. Riders can see live updates of the shuttle's locations on the Together in Motion Indiana website. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Uber Technologies has said that it will launch an optional audio-recording pilot programme in three US cities to enhance safety, reports Reuters. This will allow drivers and riders to send trip recordings to Uber in the event of a safety incident. Later this month, the service will be rolled out in Kansas City, Missouri; Louisville, Kentucky; and Raleigh-Durham, North Carolina. Riders are notified about drivers potentially recording a trip via an in-app banner and can cancel if they are uncomfortable. The Uber app stores encrypted recordings that users are unable to play. If a safety incident occurs, users filing a safety complaint can submit the recording to qualified Uber staff who are able to decrypt it. (IHS Markit Automotive Mobility's Surabhi Rajpal)

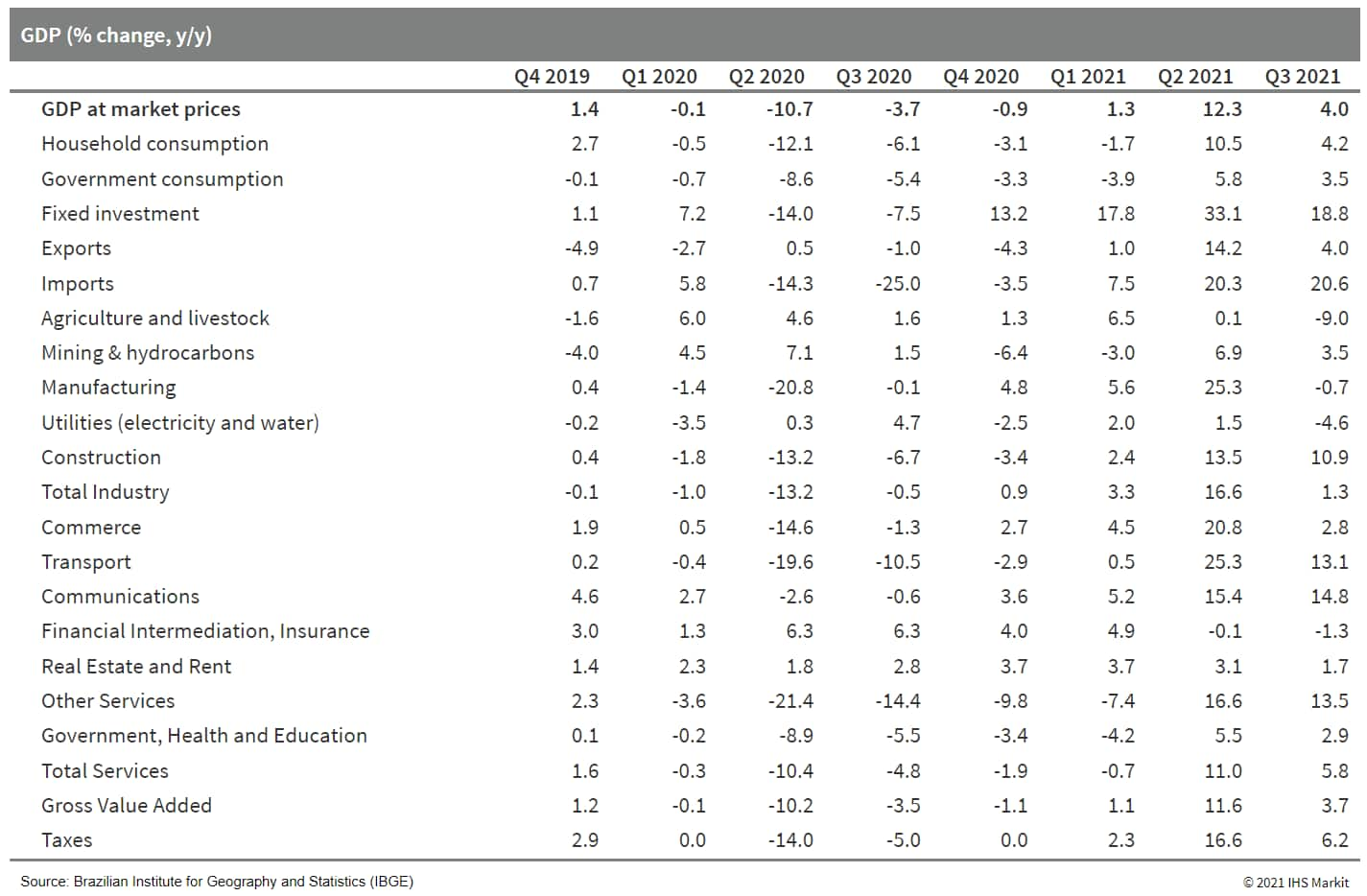

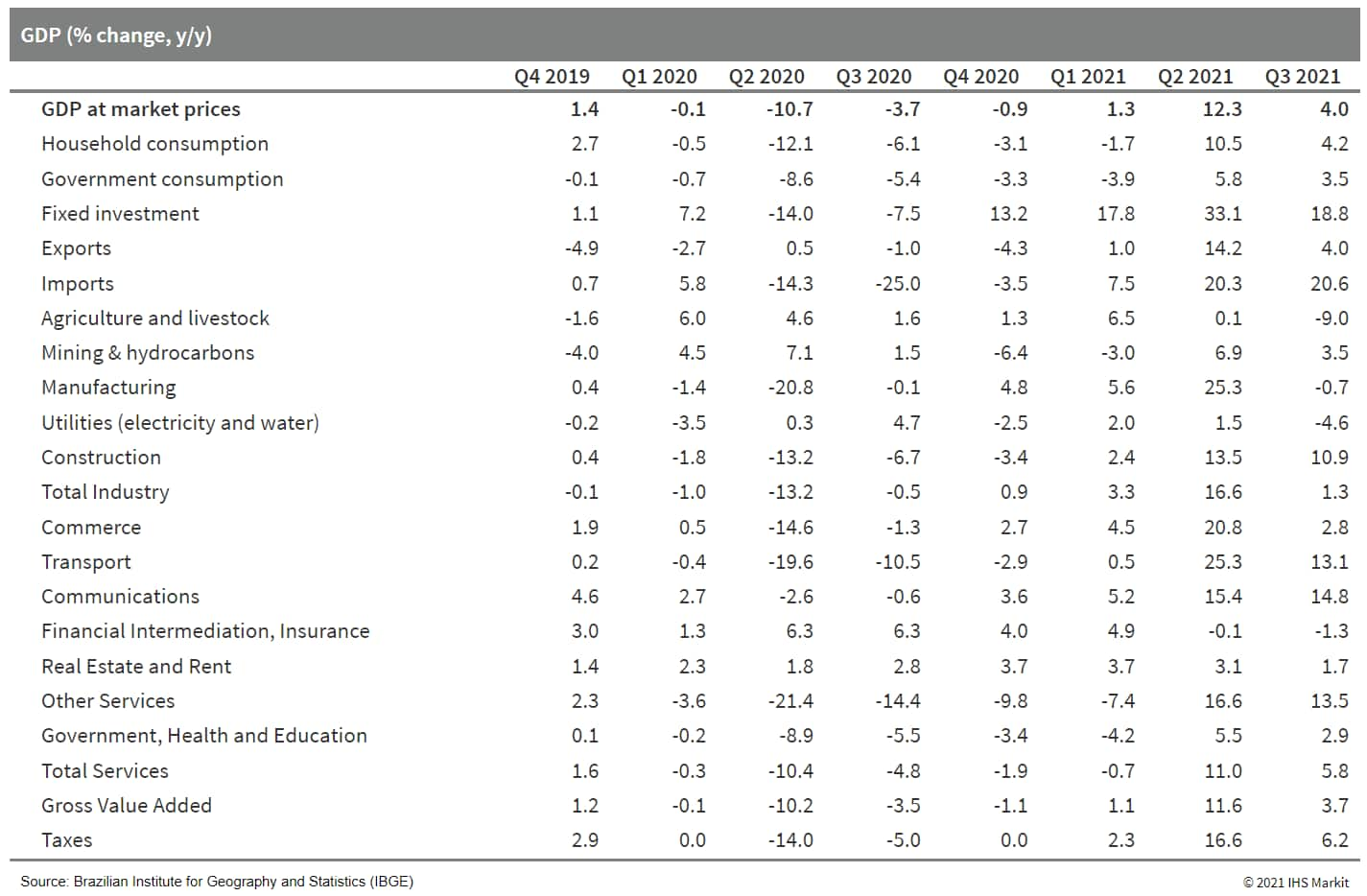

- Seasonally adjusted data show that In July-September, Brazilian real GDP contracted 0.1% quarter on quarter (q/q), when it had declined by 0.4%q/q. Thus, two consecutive quarterly declines put Brazil in a technical recession; the decline was driven by a poor performance of the agriculture sector, which has been badly hurt by a severe drought. (IHS Markit Economist Rafael Amiel)

- The service sector continued to recover, posting a sizeable expansion while industry was flat. In the latter, growth in construction was offset by the contraction of manufacturing output, a sector that is suffering from worldwide supply chain disruptions, shortages of semiconductors and higher input costs.

- From a demand perspective, consumption - both private and public - posted decent growth rates (0.9% q/q and 0.8% q/q respectively) while investment was almost flat (down 0.1%); the expansion in consumption was offset by a decline in net trade. Both exports and imports fell in the third quarter, but the decline in exports was more pronounced.

- Private consumption increased, driven by the reopening of many activities as COVID-19 cases declined and authorities continued to make progress on vaccination. Employment continued to grow, although real salaries declined because of high inflation.

- The decline in volumes exported is, in part, explained by a correction after a spectacular second quarter but the aforementioned drought took a toll on some agricultural exports such as corn and coffee. Also, supply chain disruptions hurt export of manufactures, among them exports of automobiles.

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -0.1%, Italy -0.3%, France -0.4%, Germany -0.6%, and Spain -0.7%.

- 10yr European govt bonds closed higher; UK -6bps, Italy -3bps, Germany -2bps, and France/Spain -1bp.

- iTraxx-Europe closed +1bp/58bps and iTraxx-Xover +1bp/282bps, which is flat and -9bps week-over-week, respectively.

- Brent crude closed +0.3%/$69.88 per barrel.

- The year-on-year (y/y) rate of increase in the eurozone producer price index (PPI) increased by almost six percentage points in October to 21.9%, a new record high by a very large margin and well above the market consensus expectation (of 19.0%, according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- Although base effects have played an important role in boosting y/y inflation rates during 2021, this is not the whole story. The month-on-month (m/m) increases in the eurozone PPI have also been exceptionally large. October's 5.4% m/m jump was the biggest in the series' history by a huge margin, almost double the largest previously recorded m/m increase (of 2.8%, in the prior month).

- Soaring energy prices, particularly for gas, were the main reason behind the large PPI increases in September and October. In October there was a surge of almost 17% m/m, an unprecedented rate of increase, again by a huge margin. On a y/y basis, energy prices rose by more than 60% in October, triple the previous high in 2011.

- PPI inflation rates beyond energy have also been picking up, led by intermediate goods, prices of which rose by almost 17% y/y in October.

- Further along the price formation chain, eurozone PPI inflation rates have risen to a much lesser extent. Still, at 3.4% in October, y/y consumer goods inflation was not far short of its record high of 3.8% in 2011, with further gains likely.

- Overall, the eurozone PPI inflation rate excluding energy prices hit a new record high in October, rising to 8.9%, more than double the historical peak in 2011 (of 4.2%).

- The European Commission has dismissed suggestions it has already decided to deregulate new gene editing techniques (NGTs) in the EU agriculture sector. Food Safety Commissioner Stella Kyriakides said on 29 November that the EU executive's plan to explore plants obtained from NGTs did not translate into allowing this type of innovation on the Single Market. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- "The announcement to initiate a policy action on plants obtained from certain new genomic [editing] techniques (NGTs) does not mean that we have taken the decision to deregulate these products," Kyriakides said during an EU conference.

- In April 2021, the Commission released a study which found that the EU's GMO Directive (2001/18/EC) is "not fit for purpose" and prevents several NGTs from supporting the bloc's sustainability goals. A few months later, the EU executive published a roadmap on its plan to explore options on how to better regulate some NGTs in the future.

- Kyriakides explained that the roadmap was part of the process to understand the different options available for a specific regulatory oversight as well as its impact on health and the environment - and not to open a pathway towards deregulation. "We will not compromise on safety," she added.

- During the roadmap's public consultation, around 69,000 citizens voiced their opposition to deregulate NGTs using an auto-generate response launched by several environmental groups like Greenpeace, which demanded the EU uphold existing GMO laws for NGTs.

- The Commissioner acknowledge the consultation revealed many concerns about NGTs' potential negative impacts, but she still thinks they can help support the bloc's sustainability objectives - if risks are addressed.

- Daimler's supervisory board has announced a new EUR60-billion (USD68-billion) five-year investment plan, which will underpin the biggest period of transformation in the history of the world's oldest carmaker. The plan provides the full details of funding for a previously announced plan for Mercedes-Benz to become a fully electric brand by the end of the decade. The plan has been agreed as a new financial roadmap for Daimler's Mercedes-Benz unit; a new and clear investment strategy was needed for Daimler's light vehicle business following the decision to spin off Daimler Trucks, with the separate listing due to be completed on 10 December. The idea behind this strategy is that both the passenger car and truck business will be able to operate more efficiently and responsively with separate listings and more management autonomy, while they will also be able to raise money from the capital markets independently and with more clearly communicable investment plans, while creating more value for shareholders. A large component of this investment plan for Mercedes-Benz's newly independent light-vehicle business will be to achieve the previously communicated plan of becoming an all-electric brand by the end of the decade - with the important caveat 'wherever market conditions allow'. This condition would appear to indicate that the company will plan to become an all-electric brand in Western Europe, North America and China by the end of the current decade, using three new previously announced battery electric vehicle (BEV) architectures. (IHS Markit AutoIntelligence's Tim Urquhart)

- Daimler Truck is developing a scalable autonomous truck platform that is designed for SAE Level 4 autonomous operations, according to a company statement. At Level 4, the vehicle requires no human intervention, but its applications are limited to specific conditions. The platform will involve redundancy systems with focus on four key areas - the braking system, the steering system, the low voltage power net, and network communications. If any of the primary systems encounter a fault, the Level 4 vehicle will be able to monitor and analyze it, and deploy its backup systems to securely operate the truck. The platform is based on Freightliner's market-leading Cascadia and the redundant truck chassis is being developed for Waymo Via. Dr Peter Vaughan Schmidt, head of autonomous technology group at Daimler Truck, said, "Every smart autonomous driving system needs a strong foundation: our Level 4 vehicle platform based on the Freightliner Cascadia is ideal for integration of autonomous software, hardware and compute. It can significantly contribute to enhancing safety in traffic thanks to its redundancy of systems and a multitude of sensors. It brings us much closer to our vision of accident-free driving." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ørsted has given the green light on the 242 MW Gode Wind 3 and the 900 MW Borkum Riffgrund 3 offshore wind farms. The financial close for the two projects will take the company's German portfolio to six wind farms, with a combined capacity of around 2.5 GW. Gode Wind 3 is expected to be commissioned in 2024, and Borkum Riffgrund 3, Ørsted's largest offshore wind farm in Germany, is expected to be commissioned in 2025. The company has stated that its decision to proceed was based on being able to sign several large-scale power purchase agreements with corporates, finding a partner (Glenmont Partners) for a 50% stake in the Borkum Riffgrund 3, and procuring and installing both projects as a gigawatt-scale project. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- French industrial production rose by 0.9% month on month (m/m) in October, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Production had declined by 1.5% m/m in September. (IHS Markit Economist Diego Iscaro)

- Industrial output rose by 1.2% year on year (y/y) in October. However, it was still 4.5% below its level right before the pandemic in February 2020.

- Production stood below its pre-pandemic level in all sectors, with the exception of food/beverages.

- Manufacturing of transport equipment rose by a strong 8.8% m/m, boosted by a 13.9% m/m increase in the production of equipment other than motor vehicles, trailers, and semi-trailers. October's rebound came after a decline of 8.6% m/m in September, and production is still 23.7% below that in October 2020.

- The breakdown by main industrial grouping shows rises in most categories, the exception being consumer non-durables (where production fell by 0.1%). Production of capital and consumer durables rebounded by 2.2% m/m and 1.5% m/m (following declines of 3.4% m/m and 2.7% m/m), respectively, while production of intermediate goods rose by 0.3% m/m.

- Energy production, which had declined by 0.6% m/m in August and 0.8% m/m in September, went up by 0.5% m/m in October.

- According to Statistics Norway (SSB), real GDP grew by 3.8% quarter on quarter (q/q) after a 1.1% q/q gain in the second. This implied that the overall economy returned to its pre-pandemic level during the third quarter. (IHS Markit Economist Raj Badiani)

- This was stronger than our latest estimate for real GDP developments in the third quarter, which stood at 2.4% q/q gain in the November forecast update.

- Meanwhile, the mainland economy (excluding oil and foreign shipping) grew by 2.6% q/q during the third quarter, more than double the second quarter q/q gain.

- In unadjusted terms, total real GDP rose by 3.6% year on year (y/y) in the first three quarters of this year after a 0.8% fall in the full year 2020.

- Crude oil and natural gas extraction increased sharply during the second and third quarters.

- The expenditure breakdown reveals that household consumption increased by 5.4% q/q during the third quarter. Spending on services increased by 8.6% q/q in the third quarter, led by robust consumption of hospitality services. Meanwhile, spending on goods rose by 0.9% q/q, with sales of new cars and clothing and shoes being the strongest performers

- Fixed investment rose for a second successive quarter when expanding by 1.1 q/q in the third quarter. In annual terms, it shrunk by 0.4% y/y in the first three quarters of this year after a 3.8% drop in 2020

- Total exports grew by 6.5% q/q during the third quarter, with the sales of crude oil and natural gas being the strongest performers, up by 6.1% q/q. Meanwhile, exports of services jumped 9.9% q/q, in line with recovering tourism activity.

Asia-Pacific

- Major APAC equity indices closed mixed; Japan +1.0%, Mainland China +0.9%, South Korea +0.8%, Australia +0.2%, Hong Kong -0.1%, and India -1.3%.

- Chinese ride-hailing giant Didi Chuxing (DiDi) states that it has begun preparations to withdraw its listing on the New York stock exchange and it is to pursue a listing in Hong Kong SAR, reports Reuters. DiDi stated on its Weibo social media account, "Following careful research, the company will immediately start delisting on the New York stock exchange and start preparations for listing in Hong Kong." DiDi did not provide any reason for the move. However, in a separate statement, the company said it would organize a shareholders' vote and would ensure that its New York-listed stock was convertible into "freely tradable shares" on another internationally recognized stock exchange. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota will unveil a new electric vehicle (EV) developed jointly with Chinese automaker BYD next April, reports Reuters. The new EV will feature BYD's core technologies, including its lithium iron phosphate (LFP) batteries. The report, citing people familiar with the matter, says that the model could be priced at less than CNY200,000 (USD31,396) to aim for a market in China that Tesla could target with a smaller car in the next two years. Toyota entered into a joint venture (JV) with BYD in April to develop EVs for the Toyota brand. According to the Reuters report, the upcoming new model is likely to be a compact EV similar in size to the Corolla sedan. The news that this new EV will be equipped with BYD's LFP batteries does not come as a surprise. The Chinese automaker has rolled out its self-developed Bland LFP batteries to several of its new launches, including the Han EV and Qin Plus EV. Both of these models are in high demand in China as LFP batteries are less prone to overheating and are more affordable compared with lithium-ion batteries. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Volkswagen (VW) has said it is on track to finish construction of its Anhui MEB plant in mid-2022. The first pre-production model to be built at this new plant is expected to roll off the production line in the second half of next year with mass production launch scheduled in the second half of 2023. According to CEO of VW Anhui, Dr Erwin Gabardi, the Anhui plant will begin production of battery electric vehicles (BEVs) based on VW's SSP (Scalable Systems Platform) starting from 2026. The first model coming from this plant has yet to be disclosed by the automaker. The Anhui plant, together with its two joint venture (JV) plants, Anting MEB and Foshan MEB, will give VW an annual capacity of nearly 1 million units per annum (upa) for EVs. These three plants will play a central role in accelerating VW's EV launches in China to compete with Chinese startups and Tesla. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Pork prices rose again in China in the final week of November to reach the highest level for six months. Wholesale prices increased for the seventh consecutive week to stand at CNY24.16 per kg ($3.79/kg), according to the Chinese Commerce Ministry. Despite recent gains, wholesale prices are still almost 40% down on year-ago levels. (IHS Markit Food and Agricultural Commodities' Max Green)

- The Chinese Agriculture Ministry noted that prices had increased in most parts of China, but had fallen in the north of the country due to a slowdown in pork consumption.

- On a national level, the ministry played down concerns over pork price inflation, saying supplies of pork should be sufficient in the run up to the Lunar New Year in February.

- For Chinese pig farmers, market sentiment has been transformed by recent developments. Live hog prices increased to CNY18.68 per kg - a rise of 40% in just two months, according to figures from China's National Reform and Development Commission (NRDC).

- The current hog-to-feed price ratio means farmers can now expect to make average profits of CNY265 per animal. This represents a dramatic turnaround from the situation two months ago, when farmers were estimated to be losing around CNY700 for every hog they produced.

- The NRDC said it expects pig prices to see further small increases over the short-term, allowing breeders to make considerable profits.

- In its weekly update, the Commerce Ministry said wholesale pork price rises are expected to slow as farmers send more animals to slaughter towards the end of this year.

- Nissan looks to interject racing excitement into its electric vehicle (EV) program with a concept racing car called the Ariya Single Seater Concept. The concept was presented as part of the Nissan Futures event and "explores what a future electrified performance style for Nissan could look like," according to a press statement. The concept is also a true concept, rather than previewing a specific program. Nissan global marketing divisional general manager Juan Manuel Hoyos said in the announcement, "At Nissan, we dare to do what others don't. With this concept we want to showcase the high-performance potential of the Ariya's powertrain in a motorsports-inspired package that not only hints at the design and styling of the road car that inspired it, but that also demonstrates a new and efficient EV performance language. Acting as a testbed for future technological evolution, this project can help bring excitement from the road to the race track, and also demonstrate Nissan's expertise in transferring knowledge and technology from the race track to the road." Although the Ariya crossover utility vehicle (CUV) has 389 hp in top all-wheel-drive trim, Nissan did not provide potential specifications for the concept racer. The Ariya Single Seat concept was revealed the same week as the company laid out its most clear statement on its EV future in several years with the 'Ambition 2030' plan. While the formal program included several concepts that suggest future production cars, the Single Seater Concept reinforces Nissan's commitment to Formula E and to the technology transfer between racing and road car performance. Nissan's global motorsports director, Tommaso Volpe, said in the statement announcing the Ariya Single Seater Concept, "Nissan competes in Formula E not only to race on track, but also to support the development of compelling electric vehicles for customers. (IHS Markit AutoIntelligence's Stephanie Brinley)

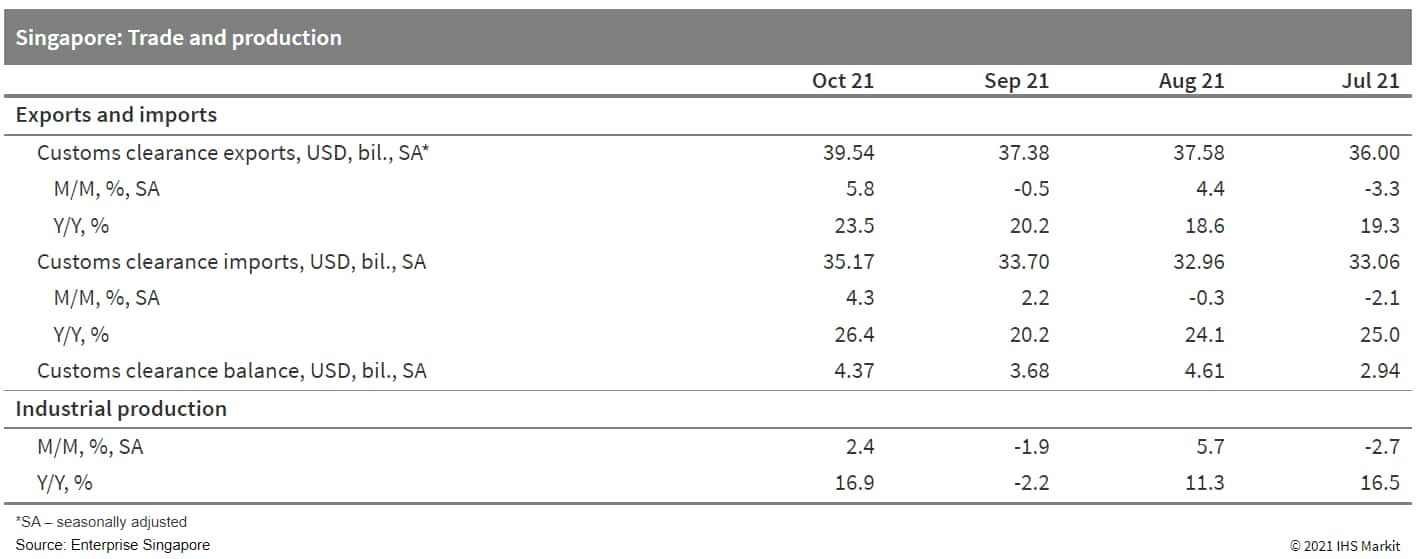

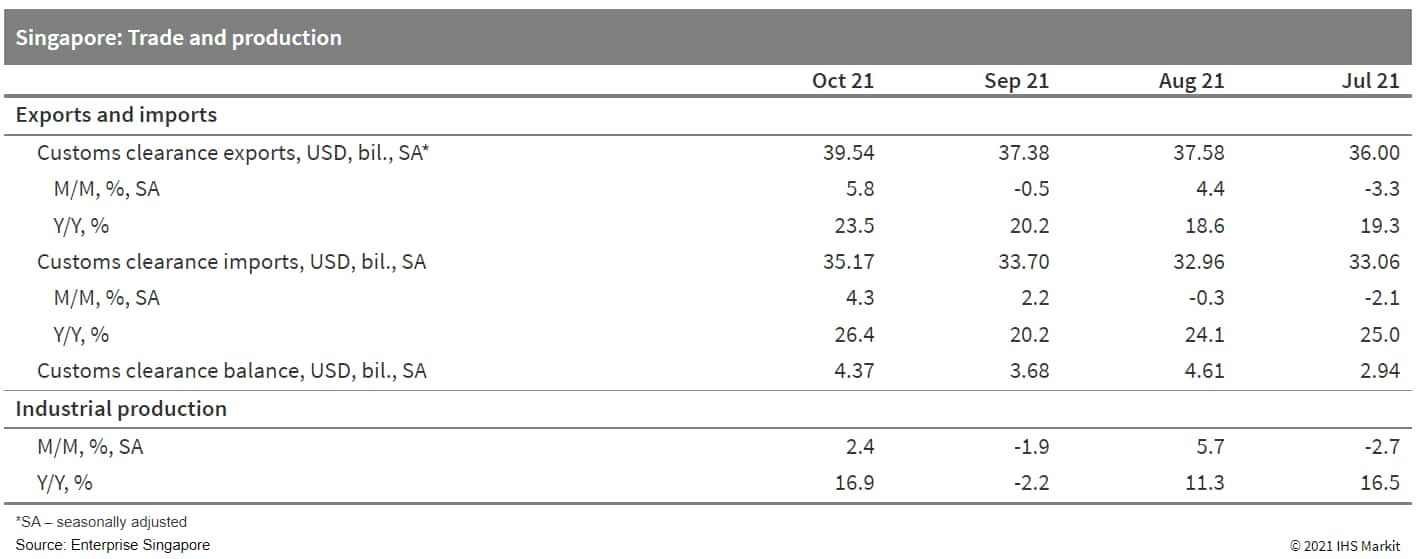

- Singapore's good economic performance in the third quarter appears to be continuing into the fourth quarter. The real economy is doing well, but inflation rates and interest rates remain concerns. (IHS Markit Economist Dan Ryan)

- Singapore's policy rate remains low, but this actually reflects international rates and currency expectations, since the Monetary Authority of Singapore targets exchange rates rather than short-term rates. Long-term rates jumped up in October and then edged up further, suggesting that markets expect an end to the unusually low rates in the short to medium term.

- The exchange rate has been relatively stable for months, but with some weakening of the Singapore dollar in the latest numbers. This could reflect the markets' assessment of the Monetary Authority of Singapore's intentions, specifically its desire to support exports by preventing an appreciation of the Singapore dollar.

- In light of the down-and-up seesaw of the second and third quarters, where real GDP fell in the second quarter and then increased by a similar amount in the third quarter, all eyes have been focused on the October number to give insight into the direction of the fourth quarter. The numbers look rather good.

- Exports increased in October, showing continued demand for Singaporean goods. However, imports also rose, showing rising domestic demand and resulting in an increase in the trade balance.

- Industrial production continues to over-perform. Although volatile, it is 20% higher than the level in the pre-pandemic 2019 year, thereby correlating well with exports and overseas demand.

- Until recently, Singapore had avoided the sharp run-up in prices that other countries experienced. However, the CPI growth rate jumped to almost 10% (month on month, seasonally adjusted, annual rate) in October compared with September, which itself was high compared with August. This was surprising, after several months of 2-4% rates.

- The State Bank of Pakistan (SBP) issued a notice on 1 December outlining the maximum amount of investment that is allowed in real estate companies. The new guideline stipulates that 25% of the housing loan target can be in the form of direct lending and investment in real estate investment trust (REIT) and the Pakistan Mortgage Refinance Company (PMRC), replacing the earlier order of a 15% limit. (IHS Markit Banking Risk's Angus Lam)

- As specified in a 2020 notice, banks have to meet a lending target of 5% of outstanding private-sector loans to housing and construction of buildings. The minimum requirement is 5% of outstanding private-sector loans by end-2021.

- In order to boost lending and help banks meet the 5% target by end-2021, the SBP in October 2020 introduced a reward-and-penalty framework to incentivize banks to lend more to the real estate sector; in April 2021, the SBP began to allow banks to invest in equity and debt of the aforementioned REIT and PMRC (see Pakistan: 8 October 2020: Pakistan's authorities introduce penalties and rewards for real-estate lending target, rebalancing loan portfolio but increasing risks).

- According to the SBP's statistical bulletin, as of June 2021, the combination of lending to "construction of buildings", "real estate activities", and "for house building" portion of consumer lending amounted to 3.2% of total domestic private-sector lending. The SBP does not release the overall sector's investment in securities in different industries but if "other" investment in securities and shares are included, the total exposure increases to 24.0%. However, this is not a realistic estimate considering that it is unlikely that all the "other" investments are in the real estate sector.

- Australian real GDP growth fell by a seasonally adjusted 1.9% quarter on quarter (q/q) during the September (third) quarter, a better-than-expected result that was bolstered by a return to growth for real exports, collapsed import demand, and government spending on healthcare. The better-than-expected result, and the relatively swift unwinding of strict lockdown measures since October in the states of New South Wales and Victoria, will result in upward revisions to Australia's near-term real GDP forecasts. (IHS Markit Economist Bree Neff)

- Compared with the 6.8% q/q plunge in real GDP growth during the June quarter of 2020, the fall in real activity during the September quarter was mild - particularly given that the two largest states by population and economic output were under a strict lockdown for most of the quarter. Nevertheless, the fall in GDP growth during the September quarter lowered the level of real GDP output to 0.2% below the pre-pandemic level, according to the Australian Bureau of Statistics (ABS). Government consumption spending was the primary domestic demand component driving growth during the September quarter, contributing 0.8 percentage point to growth. The ABS attributed that growth to increased health-sector spending at the federal (Commonwealth) and state levels, due to the Delta variant of the COVID-19 virus causing Australia's largest wave of infections since the pandemic began.

- Government capital expenditures provided a mixed picture during the quarter, and ultimately deducted 0.1 percentage point from growth during the September quarter. This is despite the federal government boosting its capital expenditures by 21.4% q/q in real terms.

- The weaker government capital expenditures offset the 0.1-percentage-point growth contribution from private real capital expenditures, which arose from growth in non-dwelling construction (up 3.9% q/q in real terms). Dwelling construction was essentially flat in real terms during the quarter as new dwelling construction fell 1.6% q/q, but alterations and additions were up 2.5% q/q. Machinery and equipment investment fell 3.1% q/q, which cannot be entirely blamed on lockdowns because the fall arose after three consecutive quarters of near record-setting growth, and may have been a natural correction point.

- Private consumption spending bore the brunt of the lockdowns, with real private consumption spending deducting 2.5 percentage points from growth and the household savings rate rebounding by 8.0 percentage points to 19.8%. The only major consumption spending categories recording growth during the quarter were those deemed essential for the practicalities of a long lockdown, including food (up 5.2% q/q), alcoholic beverages (up 7.4%), communications (up 1.2% q/q), and rent and other dwelling services (up 0.4% q/q). In response to the lockdowns, consumer spending across services categories such as transportation, operation of vehicles, recreation and culture, and hotels and restaurants registered double-digit q/q declines.

- Inventory run-down was also a significant drag on growth during the September quarter. The inventory correction was the largest in the wholesale sector, and was even larger than that observed in the June quarter of 2020. There were significant run-downs in the manufacturing sector as well, with both sectors probably suffering from supply chain issues, but also a hesitance to restock given the uncertainty caused by the continued spread of COVID-19 infections in a country that had been able to previously rein in outbreaks.

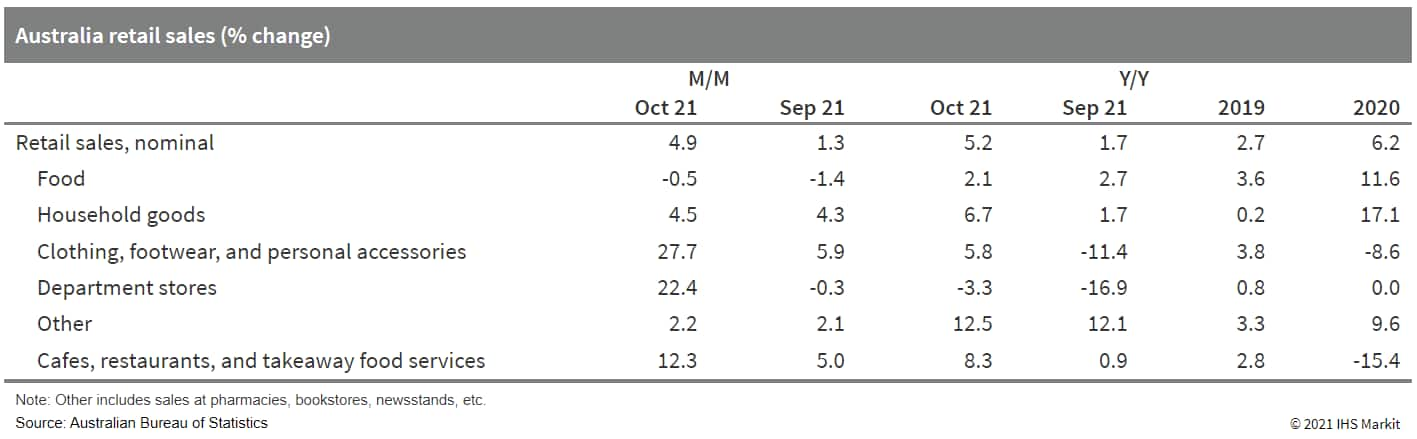

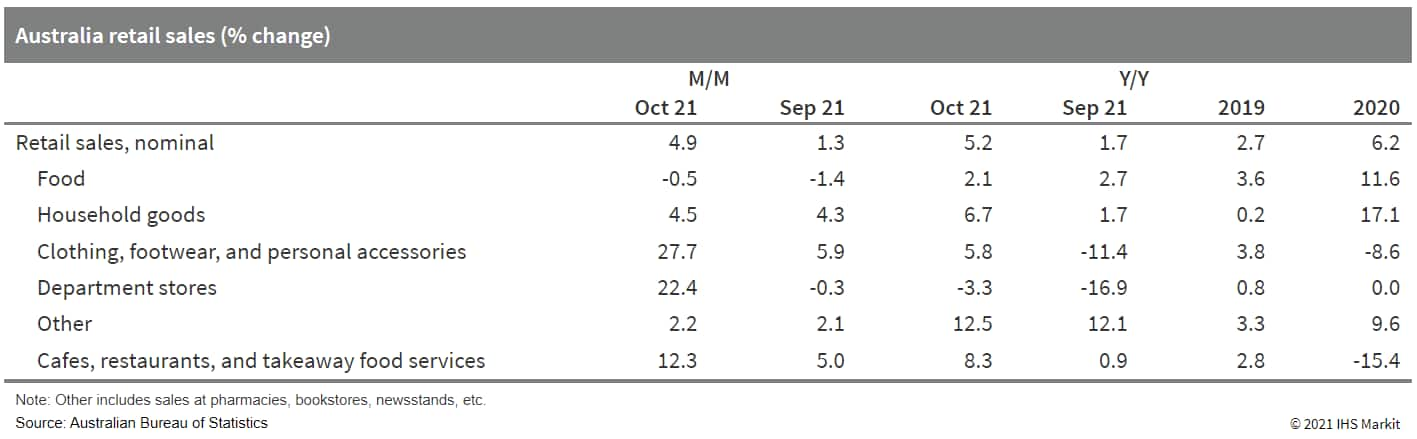

- The October retail sales data published by the ABS indicated that the reopening of the economy unleashed significant pent-up demand, with overall retail sales recording their sharpest month-on-month (m/m) surge since November 2020. These were led by sales at non-essential retail businesses and for dining at cafes, restaurants, and takeaway services.

Posted 03 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.