Most major European equity indices closed higher, the US was mixed, and all major APAC markets were lower. US government bonds closed slightly higher, while benchmark European bonds closed mixed. CDX-NA and European iTraxx closed almost flat on the day across IG and high yield. The US dollar, oil, and natural gas closed higher, while gold, copper, and silver were lower on the day. Markets will be largely focused on Friday's US non-farm payroll report and will be looking to tomorrow's US ADP private employment and Thursday's jobless claims reports for some indications on what to expect on Friday.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed, with the Nasdaq +0.2% and S&P 500 +0.03% closing at new all-time highs; DJIA flat and Russell 2000 -0.6%.

- 10yr US govt bonds closed -1bp/1.47% yield and 30yr bonds -1bp/2.09% yield.

- CDX-NAIG closed flat/48bps and CDX-NAHY +1bp/274bps.

- DXY US dollar index closed +0.2%/92.05.

- Gold closed -1.0%/$1,764 per troy oz, silver -1.3%/$25.87 per troy oz, and copper -0.3%/$4.27 per pound.

- Crude oil closed +0.1%/$72.98 per barrel and natural gas closed +1.0%/$3.63 per mmbtu.

- There are growing concerns in many countries about the accelerating spread of the Delta variant of SARS-CoV-2. According to data from Public Health England (PHE), based on data up to 23 June, the Delta variant accounted for 99% of new confirmed cases in the previous week in the UK. This is being seen as a forewarning in the US, where the progress of new variants has followed that of the UK up to now. In Germany, the Robert Koch Institute stated that between 15 and 20 June, the Delta variant accounted for 36% of new confirmed cases in the country, up from 15% in the previous week, while the variant now represents as much as 50% of all registered cases. The Delta variant is also leading to substantial surges in infection rates in Indonesia, where the growing case numbers are leading to concerns about the health system being overwhelmed. As reported by Reuters, hundreds of medical workers in the country became ill with COVID-19 despite receiving the Sinovac (China) vaccine CoronaVac amid concerns that the vaccine allegedly does not provide sufficient protection against the Delta variant. The variant is also reported to be taking hold in South Africa and driving its third wave of COVID-19. (IHS Markit Life Sciences' Brendan Melck)

- The US Conference Board Consumer Confidence Index soared in June, gaining 7.3 points (6.1%) on top of an upwardly revised May to reach 127.3. The reading was a pandemic-era high and rivaled pre-pandemic levels with a value just one point short of the 2019 average. This survey points to the likelihood of robust consumer spending growth in the second and third quarters amid a nearly complete recovery in consumer confidence. (IHS Markit Economist David Deull and James Bohnaker)

- Both the index of views on the present situation and the expectations index shared in the June increase, with the former rising 9.0 points to 157.7 and the latter rising 6.1 points to 107.0.

- The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) rose 6.6 percentage points to 43.5%, the highest since July 2000, suggesting an unusually tight labor market and extraordinary demand for workers.

- The net percentage of respondents expecting higher incomes in the next six months rose 3.2 points to 10.1%, roughly five points below the 15.0% average for the six months prior to the pandemic.

- Purchasing plans rose modestly in June but were still depressed. The share of respondents planning to buy homes in the next six months rose 0.8 point to 6.1%; the share planning to buy autos rose 0.7 point to 10.7%; and the share planning to buy major appliances rose 3.8 points to 48.1%.

- These subdued figures do not necessarily portend a slump in consumer spending, as fewer purchasing plans could reflect recently satisfied demand or an intention to switch from spending on goods to services. Still, the global pandemic continues to afflict travel plans. In June, the share of Americans planning vacations in the next six months, at 37.4%, remained well beneath pre-pandemic levels.

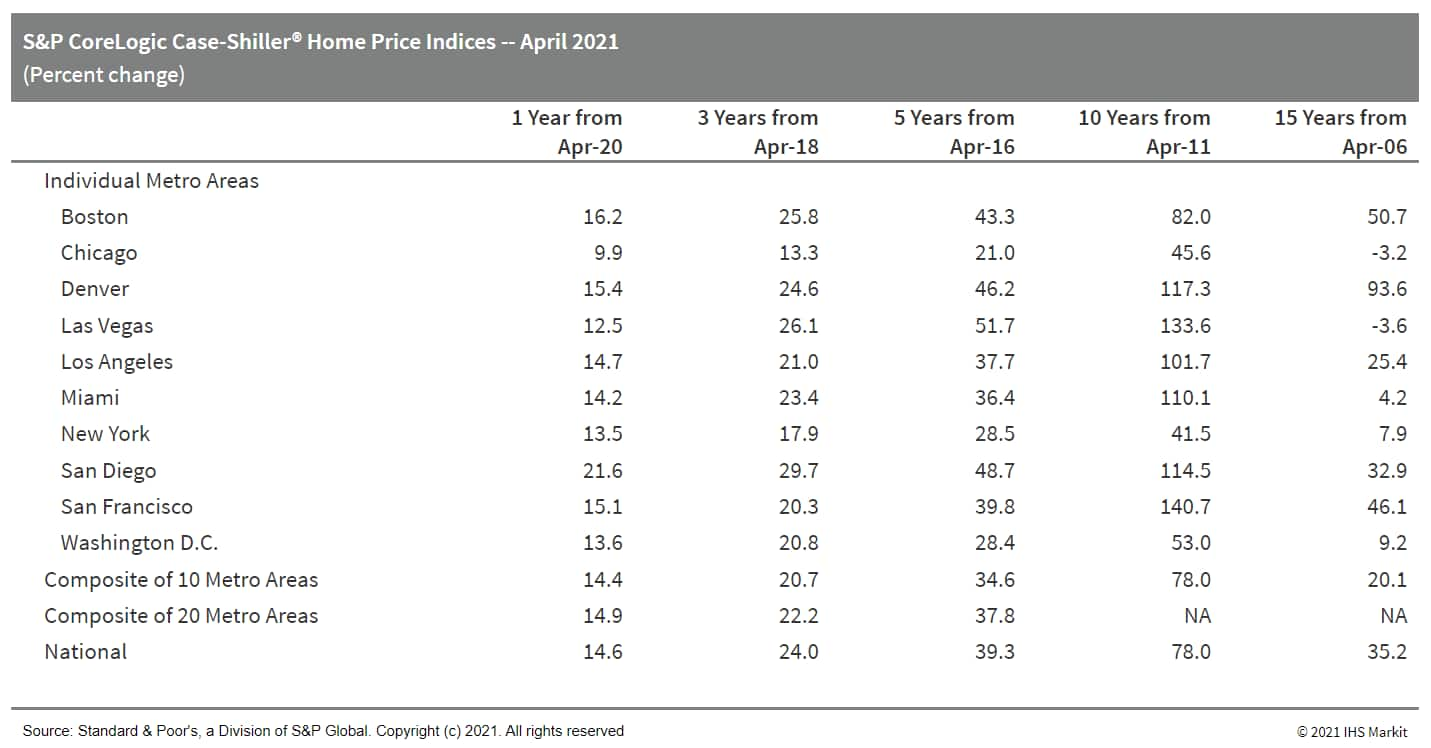

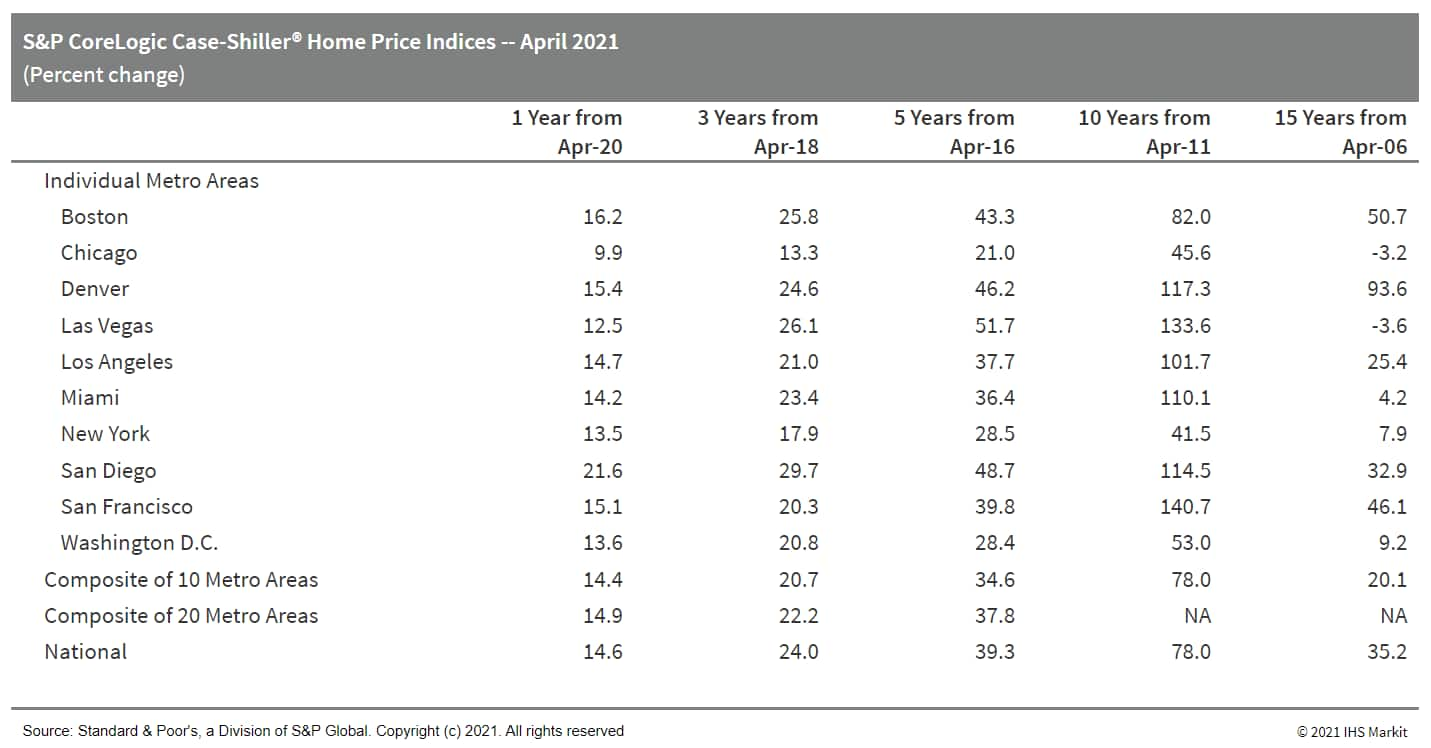

- US monthly home price growth in April remained very strong. The 10-city composite index was up 1.4% month over month (m/m) while the 20-city index was up 1.6%. Gains were largely on a par with those of March. (IHS Markit Economist Troy Walters)

- The unprecedented pace of home price growth in April was broad-based. All 20 of the cities covered were in double-digit territory with the exception of Chicago, which came in just shy of that mark. At 22.3% y/y, Phoenix once again led the pack; however, San Diego continues to close in with prices climbing 21.6% y/y. Seattle was the third city above the 20% mark with a gain of 20.2%. With April's increases, nominal home prices are now above their previous peaks in 18 of the 20 cities. In Denver and Dallas, prices are a whopping 89% and 80% higher, respectively, than their peaks during the housing boom of the 2000s.

- Monthly gains were again positive in all 20 cities, ranging from 0.9% in New York to 3.0% in San Diego.

- The 10-city and 20-city composite indices again reached record pace of growth in April at 14.4% and 14.9% respectively.

- All 20 cities covered in the report experienced growth at or near a double-digit pace once again. Increases ranged from 9.9% year on year (y/y) in Chicago to 22.3% y/y in Phoenix.

- The national index was up 14.6% y/y in April.

- Bank of America, Citibank, Goldman Sachs, and HSBC are among the banks operating in the US calling for a safe harbor to protect them against the liability of disclosing climate risk. The banks are members of a nonpartisan policy and advocacy group, the Bank Policy Institute (BPI), which also spoke out against the idea of having its members investigated by government agencies or having audits of climate disclosures because they are based on a "nascent stage of verification and data inconsistencies." The BPI, which represents universal, regional, and major foreign banks operating in the US, wrote largely in support of the disclosure of risks caused by direct climate impacts or indirect climate policies in a 9 June comment letter to the US Securities and Exchange Commission (SEC). However, it warned the SEC against prescribing a set of rules for disclosing climate risk, "given the dynamic and evolving nature of climate disclosure in all sectors" that would open companies to litigation. The SEC asked for public comment in late March on how it can improve the current process of reporting climate risks by public holding companies, and it is looking to propose a rule by October. However, sources familiar with the rulemaking process say the SEC may only issue an advanced notice to get feedback on what its rulemaking could look like. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- In an interview with Automotive News, Volvo Cars' CEO confirmed that its US plant will go all-electric first, and will be the first to build Volvo's new generation of electric vehicles (EVs). Hakan Samuelsson is quoted as saying the Ridgeville (South Carolina) plant will be the "first company factory in the world building our all-new-generation all-electric cars — before Europe and before China. This factory will... also be the only plant in the Volvo Group which only makes full-electric cars… Charleston will play a very important role in our electrification strategy. It's a huge investment that we are doing." Volvo previously announced a USD700-million investment to build EVs at the plant; the investment reportedly includes adding a second line to the plant as well as battery pack assembly. Samuelsson says he expects US buyers will catch up to Europe and China with demand for EVs, particularly for the premium market. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Brazil's raw milk prices have increased for a second month in a row, to BRL2.04 (USD0.40)/litre in May, up 3% m/m and 48% y/y, reports the Centre of Economic Studies (Cepea). This bullish trend is owed to drier weather conditions, mainly in Brazil's Central-South region, and feed costs which are currently at their highest on record. Despite the inflated milk price, data reveal a significant squeeze in production margins. This has hindered investment and pushed up cow cull rates, which is an indicator that milk production should tighten further in the upcoming months. The high unemployment and inflation rates have had an extensive effect on domestic purchasing power which is expected to limit the price growth of dairy goods, in addition to the existing low supplies and stocks, as well as sky-high feed prices. Some domestic prices have already started to go down, mainly for cheese: for example, mozzarella quotations were 2% lower m/m in April, and queijo prato has signaled of a weaker price, although was almost unchanged (-0.2% m/m) in the same month. Mozzarella averaged BRL22.60 (USD4.47)/kg and queijo prato was at BRL24.78 (USD4.90)/kg. (IHS Markit Food and Agricultural Commodities' Ana Andrade)

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Spain flat; Germany +0.9%, Italy +0.5%, UK +0.2%, and France +0.1%.

- 10yr European govt bonds closed mixed; France/Italy flat, Spain +1bp, and Germany/UK +2bps.

- iTraxx-Europe closed flat/46bps and iTraxx-Xover -1bp/229bps.

- Brent crude closed +0.2%/$74.28 per barrel.

- The UK Financial Conduct Authority (FCA) has issued a consumer warning that Binance Markets Limited, a UK entity, and the wider Binance Group, a cryptocurrency provider, lack permission to conduct any regulated financial activity in the United Kingdom. It noted that the group apparently offered UK customers cryptocurrency products and services via a website. In parallel, it warned consumers to "be wary" of firms offering high returns through cryptocurrency investment, highlighting that while the UK authorities do not regulate crypto assets, all products that are considered "securities" or derivatives are subject to formal regulation. The FCA has ordered Binance's UK entity to cease advertising the Group's services and requested it to demonstrate that it has adequate records of its UK customer base. Binance has denied that its UK operations were conducting cryptocurrency-related activity and responded that the move would have "no direct impact" on dealings with the Group, currently based in the Cayman Islands (after a prior presence in Malta). The Group has been subject to a similar warning from the US Securities and Exchange Commission (SEC) last April. The FCA's action appears to be designed to warn consumers of the substantial risks relating to the marketing of digital currencies, cautioning against exaggerated claims of the likely returns available, given the widespread "pump and dump" practices within the sector. (IHS Markit Country Risk's Brian Lawson)

- Nissan is expected to confirm battery manufacturing investment plans in the UK this week. Sky News's City Editor Mark Kleinman posted on microblogging site Twitter yesterday (28 June), "I understand Nissan will confirm as soon as this week details of its EV strategy for the UK, including the construction of a battery gigafactory in Sunderland -- paving the way for thousands of the Japanese company's electric cars to be built in Britain every year." Sources have also told Automotive News Europe (ANE) that Nissan's chief operating officer (COO) Ashwani Gupta, will visit the Sunderland factory on 1 July to make this announcement. However, when asked by The Journal, a spokesperson for Nissan said, "Having established EV [electric vehicle] and battery production in the UK in 2013 for the Nissan Leaf, our Sunderland plant has played a pioneering role in developing the electric vehicle market. As previously announced, we will continue to electrify our line-up as part of our global journey towards carbon neutrality, however we have no further plans to announce at this time." (IHS Markit AutoIntelligence's Ian Fletcher)

- Eurozone economic sentiment index hits two-decade high in June, with pricing surveys also continuing to pick up. (IHS Markit Economist Ken Wattret)

- For the fourth straight month, June's economic sentiment indicator (ESI) for the eurozone has surpassed the market consensus expectation (of 116.5, according to Reuters' survey) by some distance.

- At 117.9, up by over 3 points versus May, June's ESI is almost 14 points above its pre-pandemic level in February 2020 (of 104.0) and just a whisker shy of its all-time high of 118.2 in May 2000.

- Industrial sentiment, which has the highest weight in the ESI (of 40%), rose to another record high in June (of 12.7), almost 17 points above its average since 2000.

- Services sentiment (30% of the index) showed the biggest rise of any sector in June, jumping by over 6 percentage points (to 17.9). The services index is now over 6 points above its pre-pandemic level and almost 12 points above its average since 2000, with the cumulative increase of almost 28 points over the three months to June surpassing the pick-up during the initial reopening phase in the third quarter of 2020.

- Switching to inflation-related developments, June's survey of industrial firms' pricing intentions rose by another six points in June, reaching a record high. The survey is indicative of a continued surge in eurozone core producer price inflation which in turn will seep into consumer goods prices.

- Pricing intentions in other sectors also continued to rise in June, although to a lesser extent than for industry. Notably, the services survey is only marginally above its long-run average.

- Looking at the ESI data across the member states, most continued to show a marked improvement in economic sentiment in June. Among the larger economies, Germany outperformed, with its ESI jumping by five points to a new all-time high. Spain, in contrast, slipped by just over a point.

- Germany's Federal Statistical Office (FSO) has reported, based on data from various regional states, that the country's national consumer price index (CPI) increased by a slightly higher-than-expected 0.4% month on month (m/m) in June. Unrounded, this is about 0.05% above the 0.3% m/m average for this month in recent years. Owing to large dampening base effects from a rebound in package tour prices a year ago - when holiday travel resumed after the first wave of the pandemic had subsided - annual inflation nonetheless softened from May's 2.5% to 2.3% year on year (y/y). The EU-harmonised CPI measure also posted 0.4% m/m, with its y/y rate thus declining from 2.4% to 2.1% y/y. (IHS Markit Economist Timo Klein)

- The detailed breakdown of the German national data will only be published with the final numbers on 13 July, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). CPI in this state posted 0.5% m/m and 2.5% y/y, the latter slipping from 2.6% in May.

- In NRW, energy prices had a boosting effect in m/m terms (1.1%) but softened in annual terms from 10.4 to 9.7% on base effects. In contrast, food prices rose by 0.3% m/m and additionally posted an increase of their annual rate from 0.8% to 1.3%.

- The loosening of restrictions with respect to holiday travel and recreation/entertainment provided for m/m increases in the package tour and hotel/restaurant categories. However, annual rates only increased for the latter, whereas package tour price inflation declined sharply (from 7.4% to -5.0% y/y) due to the above-mentioned base effect. Separately, durable goods prices were boosted by clothing/shoes, where a 0.4% monthly increase sufficed to push up its annual rate from 0.1% to 3.2%.

- German chemical company BASF is aiming to use electricity from a Dutch offshore wind farm for hydrogen production and a greening of operations at its Antwerp facility in Belgium.

- BASF signed a €300 million ($357 million) contract with Swedish diversified power company Vattenfall for the purchase of 49.5% of the 1.4-GW Hollandse Kust Zuid (HKZ) offshore wind farm in Dutch waters, the output of which will be use to supply its European chemical production facilities, according to a 24 June statement. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- The facility's co-owner, Vattenfall, is also retaining an interest to supply wind power to its Dutch customers, having won a 2018 bid to supply power and assist the energy transition in the Netherlands. The Dutch government has pledged to reduce national GHG emissions by 49% by 2030 compared with 1990 levels.

- Construction of the HKZ wind farm, which will not rely on subsidies for operation, is expected to begin in July ahead of the launch of commercial operations in 2023.

- Skoda has announced its Strategy 2030 plan, part of which is focused on becoming a top-five brand by sales volume in Europe by 2030, according to a company statement. A key component to the plan will be the "further strengthening the brand's position in the entry-level segments," according to brand head Thomas Schaefer, and the brand new-fourth generation B-Car segment Fabia is at the heart of this. There will also be a programme to roll out a number of affordable battery electric vehicles (BEVs) to slot into the range below Skoda's first bespoke production BEV, the Enyaq. However, the brand's sales drive in the short term has been thwarted by the semiconductor supply crisis; it is currently having significant issues in limiting lead time in the delivery of Enyaqs to customers. Schaefer said, "Our stock is at an all-time low. There is nothing we can do. We have to hope it calms down in the second half of the year." IHS Markit reported last week that Skoda was suffering drastically from the semiconductor issue and had built up a large inventory of unfinished Octavias, which will need to be fitted with the necessary electronic control units (ECUs) as and when they become available. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Bank of Uganda (BoU) decided at its monetary policy committee (MPC) on 16 June to reduce the central bank rate (CBR) to 6.5%, down from 7%, to support Uganda's economic recovery amid persistent structural challenges. (IHS Markit Economist Alisa Strobel)

- The Ugandan central bank's MPC assessed that risks to the economic outlook are on the downside; however, there is considerable excess capacity in the economy and unevenness in the economic recovery that requires further monetary policy support.

- Although the central bank has lowered key interest rate the CBR by 0.5 percentage point in June, the band on the CBR remains at plus or minus 3 percentage points and the margins on the rediscount rate and the bank rate remain at 4 and 5 percentage points on the CBR, respectively. The rediscount rate and the bank rate are set at 9.5% and 10.5%, respectively.

- The BoU assesses that Uganda's inflation is likely to remain below the 5% target in the near term. Nevertheless, the path is likely to be shaped by uncertainties, especially if the current commodity price surge becomes another commodity super-cycle, pushing the inflation outlook upwards.

Asia-Pacific

- All major APAC equity markets closed lower; Australia -0.1%, India -0.4%, South Korea -0.5%, Japan -0.8%, and Mainland China/Hong Kong -0.9%.

- Foton Motor used its investment information platform to reveal that it is conducting preliminary co-operation talks with Huawei for autonomous vehicle (AV) business, reports Gasgoo. Meanwhile, the two companies are discussing technologies related to smart cockpits, Ethernet and radar as part of preparations to seek collaborative projects in the future. In April 2019, Foton Motor and Huawei entered an agreement to collaborate on multitude of businesses aiming to build a 5G compatible smart system for commercial vehicles. Under the agreement, the two companies will collaborate on developing an intelligent driving computer platform for commercial vehicles as well as design and research and development (R&D) of Level 3 mass-produced autonomous cars. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese battery manufacturer Contemporary Amperex Technology Co Ltd (CATL) has extended its battery supply agreement with Tesla for an additional 30 months. According to South China Morning Post, CATL will now be supplying battery packs to the automaker until December 2025 from the current deadline of June 2022. CATL said, "The agreement signifies further acknowledgement by Tesla of the product quality and production capability of our company, and will help strengthen the long-term cooperation relationship between the company and Tesla." (IHS Markit AutoIntelligence's Nitin Budhiraja)

- India's Ministry of Finance on 28 June announced through the Press Information Bureau that the government has expanded the Emergency Credit Line Guarantee Scheme (ECLGS) by INR1.5 trillion (USD20 billion) to INR4.5 trillion, with details still being drawn out. At the same time, a new guarantee scheme worth INR1.1 trillion will be made available for sectors affected by the COVID-19 virus pandemic, such as healthcare and tourism. The scheme will guarantee between 50% and 75% of the total loans depending whether it is for existing purposes or new projects. The interest rate on these loans will be curbed at between 7.95% and 8.25%, lower than the 10-11% for normal loans. To improve lending to retail borrowers, a credit guarantee scheme (which guarantees 75% of loans) worth INR75 billion will also be made available to small non-bank financial companies (NBFCs), or microfinance institutions (MFIs) to on-lend to 2.5 million customers at up to INR125,000 each. The deadline for the application is the end of March 2022. (IHS Markit Banking Risk's Angus Lam)

Posted 29 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.