Most major US and APAC equity indices closed higher, while Europe was mixed. US government, US municipal bonds, and benchmark European government bonds closed lower. European iTraxx and CDX-NA closed slightly tighter across IG and high yield. Natural gas, silver, copper, and gold were lower, the US dollar was flat, and oil was higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for Russell 2000 -0.4%; DJIA/S&P 500 +0.7% and Nasdaq +0.2%.

- 10yr US govt bonds closed +3bps/1.64% yield and 30yr bonds +1bp/2.30% yield.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -3bps/284bps.

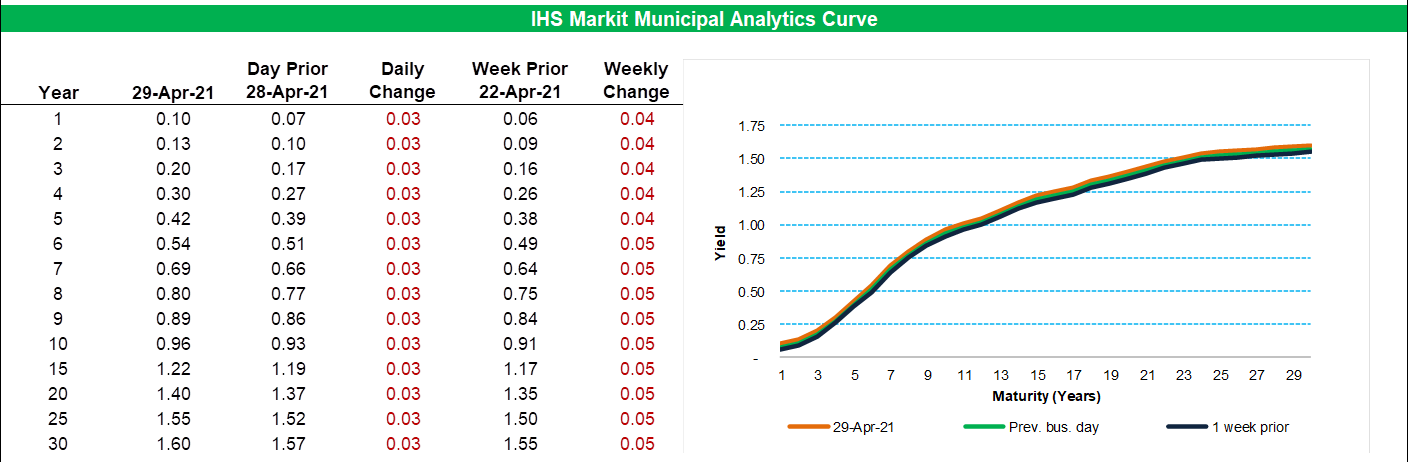

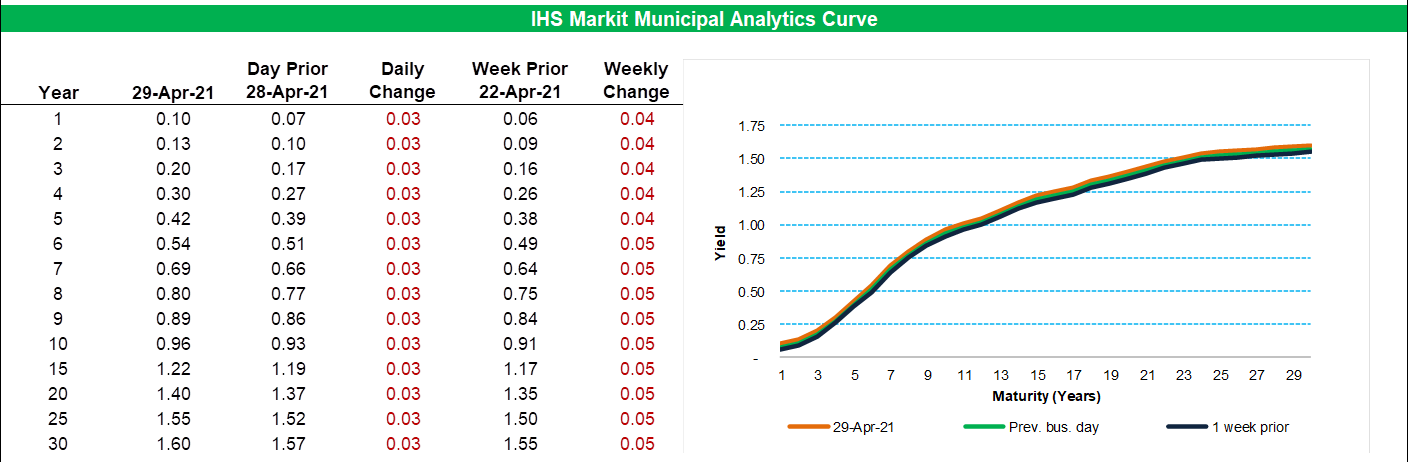

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) sold-off 3bps across the curve, leaving the curve 4-5bps worse week-over-week.

- DXY US dollar index closed flat/90.61.

- Gold closed -0.3%/$1,768 per troy oz, silver -0.1%/$26.05 per troy oz, and copper -0.2%/$4.49 per pound.

- Crude oil closed +1.8%/$65.01 per barrel and natural gas closed -1.7%/$2.91 per mmbtu.

- Amazon reported record quarterly profit as demand remained robust for its deliveries, cloud-computing and advertising businesses, capping a blockbuster earnings season for the world's largest technology companies. The Seattle company's profits in the year since the pandemic started exceeded $26 billion, more than the previous three years combined. Net income from January to March more than tripled to $8.1 billion, and revenue of $108 billion far exceeded the average of analyst predictions on FactSet. (WSJ)

- US GDP grew at a 6.4% annual rate in the first quarter, according to the BEA's "advance" estimate, as the economy continued to recover from last year's sharp, pandemic-driven contraction. This was close to our tracking estimate of 6.7%, but 1.1 percentage points above the consensus estimate of 5.3%. The advance estimate left the level of GDP 0.9% below the previous peak attained in the fourth quarter of 2019. (IHS Markit Economists Ken Matheny, Michael Konidaris, and Lawrence Nelson)

- Personal consumption expenditures grew at a 10.7% annual rate. Government consumption expenditures and gross investment posted a strong gain (+6.3%) driven by robust growth of federal nondefense spending (+44.8%), reflecting fiscal stimulus and purchases of COVID-19 vaccines for general distribution.

- Inventory investment turned into a source of drag, declining from a +1.4 percentage-points contribution to -2.6 percentage points. Net exports were a drag on GDP growth (-0.9 percentage point), but less so than in the fourth quarter (-1.5 percentage points).

- The additional federal stimulus caused disposable personal income to rise 61.3%, as transfer payments increased by $2.3 trillion. This was partially offset by decreases in proprietors' income and personal dividend income.

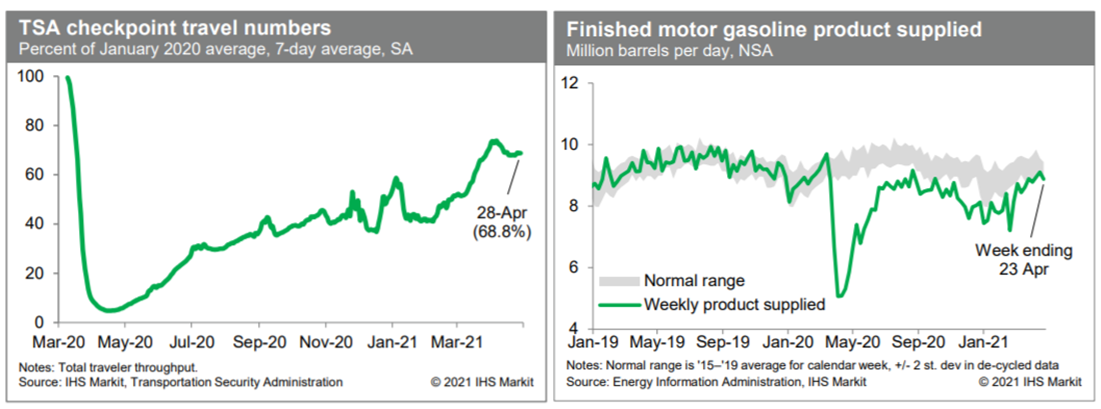

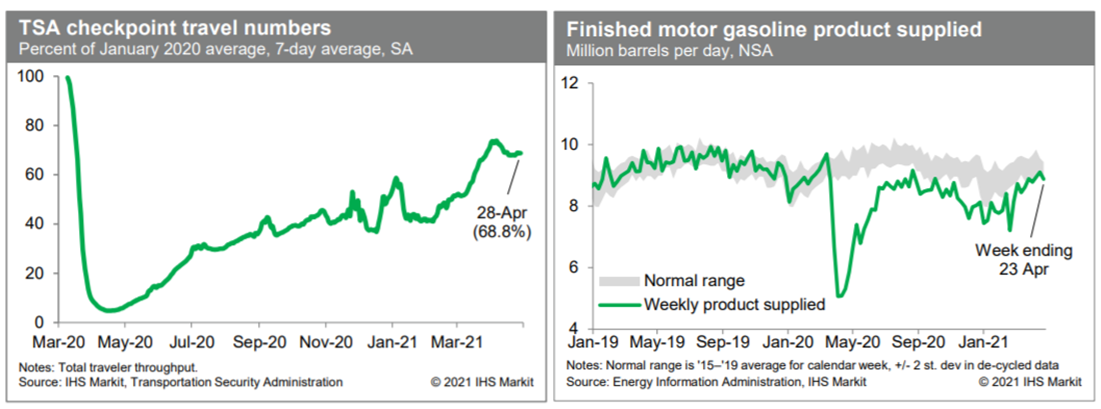

- Consumption of gasoline turned down last week but remained near the lower end of a normal range, indicating that internal mobility has just about returned to normal. Meanwhile, passenger throughput at US airports in recent days has averaged about 68.8% of the January 2020 level, down somewhat from early April but still well up from this past winter. (IHS Markit Economists Ben Herzon and Joel Prakken)

- US seasonally adjusted (SA) initial claims for unemployment insurance fell by 13,000 to 553,000 in the week ended 24 April. With the number of new daily infections falling and the pace of the inoculation campaign accelerating, states have eased restrictions on social and economic activity, giving a boost to the labor market. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, rose by 9,000 to 3,660,000 in the week ended 17 April. The insured unemployment rate remained at 2.6%.

- In the week ended 10 April, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 413,224 to 5,192,711.

- There were 121,749 unadjusted initial claims for PUA in the week ended 24 April. In the week ended 10 April, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 335,536 to 6,974,068.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 10 April, the unadjusted total fell by 845,874 to 16,559,276.

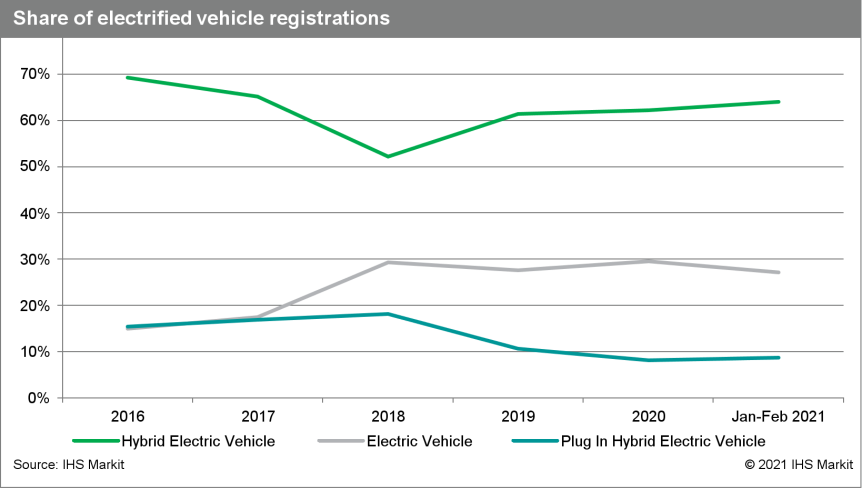

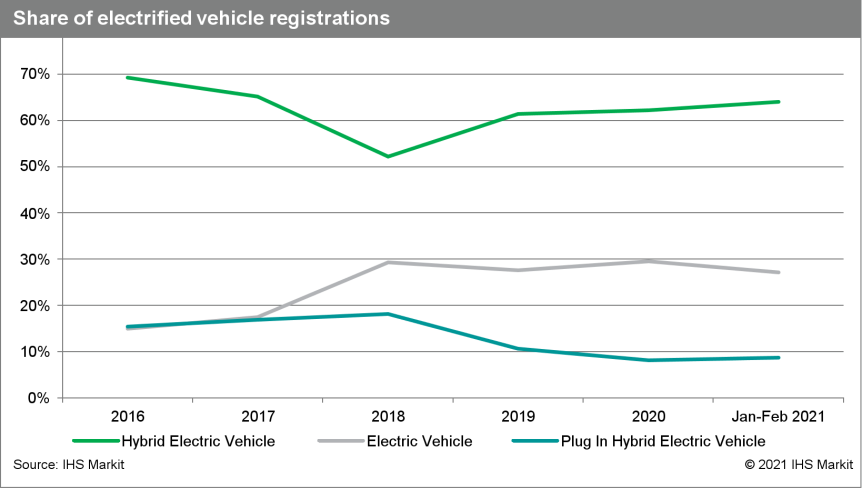

- Armed with the first two months of registration data, IHS Markit has a look at the inroads electric vehicles may be making. Their share of registrations improved from 5.9% in 2020 to 8.0% in the first two months of 2021. Although this suggests promise, most of this gain has gone to traditional HEVs rather than BEVs or PHEVs. (IHS Markit AutoIntelligence Stephanie Brinley)

- Toyota is investing UDS803 million in its Princeton, Indiana, manufacturing complex to support future production of two new UVs, according to a company statement on 28 April. Along with a more straightforward investment announcement, this statement also confirms new three-row UVs for the Toyota and Lexus brands, and the expansion of Lexus-brand production outside Japan. While this is not the first Lexus production outside Japan, Toyota has favored Japanese production for its luxury brand. The new Toyota product will give the brand a large three-row vehicle that is better suited to US tastes than the venerable Land Cruiser. Lexus will be able to better compete with BMW (the X7), Mercedes-Benz (the GLS), and Audi (the Q8). (IHS Markit AutoIntelligence Stephanie Brinley)

- General Motors (GM) has announced Ultium Charge 360, which it calls a "holistic charging approach" for supporting a charging ecosystem for electric vehicles (EVs). The program includes elements aimed at simplifying the charging experience for customers, recognizing that this can seem complicated and confusing to consumers considering buying an EV. The program integrates charging networks, GM vehicle mobile apps, and hardware and services to make the charging process easier, says the company. GM has also announced that it has agreements with seven major charging networks to create seamless access to charging locations, with the company saying that this will provide access to nearly 60,000 charging plugs across the United States and Canada. GM now has agreements with Blink Charging, ChargePoint, EV Connect, EVgo, Flo, Greenlots, and SemaConnect in the US and Canada, providing customers with access to information about the availability of charging stations in any of those networks through the GM brand's mobile apps, the location of stations along a route, as well as how to initiate and pay for charging. (IHS Markit AutoIntelligence Stephanie Brinley)

- Ride-hailing firm Uber Technologies has launched a car rental service, Uber Rent, in partnership with Avis Budget Group and Hertz, reports CNN Business. This will allow customers in the US to book rental cars through the Uber app, with the ride-hailing firm offering up to 10% of the rental cost as a credit to the user. In addition, Uber has announced plans to launch a Valet service next month in Washington, DC, that will drop off a rental car. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Spain +0.3%, UK flat, France -0.1%, Italy -0.7%, and Germany -0.9%.

- 10yr European govt bonds closed sharply lower; France/Spain +5bps and Italy/Germany/UK +4bps.

- iTraxx-Xover closed -1bp/50bps and iTraxx-Xover -2bp/249bps.

- Brent crude closed +1.9%/$68.05 per barrel.

- The "headline" economic sentiment indicator (ESI) for the eurozone has surprised massively to the upside in April for the second straight month, jumping by more than nine points, the biggest increase in the series' history. (IHS Markit Economist Ken Wattret)

- At 110.3, the ESI is now more than 10 points above its long-run average (since 2000) and has also surpassed its pre-pandemic level in February 2020 (104.0), although it remains some way below its cycle high during that expansion (115.2 in December 2017).

- Services sentiment has surged by almost 12 points, a record gain, with retail sentiment up by nine points and now back above its long-run average. The consumer and construction sentiment indices have also continued their recent strong improvements.

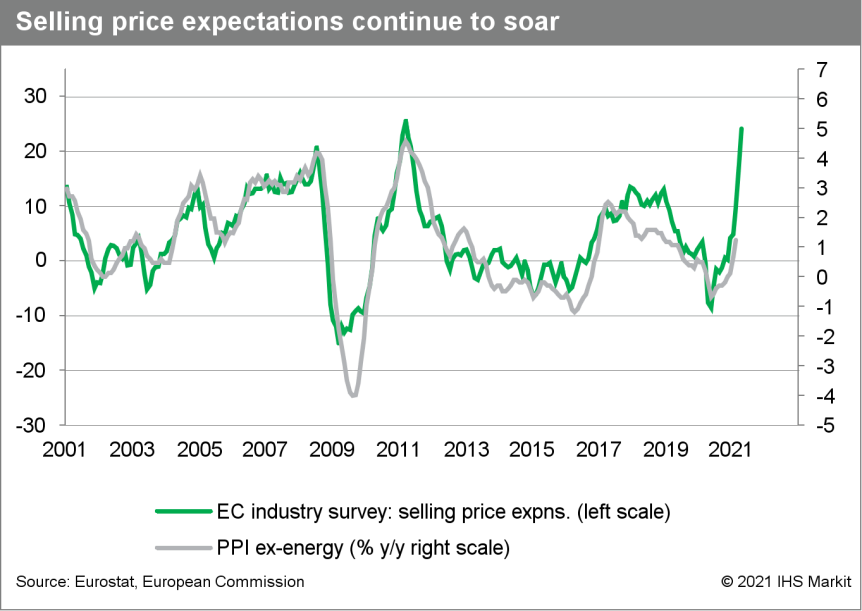

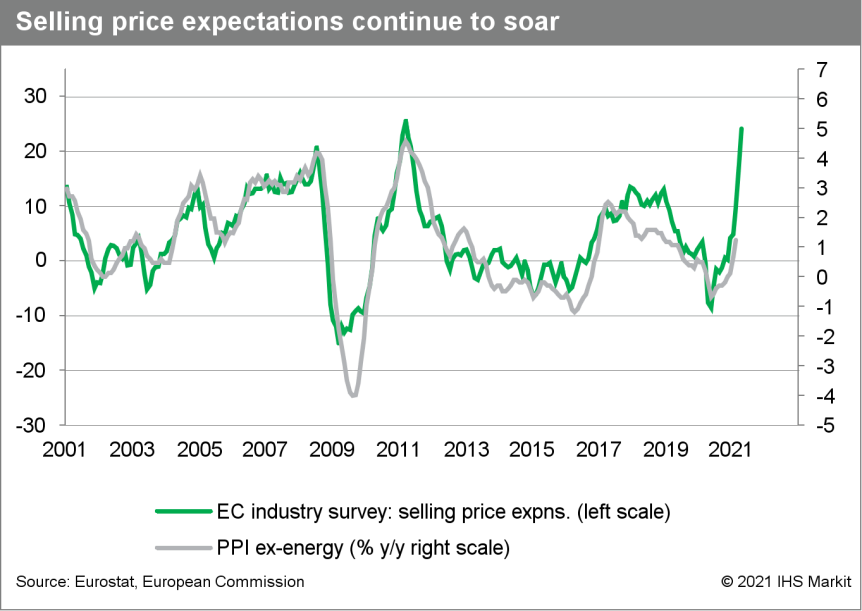

- In tandem with the jump in sentiment, surveys of pricing intentions have also risen markedly in March and April, led again by the industrial survey, which is clearly indicative of a continuation of the build-up of pipeline price pressures for goods.

- March's "headline" eurozone bank lending data from the European Central Bank (ECB), which is adjusted for loan sales and securitization effects, show an unusually pronounced deceleration in the y/y growth rate for loans to non-financial corporates (NFCs), from 7.0% down to 5.3%. (IHS Markit Economist Ken Wattret)

- However, the deceleration reflects base effects stemming from a surge in loans to NFCs in March 2020 during the initial wave of the COVID-19 pandemic. The month-on-month (m/m) rise of EUR122 billion (USD148 billion) in March 2020 was by far the largest on record as demand for loans rocketed with businesses in extreme distress during that period.

- While the y/y rate of change dropped in March this year accordingly, in fact the m/m flow of loans to NFCs was remarkably strong. The rise of EUR52 billion was one of the largest in the history of the series.

- Regarding loans to households, March's m/m increase of EUR20 billion closely matched the recent trend, with the average m/m increase since mid-2020 marginally higher at EUR21 billion.

- Seasonally adjusted German unemployment has increased by 9,000 month on month (m/m) in April, confirming that the downward trend observed during the second half of 2020 and in January 2021 has stalled for the time being. (IHS Markit Economist Timo Klein)

- In net terms, only slightly more than one-quarter of the initial, COVID-19 pandemic-related surge in unemployment in the second quarter of 2020 has been unwound as of April 2021. The end-April unemployment level of 2.760 million compares with the March 2020 cyclical low of 2.272 million and an interim high of 2.933 million in June 2020.

- The Labour Agency calculates a boosting COVID-19 effect on unemployment in April (up 16,000), reversing the previous month's -17,000, which had benefited temporarily from some cautious loosening of restrictions.

- Cumulatively since April 2020, the boosting impact on joblessness from the COVID-19 pandemic is given as 509,000, an increase of more than 20%. This is broadly consistent with the increase in Germany's (national) unemployment rate from 5.0% in March 2020 (close to 40-year lows) to 6.0% at present.

- Germany's Federal Statistical Office (FSO) has reported, based on data from various regional states, that the country's national consumer price index (CPI) has increased by 0.7% month on month (m/m) in April, which compares with a 0.5% m/m average increase for this month in recent years. (IHS Markit Economist Timo Klein)

- The annual inflation rate has advanced anew from 1.7% in March to 2.0%. The EU-harmonized CPI measure - which has a different composition and thus also seasonal pattern - has posted a rise of 0.5% m/m, its year-on-year (y/y) rate increasing from 2.0% in March to 2.1% in April.

- The fact that the harmonized inflation rate remains higher than the national rate owes to its readjustment of weights in January to the consumer spending patterns of 2020. This favored the sectors with larger price increases during the pandemic and reduced the importance of those with subdued prices (e.g. package holidays).

- EasyMile, a French developer of autonomous shuttles, has raised USD66 million in a Series B funding round led by Searchlight Capital Partners, reports TechCrunch. New investors McWin and NextStage AM and previous investors Alstom, Bpifrance, and Continental also participated in the round. The company plans to use the infused capital towards expanding deployments of autonomous shuttles in closed-campus environments. In addition, it will continue to invest in its longer-term strategy to deploy its vehicles and technology in public transportation networks. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On an annual basis, Spain's total employment fell by 2.4% year on year (y/y), or by 0.47 million jobs to 19.2 million in the first quarter, after y/y falls of 3.3% in the second half of last year and 6.1% in the second quarter, which was the first drop since early 2014. (IHS Markit Economist Raj Badiani)

- This compares with gains of 1.1% y/y in the first quarter of 2020, 2.3% in 2019, and 2.7% in 2018.

- Employment losses stood at 0.8 million, or a fall of 3.9% between the final quarter of 2019 and the first quarter of 2021.

- A breakdown by economic activity reveals that services endured sharp job losses in the first quarter, down by 2.3% y/y (344,500 jobs) to 14.5 million. This is in line with the COVID-19 restrictions targeting the hospitality, leisure, and travel sectors.

- Meanwhile, the industrial sector shed 127,100 jobs or 4.6% when compared to a year earlier to stand at 2.642 million in the first quarter.

- Hino Motors and Israeli e-mobility company REE Automotive have signed an agreement to jointly develop a next-generation commercial mobility solution involving a modular platform, according to a company press statement. The partnership will involve the development of modular electric commercial vehicle (CVs) through the integration of Hino's manufacturing expertise in the CV segment and REE's innovative and highly competitive proprietary REEcorner Technology. The intended product will comprise a modular platform carrying a customized Mobility Service Module on top that can be easily detached from the platform. The solution will boast a low-floor, full-flat design that flexibly meets customers' needs and also supports autonomous driving. (IHS Markit AutoIntelligence's Nitin Budhiraja)

Asia-Pacific

- Most APAC equity markets closed higher except for South Korea -0.2%. Hong Kong +0.8%, Mainland China +0.5%, Australia +0.3%, India +0.1%, and South Korea -0.2%.

- Baidu will launch a commercial driverless robotaxi service in Beijing (China) starting from 2 May, according to a company statement. Baidu claims to be the first Chinese company to offer a paid autonomous vehicle (AV) service without a safety driver behind the wheel. By using the Apollo Go App, riders can book the service which will first be launched in city's Shougang Park to transport people to sports halls, work areas, coffee shops and hotels. Beijing Shougang Park is also one of the venues for the 2022 Beijing Winter Olympics and these robotaxis will be then used to provide shuttle services for athletes and staff. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese electric vehicle (EV) startup NIO has started construction of its smart EV industrial park in Hefei, Anhui province (China), reports Gasgoo. Called the Neo Park, the facility covers an area of 11.2 million square metres and includes manufacturing and research and development (R&D) facilities with designed annual capacity of 1 million vehicles and 100 GWh batteries. The R&D will focus on development of technologies related to complete vehicles, core parts, and autonomous vehicle operation. William Bin Li, founder, chairman, and CEO of NIO, has indicated that the Neo Park will have over 10,000 R&D staff members and 40,000 technicians. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Sky-well New Energy Automobile Group has launched 'Skyworth Auto', a new electric vehicle (EV) marque brand, reports Gasgoo. Vehicles under the brand will be built on two all-electric vehicle platforms, the 'BE' and the 'CE', from 2020-25. The company plans to introduce at least four all-new full-electric models under the brand, while those with hybrid systems and other types of powertrains will be introduced in future. Sky-well New Energy Automobile Group was founded in 2011 and focuses on manufacturing and sales of large, medium, and light buses; passenger cars; and related components. (IHS Markit AutoIntelligence's Nitin Budhiraja)

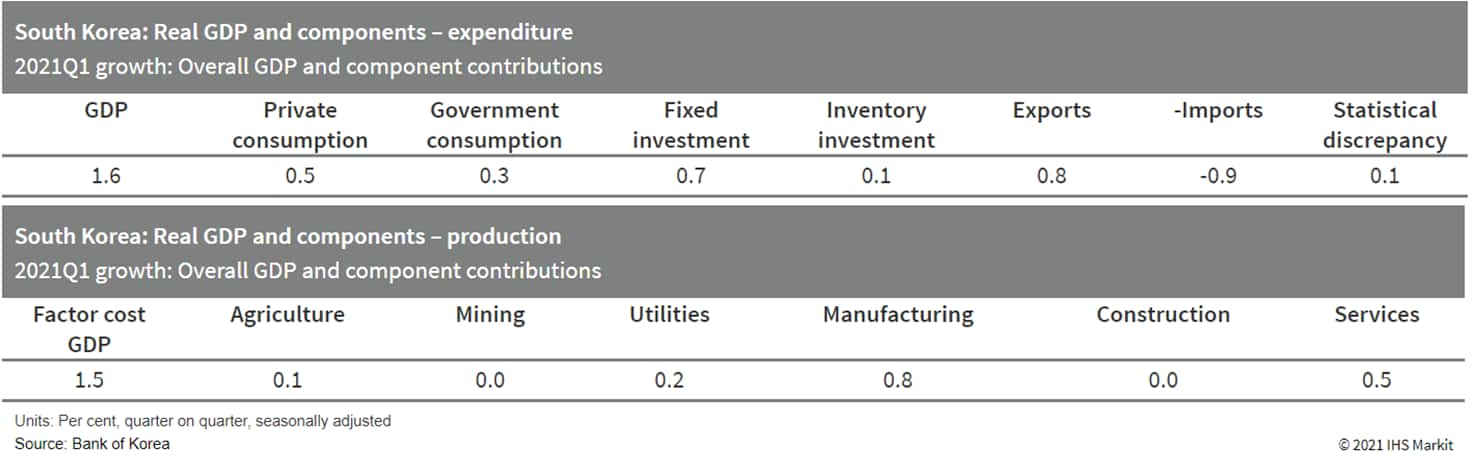

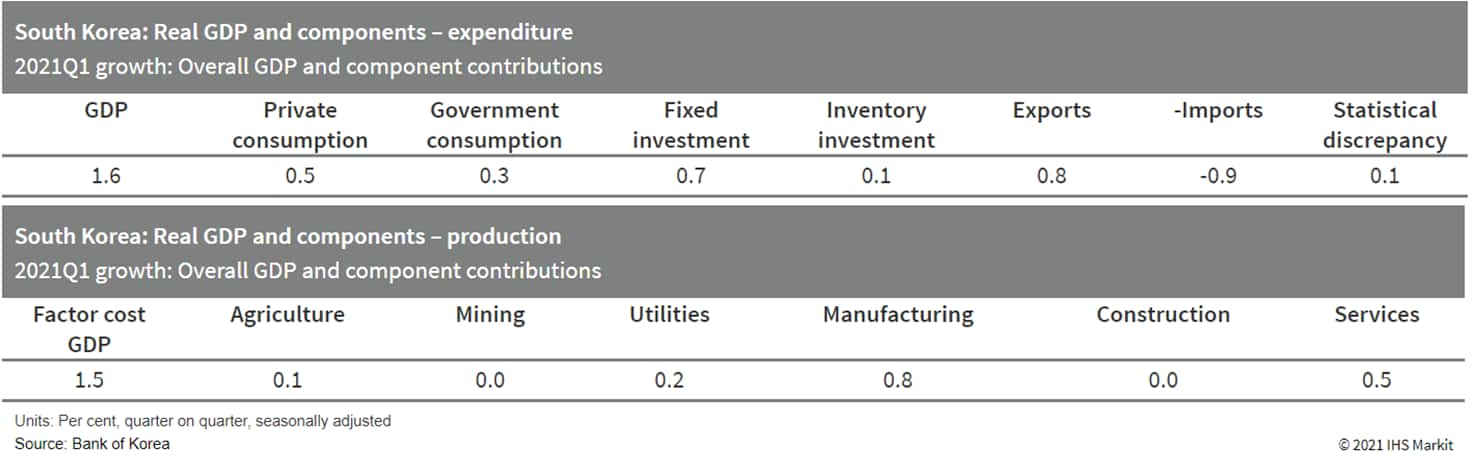

- South Korea's first-quarter real GDP (seasonally adjusted) increased by 1.6% over the previous quarter. This equates to a very strong 6.6% annualized growth rate. (IHS Markit Economist Dan Ryan)

- First-quarter 2021 GDP is now up 1.8% over the first quarter of 2020. This is the first year-on-year (y/y) increase since the start of the pandemic.

- In the first quarter of 2021, the expenditure component showing the largest gain was exports. This comports with monthly data that showed strong growth in the exports of manufactured goods.

- Fixed investment was another big contributor to growth. Much of this was spent to increase manufacturers' capacity and efficiency, and to some extent to improve service-sector productivity.

- Kia will work with its battery supplier SK Innovation to recycle used electric vehicle (EV) batteries to secure valuable metals and reduce waste, reports the Yonhap News Agency. The two companies will work together to process and reuse spent EV batteries in energy storage systems (ESS) or recover metals to make new batteries, which could lower manufacturing costs. (IHS Markit AutoIntelligence's Jamal Amir)

- Samsung Engineering posted a positive set of financial figures for the first quarter of 2021, with strong margins and backlog growth providing grounds for optimism for the Korean contractor. Total revenue of USD1.4 billion (KRW1.5 trillion) was registered in the first quarter of 2021, an increase of 2.8% compared to the first quarter of 2020. This was almost evenly split between the company's business segments, with the hydrocarbons segment accounting for 52% of revenue in the first quarter of 2021. The solid revenue performance of this segment is largely the result of a strong order performance in 2018 and 2019, with key projects such as the Sitra refinery in Bahrain and the Sriracha refinery in Thailand accounting for much of today's revenue. (IHS Markit Upstream Costs and Technology's William Cunningham)

- Olam Food Ingredients (OFI) is acquiring US private label spices and seasonings manufacturer Olde Thompson for USD950 million through its wholly owned subsidiary Olam Holdings Inc. Olam said this acquisition reinforces its growth strategy of being a global leader in providing sustainable, natural, value-added food and beverage ingredients and solutions. (IHS Markit Food and Agricultural Commodities' Julian Gale)

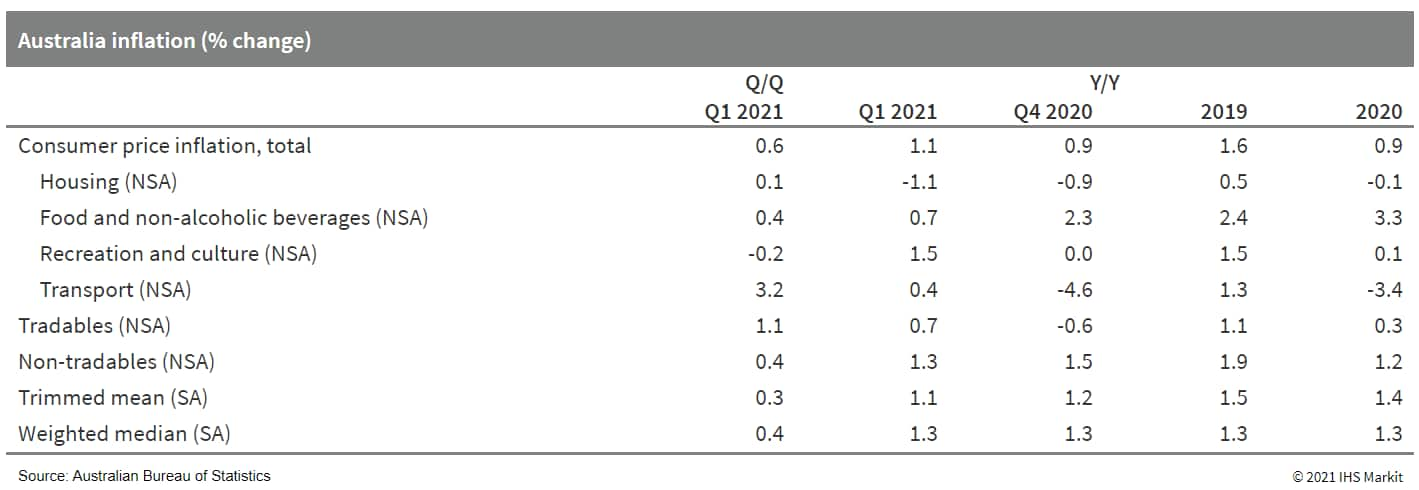

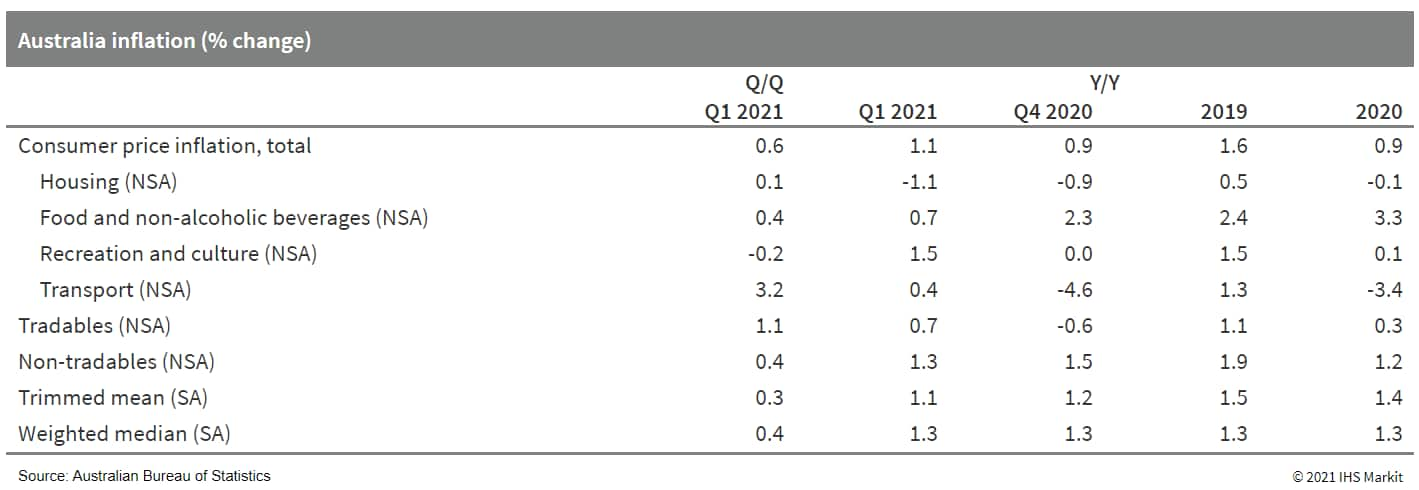

- According to the Australian Bureau of Statistics, consumer price pressures were well contained with the trimmed mean (core) inflation measure slipping to a fresh record-low of 1.1% year on year (y/y), while the weighted median measure of core inflation held steady for a second consecutive quarter at 1.3% y/y. (IHS Markit Economist Bree Neff)

- The most significant upward pressure on consumer prices during the March quarter came from tradables inflation, which was boosted by an 8.7% q/q surge in automotive fuel prices. A 7.3% q/q rise in accessories prices was also attributable to jewelers passing on high precious metal prices.

- Domestic inflation - as measured by non-tradables goods and services prices - meanwhile remained fairly weak, rising just 1.3% y/y compared with an average inflation rate of 3.0% y/y from the March quarter of 2010 through the December quarter of 2019.

- The strongest source of domestic price pressure arose from annual adjustments to the number of people eligible for government health and pharmaceutical benefits as of 1 January.

Posted 29 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.