All major European equity indices closed higher, while APAC and US markets closed mixed. US government bonds closed higher, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. Oil, natural gas, and silver closed higher, gold was flat, and the US dollar and copper closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- US equity indices closed mixed; Russell 2000 +1.5%, Nasdaq +0.7%, S&P 500 0%, and DJIA -0.4%.

- 10yr US govt bonds closed -2bp/1.23% yield and 30yr bonds -1bp/1.89% yield.

- CDX-NAIG closed -1bp/49bps and CDX-NAHY -2bps/287bps.

- DXY US dollar index closed -0.1%/92.32.

- Gold closed 0%/$1,800 per troy oz, silver +0.9%/$24.88 per troy oz, and copper -1.4%/$4.48 per pound.

- Crude oil closed +1.0%/$72.39 per barrel and natural gas closed +0.6%/$3.97 per mmbtu.

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon. There were no changes to current policy settings. The target for the federal funds rate was held at a range of 0.00-0.25%. Large-scale asset purchases (LSAPs) will continue at the rate of approximately $120 billion per month. Changes to the post-meeting statement suggest that the FOMC is getting closer to determining it will be appropriate to announce a "taper" of its LSAPs, but it made no explicit announcement of a taper in today's statement. Today's statement is consistent with our assumptions for monetary policy. (IHS Markit Economists Ken Matheny and Kathleen Navin)

- The chairman of the US Securities and Exchange Commission (SEC) said the agency will consider a "mandatory climate disclosure rule" by the year's end to respond to investors who have been clamoring for clarity on this topic for months. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- "Companies and investors alike would benefit from clear rules of the road. I believe the SEC should step in when there's this level of demand for information relevant to investors' decisions," said Gary Gensler, who made the announcement about the rulemaking at a "Climate and Global Financial Markets" webinar hosted by Principles for Responsible Investment (PRI), a United Nations affiliated group of investors that certifies companies with environment, social, and governance portfolios.

- Saying he had directed SEC staff to develop the rule requiring mandatory disclosure, Gensler noted the rule will help investors representing tens of trillions of dollars (and in increasing numbers) understand the climate risk of the companies whose financial products or debt or even stock they own or might want to buy.

- The SEC asked for public comment in late March on how it can improve the current process of reporting climate risks by public holding companies.

- For quantitative disclosures, he said companies could include information about the financial impacts of climate change, progress towards climate-related goals, and most importantly, GHG metrics such as reporting the emissions they release when they are manufacturing the product and the releases from the use of those end products.

- The US nominal goods deficit widened by $3.0 billion in June to $91.2 billion, in contrast to IHS Markit's assumption of a narrowing, while the combined inventories of wholesalers and retailers rose 0.6%. The latter was less of an increase than we had assumed. (IHS Markit Ben Herzon and Lawrence Nelson)

- The widening of the goods deficit in June reflected a modest, 0.3% gain in exports combined with a larger, 1.5% increase in imports.

- Despite the broad trade value of the US dollar having moved below its pre-pandemic trend (which would typically weigh on imports), nominal goods imports have surged well above the pre-pandemic trend. Some of this is a purely nominal phenomenon, as import prices have surged recently. But real good imports have also overshot the February 2020 level.

- The strength in imports in part reflects a pandemic-induced rotation away from services consumption toward goods consumption. We expect this rotation to reverse as consumption of services recovers.

- Nominal goods exports have also surpassed the pre-pandemic trend, likely reflecting the relatively weak dollar (relative to 2019) and elevated demand for goods in foreign markets.

- Amgen (US) has entered into an agreement to acquire privately held clinical-stage biotech TeneoBio (US) in exchange for an upfront cash payment of USD900 million, plus potential future milestone payments of up to an additional USD1.6 billion. According to a press release from the two companies, the acquisition includes TeneoBio's proprietary bi-specific and multi-specific antibody technologies, as well as TNB-585, which is a Phase I bi-specific T cell-engager for the treatment of metastatic castration-resistant prostate cancer (mCRPC), and several pre-clinical oncology pipeline assets with the potential for near-term investigational new drug (IND) filings. Prior to the close of the acquisition, three TeneoBio affiliates - TeneoTwo, TeneoFour, and TeneoTen - will be spun-off to TeneoBio's existing equity holders. The deal is expected to close in the second half of 2021 (IHS Markit Life Sciences' Milena Izmirlieva)

- Ford has announced that its upcoming Ion Park will be located in Romulus, Michigan. The "collaborative learning laboratory" will be aimed at driving high-volume battery cell delivery, better range, and lower costs. Ford is calling this a new global battery center of excellence and a new home base for researching new technologies - including helping to develop and manufacture lithium-ion and solid-state battery cells and arrays - and piloting advanced manufacturing techniques. The new laboratory will open in 2022, and accounts for USD100 million of Ford's planned USD185-million investment in developing, testing, and building vehicle battery cells and cell arrays; the USD185 million is part of Ford's USD30-billion electrification investment. (IHS Markit AutoIntelligence's Stephanie Brinley)

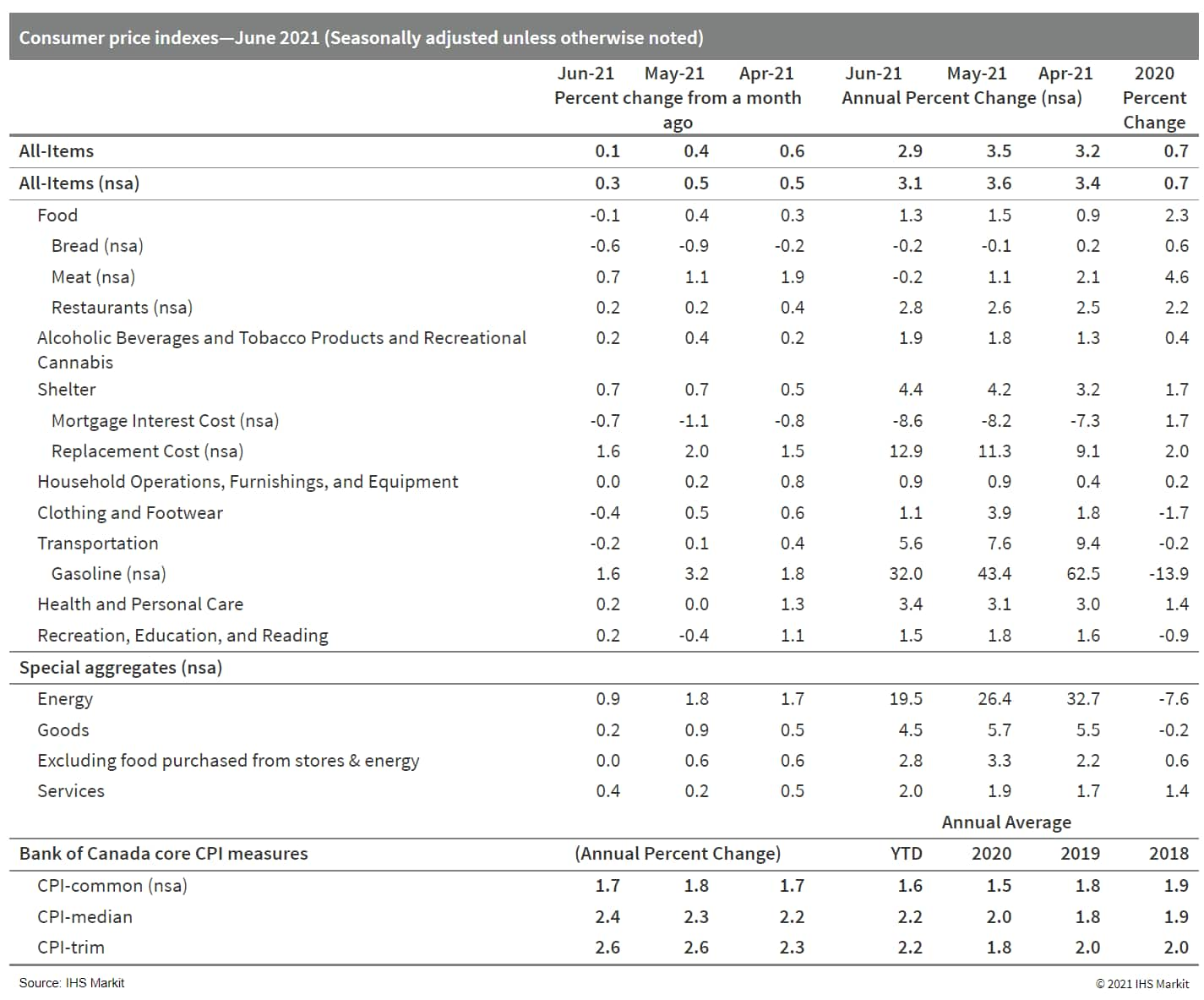

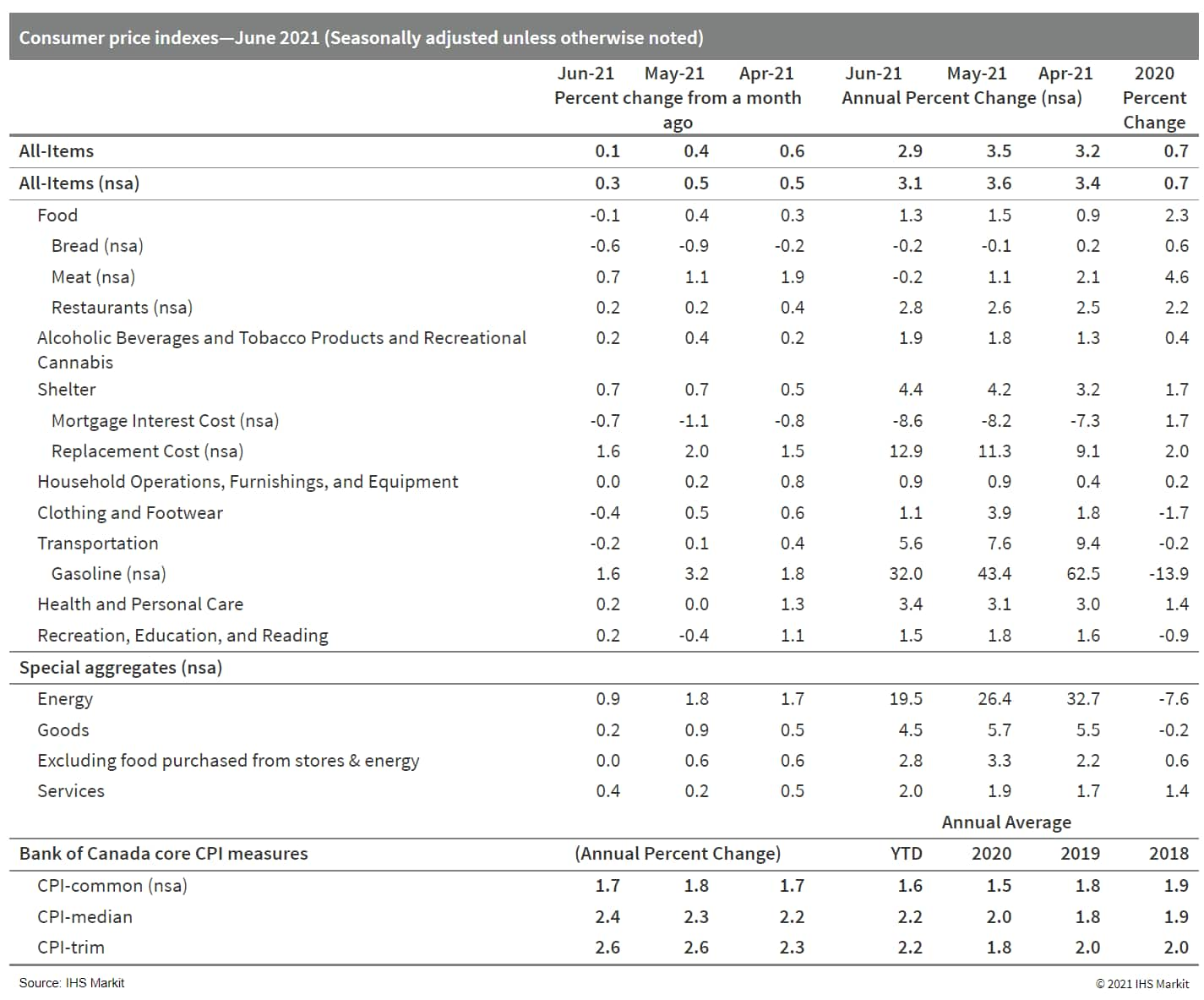

- Canada's consumer prices inflation advanced 0.1% month on month (m/m) rise on a seasonally adjusted basis (SA) and gained 0.3% m/m on a non-seasonally-adjusted basis (NSA) again. (IHS Markit Economist Arlene Kish)

- The summer annual inflation rates cooled to 2.9% year on year (y/y) SA and 3.1% y/y NSA.

- The average core inflation rate was steady at 2.2% y/y, with the consumer price index (CPI)-trim inflation rate advancing the fastest at 2.6% y/y.

- Goods price inflation eased in the month, accounting for the overall deceleration in consumer prices.

- June's inflation rate suggests that monetary policy is on the right track even if second-quarter inflation was a bit below the Bank of Canada's July Monetary Policy Report's projection.

Europe/Middle East/Africa

- All major European equity indices markets closed higher; France +1.2%, Italy +0.7%, Spain +0.4%, and Germany/UK +0.3%.

- 10yr European govt bonds closed mixed; Germany -1bp, Italy/Spain flat, France +1bp, and UK +2bps.

- European iTraxx closed -1bp/47bps and iTraxx-Xover -3bps/235bps.

- Brent crude closed +0.5%/$73.87 per barrel.

- The UK's Competition and Markets Authority (CMA) has announced that it is launching a probe into electric vehicle (EV) charging operators as part of a wider push to expand the country's charging infrastructure. In a statement, the CMA has said that following a market study relating to the sector, it has found that some areas are developing well, including the installation of locations at shopping centers, workplaces and private locations such as garages and driveways. However, it noted that other areas are facing problems, with concerns raised over the choice and availability of charge points at motorway service stations, where it said competition is limited. Furthermore, it said that on-street charger rollout by local authorities is too slow, while rural areas "risk being left behind with too few charge points due to lack of investment." The CMA has also highlighted that charging can sometimes be "difficult and frustrating" for drivers, which could stop customers switching from internal combustion engine (ICE) vehicles. These include concerns over reliability, and differences in pricing and payment methods. The CMA added that it has now launched "a competition law investigation into long-term exclusive arrangements between the Electric Highway - a ChargePoint provider - and three motorway service operators - MOTO, Roadchef and Extra". (IHS Markit AutoIntelligence's Ian Fletcher)

- Floventis Energy, a newly established joint venture between SBM Offshore and Cierco, has been granted seabed rights for an offshore wind project in the Celtic Sea subject to a Habitats Regulations Assessment (HRA). SBM Offshore said that the Crown Estate has confirmed its intention to move forward with the lease process for two 100MW floating wind test and demonstration sites in the UK Celtic Sea to Llyr Floating Wind. The formal award for the Llyr project is subject to a HRA assessment, and further environmental assessments and surveys in line with the regulatory consent processes. Floventis Energy is a joint venture with Cierco which will aim to secure seabed rights and relevant permits before developing floating offshore wind projects. (IHS Markit Upstream Costs and Technology's Kelvin Sam)

- German firm BioNTech has announced the launch of a major project for the development of an mRNA-based malaria vaccine for sustainable supply to Africa in particular. The company is aiming to generate a well-tolerated vaccine with high protective effectiveness, and intends to implement sustainable supply strategies across Africa, in collaboration with the World Health Organization (WHO) and the Africa Centres for Disease Control and Prevention (Africa CDC). The project is being undertaken as part of the "eradicateMalaria" initiative co-ordinated by the non-profit kENUP Foundation. BioNTech plans to assess multiple vaccine candidates featuring established malaria targets such as the Plasmodium circumsporozoite protein (CSP), together with novel antigens from preclinical discovery investigations. This will be followed by selection of the most promising mRNA vaccine candidates for clinical trials, with entry of the first candidate into trials anticipated by the end of 2022. In parallel, BioNTech is planning to set up advanced mRNA manufacturing facilities, either alone or in collaboration with partners, for sustainable supply of mRNA vaccines to Africa. (IHS Markit Life Sciences' Janet Beal)

- A consortium led by Volkswagen (VW) is in advanced talks to buy French car rental company Europcar. The deal is expected to value Europcar's equity at around EUR2.5 billion (USD3 billion), reports Reuters. Europcar confirmed that it was discussing a potential offer of around EUR0.50 per share and had turned down an earlier proposal from the automaker and investors Attestor and Pon Holdings to acquire the company for EUR0.44 a share. According to the report, if acceptance levels reach a particular threshold then the price might evolve or include sweetener conditions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Free2Move eSolutions has partnered with Leasys to launch a free charging project, according to a company statement. Under this partnership, the rental fee of all electric and hybrid cars rented with Noleggio Chiaro, a flagship product in the Leasys portfolio, will include an easyWallbox, which is an easy-to-use plug-and-play charging unit. Free2Move eSolutions is a new e-mobility joint venture (JV) between Stellantis and Engie EPS formed in April. The JV aims to support the transition to electric mobility by offering a range of services including installation of charging infrastructures, public and home charging subscriptions with monthly fee, battery lifecycle management, and advanced energy services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- France's consumer confidence index has declined modestly in July. The headline index now stands at 101, down from 103 in June. June's reading had been the highest since March 2020. Despite its decline in July, the index remains above its long-term average of 100. (IHS Markit Economist Diego Iscaro)

- The modest decline in sentiment in July is likely to have been triggered by the increase in COVID-19 cases since the start of the month. The increase in cases has prompted the authorities to introduce mandatory vaccinations for all healthcare workers, while residents in France will be required to provide a "health pass" to enter shops and hospitality venues and to undertake long-distance train journeys.

- The forward-looking indicators in the consumer confidence survey have deteriorated somewhat in July, although they remain at healthy levels. In particular, households are less upbeat about the economic outlook and their personal financial situation compared with June.

- The number of households willing to make a major purchase over the coming year has declined compared with June, but remains above its long-term average. Similarly, the number of respondents expecting an increase in unemployment, which had collapsed in June, has increased somewhat in July.

- Households' concerns about inflation have also increased in July, with the indices measuring past and expected future increases in prices rising.

- The Bank of Spain estimates that real GDP grew by 2.2% q/q in the second quarter. This baseline assessment assumes a gradual reduction in the excess household saving accumulated during the peak of the pandemic. (IHS Markit Economist Raj Badiani)

- This was preceded by the economy slipping back by 0.3% q/q in the first quarter and stagnating in the final three months of 2020.

- The central bank estimates the return to growth in the second quarter was primarily due to reviving household spending in line with improving confidence prompted by a significant removal of the pandemic-containment measures (especially following the end of the state of alert on 9 May) and an increasingly effective vaccination campaign.

- In addition, growth benefited from improving Spanish exports in line with the recovery in demand from the advanced economies as a whole and from China.

- The Czech government has approved a memorandum of understanding (MoU) between itself and the state-owned energy company CEZ to build an electric vehicle (EV) cell producing 'Gigafactory', according to a CTK news agency report. Industry and Trade Minister Karel Havilcek said that the MoU is for a factory with investment of CZK50 billion (USD228 million) invested that will create at least 2,300 jobs. The MoU was signed between Havilcek and the CEO of CEZ head Daniel Banes. (IHS Markit AutoIntelligence's Tim Urquhart)

- Dubai-based Udrive, an app-based pay-per-minute car rental service, has announced the completion of a fundraising round worth USD5 million, reports the Khaleej Times. The investment round was led by prominent regional business leaders and three venture capitalists, bringing the post-round valuation of the company to USD20 million. Udrive plans to use the infused capital to enhance the data analytics capabilities of its platform, with a focus on improving user experience. Udrive was founded as a traditional car rental company, Aimex Rent A Car, and was rebranded as Udrive, a by-the-minute rental model, in 2016. Udrive aims to double its fleet over the next three months as it prepares to host an influx of visitors to the Expo 2020 Dubai world fair in October. The company has also set a 500% revenue growth target over the next 12 months. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Dubai-based Swvl Inc., a ride-sharing technology startup, is reportedly nearing a merger deal with a special-purpose acquisition company (SPAC) to go public. Swvl plans to merge with Queen's Gambit Growth Capital in a deal that would value the combined company at USD1.5 billion, reports the Wall Street Journal. Other investors, including Agility, Luxor Capital Group LP, and Zain Group, a mobile voice and data service operator in the Middle East and Africa, plan to invest an additional USD100 million through private investment in public equity (PIPE), associated with the deal. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Central Bank of Nigeria's (CBN)'s Monetary Policy Committee (MPC) unanimously voted to keep the monetary policy rate (MPR) unchanged at 11.5% during its July meeting, which stretched from 26 to 27 July. The asymmetric corridor of +100/-700 basis points around the MPR was also left unchanged. (IHS Markit Economist Thea Fourie)

- The Nigerian economy grew by 0.51% year on year (y/y) during the first quarter. Initial estimates suggest that the GDP recovery will continue during the second quarter albeit at a slow pace.

- The manufacturing purchasing managers' index (PMI) compiled by the Nigeria National Bureau of Statistics (NBS) edged up to a reading of 46.6 in July from 45.5 in June, while the non-manufacturing PMI improved to 44.8 in June from 43.0. Both PMI indicators remain below the 50-neutral level, nonetheless.

- Headline inflation remains well above the CBN's inflation objective of 6%-9% but has been edging down in recent months. A drop in both food and core inflation supports the unchanged MPR decision: food and core inflation slowed to 21.7% y/y and 13.1% y/y in June from 22.3% y/y and 13.2% y/y in May, respectively.

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +1.5%, South Korea +0.1%, India -0.3%, Mainland China -0.6%, Australia -0.7%, and Japan -1.4%.

- New regulations restricting after-school tutoring services may force restructuring of the booming education industry and potentially trigger risk-off sentiment for capital investment in this highly profitable service sector. (IHS Markit Economist Yating Xu)

- The Chinese State Council and the Central Committee of the Communist Party of China issued a document on 20 July detailing restrictions on after-school tutoring services.

- According to the document, after-school training companies will be prohibited from providing overseas educational classes or classes that go beyond the standard school curriculum. Meanwhile, foreign investors will not be allowed to invest in the sector via mergers and acquisitions, franchising, or variable interest entity arrangements.

- The State Council document was a response to the requirements detailed at the "Two Sessions" meeting to reduce students' homework burden. In line with Chinese President Xi Jinping's vow to protect children's physical and mental health, this issue was on the agenda of China's 2021 annual legislative and political meetings. An official from China's Ministry of Education also stated in March that the government would be increasing scrutiny over after-school tutoring institutions and will investigate and punish those engaging in illegal training activities.

- GAC Aion, a wholly owned subsidiary of GAC Group's new energy vehicle (NEV) business, will integrate RoboSense's second-generation solid-state LiDAR into its autonomous system ADiGO, reports Gasgoo. RoboSense said that this LiDAR is based on a two-dimensional MEMS chip scanning architecture that help improve its perception capabilities. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicles (EVs) accounted for 1.3% of total new car, taxi, and bus registrations in Singapore during the first half of 2021, up from 0.3% in the whole of 2020, reports the Business Times. The number of new EVs registered in the country grew from 139 in the whole of last year to around 340 in just the first six months of 2021. About 60 electric buses will be deployed this year, boosting EV adoption in Singapore, according to Transport Minister S Iswaran. The growth in EV sales has come on the back of incentives announced by the Singaporean government to make alternative-powertrain vehicles more attractive and encourage their adoption by narrowing the upfront cost gap between such vehicles and their internal combustion engine (ICE) equivalents. (IHS Markit AutoIntelligence's Jamal Amir)

- The Philippines' government recorded a higher fiscal deficit during the first six months of 2021, amounting to PHP716.1 billion (USD14.2 billion), which marked a 27.8% increase from PHP560.4 billion during the same period last year. It was attributed to a 9.6% year-on-year (y/y) expansion in government spending that outpaced a 2.5% y/y gain in government revenue during January-June. (IHS Markit Economist Ling-Wei Chung)

- Despite the increase, the fiscal shortfall came below the government's projection of PHP1,018 billion during the first six months of 2021 as fiscal spending was 9.6% short of the government's target but revenue came 4.8% higher than the target.

- In June, the budget deficit totaled PHP149.9 billion, narrowing from a deficit of PHP200.3 billion in May but reversing a surplus of PHP1.8 billion posted during the same month last year. June's deficit was prompted by climbing government expenditure and plunging revenues.

- Total spending jumped 13.2% y/y to PHP395.4 billion, which was attributed to the disbursements of the infrastructure program and capital outlay projects. Within that, primary spending (excluding interest payments) - accounting for 92% of total spending - climbed 13.6% y/y, while interest payments expanded 8.6% y/y in June.

- Government revenue slumped 30% y/y in June to PHP245.6 billion, reversing a 69.3% y/y surge in May. The drop in June was attributed to a 34.6% y/y plunge in tax revenue, which accounted for 87% of total revenue collection in June. In 2020, the deadline for income tax filing and payments was extended to June from April because of the considerations of virus containment measures, which created a higher comparison base for 2021.

Posted 28 July 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.