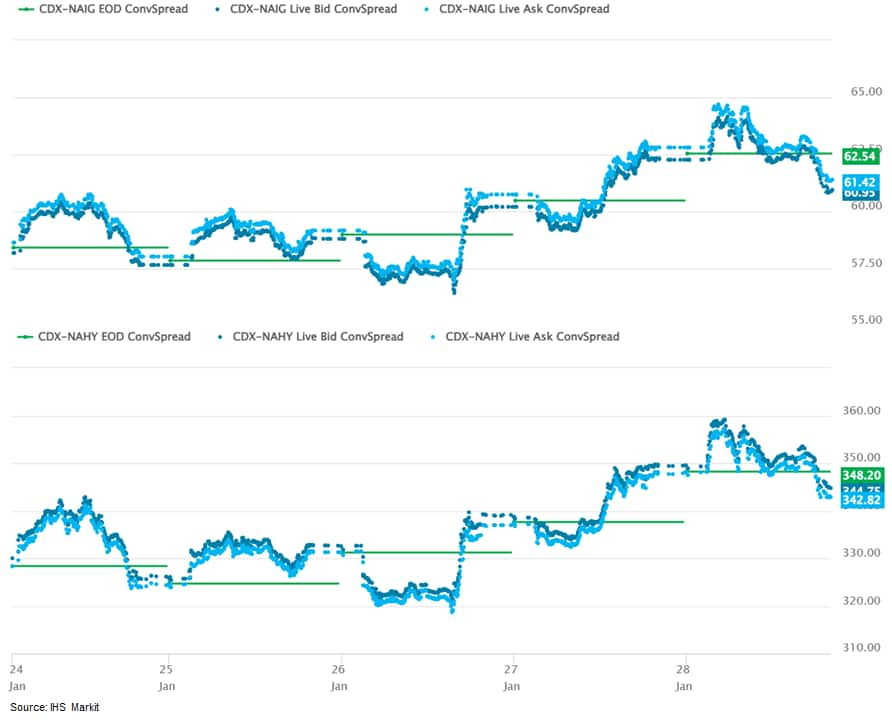

All major US equity indices closed higher, APAC markets were mixed, and all major European indices closed lower. US government bonds closed higher, while most benchmark European bonds were lower on the day. CDX-NA closed tighter across IG and high yield, while European iTraxx was wider on the day. Natural gas and oil closed higher, the US dollar was flat, and gold, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed sharply higher; Nasdaq +3.1%, S&P 500 +2.4%, Russell 2000 +1.9%, and DJIA +1.7%.

- 10yr US govt bonds closed -3bps/1.77% yield and 30yr bonds -2bps/2.08% yield.

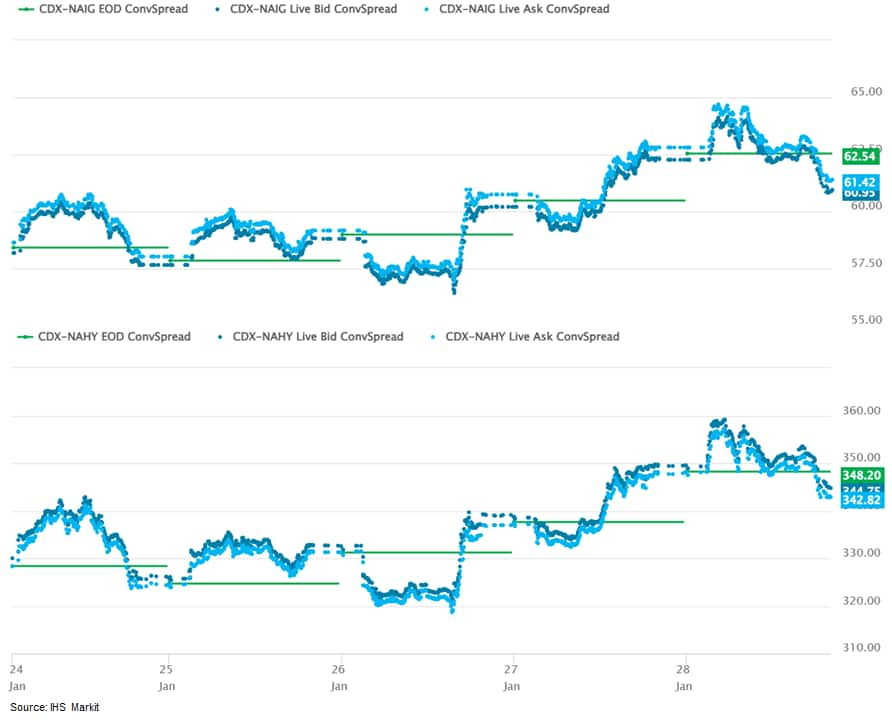

- CDX-NAIG closed -2bp/61bps and CDX-NAHY -4bps/344bps, which is +3bps and +16bps week-over-week, respectively.

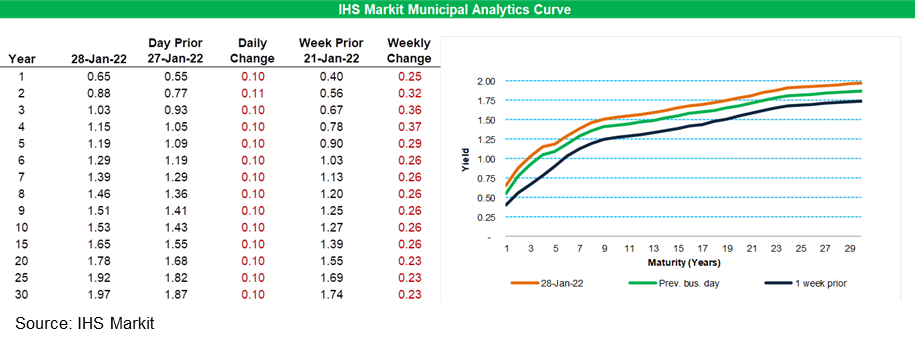

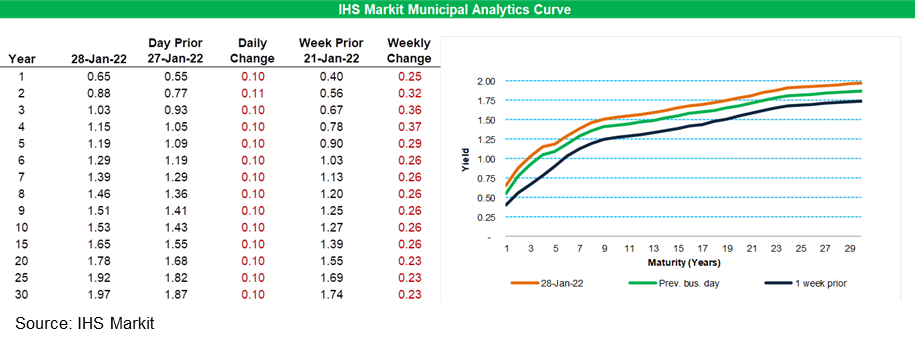

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) sold-off 10bps across the entire curve, with the curve 23-37bps worse week-over-week.

- DXY US dollar index closed flat/97.27.

- Gold closed -0.5%/$1,787 per troy oz, silver -1.7%/$22.30 per troy oz, and copper -2.6%/$4.31 per pound.

- Crude oil closed +0.2%/$86.82 per barrel and natural gas closed +8.3%/$4.64 per mmbtu.

- US real personal consumption expenditures (PCE) declined 1.0% in December as real PCE for goods declined 3.1% and real PCE for services rose 0.1%. The decline in goods PCE reflects a pullback in spending following early holiday shopping as well as an ongoing adjustment of spending patterns back toward pre-pandemic norms. The small increase in real PCE for services, meanwhile, leaves it still below its pre-pandemic trend. (IHS Markit Economists Kathleen Navin and Gordon Greer III)

- The weakness in real PCE for goods was broad based, with notable declines in furnishings and durable household equipment (-6.2%), recreational goods and vehicles (-4.9%), and clothing and footwear (-6.2%).

- Although overall spending on services edged higher in December, virus-sensitive categories such as food services declined, suggesting growing concerns related to the spread of the Omicron variant began to play a role in the December data.

- Personal income increased 0.3% in December, and the personal saving rate rose 0.7 percentage point to 7.9%. Real disposable personal income decreased 0.2% amid higher consumer prices. Wage and salary income increased 0.7% in December and has essentially recovered to its pre-pandemic trend, up 13.4% over the last two years.

- The PCE price index increased 0.4% in December and its 12-month change was 5.8%. Excluding food and energy, the core PCE price index rose 0.5% in December and 4.9% over 12 months.

- The pandemic and elevated inflation remain headwinds for household spending, but personal income growth rooted in strongly rising wages is expected to support faster expansion in PCE in coming months.

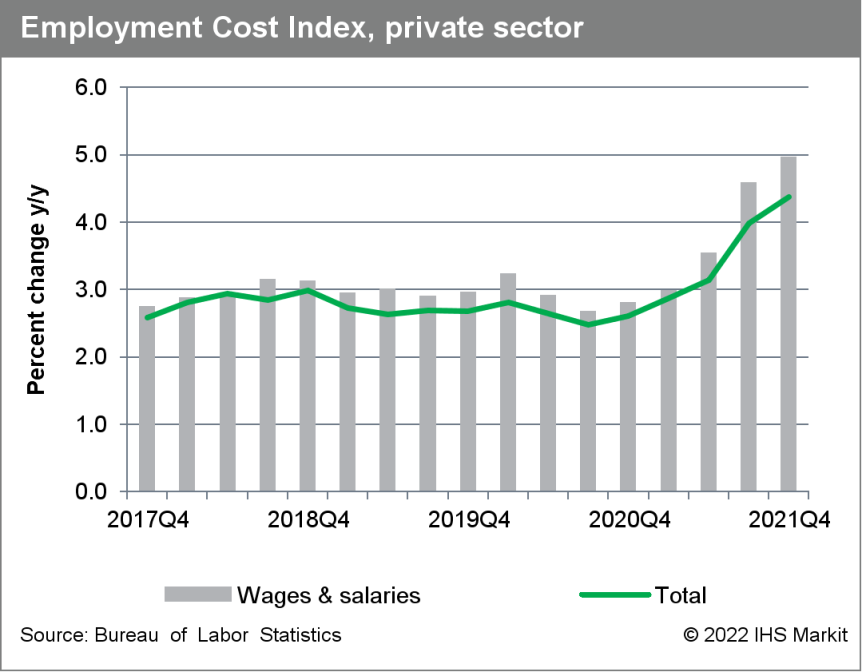

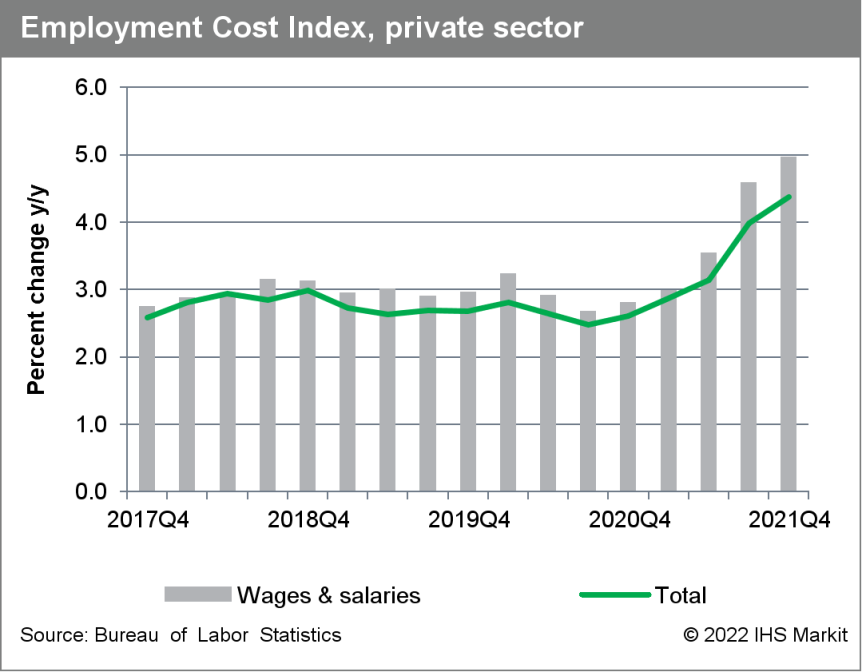

- The US Employment Cost Index (ECI) increased 1.0% in the three months ending in December 2021 (the sample is from monthly payroll records that include 12 December). (IHS Markit Economist Patrick Newport)

- Year-over-year (y/y) growth moved from 3.7% in September to 4.0% in December.

- Wages and salaries (about 70% of compensation costs) rose 1.1% for the three-month period and 4.5% y/y; benefits (about 30% of compensation) increased 0.9% for the three-month period and 2.8% y/y.

- Private industry compensation grew 4.4% y/y; wages and salaries (about 70% of compensation costs) rose 5.0%, and benefits (about 30% of compensation) climbed 2.9%.

- State and local government compensation increased 2.6% y/y; for this sector, wages and salaries (about 62% of compensation costs) rose 2.7%, and benefits (about 38% of compensation) increased 2.5%.

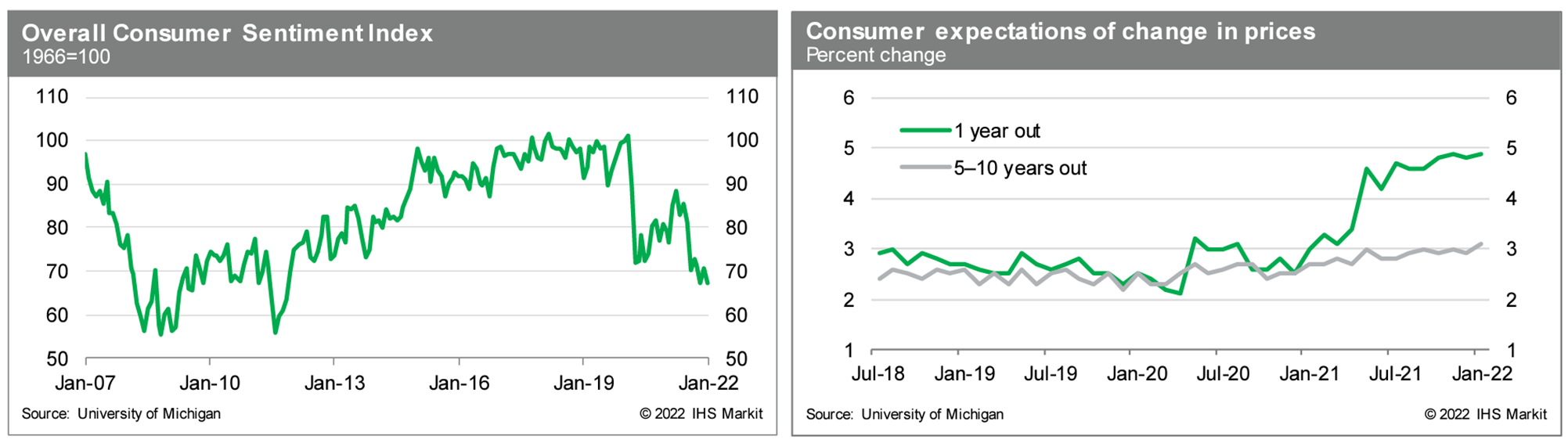

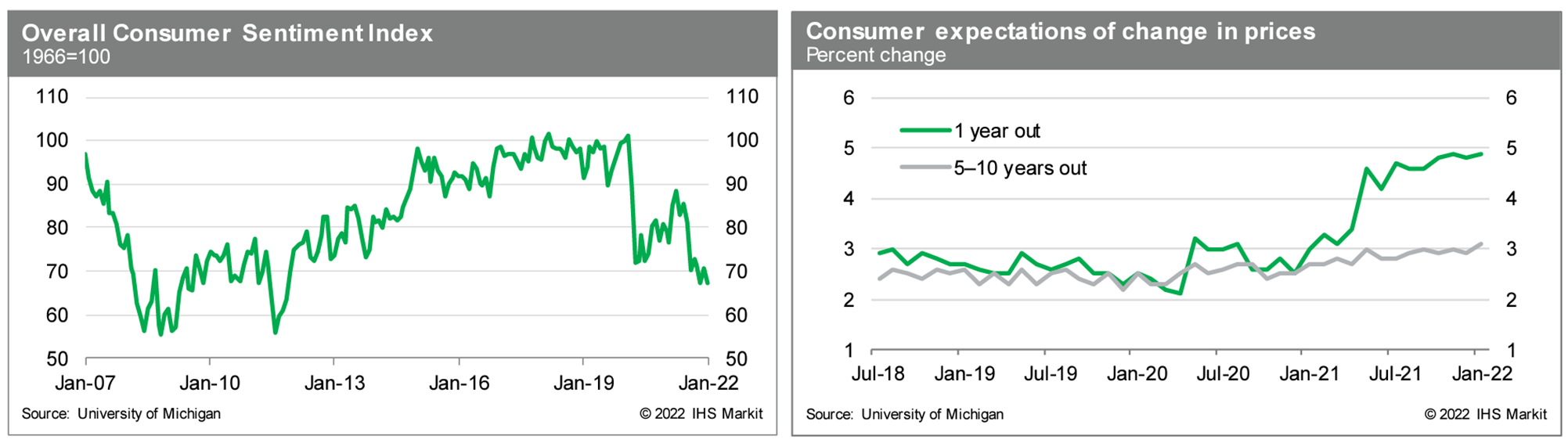

- The US University of Michigan Consumer Sentiment Index fell 3.4 points to 67.2 in the final January reading—slumping to its lowest level since November 2011. (IHS Markit Economists Akshat Goel and William Magee)

- A combination of falling stock prices, low confidence in government economic policies, and heightened geopolitical risks in addition to the existing themes of the Omicron variant and rising prices has created the perfect storm for consumer sentiment—sentiment is down 23.9% since April 2021.

- While there are myriad factors pulling down sentiment, escalating inflation appears to be the foremost source of drag. At 7.0%, the 12-month increase in the consumer price index (CPI) in December was the highest in nearly four decades. The median expected one-year inflation rate in the University of Michigan survey edged up 0.1 percentage point to 4.9%, its highest level since 2008.

- Households earning below $100,000 per year were most affected by higher consumer prices—the index of sentiment for these households declined 7.7 points, while that for households earning over $100,000 per year rose 1.3 points.

- The index of buying conditions for automobiles fell by 12.0 points in January as high prices and limited inventories continue to be a drag on buying sentiment. The price of new vehicles is up 12.3% since March while used car prices are up 39.0% since March.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the IHS Markit expectation for solid job and wage growth in the coming months, which should continue to support ongoing growth of consumer spending. Sentiment will track spending more closely as inflation subsides, although these may not align until next year.

- A US House of Representatives' panel is to hold a hearing on 2 February on autonomous vehicles (AVs), reports Reuters. The House Transportation and Infrastructure Committee's subcommittee on highways and transit said the hearing, entitled 'The Road Ahead for Automated Vehicles', is to include experts, labour leaders, and industry representatives. The president of the Transport Workers Union of America, John Samuelsen, and the head of safety at AV startup Aurora Innovation, Nat Beuse, are to be present at the hearing. Representatives of the Teamsters union and the Autonomous Vehicle Industry Association (AVIA), a coalition of companies such as Ford Motor, Lyft, Uber Technologies, and Waymo, are also to testify. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Environmental Defense Fund (EDF) joined other groups on January 27 in petitioning FDA to rescind the use of bisphenol-A (BPA) for adhesives and coatings and strictly limit migration on substances that contact food. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- Spurred by new findings from the European Food Safety Authority (EFSA), the groups say harmful effects from BPA exposure can occur at levels 100,000 times lower than previously thought.

- The groups based their petition on studies of dietary BPA exposure published since 2013 and released December 15, 2021 by a 17-member expert panel convened by EFSA. That panel unanimously concluded "there is a health concern from dietary BPA exposure for all age groups."

- The EFSA panel established a new tolerable daily intake (TDI) of 0.04 nanograms of BPA per kilogram of body weight per day (ng/kg bw/d) and identified the immune system as the "most sensitive health outcome category to BPA exposure," the petition says.

- "Using FDA's own exposure estimates, the average American is exposed to more than 5,000 times the safe level of 0.04 ng BPA/kg bw/day set by the EFSA Expert Panel," the groups say in the new petition. "Without a doubt, these values constitute a high health risk and support the conclusion that uses of BPA are not safe according to 21 CFR § 170.3(i)."

- Used in food packaging since the 1960s, BPA is a structural component in polycarbonate beverage bottles and metal can coatings, which protect the food from directly contacting metal surfaces. BPA is found in epoxy resins, which act as a protective lining on the inside of some metal-based food and beverage cans.

- In 2014, FDA took a new look at BPA, which involved a four-year review of more than 300 scientific studies and concluded the findings did not warrant a change in FDA's safety assessment of BPA in food packaging. In 2013, however, in response to food additive petitions, the agency opted to no longer allow the use of BPA-based materials in baby bottles, sippy cups, and infant formula packaging.

- On January 27, Naturgy Candela Devco LLC notified the Public Utilities Commission of Nevada that it has just applied with the US Bureau of Land Management (BLM) for approval of the up-to-2,250-MW (ac) Chill Sun Solar Project. This project would consist of the photovoltaic solar facility, a battery energy storage system, a 525-kV generation-tie line and associated facilities to be located in Nye County, Nevada. The company said it will apply with the Commission for a permit or permits on this project once it clears BLM's environmental review process. The project site is located on BLM-managed land about 14 miles north of the town of Beatty in Nye County. The notice doesn't give a size for the battery storage facility. The project is, at this point, due to go into service as of September 30, 2027. This has been a busy month for the Commission in terms of such notices. On January 3, these three notices were also lodged (IHS Markit PointLogic's Barry Cassell):

- Bonnie Clare Solar LLC - It has applied with BLM for approval to construct the Bonnie Clare Solar Project, consisting of a 1,500-MW photovoltaic facility, a battery energy storage system, a 230-kV generation-tie line and associated facilities in Nye County, Nevada.

- Orken Solar LLC - It applied with BLM for approval to construct the Orken Solar Project, consisting of a 1,500-MW photovoltaic facility, a battery energy storage system, a 230-kV generation-tie line and associated facilities in Nye County, Nevada.

- American Glory Solar LLC - It is seeking BLM approval for the American Glory Solar Project, consisting of a 1,500-MW photovoltaic solar facility, a battery energy storage system, a 230-kV generation-tie line and associated facilities in Esmeralda County, Nevada.

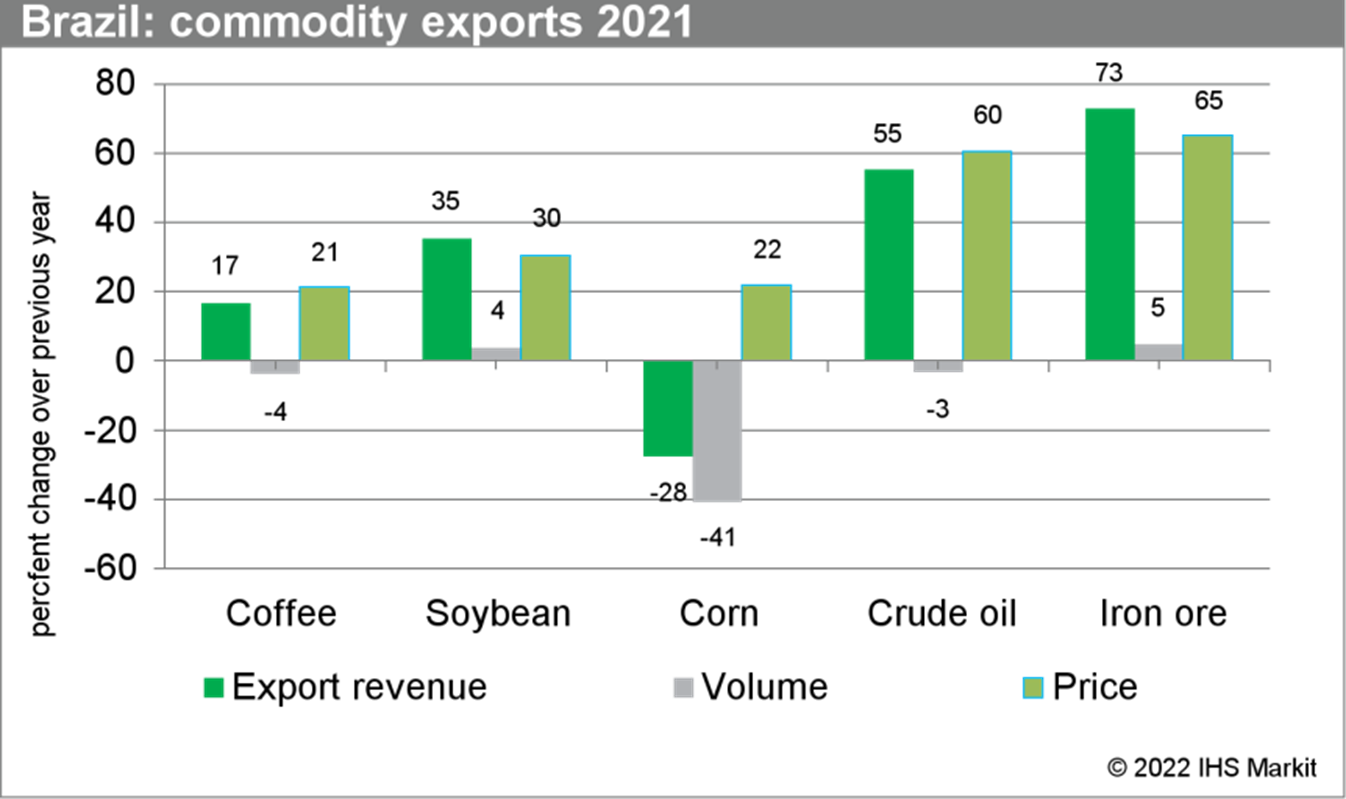

- The Central Bank of Brazil (Banco Central do Brasil) reported that the current-account deficit of the balance of payments, the widest measure of an external balance, amounted to USD28 billion in 2021, wider than the USD24 billion gap posted a year earlier. Nevertheless, it does not represent an increase in external vulnerability as the deficit was fully financed by foreign direct investment. (IHS Markit Economist Rafael Amiel)

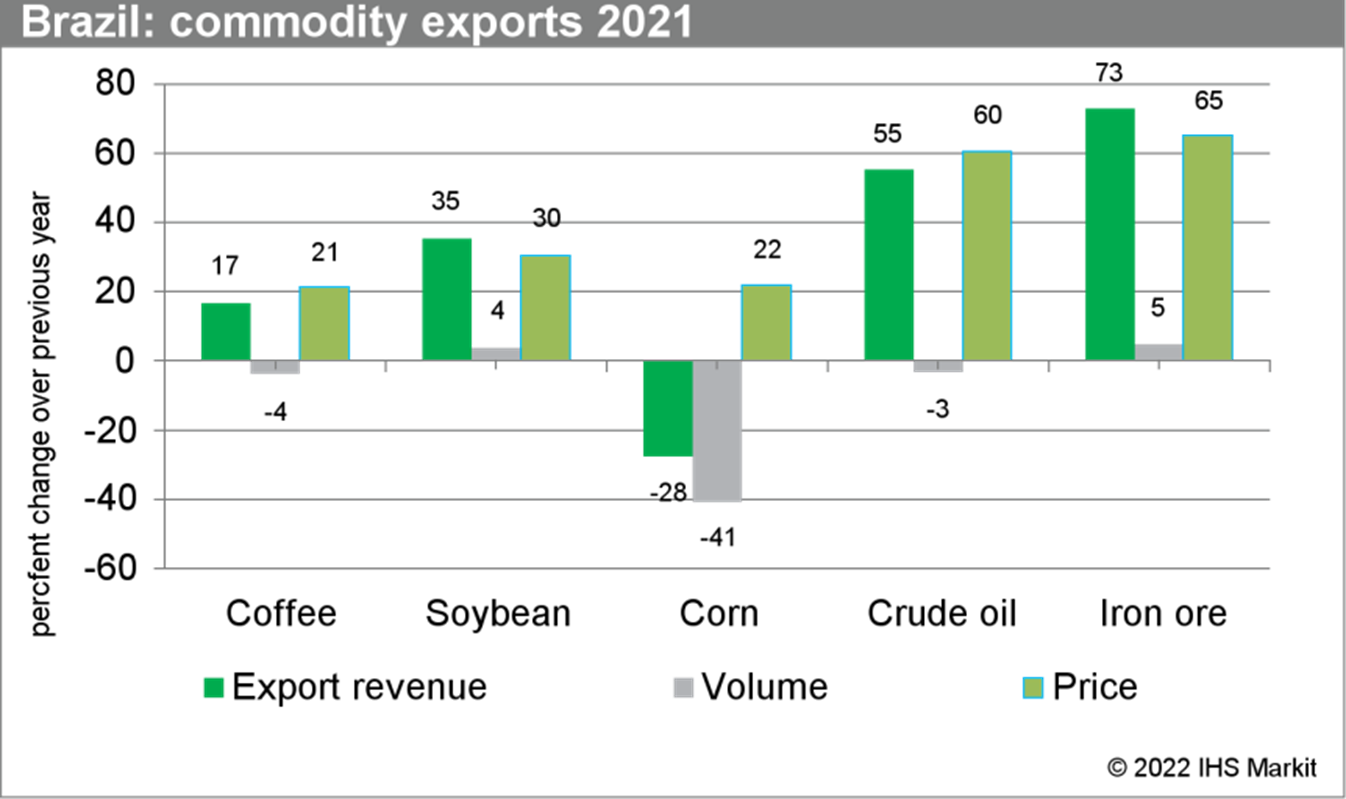

- The trade surplus increased, pushed by favorable commodity prices and also higher volume exported for some goods such as iron ore and soybeans; the latter increased despite a difficult year for Brazil's agriculture because of adverse weather. Prices of commodities skyrocketed in international markets and significantly benefited Brazil's external accounts. Soybeans, iron ore, and crude oil account for over 40% of Brazil's export revenue.

- The higher trade surplus, coupled with a narrower deficit in the service account (see table below), was not enough to offset a wider primary income deficit that was driven by increased repatriation of profits and dividends by foreign firms.

- As in previous years, the current-account deficit was covered by foreign direct investment; net portfolio investment was also positive.

- Another favorable development for Brazil's external accounts was the allocation by the International Monetary Fund of special drawing rights in an amount equivalent to USD15 billion, registered under other investments.

- Chinese automaker Great Wall Motors has announced plans to invest BRL10 billion (USD1.8 billion) in its Iracemapolis manufacturing facility in Brazil, reports Automotive Business Brazil. The plans include an investment of BRL4 billion from 2023 to 2025 and the remainder over an indefinite period, according to the report. By 2025, Great Wall aims to achieve a 60% localization rate of its vehicles produced in Brazil, and an annual production capacity of 100,000 vehicles per year. However, company executives say that is the optimistic scenario, which suggests actual output could be more modest in the first years of the plan, the report states. Great Wall reportedly confirmed that, of the vehicles produced under the plan, some would be sold in Brazil and some exported to other Latin American countries. In addition, Great Wall plans to build electric and hybrid vehicles, as well as ICE vehicles, in Brazil. Great Wall purchased the Brazilian facility from Daimler, with this latest report providing further details of the company's plans, but largely confirming elements of the investment plan already reported. Although the facility could have a production capacity of 100,000 units per year, IHS Markit forecasts output to be more modest through 2030, at less than 20,000 units in most years. The facility was a Mercedes-Benz plant, building the GLA and C-Class from 2016 to 2020, with output peaking in 2017 at 8,432 units. IHS Markit forecasts that Great Wall will offer its Haval H2, Ora Haomao, and Poer Pao II in Brazil in 2023, adding the Tank300 in 2024, including some imported units. IHS Markit forecasts Great Wall's Brazilian sales to reach 14,300 units in 2024. (IHS Markit AutoIntelligence's Stephanie Brinley)

- All the members of the Central Bank of Chile (Banco Central de Chile: BCC)'s board during a meeting on 26 January agreed to raise the monetary policy rate aggressively again, this time by 150 basis points, amounting to a total of 500 basis points in increases in six months. More monetary policy tightening is expected in 2022. (IHS Markit Economist Claudia Wehbe)

- Chile's consumer prices gained by 0.8% in December 2021, accelerating from 0.5% month on month (m/m) in the prior month. The result was mainly driven by rising prices in transportation and food and non-alcoholic beverages.

- Annual inflation closed December 2021 by reaching a 13-year high of 7.2%, up from 6.7% in November 2021. Meanwhile, core consumer price inflation that excludes volatile components - food and energy prices - closed the year at 5.2%, up from 4.7%. Inflation of volatile components closed December 2021 by spiking at 10.9%, up from 10.5% year on year (y/y) in the prior month.

- Chile's unadjusted monthly economic activity indicator, a proxy for GDP, decelerated modestly to 14.3% y/y in November 2021, from 15.0% y/y during October 2021, posting another historical record. The result was mainly driven by contributions in services

- Bolivia's real GDP expanded by 8.0% year on year (y/y) in the third quarter of 2021, according to Bolivia's National Institute of Statistics (Instituto Nacional de Estadística: INE). The annual growth rate was influenced by the low statistical base in third-quarter 2020, when economic reopening was just beginning. IHS Markit calculates a seasonally adjusted quarterly growth rate of 1.0%. (IHS Markit Economist Jeremy Smith)

- Private consumption made the largest contribution to third-quarter growth, explained mainly by continued progress on COVID-19 vaccination and the gradual relaxation of restrictions on economic activity, helping to reactivate the service sector.

- President Luis Arce announced on 22 January that the country had recorded 6% real GDP growth for full-year 2021, which, if confirmed by the INE, would be consistent with IHS Markit estimates for the fourth quarter.

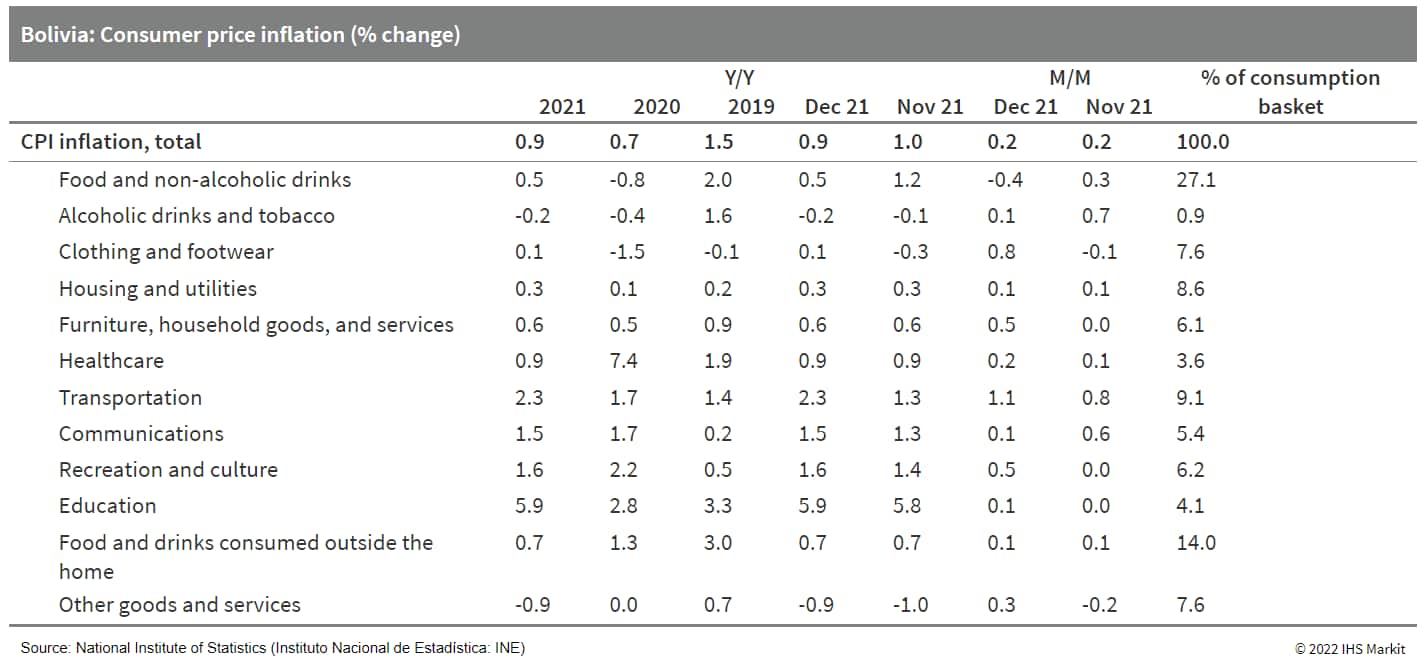

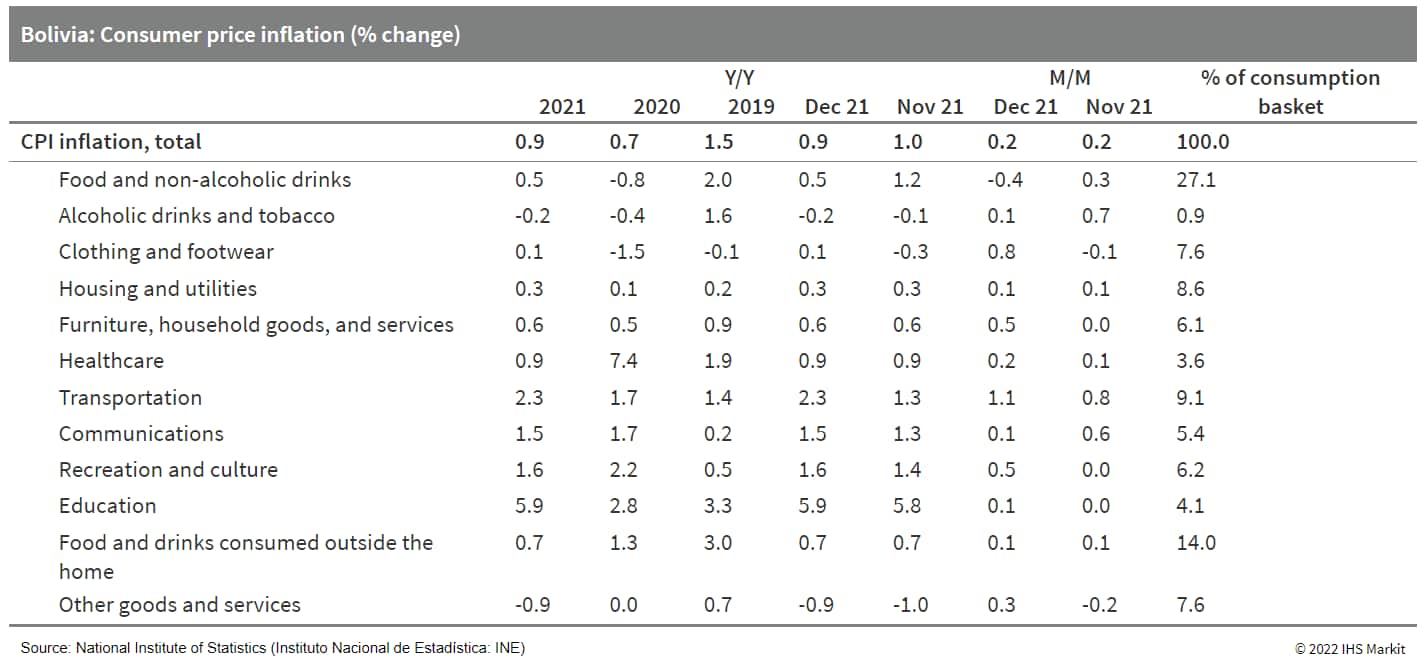

- Full-year consumer price inflation was just 0.9% in 2021, standing in marked contrast to the regional and global trends.

- Weak demand, a stable exchange rate, and large fuel subsidies largely insulated Bolivian consumers from inflationary pressures in 2021. Food prices, the largest component of the consumer basket, increased just 0.5% despite a 25% increase in the United Nations Food and Agriculture Organization (FAO) Food Price Index, which measures international price movements for major food commodities.

Europe/Middle East/Africa

- All major European equity markets closed lower; France -0.8%, Spain -1.1%, UK -1.2%, Italy -1.2%, and Germany -1.3%.

- Most 10yr European govt bonds closed lower except for Italy -1bp; Germany +1bp, France/UK +2bps, and Spain +3bps.

- iTraxx-Europe closed +1bp/59bps and iTraxx-Xover +6bps/286bps, which is +4bps and +17bps week-over-week, respectively.

- Lotus has announced that it has signed a memorandum of understanding (MOU) with UK-based battery manufacturing startup Britishvolt on research and development (R&D) related to new electric vehicle (EV) technology. According to a statement, the pair plan "the co-development of an innovative new battery cell package to power the next generation of electric sports cars from Lotus". The managing director of Lotus Cars, Matt Windle, said, "Lotus is delighted to be collaborating with Britishvolt to develop new battery cell technology to showcase the thrilling performance that a Lotus EV sports car can deliver. These are the first exciting steps on the journey towards an all-new electric sports car from Lotus, and yet another step towards the transformation towards sustainable, renewable electricity stored in batteries." (IHS Markit AutoIntelligence's Ian Fletcher)

- Bentley has announced that it plans to launch five battery electric vehicles (BEVs) by 2030. The automaker said in a statement that under this "Five-in-Five plan", it will launch a vehicle each year between 2025 and 2030, all of which will be designed, developed and built at its facility in Crewe (UK). During a press conference, it was noted that the first BEV to be launched would be a white-space product in late 2025. This will then be followed by electric replacements for its current line-up: the Bentayga, Continental GT, Continental GTC and Flying Spur. These new BEVs will be supported by GBP2.5 billion of "sustainable investment" into the business which will take place over the next 10 years. This will underpin the "complete transformation of Bentley's entire product portfolio, and the historic Crewe Campus by embedding an industry-leading greenfield facility into a world-leading, next generation digital, low environmental impact, high-value advanced manufacturing facility." (IHS Markit AutoIntelligence's Ian Fletcher)

- Following the receipt of a United Kingdom Department of Business, Energy and Industrial Strategy (BEIS) GBP750,000 (USD1.0 million) grant for its articulated wind column demonstrator project, AWC Technology has appointed partner Offshore Design Engineering (ODE) to oversee the concept and pre-FEED works. The project will further develop the Articulated Wind Column (AWC) design, which the company claims in suitable for wind turbines in water depths of between 80 to 250 meters. The AWC design consists of a ballasted buoyant vertical column with an articulated joint at the base, and was originally developed by Marine Engineering Energy Solution Limited (MEES) and DORIS Engineering (DORIS) for the Maureen offshore oil field in the North Sea.The design has been selected by developer Enterprize Energy for its 3.2 GW Urban Sea project offshore Ireland and may be under consideration for its 3.4 GW Thang Long offshore wind farm project in Vietnam. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The eurozone economic sentiment indicator (ESI) has declined for the third successive month in January, by just over one point to 112.7. Given revisions to prior months' data, January's outcome significantly undershoots the market consensus expectation (of 114.5). Key points from the activity side of January's survey include the following (IHS Markit Economist Ken Wattret):

- Sentiment has declined in four of the five key sectors in January, with retail (just 5% of the ESI) the exception. Although relatively elevated still, sentiment indices across all key sectors are down from their recent peaks.

- Services sentiment (20% of the ESI) has fallen by almost two points, after tumbling by more than seven points in December 2021, one of the biggest declines in the series' history. Echoing the recent weakness of IHS Markit's PMIs, services activity has been hit hard by the latest wave of the COVID-19 pandemic.

- Although industrial sentiment (the highest weighted sector, at 40% of the ESI) has edged down, most of the sub-surveys, including order books and production expectations, are robust. Demand remains solid despite ongoing supply chain disruption to production.

- Consumer sentiment (20% of the ESI) has also edged down, as already indicated by the prior 'flash' data. Consumer expectations of the economic outlook have fallen sharply, however.

- Overall employment expectations have softened in each of the last two months but the index remains well above its long-run average, indicating that businesses remain confident about economic prospects despite the various growth headwinds at present.

- German real GDP contracted by a larger-than-expected 0.7% quarter on quarter (q/q) in the final quarter of 2021, but upward revisions to previous quarters nonetheless raised full-year-2021 growth to 2.8%. Private consumption was the main drag on growth in late 2021 owing to the renewed tightening of pandemic restrictions, but weaker construction contributed too. (IHS Markit Economist Timo Klein)

- 'Flash' data released by the Federal Statistical Office (FSO) of Germany shows that German real GDP declined by 0.7% q/q in the fourth quarter of 2021, with its end-2021 level thus still falling short of its pre-pandemic level by 1.5%. Fourth-quarter-2021 growth was somewhat weaker than expected, but upward revisions to previous quarters raised growth in 2021 overall to 2.8% (versus the 2.7% 'flash' release on 14 January). IHS Markit continues to predict GDP growth of 3.8% in 2022, as high-frequency indicators and pandemic developments suggest that a rebound has begun in January already.

- As usual, only the 'flash 'data relating to total GDP (real and nominal) have been released now - detailed component data will be provided only on 25 February. Guidance provided by the FSO in its press release suggests that a major downward correction of private consumption was the main reason for negative growth in the fourth quarter of 2021. Contracting construction activity also contributed, whereas public consumption was an offset to the upside. The FSO failed to give indications about external trade or equipment spending.

- The fourth-quarter-2021 dip in consumer spending, following cumulative growth of more than 10% in the two preceding quarters, is closely linked to the renewed tightening of pandemic restrictions during November-December 2021. This reflects the initial worsening of the pandemic situation due to the Delta variant of the COVID-19 virus and German authorities' subsequent hesitancy to loosen restrictions in view of the looming Omicron wave.

- French real GDP is estimated to have risen by 0.7% quarter on quarter (q/q) during the fourth quarter of 2021, according to 'flash' figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Moreover, the growth estimates for each of the first three quarters of 2021 have been revised upwards by 0.1 percentage point. (IHS Markit Economist Diego Iscaro)

- Real GDP increased by 5.4% year on year (y/y) during the fourth quarter, and by 6.9% in 2021 as a whole. It is now 0.9% above its pre-pandemic level during the fourth quarter of 2019.

- Households' spending grew for the third consecutive quarter during the final three months of last year, rising by 0.5% q/q (+5.6% q/q during the third quarter). While spending on hotel and restaurant services was stagnant during the fourth quarter, hit by a worsening of the pandemic since mid-November 2021, spending on transport services rose by 5.7% q/q.

- Household consumption of goods grew by 0.3% q/q (+2.0% q/q in the third quarter), driven by food (+1.3% q/q) and energy (+0.3% q/q) consumption. Spending on durable goods declined by 0.5% during the fourth quarter.

- Fixed investment also performed solidly during the fourth quarter, rising by 0.5% q/q (following a 0.1% q/q increase in the third quarter). Investment in IT services was particularly strong (+3.9% q/q) and helped to offset declines in investment in manufactured goods (-1.2% q/q) and in construction (-0.4% q/q).

- On the external side, real exports rose by 3.2% q/q, boosted by higher sales of transport services (+13.6% q/q) and other industrial goods (+2.7% q/q). Imports grew by a stronger 3.6% q/q, driven by an 8.8% q/q increase in imports of transport equipment.

- The chief executive of Italy's UniCredit stated on a media call on 28 January that the stopped has halted its plans to acquire Russian bank Otkritie given the current political tensions between Russia and Ukraine. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- The potential acquisition had been announced earlier this month, where UniCredit had hoped to expand its operations in Russia and become the country's fourth-largest lender.

- However, because of the current tensions between Russia and Ukraine and potential sanctions that the European Central Bank (ECB) could impose on the bank because of the conflict have led to UniCredit opting not to increase its exposure in the country.

- The latest development reveals that the Central Bank of Russia (CBR)'s plans to sell Otkritie will be significantly limited as long as the conflict lasts, with likely few foreign bidders for the institution. Because of this, the diversification of ownership in the Russian banking sector is likely to continue to be significantly exposed to the domestic market, with most lenders being state-owned or domestically owned.

- Lamborghini is said to have pushed back the introduction of its first BEV model to the end of the decade. A spokesperson for the Italian sports car manufacturer confirmed to Reuters comments made by its CEO Stephan Winkelmann to Italian news agency ANSA. The represented also confirmed that it would be a four-seat coupé-styled sport utility vehicle (SUV). Winkelmann was also quoted by Autocar as saying that the new BEV would have "more ground clearance than a normal car" but added that there "isn't a clear decision taken so far, and therefore it's a bit early to discuss this in depth." He said that a final concept will be drawn up this year, "not only volumes, pricing and body style, but also much more on the content of the car," before stating, "If everything goes accordingly, we're going to kick off the project by the end of this year". Given that the project remains in its early stages, Winkelmann gave no details as to the technical make-up of its new BEV, including whether it would have home-grown content. Regarding the future of internal combustion engine (ICE) technology in its line-up, which has been key to the evocative nature of the brand's products, Winkelmann said that it was still unclear. He said, "It could be that for the super-sports car business, we have an extended period of hybridization if this is allowed by homologation, sustainability rules and maybe by synthetic fuels. This is a door we're leaving open so far." The comments made by Winkelmann indicate that the automaker no longer plans to introduce its first BEV in 2028 as initially planned. Part of the reason for this could be down to the ICE powertrain being an intrinsic part of the character of its products, alongside the dramatic styling. While this is especially the case for its sports car, the engine also contributes to the appeal of the current Urus, and this will only be enhanced with an update planned in 2023, which Autocar suggests will make the vehicle both lighter and more powerful. (IHS Markit AutoIntelligence's Ian Fletcher)

- The monetary policy committee (MPC) of the South African Reserve Bank (SARB) decided to increase the policy rate, the repo rate, by 25 basis points to 3.75% during its January 2022 meeting - in line with market and IHS Markit's expectations. At the meeting, the 25-basis-point interest rate hike was supported by four MPC members, with one MPC member voting for an unchanged interest rate stance. (IHS Markit Economist Thea Fourie)

- The central bank has revised upwards its headline inflation expectations for 2022, with the SARB now expecting inflation to average 4.9%, up from 4.3% previously. For 2023-24, the SARB penciled in a headline inflation expectation of 4.5% - the mid-point of the inflation-target range of 3-6%.

- The risk to the inflation outlook is tilted to the upside, the SARB warns. High global producer and food prices, a sharp upward spike in global oil prices, and persistent electricity and other administrative price hikes add to the inflation uncertainty. For 2022, the SARB now expects domestic fuel prices to rise by 13.7% (from 4.6% previously), while local electricity prices are expected to rise by 14.5% this year.

- Reduced quantitative easing and interest rate tightening in developed economies could occur faster than the SARB's baseline outlook, which could result in capital flow reversal for riskier emerging markets. The SARB expects the first US Federal Reserve fund rate hike in June 2022. Furthermore, inflation expectations in South Africa have shifted up to 4.8% in 2022 (from 4.4% previously), maintaining this level over the medium term.

Asia-Pacific

- Major APAC equity indices closed mixed; Australia +2.2%, Japan +2.1%, South Korea +1.9%, India -0.1%, Mainland China -1.0%, and Hong Kong -1.1%.

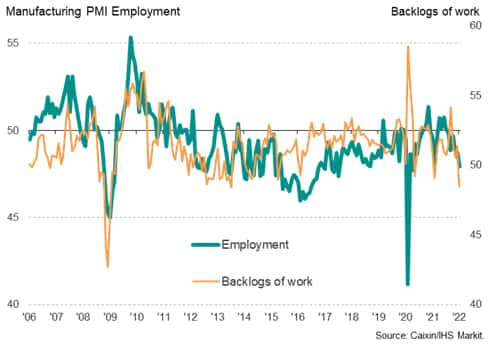

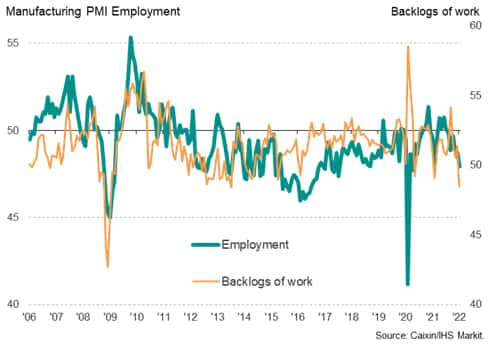

- Tightened restrictions to fight the Omicron wave has led to a renewed decline in manufacturing production in mainland China, with demand also weakening - notably from export markets. With producers' order books becoming increasingly depleted, firms cut staffing levels to an extent not seen since April 2020. The scope for Chinese authorities to combat the slowdown were enhanced by price pressures remaining very subdued, certainly by international standards. However, perhaps of greater concern is the impact on global supply chains - and inflation - from this additional disruption to the Chinese manufacturing economy. (IHS Markit Economist Chris Williamson)

- Manufacturing production in mainland China fell in January, according to PMI survey data produced for Caixin by IHS Markit, as the Omicron wave disrupted business activity. The survey data had shown output growth accelerating in December ahead of the Omicron outbreak, rising at the fastest rate for two years, as business revived from the Delta wave, which had been linked to output falling between August and October. However, the re-imposition of restrictions to safeguard against the spread of COVID-19 in several regions during January were reported to have again curbed factory production and stymied demand.

- New orders likewise fell back into decline amid the January Omicron restrictions, fueled by the largest drop in export orders recorded by the survey for 20 months.

- Ominously, the January survey also showed that the drop in new orders caused backlogs of uncompleted work to fall at a rate not exceeded since the height of the global financial crisis in 2008-9. This depletion of manufacturing order books hints at the build-up of excess capacity relative to demand, and in turn caused increasing numbers of firms to scale back workforce headcounts. The resulting decline in factory employment was the largest recorded since the early stages of the pandemic in April 2020.

- An additional impact of the Omicron wave was a further lengthening of supply chains, with average supplier delivery times lengthening to the greatest extent since October. This constriction of supply in turn drove up prices for purchased inputs at manufacturers, though importantly the rate of inflation remained far below the surging rates of increase seen in the months prior to last November. Average prices for goods leaving the factory gate also rose at a sharply reduced rate compared to that seen throughout much of last year, albeit picking up slightly in January.

- BYD has announced that it has gained approval from market regulators for an IPO of its semiconductor unit, BYD Semiconductor Company Limited, on China's Shenzhen-based ChiNext board. BYD aims to raise CNY2.68 billion (USD314.25 million) through the IPO. BYD gained approval from the Hong Kong Stock Exchange for the spin-off of its semiconductor unit in October 2021, paving the way for the automaker to seek a separate listing of the semiconductor unit in mainland China. BYD's semiconductor division mainly makes power semiconductors and intelligent sensors. The automaker said in its 2020 annual report that BYD Semiconductor had already become a leading manufacturer of automotive-grade insulated-gate bipolar transistors (IGBTs) in China, and it believes that a spin-off listing of the unit will help it further improve its financing capacity and brand recognition. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) battery-maker CATL expects its full-year 2021 net profit to have reached between CNY14 billion (USD2.206 billion) and CNY16.5 billion, representing a surge of 150.75-195.52% year on year (y/y). Net profit excluding the company's non-recurring gains and losses is expected to have totaled CNY12 billion to CNY14 billion, a y/y increase of 181.38% to 228.28%. CATL attributed last year's profit increase to improved EV battery sales and its increased production capacity, which enabled it to ramp up deliveries of EV batteries to clients. According to data from the China Automotive Power Battery Industry Innovation Alliance (CAPBIIA), CATL's installed battery capacity reached 80.51 GWh last year, accounting for 52.1% of the Chinese EV battery market. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Paraxylene (PX) Asia Contract Price (ACP) negotiators failed to settle the February contract amid wide bid-offer expectations, two sources told OPIS on Friday. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Negotiations were stymied by a $900/mt CFR Asia versus $1,080/mt CFR buy-sell gap, said one source in China.

- PX users bid $850-900/mt CFR on Thursday, the source said.

- Buyers participating in the PX ACP process include U.K.-headquartered INEOS, Japan's Mitsui, Japan's Mitsubishi, Taiwan's China American Petrochemical (CAPCO), China's Yisheng Petrochemical, China's Shenghong Petrochemical, and Taiwan's Oriental Petrochemical (OPTC).

- OPIS previously reported that the February contract was offered at $1,080-1,100/mt CFR.

- The lowest February ACP nominations came at $1,080/mt CFR from four producers -- Japan's ENEOS, South Korea's SK Global Chemical (SKGC), U.S.-headquartered ExxonMobil and India's Reliance. A $1,090/mt CFR offer was made by Japan's Idemitsu Kosan, while South Korea's S-Oil nominated the highest ACP at $1,100/mt CFR.

- The PX ACP also failed to settle in January, with buyers squaring off at $810/mt CFR against sellers at $940/mt CFR.

- Prices of Chinese preservatives Nisin and Potassium Sorbate fell in January 2022. Average Nisin prices dropped 1.2% m/m from CNY181.67/kg in December 2021 to CNY 179.5/kg in January 2022. Over the same period Average Potassium Sorbate prices also dropped 1.21% m/m from CNY38.11/kg to CNY37.66/kg. The price falls are likely due to reduced demand after the festive period. Currently Mainland China's production capacity of potassium sorbate significantly exceeds domestic consumption and is largely exported. China is also the world's largest nisin producer and most of its production is for export. The prices of Nisin and Potassium Sorbate are expected to stay relatively stable in the near future. (IHS Markit Food and Agricultural Commodities' Mark Chooi)

- As the world's first seaborne shipment of liquefied hydrogen gets underway, optimists see the dawn of a hydrogen economy that could help avert climate disasters in the coming decades. Having arrived at Hastings, Victoria, Australia on 20 January, the world's first purpose-built liquefied hydrogen carrier-the Suiso Frontier-is preparing to transport the fuel back to the Japanese port of Kobe by the end of February. (IHS Markit Net-Zero Business Daily's Max Lin)

- Some observers have compared the vessel to the Elizabeth Watts, which carried the world's first ocean-going oil cargo in 1861, and the Methane Pioneer, responsible for moving the first LNG shipment in 1959. Suiso means hydrogen in Japanese.

- "This is kind of like a history-making event, with the first international shipment of liquid hydrogen … for the purpose of trade between two countries," Daryl Wilson, executive director of industry body the Hydrogen Council, told Net-Zero Business Daily.

- Experts believe hydrogen must have a greater share in the future energy mix for the world to counter climate change. According to the International Energy Agency, global demand for low-carbon hydrogen needs to amount to 520 million metric tons (mt)/year by 2050 to help achieve net-zero emissions at the midcentury point.

- The vision can be only realized if hydrogen can be shipped by sea. European and Northeast Asian countries will seek large quantities of hydrogen from overseas suppliers as they cannot produce sufficient volumes to meet domestic demand, the International Renewable Energy Agency (IRENA) has predicted.

- But there remain stiff technical and commercial challenges in seaborne hydrogen transportation. In liquid form, hydrogen needs to be stored in tanks at minus 253 degrees Celsius-just 20 degrees above absolute zero-to avoid evaporation.

- The temperature is much lower than the boiling points of common seaborne commodities. LNG, often described as a super-chilled fuel, only needs to be cooled to minus 162 degrees Celsius for shipping and storage.

- When constructing the Suiso Frontier, the pilot vessel for the Hydrogen Energy Supply Chain (HESC) project, Kawasaki Heavy Industries (KHI) had to install a double-walled, vacuum-insulated tank with a capacity of 1,250 cubic meters (cu m) for this purpose.

- In the HESC's pilot phase, Japan and Australia together committed A$500 million ($351 million) to creating a hydrogen supply chain between the two countries. The Australian federal and Victorian state governments each contributed A$50 million, while Tokyo footed the rest of the bill.

- Aside from the vessel, the supply chain includes a demonstration plant that produces hydrogen gas from biomass and brown coal in Victoria's Latrobe Valley via gasification, a 0.25-mt/day liquefaction plant in Hastings, and land-based transportation and storage facilities in Japan and Australia.

- Toyota Group has reported an increase in global output in December 2021 despite a shortage of certain parts due to the resurgence of COVID-19 cases in Southeast Asia affecting its operations. According to data released by the automaker, Toyota Group's worldwide output, including subsidiaries Daihatsu and Hino, improved by 7.9% year on year (y/y) to 947,992 units in December 2021. Of this total, the Toyota brand reported a 6.0% y/y increase in production to 801,145 units and Daihatsu reported a 17.8% y/y increase to 130,525 units. Hino's production also advanced by 35.2% y/y to 16,322 units. The group's overall domestic production was up by 3.3% y/y to 358,243 units last month. This included 260,760 units by the Toyota brand, a 3.2% y/y increase. Daihatsu's domestic production was up by 1.0% y/y to 84,985 units and Hino's output increased by 23.2% y/y to 12,498 units. The group's production outside its domestic market increased by 10.9% y/y to 589,749 units last month. This included overseas production of 540,385 units of Toyota-brand models, up by 7.5% y/y, and 45,540 units of Daihatsu models, up by 70.3% y/y. Hino's overseas output increased by 98.4% y/y to 3,824 units. Since September 2021, Toyota has substantially trimmed its global output owing to challenges in acquiring components. Its output in several markets was hit by a decline in operations at several local suppliers and by the prolonged spread of COVID-19 in Southeast Asia, as well as the impact of tighter semiconductor supplies. As a result, the automaker implemented a series of production cuts in December 2021 and January 2022. As a result of these revisions, the automaker now projects that its total global production in the fiscal year (FY) ending 31 March 2022 will be lower than the 9 million units it had previously forecast. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The Seoul government has said that cab-sharing services can be offered legally in the South Korean capital starting from today (28 January), reports the Korea Herald. Cab sharing, which has been banned in South Korea for the past four decades, is becoming legal as a revision of the taxi industry development law approved in July 2021 takes effect. According to the government, the new law allows only online transportation platforms to voluntary offer taxi-sharing services. A taxi platform called 'Banban (half-and-half) Taxi' will offer cab-sharing services for its users who select a shared ride call in its smartphone app. Users whose routes overlap by at least 70% are automatically matched and the fare is computed automatically based on the distance travelled. In the 1970s, taxi sharing was common in South Korea, but it was banned in 1982 owing to issues such as frequent vehicle stops and fare disputes. The government has now implemented a few passenger safety measures to reduce anxiety about riding with strangers and fear of crime. Only passengers of the same gender are permitted to travel together and users may only register for the app using their genuine names and must pay using their own credit cards. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 28 January 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.