Most major APAC equity markets closed higher, Europe was mixed, and most US indices were lower. US and benchmark European government bonds closed sharply higher. European iTraxx closed slightly tighter across IG and high yield and CDX-NA was modestly wider on the day. The US dollar, Brent, natural gas, gold, and silver closed higher, WTI was flat, and copper was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Nasdaq flat; S&P 500 -0.2%, DJIA -0.2%, and Russell 2000 -1.0%.

- 10yr US govt bonds closed -4bps/1.60% yield and 30yr bonds -5bps/2.25% yield.

- CDX-NAIG closed +1bp/52bps and CDX-NAHY +2bps/293bps.

- DXY US dollar index closed -0.2%/89.64.

- Gold closed +0.7%/$1,898 per troy oz, silver +0.5%/$28.06 per troy oz, and copper -0.4%/$4.51 per pound.

- Crude oil closed flat/$66.07 per barrel and natural gas closed +0.5%/$2.97 per mmbtu.

- US new home sales fell 5.9% in April (±11.2%, not statistically significant) to a seasonally adjusted annual rate of 863,000. (IHS Markit Economist Patrick Newport)

- Sales figures for December through March were collectively revised down by 113,000. (Note: About one-fourth of new home sales—homes sold before a permit is issued—are imputed. Imputed sales account for most of the data revisions to new home sales.)

- The three-month average—a solid 878,000 units—had edged down since last September, when it peaked at 974,000 units. (Note: The three-month and quarterly estimates are more reliable than monthly estimates because averaging reduces statistical noise.)

- Year-to-date sales were up 51% in the Northeast, 46% in the Midwest and South, 3.6% in the West, and 34% nationally.

- The average price of a new home soared to a record $435,400, up 21% from a year earlier; the median price scored its second-highest reading ever, $372,400, up 20% from a year earlier. Although these estimates are not precise—and are subject to large revisions—they suggest the builders' profit margins may be widening. The Census' construction cost index for homes under construction was up 8.8% from a year earlier in April.

- Inventory rose by 12,000 units to 316,000. The months' supply edged up 4 ticks to 4.4 months.

- Monthly home price growth in March accelerated yet again. The S&P CoreLogic Case-Shiller 10-city composite index was up 1.4% month over month (m/m) while the 20-city composite index was up 1.6%. (IHS Markit Economist Troy Walters)

- Monthly gains were positive in all 20 cities, ranging from 0.7% in New York to 3.1% in Phoenix.

- Both the 10-city and 20-city composite indices set yet another record for the fastest pace of year-over-year (y/y) growth, up 12.8% and 13.3%, respectively. For the 10-city index, this was the fastest pace since February of 2014, while for the 20-city index it was fastest since December 2013.

- Annual price appreciation was positive in all 20 cities covered. Astoundingly, 19 of the 20 cities covered are now in double-digit territory. Gains ranged from 9.0% in Chicago to 20.0% in Phoenix.

- The national index was up 13.2% y/y in March.

- The US Conference Board Consumer Confidence Index was essentially stable in May, slipping 0.3 point (0.3%) to 117.2. This marginal decline followed an increase of 22.3 points over the two months through April. The April reading was revised down by 4.2 points, but headline consumer confidence in May remains near its pandemic-era high and supports our expectation of strong consumer spending in the second quarter. (IHS Markit Economists David Deull and James Bohnaker)

- Stability in the headline index masked divergence in the components. The index measuring views on the present situation rose significantly, by 12.4 points, to 144.3—the highest since March 2020. In contrast, the expectations index retreated by 8.8 points to 99.1. The gap between these two was the widest since March 2020. A larger gap is typically associated with a later phase of expansion in the business cycle.

- The tightening labor market drove the gain in the present situation index. The labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) rose 13.0 percentage points to 34.6%, the highest since January 2020, implying that jobs are about as easy to find as they were before the pandemic.

- The equivalent measure for views on current business conditions, though much improved from -20.2% in February, was still in the red at -3.1%.

- While FDA is stepping up chemical standards for baby food, consumer groups say FDA should look at another increasingly popular food item - vinegar products - after they found "dangerously high levels" of arsenic and lead in national brands. Food & Water Watch and Empire State Consumer Project (ESCP) are asking FDA in a May 24 letter to set limits and warnings for arsenic and lead in vinegars after testing 24 national brands of vinegar or vinegar reductions and glazes sold at retailers like Walmart, Target and Wegmans. ESCP said it found nearly half (11) of the products were contaminated with arsenic or lead, with seven brands testing positive for both. All but one of the samples testing positive were balsamics, and all were imported from Italy, Greece or Spain, the groups said Monday. The following brands were singled out for high levels of arsenic and lead: Great Value (Walmart) Balsamic Vinegar, Rachel Ray Balsamic Reduction, Colavita Balsamic Vinegar, Wegmans Aged Balsamic Vinegar of Modena and Alessi Balsamic Reduction. Another group in 2002 had tested similar products and found contaminants, which led to California Proposition 65 labeling requirements on bottles and shelves, but no other action had been taken and the groups are looking for federal changes. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- Ford's president of the Americas and International Markets Group, Kumar Galhotra, says the company is "working toward" an all-electric line-up in the US, with no timing indicated, reports Automotive News. Separately, the company is renaming a Michigan (US) transmission plant to reflect its shift to electric motor and transmission production. Reuters quotes Galhotra as saying the F-150 Lighting was "just the beginning of a whole new era at Ford," which could eventually mean an all-electric line-up in the US. Galhotra said Ford has not set a target date, but is on the path to an electric line-up. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US startup electric vehicle (EV) maker Lordstown Motors has revised downwards its expectations on its production volume in 2021 and is looking for extra capital to continue with its plans, according to media reports. Reuters reports Lordstown CEO Steve Burns as saying that production will be "at best 50%" of prior expectations. However, Lordstown is still expected to start production in September. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed mixed; Germany +0.2%, Italy/Spain flat, France -0.3%, and UK -0.3%.

- 10yr European govt bonds closed sharply higher; Italy/Spain -5bps, Germany/France -4bps, and UK -2bps.

- iTraxx-Europe closed -1bp/51bps and iTraxx-Xover -3bps/254bps.

- Brent crude closed +0.2%/$68.49 per barrel.

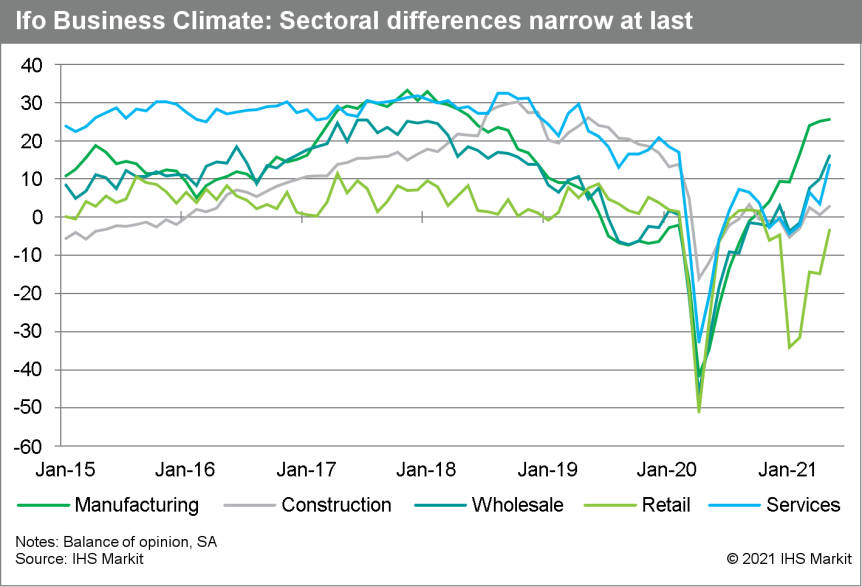

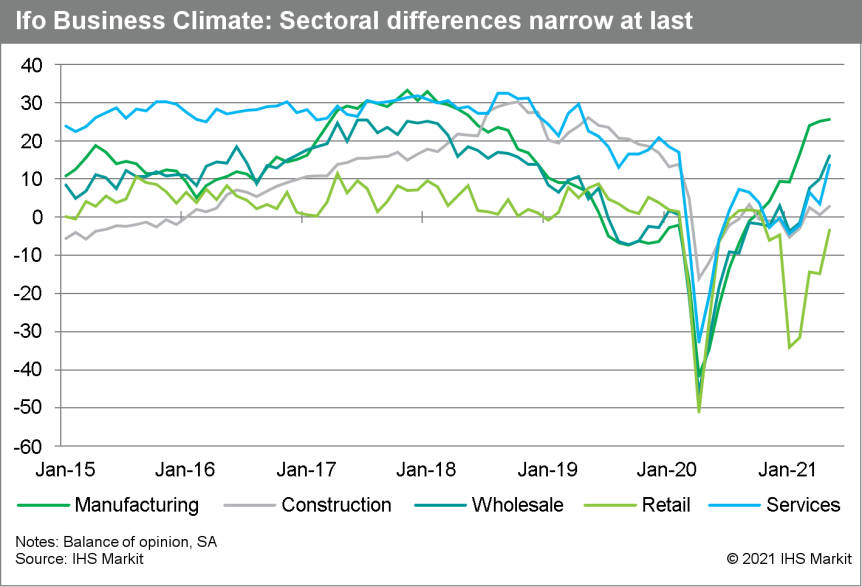

- In May, Germany's headline Ifo index, which reflects business confidence in industry, services, trade, and construction combined, improved markedly from 96.6 to 99.2. (IHS Markit Economist Timo Klein)

- This is its highest level since May 2019 and exceeds its long-term average of 97.0.

- Business expectations more than made up for their limited correction in April, now rising from 99.2 to 102.9. This is its highest level since November 2017.

- Interestingly, expectations in the manufacturing sector deteriorated against the general trend, presumably due to worries about supply chain interruptions and associated input price increases.

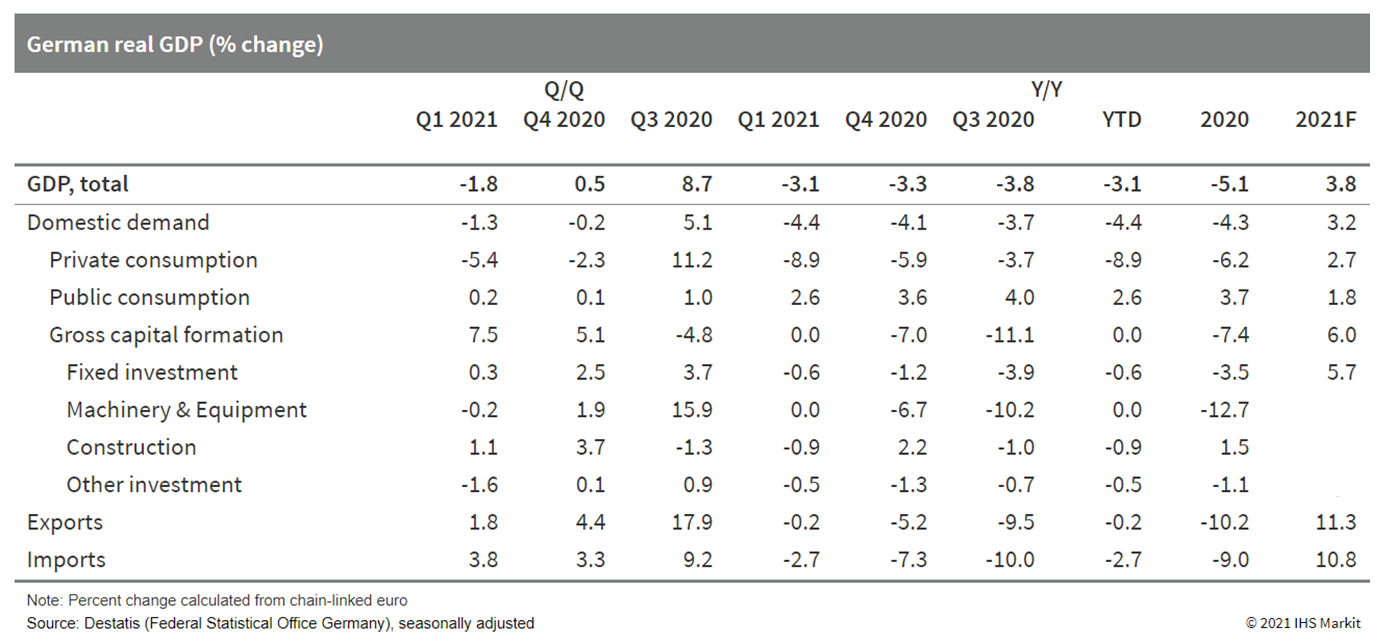

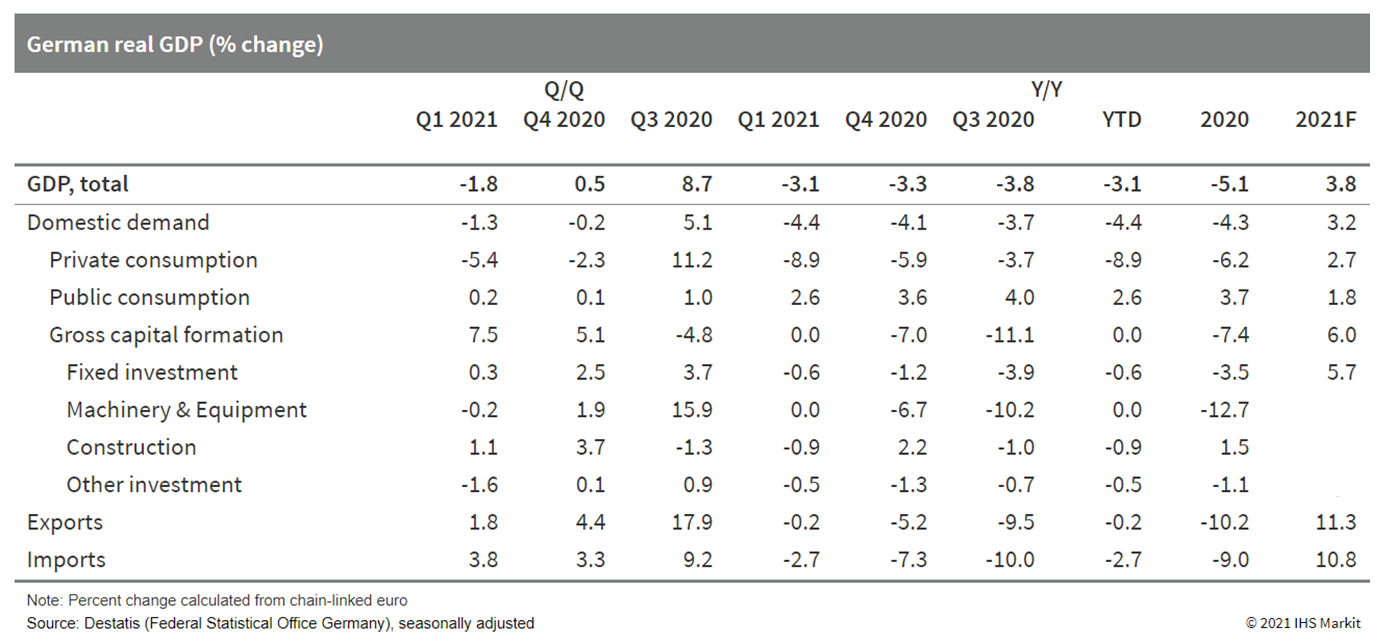

- German real GDP declined by 1.8% quarter on quarter (q/q) in the first quarter of 2021, revised from the initially released -1.7% q/q. The setback means that GDP in early 2021 was still about 3% below that of a year ago, when the pandemic first struck in mid-March. (IHS Markit Economist Timo Klein)

- Annual growth in 2020 has been revised up slightly to -5.1% y/y in calendar-adjusted terms and -4.8% in non-adjusted terms.

- The detailed breakdown for the first quarter reveals that private consumption was the main depressing factor, although net exports also represented a burden due to unexpectedly strong imports.

- Fixed investment was a positive surprise, and strong stock-building equally prevented an even sharper GDP decline.

- Mercedes-Benz has acquired a stake in Swedish company H2 Green Steel (HSGS) which will eventually mean carbon-neutral-production steel can be used in its car manufacturing, according to a company statement. The stake is another component of Daimler and the Mercedes-Benz passenger car brand's Ambition 2039, its goal to achieve a fully connected and CO2-neutral vehicle fleet in 2039. (IHS Markit AutoIntelligence's Tim Urquhart)

- Audi has announced that it is installing a network of six 'premium' charging hubs in Germany for its battery electric vehicles (BEVs), according to a company statement. The work will start in the second half of this year on the six locations ahead of a 'possible serial roll-out' of the charging station format. The hubs will be high power charging (HPCs) with charging points with up to 300 kw, which will allow an E-tron GT charge to 80% of capacity in 23 minutes. The precise locations of these new charging stations are yet to be determined, but Audi is in discussions with potential partners. (IHS Markit AutoIntelligence's Tim Urquhart)

- BW Ideol has announced the signing of a EUR4 million (USD4.9 million) engineering contract and license agreement related to the 30 MW EolMed project demonstrator project, off the Mediterranean coast of France. The project, owned by Qair and Total, is in 60 meters water depth, and will comprise three Vestas 10 MW turbines installed on BW Ideol's proprietary Dampening Pool floating foundation. In March, BW Ideol was listed on the Oslo Stock Exchange. The company raised NOK575 million (USD70 million) and announced ambitions to be a pure-play floating offshore wind developer and EPCI company. Utilizing acquired company Ideol's technology, the BW Ideol is targeting a 10 GW portfolio by 2030, of which 1.5 GW will be operational by that time. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Technip Energies has been awarded two contracts by Neste for work on the development of their renewables production platform in Rotterdam, the Netherlands. The first contract is an EPCM contract for the modification of Neste's existing renewables production refinery in Rotterdam, the Netherlands, to enable production of sustainable aviation fuel (SAF). The modifications to the refinery, an investment of approximately USD233 million (EUR190 million), will enable Neste to optionally produce up to 500,000 tons of SAF per annum as part of the existing capacity. Technip Energies has also been awarded a FEED contract for an additional renewable products refinery in Rotterdam. This contract is part of Neste's preparations to enable a final investment decision, targeted for the end of 2021 or beginning of 2022. The production process is based on Neste's proprietary NEXBTL technology, which allows the conversion of waste and residue feedstock into renewable products like renewable diesel, SAF and renewable solutions for the polymers and chemical industry. (IHS Markit Upstream Costs and Technology's William Cunningham)

- Low base effects triggered a sharp rebound in Poland's industrial output in April, soaring 44.5 year on year (y/y). However, results were less favorable in seasonally adjusted terms, with production down 0.4% m/m, the first decline since August. (IHS Markit Economist Sharon Fisher)

- By industrial grouping, the strongest growth was reported in durable consumer goods (up 146.3% y/y) and capital goods (up 109.5% y/y). Energy reported the slowest y/y growth (up 7.6%).

- Supply-chain disruptions and rising commodity prices are driving up industrial producer prices, which surged 5.3% y/y in April and 0.5% m/m. Price growth was particularly robust in the mining sector (up 22.1% y/y), boosted by a surge in metal ores.

- Including the automotive category, real retail sales jumped 21.1% y/y in April, partly due to a surge in car and clothing sales. Nevertheless, seasonally adjusted sales fell 6.8% m/m, as non-essential shops were closed in an effort to control the spread of the COVID-19 virus.

- PKN Orlen will invest $3.69 billion building a new cracker, five derivative units at its olefins complex in Plock, Poland. PKN Orlen (Plock) has announced a 13.5-billion zloty ($3.69 billion) expansion of its olefins complex in Plock, Poland, including construction of a new 740,000-metric tons/year steam cracker and five downstream derivative units. The company's supervisory board has approved the Olefins Complex III expansion project, enabling PKN Orlen to proceed with the planned signing of engineering, procurement, construction, and commissioning (EPCC) contracts with its preferred bidders Hyundai Engineering and Técnicas Reunidas, it says. The estimated value of the project is based on a lump-sum bid for the cracker and related downstream units, as well as detailed estimates of expenditure on the necessary infrastructure, it says. A special purpose vehicle, Orlen Olefiny, has been established to implement the project, it adds. The Olefins Complex III expansion will be "the largest petrochemical investment project in Europe in the last 20 years," according to PKN Orlen. The five planned derivatives units will include a large ethylene oxide (EO) and ethylene glycol (EG) plant, it says. The specific production capacities, as well as the other planned units, were not given. The expansion is scheduled for completion in the first quarter of 2024, with production to get underway early in 2025. (IHS Markit Chemical advisory)

- A court in Norway has fined Tesla for reducing the capabilities of the battery on its Model S following an update in 2019, reports Nettavisen. According to the report, the court has ordered the automaker to pay NOK136,000 each to 30 customers of vehicles built between 2013 and 2015. The court judgment was made in the absence of local subsidiary, Tesla Norway AS, which did not file a response. The report adds that Tesla has to make this payment by 31 May or appeal the case by 17 June to the Oslo Conciliation Board (Norway). The case has been brought after it was found that owners of these vehicles experienced a reduction in both range and the rate of charging following the update. The changes are likely to have been aimed at protecting the lifespan of this component, but they cut back two of the main reasons for purchasing a Tesla in the first instance - its range and speed of charging. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- Most APAC equity markets closed higher except for India closing flat; Mainland China +2.4%, Hong Kong +1.8%, Australia +1.0%, South Korea +0.9%, and Japan +0.7%.

- Chinese beef imports remained at high levels in April with countries in North and South America gaining market share at the expense of Australia and Europe. China imported 188,374 tons of beef (excluding offal) in April - up 14% y/y. Of this total, some 38% came from Brazil while a further 21% came from Argentina. The Argentine government's decision to suspend beef exports for 30 days will open up significant opportunities to rival suppliers, including not only Brazil but also Uruguay, New Zealand and the US. US exporters are already making good progress in the Chinese market, shipping 9,414 tons in April, up from just 600 tons in the same month last year. Chinese imports from New Zealand increased by 35% y/y to reach 19,919 tons, while imports from Uruguay were up 31% y/y at 24,425 tons. Australia continued to lose ground however, shipping just 14,299 tons to China in April. This is little over half the amount shipped in the same month last year. China is still blocking imports from several Australian suppliers under a suspension whose introduction coincided with a rise in political tensions between the two countries. (IHS Markit Food and Agricultural Commodities' Max Green)

- Chinese telecoms company Huawei has reiterated that it does not plan to build cars and would continue to support automakers building vehicles using its ICT (information and communications technology) capabilities, reports Gasgoo. Huawei further confirmed that it has not invested in any automaker and has no plans to do so. The company also said that it has chosen BAIC BJEV, Changan Auto, and GAC Group as its strategic partners, supporting them in developing their own sub-brands. Vehicles featuring Huawei's autonomous solutions are allowed to bear the "HI" logo after permission from Huawei. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Orsted, Japan Wind Development Co. (JWD), and Eurus Energy are partnering to develop offshore wind projects in Akita Prefecture. The consortium is participating in Japan's first offshore wind auction which closes on 27 May 2021. The companies are currently developing two projects, the 415 MW Noshiro/Mitane/Oga and 730 MW Yurihonjo wind farms, located off the coast of Akita, that were previously designated under Japan's Offshore Renewable Energy Act in 2018. These projects are in the process of obtaining permits and have completed site investigations. Eurus Energy, a leading onshore wind energy company is owned by TEPCO (40%) and Toyota Tsusho (60%). JWD also develops onshore wind in Japan, and is experienced in the power market and supply chain. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Hyundai has upgraded both the design and performance of its Xcient Fuel Cell truck, the world's first mass-produced heavy-duty truck powered by hydrogen, according to a company statement. The truck gets a new radiator grille with a linear and bold 'V' shape chrome details and multi-dimensional mesh patterns. The blue point color surrounding the grille and the decal graphics vividly visualizes Xcient's use of eco-friendly hydrogen energy, according to the automaker. The fuel-cell system's durability as well as the truck's overall fuel efficiency has been improved to better meet the demands of commercial fleet customers. The upgraded Xcient Fuel Cell is equipped with a 180 kW hydrogen fuel-cell system with two 90 kW fuel-cell stacks, newly modified for this heavy-duty truck, and a 350 kW electric motor with maximum torque of 2,237 Nm. Seven large hydrogen tanks offer a combined storage capacity of around 31 kg of fuel, while three 72 kWh high voltage batteries provide an additional source of power. Hyundai claims that the maximum driving range of the upgraded Xcient Fuel Cell truck is around 400 km. It takes around 8-20 minutes to refuel a full tank of hydrogen, depending on the ambient temperature. (IHS Markit AutoIntelligence's Jamal Amir)

- Adani Group (Ahmedabad, India) plans to invest 292 billion Indian rupees ($4 billion) to build a coal-to-polyvinyl chloride (PVC) complex at Mundra in Gujarat State, India. The proposed PVC plant will have a production capacity of 2 million metric tons/year (MMt/y), it says in an application to India's environment ministry. PVC grades such as suspension PVC resin, chlorinated PVC (C-PVC), and emulsion PVC (paste) would also be produced, it says. Adani will also build a vinyl chloride monomer (VCM) plant, with a capacity of 2.002 MMt/y, to produce the PVC. The company also proposes a chlor-alkali plant with a production capacity of 1.31 MMt/y for caustic soda, 1.23 MMt/y hydrochloric acid (HCL), and 16,000 metric tons/year sodium hypochlorite. The chlor-alkali plant would also produce 130,000 metric tons/year caustic potash, 100,000 metric tons/year potassium carbonate, and 200,000 metric tons/year sodium bicarbonate. The project also would include a calcium carbide and acetylene unit, which will produce 2.86 MMt/y lime, 2.9 MMt/y calcium carbide, 860,000 metric tons/year acetylene, and hydrate lime sludge. Adani says 3.1 MMt/y of coal will be required as feedstock for the project, with the coal to be imported mainly from Australia, Russia, and other countries. (IHS Markit Chemical Advisory)

- Prime Minister Pham Minh Chinh on 24 May ordered ministries and local governments to accelerate efforts to contain the COVID-19 virus in more than 300 industrial parks nationwide as Vietnam faces its most severe COVID-19 outbreak so far. The number of local transmission cases has continued to rise since 27 April, the beginning of the latest outbreak, and reached 2,506 as of midday on 25 May according to the Ministry of Health. The outbreak has brought Vietnam's total number of infections to 5,561, with 44 fatalities. (IHS Markit Country Risk's Anton Alifandi)

- Although Vietnam has recorded low COVID-19 cases by global standards, its strict containment measures increase the likelihood of supply chain disruptions, notably in manufacturing. Northern industrial provinces have been the worst hit by the current outbreak, particularly Bac Giang (1,156 cases), Bac Ninh (507), and Hanoi (316). Spikes of infections in industrial zones in Bac Giang province prompted the local authority to temporarily shut down four industrial parks last week, including those hosting suppliers of global electronic companies that operate in Vietnam, such as Foxconn and Samsung.

- Vietnam will continue to rely on government containment measures such as movement restrictions and factory shutdowns to control the spread of COVID-19 due to a slow vaccine rollout, at least until the end of 2021. Vietnam lags behind its neighbors in terms of the ratio of vaccination per capita. As of 18 May, official figures show only 1.01 million frontline workers have been vaccinated and public vaccination of its 97-million-strong population is unlikely to begin until the end of 2021.

Posted 25 May 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.